The Cadence of Defined Outcomes

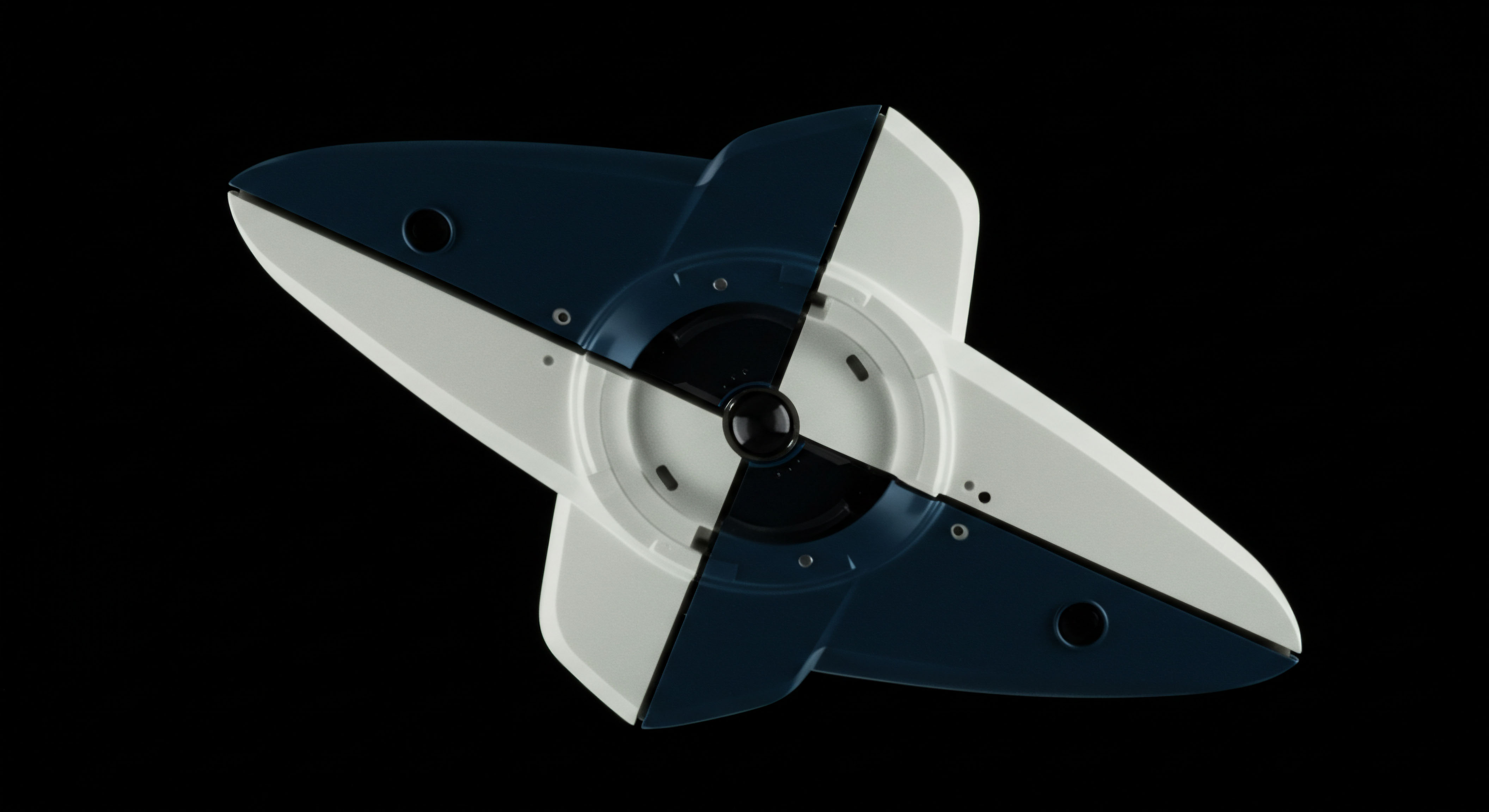

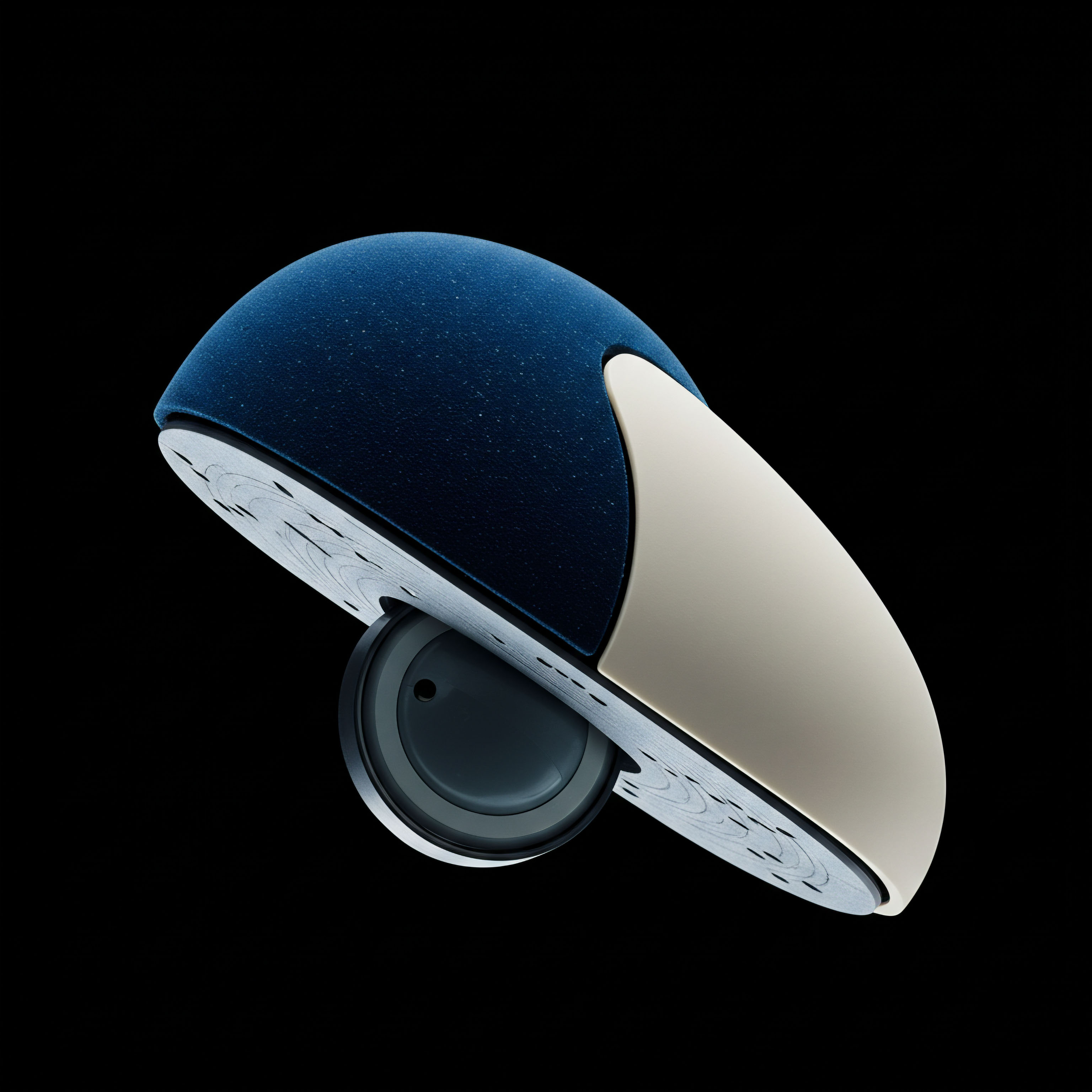

The iron condor is a four-legged options structure designed to produce consistent returns in markets exhibiting low volatility. It is a defined-risk strategy that establishes a profitable range for an underlying asset’s price movement over a specific period. You are constructing a position that benefits from the passage of time and neutral price action. This is achieved by simultaneously selling an out-of-the-money put spread and an out-of-the-money call spread on the same underlying asset with the same expiration date.

