Execution Edge Unlocked

Superior options execution begins with a profound grasp of the Request for Quote (RFQ) mechanism. This is a foundational instrument, designed to aggregate institutional-grade liquidity for significant derivatives positions. It functions as a direct conduit to multiple market makers, enabling traders to solicit competitive pricing for complex or large block trades. This structured approach directly addresses the challenge of securing optimal price discovery in fragmented markets, a critical factor for achieving alpha.

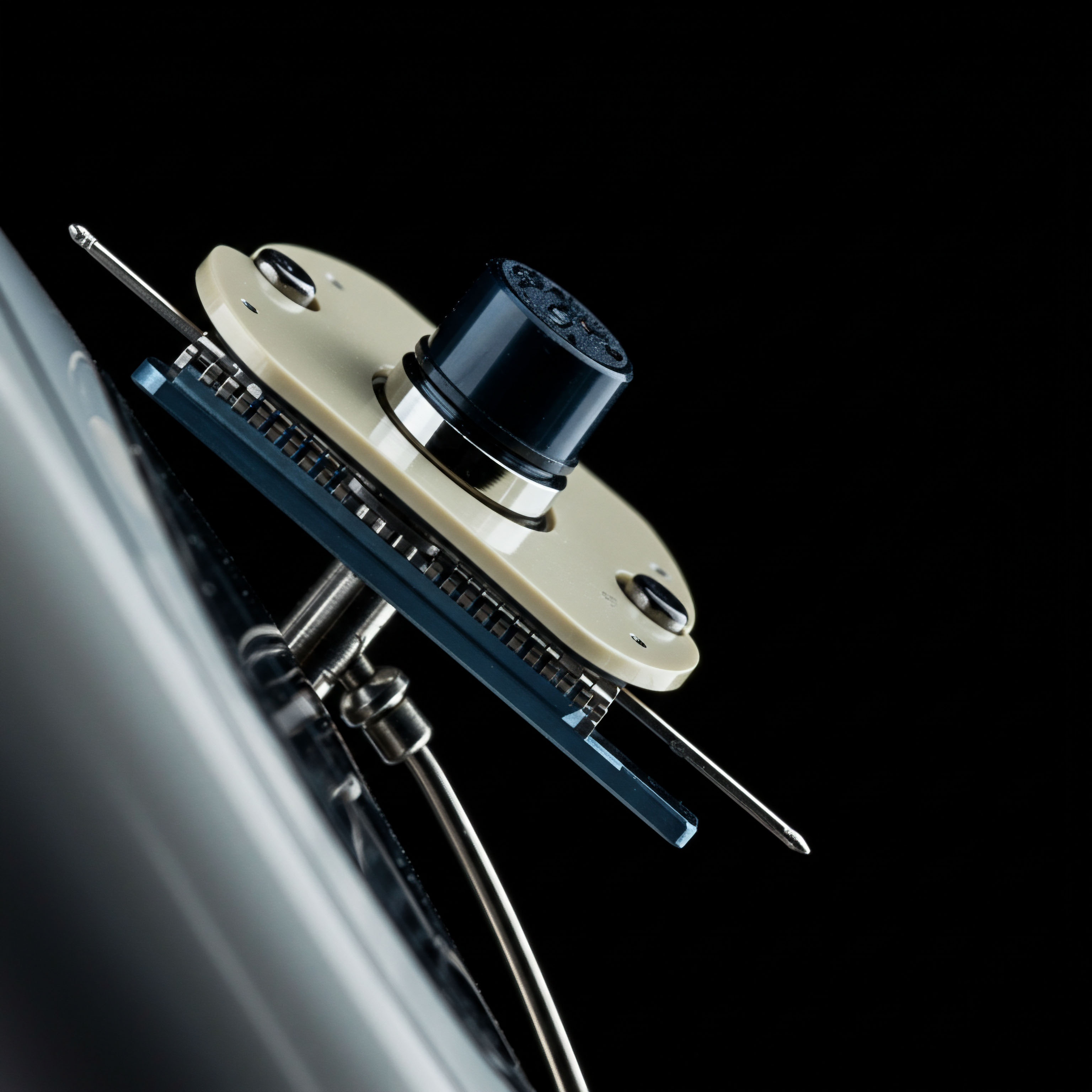

The RFQ mechanism establishes a transparent negotiation environment. Participants submit their order intentions, receiving firm, executable quotes from various liquidity providers. This process ensures a robust competitive dynamic, driving favorable pricing for the initiating trader. Understanding this operational architecture provides a distinct advantage, moving beyond passive order book interaction to an active solicitation of liquidity.

