The Defined Risk Perimeter

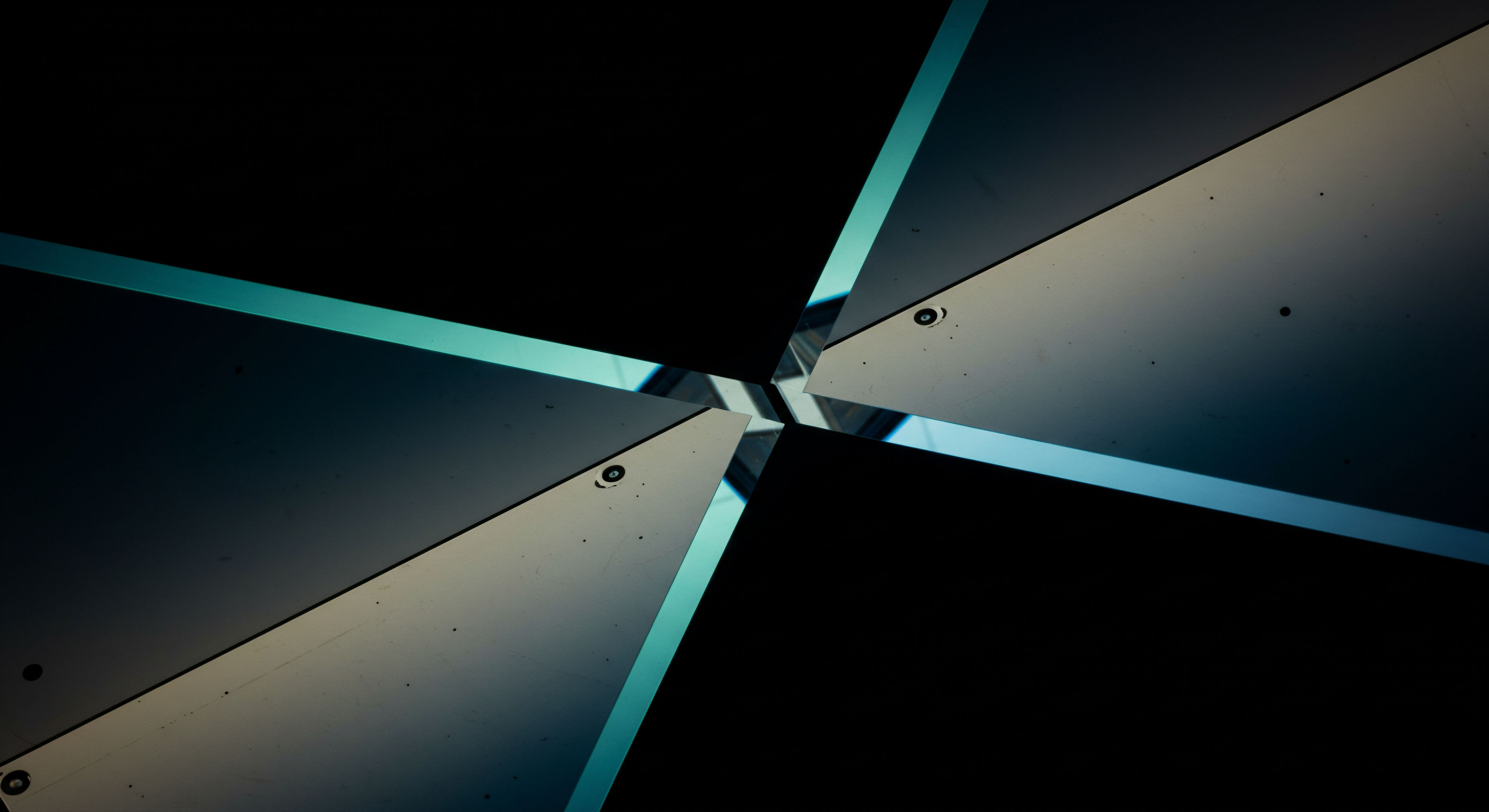

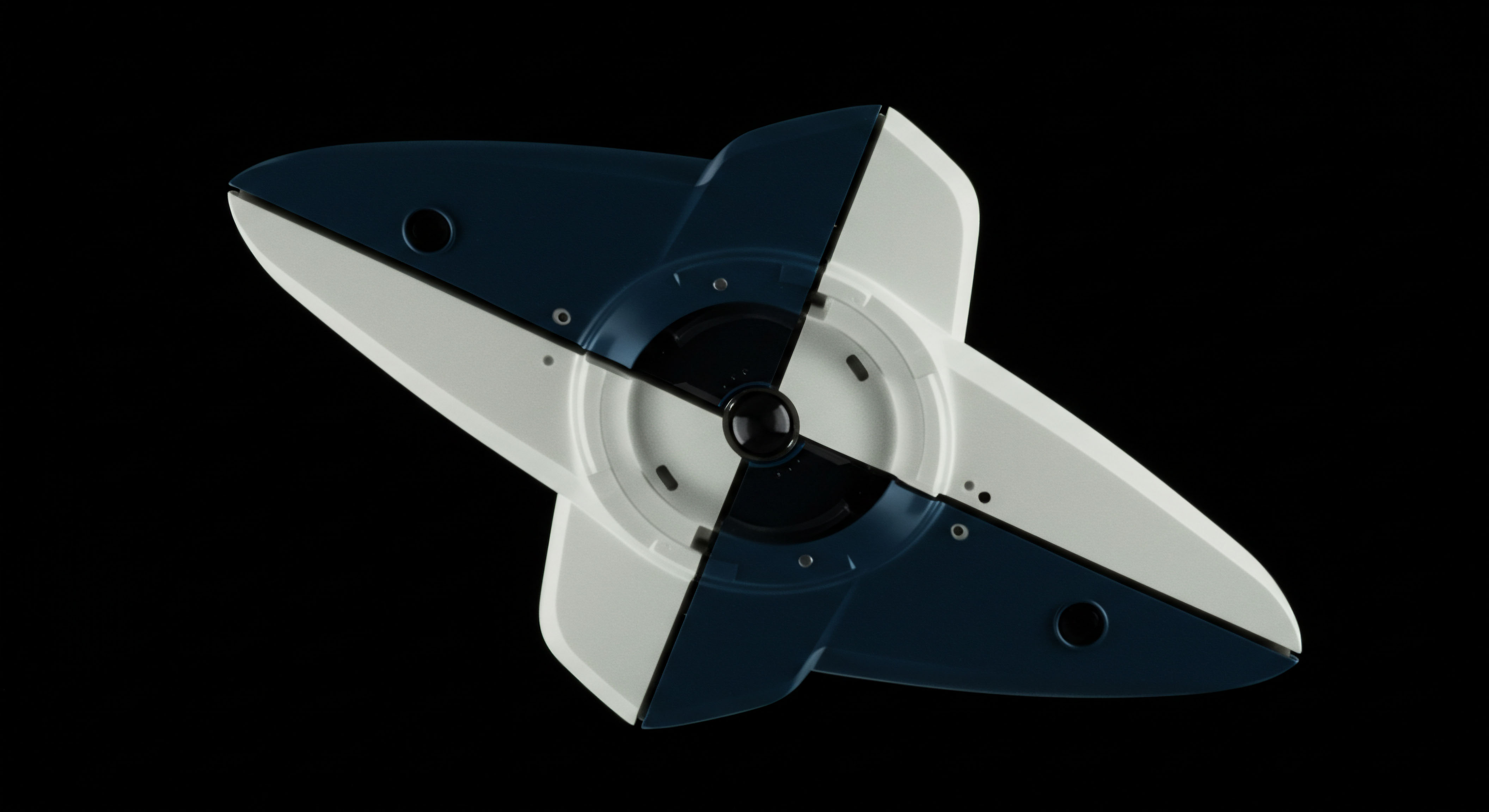

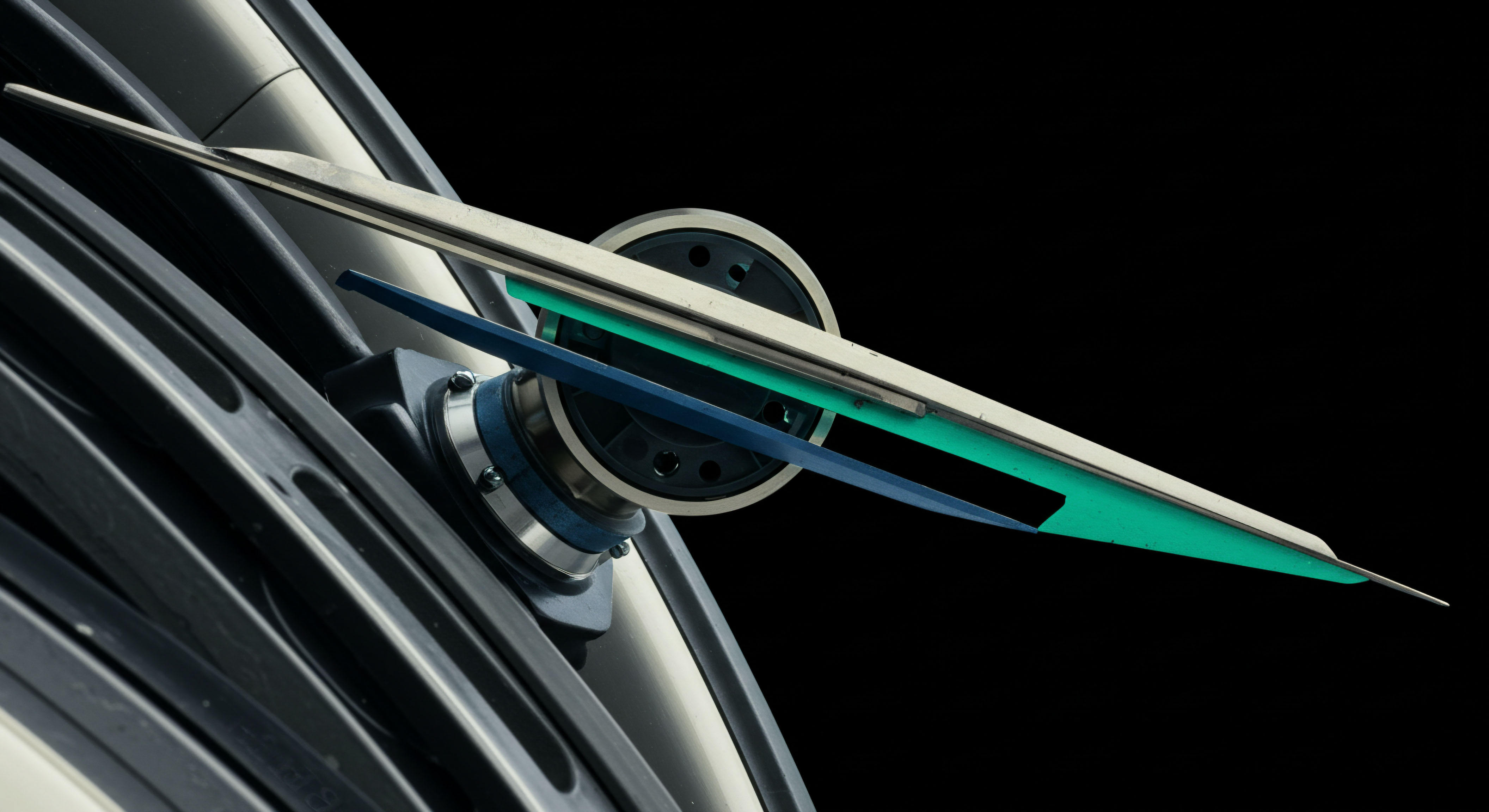

The collar strategy is a systemic approach to asset protection and income generation, engineering a defined risk perimeter around a core holding. It involves the simultaneous purchase of a protective put option and the sale of a covered call option against a long stock position. This structure establishes a clear floor for potential losses and a ceiling for potential gains, transforming an open-ended risk profile into a calculated, bounded exposure. The put option acts as a structural support, guaranteeing a minimum sale price for the asset, thereby creating a definitive boundary against downside volatility.

Concurrently, the premium generated from selling the call option serves to finance, either partially or entirely, the cost of this downside protection. This elegant trade-off is the central mechanism of the collar. It allows an investor to maintain ownership of an appreciated asset while systematically neutralizing short-term price uncertainty. The position is calibrated to a specific market outlook, offering a sophisticated method for safeguarding capital without resorting to outright liquidation of the underlying position. It is a tool for those who think in terms of strategic asset management over reactionary trading.