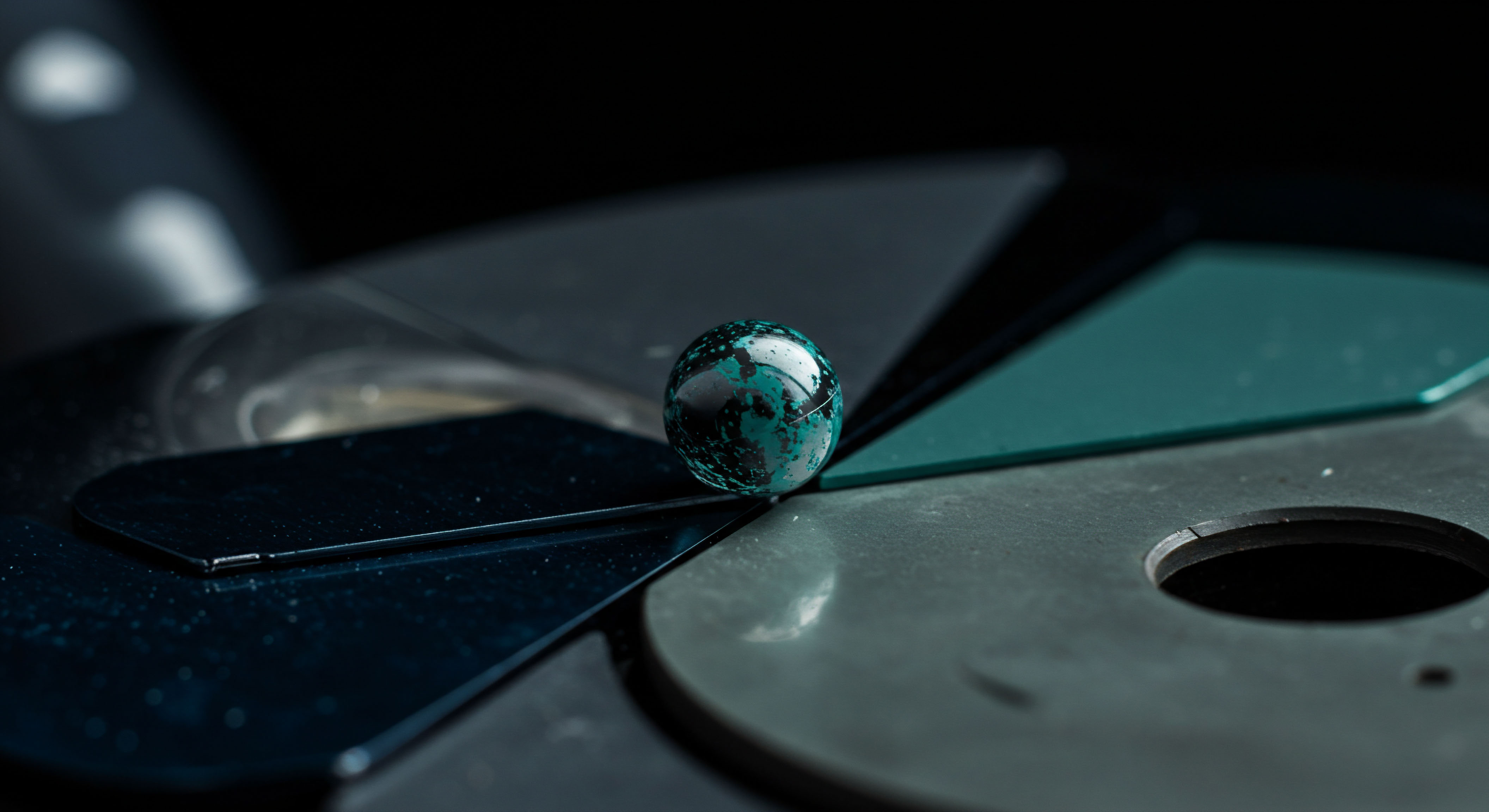

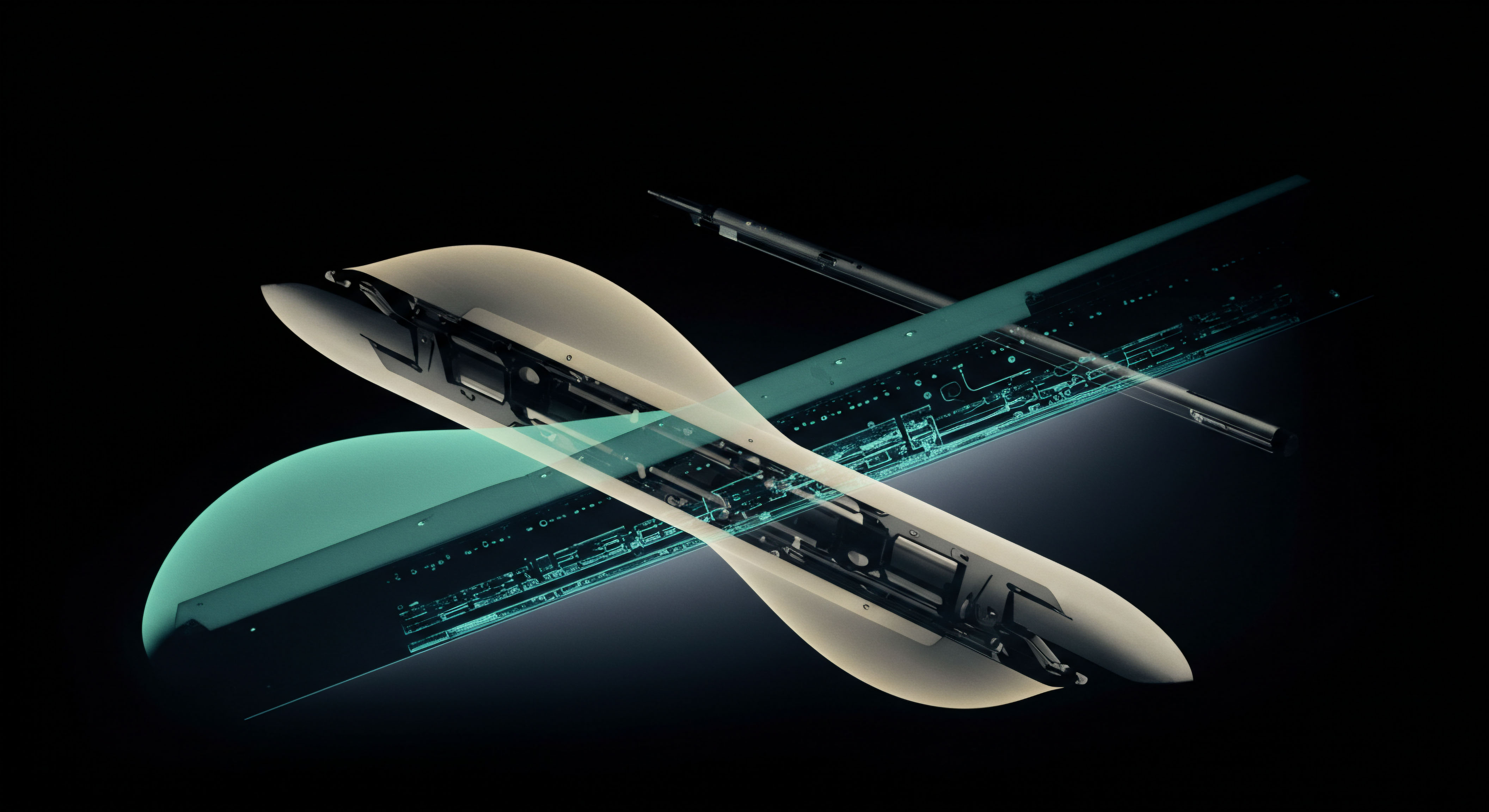

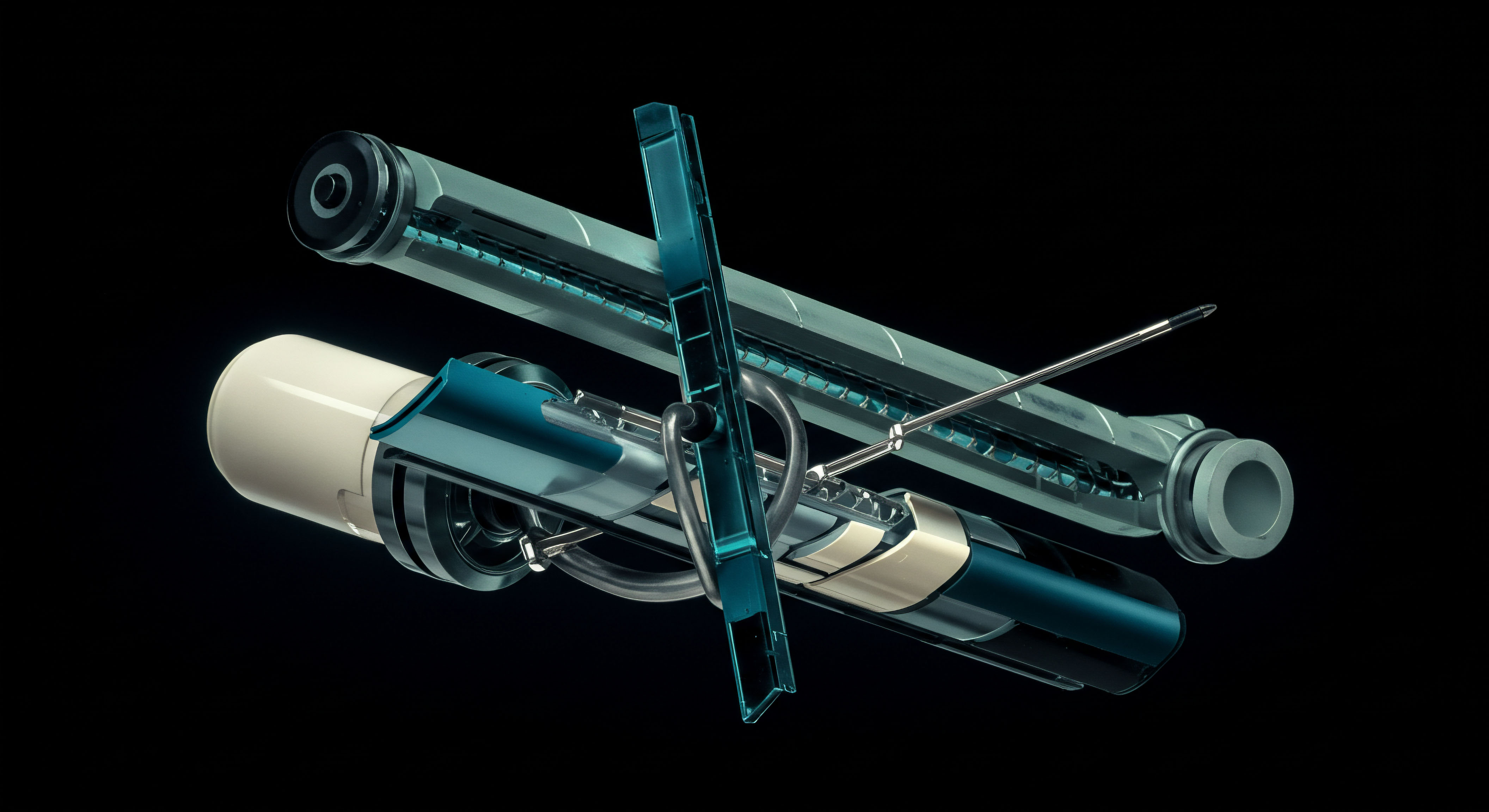

The structure’s name comes from the shape of its profit-and-loss graph, which resembles the wingspan of a large bird. Your objective is to collect the initial premium from selling these two spreads. The maximum gain is this net credit received when initiating the position. This outcome occurs when the underlying asset’s price remains between the two short strike prices through expiration, causing all four options to expire worthless.

The trade is engineered for range-bound markets, giving you a systematic method for generating income from assets that are consolidating or moving sideways. It represents a proactive approach to portfolio management, allowing you to generate returns without needing to predict market direction.

Calibrating the Monthly Income Engine

Deploying an iron condor effectively requires a systematic, multi-step process. Your success depends on diligent preparation and a clear understanding of the mechanics from asset selection through trade management. A disciplined methodology transforms this options structure into a reliable engine for monthly income generation.

Every decision, from the underlying asset to the timing of your exit, contributes to the probability of a successful outcome. This process is designed to be repeatable, allowing you to consistently identify and capitalize on high-probability opportunities in the market.

Selecting the Optimal Underlying Asset

The foundation of a successful iron condor trade is the choice of the underlying asset. You are seeking assets that exhibit specific characteristics conducive to a range-bound strategy. The ideal candidate is a highly liquid stock or exchange-traded fund (ETF) with a history of price stability. High liquidity, evidenced by significant trading volume and tight bid-ask spreads, ensures that you can enter and exit the four-legged position with minimal friction and cost.

