Execution Dynamics

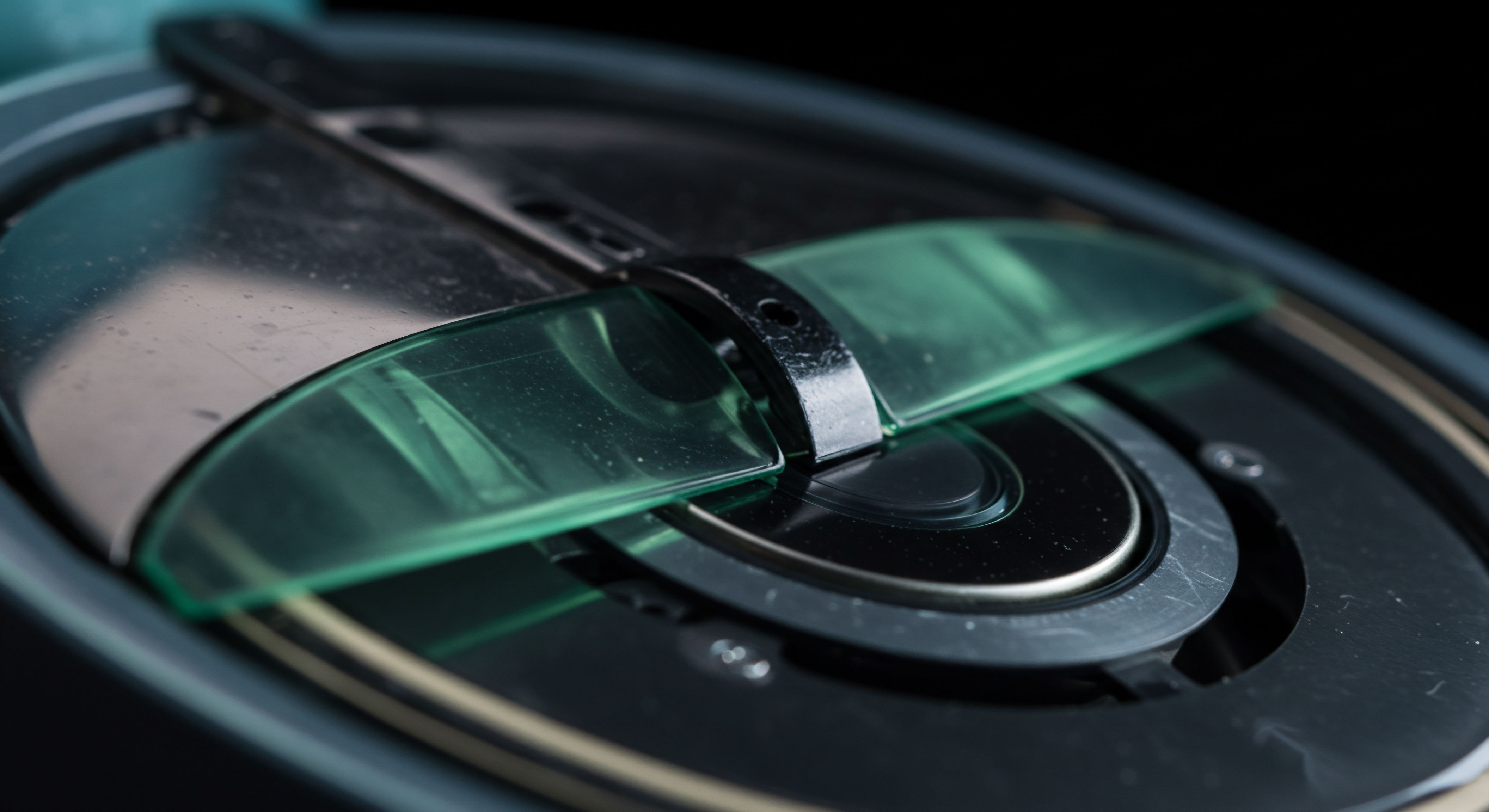

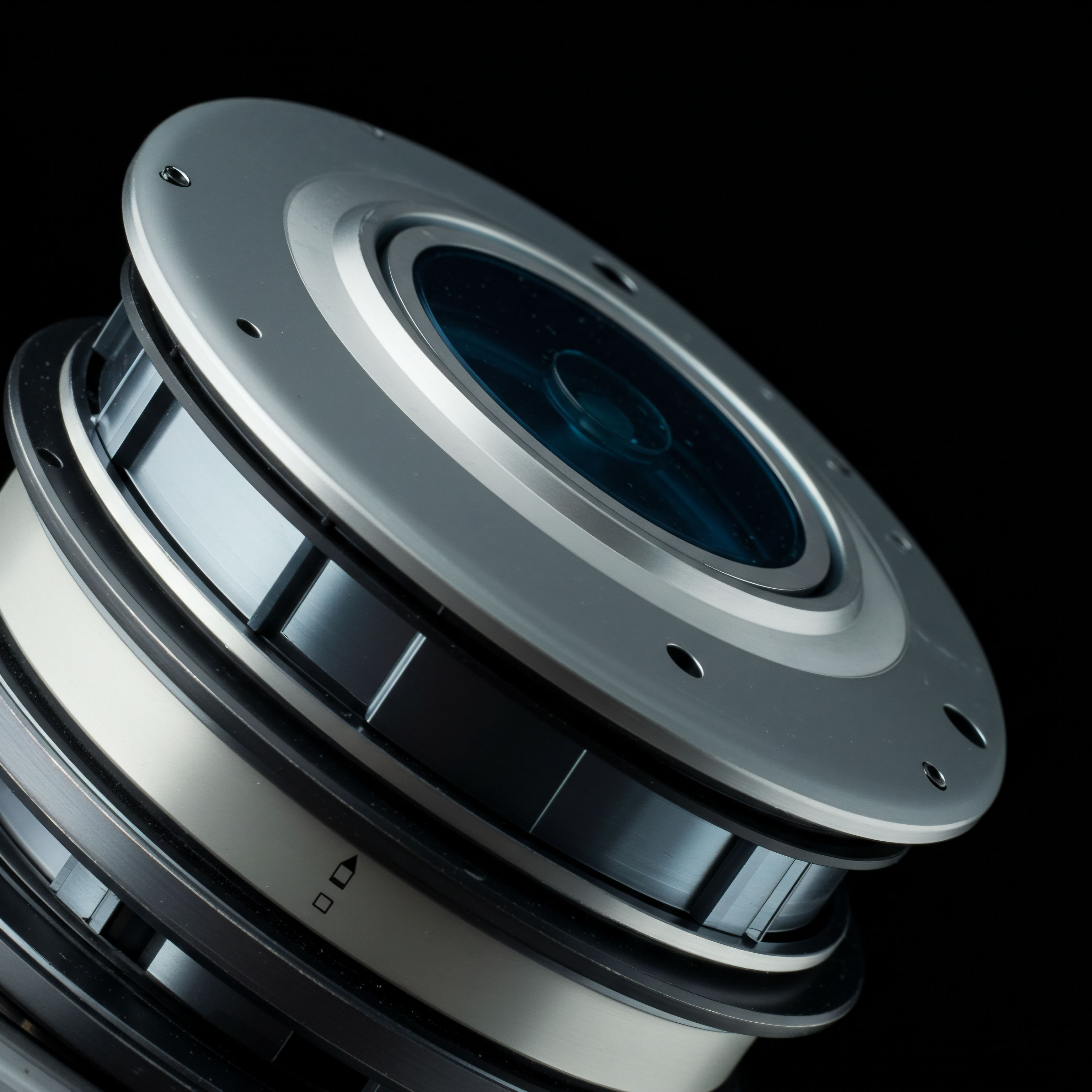

Atomic crypto options represent a powerful advancement in market execution, redefining how sophisticated participants engage with digital asset derivatives. This innovative approach directly addresses the challenges of liquidity fragmentation inherent in volatile crypto markets. Understanding the underlying mechanisms of Request for Quote (RFQ) execution reveals a pathway to superior price discovery and anonymity for significant positions.

