Execution Foundations

Superior outcomes in crypto options demand a deliberate execution methodology. Market participants seeking an edge recognize the critical role of precision in liquidity aggregation and price discovery. This pursuit of exactitude guides many to the Request for Quote mechanism, a robust instrument for commanding liquidity and securing advantageous pricing.

Understanding the RFQ system reveals its fundamental operation. Participants broadcast their trading intentions to a select group of liquidity providers. These providers then compete, submitting tailored quotes for the desired options contracts. This structured competition fosters an environment where price discovery optimizes for the initiator, reducing potential market impact for substantial order flow.

The true measure of execution quality extends beyond the lowest quoted price at a given moment. It embraces the certainty of fill, the mitigation of information leakage, and the capacity to transact complex multi-leg strategies with seamless efficiency. The most effective execution frameworks consistently deliver these elements, transforming market participation into strategic advantage. For those dedicated to elevating their performance, mastering these foundational principles initiates the path toward market leadership.

Consistent outperformance in crypto options arises from commanding liquidity and precision in price discovery, driving strategic advantage.

Investment Strategies

Deploying advanced execution techniques transforms theoretical market understanding into tangible portfolio gains. The RFQ mechanism offers a distinct advantage for traders seeking to capture specific market views, securing superior pricing and reduced slippage. This segment outlines actionable strategies for integrating RFQ into your crypto options investment framework.

Volatility Trades Refined

Capturing implied volatility shifts demands a disciplined execution approach. RFQ provides a structured environment for acquiring or divesting complex volatility structures, ensuring competitive pricing across multiple liquidity providers.

Straddles and Strangles

Executing straddles or strangles, which profit from significant price movements regardless of direction, benefits immensely from RFQ. Traders submit their multi-leg order as a single package, compelling market makers to quote a unified price. This method reduces leg risk and secures a tighter overall spread, a direct pathway to superior entry points.

Collars for Asset Protection

Constructing an options collar provides a robust method for protecting long-held crypto assets against downside risk while generating income. Implementing a collar through RFQ ensures advantageous pricing for the combined purchase of an out-of-the-money put and the sale of an out-of-the-money call. The aggregated quoting process sharpens the cost basis for this defensive strategy.

Block Trade Execution

Transacting large volumes of crypto options requires a mechanism that absorbs substantial order size without disrupting market equilibrium. RFQ excels in this domain, providing a discreet and highly effective channel for substantial trades.

Large Order Efficiency

Institutional-sized block trades, particularly in less liquid crypto options, often encounter considerable price impact on open order books. An RFQ process addresses this by engaging dealers directly and privately. The resulting quotes reflect a deeper liquidity pool, enabling the execution of large orders with minimal footprint.

Multi-Leg Strategy Synthesis

Sophisticated multi-leg options strategies, such as condors or butterflies, present execution challenges on fragmented order books. Consolidating these intricate orders into a single RFQ request compels market makers to price the entire structure. This simplifies execution and yields superior pricing, making complex strategies genuinely feasible.

- Define clear trading objectives for each options strategy.

- Specify the desired strike prices, expiries, and quantities within the RFQ.

- Monitor multiple dealer responses for the most favorable aggregate pricing.

- Execute swiftly upon receiving an acceptable quote.

- Review post-trade analytics to refine future RFQ submissions.

Precision yields alpha.

Strategic Mastery

Elevating execution capabilities transforms tactical gains into a lasting, long-term market advantage. This section explores the sophisticated applications of RFQ within a comprehensive portfolio framework, detailing how to extend its utility beyond individual trades to systemic market command.