Assets with low implied volatility are often good candidates, although entering trades when implied volatility is high and expected to fall can enhance the profitability of the position. Avoid assets that have upcoming earnings announcements or other scheduled news events before your chosen expiration date, as these can introduce sharp, unpredictable price movements. Your goal is to operate in a predictable environment where the asset’s price is likely to remain within a calculated range.

An iron condor entered with 30 to 60 days until expiration and positioned during periods of high implied volatility offers a structured method to systematically harvest premium.

The Precision of Strike Selection

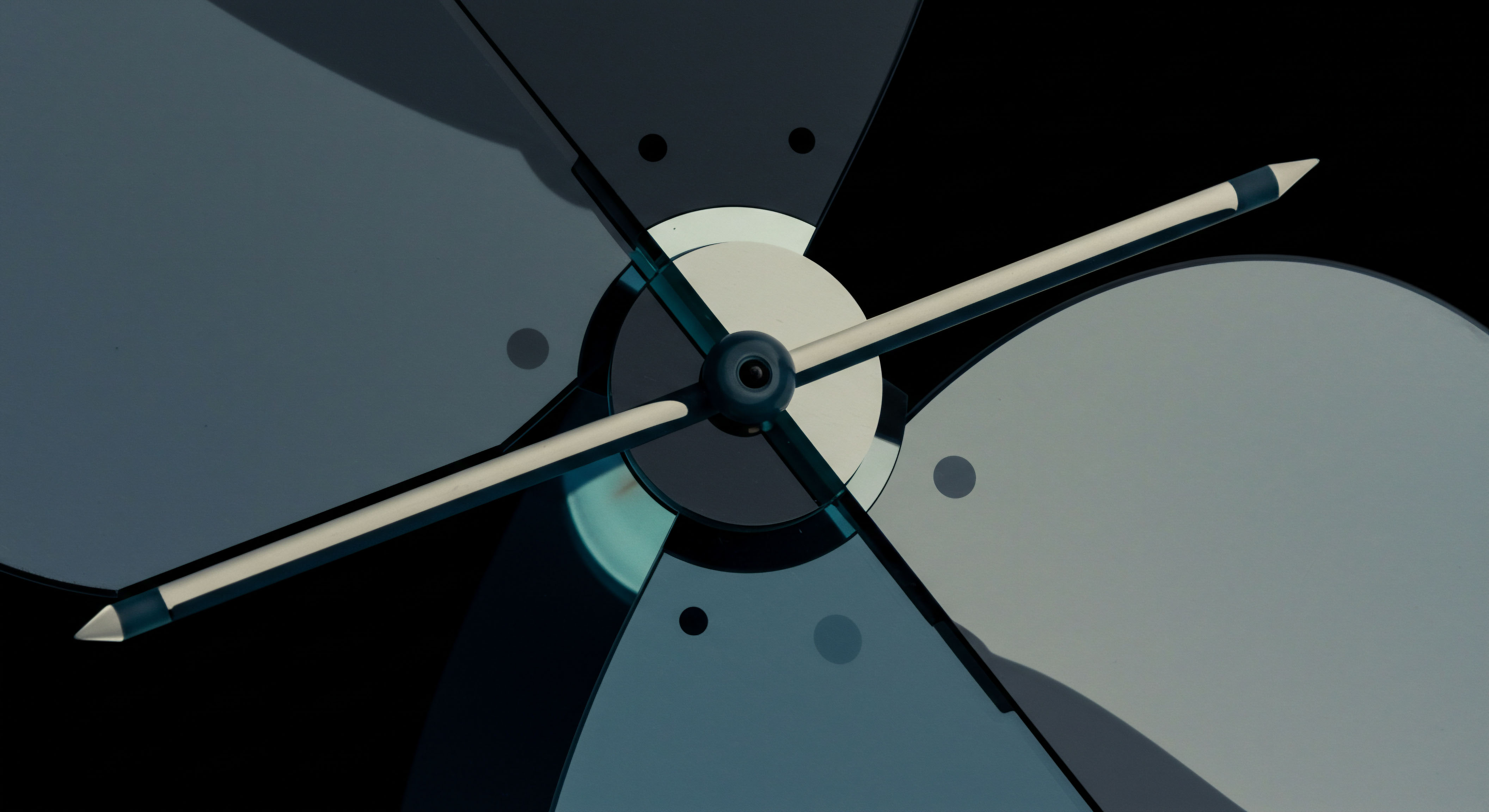

The placement of your short strikes is the most critical decision in constructing your iron condor. This choice directly dictates your probability of success and the premium you will collect. A common professional practice involves using delta, a Greek metric that measures an option’s sensitivity to price changes in the underlying asset. Delta also serves as a rough proxy for the probability of an option expiring in-the-money.

For a standard iron condor, traders often sell the short put and short call options at a specific delta. Selecting a lower delta for your short strikes increases the distance between your position and the current asset price, thereby raising your probability of success. A higher delta will be closer to the money, generating more premium but with a lower probability of profit. The long options, which define your risk, are then purchased further out-of-the-money, completing the spreads.

- Conservative Approach (Higher Probability) ▴ Sell short strikes around the 10-15 delta. This places your position far from the current price, creating a wide profit range. The premium collected will be smaller, resulting in a lower return on capital.

- Standard Approach (Balanced Profile) ▴ Sell short strikes around the 16-20 delta. This corresponds roughly to a one-standard-deviation price move and offers a balance between premium income and probability of success.

