Mastering Price Discovery for Crypto Options

Achieving superior pricing in crypto derivatives demands a direct engagement with liquidity. Understanding the Request for Quote mechanism represents a fundamental step in securing optimal execution. This process allows participants to solicit bids and offers from multiple market makers simultaneously, centralizing competitive pricing for complex digital asset instruments.

A Request for Quote (RFQ) system streamlines the price discovery process for bespoke or large block trades. Participants submit their desired trade parameters, and a select group of liquidity providers respond with executable prices. This structured interaction provides a transparent view of market depth for specific instruments, ensuring competitive terms before trade commitment.

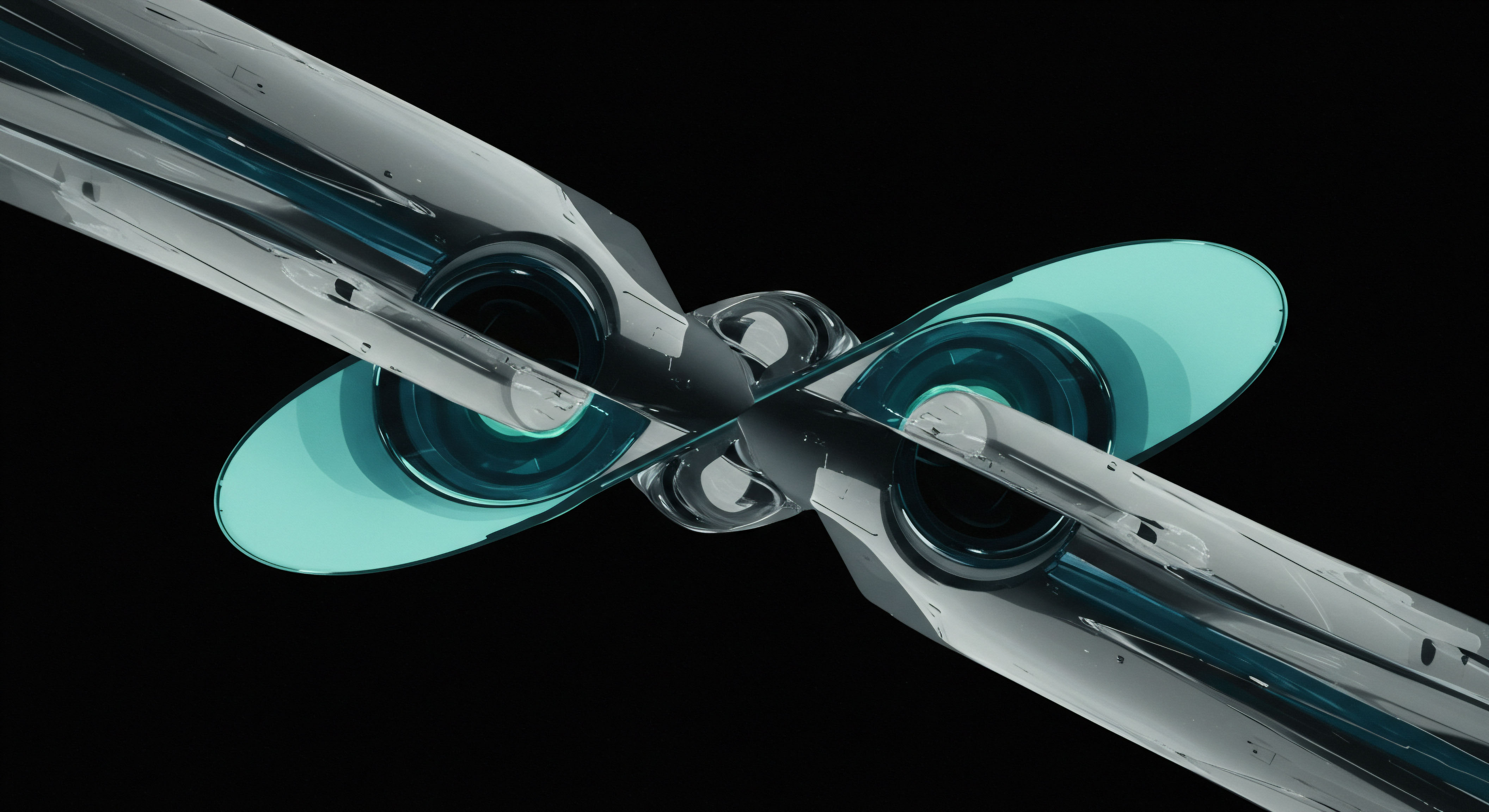

Direct engagement with liquidity through an RFQ system unlocks competitive pricing for crypto derivatives.