The intricate dynamics of decentralized and centralized venues, however, often obscure the precise liquidity available, demanding a focused understanding of execution dynamics. RFQ systems streamline this process, allowing traders to solicit competitive quotes from multiple dealers simultaneously. This direct interaction ensures transparent pricing and minimizes information leakage, securing optimal terms for each transaction.

RFQ systems empower traders to command liquidity, securing superior pricing and anonymity for substantial crypto options positions.

Mastering this direct negotiation process transforms the execution of complex strategies. It moves beyond mere order placement, offering a strategic lever for market participants. The ability to anonymously gauge market depth and secure bespoke pricing elevates trading outcomes, positioning individuals for consistent advantage in a rapidly evolving financial landscape.

Strategic Options Deployment

Executing substantial positions requires a direct approach to market impact mitigation. Block trading within the RFQ framework provides a robust method for securing optimal fills, preserving alpha for large-scale operations. This systematic engagement with liquidity providers ensures your intentions remain private while accessing the deepest available pricing.

Block Trading Advantages

Leveraging block trades through an RFQ system allows for the discreet execution of significant orders. This method prevents adverse price movements often associated with large public orders, maintaining the integrity of your strategic intent. Participants gain the ability to move substantial capital without signaling their position to the broader market, a distinct advantage in competitive environments.