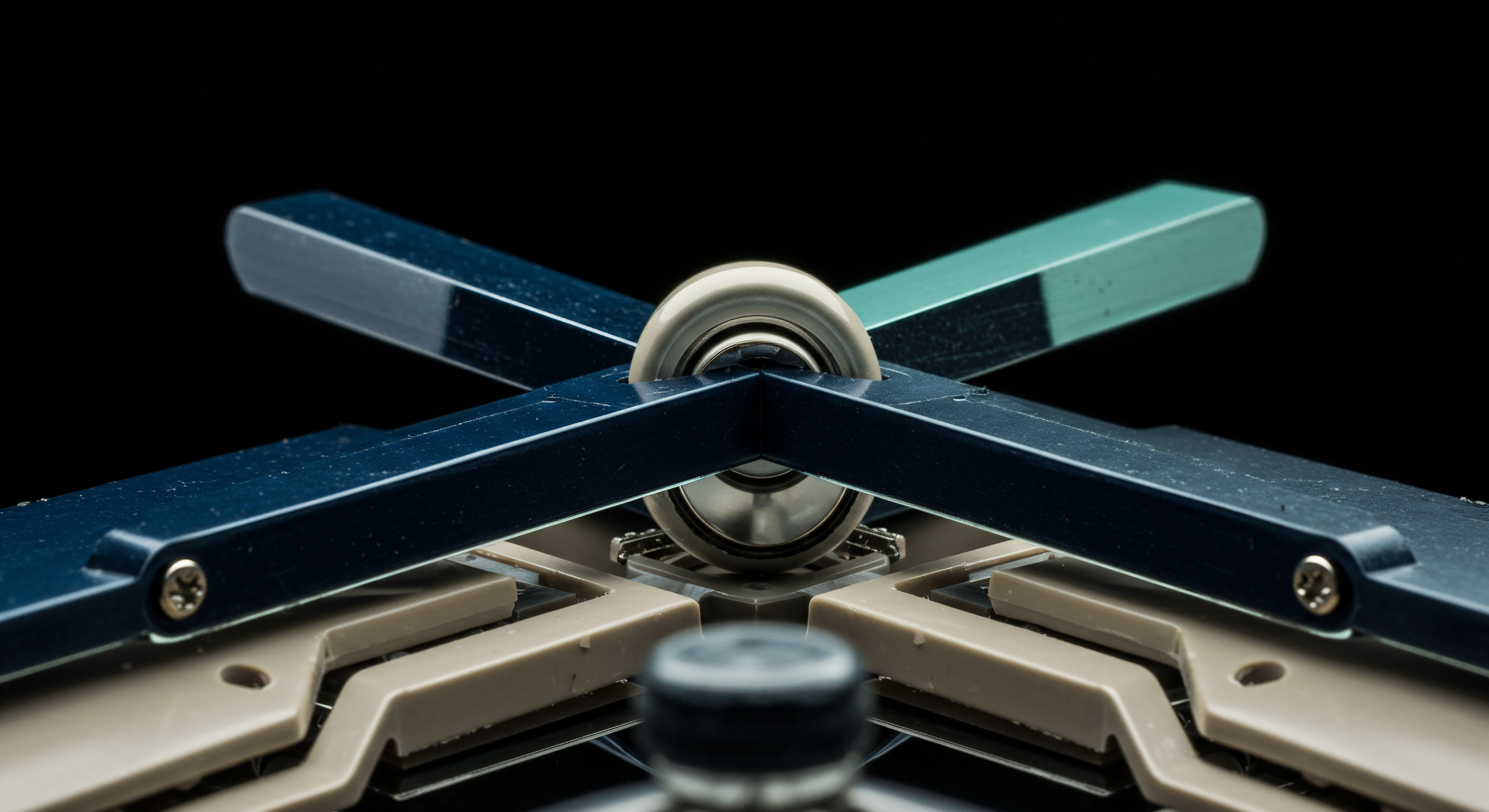

Understanding the mechanics begins with recognizing its three core components ▴ the long stock, the long put, and the short call. An investor holding at least 100 shares of an underlying asset first identifies a price level below which they are unwilling to accept further loss. This determination informs the strike price of the protective put they will purchase. A put option grants the holder the right, not the obligation, to sell the underlying asset at this predetermined strike price on or before a specific expiration date.

The acquisition of this right establishes the ‘floor’ value for their holding. To offset the premium paid for the put, the investor then sells a call option with a strike price set above the current market price of the asset. This short call obligates the seller to deliver their shares at the call’s strike price if the market price rises above it by expiration. This action creates the ‘ceiling’ on their potential profit, with the premium received acting as immediate income. When calibrated correctly, the income from the call can equal the cost of the put, creating what is known as a “zero-cost collar.”

Systematic Wealth Preservation and Yield

Deploying a collar is an exercise in precision. It requires a clear-eyed assessment of risk tolerance, return objectives, and the specific time horizon for the protection. The strategic selection of strike prices and expiration dates dictates the entire risk-reward profile of the position, transforming a general desire for safety into a quantifiable financial structure. The process is systematic, moving from a broad objective to a series of specific, calculated decisions that define the boundaries of the investment’s performance.

Calibrating the Protective Floor and Profit Ceiling

The selection of the put and call strike prices is the primary act of strategic calibration. These choices determine the width of the collar ▴ the range within which the asset’s value will fluctuate for the duration of the options’ life. A “tight” collar involves selecting a put strike close to the current stock price and a call strike that is also relatively near. This configuration offers a higher degree of downside protection but simultaneously imposes a more restrictive cap on upside potential.

Conversely, a “wide” collar, with strike prices further away from the current market price, allows the underlying stock more room to appreciate before gains are capped. This wider structure, however, comes at the cost of a lower protective floor, exposing the investor to a greater potential loss before the put option engages. The decision hinges on the investor’s immediate priority ▴ maximizing protection or preserving upside potential.

For a zero-cost collar, many traders keep both the short call and long put around 5% out of the money.

