Mastering Execution Dynamics

Superior execution stands as the definitive separator in high-value crypto markets. Achieving optimal price discovery, particularly for significant options and block trades, demands a sophisticated approach. The Request for Quote (RFQ) mechanism presents a powerful, professional-grade solution.

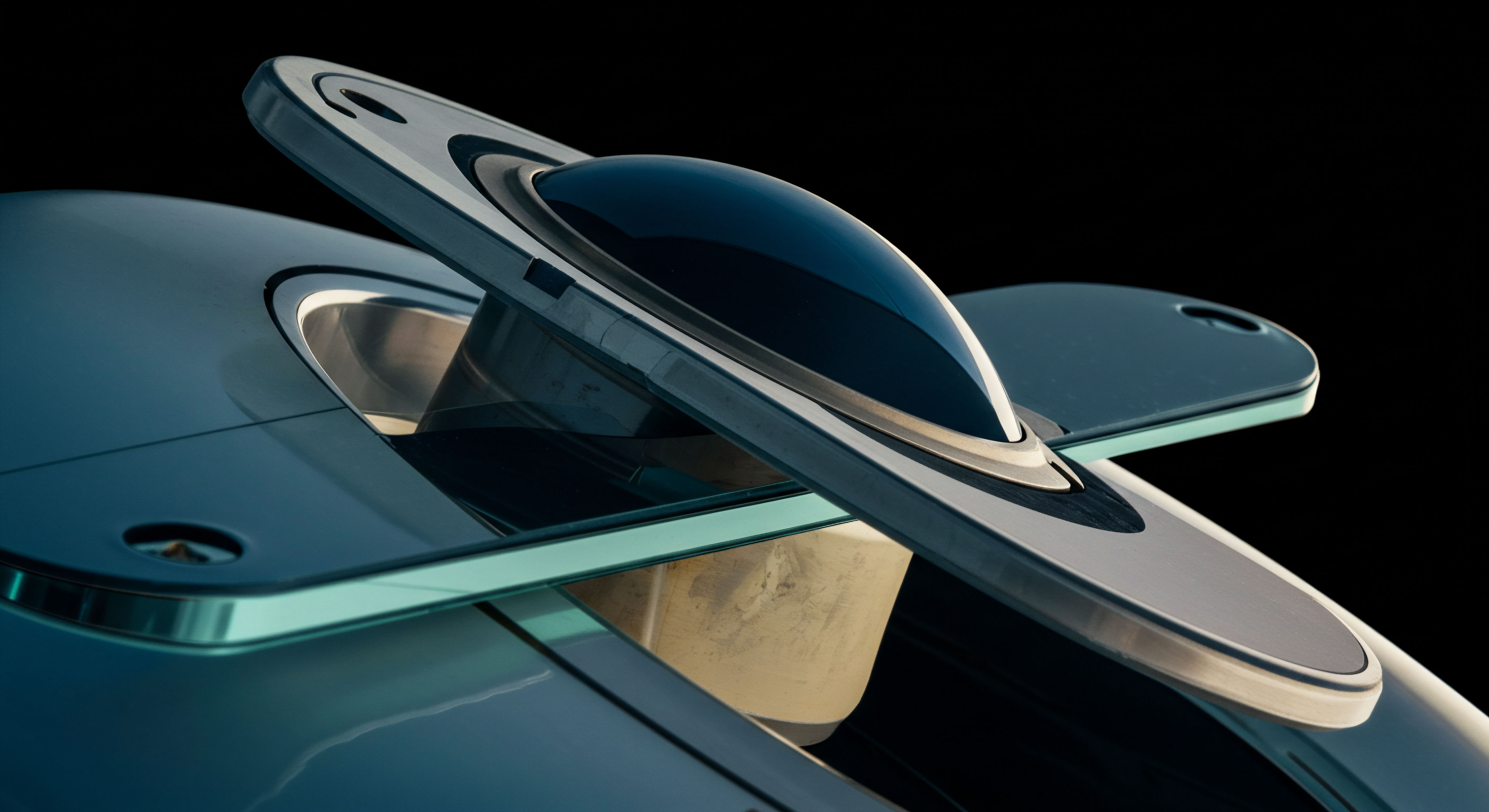

This system facilitates a direct interaction with multiple liquidity providers, compelling them to compete for your order. Such a structure ensures a transparent, competitive environment for price formation, moving beyond the limitations of single-venue order books.

