Execution Command

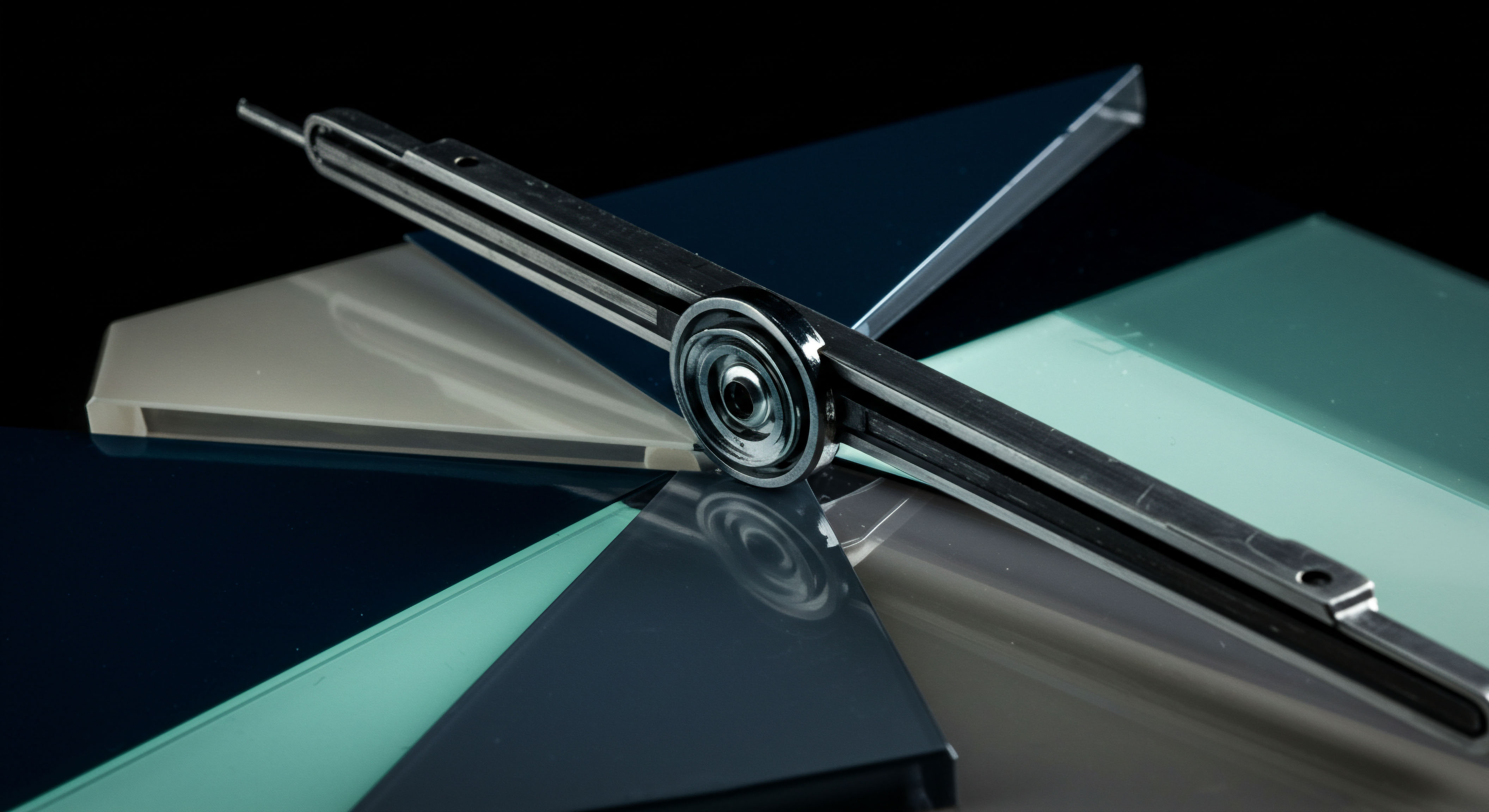

Superior execution in crypto options begins with mastering the request for quotation (RFQ) system. This mechanism fundamentally reshapes how traders access liquidity and secure pricing, moving beyond fragmented order books. It allows participants to solicit bids and offers from multiple market makers simultaneously, concentrating liquidity that might otherwise scatter across disparate venues.

