Execution Mastery for Large Crypto Trades

Achieving superior execution for substantial crypto positions demands a strategic mindset, moving beyond conventional market interactions. The landscape of digital assets, characterized by its inherent fragmentation, presents unique challenges and unparalleled opportunities for those equipped with the right tools. Understanding specialized trading mechanisms marks the first step toward commanding liquidity and securing advantageous pricing for significant capital deployments.

Request for Quote (RFQ) systems represent a fundamental shift in how large trades interact with market liquidity. This direct engagement method allows participants to solicit tailored pricing from multiple liquidity providers simultaneously, fostering competitive bids. Such a direct approach ensures price discovery happens on your terms, significantly influencing the cost basis of large block orders.

Options trading, when integrated into a comprehensive strategy, offers a versatile instrument for managing risk and expressing directional or volatility views with precision. These financial contracts provide a means to gain exposure to underlying assets without direct ownership, offering distinct advantages for capital efficiency and hedging. Mastering their application unlocks advanced tactical capabilities.

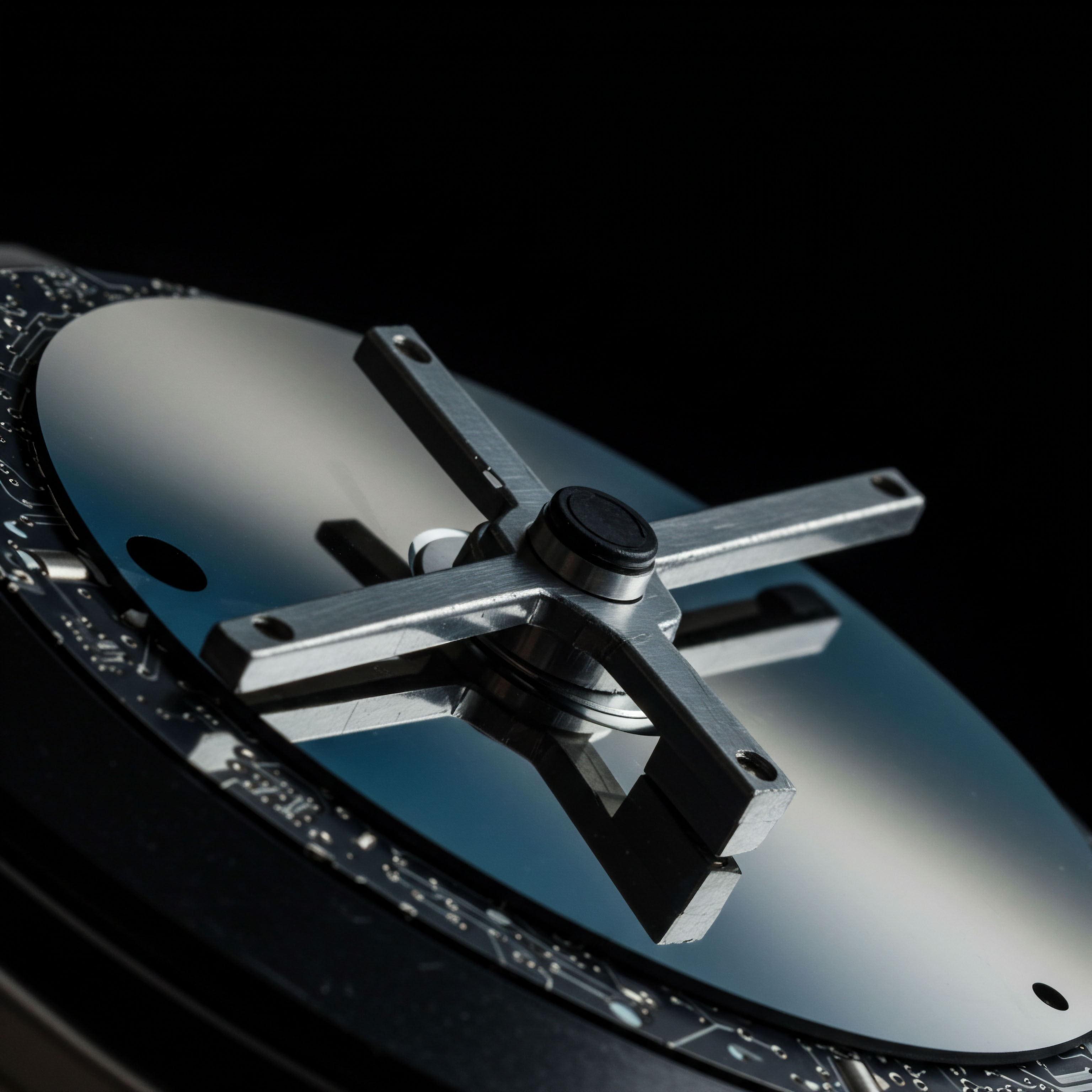

Sophisticated market participants leverage direct engagement systems to command liquidity and secure advantageous pricing for substantial crypto positions.

