Mastering Liquidity’s Hidden Channels

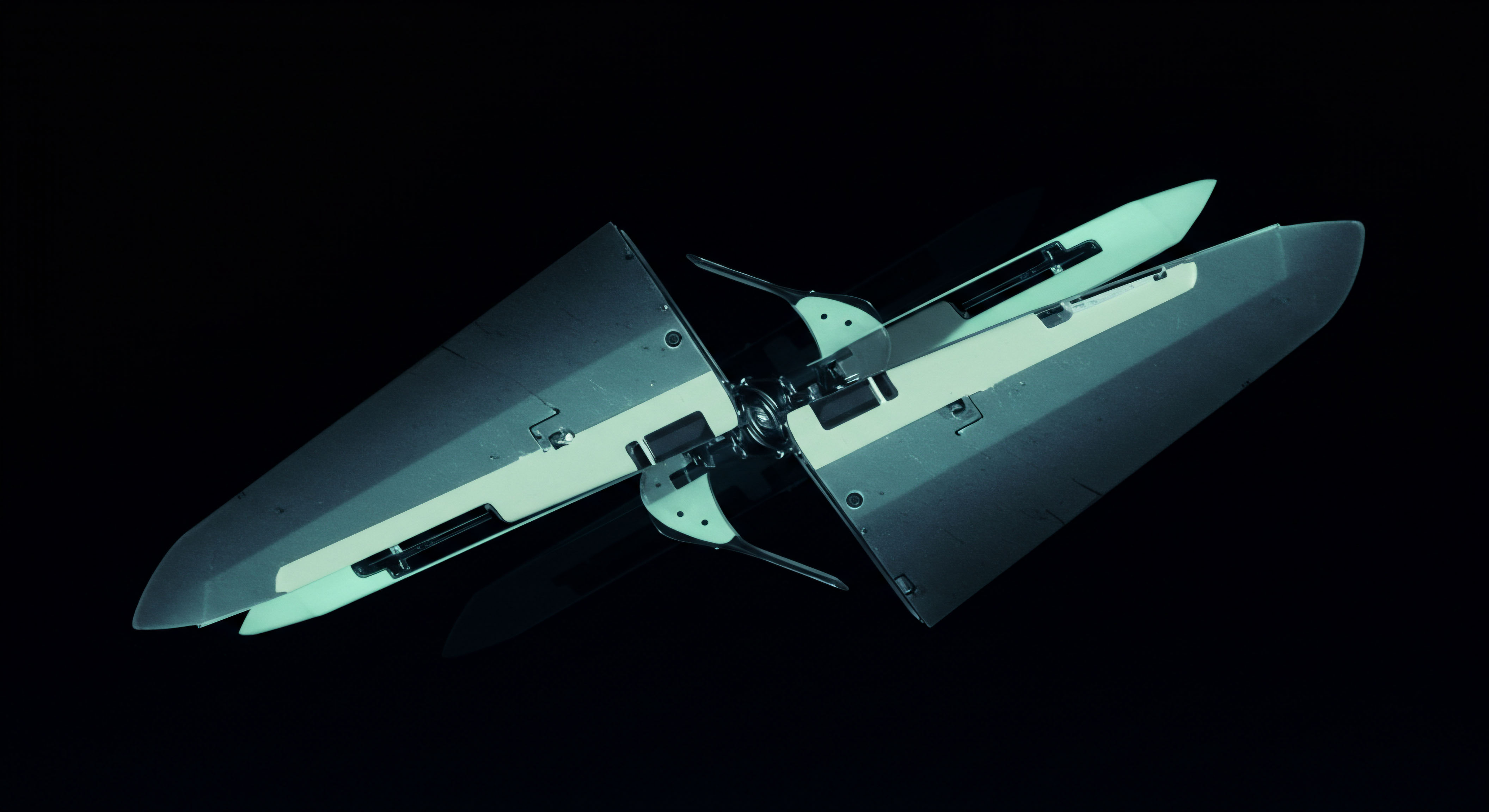

Superior execution in the volatile crypto options market commences with a foundational understanding of its underlying mechanisms. Professional traders recognize that significant capital deployment demands an execution methodology transcending standard exchange order books. This realization directs attention toward block trading, a sophisticated approach allowing for the discreet placement of substantial orders.

The inherent fragmentation of liquidity across various venues presents a constant challenge for large-scale operations. Overcoming this requires a direct, efficient method for sourcing competitive pricing without incurring undue market impact. Such a method enables participants to command liquidity on their own terms, securing favorable pricing for substantial positions.

