Commanding Liquidity Execution

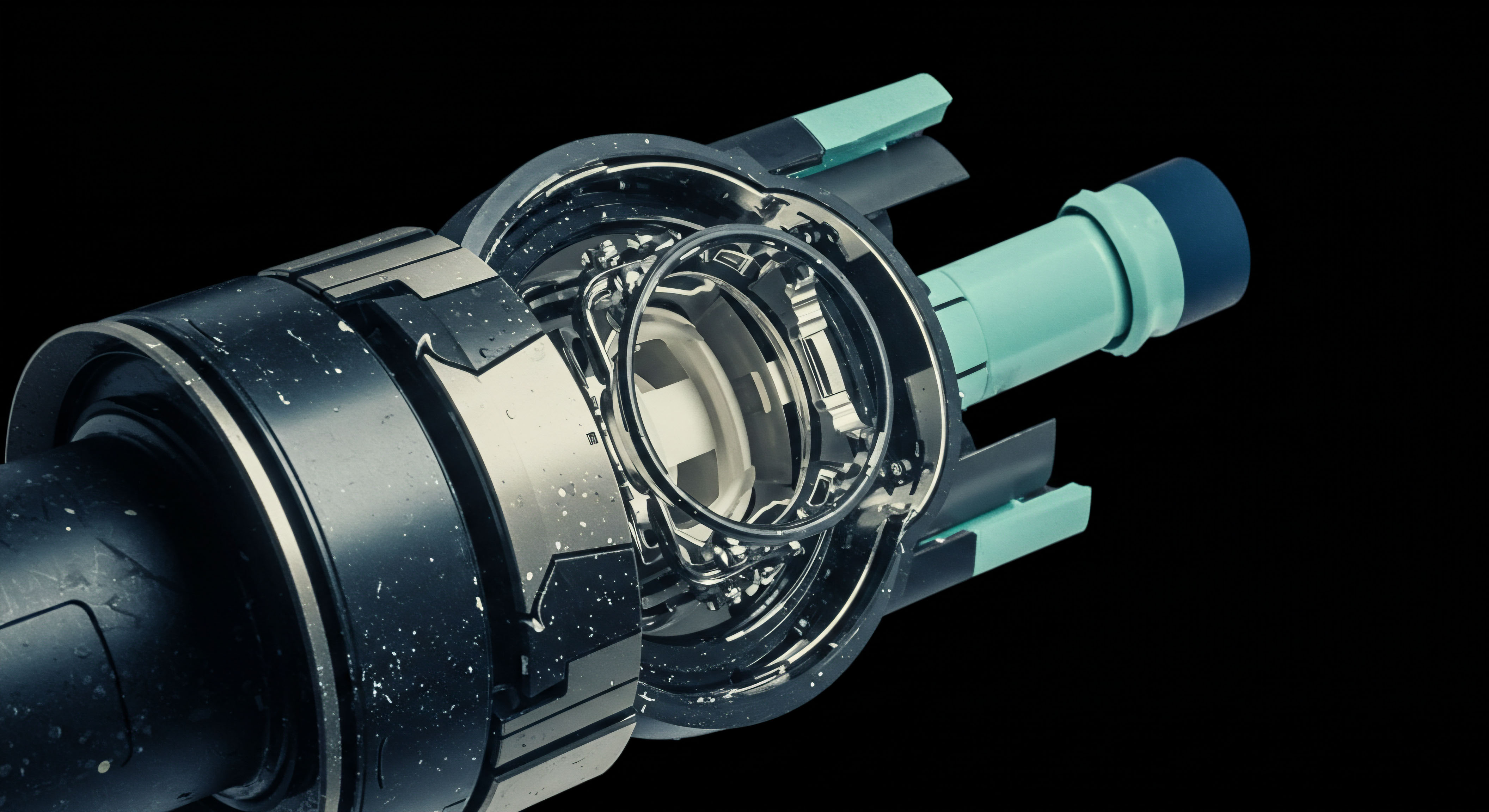

Precision trading in digital asset markets demands an execution framework that transcends conventional spot transactions. Request for Quote (RFQ) strategies offer a direct conduit to institutional-grade liquidity, allowing participants to dictate terms for significant positions. This mechanism fundamentally reshapes how large block trades and complex options structures are priced and cleared, moving beyond fragmented order books to a more controlled environment.