Understanding the RFQ system reveals a pathway to commanding tighter spreads and securing advantageous fills. Traders gain the ability to aggregate competitive pricing from a range of counterparties, fostering an environment where market makers vie for business. This dynamic ensures that a trader’s order receives the most favorable terms available, directly impacting profitability.

The RFQ system transforms options trading by centralizing competitive pricing from diverse market makers, ensuring optimal execution.

Adopting this method establishes a distinct advantage, moving beyond reactive market participation to a proactive stance. It offers a structured approach to large order execution, particularly valuable for block trades where significant capital deployment demands precision. Traders employing RFQ effectively reduce implicit costs, translating directly into enhanced investment performance.

Strategic Capital Deployment

Deploying capital effectively in crypto options requires a deliberate approach to execution, particularly for larger positions. The RFQ system stands as a critical tool for achieving this precision. It empowers traders to engage directly with liquidity providers, securing pricing that reflects true market depth without adverse impact.

Block Trade Mastery

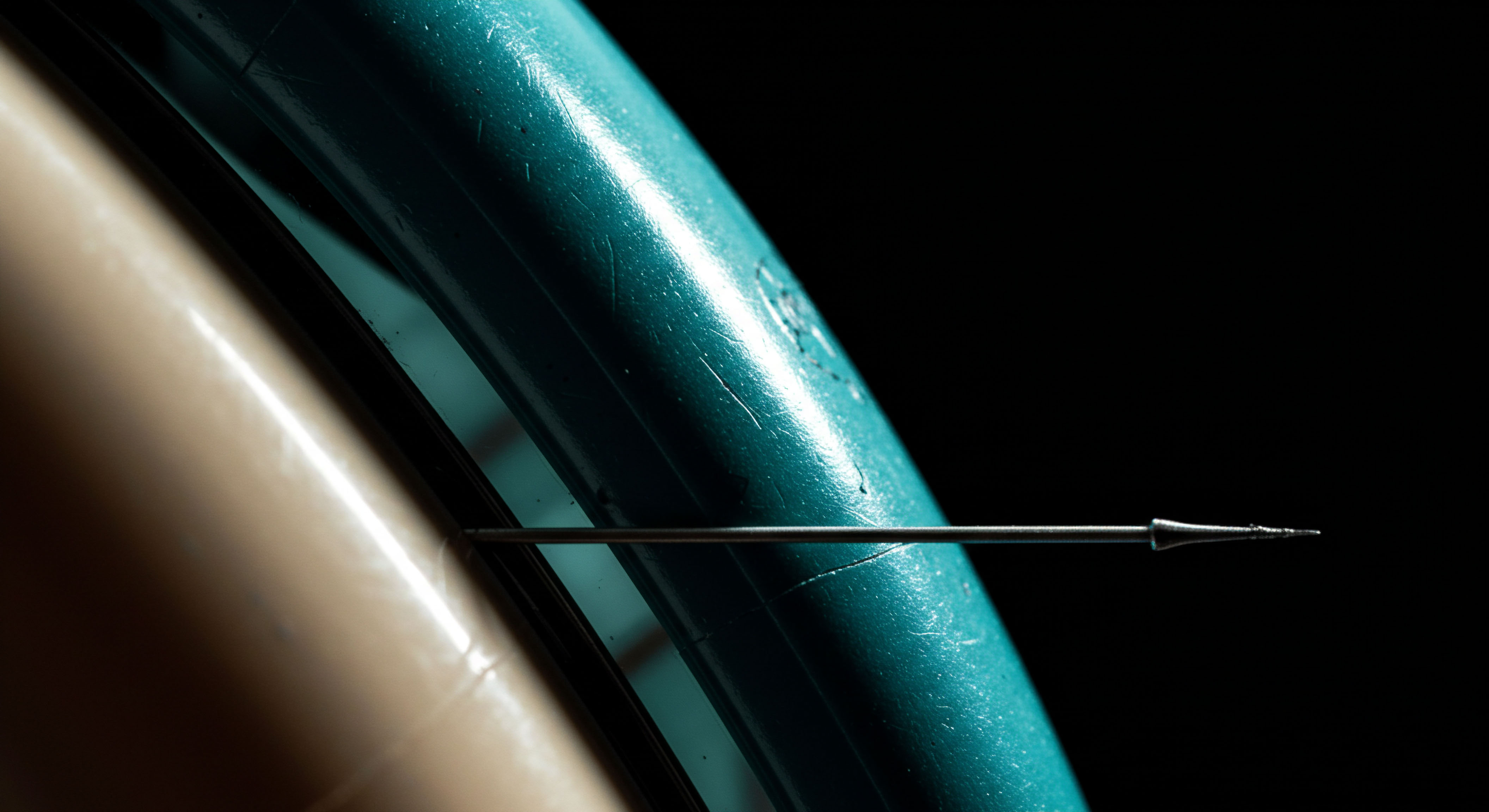

Executing substantial options positions, known as block trades, demands a sophisticated method. Using RFQ for these transactions shields large orders from public market visibility, preventing front-running and minimizing price slippage. This allows institutional participants to move significant volume discreetly, preserving alpha.

Consider the scenario of a large BTC straddle. Attempting to build this position through an open order book often leads to escalating costs as market depth diminishes. An RFQ process, conversely, solicits firm quotes for the entire multi-leg position, ensuring a unified and competitive price for the complete strategy.

Block trading through RFQ ensures discreet execution and superior pricing for substantial options positions.