Understanding the mechanics of an RFQ is foundational for any serious market participant. When initiating an RFQ, you broadcast your trading intent to a selected group of counterparties. These participants then submit their most competitive bids and offers, tailored precisely to your specified size and instrument.

The process centralizes competitive pricing, granting you direct control over the execution terms. This methodical approach significantly reduces information leakage and price impact, factors that frequently erode value in less structured trading environments.

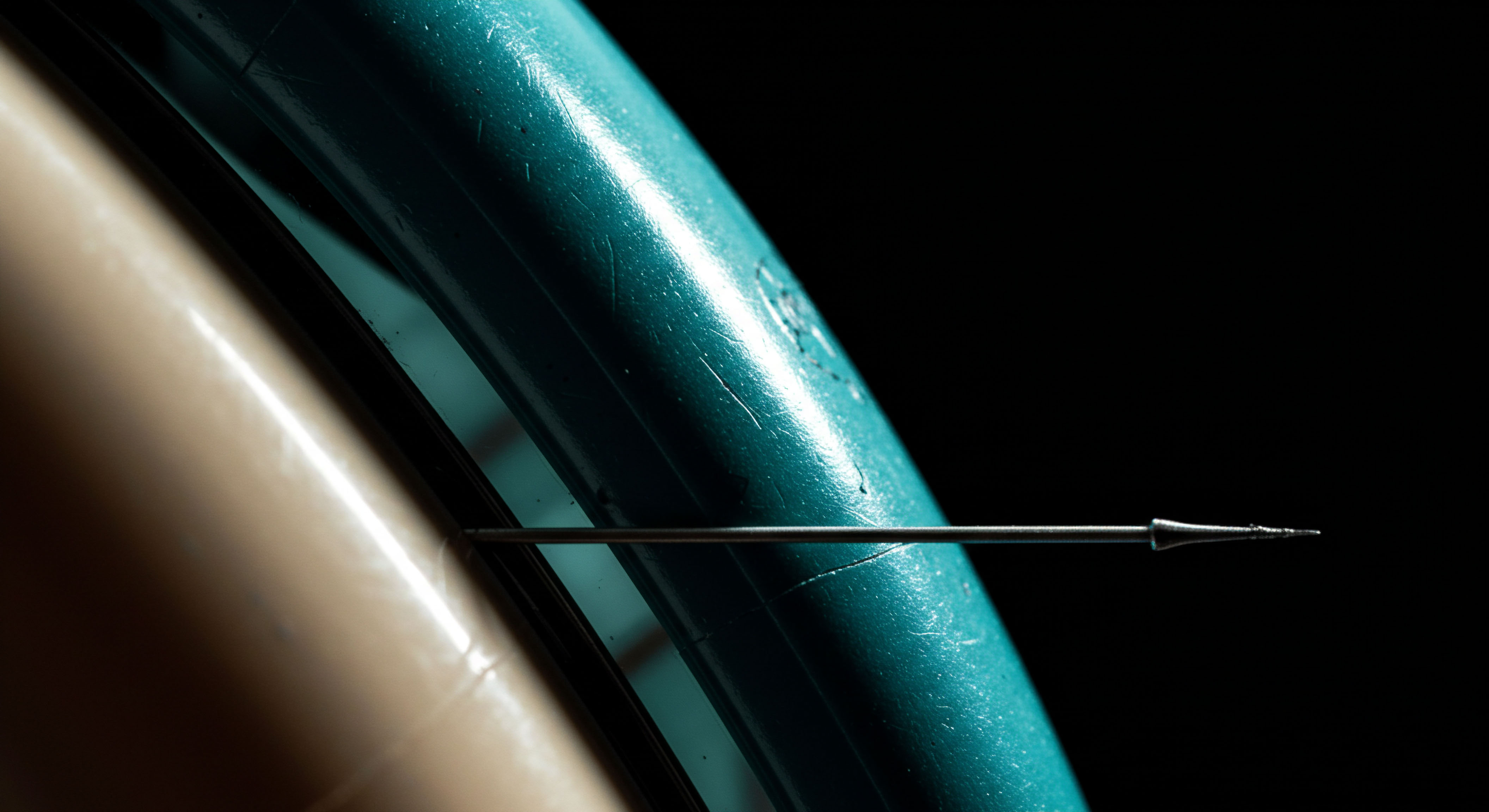

A direct connection to multiple liquidity providers ensures transparent, competitive price formation, elevating execution quality.

