Commanding Crypto Options

Mastering crypto options demands a precise approach to market interaction. Professional traders recognize the direct impact of execution quality on portfolio performance. Request for Quote (RFQ) systems and block trading mechanisms represent foundational pillars for achieving superior outcomes. These tools transform how participants engage with liquidity, moving beyond superficial market access to a deliberate command over trade terms.

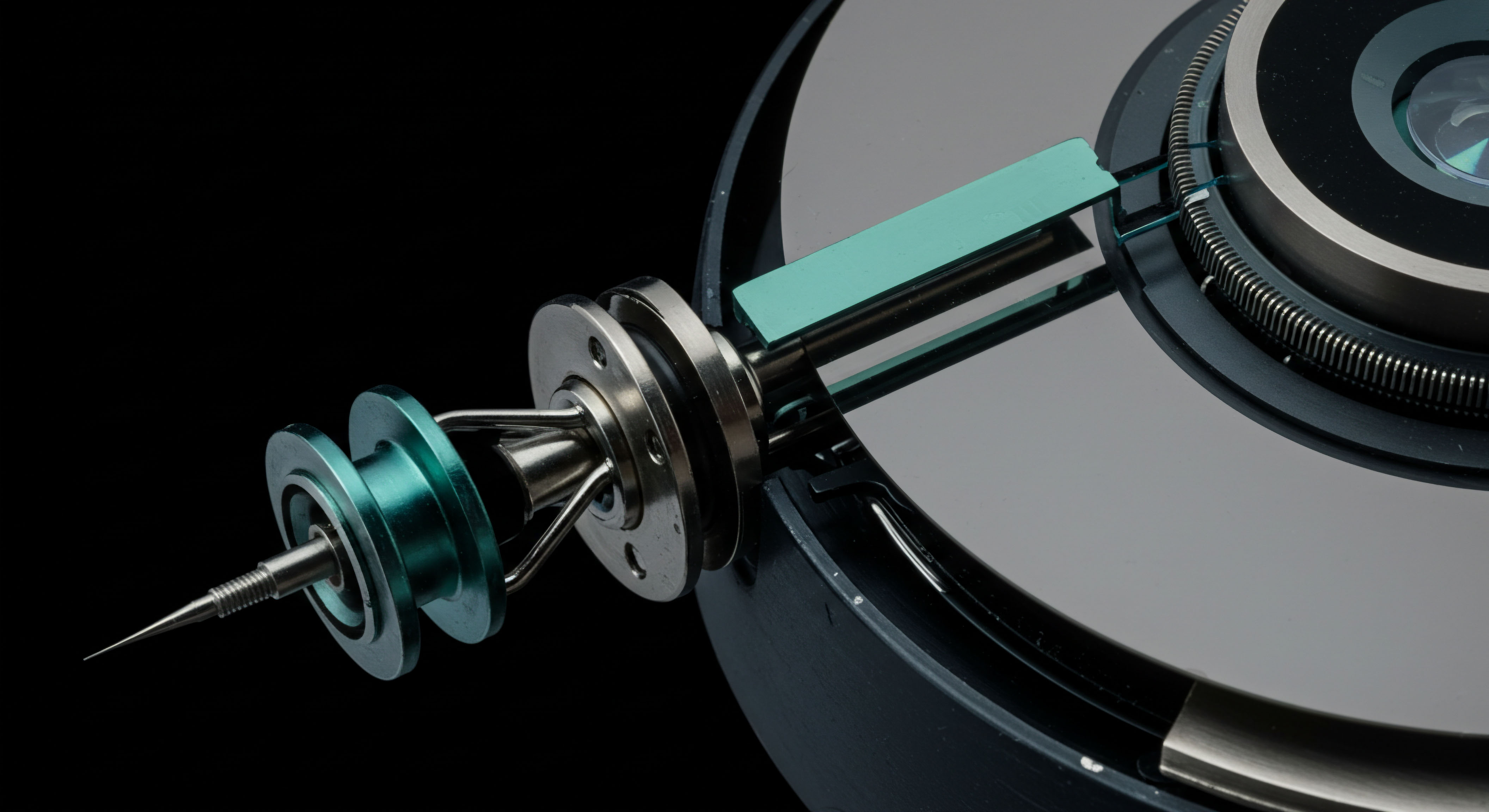

The RFQ mechanism, at its core, enables direct engagement with multiple liquidity providers. This process facilitates competitive pricing for options positions, particularly for larger orders. It operates by allowing a trader to solicit quotes from several dealers simultaneously, ensuring optimal price discovery. Understanding this fundamental mechanism lays the groundwork for strategic execution.