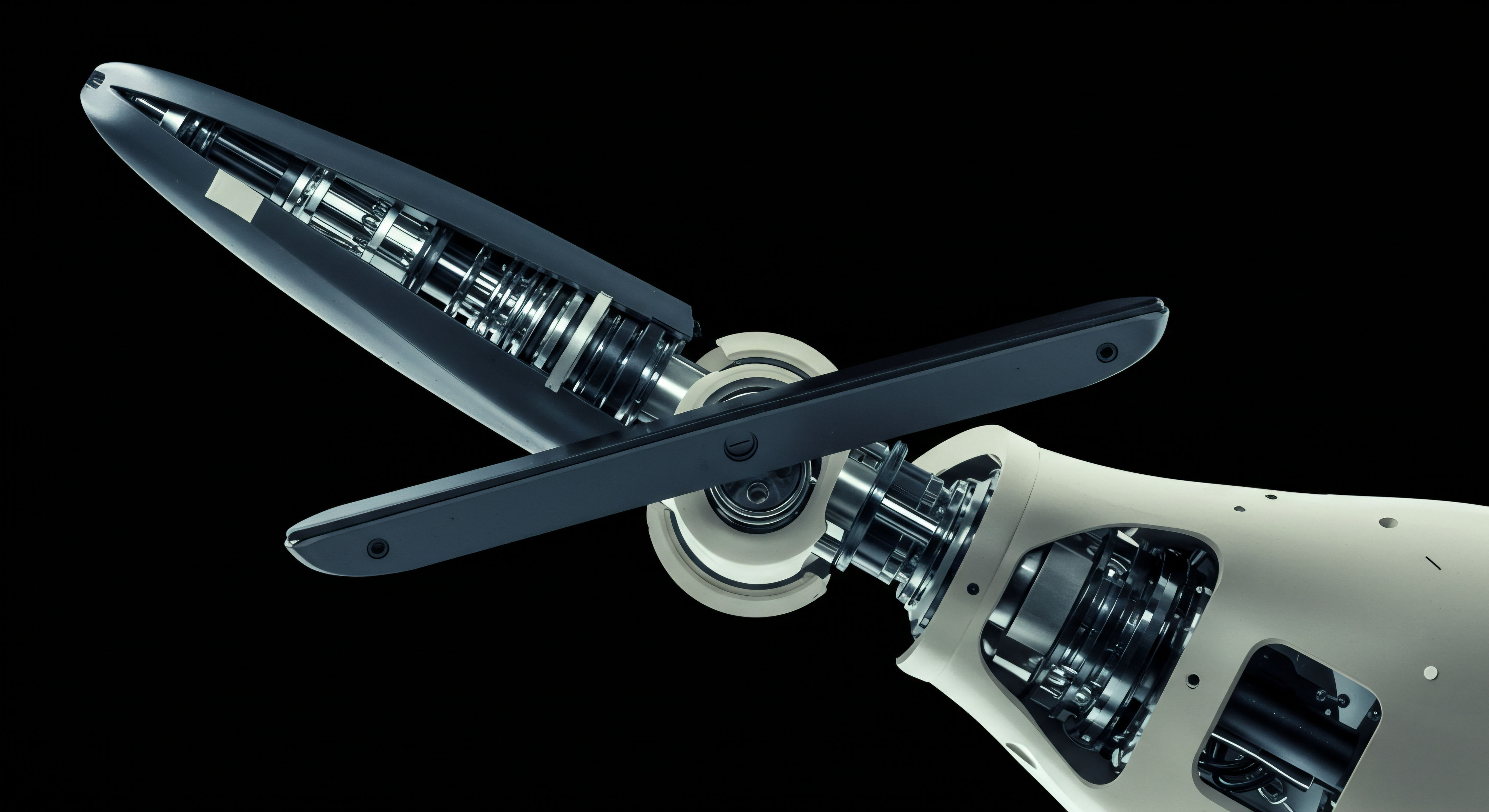

Constructing the Zero-Cost Collar

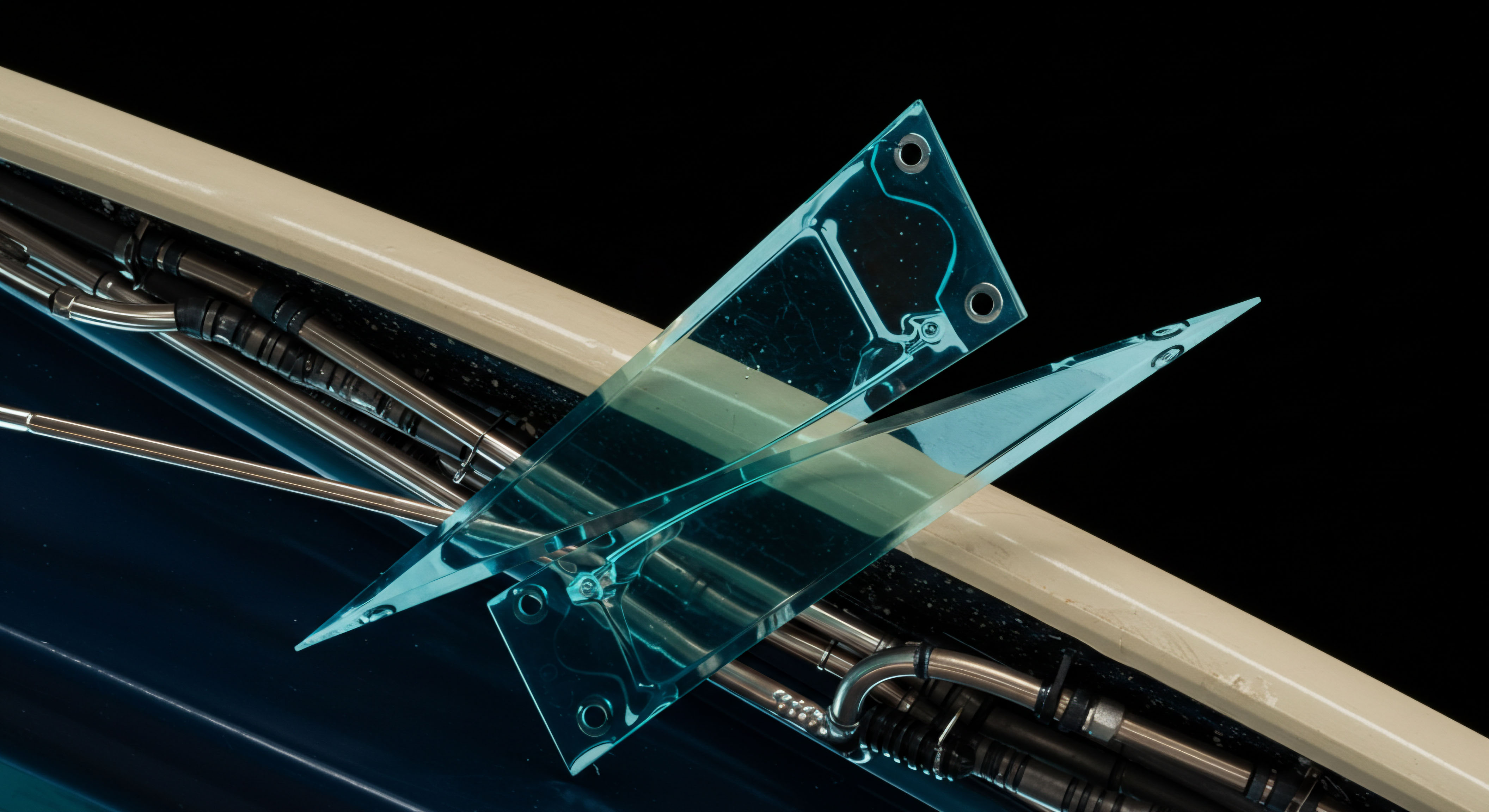

A primary objective for many sophisticated investors is the construction of a zero-cost collar. This involves a careful balancing act where the premium received from selling the out-of-the-money call precisely offsets the premium paid for the out-of-the-money put. Achieving this equilibrium neutralizes the explicit cost of hedging, making the downside protection a self-financing feature of the position. The process involves analyzing the options chain to find a pair of put and call contracts with equivalent premiums at equidistant strike prices from the current stock price.