The inherent design of RFQ platforms counters the fragmentation prevalent in digital asset markets. By aggregating quotes from diverse sources, it provides a singular point of access to substantial trading interest. This aggregation enhances the efficiency of execution, particularly for positions that might otherwise incur significant market impact.

Executing Superior Trades in Digital Assets

Deploying RFQ strategies requires a disciplined approach to trade structuring and execution. Strategic application allows for significant improvements in the cost basis of positions and overall portfolio performance. A precise understanding of market conditions complements the tactical use of RFQ.

Optimizing Options Spreads Execution

Constructing multi-leg options spreads often presents challenges on open order books due to slippage across individual legs. Utilizing an RFQ for these complex structures ensures atomic execution at a single, composite price. This approach removes the execution risk associated with sequential leg filling, preserving the intended risk-reward profile.

- Define the precise strike prices, expiry dates, and quantities for each leg of the spread.

- Submit the entire multi-leg order as a single RFQ, seeking a net price from liquidity providers.

- Evaluate the aggregated quotes, selecting the most advantageous price for the complete spread.

This method offers a distinct advantage for strategies like straddles, collars, or butterflies, where the simultaneous execution of all components is paramount. It prevents adverse price movements on one leg from eroding the profitability of the entire position.

Commanding Block Trade Liquidity

Executing large block trades in Bitcoin or Ethereum options without impacting market prices demands a controlled environment. RFQ systems provide the necessary infrastructure, allowing institutions to move substantial volume discreetly. This preserves alpha by minimizing information leakage and mitigating potential adverse selection.

Minimizing Slippage in High-Volume Orders

A primary concern for large orders involves the potential for price deviation from the quoted market. RFQ addresses this by soliciting firm quotes for the entire desired size. This guarantees a specific execution price for the full block, eliminating uncertainty surrounding fill rates and final costs.

Comparing execution costs across different methods reveals the efficacy of RFQ. Consider a scenario involving a 500 BTC options block. Direct market orders risk significant price decay as order book depth is consumed. An RFQ, conversely, provides a guaranteed price for the entire block, offering a measurable advantage in basis points.

| Execution Method | Average Slippage (Basis Points) | Price Certainty |

|---|---|---|

| Market Order (Large Block) | 15-30 | Low |

| Limit Order (Large Block) | 5-15 | Medium (Partial Fills) |

| RFQ (Large Block) | 0-2 | High (Guaranteed Fill) |

The data clearly illustrates RFQ’s superior performance in mitigating slippage for substantial orders. This direct control over execution cost contributes directly to the overall profitability of a trading desk.

Building an Edge through Advanced Liquidity Control

Transcending basic execution, the advanced deployment of RFQ systems integrates into broader portfolio management and risk mitigation strategies. This elevates trading operations from reactive responses to proactive market engagement, creating a sustainable competitive advantage.

Integrating RFQ into Volatility Strategies

Volatility trading strategies, such as buying or selling implied volatility through options, rely heavily on precise pricing. RFQ facilitates the efficient execution of complex volatility trades, including custom volatility swaps or variance hedges. Securing tight spreads on these instruments enhances the efficacy of the strategy and optimizes its return profile.

Employing RFQ for large-scale volatility exposures allows portfolio managers to enter or exit positions with minimal market footprint. This capability proves vital during periods of heightened market stress, when liquidity often becomes fragmented and bid-ask spreads widen significantly.

Crafting Bespoke Derivatives Exposure

Beyond standard options, RFQ platforms enable the creation of highly customized derivatives contracts tailored to specific risk appetites or market views. This involves negotiating terms directly with liquidity providers for exotic options or structured products. Such bespoke instruments provide unparalleled precision in managing specific exposures.