An advanced mechanism for achieving this involves direct engagement with multiple liquidity providers simultaneously. This direct interaction facilitates the discovery of optimal pricing for large option positions, minimizing the potential for adverse price movements. A trader gains a distinct advantage by accessing deep pools of capital, bypassing the typical slippage associated with public order books.

Achieving best execution in crypto options block trades requires a direct conduit to multi-dealer liquidity, bypassing market impact.

Understanding this mechanism means appreciating its capacity to significantly reduce transaction costs. Every basis point saved on a large block trade compounds into substantial alpha over time. This efficiency stems from the ability to solicit bids and offers from multiple professional counterparties, fostering a competitive environment for execution.

This foundational knowledge establishes the groundwork for a more assertive stance in the market. It positions the discerning trader to leverage a tool specifically designed for the demands of institutional-grade trading. Recognizing these dynamics equips one with the clarity required to move beyond reactive trading, embracing a proactive approach to capital deployment.

Strategic Capital Allocation for Market Advantage

Deploying capital effectively within crypto options markets necessitates a calculated approach to block trading. This section details actionable strategies, translating foundational understanding into tangible market outcomes. Successful execution hinges upon precision in structuring trades and selecting optimal venues for price discovery.

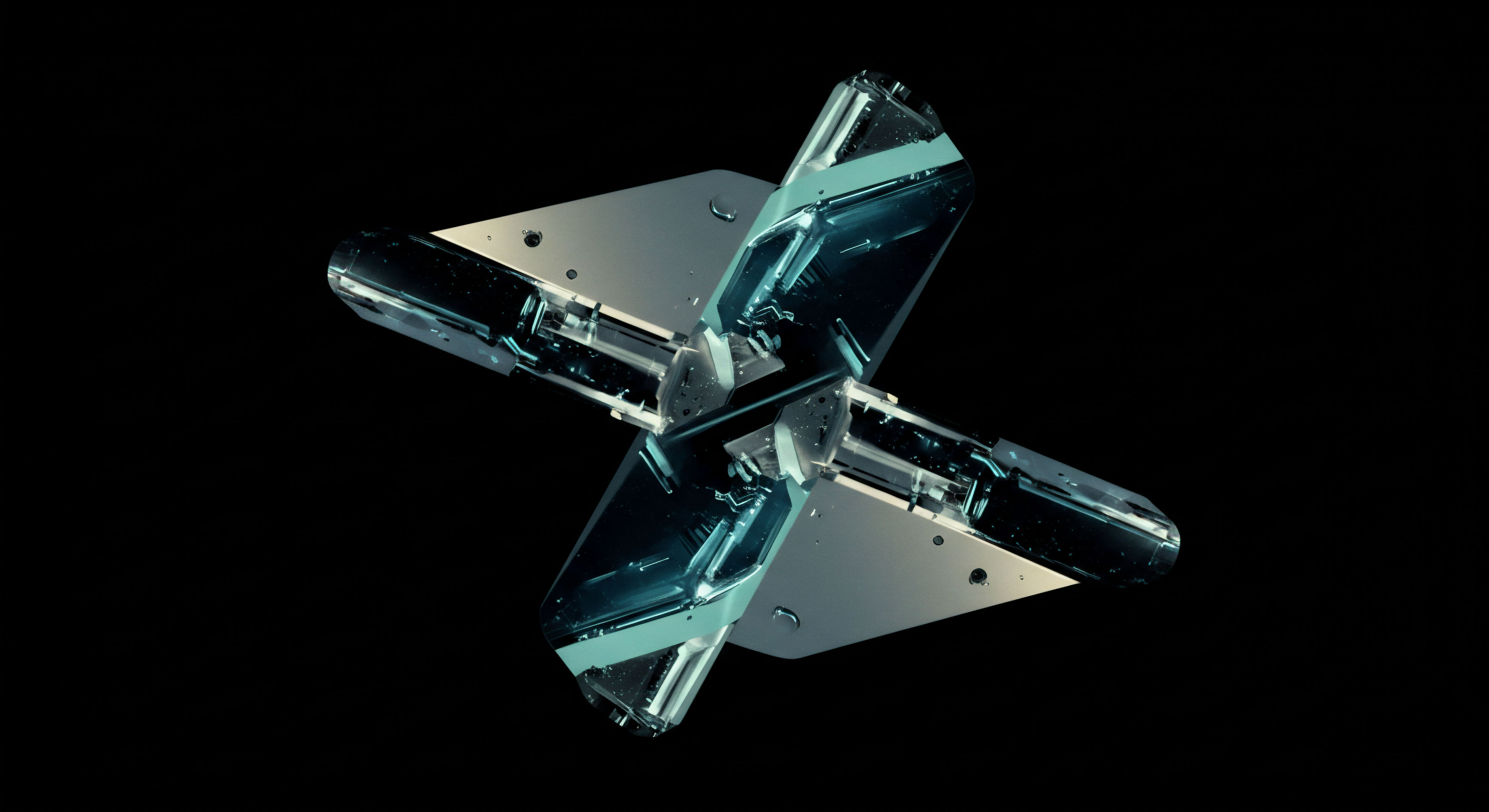

Consider the tactical application of options spreads. A vertical spread, for instance, can capitalize on directional views with defined risk parameters. Executing such a spread as a block trade ensures that both legs fill simultaneously at a predetermined differential, removing leg risk inherent in fragmented public markets. This coordinated execution secures the intended risk-reward profile with unwavering certainty.

Orchestrating Complex Positions

Multi-leg options strategies, such as straddles or collars, represent sophisticated tools for expressing volatility views or managing existing exposures. A straddle, capturing expected price movement without a strong directional bias, benefits immensely from block execution. This method ensures both the call and put components transact at advantageous prices, preserving the intended implied volatility profile.

Optimizing Collars for Portfolio Hedging