For instance, with a stock at $100, an investor might find that the 95-strike put costs $1.25 per share, while the 105-strike call generates a premium of $1.25 per share. Executing this combination results in a defined risk profile with no net cash outlay for the options structure itself.

- Assess the Core Holding: The strategy begins with an existing long position in an underlying asset, typically 100 shares per options contract, that has unrealized gains you wish to protect.

- Define the Protection Horizon: Determine the timeframe for the desired protection. Options expirations are typically selected from 30 to 90 days out to provide a meaningful period of coverage without incurring excessive time decay costs on the long put.

- Establish the Downside Floor: Select a put option strike price below the current stock price. This strike represents the absolute minimum sale price for your shares during the option’s life. The distance of the strike from the current price reflects your specific risk tolerance.

- Identify the Upside Ceiling: Select a call option strike price above the current stock price. This strike represents the price at which you are willing to sell your shares and cap your gains. The premium from this call will finance the protective put.

- Analyze the Premium Balance: Compare the cost of the selected put option with the income generated by the selected call option. Adjust strike prices as needed to achieve the desired net cost, aiming for a zero-cost or credit-generating structure where possible.

- Execute as a Single Transaction: The collar should be executed as a multi-leg options spread. This ensures simultaneous entry into both the long put and short call positions, locking in the calculated net premium and avoiding execution risk from price movements between individual trades.

