Professional RFQ Foundation

Discerning traders command market outcomes through superior execution systems. The Request for Quote, or RFQ, mechanism in crypto options stands as a foundational operational framework for achieving precise liquidity sourcing and optimal price discovery. This sophisticated method empowers participants to solicit bids and offers from multiple market makers simultaneously, securing competitive pricing for blocks of options contracts. Understanding its operational core marks the initial step toward wielding a significant market edge.

This approach directly addresses the imperative for efficiency in digital asset markets. A professional engages directly with liquidity providers, shaping the terms of their transaction. This direct interaction ensures pricing reflects current market conditions with remarkable accuracy, a stark contrast to fragmented or opaque order book executions. Mastering this foundational interaction elevates one’s trading posture, moving beyond reactive participation to proactive command.

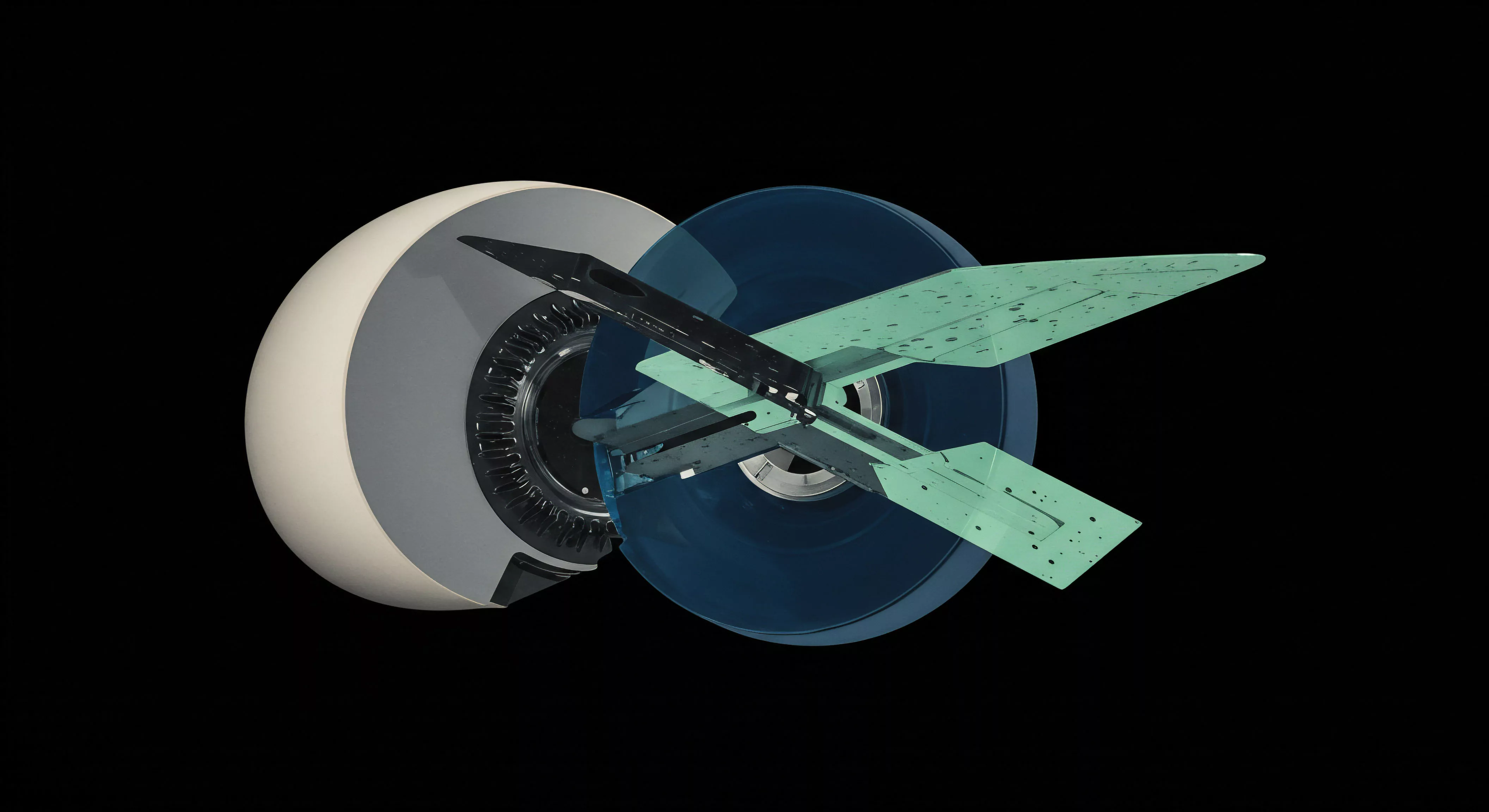

The RFQ mechanism in crypto options provides a direct channel for commanding liquidity and securing optimal pricing from multiple market makers.