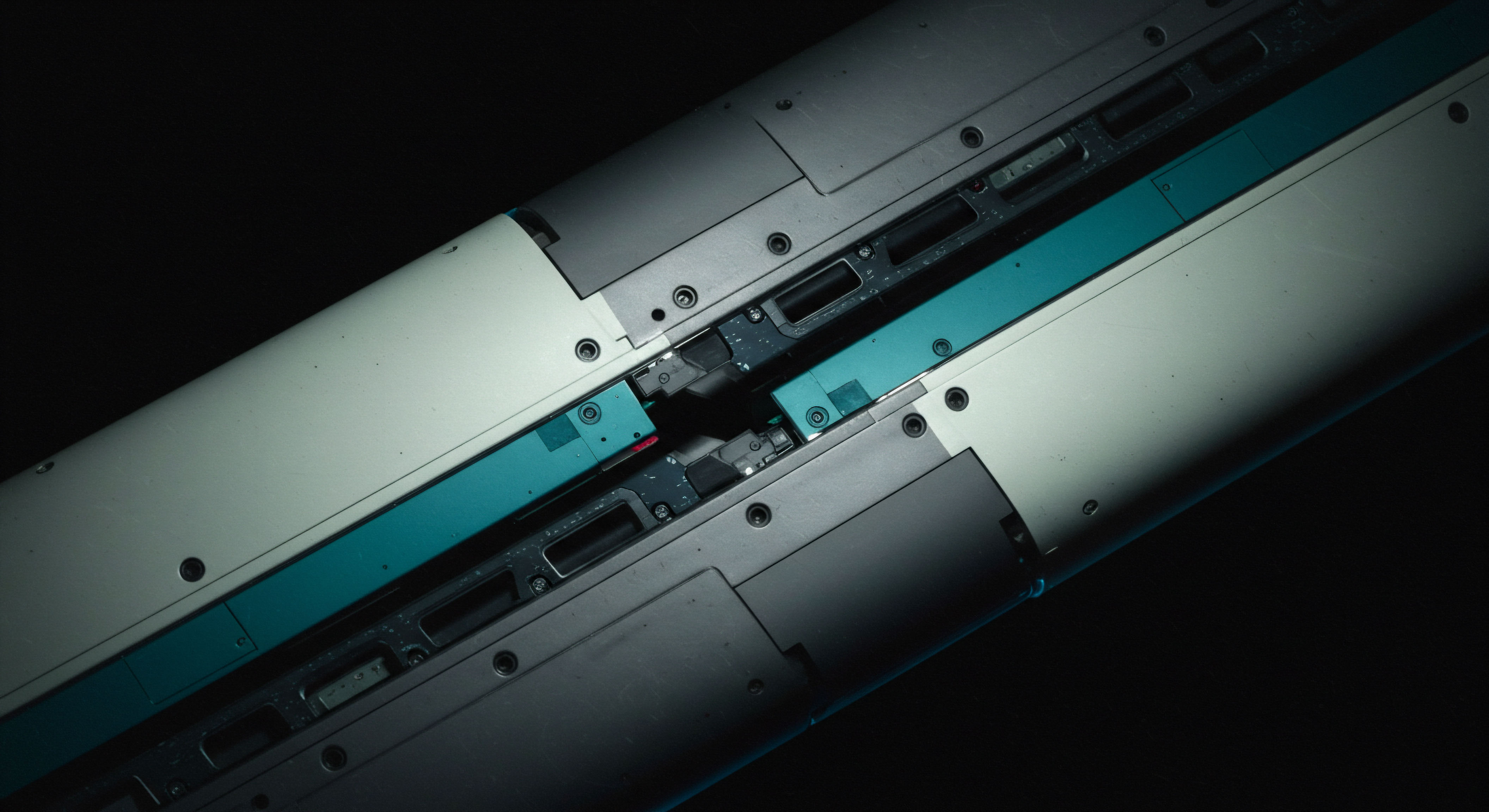

Block trading, often conducted through RFQ, addresses the challenge of moving substantial options positions without undue market impact. Such transactions bypass the public order book, protecting against adverse price movements that often accompany large orders. This discrete method safeguards a trader’s intent and preserves their desired entry or exit points. The ability to move significant capital efficiently defines a true market edge.

Achieving superior execution in crypto options hinges on a deliberate command over trade terms through professional-grade mechanisms.

Developing proficiency with these instruments builds a robust framework for consistent performance. The initial steps involve recognizing the inherent advantages these structured interactions offer. They provide a transparent, competitive environment for pricing complex derivatives. A trader’s journey toward market command begins with internalizing these core principles of operational advantage.