It represents a direct negotiation channel with multiple liquidity providers, ensuring competitive pricing and minimized market impact for substantial volumes. Understanding its core mechanics establishes a critical foundation for superior market engagement.

RFQ strategies provide a direct channel to institutional liquidity, enabling superior execution for substantial crypto positions.

The RFQ process functions as a private auction, inviting bids and offers from a curated group of market makers. This contrasts sharply with public order books, where large orders often incur significant slippage due to insufficient depth. Through an RFQ, a trader broadcasts their intent to transact a specific crypto asset, an options contract, or a multi-leg spread, without revealing their identity to the broader market.

Liquidity providers then submit firm quotes, reflecting their best price for the specified size. This direct engagement fosters an environment where pricing reflects genuine supply and demand dynamics, free from the immediate volatility of public exchanges.

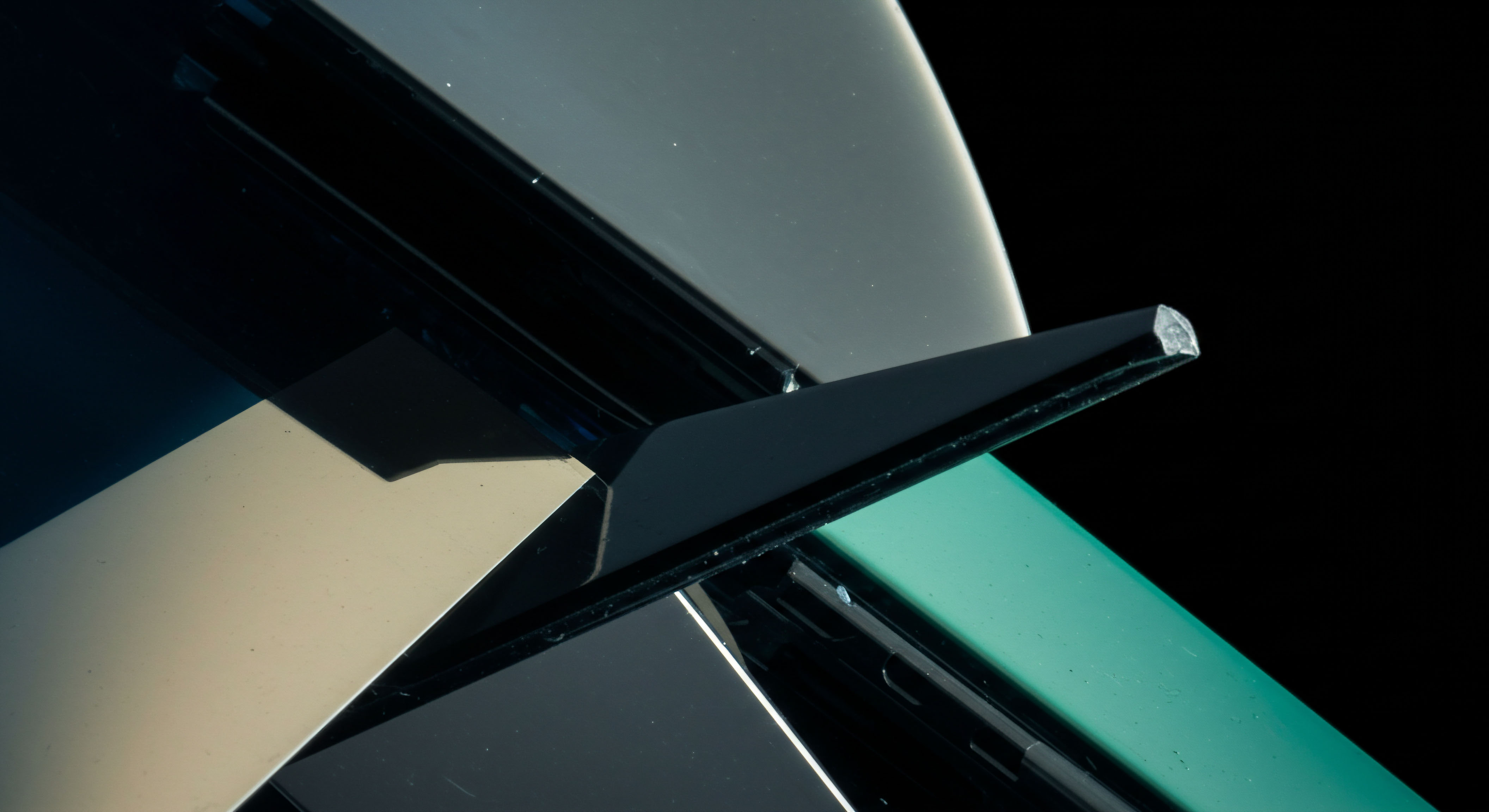

Implementing an RFQ strategy requires a clear understanding of its inherent advantages. It allows for the execution of large orders with minimal footprint, preserving the intended price discovery. Furthermore, it facilitates the trading of exotic options or bespoke structures that may lack deep liquidity on standard exchanges.

The ability to secure firm pricing from multiple counterparties before execution represents a powerful lever for optimizing transaction costs. This systematic approach to sourcing liquidity transforms a reactive market participation into a proactive engagement, where a trader actively shapes their execution outcome.

Deploying RFQ for Strategic Returns

Capitalizing on RFQ strategies demands a disciplined approach, integrating them into a broader investment framework focused on risk-adjusted returns. The application extends across various asset classes within the crypto domain, from large-cap spot assets to intricate options spreads. This section outlines actionable strategies, providing a pragmatic roadmap for traders seeking to leverage RFQ capabilities.

Block Trading Spot Assets