The operational efficiency derived from this method translates directly into quantifiable gains. Market participants observe tighter spreads and improved fill rates, particularly with larger orders that might otherwise move the market against them. Deploying an RFQ systematically refines a trader’s capacity to secure favorable terms, a distinct advantage in the dynamic crypto derivatives landscape. This process transforms a transactional activity into a strategic endeavor, aligning execution with overarching portfolio objectives.

Deploying Strategic Positions

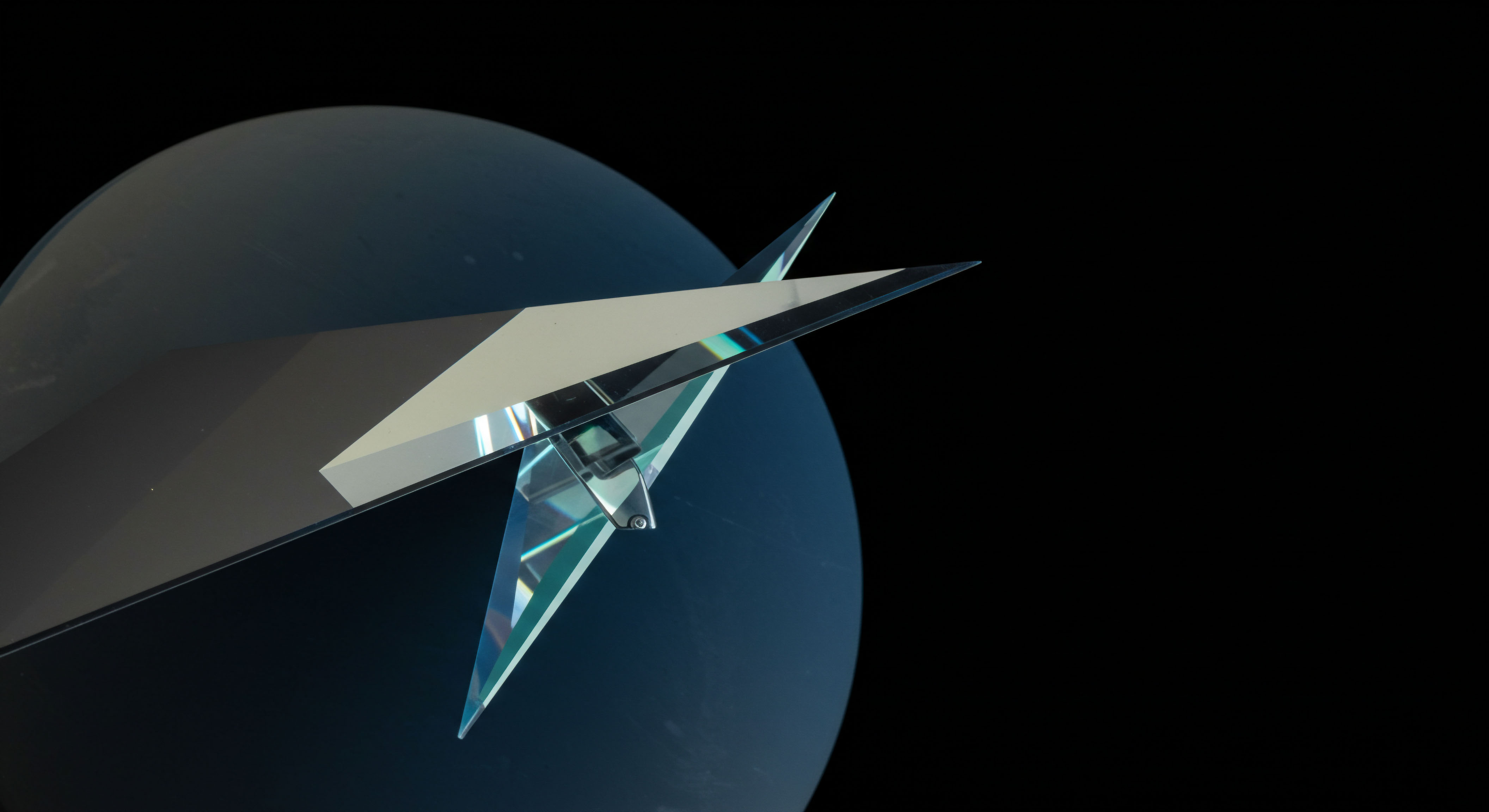

Transitioning from theoretical understanding to actionable deployment requires a precise application of RFQ capabilities within your investment strategies. High-value crypto options and block trades demand an execution discipline that maximizes capital efficiency and minimizes market friction. The RFQ mechanism becomes an indispensable tool for achieving these critical objectives, allowing for tailored execution that aligns with specific market views.