Multi-Leg Strategy Precision

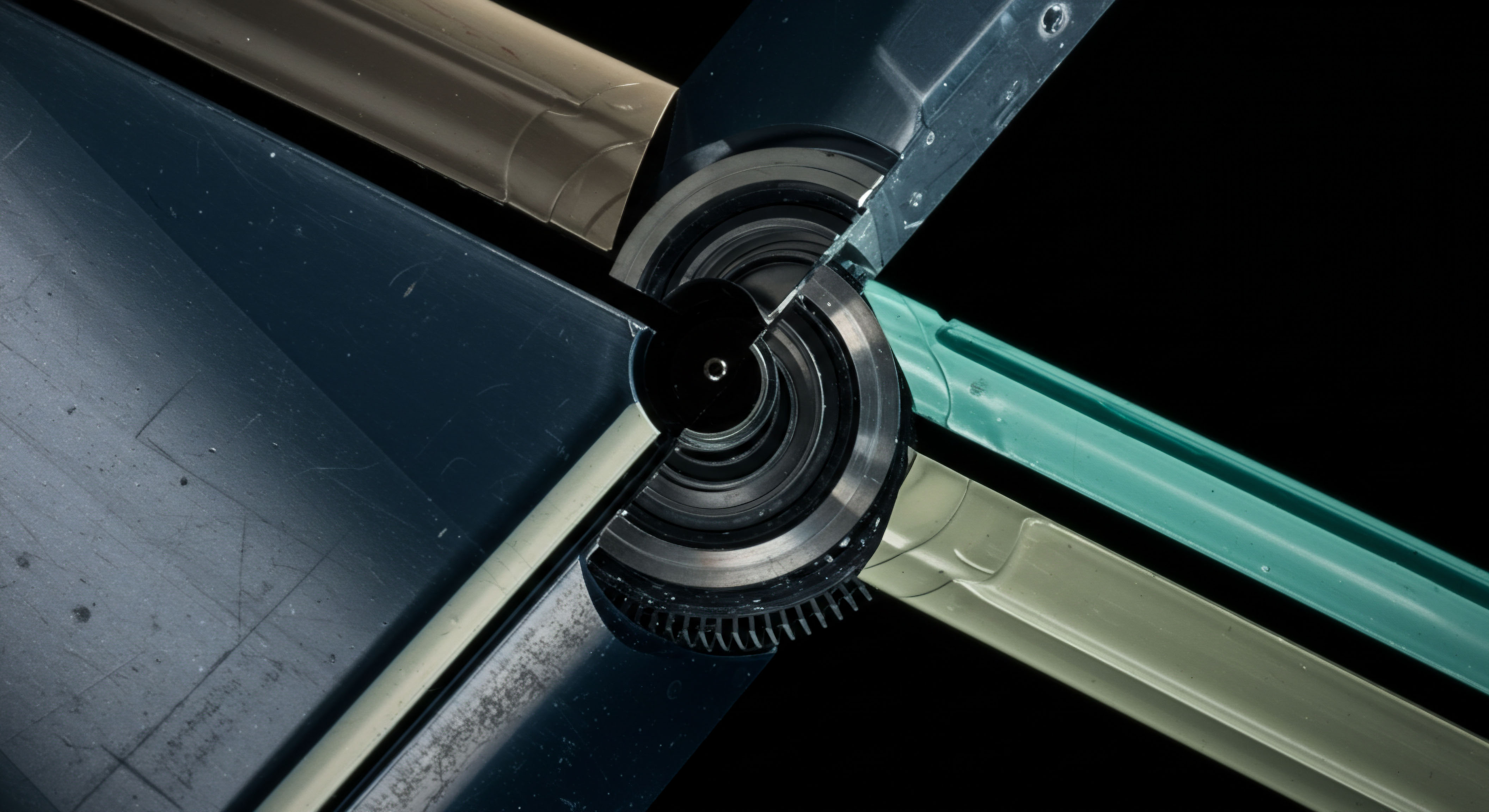

Options spreads and complex multi-leg positions inherently require simultaneous execution across various strike prices and expiries. RFQ systems excel in this area, allowing traders to request a single quote for an entire spread. This capability eliminates leg risk, where individual components of a spread might fill at unfavorable prices.

Securing a single, executable price for a complex structure, such as an ETH collar, streamlines the trading process. This approach ensures the desired risk-reward profile of the strategy remains intact from inception. Traders gain confidence in their entry points, knowing the entire position is acquired at a transparent, pre-negotiated rate.

Precision execution is paramount.

Here are key elements of options execution within an RFQ environment:

- Anonymous Price Discovery ▴ Submitting an RFQ without revealing identity protects trade intent.

- Consolidated Liquidity ▴ Accessing multiple market makers from a single interface streamlines sourcing.

- Customizable Orders ▴ Specifying complex multi-leg structures within a single request simplifies execution.

- Reduced Market Impact ▴ Large orders receive quotes without affecting public order book dynamics.

- Transparent Pricing ▴ Receiving competitive, firm quotes before execution ensures clarity on costs.

Systemic Edge Amplification

Advancing beyond foundational understanding, the strategic deployment of RFQ in crypto options cultivates a systemic edge. This involves integrating execution insights into broader portfolio construction and volatility management. It transforms individual trade advantages into a consistent, compounding force for returns.

