The Financial Engineering of Certainty

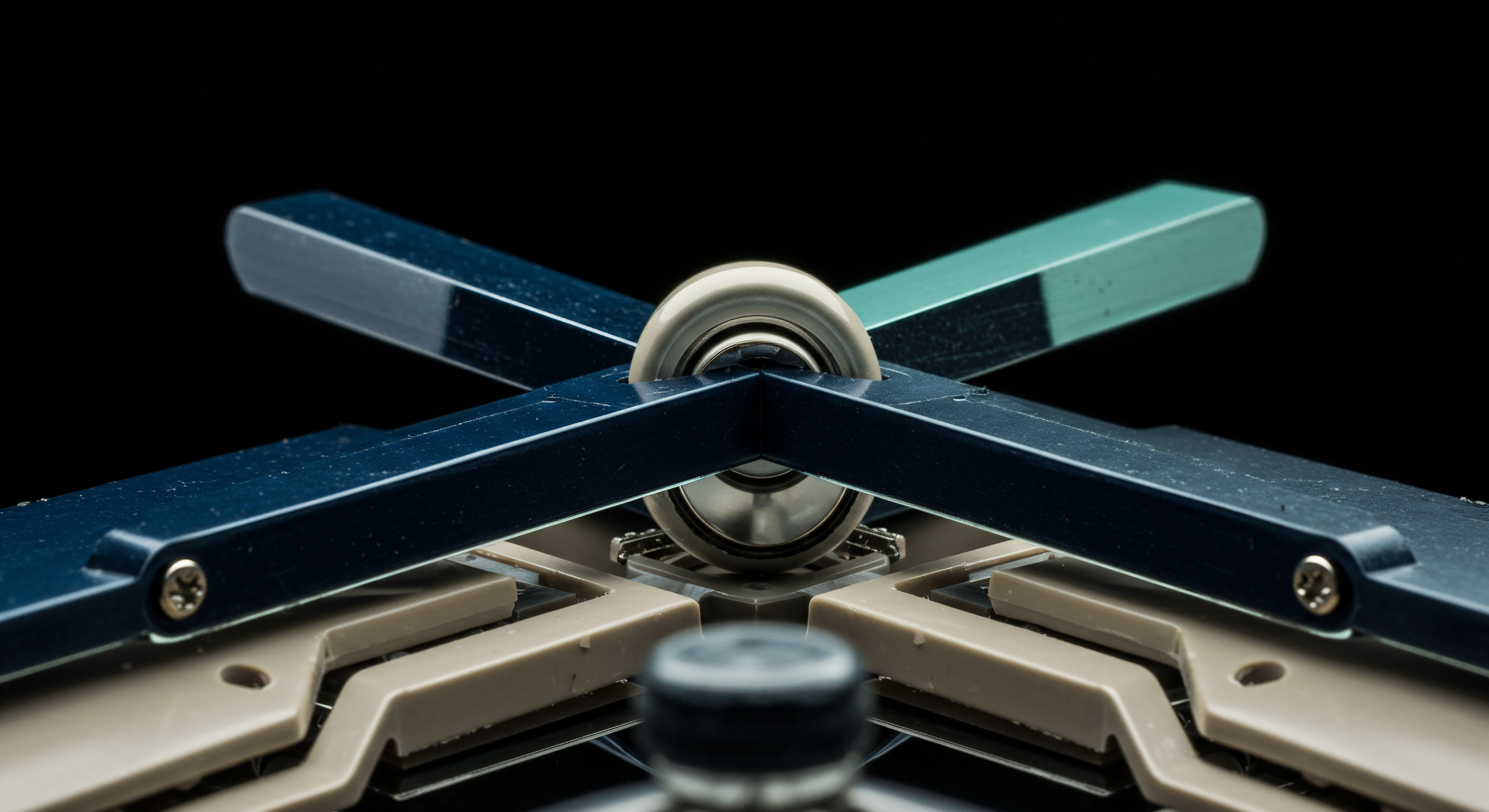

A collar establishes a defined price channel around a core holding, securing a predictable outcome in an unpredictable market. This strategic tool is constructed by holding a long position in an asset while simultaneously purchasing a protective put option and selling a covered call option. The put option establishes a definitive price floor, creating a hard stop against significant downside valuation shifts. The covered call generates premium income, which is applied to finance the purchase of the protective put, thereby reducing or eliminating the cash outlay for the hedge.

This combination of instruments creates a clear performance boundary for the asset. The investor retains all gains up to the strike price of the call option and is shielded from losses below the strike price of the put option. It is a structure designed for investors who have a positive long-term view on an asset but require a mechanism to neutralize short-term volatility. The primary function is to lock in unrealized gains and defend a position from sharp, adverse price movements with minimal upfront cost.

