Execution Command

The pursuit of superior crypto execution demands a deliberate shift in operational approach. Request for Quote (RFQ) stands as a foundational mechanism for professional-grade trading, empowering participants to command liquidity on their own terms. This direct engagement model moves beyond conventional order book limitations, offering a distinct advantage in volatile digital asset markets. Understanding its core functionality establishes a critical base for advanced trading endeavors.

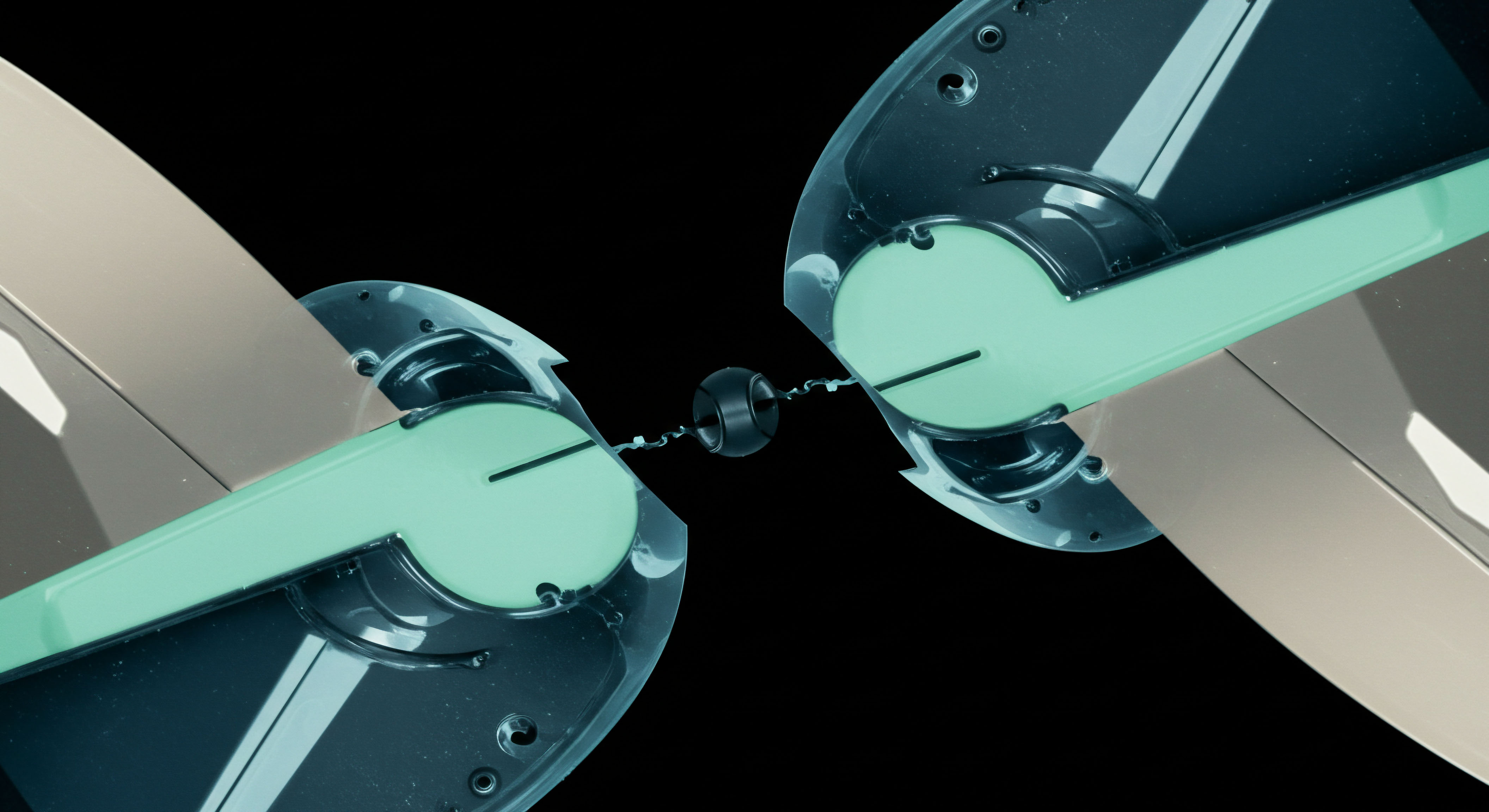

RFQ facilitates a private, competitive bidding environment among multiple liquidity providers for a specific trade. This structured interaction ensures optimal pricing and minimal market impact, especially for substantial positions. Participants initiate a request, detailing the asset, size, and desired terms, then receive tailored quotes from various market makers. The process guarantees a transparent and efficient discovery of the best available price.