Profit and Loss Scenarios

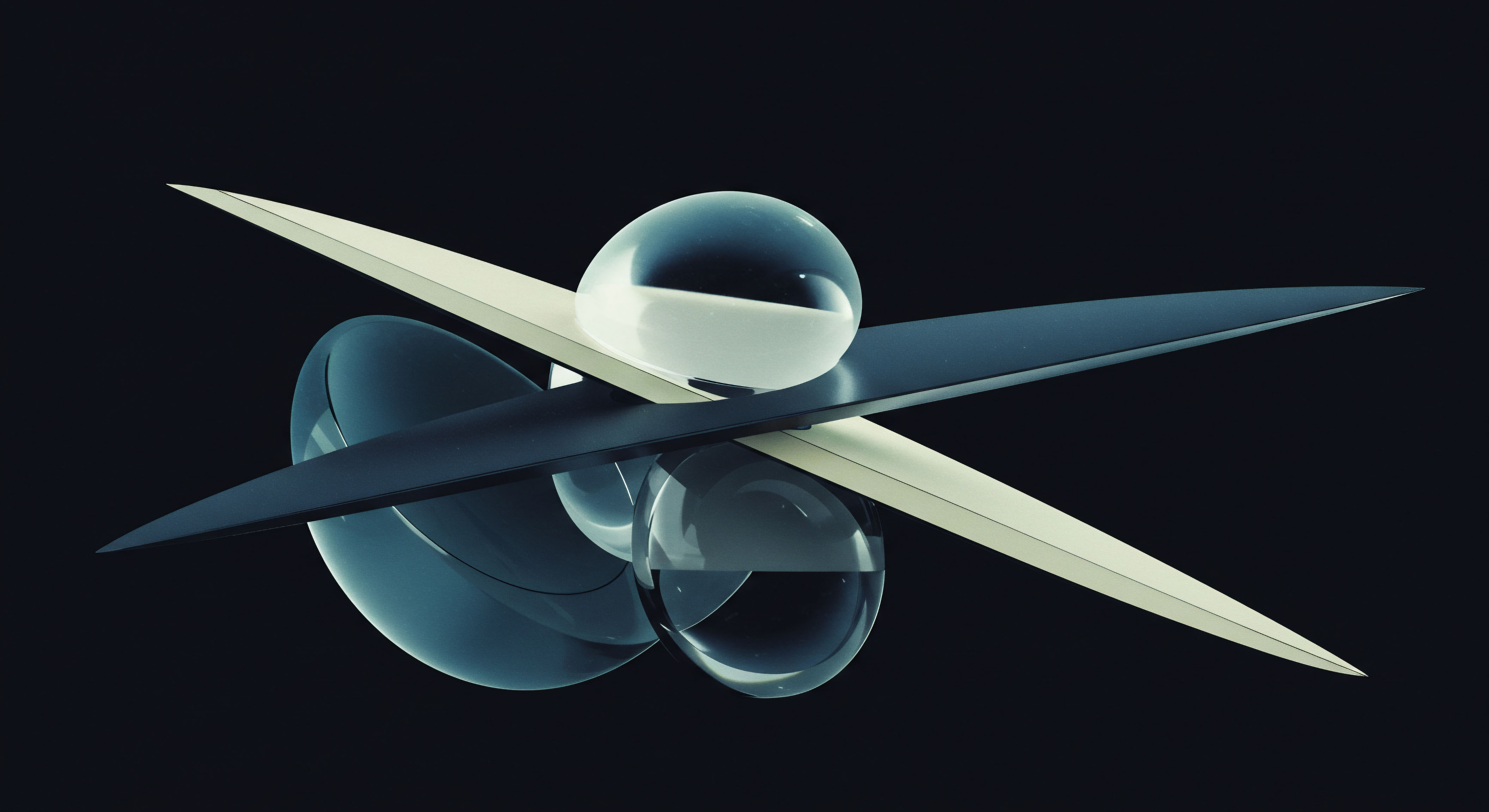

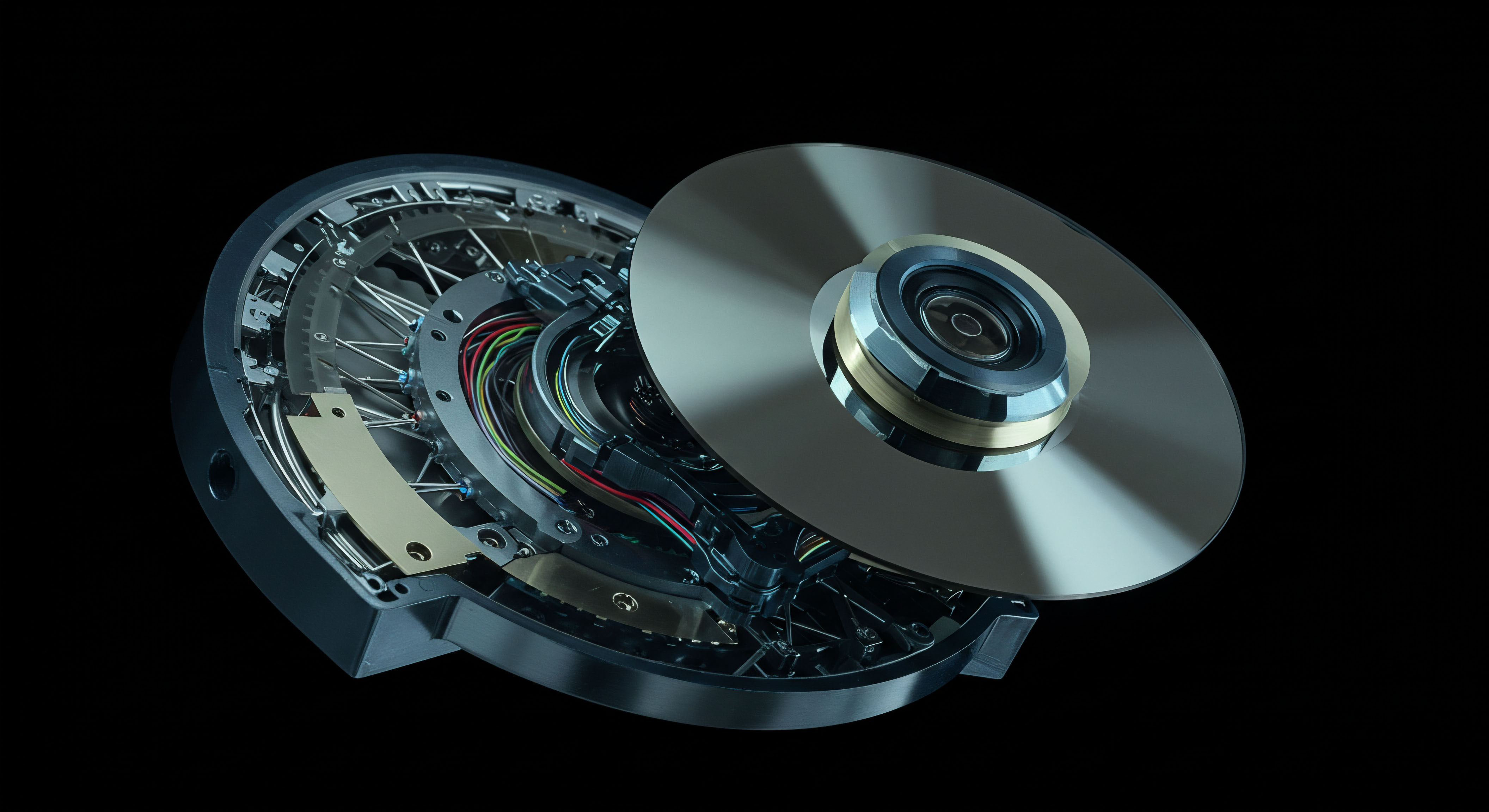

The collar’s structure creates three distinct outcomes determined by the underlying stock’s price at expiration. Understanding these scenarios is fundamental to its deployment. The strategy removes the extremes of performance, delivering a predictable range of results. This predictability is its core strength.

First, if the stock price at expiration is between the put strike and the call strike, both options expire worthless. The investor retains the underlying stock and the net premium received (or paid) when initiating the position. The outcome is simply the performance of the stock, adjusted for the initial cost of the collar. Second, should the stock price fall below the put strike, the long put option becomes valuable.

The investor can exercise the put, selling their shares at the strike price and establishing the maximum defined loss. The maximum loss is calculated as the initial stock price minus the put strike price, adjusted for the net premium of the collar. Third, if the stock price rallies above the call strike, the short call option will be exercised against the investor. They will be obligated to sell their shares at the call strike price, realizing the maximum defined profit.

The maximum gain is the call strike price minus the initial stock price, plus any net credit received from the options. Every potential outcome is known from the moment the position is established.