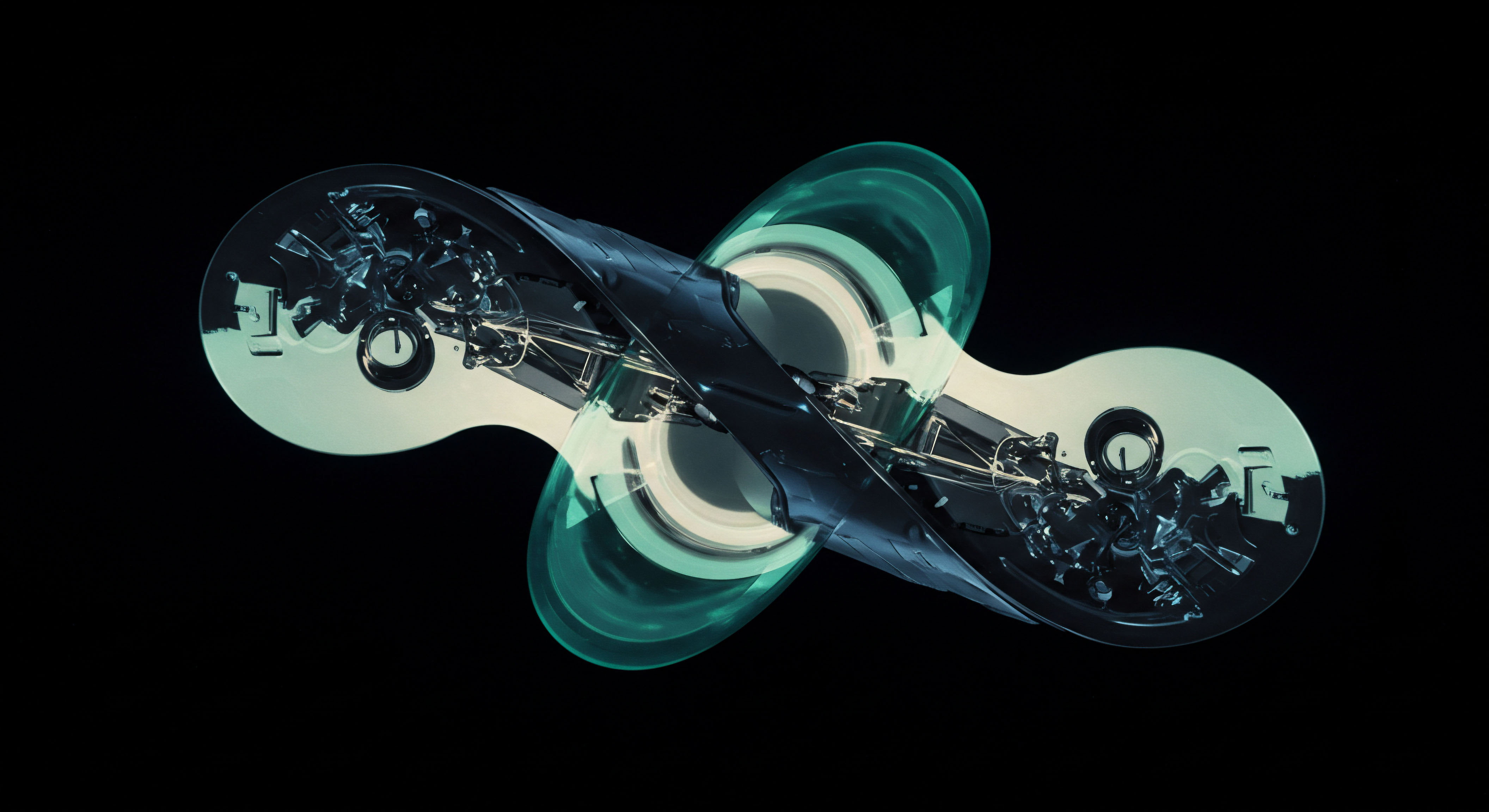

A direct conduit to multiple market makers, the RFQ mechanism aggregates institutional-grade liquidity for significant derivatives positions.

Grasping the inherent efficiencies of the RFQ mechanism marks a significant step for any trader seeking to elevate their market performance. It represents a systemic advantage, a structured approach to securing optimal pricing for options contracts. Recognizing its utility prepares a trader for the strategic deployment of advanced execution techniques.

Strategic Deployment of RFQ

Deploying the RFQ mechanism strategically translates directly into enhanced trading outcomes. This section outlines actionable methods for leveraging this powerful tool, focusing on its application across various options strategies and market conditions. A disciplined approach to RFQ execution builds a tangible market edge.

Optimal Entry for Options Spreads

Executing multi-leg options spreads demands precision to minimize slippage across individual components. An RFQ streamlines this process, allowing for simultaneous quotation of complex structures like straddles, collars, or butterflies. This capability ensures a unified price for the entire spread, mitigating the risk of adverse price movements between legs.

