Commanding Liquidity with Precision

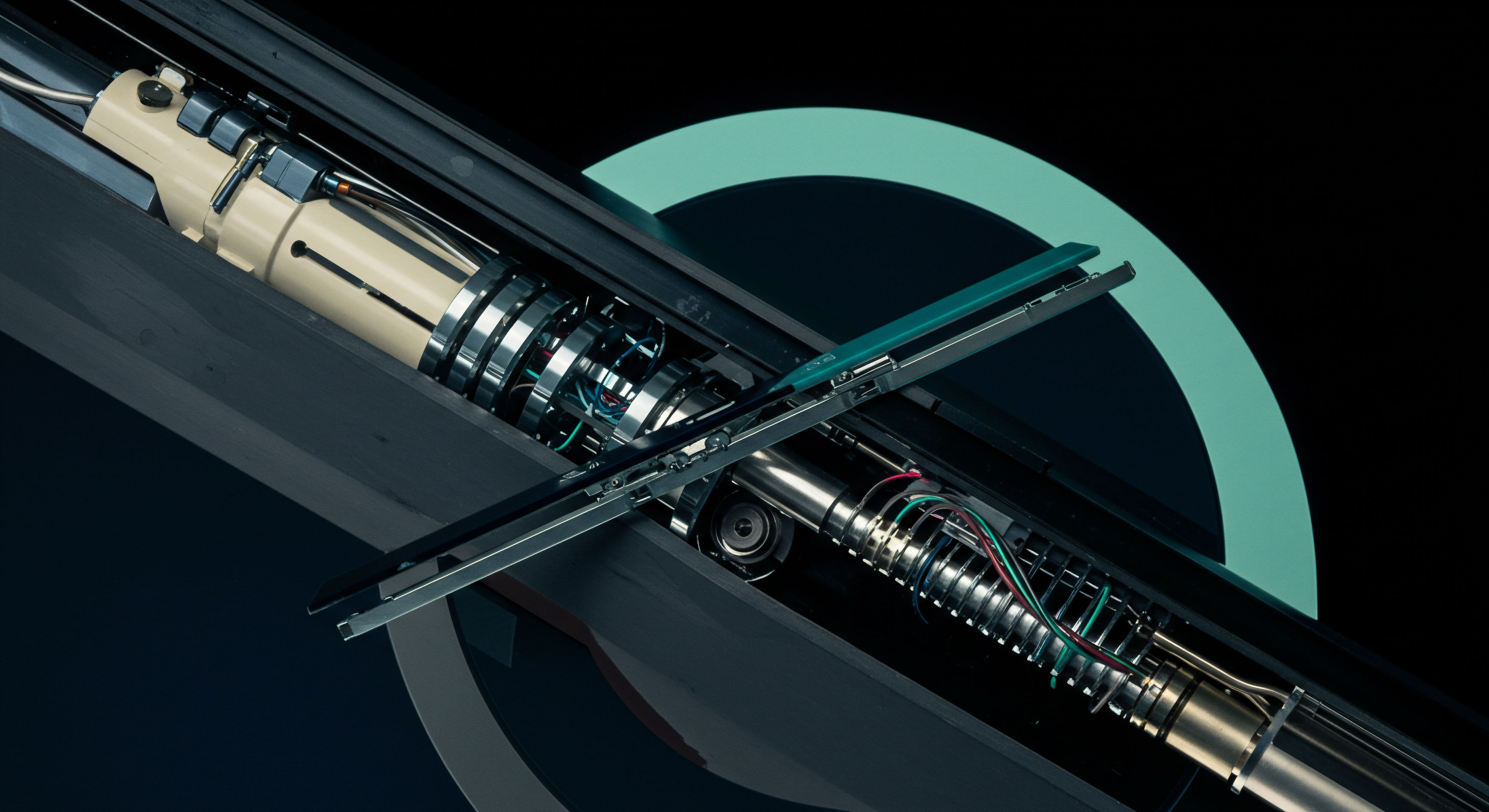

Mastering large-scale asset transactions demands a refined approach to market interaction. Achieving superior execution for significant trade volumes, often referred to as block trades, necessitates bypassing the inherent limitations of open order books. This is where a Request for Quote (RFQ) system demonstrates its indispensable value, transforming a potentially disruptive market event into a controlled, strategic maneuver. An RFQ empowers a trader to solicit competitive bids and offers from multiple liquidity providers simultaneously, all within a private, controlled environment.