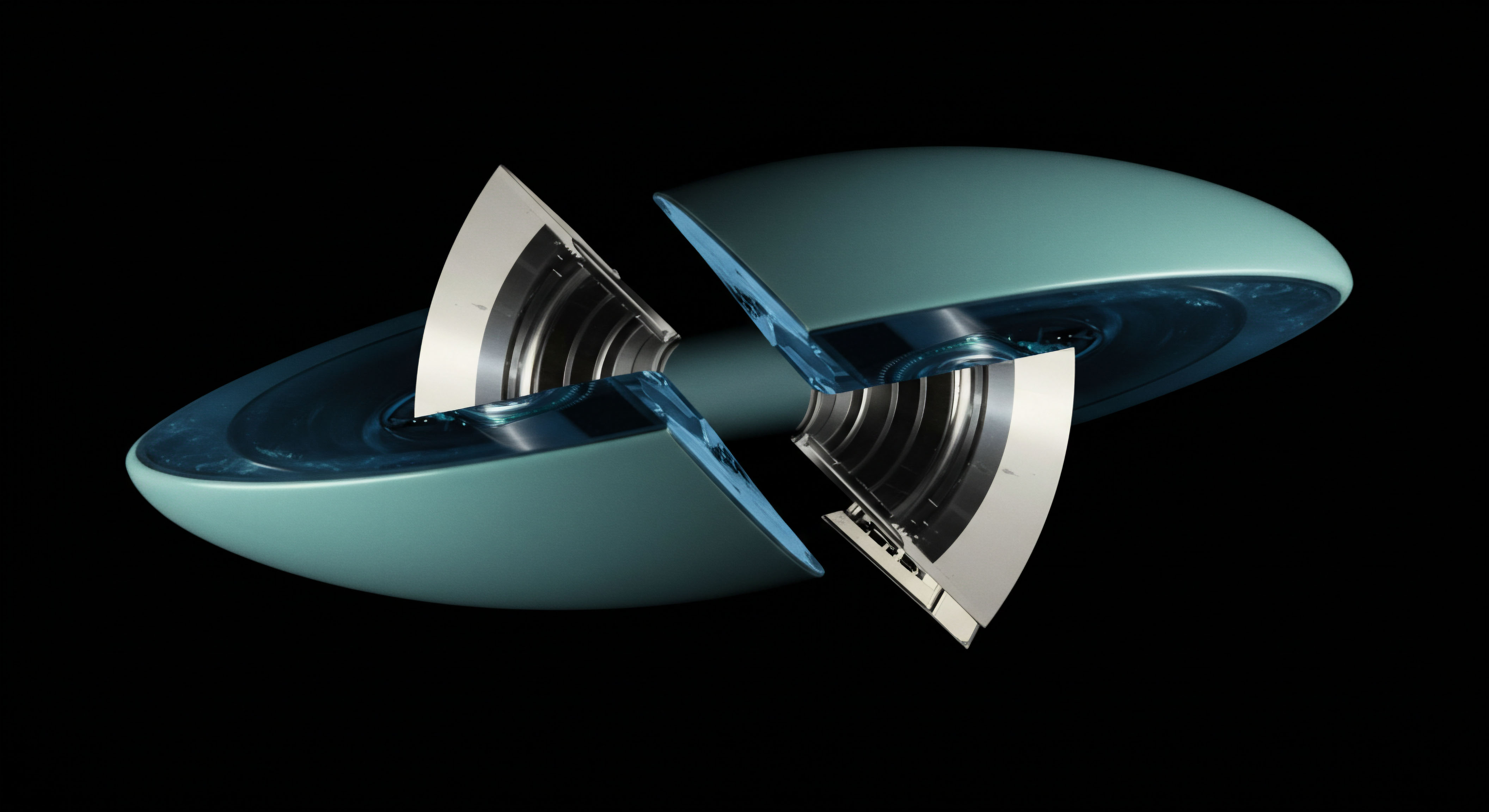

Customized derivatives, negotiated through RFQ, offer unparalleled precision in managing unique market exposures.

This advanced application moves beyond simply executing existing products; it involves designing and pricing novel financial instruments. The process requires a deep understanding of quantitative finance and risk modeling, transforming market constraints into strategic opportunities.