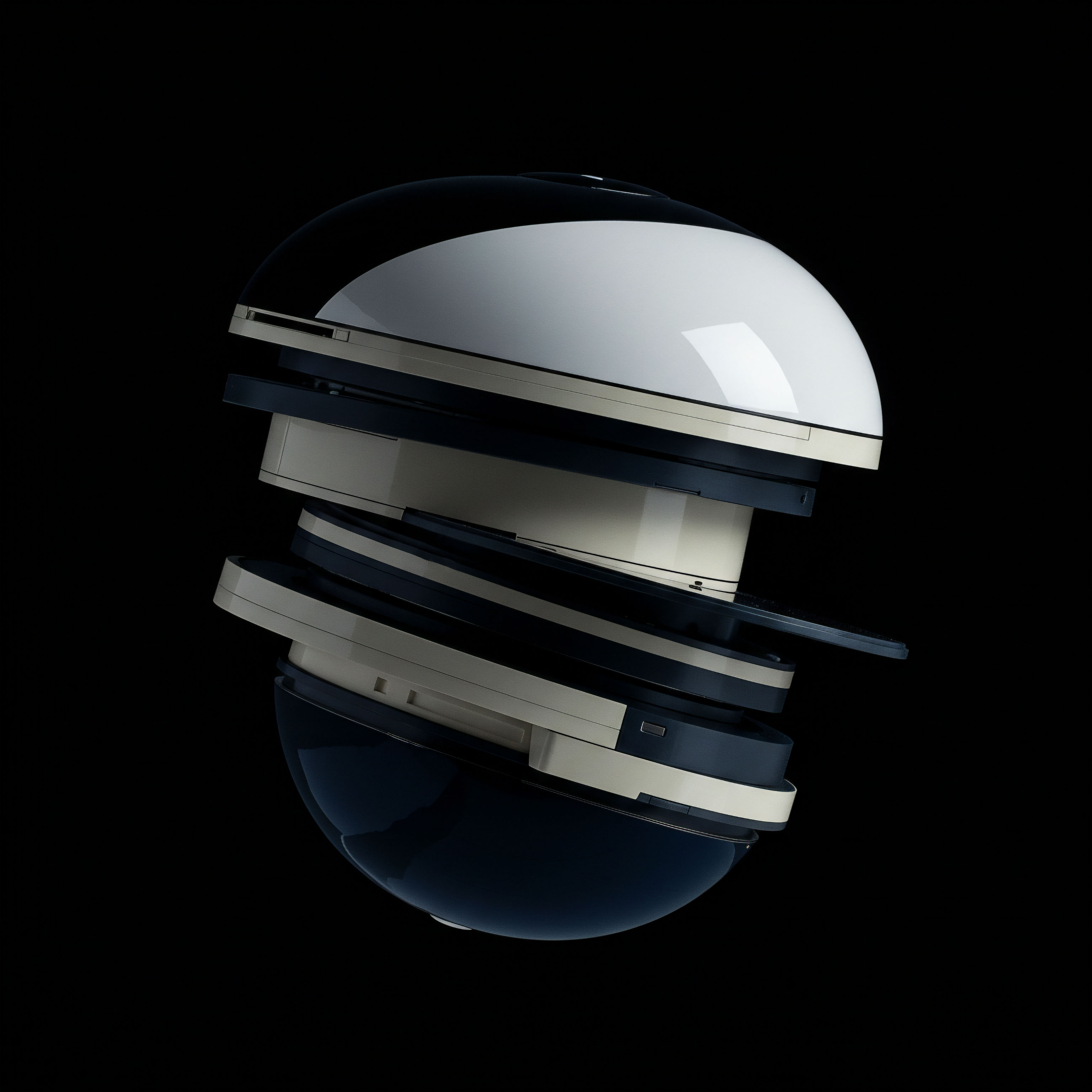

Portfolio Command

A strategic mindset views individual option trades as components within a larger portfolio structure. RFQ facilitates the construction and adjustment of these complex portfolios, providing precision in every rebalancing and hedging operation.

Proactive Hedging

Dynamic hedging strategies require rapid, precise adjustments to options positions in response to changing market conditions. Utilizing RFQ for these adjustments provides superior pricing for large or multi-leg hedges, maintaining desired risk exposures with heightened accuracy. This proactive stance shields capital from unforeseen market shifts.

Sustained Alpha Generation

Reliable alpha generation arises from repeatable processes and superior execution. RFQ supports this by providing a robust channel for transacting directional or relative value options strategies. The ability to source competitive pricing for bespoke structures directly contributes to the persistent outperformance of a trading book.

Advanced Risk Control

Mastering risk extends beyond simple position sizing. It involves anticipating extreme market events and employing sophisticated mechanisms to shield capital. RFQ holds a central role in deploying these advanced protective measures.

Extreme Event Protection

Tail risk events, characterized by low probability and high impact, demand specialized options strategies for protection. Constructing protective put spreads or purchasing far out-of-the-money options through RFQ secures advantageous acquisition of these insurance-like positions. The competitive quoting process reduces the cost of safeguarding against severe downturns.

