Execution Command in Crypto Options

Achieving market superiority in crypto options demands an unwavering focus on execution command. Sophisticated traders understand that the path to consistent alpha lies in controlling every variable of a trade, moving beyond speculative entries to embrace a systemic approach. Precision trading in this dynamic arena hinges on leveraging specialized mechanisms that grant unparalleled control over liquidity and pricing.

A Request for Quote (RFQ) system represents a fundamental tool in this pursuit, enabling participants to solicit competitive bids and offers from multiple liquidity providers simultaneously. This direct engagement fosters a transparent environment, allowing for price discovery tailored to specific order sizes and instrument complexities. The ability to command liquidity on one’s terms becomes a distinct market advantage.

Block trading, often facilitated through RFQ mechanisms, allows for the execution of substantial options positions without unduly influencing public order books. This strategic method safeguards against adverse price impact, a persistent concern when deploying significant capital in nascent markets. Professional traders recognize the imperative of executing large orders with minimal footprint, preserving the integrity of their strategic intent.

Mastering RFQ and block trading transforms crypto options from a reactive gamble into a disciplined exercise of market command.

Understanding the interplay between RFQ and block trading illuminates a clear pathway for disciplined capital deployment. It introduces a structured methodology for price discovery and execution that prioritizes efficiency and discretion. This foundational comprehension equips traders with the initial mental models necessary for navigating the complexities of advanced derivatives.

Strategic Capital Deployment

Deploying capital effectively in crypto options requires a methodical application of advanced execution tools. The Alpha-Focused Portfolio Manager identifies specific market conditions and aligns them with a chosen options structure, ensuring every trade reflects a precise directional or volatility view. This involves more than simply selecting an option; it demands a comprehensive approach to pricing and liquidity sourcing.

Optimizing Liquidity Sourcing

Engaging multi-dealer liquidity through an RFQ ensures a competitive landscape for your orders. This competitive tension frequently yields tighter spreads and improved fill rates, directly impacting your cost basis. Observing how different liquidity providers respond to varied RFQ parameters provides valuable insight into prevailing market depth and institutional interest.

- Define your precise options leg or multi-leg strategy.

- Specify desired size and tenor with clarity.

- Submit RFQs across a diverse pool of vetted liquidity providers.

- Evaluate quoted prices against internal fair value models.

- Execute with the provider offering the most favorable terms, considering both price and execution certainty.