Multi-Leg Options Structures

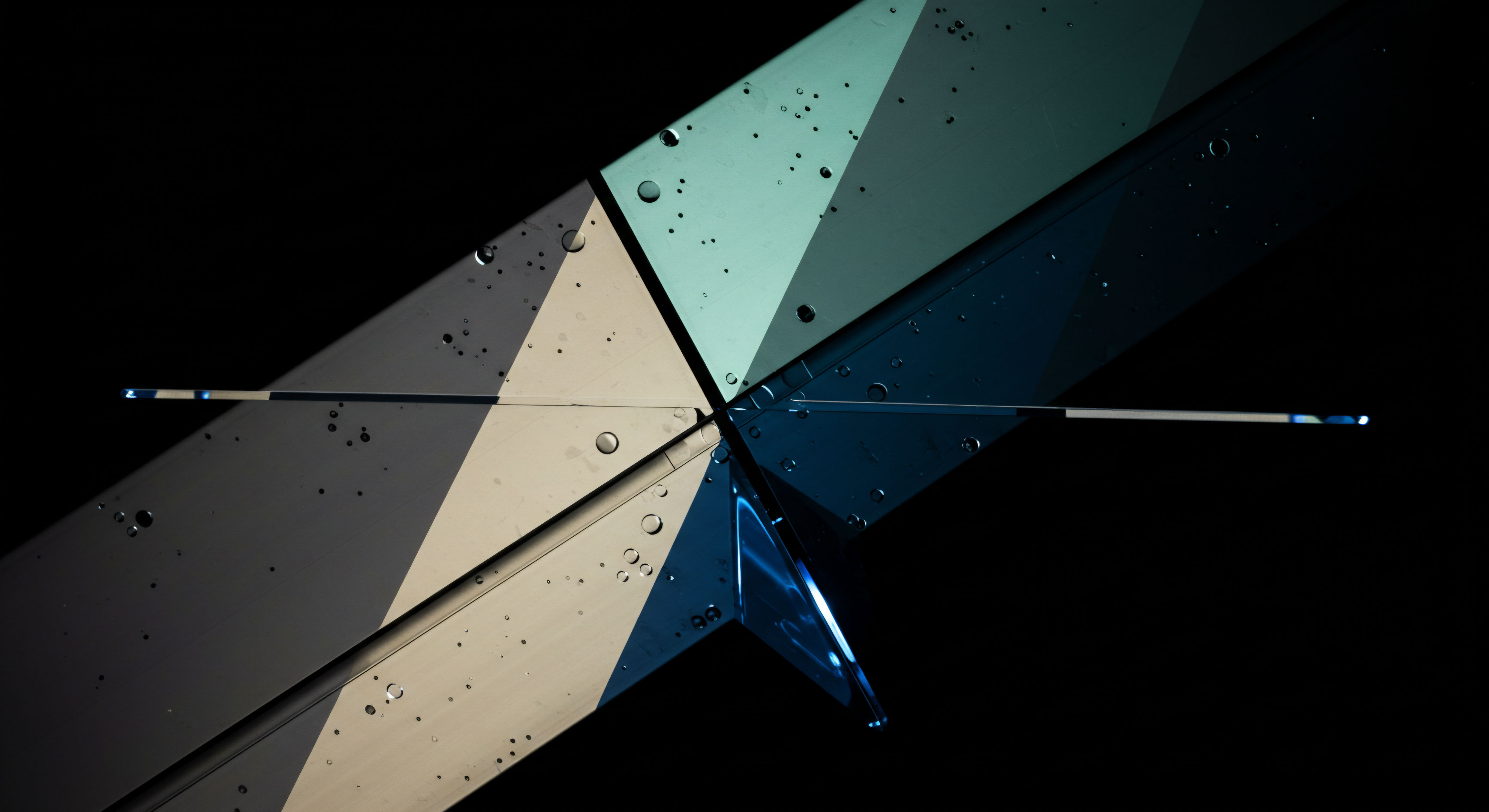

Constructing multi-leg options strategies demands precision in execution across all components. RFQ capabilities extend to complex structures, enabling simultaneous pricing and execution of spreads, straddles, and collars. This coordinated approach mitigates leg risk and ensures the entire strategy is implemented at a single, cohesive price point, aligning perfectly with your market view.

- Define the precise multi-leg structure and desired expiry.

- Submit the RFQ to a network of qualified dealers.

- Evaluate competitive quotes, considering implied volatility and spread tightness.

- Execute the entire complex position as a single, atomic transaction.

Volatility Capture Strategies

Atomic options facilitate precise engagement with volatility shifts. Traders can employ specific options combinations to capitalize on anticipated movements in implied volatility, whether through outright variance trades or more complex vega-hedged positions. The RFQ mechanism ensures accurate pricing for these intricate volatility exposures, optimizing entry and exit points.

Execution is paramount.

Each strategy demands rigorous attention to capital allocation and risk parameters. Understanding the quantifiable impact of slippage and fill rates on overall portfolio performance guides selection of the most effective execution path. This methodical application of advanced tools translates directly into enhanced risk-adjusted returns.

Advanced Portfolio Command

Integrating atomic options into a comprehensive portfolio strategy transcends individual trade execution, becoming a force multiplier for alpha generation. This demands a sophisticated understanding of how these instruments interact with existing holdings and broader market exposures. We aim for systemic enhancement of return profiles.

Sophisticated Risk Management

Deploying advanced options strategies necessitates a dynamic risk management framework. Employing stress testing and scenario analysis for complex options books reveals potential vulnerabilities under extreme market conditions. The objective remains a robust defense against unforeseen shifts, preserving capital while optimizing for growth opportunities.

Alpha Generation Integration

The strategic deployment of atomic crypto options contributes directly to overall portfolio alpha. This involves identifying specific market inefficiencies where precise options execution provides a measurable edge. Consider using options to synthetically adjust delta, manage tail risk, or generate income from underlying holdings, all executed with professional-grade efficiency.

The future of crypto derivatives involves continuous innovation in execution venues and liquidity provision. Mastering atomic options today positions traders at the forefront of this evolution, ready to capitalize on new market structures as they emerge. This sustained advantage requires constant refinement of execution practices and an unwavering commitment to operational excellence.

Command Your Market Future

The pursuit of superior market outcomes remains an enduring challenge. Precision Trading Mastering Atomic Crypto Options offers a definitive path for those committed to a professional-grade approach. It transforms market engagement into a strategic discipline, allowing individuals to shape their financial destiny with decisive action and unparalleled execution quality. The true mastery lies in the consistent application of these advanced tools, turning every market interaction into a calculated advantage.