Dynamic Risk Engineering and Portfolio Integration

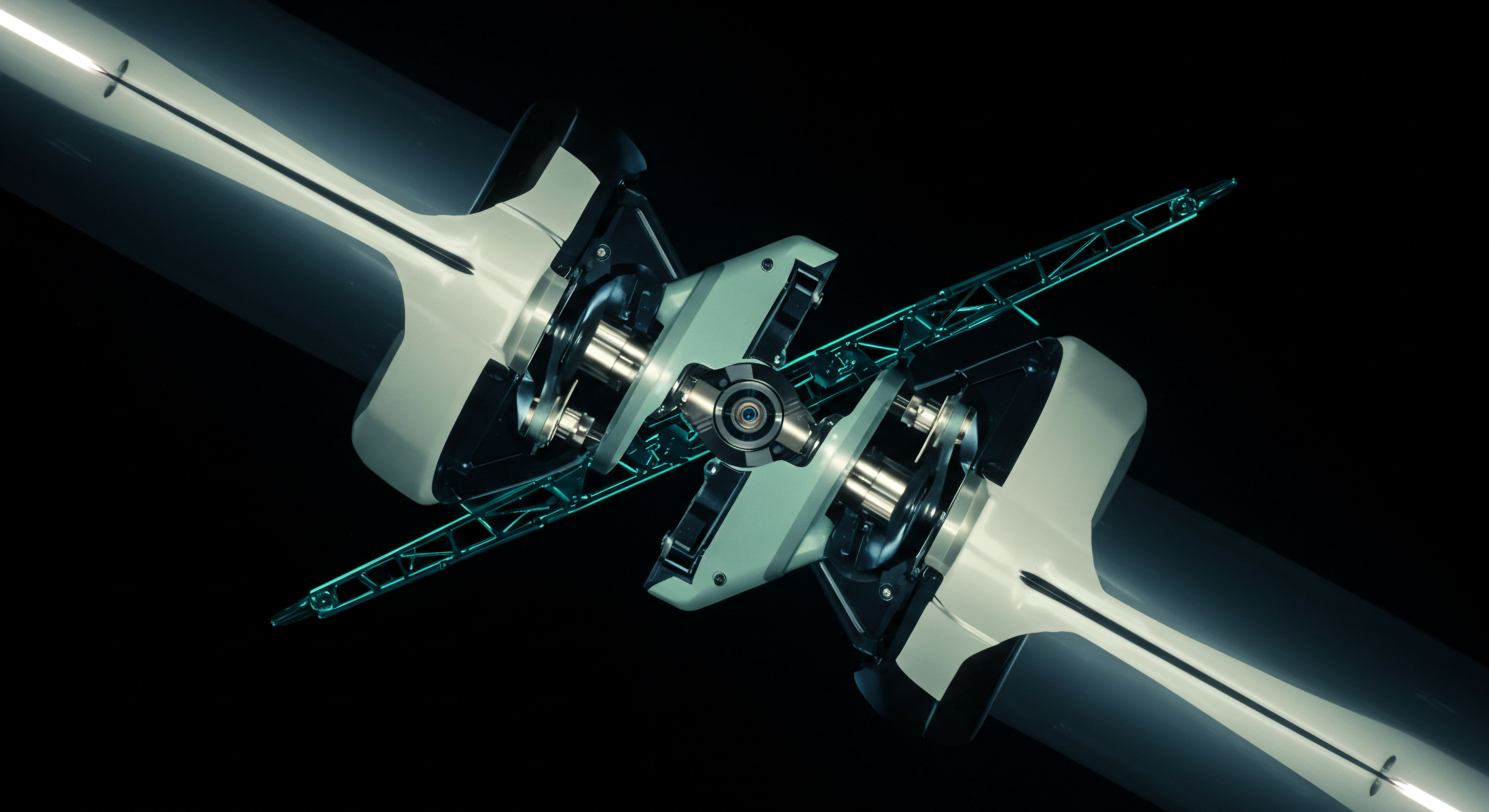

Mastery of the collar extends beyond a static “set-and-forget” hedge. It evolves into a dynamic tool for risk engineering, actively managed to align with changing market conditions and portfolio objectives. Advanced applications involve adjusting the collar’s parameters in response to shifts in volatility, price action, and the investor’s own strategic outlook.

This elevates the collar from a simple protective instrument to a component of a sophisticated, adaptive portfolio management system. The focus shifts from a single asset’s protection to the strategic modulation of overall portfolio beta and the generation of alpha through tactical adjustments.

Managing the Collar through Time

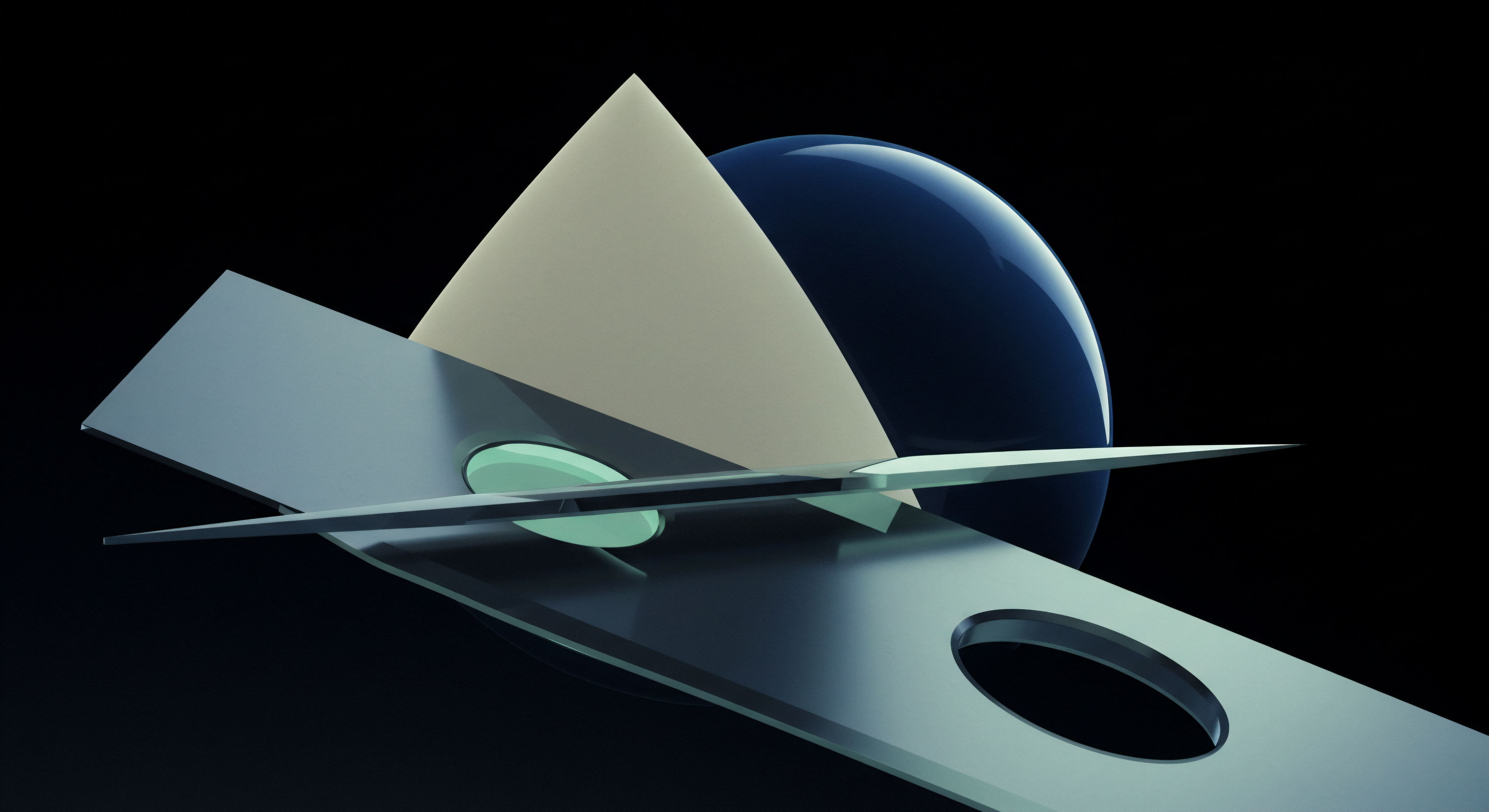

A static collar provides protection for a fixed duration. A dynamic approach involves actively “rolling” the position. For example, if the underlying asset’s price increases significantly and approaches the short call strike, an investor might choose to roll the entire structure up and out. This entails closing the existing collar and opening a new one with higher strike prices and a later expiration date.

This action effectively raises the protective floor and the potential profit ceiling, allowing the position to continue participating in the asset’s uptrend while maintaining a defined risk perimeter. Conversely, if the expiration date is approaching and the investor wishes to maintain protection, they can roll the collar forward to a later expiration, recalibrating the strike prices based on the current market price and their revised forecast.