- Aggressive Approach (Higher Premium) ▴ Sell short strikes at the 25-30 delta or higher. This narrows the profit range but significantly increases the premium collected. This approach requires more active management as the strikes are closer to the money.

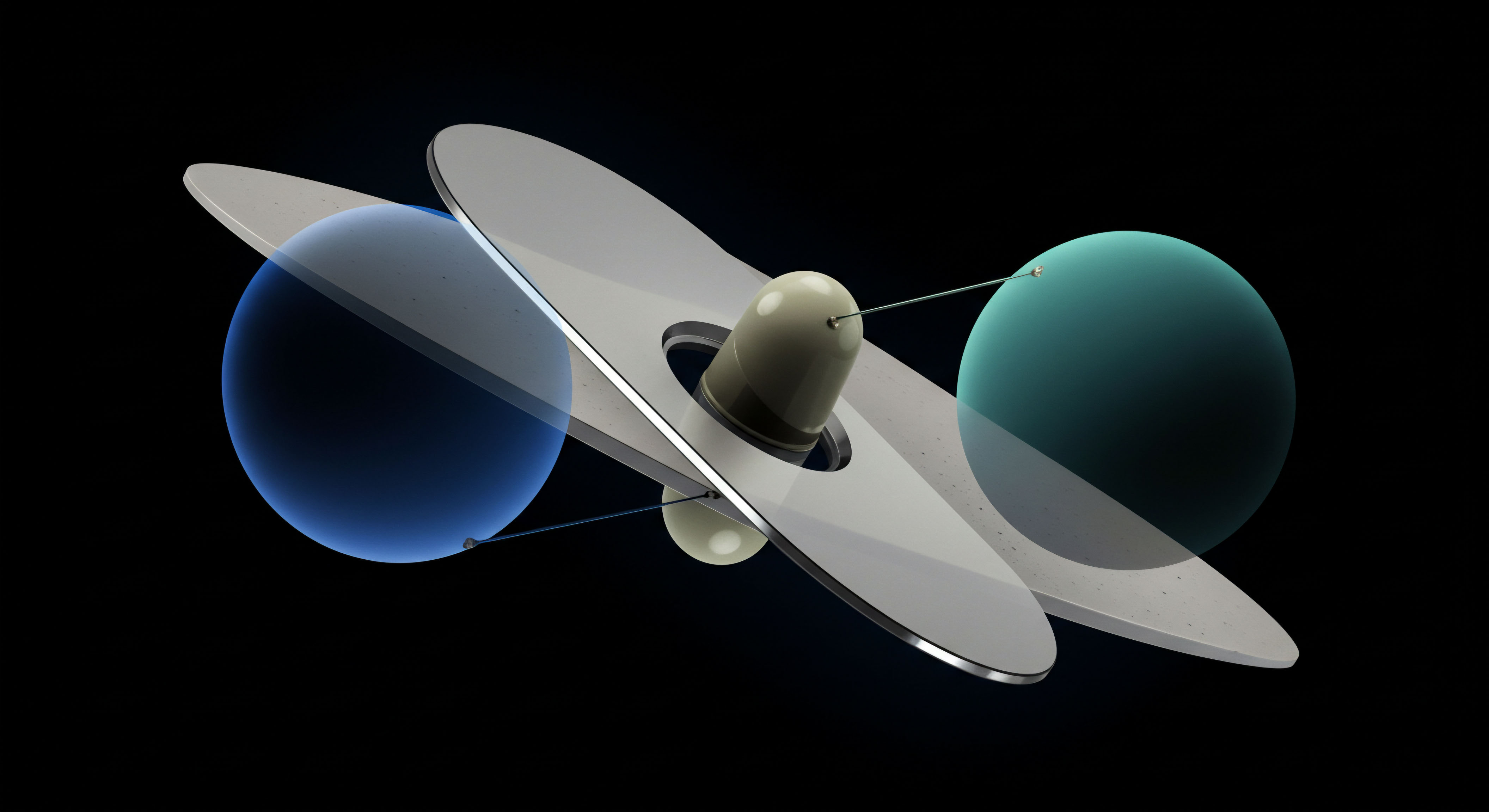

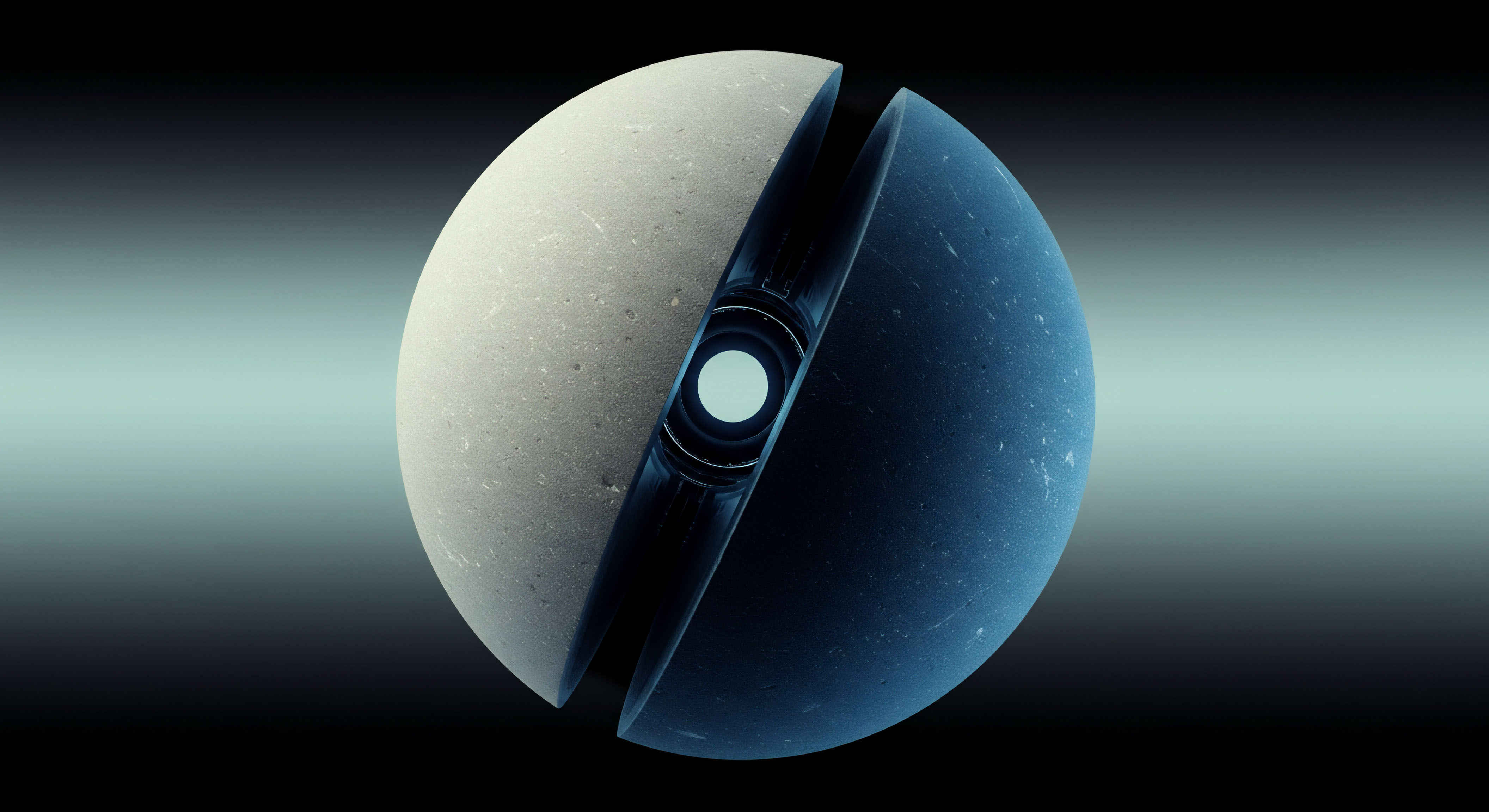

Defining Profit and Risk Parameters

The iron condor offers the significant advantage of a completely defined risk profile from the moment of entry. You know your exact maximum profit and maximum loss before committing capital. The maximum profit is the net credit you receive for selling the two credit spreads. This is the ideal outcome, achieved if the underlying price closes between your short strikes at expiration.

The maximum loss is calculated as the width of the spread between your long and short strikes, minus the net credit you received. For instance, if you construct an iron condor with $5-wide spreads and collect a $1.50 credit, your maximum loss per share is $3.50 ($5.00 – $1.50). This defined-risk nature allows for precise position sizing and portfolio allocation. Many professional traders establish a profit target, often 50% of the maximum potential profit, and an exit plan if the trade moves against them, such as when the loss reaches 1.5x to 2x the premium received.