Executing substantial spot positions through an RFQ minimizes market impact. When deploying capital into Bitcoin or Ethereum, a direct RFQ allows for a single, consolidated execution at a pre-negotiated price. This bypasses the need to slice orders into smaller clips, which can inadvertently signal market intent and drive prices unfavorably. Securing a firm quote across multiple providers ensures best execution, translating directly into enhanced entry or exit points for significant holdings.

Consider the immediate advantage. A large order placed on a public exchange often faces a thin order book, forcing execution through multiple price levels. An RFQ consolidates this liquidity, offering a single, aggressive price. This strategic deployment preserves capital efficiency, a critical component of alpha generation in volatile markets.

Options RFQ for Volatility Management

Crypto options markets present unique opportunities for volatility speculation and hedging. RFQ becomes indispensable for constructing complex options positions, particularly multi-leg spreads. Traders can request quotes for strategies such as straddles, collars, or butterflies across various strike prices and expiries. This capability allows for precise expression of market views or robust portfolio protection.

Executing these strategies on a public exchange can introduce significant leg risk, where individual components of a spread fill at disparate prices. An RFQ mitigates this by providing a single, all-inclusive price for the entire spread. This ensures the intended risk-reward profile of the strategy remains intact upon execution.

- BTC Straddle Block Execution ▴ Requesting a combined bid/offer for a Bitcoin straddle (simultaneous purchase of a call and a put with the same strike and expiry) through RFQ guarantees atomic execution, removing leg risk.

- ETH Collar RFQ ▴ Implementing an Ethereum collar (buying a put, selling a call, holding the underlying) to hedge downside exposure while generating income becomes streamlined. The RFQ ensures the spread’s components execute as a single unit.

- Volatility Block Trade ▴ Large directional bets on implied volatility, often involving multiple options series, gain significant precision through RFQ, securing optimal pricing from competing market makers.

Accuracy matters.