Block trading, the execution of large orders outside of public order books, represents a critical avenue for minimizing market impact. This method ensures that substantial capital movements do not unduly influence prices, preserving the integrity of a trade’s intended valuation. Successfully navigating this environment requires a clear understanding of its mechanics and the inherent benefits it confers upon discerning traders.

Consistently achieving best execution across disparate liquidity sources presents a complex endeavor. This requires deep comprehension of market microstructure, encompassing order book dynamics, spread variations, and the impact of execution venues. The strategic trader acknowledges these complexities, employing specific methods to navigate them effectively.

Deploying Advanced Crypto Trade Strategies

Translating foundational understanding into tangible market advantage requires the systematic application of advanced trading methods. Successful engagement with large crypto trades centers on precision, strategic timing, and access to deep liquidity. This section details actionable strategies for leveraging specialized mechanisms to achieve superior investment outcomes.

RFQ for Spot Crypto Blocks

Executing large spot crypto trades through an RFQ system represents a direct path to minimizing slippage and securing competitive pricing. Instead of exposing a large order to the open market, which can incur significant price impact, an RFQ allows a trader to solicit quotes from a curated group of dealers. This competitive environment typically yields tighter spreads and more favorable fill rates.

- Define your trade parameters with clarity, specifying asset, size, and desired execution window.

- Engage multiple liquidity providers through a dedicated RFQ platform to generate competitive bids.

- Evaluate quotes based on price, fill certainty, and counterparty reputation, prioritizing the most advantageous terms.

- Confirm the trade, ensuring immediate settlement to mitigate market volatility risks.

Options RFQ for Tailored Risk Management

The strategic deployment of crypto options via RFQ systems enables the construction of bespoke risk profiles. Whether seeking to hedge existing spot positions, express volatility views, or generate income, options offer unparalleled flexibility. Utilizing an RFQ for options allows for customized pricing on complex multi-leg strategies, which often experience wider spreads on standard exchanges.

Constructing Volatility Strategies

A trader seeking to capitalize on anticipated price swings without a directional bias might implement a BTC straddle block. This involves simultaneously buying a call and a put option with the same strike price and expiry. An RFQ ensures the trader receives the best combined price for both legs, preserving the potential profit margin. This approach demands a clear understanding of implied volatility and its potential shifts.

Implementing Hedging Mechanisms

For those holding substantial ETH positions, an ETH collar executed via RFQ offers a robust hedging solution. This involves buying a put option to protect against downside risk while simultaneously selling a call option to offset the put’s cost. The RFQ process facilitates efficient pricing for both legs, creating a defined risk-reward profile for the underlying asset. The diligent selection of strike prices and expiry dates remains paramount for effective risk mitigation.

The true edge in large crypto trading emerges from a meticulous selection of execution channels. This involves a comprehensive understanding of liquidity dynamics, counterparty capabilities, and the inherent cost structures associated with different trading venues.

Consider the profound difference in execution quality when a substantial order bypasses fragmented public order books, instead accessing aggregated, deep liquidity through a specialized dealer network. The impact on overall portfolio performance, compounded over numerous trades, becomes substantial. This demands a keen eye for detail and an unwavering commitment to securing the best possible terms for every transaction.

Advanced Strategic Integration for Portfolio Alpha

Moving beyond individual trade execution, the strategic integration of specialized trading mechanisms elevates portfolio performance. This advanced application transforms execution from a transactional necessity into a consistent source of alpha. Mastering these capabilities allows for the systematic capture of market inefficiencies and the robust management of portfolio-wide exposures.