Strategic Options Deployment

Deploying capital effectively in crypto options requires a clear strategy, leveraging RFQ and block trading for tangible gains. These methods are essential for minimizing slippage and securing best execution across various market conditions. Traders utilize them to construct positions that align with their specific market outlook and risk parameters.

Structuring Positions with RFQ

The RFQ process provides a competitive environment for multi-leg options strategies. Traders can request quotes for complex spreads, such as straddles, collars, or butterflies, ensuring that all legs execute simultaneously at a favorable aggregate price. This synchronized execution mitigates leg risk, a common pitfall in fragmented markets. A clear view of the combined premium optimizes the trade’s cost basis.

Volatility Strategies and RFQ

Implementing volatility-centric strategies, like long or short straddles, benefits immensely from RFQ. These positions are highly sensitive to price and implied volatility. Obtaining quotes from multiple dealers through an RFQ ensures the trader captures the tightest bid-ask spread for these often capital-intensive structures. This direct approach translates into immediate P&L advantage upon entry.

Hedging Portfolios with RFQ

Portfolio managers employ RFQ for efficient hedging. A common application involves constructing a covered call or protective put position on a significant crypto holding. The RFQ process allows for the acquisition or sale of these options at competitive prices, effectively establishing a financial firewall against adverse price movements or generating income from existing assets. This disciplined risk management enhances overall portfolio stability.

Executing Block Trades with Precision

Block trading in crypto options is reserved for substantial order sizes, ensuring minimal market footprint. This method is critical for institutional players or high-net-worth individuals moving large quantities of Bitcoin (BTC) or Ethereum (ETH) options. The execution is typically facilitated over-the-counter (OTC) through specialized desks, often initiated via an RFQ.

Executing block trades demands careful counterparty selection. Traders prioritize dealers with deep liquidity pools and a history of reliable execution. The negotiation process within a block trade can also allow for custom terms, providing flexibility beyond standard exchange offerings. This direct negotiation secures advantageous pricing for significant capital deployments.

Block Trade Execution Workflow

- Define Position Parameters ▴ Specify the underlying asset (BTC, ETH), option type (call/put), strike price, expiry, and desired size.

- Initiate RFQ ▴ Submit the request to a select group of pre-approved liquidity providers or through a multi-dealer platform.

- Evaluate Quotes ▴ Compare the aggregate pricing and execution terms offered by various dealers. Consider factors beyond price, such as counterparty reliability and settlement efficiency.

- Execute Trade ▴ Select the optimal quote and confirm the block transaction. This typically occurs off-exchange, ensuring discretion.

- Post-Trade Confirmation ▴ Verify all terms and settlement details with the chosen counterparty.

The strategic deployment of these mechanisms transforms speculative interest into quantifiable outcomes. Each execution becomes a calculated maneuver within a larger financial strategy, driven by a pursuit of optimal pricing and reduced transaction costs. A commitment to this process builds a demonstrable edge.

Advanced Options Integration

Expanding capabilities in crypto options involves integrating advanced strategies and risk frameworks into a cohesive trading system. This progression moves traders from individual transactions to a comprehensive approach to market dynamics. The focus shifts toward maximizing capital efficiency and generating consistent alpha across diverse market cycles.