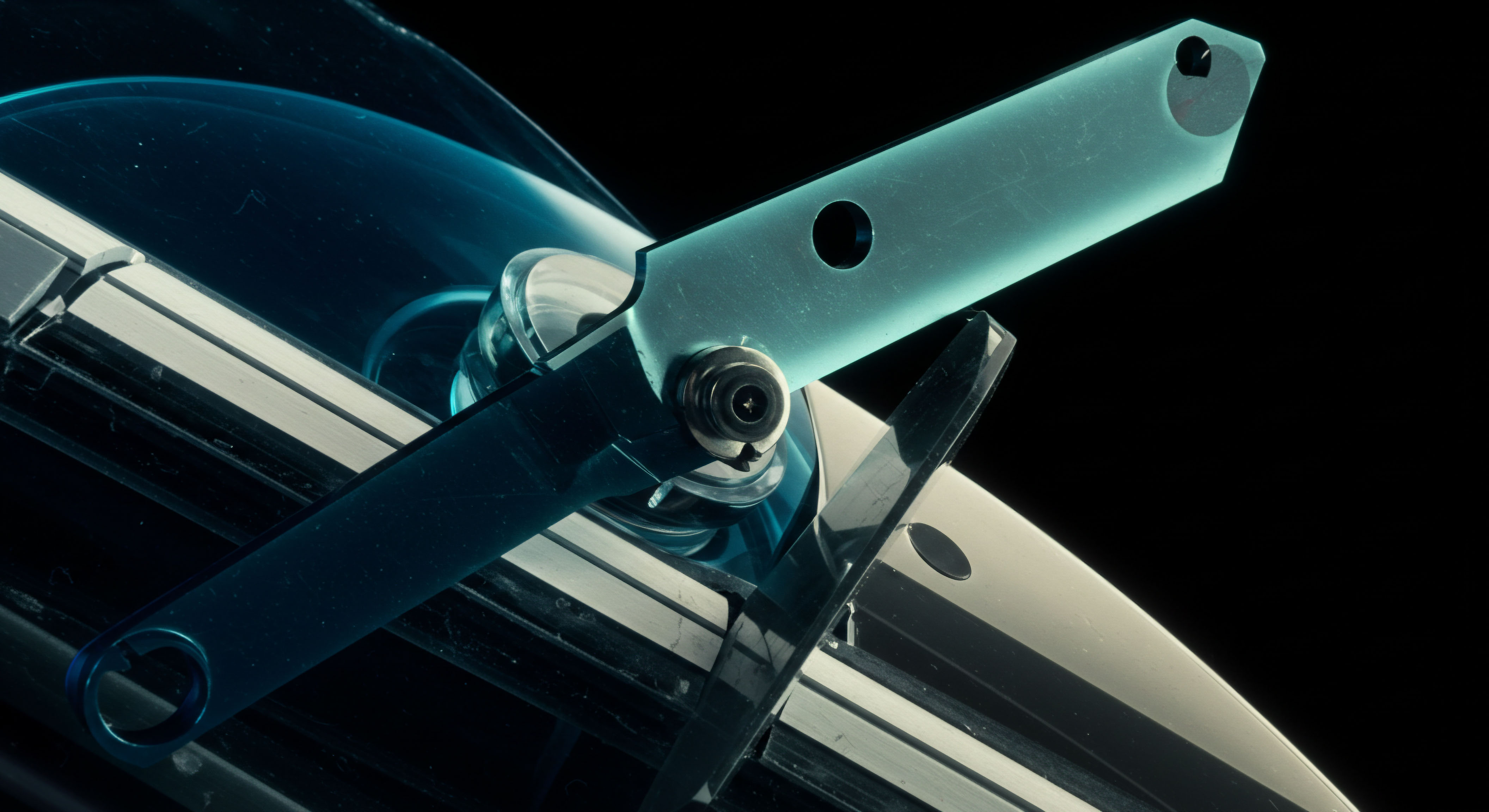

Multi-Leg Execution for Advanced Spreads

Advanced options traders frequently employ multi-leg strategies to fine-tune their exposure to price, volatility, and time decay. An RFQ simplifies the complex logistics of executing these structures. By requesting a single quote for a three- or four-leg spread, the trader receives a consolidated price, eliminating the sequential execution risk inherent in traditional methods. This strategic advantage translates into superior control over the trade’s P&L dynamics.