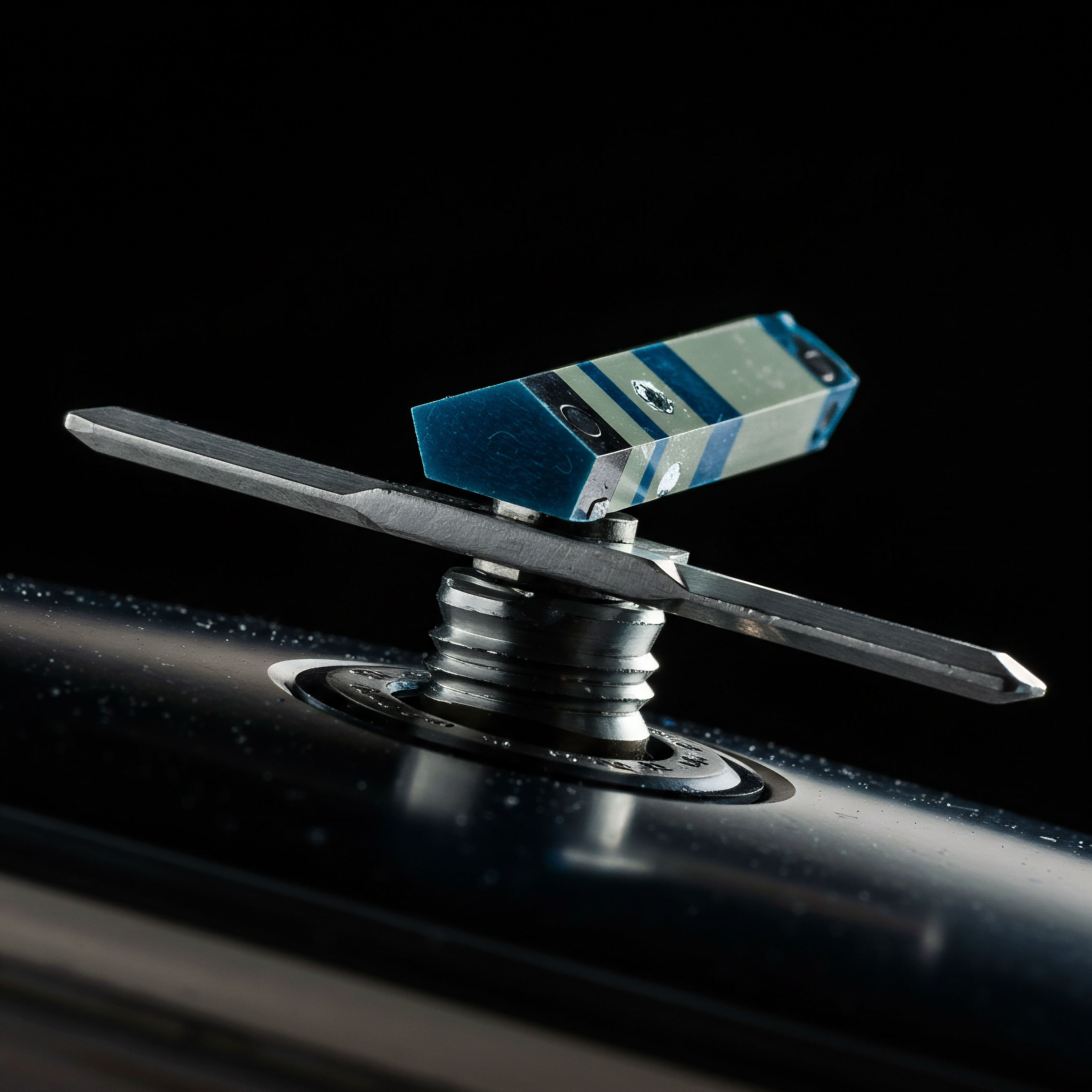

Automated Execution Systems

The convergence of RFQ with algorithmic trading systems represents the frontier of execution superiority. Algorithmic strategies can automatically generate RFQ requests for specific options trades, allowing for instantaneous price discovery and execution across multiple dealers. This seamless interplay delivers supreme speed and precision for high-frequency or complex quantitative strategies.

Algorithmic coordination with RFQ mechanisms delivers supreme speed and precision for high-frequency or complex quantitative strategies.

The Trader’s Immutable Edge

The journey from understanding execution fundamentals to commanding sophisticated options strategies signals a powerful transformation. Market dynamics constantly evolve, yet the principles of superior execution remain constant. Traders who embrace this continuous refinement develop a lasting advantage.

They traverse complexity with clarity, converting volatility into favorable positions, always extending the boundaries of what is possible in crypto derivatives. This unwavering pursuit of excellence defines the true market leader.

Glossary

Crypto Options