Collars, a common hedging technique, involve selling an out-of-the-money call and buying an out-of-the-money put against a long asset position. This defines a profit range and limits downside risk. Executing this as a single block transaction across multiple dealers provides superior pricing for all three components, effectively lowering the cost of protection while optimizing the upside cap.

- Identify a specific market view (directional, volatility-based, or hedging).

- Select the appropriate multi-leg options structure (e.g. vertical spread, straddle, collar).

- Consolidate the entire trade into a single block order for simultaneous execution.

- Engage multiple professional liquidity providers to solicit competitive pricing.

- Analyze received quotes for minimal slippage and optimal fill rates, prioritizing overall cost efficiency.

The comparative advantage of block trading for these structures becomes evident when evaluating transaction costs. Data consistently shows that direct, multi-dealer engagement reduces effective spreads and minimizes price impact for larger orders. This quantifiable edge directly translates into enhanced returns for the astute capital manager.

Direct engagement with multiple liquidity providers for block trades consistently yields superior pricing and reduced slippage across complex options structures.

Furthermore, the anonymity afforded by block trading channels prevents market signaling. Large orders executed on public venues can alert other participants, leading to adverse price movements. The private nature of block transactions preserves alpha by concealing trading intentions, a critical element for any substantial position. This discrete approach safeguards the integrity of one’s trading thesis.

Cultivating Portfolio Dominance

Moving beyond individual trade execution, the strategic integration of block trading capabilities shapes a more resilient and alpha-generating portfolio. This advanced perspective considers how this mechanism influences overall portfolio construction, risk attribution, and long-term market positioning. Mastery involves a holistic view of capital deployment.

The ability to execute large, complex options positions with precision allows for finer control over portfolio sensitivities. Managing delta, gamma, vega, and theta across an entire book becomes a more exact science when execution quality for individual components is consistently high. This enables portfolio managers to adjust exposures dynamically, responding to evolving market conditions with surgical accuracy.