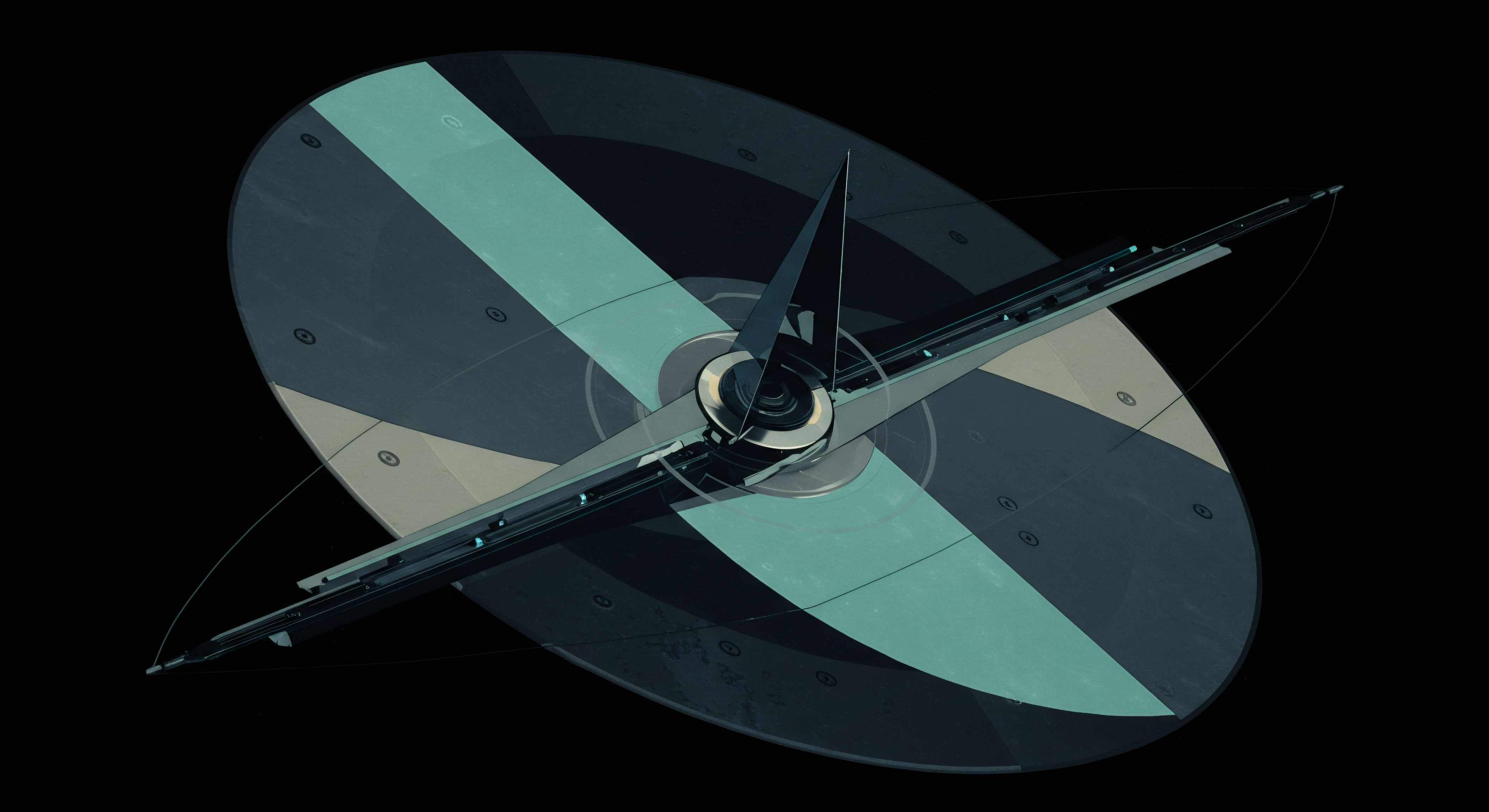

The strategic deployment of RFQ becomes a cornerstone of an adaptive trading system. It provides the capacity to dynamically adjust exposures, hedge idiosyncratic risks, and capitalize on transient market dislocations with superior execution quality. This represents a continuous optimization cycle for capital deployment.

The Command of Market Flow

Mastering advanced RFQ strategies for crypto is a deliberate choice to command market flow, rather than merely participate in it. It is about equipping oneself with the tools that transform ambition into tangible market performance. The continuous refinement of execution mechanics remains an enduring pursuit for every serious market participant.

Glossary

Price Discovery

Large Block