Beyond the Monthly Cadence

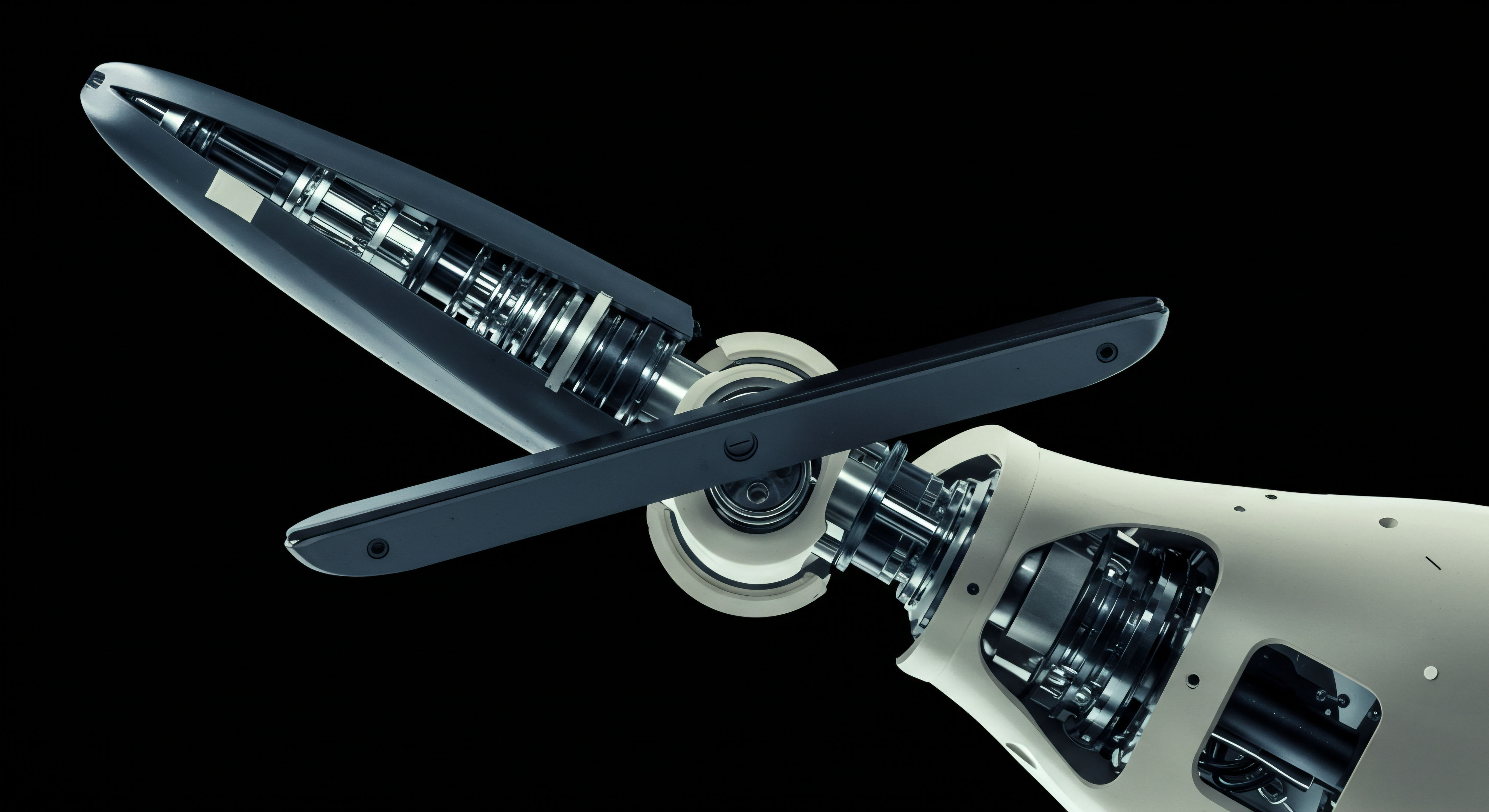

Mastery of the iron condor extends beyond the initial trade setup. It involves developing a sophisticated understanding of adjustments, portfolio integration, and the management of Greek exposures. Advanced practitioners view the iron condor as a dynamic position that can be adapted to changing market conditions.

This allows for the defense of positions, the enhancement of returns, and the strategic management of a portfolio of income-generating trades. This higher level of management transforms the strategy from a static monthly trade into a fluid and responsive part of your overall trading book.

Advanced Adjustment Techniques

Markets are dynamic, and even high-probability trades can be challenged. When the price of the underlying asset trends toward either your short put or short call, you have a number of strategic adjustments available. The objective of an adjustment is to move the profitable range of your position to better align with the new market reality, often while collecting an additional credit. This action can increase your maximum profit, reduce your maximum loss, and widen your break-even points.

A primary adjustment technique is to roll the untested, or profitable, side of the condor closer to the current price. For example, if the asset price rallies, testing your call spread, you can close your original put spread and open a new one at higher strike prices, closer to the money. This collects more premium and effectively shifts your entire profit range higher. Another common adjustment is rolling the entire position out in time to a later expiration cycle, giving the trade more time to be profitable.

Portfolio Integration and Position Sizing

A professional approach to iron condors involves integrating them into a broader portfolio context. Rather than viewing each condor in isolation, consider its contribution to your portfolio’s overall Greek exposures and return profile. You can run multiple iron condor positions across different, uncorrelated underlying assets to diversify your risk. Position sizing is a critical component of risk management.

A common guideline is to allocate a small percentage of your total portfolio capital, such as 1-5%, to the maximum potential loss of any single iron condor position. This ensures that a single losing trade will have a minimal impact on your overall portfolio value. By managing a portfolio of condors, you are building a system designed to profit from statistical probabilities over a large number of occurrences, smoothing your equity curve and creating a more consistent income stream.

Managing Volatility and Time Decay

The iron condor is a short vega and long theta position. This means the trade profits from decreases in implied volatility (vega) and the passage of time (theta). A deep understanding of these two Greeks is essential for advanced management. The ideal time to enter an iron condor is when implied volatility is high, as this inflates the premiums you collect.

As volatility subsequently falls, the value of your short options decreases, creating a profit. Theta represents the daily rate at which your position’s value increases as time passes. This decay accelerates as you get closer to the expiration date. Advanced traders monitor their position’s vega and theta to understand how sensitive their profit is to changes in volatility and time.

This knowledge informs decisions about when to take profits or adjust a position. For example, a sharp increase in implied volatility can turn a profitable position into a losing one, even if the price has not moved, signaling a potential need for adjustment.

The Strategist’s Viewpoint

You have now moved from understanding the mechanics of a powerful income tool to the strategic framework for its deployment. The iron condor is more than a single trade; it is a systematic approach to viewing the market as a field of probabilities. Its structure provides a way to engineer outcomes based on market inaction.

By internalizing the principles of asset selection, strike placement, and dynamic adjustment, you build a process for generating consistent, defined-risk returns. This is the foundation of a professional-grade trading operation.

Glossary

Underlying Asset

Expiration Date

Net Credit

Portfolio Management

Monthly Income

Iron Condor

Implied Volatility

Short Strikes

Defined Risk

Maximum Loss