Volatility trading, for example, becomes a realm of heightened opportunity. Structuring complex volatility trades, such as synthetic long or short positions, benefits immensely from RFQ’s ability to source precise pricing for various components. This enables traders to express nuanced market views with greater accuracy and less slippage.

A trader might consider how the efficiency gained from RFQ execution alters their overall capital allocation strategy. Does superior execution allow for larger position sizing within defined risk parameters, or does it free up capital for deployment in other uncorrelated assets? The questions extend beyond a single trade to the very fabric of portfolio design. This deep consideration highlights the ongoing intellectual demands of market leadership.

Developing a comprehensive framework for managing execution risk complements this approach. Understanding the empirical distribution of RFQ fill rates and price improvements allows for more accurate post-trade analysis. This feedback loop continuously refines execution parameters, further sharpening a trader’s market acumen.

Mastery of this domain translates directly into enhanced alpha generation, moving past mere transactional efficiency to a truly optimized trading enterprise.

The Unseen Lever

The pursuit of superior outcomes in crypto options trading demands more than intuition; it requires a deep engagement with the mechanisms that govern market interaction. Command over execution quality, particularly through sophisticated methods, serves as a silent, yet powerful, lever for performance. This capability shapes the very trajectory of investment returns, distinguishing casual participation from deliberate, professional engagement. Future market dynamics will continue to reward those who prioritize systemic advantage, recognizing that true edge stems from a refined operational cadence.