The decision to implement a collar is driven by a desire to secure gains while managing the costs associated with hedging. Investors holding a stock that has appreciated significantly can use this structure to protect their profits from a market downturn. The premium received from selling the call option is a critical component, as it directly offsets the cost of the put option that provides the downside protection. This dynamic makes the collar a highly cost-effective hedging instrument.

The selection of strike prices for the put and call options determines the exact range, or “collar,” within which the stock’s value will fluctuate for the holder. A narrower collar offers tighter control but also restricts potential upside more severely. A wider collar allows for more price appreciation while offering a lower level of protection. This flexibility allows an investor to tailor the hedge to their specific risk tolerance and market outlook.

The Proactive Defense of Capital

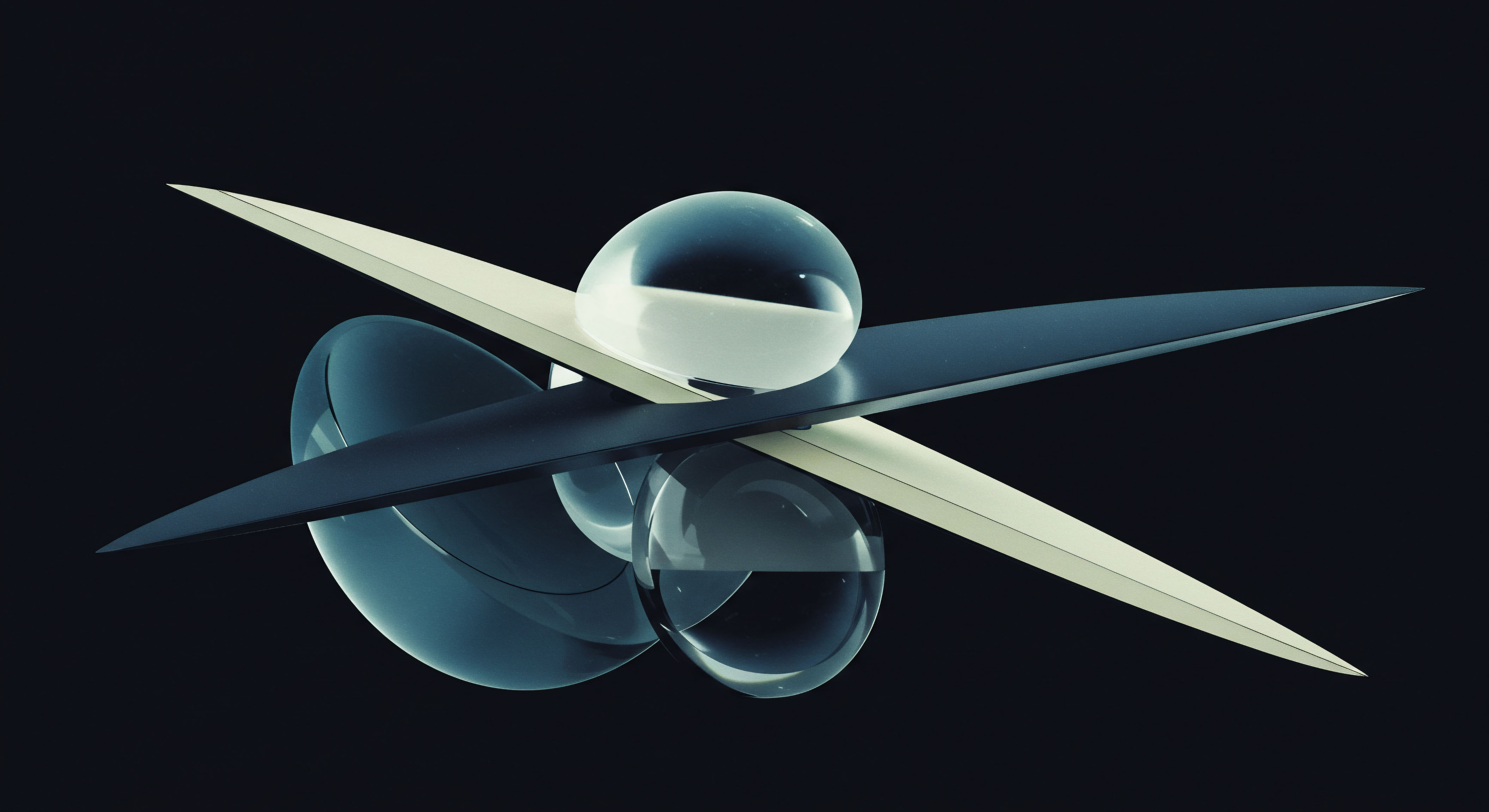

Deploying a collar is a proactive measure to impose control over a volatile asset. It is a calculated decision to trade a portion of potential upside for a high degree of certainty. The structure is particularly useful for concentrated positions where a significant decline could have a material impact on a portfolio.