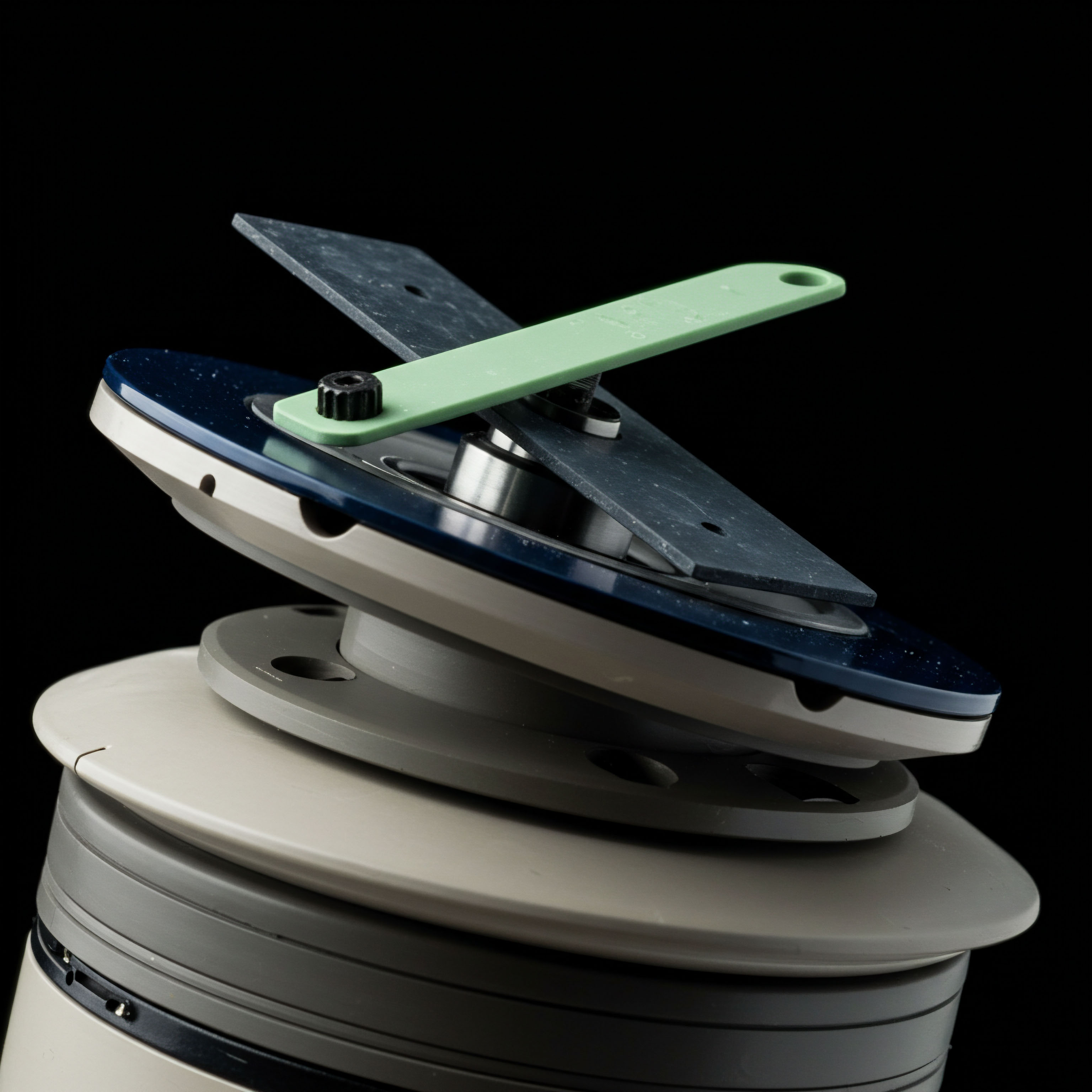

Multi-Leg Execution Sophistication

Advanced traders employ multi-leg options strategies, often involving three or more options contracts, to express highly specific market views or construct intricate hedging overlays. Executing these complex positions through an RFQ system ensures synchronized pricing across all legs, mitigating leg risk and slippage that often plagues such trades on disparate venues. This level of control provides a distinct advantage in managing volatility and directional exposure.

Systematic Risk Mitigation

Integrating large trade execution methods into a broader risk management framework enhances portfolio resilience. Utilizing options blocks for tail risk hedging, for example, provides a defined cost for catastrophic downside protection across a significant asset base. This proactive approach to risk, rather than reactive measures, preserves capital during adverse market conditions and maintains long-term compounding potential. The careful calibration of strike prices and expiry cycles remains a cornerstone of this protective layer.

Commanding Volatility Exposure

The ability to trade volatility as a distinct asset class, independent of directional price movements, represents a sophisticated application of options blocks. A volatility block trade allows a trader to express a view on future price dispersion, rather than the price itself. This strategy demands precise execution and access to deep liquidity, areas where RFQ systems excel. Constructing these trades requires a deep understanding of implied and realized volatility metrics, transforming market sentiment into a tradable asset.

The Unseen Edge in Digital Asset Markets

The pursuit of superior trading outcomes culminates in a mastery of execution, transforming complex market dynamics into a field of strategic advantage. For the discerning participant, the digital asset arena presents an evolving challenge, one where conventional methods fall short. Success stems from embracing advanced systems, ensuring every significant capital deployment reflects a deliberate, calculated command of market forces. This journey defines the truly impactful trader, consistently shaping their financial destiny through intelligent action.