The inherent design of an RFQ system fundamentally addresses the challenge of market impact. Placing a substantial order directly onto an open exchange often signals intent, leading to adverse price movements that erode potential gains. Through an RFQ, a trader effectively polls the market’s deepest liquidity pools without revealing their position prematurely.

This discrete interaction allows for the aggregation of competitive pricing, ensuring the trade executes at optimal levels. Understanding this mechanism establishes a foundational pillar for any serious participant in the derivatives space.

Sophisticated trading environments reveal a 15-20% reduction in slippage for large block orders executed via RFQ compared to open market execution.

Engaging with an RFQ system represents a deliberate choice to operate with an advantage. It positions the trader as a conductor of liquidity, orchestrating responses from a diverse set of market makers. This capability is especially pronounced in the realm of crypto options, where market depth can fluctuate. Recognizing the systemic benefits of this execution methodology marks a crucial step in elevating one’s trading acumen.

Deploying Capital with Strategic Advantage

Translating conceptual understanding into tangible trading advantage defines a professional’s trajectory. Applying RFQ mechanisms to options trading, particularly within the crypto asset class, unlocks a spectrum of advanced strategies designed for superior value capture. This approach allows for the meticulous construction and execution of complex derivatives positions, optimizing entry and exit points for substantial capital deployments.