Optimizing Bitcoin Options Blocks

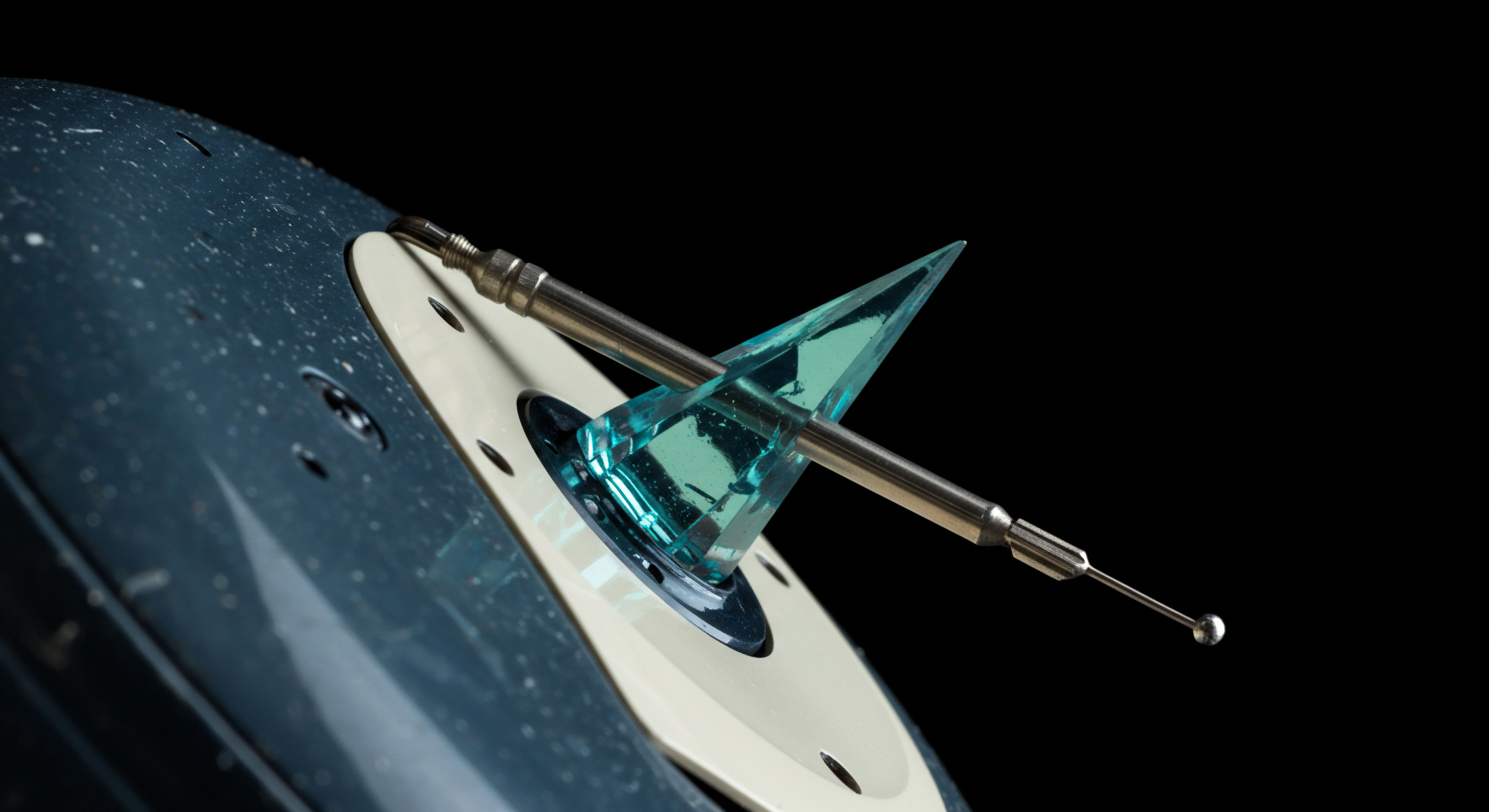

Executing substantial Bitcoin options blocks through an RFQ offers a significant edge. Instead of passively accepting prices on an open order book, a direct RFQ solicits bespoke quotes from multiple dealers. This approach proves invaluable when positioning for major volatility events or structuring complex multi-leg options strategies. The ability to compare firm quotes from various liquidity sources ensures you secure the most advantageous entry or exit points for your Bitcoin derivatives exposure.