The Collar and Volatility Skew

A deeper understanding of the collar involves its relationship with volatility. The pricing of options is heavily influenced by implied volatility, and the “volatility skew” describes the pricing disparity between out-of-the-money puts and calls. Typically, OTM puts trade at higher implied volatilities than OTM calls, a reflection of the market’s tendency to fear downside crashes more than upside rallies. A skilled strategist can use this skew to their advantage.

In periods of high market anxiety, the premium for puts increases. An investor establishing a collar in this environment can demand a higher premium for the call they are selling to finance the more expensive put, potentially allowing them to set a wider spread between the strikes for a zero-cost structure. This is a moment of intellectual grappling for the strategist ▴ the very fear that necessitates the hedge also makes its financing structure potentially more favorable. Recognizing and acting on these volatility dynamics separates mechanical application from strategic mastery. It requires a nuanced view of market sentiment as a tradable input.

Integrating Collars at the Portfolio Level

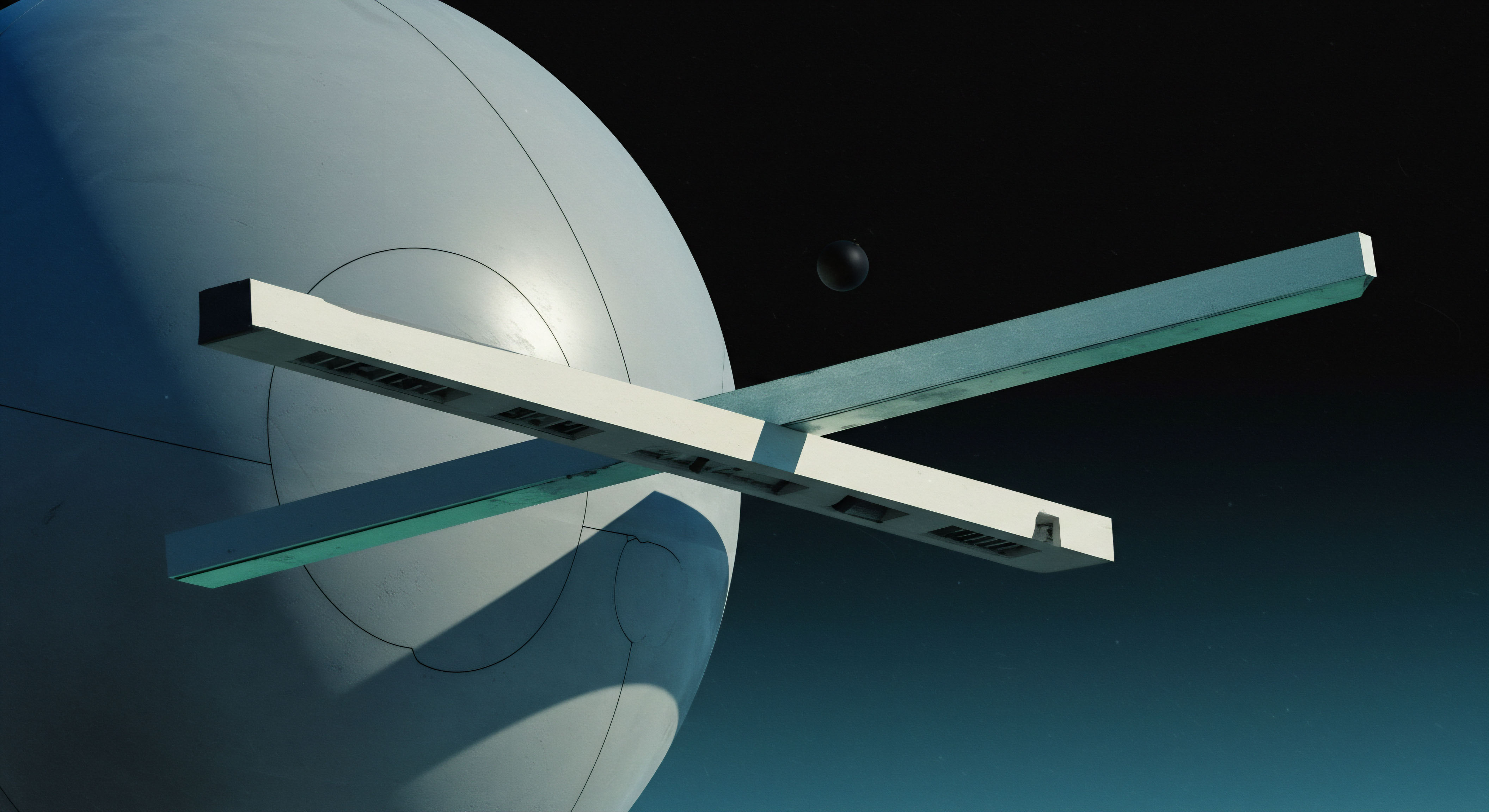

The collar strategy can be applied at a macroeconomic level by using broad-market index options (such as those on the SPX or NDX) to hedge an entire portfolio of equities. An investor with a diversified stock portfolio can purchase a put option on a market index and finance it by selling a call option on the same index. This creates a risk-defined band around the entire portfolio’s market exposure. This macro-level application is a powerful tool for institutions and high-net-worth individuals seeking to protect aggregate portfolio value during periods of anticipated market turbulence without liquidating dozens of individual positions.

It provides a capital-efficient method for managing systemic risk. For large positions, sourcing liquidity for these options legs is paramount. Executing large, multi-leg options trades like portfolio collars through a Request for Quote (RFQ) system allows an investor to receive competitive bids from multiple market makers simultaneously. This process minimizes slippage and ensures best execution, a critical factor when dealing with the substantial premiums associated with index options.

This is true portfolio control.

The Boundary of Certainty

The collar is more than a trade structure; it is a declaration of intent. It signifies a shift from passive participation in market outcomes to the active design of them. By defining the absolute boundaries of profit and loss, an investor imposes their will upon an uncertain future, converting open-ended anxiety into a closed system of calculated risk. This act of defining the perimeter is the ultimate expression of control.

It allows one to remain invested in the market’s potential for growth while being insulated from its capacity for catastrophic decline. The collar creates a space for rational decision-making, free from the emotional pressures of extreme price swings. It is the framework within which long-term conviction can be held with short-term peace of mind, a mechanism for navigating volatility with unwavering strategic composure.

Glossary

The Collar Strategy

Protective Put

Call Option

Strike Price

Put Option

Current Market Price

Zero-Cost Collar

Strike Prices

Current Stock Price

Market Price

Current Stock

Defined Risk

Long Put

Stock Price

Short Call

Volatility Skew