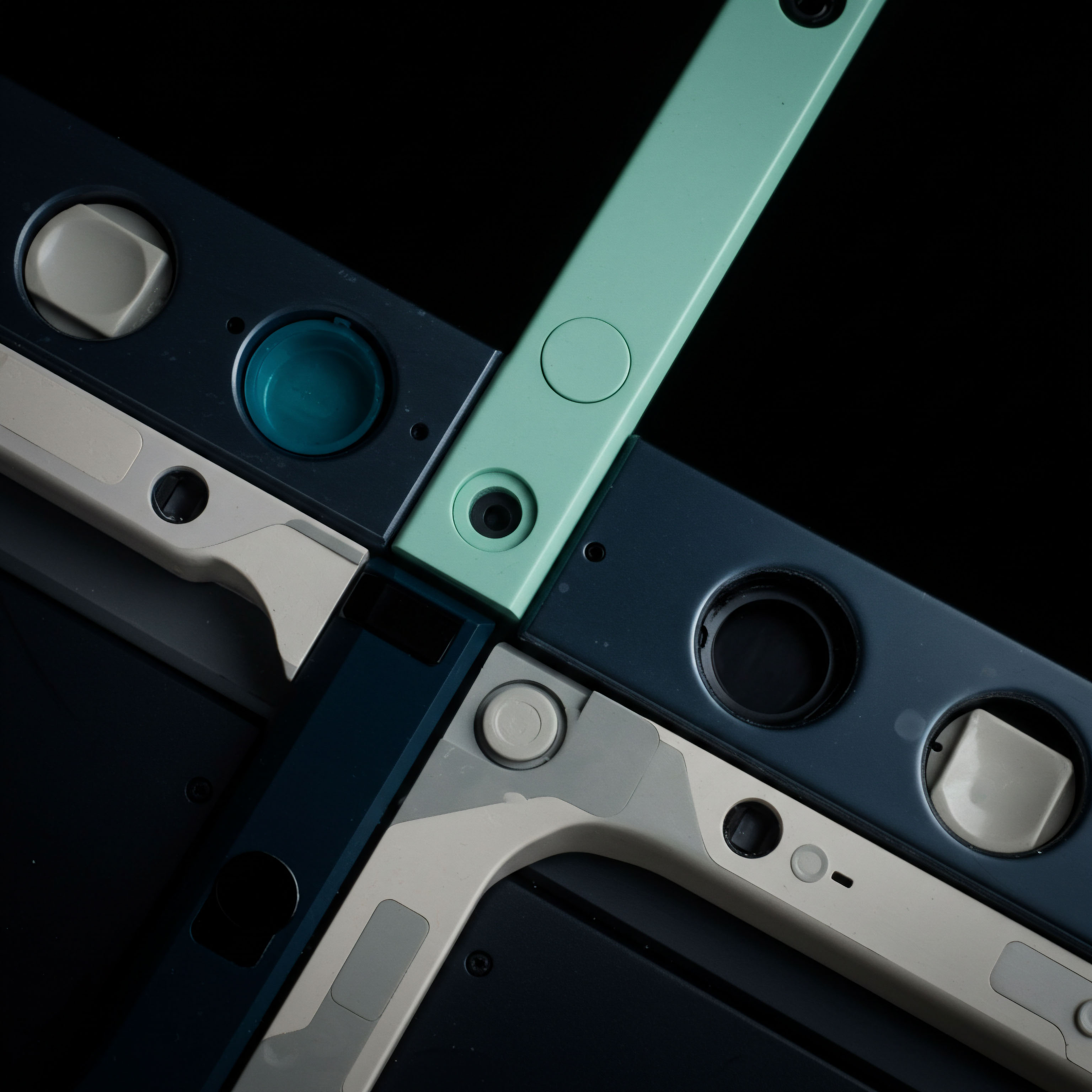

Orchestrating Multi-Leg Options Spreads

Executing multi-leg options spreads through an RFQ offers a significant edge. Instead of legging into individual components on an open exchange, which introduces execution risk and potential price deterioration, an RFQ allows for the simultaneous pricing of an entire spread. This atomic execution ensures the desired risk-reward profile of the strategy remains intact, eliminating the uncertainty associated with fragmented fills.

- BTC Straddle Blocks ▴ Deploying a BTC straddle, which capitalizes on volatility expectations, finds its ideal execution via RFQ. Requesting a block quote for both the call and put components at a specific strike and expiry ensures a precise entry, mitigating the risk of divergent pricing for each leg.

- ETH Collar RFQ ▴ Implementing an ETH collar strategy, a common method for downside protection and income generation on existing holdings, benefits immensely from multi-dealer liquidity. An RFQ consolidates competitive pricing for the long put and short call, delivering a tightly priced hedge.

The strategic advantage derived from this method extends to minimizing slippage across all components of a complex trade. By receiving a single, composite price from multiple dealers, the trader ensures an execution that aligns closely with pre-trade analytics, preserving the intended profit margins.