Precision in Multi-Leg Strategies

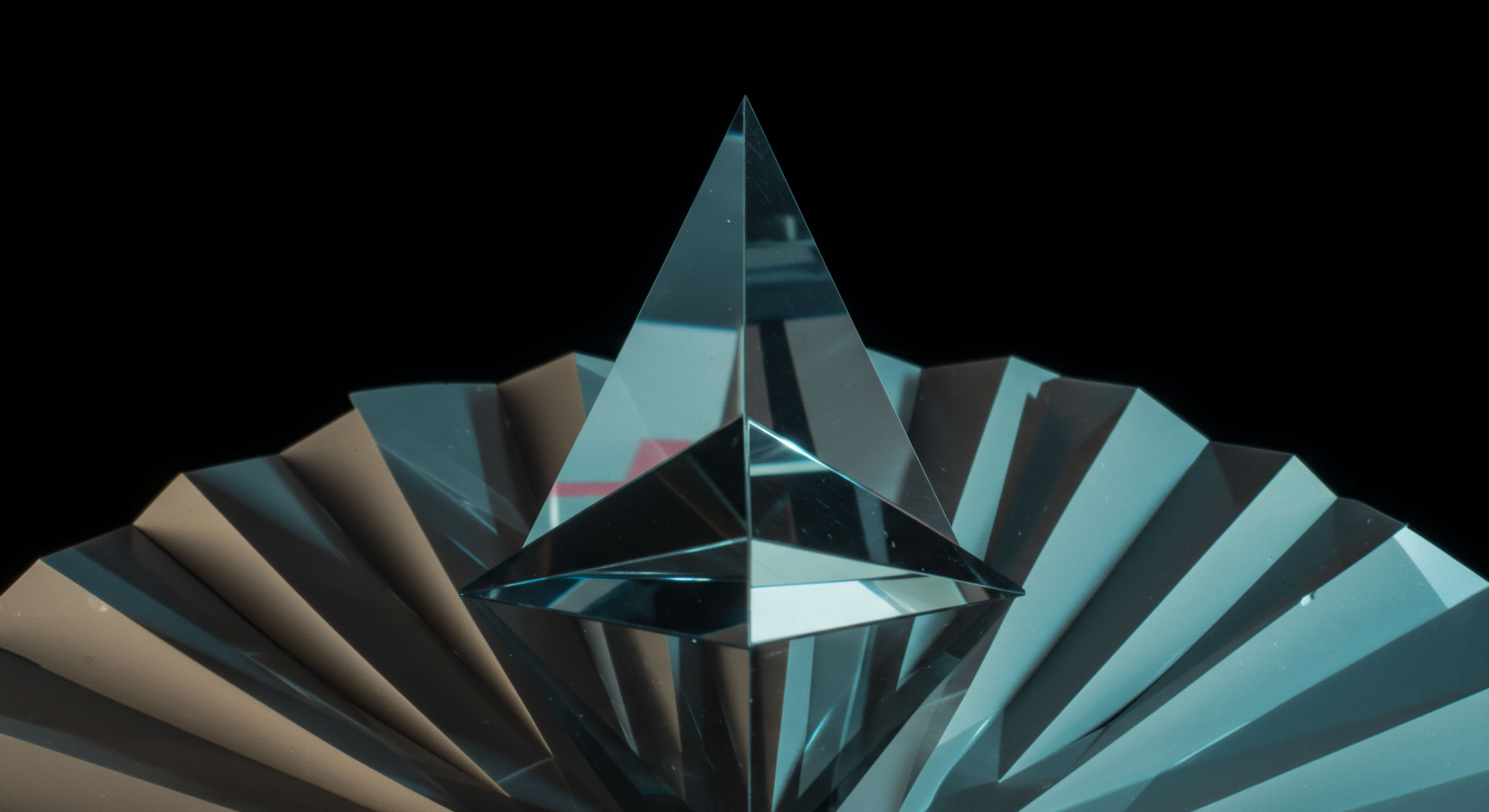

Complex options spreads, such as straddles or collars, benefit immensely from RFQ execution. A single RFQ can bundle all legs of a spread, allowing liquidity providers to quote a composite price. This holistic approach prevents adverse price movements between individual leg executions, a common pitfall in fragmented markets. The coordinated execution of these multi-leg positions preserves the intended risk-reward profile, a critical element for sophisticated options traders.