Optimizing Capital Efficiency

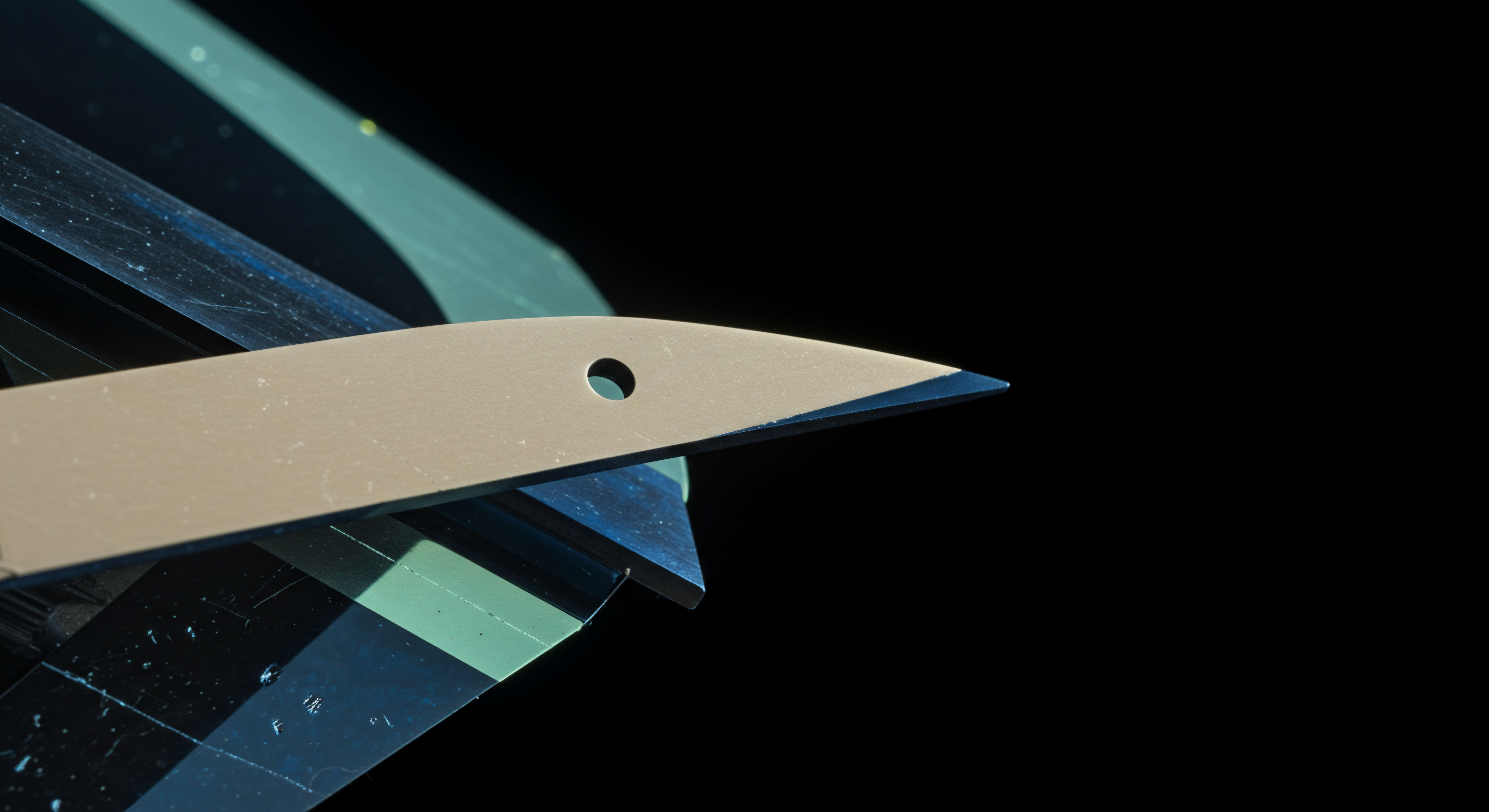

Advanced traders continually seek ways to optimize capital deployment. Utilizing options spreads via RFQ reduces the upfront capital requirement compared to outright long options positions. A well-constructed spread allows for a more precise expression of a market view with a defined risk profile. This strategic choice frees up capital for other opportunities, enhancing overall portfolio agility.

Dynamic Delta Hedging

Managing the delta of a large options portfolio is paramount for professional traders. Block trades and RFQ facilitate the efficient rebalancing of delta exposure. Traders can execute large, discrete transactions to adjust their overall portfolio delta, mitigating unwanted directional risk.

This proactive management maintains the desired risk posture, preventing adverse shifts in market exposure. Precision matters.

The ongoing assessment of market microstructure continually refines these strategies. Traders engage in a constant intellectual grappling with liquidity fragmentation, seeking to understand how RFQ protocols overcome these challenges. The objective remains a consistent optimization of execution pathways.

Volatility Surface Command

A sophisticated understanding of the volatility surface provides a distinct advantage. Traders use RFQ to capitalize on mispricings across different strikes and expiries. Constructing complex volatility trades, such as calendar spreads or volatility arbitrage strategies, becomes executable with the competitive pricing offered through multi-dealer platforms. This analytical depth translates directly into actionable trading opportunities.

Integrating these advanced concepts into a trading framework creates a robust, adaptive system. Each executed trade reinforces a larger strategic vision, moving beyond reactive market engagement. The path to command involves a relentless pursuit of informational and execution advantage, built upon the bedrock of professional-grade tools. This commitment defines long-term success in the derivatives arena.

Architecting Market Dominance

The journey to commanding crypto options represents an evolution in trading philosophy. It necessitates a shift toward a systems-engineering perspective, where every trade becomes a deliberate component of a larger, optimized framework. This is about establishing a direct, unwavering control over execution, transforming market engagement into a strategic advantage.

Future market cycles will reward those who master these advanced operational structures, securing their position at the vanguard of financial innovation. Your path to market dominance begins with this decisive, informed action.

Glossary

Crypto Options

Block Trading

Best Execution

Capital Efficiency

Options Spreads