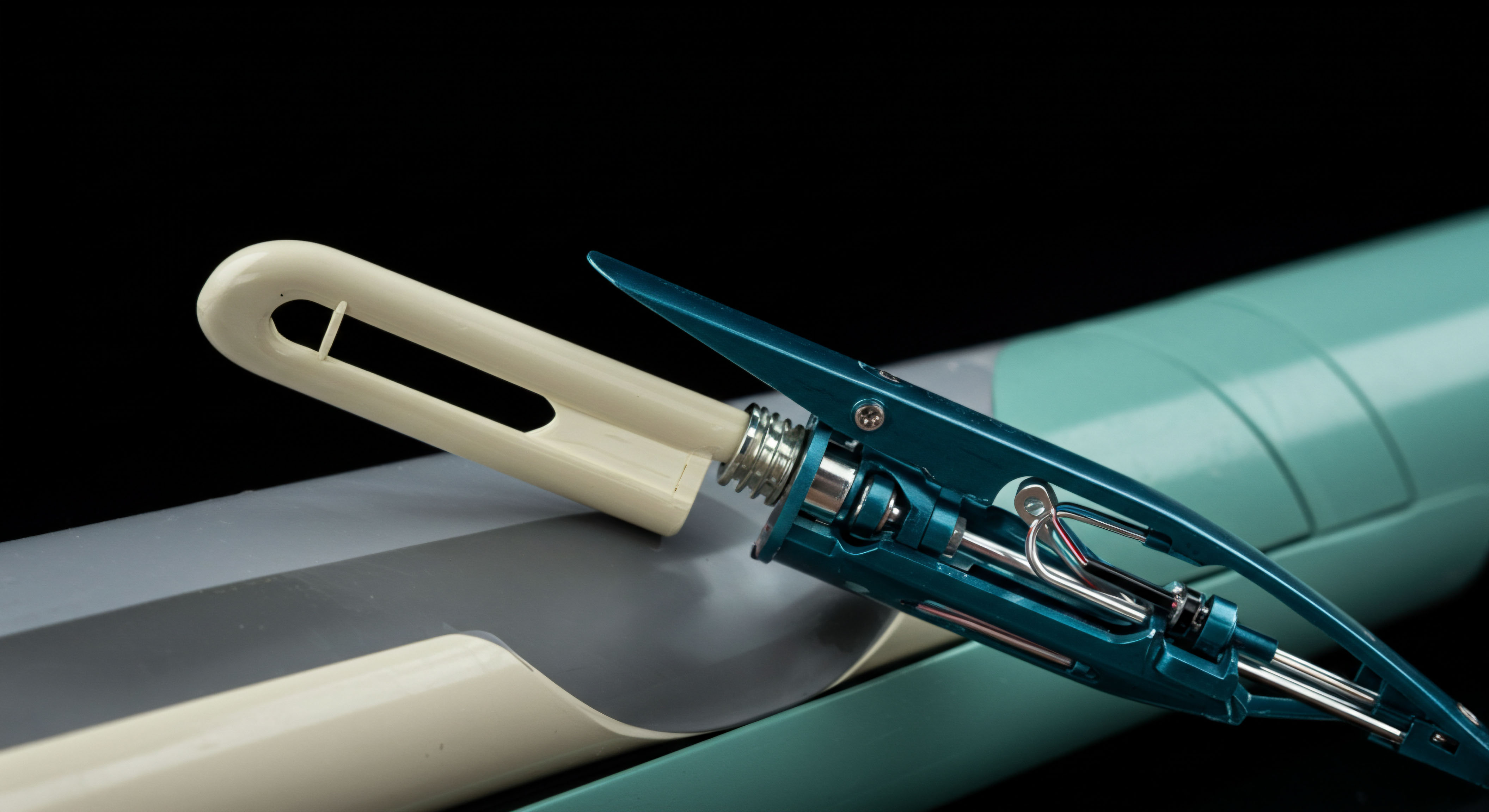

Aggregating Multi-Dealer Liquidity

Advanced practitioners leverage platforms that aggregate liquidity from numerous institutional dealers. This creates a virtual order book of unparalleled depth, ensuring that even the largest block trades find optimal counterparty matches. The sophistication lies in the technology that seamlessly compiles and presents these quotes, allowing for rapid decision-making under pressure.

Algorithmic Execution within Private Channels

Some sophisticated trading operations deploy proprietary algorithms within these private block trading channels. These algorithms analyze real-time market data, liquidity provider behavior, and internal risk parameters to optimize execution timing and sizing. This fusion of human strategic intent with automated precision represents the apex of trading technology. Such systems continuously learn from market interactions, refining their execution logic over time.

The enduring edge derived from these capabilities extends beyond immediate cost savings. It lies in the capacity to implement sophisticated strategies that would otherwise be impractical or prohibitively expensive on open exchanges. This includes the execution of bespoke, over-the-counter (OTC) options, tailored precisely to unique risk management requirements or idiosyncratic market views. The ability to source and execute these customized instruments offers a distinct competitive advantage.

Navigating these advanced applications demands a rigorous risk management framework. Each block trade, particularly for complex derivatives, must be analyzed within the context of the overall portfolio’s value-at-risk (VaR) and stress test scenarios. Continuous monitoring of counterparty exposure and market liquidity remains paramount. A disciplined approach ensures that strategic gains are preserved against unforeseen market dislocations.

Mastering these aspects allows for a commanding presence in highly liquid markets. The relentless pursuit of superior execution distinguishes the enduring capital manager.

Commanding Your Capital Trajectory

The journey toward market mastery represents a continuous process of refinement and strategic adaptation. Understanding the dynamics of block trading in crypto options fundamentally reshapes one’s engagement with capital markets. It moves the conversation from merely participating to actively shaping execution outcomes, establishing a new standard for performance. This proactive stance defines the future of sophisticated capital deployment.

Every decision regarding execution, from the smallest spread to the largest multi-leg block, contributes to the overall trajectory of capital growth. The tools and techniques discussed represent not endpoints, but rather powerful accelerators on this path. Traders capable of harnessing these capabilities demonstrate an unwavering commitment to operational excellence. This commitment yields enduring market advantage.

Glossary

Capital Deployment

Crypto Options

Block Trading