Strategic Crypto Options Foundations

Mastering crypto options begins with understanding their profound utility as instruments of precision. These derivatives empower investors to calibrate exposure, manage risk, and express nuanced market views with unparalleled exactitude. They serve as a sophisticated framework for navigating the inherent volatility of digital assets, moving beyond simplistic spot market positions.

Options derive their value from underlying assets, offering a potent means to gain leveraged exposure or hedge existing portfolios. Their intrinsic structure allows for defined risk parameters, providing a clearer operational landscape for strategic capital deployment. Understanding the mechanics of calls and puts forms the bedrock of any advanced crypto investment approach, providing a lexicon for commanding market dynamics.

Precision in options trading transcends mere speculation; it is the art of engineering market outcomes.

The strategic investor recognizes options as tools for architecting specific profit and loss profiles. They enable the isolation of particular market factors, such as price direction, volatility, or time decay, allowing for targeted engagement. Developing proficiency in these foundational elements establishes a significant market advantage.

Seizing control of market participation demands a clear vision.

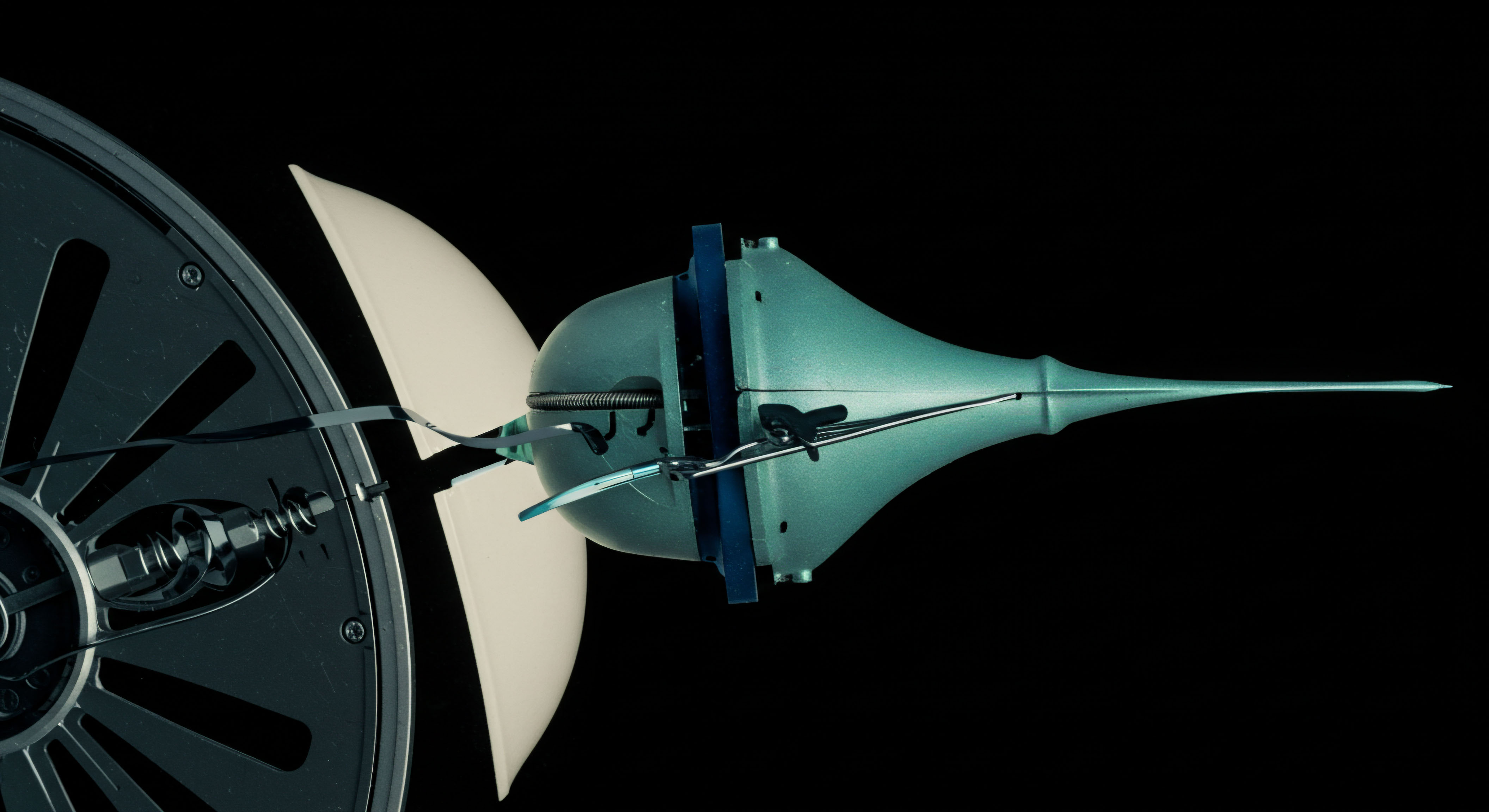

Deploying Options Strategies

Transitioning from foundational understanding to active deployment requires a methodical approach, translating market insights into actionable trade structures. Professional-grade strategies leverage options for defined outcomes, optimizing capital efficiency and execution quality. These methods are designed to capitalize on specific market conditions with a disciplined focus on risk-adjusted returns.