Acquiring mastery over RFQ transforms market engagement. It represents a systematic solution to the inherent challenges of fragmented liquidity and price slippage prevalent across many crypto venues. The mechanism centralizes competitive pricing, granting traders a direct channel to deep liquidity pools. This operational clarity provides a tangible edge, securing more favorable execution outcomes across a spectrum of digital assets.

Mastering Request for Quote fundamentally reshapes crypto execution, moving traders from passive price takers to active liquidity commanders.

Strategic Capital Deployment

Deploying capital with precision demands an execution framework that aligns directly with strategic objectives. RFQ provides this framework, enabling sophisticated traders to implement a range of strategies with enhanced control and efficiency. The ability to solicit competitive bids for complex positions ensures every trade optimizes capital deployment and minimizes adverse market footprint.

Options Trading Precision

Crypto options trading thrives on exacting execution, where fractional price improvements significantly influence profitability. RFQ empowers traders to construct and execute intricate options strategies with unparalleled control.

Single-Leg Options

Executing single-leg Bitcoin or Ethereum options through RFQ ensures competitive pricing for both calls and puts. This direct approach mitigates the risk of wide spreads encountered on public order books, particularly for larger clip sizes. Receiving multiple, firm quotes before committing allows for an informed decision, optimizing entry or exit points.

Multi-Leg Options Spreads

The true power of RFQ emerges in the execution of multi-leg options spreads. Strategies such as straddles, collars, or iron condors require simultaneous execution of multiple options legs to lock in desired risk-reward profiles. RFQ enables traders to request a single, composite price for the entire spread, eliminating leg risk and ensuring a cohesive execution. This capability preserves the intended strategic advantage.

- BTC Straddle RFQ ▴ Requesting a combined bid/offer for an at-the-money call and put, capturing volatility views with a unified execution price.

- ETH Collar RFQ ▴ Securing a protective put while simultaneously selling an out-of-the-money call against an ETH holding, managing downside risk and generating income through a single, negotiated trade.

- Volatility Block Trade ▴ Executing large notional options positions designed to capitalize on anticipated volatility shifts, ensuring deep liquidity access and minimal price impact.

Block Trading Efficiency

Executing substantial blocks of cryptocurrency presents unique challenges concerning price impact and anonymity. RFQ offers a discrete and efficient channel for large-scale asset transfers.

Anonymous Options Trading

Maintaining discretion during large trades safeguards market positions and prevents front-running. RFQ facilitates anonymous interaction with liquidity providers, allowing traders to execute significant Bitcoin or Ethereum options blocks without revealing their intentions to the broader market. This privacy protects alpha generation.