Successful implementation requires a clear understanding of the asset’s behavior, the desired level of protection, and the acceptable ceiling on future gains. The process is systematic, moving from asset assessment to the precise calibration of the options that will form the hedge.

A collar is an options strategy that involves buying a downside put and selling an upside call to protect against large losses, but that also limits large upside gains.

Calibrating the Hedge

The effectiveness of a collar is determined by the careful selection of its components. The process involves analyzing the underlying asset and selecting options that align with the investor’s objectives for risk and reward. This calibration is a critical step in building a successful defensive position.

Asset and Time Horizon Selection

The first step is to identify the specific asset to be hedged. This strategy is most effective for individual stocks or exchange-traded funds (ETFs) that have experienced significant appreciation. The investor must have a clear reason for holding the asset long-term, coupled with a concern about near-term price risk. The time horizon for the hedge is also a key consideration.

Collars are temporary structures, and the expiration date of the options should align with the anticipated period of uncertainty. Using longer-dated options, such as LEAPS®, can extend the period of protection, though this will influence the premium costs and receipts.

Strike Price Configuration

The core of the collar strategy lies in the selection of the strike prices for the put and call options. These choices define the floor and ceiling for the asset’s value.

- The Protective Put (Floor) ▴ The investor buys an out-of-the-money (OTM) put option. This option gives the holder the right to sell the asset at the strike price, establishing a minimum exit price. The strike price of the put determines the maximum potential loss on the position. Selecting a put strike closer to the current stock price provides more protection but increases the cost of the option.

- The Covered Call (Ceiling) ▴ The investor sells an out-of-the-money (OTM) call option. This generates income that helps pay for the protective put. The strike price of the call sets the level at which the investor is willing to sell the stock, capping the potential for further gains. A higher strike price allows for more upside participation but generates less premium income.