Consider a BTC straddle block, where volatility expectations drive the trade. Submitting this as a single RFQ guarantees a consolidated price, reflecting the market makers’ aggregate view on the implied volatility surface. This avoids the pitfalls of sequential execution, where filling one leg could impact the pricing of subsequent legs.

Large Block Execution

Trading substantial options blocks necessitates a mechanism capable of absorbing significant order size without undue market impact. The RFQ provides this capacity, channeling a single order to a network of dealers prepared to quote on size. This preserves anonymity and secures liquidity for orders that might otherwise disrupt conventional order books.

For an ETH options block, an RFQ allows a trader to command multi-dealer liquidity. This process ensures the execution of large positions at a fair price, a critical component of institutional-grade trading. It transforms the challenge of size into an opportunity for competitive price discovery.

Minimizing Slippage across Market Regimes

Slippage represents a silent tax on trading profits. The competitive quoting environment of an RFQ actively works to minimize this cost. By soliciting bids and offers from numerous market makers, a trader accesses the tightest available spreads, regardless of prevailing market conditions. This precision applies to both highly liquid and less active options.

An RFQ’s competitive dynamic ensures that the bid-ask spread is consistently challenged. This constant pressure on pricing translates directly into superior fill rates and reduced transaction costs for the trader. It serves as a powerful defense against liquidity fragmentation.

RFQ Application Scenarios

- Volatility Blocks ▴ Execute large trades based on volatility views, such as BTC straddle blocks or ETH collar RFQs, securing a consolidated price for the entire structure.

- Multi-leg Execution ▴ Obtain simultaneous quotes for complex options spreads, preventing adverse price drift between individual legs.

- OTC Options Sourcing ▴ Access over-the-counter liquidity for highly customized or illiquid options contracts, ensuring competitive pricing from specialized dealers.

- Anonymous Trading ▴ Preserve trade anonymity for large positions, preventing market participants from front-running or reacting to order intentions.

Mastering Advanced RFQ Applications

Advancing beyond fundamental RFQ deployment requires integrating its capabilities into a comprehensive portfolio strategy. This section delves into sophisticated applications, connecting the mechanism to broader risk management frameworks and the pursuit of sustained market advantage. Mastery of RFQ transforms it into a core component of an alpha-generating strategy.

Integrating RFQ with Algorithmic Execution

The RFQ mechanism forms a powerful synergy with advanced algorithmic execution strategies. Traders can employ algorithms to determine optimal timing for RFQ submissions, considering factors such as prevailing market liquidity, volatility spikes, and order book depth. This combination elevates execution quality, blending human strategic insight with automated precision.

Consider a scenario where an algorithm identifies a temporary liquidity pocket. Initiating an RFQ at this precise moment capitalizes on favorable market conditions, securing superior pricing for large options blocks. This dynamic interplay represents a sophisticated approach to market interaction.

Volatility Arbitrage and RFQ

Sophisticated traders employ RFQs to execute volatility arbitrage strategies with heightened efficiency. Identifying discrepancies between implied and realized volatility presents opportunities, and the RFQ facilitates the rapid, competitive execution of options positions designed to capture these differences. This demands an acute sense of market microstructure.

A trader targeting a specific volatility skew can utilize an RFQ to solicit prices across a range of strikes and expirations. This provides an immediate, consolidated view of the market makers’ collective pricing, allowing for swift action on identified arbitrage opportunities. It is a testament to the mechanism’s tactical power.

Risk Management Frameworks

The RFQ mechanism plays an instrumental role within robust risk management frameworks. By providing transparent and competitive pricing, it establishes a clear cost basis for positions, simplifying subsequent risk calculations. Furthermore, the ability to execute large blocks with precision minimizes unexpected slippage, a common source of execution risk.

Managing portfolio delta or gamma exposure often necessitates rapid, large-scale options adjustments. An RFQ enables these adjustments to occur efficiently, securing the required liquidity without adversely impacting the market. This disciplined approach safeguards portfolio integrity during periods of heightened market activity.

Developing an acute understanding of RFQ execution parameters allows for a deeper control over transaction costs and market impact. This expertise is a cornerstone of professional-grade trading, translating into a consistent edge. It moves a trader beyond mere participation towards commanding market dynamics.

Commanding Liquidity Dynamics

The pursuit of superior options execution necessitates a proactive engagement with market structures. The RFQ mechanism represents a strategic lever, a tool for actively shaping liquidity dynamics rather than merely reacting to them. Traders who master this approach unlock a profound advantage, translating competitive pricing into measurable alpha. The evolution of trading demands this level of precision and control.

Embracing the RFQ means recognizing that market opportunities await those equipped with the right operational architecture. This commitment to advanced execution protocols defines the next generation of trading success. It solidifies a path towards consistent outperformance.

Glossary

Market Makers

Rfq Mechanism

Minimize Slippage

Multi-Dealer Liquidity

Multi-Leg Execution