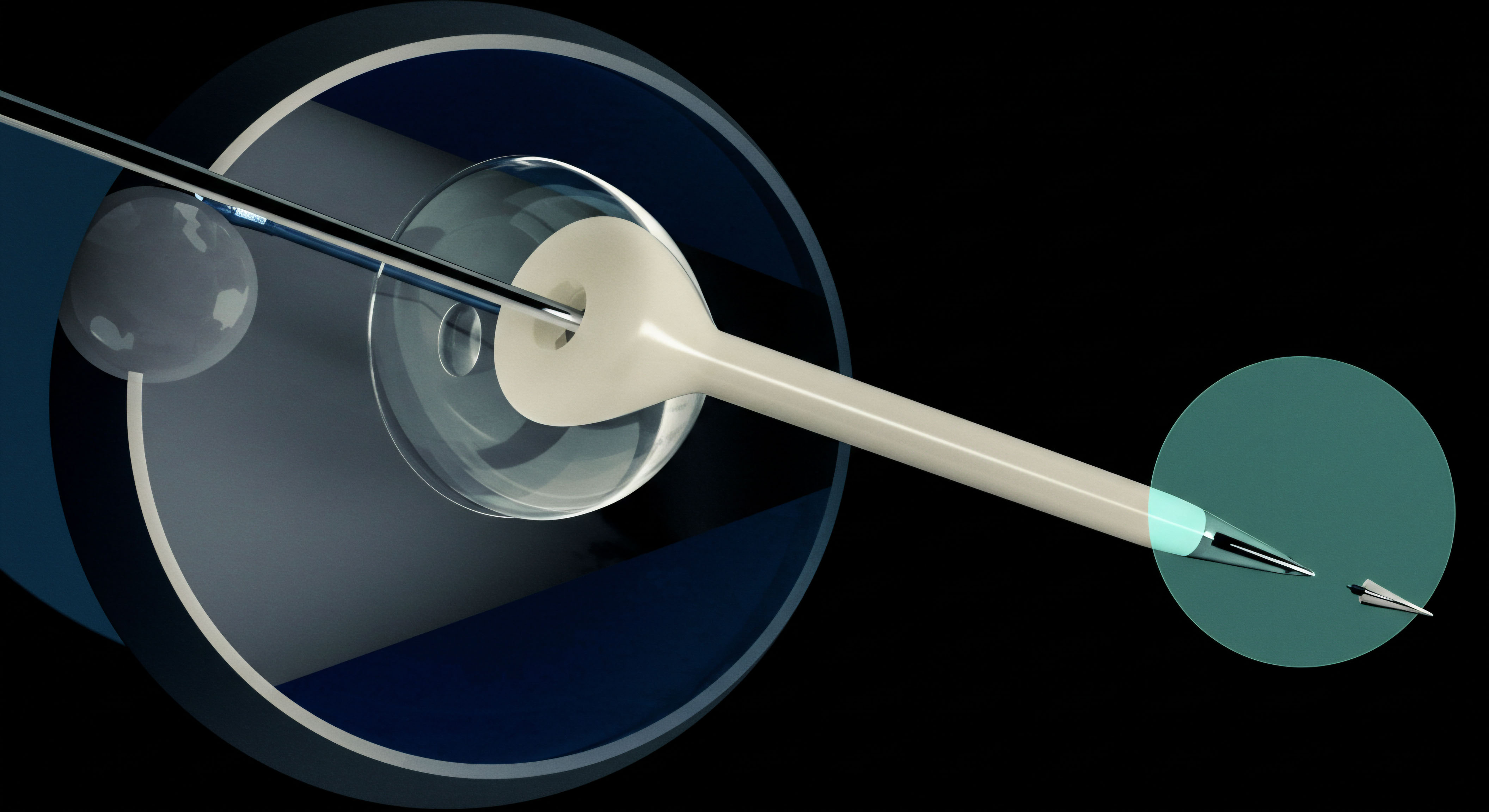

Optimizing Volatility Block Trades

Volatility block trades, which involve large positions designed to express a view on implied volatility, demand precise execution. An RFQ system facilitates this by enabling the anonymous solicitation of quotes from a broad range of market makers. This discretion prevents the market from reacting to the trader’s intentions, preserving the integrity of the volatility trade’s pricing.

Securing best execution for these substantial trades relies on the competitive tension fostered by a multi-dealer RFQ environment. Each liquidity provider, unaware of the full market interest, strives to offer the most attractive price, directly benefiting the requesting party. This dynamic competition yields superior fill rates and more favorable pricing, directly impacting the profitability of large directional or non-directional volatility plays.

Forging a Durable Edge with Sophisticated Trade Craft

Moving beyond individual trade execution, the integration of advanced RFQ capabilities into a holistic trading framework elevates market engagement to a strategic domain. This systematic approach transforms episodic opportunities into a consistent, measurable edge, deeply embedded within a trader’s operational calculus.

