Accessing Deep Crypto Liquidity

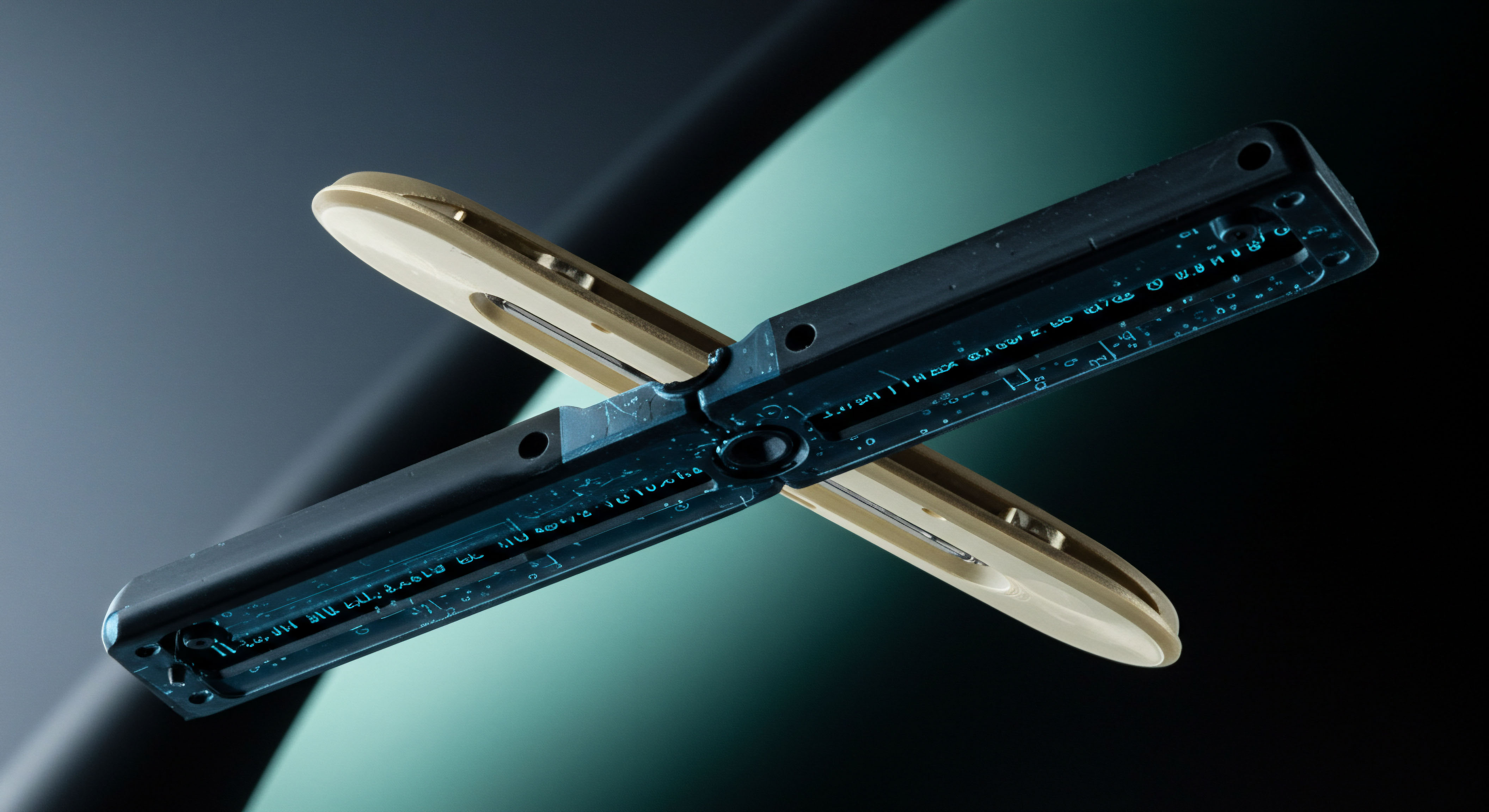

Professional traders operate within an ecosystem where profound liquidity forms a strategic imperative. Optimal execution in dynamic crypto environments necessitates direct engagement with substantial order flow. Request for Quotation (RFQ) systems and specialized block trading avenues represent fundamental mechanisms for achieving this crucial market interaction.