Consider a BTC straddle block. Executing each leg separately risks mispricing and slippage, eroding the expected profitability. An RFQ for the entire straddle compels dealers to quote a unified price, reflecting the true market value of the combined position. This operational discipline safeguards the integrity of your strategic intent.

- Identify target crypto options ▴ BTC, ETH, SOL derivatives.

- Define desired block size and strike prices.

- Specify preferred expiry dates for options.

- Select multiple reputable liquidity providers.

- Evaluate all submitted quotes for best execution.

- Execute the trade, confirming terms and conditions.

Enhancing ETH Options Volatility Plays

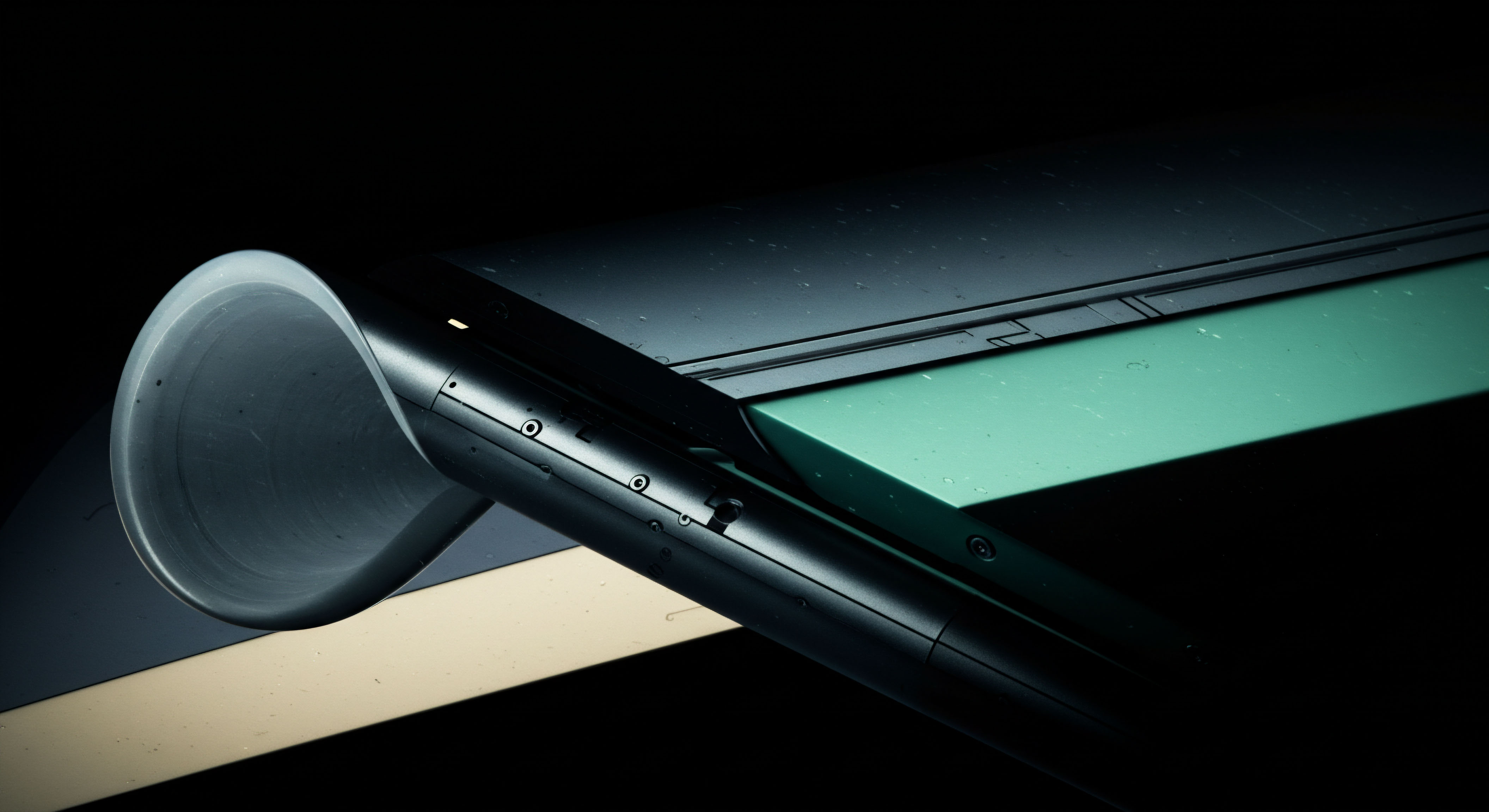

ETH options, particularly those aimed at capturing volatility, demand a highly refined execution method. When anticipating significant price swings, a well-executed ETH options block can amplify returns. An RFQ for ETH volatility blocks allows for anonymous interaction with a deep pool of institutional liquidity, securing competitive pricing without signaling your market intentions prematurely. This anonymity preserves your strategic advantage, preventing front-running or adverse price impact.

For instance, an ETH collar RFQ provides a robust method for hedging existing ETH holdings while generating income. This simultaneously involves buying a put option and selling a call option. By requesting quotes for the entire collar, you ensure the premium received offsets the cost of protection efficiently. The RFQ system simplifies the logistical challenge of coordinating these interdependent transactions, yielding a more streamlined and cost-effective outcome.

Cultivating Sustained Market Edge

The mastery of RFQ extends beyond individual trade execution, integrating into a broader philosophy of portfolio construction and sustained alpha generation. This mechanism transforms reactive trading into a proactive pursuit of market command, shaping your overall engagement with high-value crypto derivatives. A systematic deployment of RFQ becomes a cornerstone of long-term strategic advantage, refining every aspect of your execution discipline.

Systemic Risk Mitigation

Incorporating RFQ into your daily workflow builds a robust defense against systemic execution risks. The transparent pricing environment and competitive dealer engagement inherently mitigate the risks associated with liquidity fragmentation and market volatility. By consistently seeking multiple quotes, you establish a benchmark for fair value, reducing the potential for adverse selection and ensuring optimal capital deployment across your entire portfolio. This approach provides a clear, measurable benefit to your overall risk-adjusted returns.