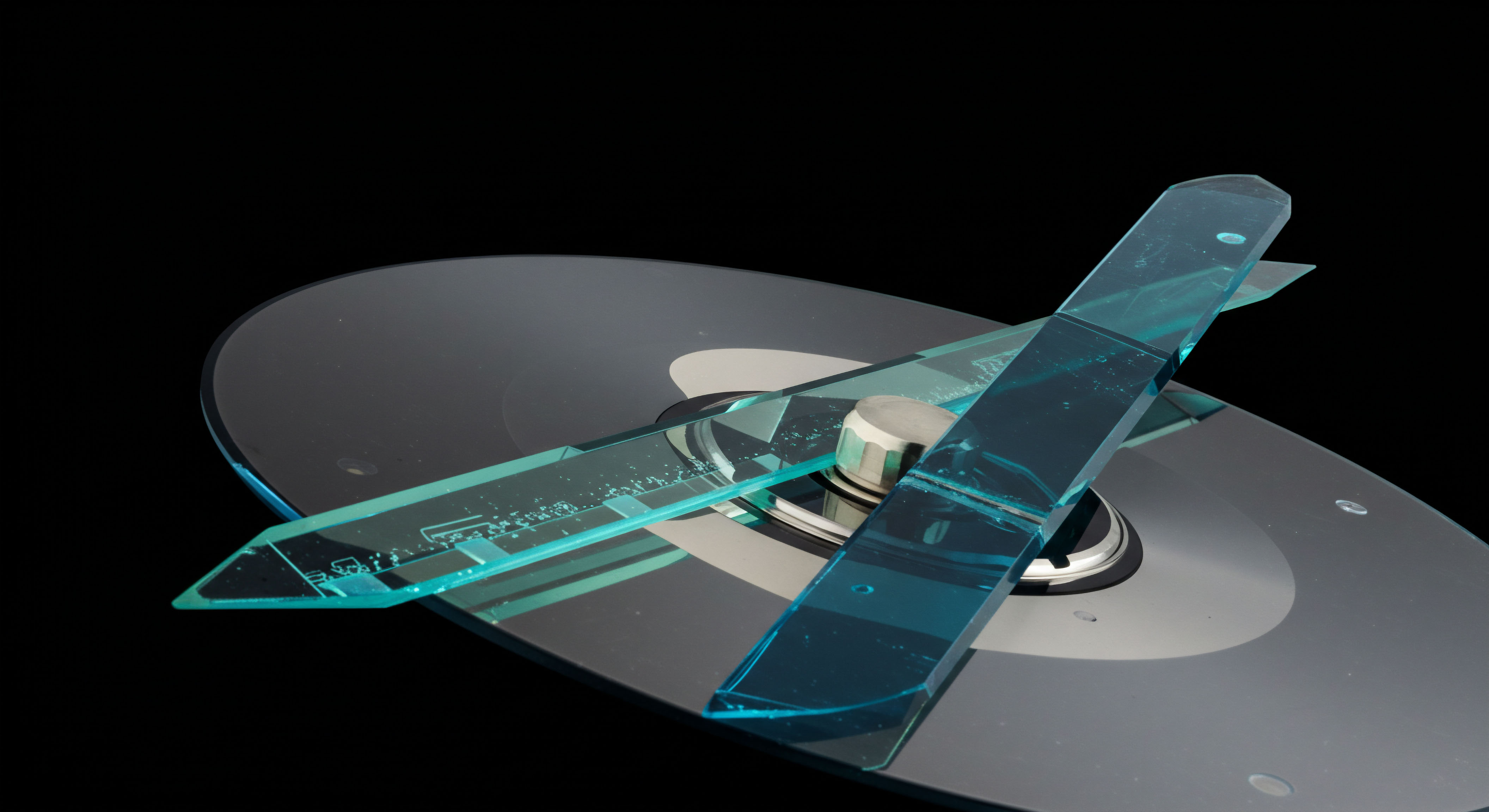

Integrating OTC Options with Exchange Liquidity

A sophisticated trader understands the nuanced interplay between over-the-counter (OTC) options and exchange-traded derivatives. RFQ bridges this divide, enabling a seamless transition of large positions between venues or the strategic sourcing of liquidity from both. This hybrid approach allows for bespoke structuring in the OTC market while leveraging the competitive pricing and clearing efficiency of exchange-linked RFQ systems. The ability to command multi-dealer liquidity across these distinct environments presents a formidable advantage in managing exposure and optimizing capital deployment.

Consider the strategic implications for managing significant options positions. An RFQ allows for a rapid, discreet assessment of the market’s capacity to absorb or provide liquidity for large blocks. This real-time intelligence informs position sizing, hedging strategies, and overall risk posture. Mastering this dynamic interaction creates a significant competitive differential.

Advanced Risk Management through Precise Execution

The precision afforded by RFQ systems extends directly into advanced risk management. By consistently achieving superior execution prices, a trader inherently reduces the cost basis of their positions. This lower cost basis translates into wider margins of error and increased resilience against adverse market movements. Every basis point saved on execution compounds over time, directly contributing to enhanced portfolio performance metrics such as Sharpe ratios.

Moreover, the controlled environment of an RFQ mitigates information leakage, a critical concern for large market participants. Maintaining anonymity during the price discovery phase protects the trader from predatory market behavior, ensuring their strategic intent remains uncompromised. This discreet execution environment is fundamental for preserving alpha in high-stakes trading. The strategic deployment of an RFQ represents a deliberate act of engineering superior outcomes, moving beyond mere participation to actively shaping one’s market experience.

Your Trajectory to Market Supremacy

The journey toward consistent market outperformance is defined by a commitment to superior execution and strategic foresight. Understanding and deploying advanced mechanisms for block trading in options provides a definitive advantage. It is a commitment to precision, to commanding liquidity on one’s terms, and to building a trading future where every large transaction contributes to a compounding edge. This disciplined approach fundamentally redefines engagement with dynamic financial markets.

Glossary

Rfq System

Multi-Dealer Liquidity

Eth Collar Rfq