RFQ, a direct negotiation channel, permits participants to solicit competitive bids and offers from multiple liquidity providers concurrently. This structured engagement yields superior pricing for significant positions, orchestrating a tailored liquidity environment. The process provides traders with advantageous execution, circumventing the inherent constraints of public order books.

Block trading, frequently executed off-exchange or through dedicated venues, facilitates the movement of considerable volumes without disturbing prevailing market dynamics. These pre-arranged transactions mitigate market impact while maintaining transaction discretion. A sophisticated approach to crypto markets involves mastering these channels for superior entry and exit points.

Commanding liquidity on your terms redefines market access into a strategic advantage.

Strategic Capital Deployment

Engineered Execution Frameworks

Optimizing Options Spreads with RFQ

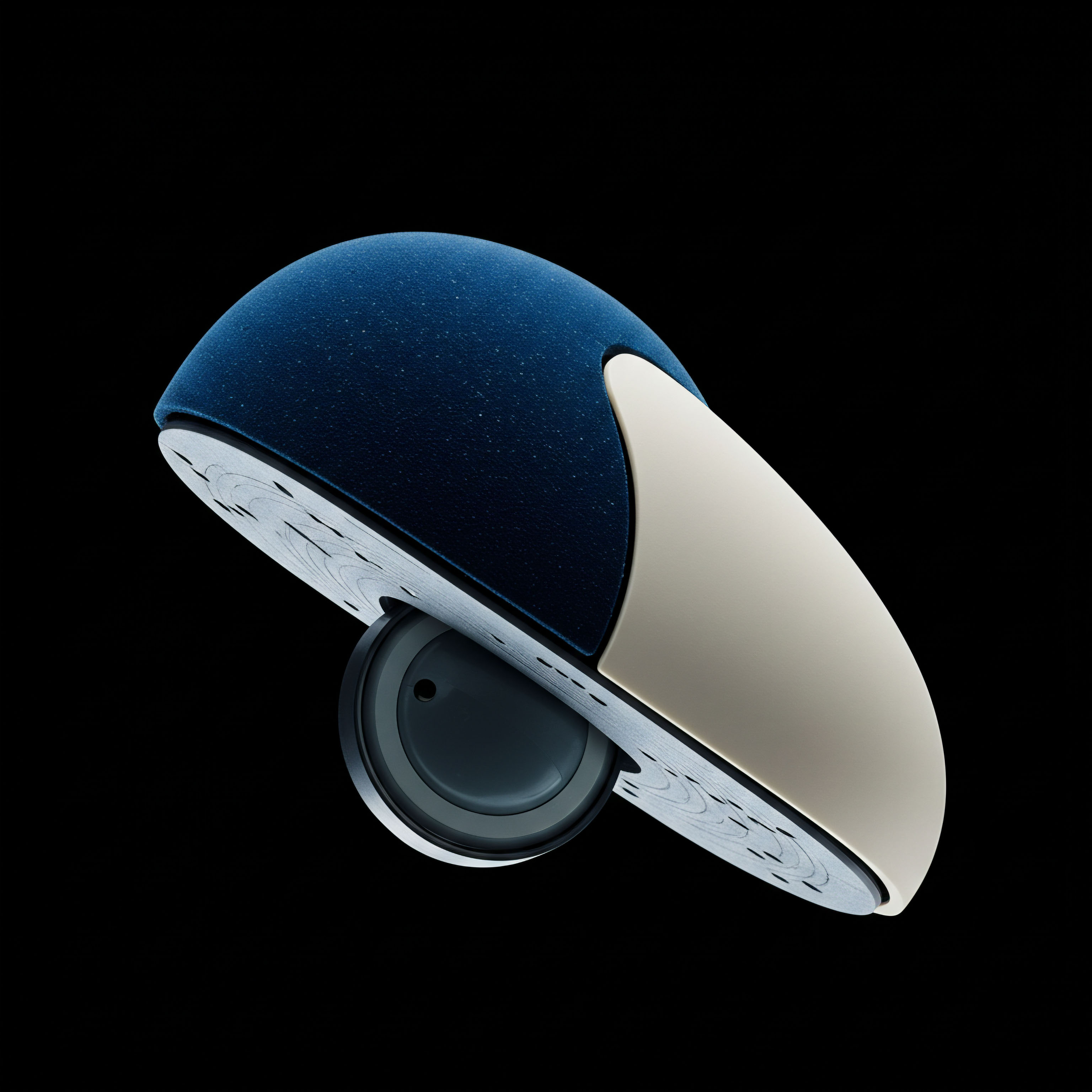

Deploying multi-leg options spreads demands precision, especially with substantial capital allocations. An Options RFQ simplifies this complexity, allowing a single request for a combined strategy. This approach guarantees atomic execution across all legs, mitigating leg risk and securing the desired P&L profile. Traders gain control over their volatility exposure and directional bets with unmatched efficiency.

Block Trading Large Positions

Executing large Bitcoin or Ethereum options blocks requires a dedicated conduit to prevent market signaling. Bitcoin Options Block and ETH Options Block facilities provide this necessary infrastructure. These channels connect directly with institutional liquidity pools, ensuring a discrete transaction. The objective centers on minimizing slippage and securing best execution, preserving capital for the intended market view.

Strategic Volatility Exposure

Managing volatility effectively represents a core competency for advanced derivatives practitioners. A BTC Straddle Block or an ETH Collar RFQ provides precise tools for this endeavor. These structures provide traders with a specific volatility outlook or hedge existing positions against adverse price movements. The capacity to construct these positions through private negotiation channels grants a distinct advantage in managing portfolio risk.

Consider these tactical applications:

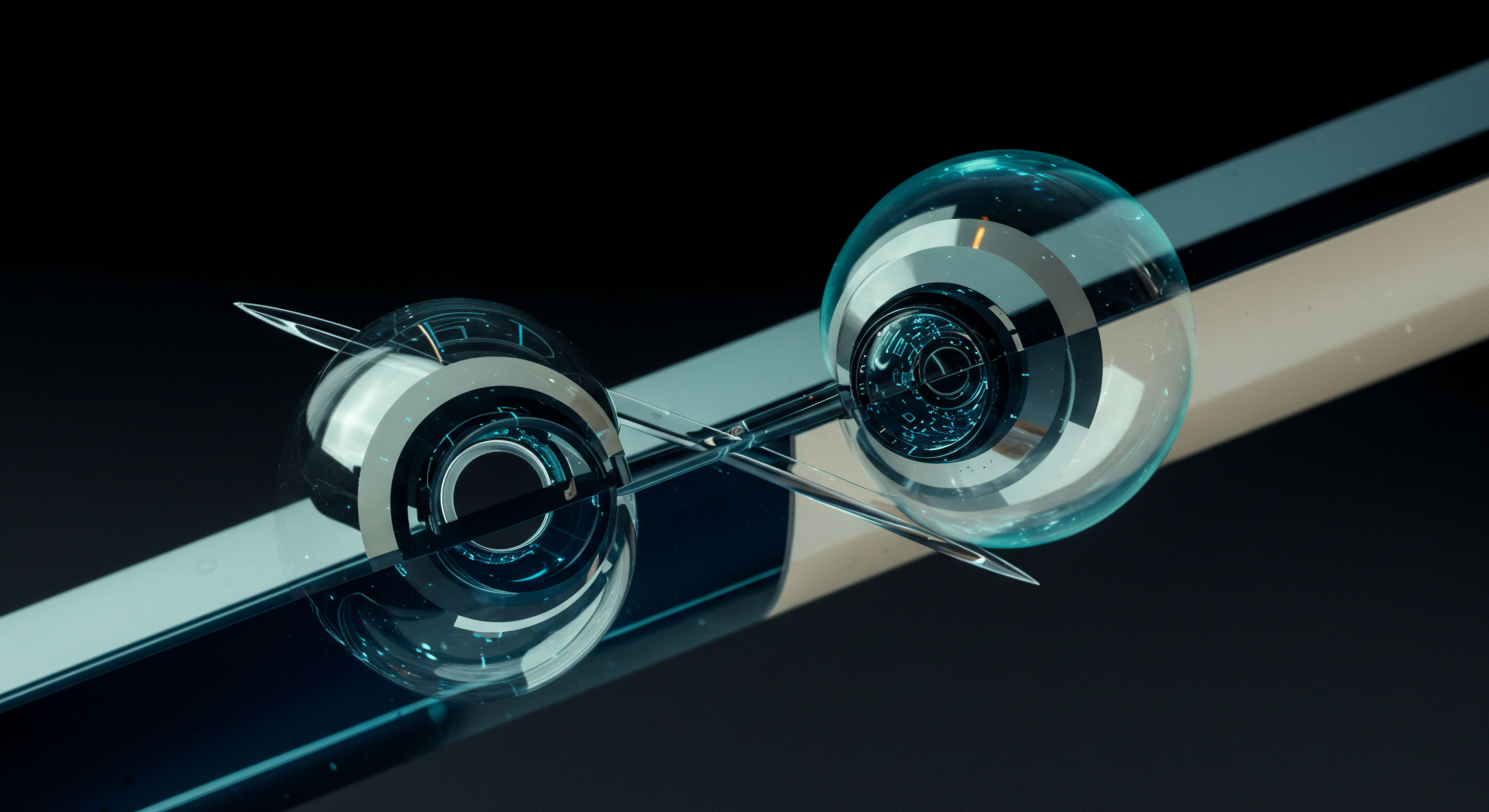

- Multi-dealer Liquidity Aggregation ▴ Poll multiple dealers through RFQ, identifying the most competitive pricing for complex multi-leg options strategies.

- Anonymous Options Trading ▴ Access block venues for discretion, preventing front-running or market impact from substantial orders.

- Volatility Block Trade Execution ▴ Apply pre-negotiated blocks for large-scale volatility plays, ensuring a clean entry or exit at a predetermined price.

- OTC Options Customization ▴ Design highly specific, tailor-made options contracts directly with counterparties, extending beyond standardized exchange offerings.

Precision execution across deep liquidity channels delivers a quantifiable edge in every trade.