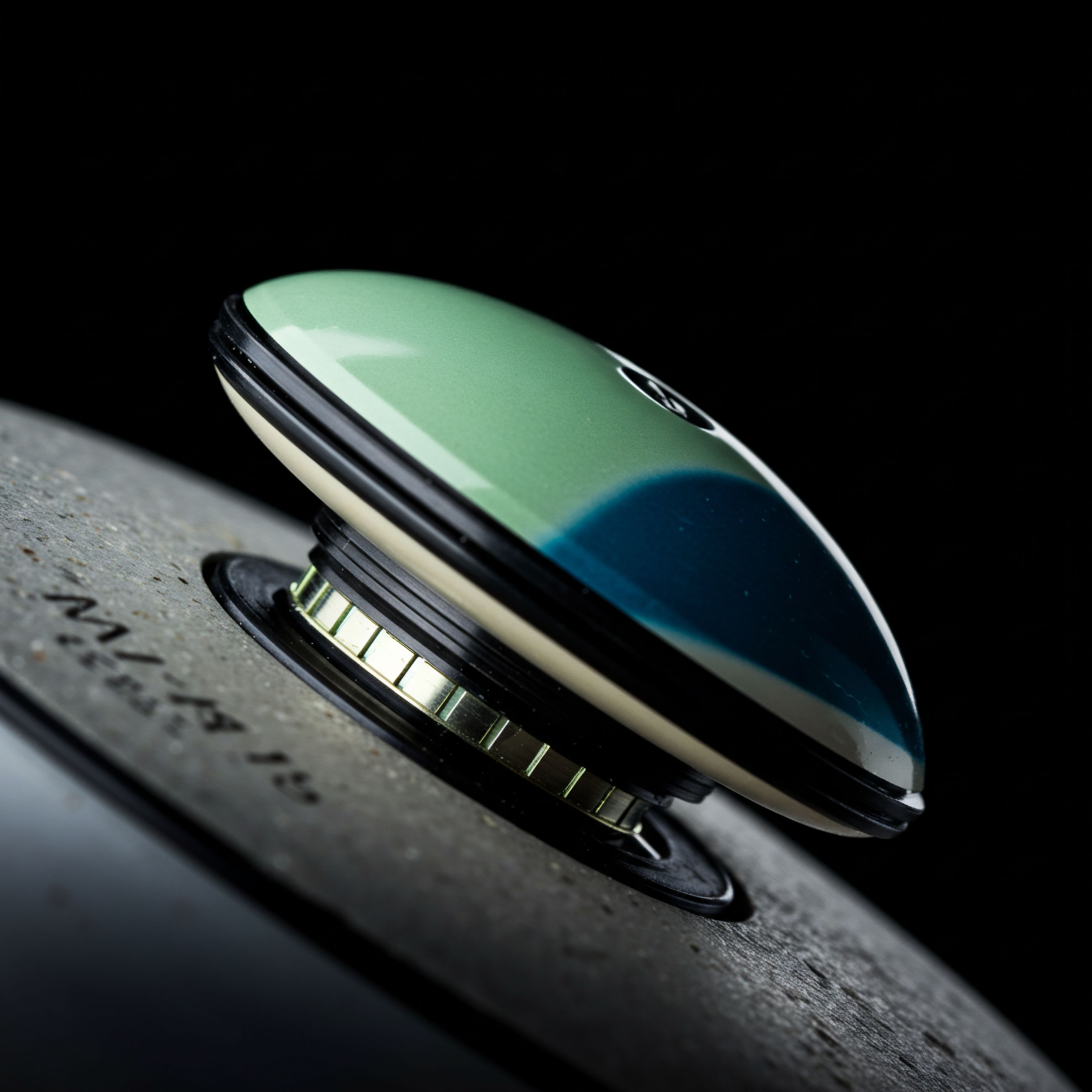

Structuring Bitcoin Options Blocks

Executing large Bitcoin options blocks through RFQ channels minimizes slippage and preserves trade intent. A strategist might deploy a BTC Straddle Block to capitalize on anticipated volatility around a major event, knowing the block trade will absorb the volume without signaling their position prematurely. The ability to transact substantial notional value discretely represents a significant edge.

ETH Collar RFQ for Hedging

Consider an ETH Collar RFQ for managing directional risk on a substantial Ethereum holding. This involves simultaneously selling an out-of-the-money call option and buying an out-of-the-money put option, typically with the same expiration. Executing this as a multi-leg RFQ ensures the entire spread trades as a single package, mitigating leg risk and securing a predefined risk-reward profile. The combined execution offers a systemic approach to portfolio protection.

Precision in execution translates directly into superior risk-adjusted returns across your crypto options portfolio.

The disciplined application of these strategies reinforces the trader’s command over market dynamics. It shifts the focus from reactive responses to proactive strategic deployment, anchoring decisions in quantifiable outcomes. This deliberate approach shapes a consistent, repeatable framework for investment success.

Advanced Strategic Integration

Elevating one’s trading acumen involves seamlessly integrating precision execution methods into a comprehensive portfolio strategy. The Alpha-Focused Portfolio Manager continually seeks next-level edges, understanding that market mastery extends beyond individual trades to encompass systemic advantage. This means viewing RFQ and block trading not as isolated tactics, but as foundational elements within a sophisticated operational framework.

Volatility Block Trade Dynamics

Advanced traders deploy volatility block trades to express nuanced views on implied volatility without taking outright directional exposure. A large block trade on a Bitcoin options volatility swap, for instance, allows for efficient hedging or speculation on the future path of volatility itself. Executing such a complex instrument through a dedicated RFQ ensures the integrity of the pricing and minimizes market impact, a critical consideration for capturing fleeting volatility edges.

The ability to anonymize options trading within these private execution channels safeguards strategic intent. This discretion becomes paramount when positions are substantial, preventing front-running or adverse price movements driven by market awareness of large orders. Preserving anonymity grants a significant tactical advantage, allowing for the true expression of a market view without external interference.