Direct Liquidity Sourcing

Direct liquidity sourcing through RFQ establishes a clear channel to significant order flow. Participants submit their desired options structure, whether a single leg or a complex spread, to a network of qualified dealers. These dealers then compete to offer the best possible terms. This competitive dynamic inherently drives pricing efficiency, benefiting the initiator of the request.

Price Discovery Dynamics

Price discovery within an RFQ system unfolds through a rigorous, competitive process. Market makers, equipped with advanced pricing models and real-time data, submit their most aggressive quotes. This real-time contest ensures the trader accesses the tightest spreads available for their specific options position. Such a dynamic optimizes entry and exit points, a critical element for generating alpha.

Strategic Options Deployment

Deploying RFQ within a crypto options investment framework requires a clear understanding of its application across various strategic objectives. The ability to execute complex options positions with precision translates directly into tangible performance gains. This section outlines specific, actionable strategies for leveraging RFQ, ensuring each trade aligns with a defined risk-adjusted return objective.

Block Trade Execution

Executing large block trades demands a system capable of absorbing significant size without undue market impact. RFQ excels in this domain, providing a confidential channel for institutional-sized orders. Initiating a block RFQ allows a trader to transact substantial volume at a single, negotiated price, bypassing the slippage inherent in cascading smaller orders through public order books. This method preserves capital efficiency, a paramount consideration for substantial positions.

Multi-Leg Spread Construction

Sophisticated options strategies frequently involve multiple legs, such as straddles, collars, or iron condors. Constructing these spreads requires simultaneous execution of constituent options to lock in the desired risk profile. An RFQ for multi-leg spreads streamlines this process, allowing market makers to quote the entire package as a single unit. This atomic execution prevents leg risk, where individual legs fill at unfavorable prices, distorting the intended strategy.

Consider a BTC straddle block, designed to capitalize on expected volatility. An RFQ for this specific spread ensures both the call and put options execute concurrently, maintaining the integrity of the strategy’s delta and gamma exposure. Similarly, an ETH collar RFQ provides a controlled mechanism for downside protection and income generation, locking in the protective put and covered call components at optimal prices.

The true power lies in its capacity to handle complexity with streamlined efficiency.

- Define the options strategy and desired contract specifications.

- Submit the RFQ to multiple qualified liquidity providers.

- Evaluate competing quotes for optimal pricing and size.

- Execute the trade, securing the desired position at a single, agreed-upon price.

- Monitor the position, adjusting risk parameters as market conditions shift.

Volatility Plays and Tail Risk Hedging

Options contracts provide direct exposure to volatility, a critical factor in crypto markets. RFQ enables precise execution of volatility block trades, allowing traders to express views on implied volatility with accuracy. This applies whether one seeks to profit from anticipated volatility spikes or to hedge against unexpected market turbulence. Furthermore, RFQ facilitates the acquisition of deep out-of-the-money options for tail risk hedging, securing protection at scale.

RFQs enable precise execution of volatility trades and efficient tail risk hedging, optimizing capital deployment against market shifts.

Mastering Advanced Applications

Expanding one’s operational capacity with RFQ means integrating it into a broader portfolio management and risk mitigation system. The strategic advantage of RFQ extends beyond individual trade execution, influencing capital allocation and overall portfolio resilience. This progression from execution to systemic mastery defines the advanced practitioner.

Portfolio Integration and Capital Efficiency

Integrating RFQ into a holistic portfolio management system optimizes capital deployment across diverse crypto options strategies. The ability to precisely price and execute positions of varying sizes and complexities enhances overall portfolio efficiency. This includes managing exposure to various underlying assets, optimizing delta-hedging costs, and dynamically adjusting volatility exposure. The system’s capacity to deliver superior execution directly impacts the portfolio’s Sharpe ratio.

Dynamic Risk Mitigation

Dynamic risk mitigation represents a sophisticated application of RFQ. As market conditions evolve, portfolio managers frequently adjust hedges or rebalance options positions. Executing these adjustments through RFQ minimizes transaction costs and price impact, preserving the integrity of the portfolio’s risk profile.

This proactive approach to risk management, driven by efficient execution, becomes a cornerstone of sustained performance. One must constantly calibrate their assessment of liquidity depth against the urgency of a hedging adjustment, ensuring the RFQ mechanism delivers its full potential in volatile environments.

Systemic Edge Generation

A systemic edge emerges from consistently leveraging RFQ for best execution. This sustained advantage translates into superior net entry and exit prices, reducing the cost basis of positions and amplifying profit potential. The systematic application of RFQ transforms individual trades into a continuous stream of optimized outcomes, building a durable advantage in the competitive landscape of crypto options.

Commanding Market Destiny

The path to market mastery unfolds through the deliberate adoption of superior operational frameworks. RFQ for crypto options stands as a powerful instrument, transforming execution from a reactive endeavor into a proactive strategic command. Traders who internalize its mechanisms and integrate its capabilities into their broader investment system forge a distinctive, quantifiable edge, shaping their financial trajectory with unwavering precision.

Glossary

Crypto Options

Btc Straddle Block

Eth Collar Rfq