The ability to anonymously solicit quotes for intricate options combinations protects the trader’s strategic intent. Liquidity providers compete to offer the best price for the complete package, optimizing the entry cost for sophisticated strategies. This operational efficiency is a hallmark of professional trading desks.

Mastery beyond Execution

True mastery of RFQ strategies extends beyond efficient execution; it encompasses their integration into a holistic portfolio management framework, building a sustainable market edge. This involves leveraging RFQ for sophisticated risk management, optimizing capital deployment, and continually refining execution parameters.

Strategic Portfolio Integration

Integrating RFQ capabilities into a broader portfolio strategy elevates overall performance. For instance, a fund managing substantial crypto holdings can utilize RFQ for rebalancing, minimizing the market impact of large asset allocations. Furthermore, options RFQ enables the precise construction of delta-neutral strategies or the dynamic hedging of directional exposures, providing granular control over portfolio risk metrics. This systematic application of RFQ ensures that every transaction contributes positively to the overarching investment objective, optimizing risk-adjusted returns.

Consider the compounding effect of consistently achieving superior execution. Over time, the cumulative savings on slippage and transaction costs, facilitated by RFQ, significantly enhance portfolio alpha. This operational discipline forms the bedrock of long-term success in high-velocity markets.

Advanced Risk Management through RFQ

RFQ strategies offer a potent tool for advanced risk management, extending beyond simple trade entry. Traders can use RFQ to liquidate large, illiquid options positions with minimal price dislocation. This becomes especially critical during periods of heightened market stress, where public order books might evaporate. Securing firm quotes from multiple dealers provides a reliable exit mechanism, preserving capital during adverse market movements.

Moreover, RFQ facilitates the rapid deployment of crisis hedges. Imagine a sudden market downturn requiring immediate downside protection. An options RFQ allows for the swift, efficient acquisition of protective puts or the establishment of bear spreads, ensuring timely risk mitigation. This proactive stance on risk control differentiates robust trading operations.

The strategic deployment of RFQ for hedging complex options portfolios, particularly those involving multi-asset exposures, presents an intricate challenge. It requires a nuanced understanding of cross-asset correlations and the ability to synthesize multiple RFQ responses into a cohesive risk reduction strategy. This process demands a keen analytical mind, constantly evaluating the marginal benefit of each potential quote against the aggregate portfolio risk. Such a sophisticated approach moves beyond simple transaction management, evolving into a dynamic, real-time optimization of capital preservation and growth.