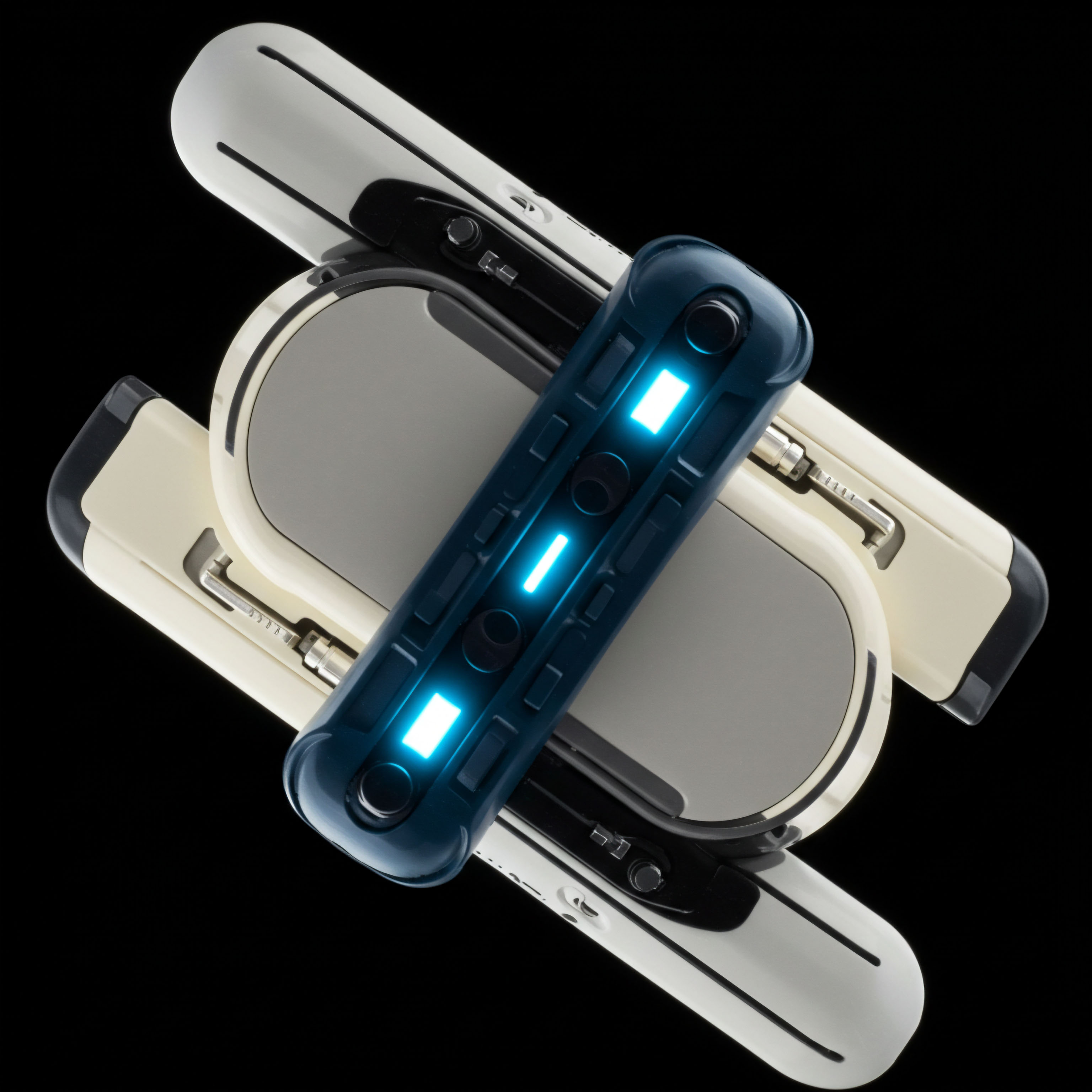

Multi-Dealer Liquidity Aggregation

RFQ aggregates liquidity from numerous dealers, presenting a unified view of competitive pricing for block trades. This multi-dealer environment ensures participants access the deepest pools available, securing best execution across various crypto assets. The competitive dynamic among providers drives tighter spreads and superior fill rates.

Consider the measurable impact of RFQ on execution quality:

The strategic deployment of RFQ provides a measurable advantage. Transaction cost analysis often reveals a significant reduction in slippage compared to traditional order book execution, particularly for larger trades. This direct correlation between execution method and realized profit underpins its value.

Precision execution through RFQ converts strategic insight into tangible gains, minimizing market friction across complex derivatives and block trades.

Advanced Portfolio Command

Expanding beyond individual trade execution, RFQ integrates seamlessly into a holistic portfolio management framework. This sophisticated approach transforms a tactical tool into a strategic lever for long-term alpha generation and robust risk management. The mastery of RFQ elevates trading operations to an institutional standard.

Systemic Risk Mitigation

Integrating RFQ into a comprehensive risk management strategy allows for proactive position adjustment and hedging. Large-scale portfolio rebalancing or the implementation of complex hedging overlays can be executed with reduced market impact, preserving portfolio value. The controlled environment of RFQ provides a vital buffer against systemic market volatility.

Visible intellectual grappling with the nuanced interplay between liquidity dynamics and systemic risk underscores the RFQ’s profound impact. The challenge resides in consistently translating micro-execution advantages into macro-portfolio resilience.

Quantitative Execution Edge

Quantitative funds and algorithmic traders leverage RFQ to refine their execution algorithms. By integrating RFQ capabilities, these systems gain a powerful channel for optimizing large orders, particularly in less liquid or highly volatile derivatives markets. This creates a feedback loop where quantitative analysis informs RFQ parameters, and RFQ execution data refines subsequent algorithmic decisions.

The application of RFQ within advanced quantitative frameworks demands a continuous assessment of market microstructure. Optimizing for factors such as price impact, fill rate, and latency requires a dynamic calibration of RFQ parameters against prevailing market conditions. This iterative process of refinement yields a persistent execution edge.

My personal conviction is that the future of institutional crypto trading fundamentally hinges upon the mastery of such bespoke execution channels. The delta between average and exceptional performance will increasingly narrow to the quality of one’s operational framework.

RFQ evolves beyond a mere execution method, becoming a cornerstone of advanced portfolio strategy, fortifying positions against market caprice.

Unlocking Asymmetric Advantages

The landscape of digital asset trading continues its rapid evolution, yet the principles of superior execution remain constant. RFQ represents a critical advancement, offering a mechanism for direct engagement with liquidity that redefines market participation. This strategic imperative provides a pathway to consistently outmaneuver the inherent frictions of decentralized finance, securing a distinct and enduring advantage. Traders who internalize this command over execution positions themselves at the forefront of capital efficiency.