Advanced Portfolio Command

Portfolio Resilience through Advanced Execution

Integrating Algorithmic Precision

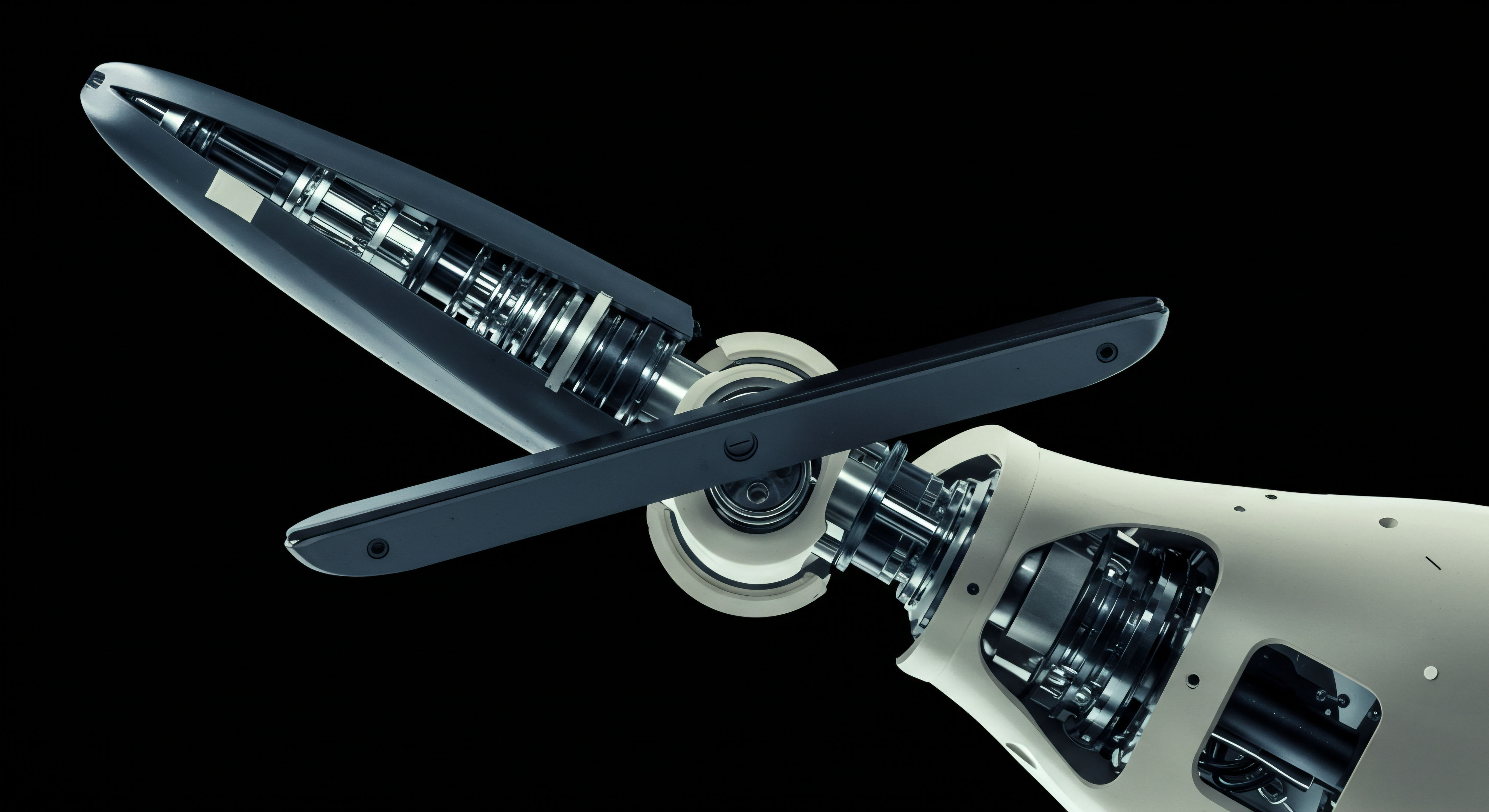

The convergence of advanced execution methods with algorithmic trading systems marks a notable evolution for portfolio managers. Algorithmic execution, when directed through RFQ or block channels, redefines discretionary trading into a systematic advantage. This integration supports dynamic order sizing, intelligent routing, and real-time risk mitigation. Crafting an AI trading bot to interact with these deep liquidity avenues represents the next frontier in achieving sustained alpha generation.

Macro Hedging with Options Blocks

Large-scale portfolio hedging against systemic market shifts demands instruments capable of absorbing substantial capital without undue market disturbance. Options blocks serve as a superior vehicle for deploying macro hedges. Consider the strategic deployment of a volatility block trade to protect against broad market downturns or unexpected spikes in implied volatility. This proactive stance safeguards portfolio integrity during periods of heightened uncertainty.

The very structure of market microstructure, with its inherent fragmentation, presents both challenges and opportunities. Many interpret these complexities as market friction, yet a deeper analytical engagement reveals a different truth. Grasping derivatives pricing models and their interaction with execution venues becomes critically important.

A thorough grasp of these dynamics facilitates the strategic positioning of capital, converting perceived inefficiencies into actionable edges. This requires a constant re-evaluation of execution methodologies against prevailing market conditions.

Mastering advanced execution pathways builds a resilient, alpha-generating portfolio.

Unseen Currents, Unrivaled Command

The pursuit of consistent market outperformance always leads to the same truth ▴ command over execution defines success. Mastering the channels of deep crypto liquidity converts passive participation into strategic dominance. This is the professional method.