Refining Execution and Capital Efficiency

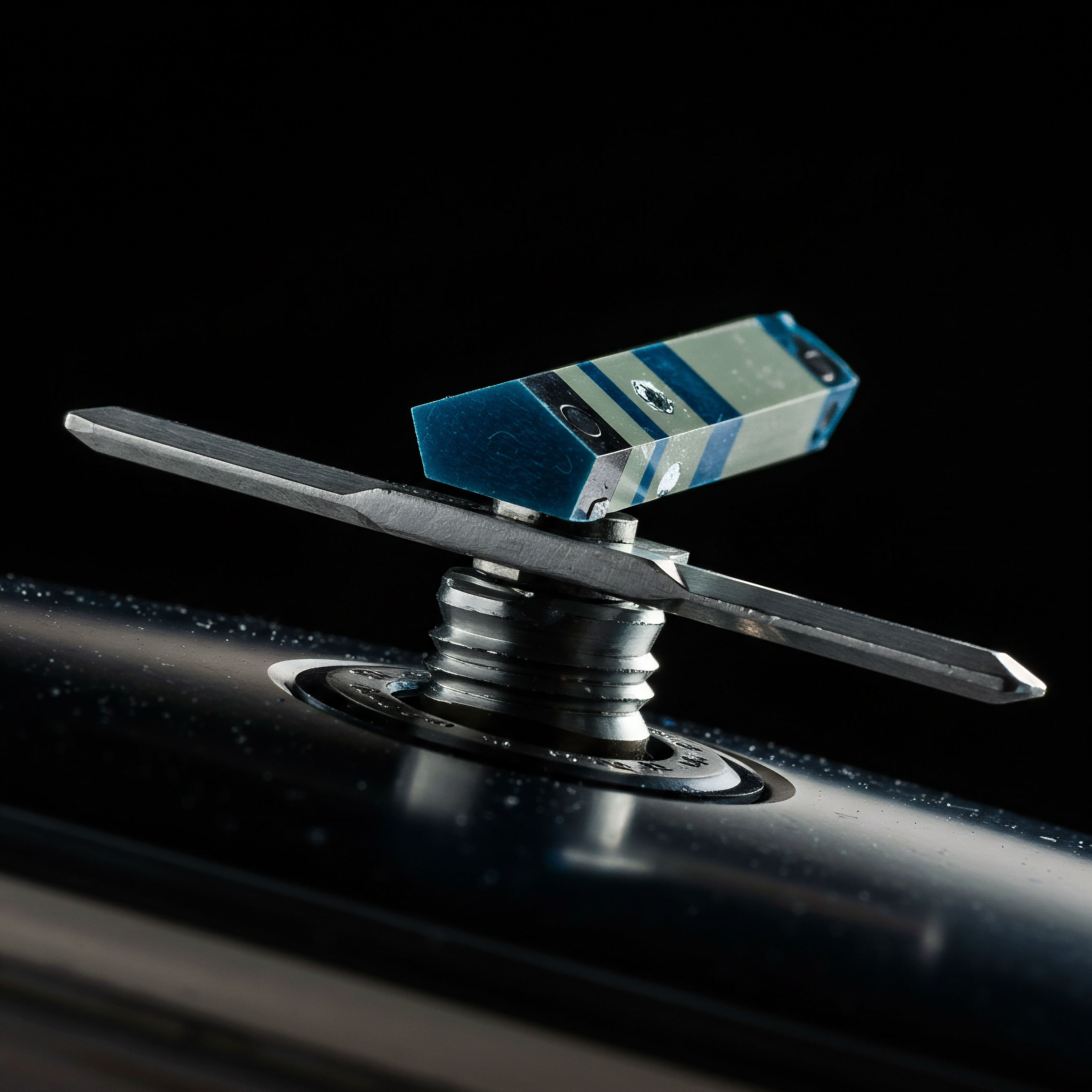

Continuous refinement of RFQ execution parameters drives further capital efficiency. This involves analyzing historical RFQ data to identify optimal liquidity providers, assessing quote competitiveness, and understanding the impact of various order types. Traders can fine-tune their RFQ requests, specifying tighter execution windows or preferred counterparties, to consistently achieve best execution. This iterative process of data-driven optimization ensures that the RFQ mechanism remains a sharp edge in a competitive landscape.

Ultimately, mastering RFQ transforms trading into a command of liquidity. It shifts the dynamic from reacting to market conditions to actively shaping execution outcomes. This proactive approach cultivates a robust, resilient trading methodology capable of navigating the complexities of digital asset markets with unparalleled precision.

The Unseen Advantage

The path to market leadership in crypto derivatives unfolds through strategic command of execution. Precision RFQ strategies represent a distinct advantage, a systematic method for asserting control over liquidity and pricing. It elevates trading beyond speculation, establishing a foundation of calculated opportunity and demonstrable edge. This capability empowers the astute trader to navigate complexity with confidence, transforming market dynamics into a field of engineered outcomes.

Glossary

Rfq Strategies

Best Execution

Btc Straddle Block

Eth Collar Rfq

Volatility Block Trade