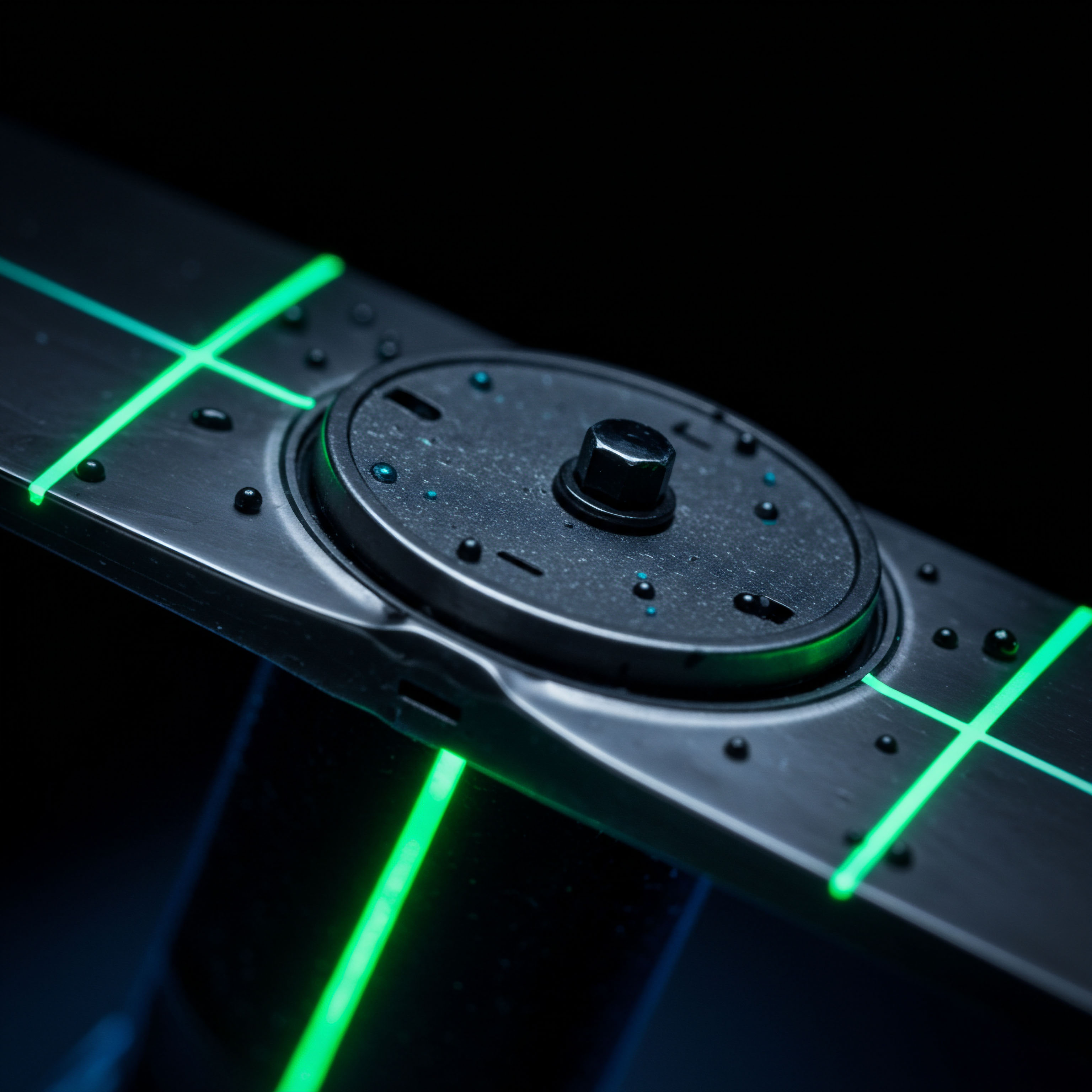

Multi-Leg Execution Precision

Mastering multi-leg execution through RFQ protocols represents a pinnacle of options trading sophistication. Consider constructing complex options spreads such as iron condors or butterfly spreads for finely tuned exposure to specific price ranges and volatility levels. The integrated nature of RFQ for these multi-leg structures guarantees simultaneous execution, eliminating the inherent risks associated with legging into positions on disparate order books. This unified approach offers both efficiency and control.

Sophisticated multi-leg execution within RFQ environments unlocks unprecedented control over complex options strategies.

This strategic approach to crypto options transforms the market from a chaotic environment into a landscape of engineered opportunities. It demands a commitment to understanding the mechanics of execution as deeply as the underlying market drivers. Such mastery positions the trader to consistently extract value, building a robust, alpha-generating portfolio that stands apart.

Commanding Your Market Future

The journey into precision crypto options trading reshapes one’s entire engagement with financial markets. It calls for a relentless pursuit of operational excellence, a commitment to understanding the subtle interplay between strategy and execution. Envision a trading future where every position taken, every hedge deployed, and every block executed reflects a deliberate act of market command. This disciplined approach builds enduring market presence.

This elevated form of trading transcends mere price action, focusing on the systemic advantages derived from superior tools and frameworks. It is a path for those who seek to engineer their outcomes, to move beyond reactive trading into a realm of proactive strategic mastery. The market awaits those prepared to seize control.

Glossary

Crypto Options

Multi-Dealer Liquidity

Btc Straddle Block

Eth Collar Rfq