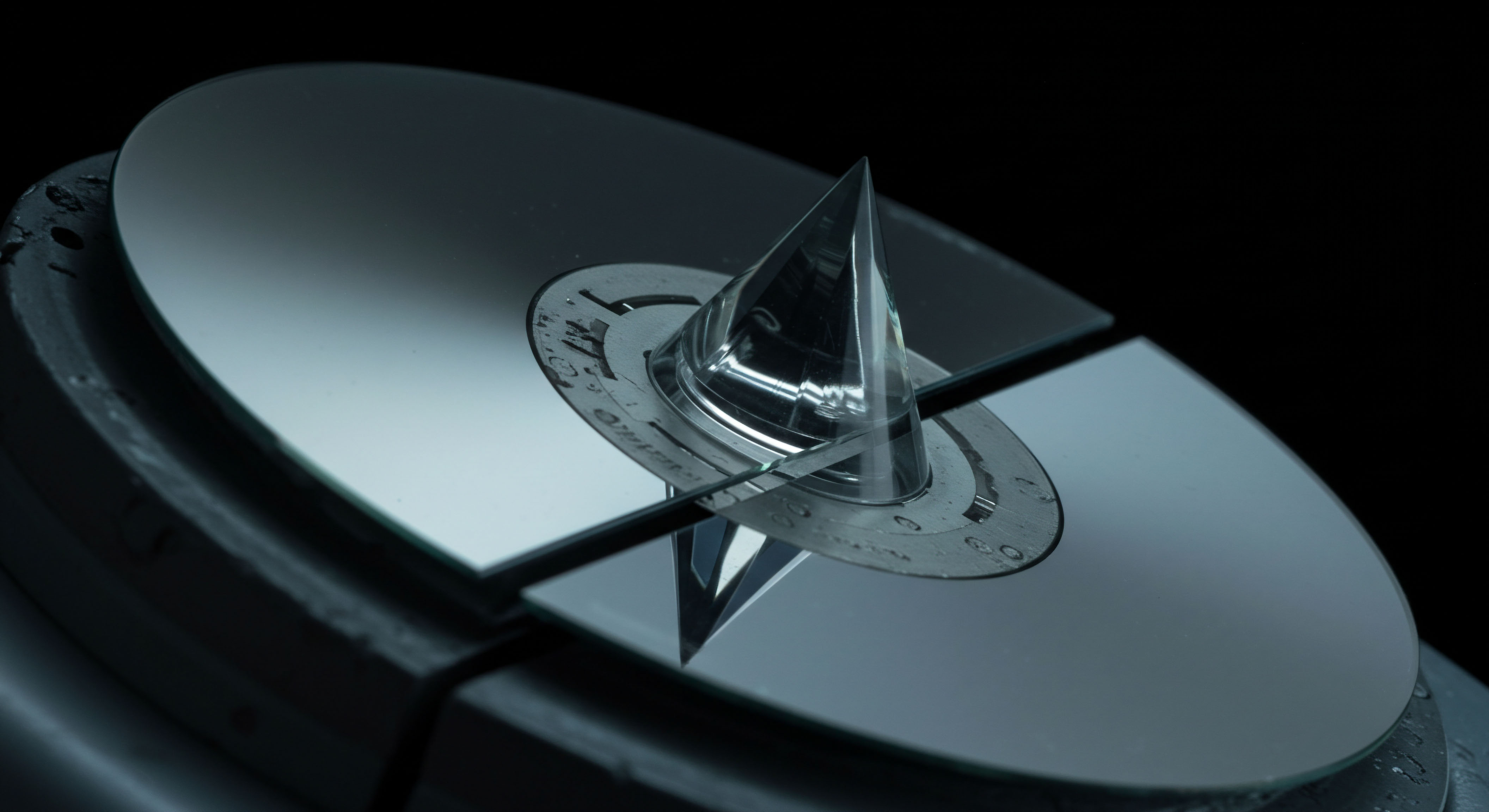

Optimizing Execution with RFQ

Executing significant options positions demands a superior method for sourcing liquidity. A Request for Quote (RFQ) system provides a competitive environment where multiple dealers bid on a specific trade, ensuring favorable pricing and minimal market impact. This process significantly enhances execution quality for block trades, moving beyond fragmented liquidity pools.

The strategic deployment of an RFQ ensures price discovery occurs under optimal conditions. Traders present their desired options parameters, and liquidity providers compete to offer the tightest spreads. This structured approach directly translates into reduced transaction costs and improved fill rates, vital for large-scale capital deployment.