This constant pursuit of best execution, a practice deeply embedded within institutional trading, reveals a deeper truth ▴ market success stems from the consistent application of superior operational methods. It requires an unwavering commitment to refining every component of your trading process. One often finds that the seemingly small efficiencies, compounded over time, delineate the truly exceptional from the merely competent. This ongoing dedication to precision, a hallmark of seasoned strategists, separates those who merely participate from those who genuinely shape their market outcomes.

Algorithmic Integration for Scale

For institutions managing substantial crypto derivative portfolios, integrating RFQ capabilities into algorithmic execution platforms represents the next frontier. Automated RFQ submissions can dynamically source liquidity, ensuring that even high-frequency or complex portfolio rebalancing orders receive the most competitive pricing. This synergy of human strategy and machine efficiency unlocks unprecedented scale and precision, a powerful lever for enhancing overall portfolio performance. Such an integration ensures consistent execution quality across diverse market conditions.

This advanced application allows for the simultaneous management of multiple crypto options RFQs, optimizing for various parameters such as price, fill rate, and anonymity. The capacity to orchestrate large-scale, multi-dealer liquidity interactions through intelligent automation marks a significant evolution in crypto derivatives trading. It elevates execution from a tactical consideration to a strategic advantage, consistently delivering a superior return on investment.

The Apex of Execution Discipline

The pursuit of excellence in high-value crypto markets culminates in a rigorous execution discipline. Mastering the RFQ mechanism provides a direct pathway to command liquidity and define your terms, rather than simply reacting to market forces. This proactive stance reshapes your entire engagement with derivatives, forging a distinct advantage. The ongoing evolution of these markets rewards those who proactively engineer their outcomes, consistently seeking the most precise and efficient pathways to strategic goals.

Glossary

High-Value Crypto

Liquidity Providers

Execution Discipline

Btc Straddle Block

Best Execution

Eth Options Block

Eth Options

Eth Collar Rfq