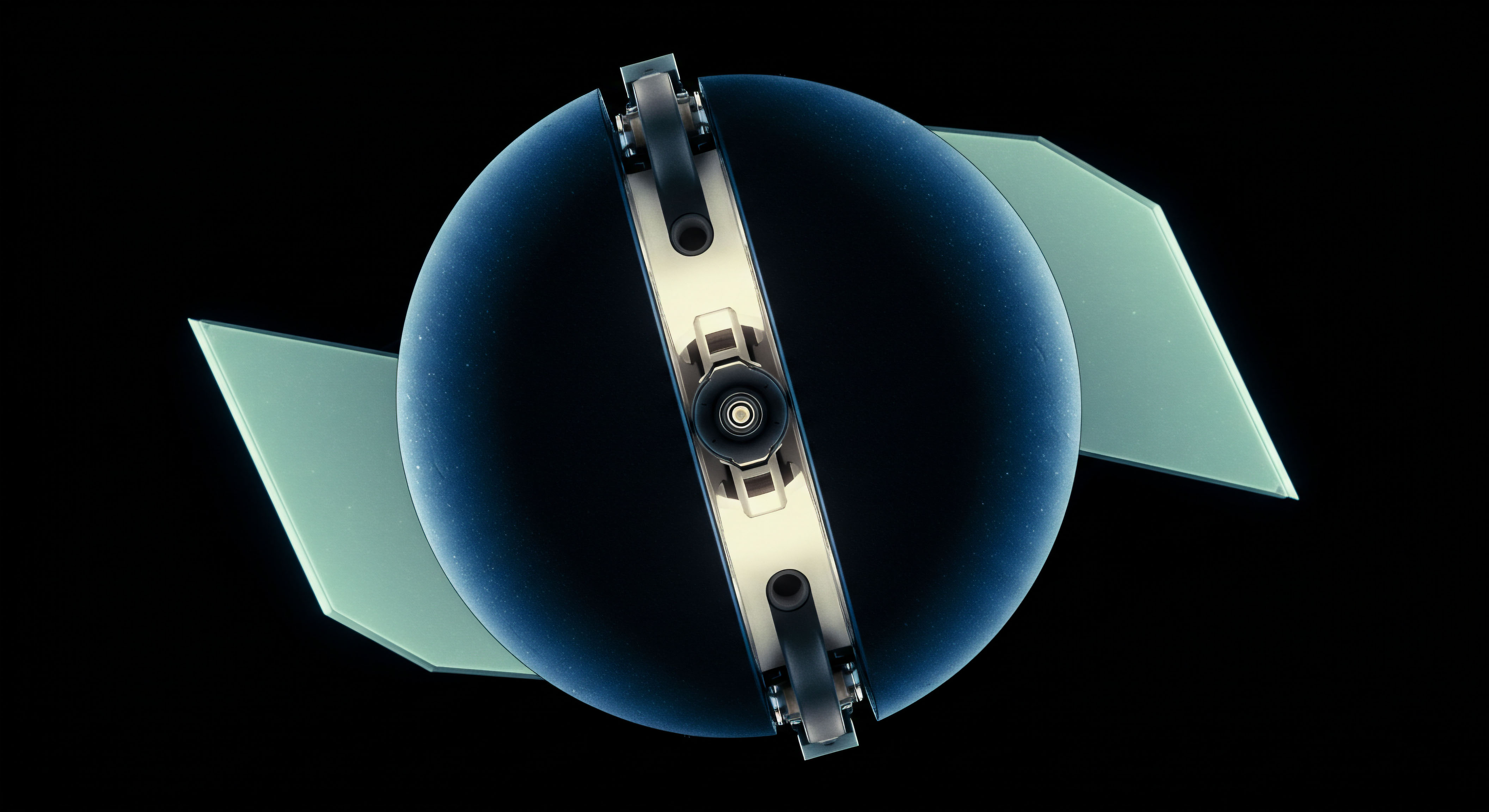

Executing the Zero-Cost Collar

A popular variation of this strategy is the “zero-cost collar,” where the premium received from selling the call option is equal to the premium paid for the put option. This creates a hedge with no net cash outlay at the time of initiation. The trade-off is that achieving a zero cost often requires accepting a lower ceiling on gains or a lower floor for protection. The investor must carefully balance the strike prices to find a combination where the premiums offset each other.

This requires active management and a solid understanding of options pricing. The goal is to construct a robust defense against volatility without incurring an upfront expense, making it a powerful tool for capital preservation.

Systematic Risk Mitigation and Return Shaping

Mastering the collar moves an investor from simple hedging to strategic portfolio management. The collar can be adapted to various market conditions and portfolio objectives, serving as a dynamic tool for shaping returns. Advanced applications involve adjusting the collar in response to market movements, using it to generate income, and integrating it into a broader risk management framework.

These techniques require a deeper understanding of options dynamics and a proactive approach to portfolio oversight. The collar becomes a component of a system designed to produce consistent, risk-adjusted performance.

Dynamic Collar Adjustments

A static collar provides protection for a fixed period. A dynamic approach involves actively managing the position as market conditions change. If the underlying asset’s price rises significantly, an investor might “roll” the collar up. This involves closing the existing options and opening new ones with higher strike prices.

This action raises both the floor and the ceiling, allowing the investor to lock in new gains while maintaining protection. Conversely, if the asset’s price falls, the collar can be adjusted downward to reflect the new valuation. These adjustments allow the hedge to evolve with the market, providing continuous and relevant protection.

Collars for Income Generation

While primarily a defensive strategy, the collar can be configured to generate a net credit. If the premium received from the sold call option is greater than the premium paid for the put option, the position generates income at the outset. This is often achieved by selecting a call strike price that is closer to the current asset price or a put strike that is further away.

This approach slightly alters the risk-reward profile, increasing the income component while potentially lowering the ceiling for gains or the floor for losses. Investors use this variation when they have a neutral to slightly bullish outlook and wish to generate yield from their long-term holdings while maintaining a degree of protection.

Integrating Collars into a Portfolio

At the most advanced level, collars are integrated into a holistic portfolio risk management system. An investor might apply collars to multiple positions within a portfolio, creating a diversified set of hedged assets. This can be particularly effective in managing concentration risk in a portfolio with large single-stock positions. The use of collars can also be timed to coincide with periods of expected market turbulence, such as earnings announcements or macroeconomic data releases.

By systematically applying these protective structures, an investor can reduce overall portfolio volatility and create a more predictable return stream. This transforms the collar from a single-trade tactic into a strategic element of long-term wealth preservation and growth.

The Transition to Strategic Certainty

The mastery of the collar represents a fundamental shift in an investor’s relationship with risk. It is the move from passive hope to the active construction of outcomes. The knowledge gained is not just about a single options strategy; it is about the ability to look at a portfolio, identify specific vulnerabilities, and engineer a precise solution.

This is the foundation of a more sophisticated and resilient approach to the markets, where control and confidence replace fear and uncertainty. The path forward is one of continuous learning and application, using these tools to build a stronger, more predictable financial future.

Glossary

Protective Put

Covered Call

Strike Price

Call Option

Cost-Effective Hedging

Put Option

Strike Prices

Leaps

Collar Strategy

Zero-Cost Collar