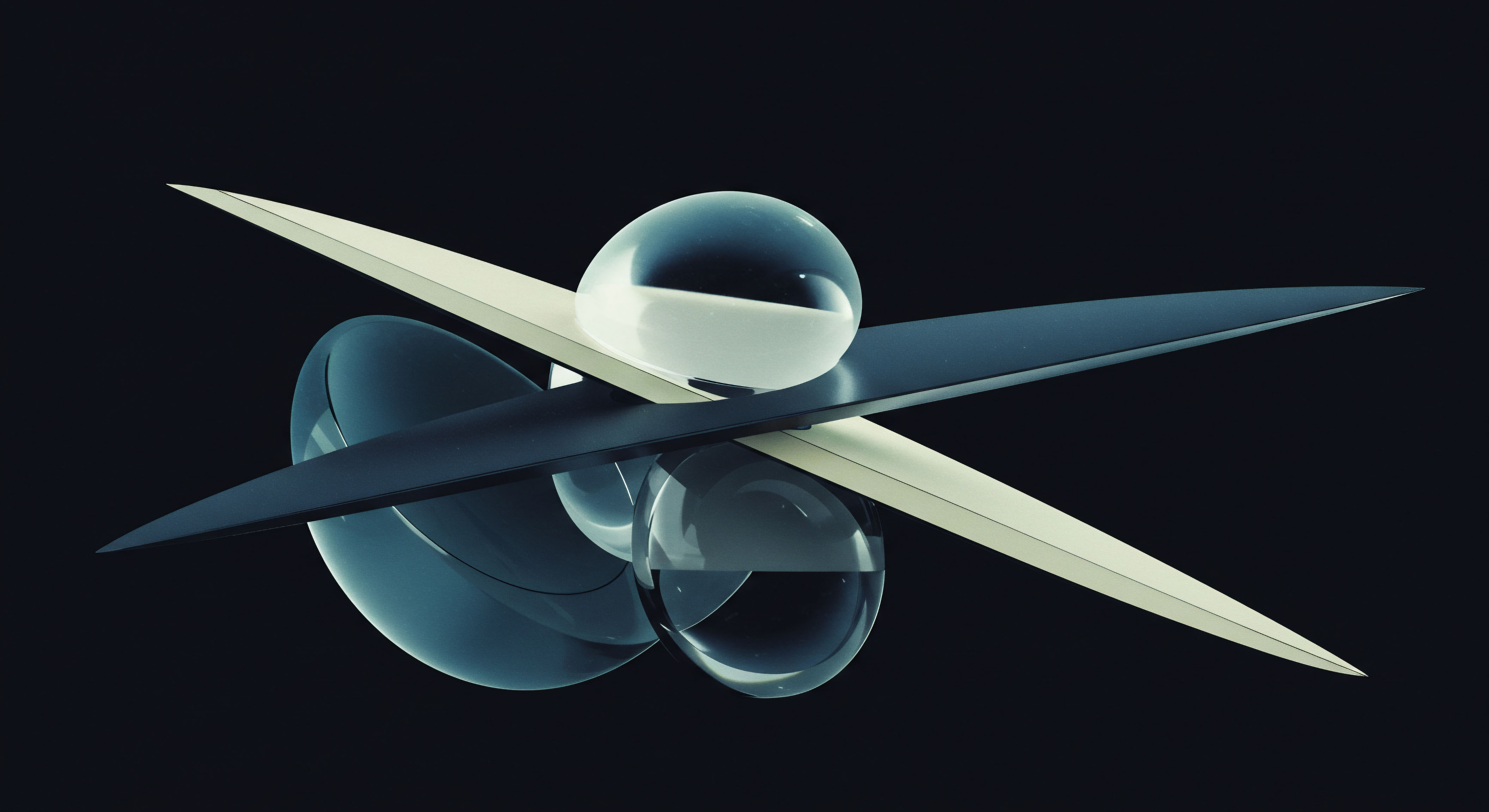

Multi-Leg Strategies for Market Edge

Beyond simple calls and puts, multi-leg options strategies enable investors to construct complex risk-reward profiles tailored to precise market outlooks. These structures allow for simultaneous engagement with multiple market variables, offering refined control over portfolio exposures.

Covered Call Dynamics

Generating income from existing crypto holdings involves the systematic deployment of covered calls. Selling call options against an owned underlying asset provides immediate premium income, reducing the effective cost basis of the position. This strategy offers a defensive posture in stable or moderately bullish markets, enhancing yield without relinquishing the underlying asset entirely.

Protective Put Applications

Shielding a portfolio from downside volatility involves the purchase of protective puts. This strategy acts as an insurance policy, establishing a floor below which the portfolio value cannot fall. Acquiring puts safeguards capital during periods of heightened market uncertainty, preserving gains while retaining upside potential.

Advanced Volatility Plays

Harnessing volatility movements requires structures like straddles and collars. A long straddle, for instance, profits from significant price movement in either direction, ideal for anticipating a major market event without a directional bias. Conversely, a collar combines a covered call with a protective put, defining a precise profit range while mitigating extreme outcomes.

Strategic deployment of these multi-leg configurations requires a keen understanding of their individual components and their collective impact on portfolio performance. The ability to select and implement these strategies defines a sophisticated investor.

- Enhanced Price Discovery ▴ RFQ systems secure competitive pricing across diverse liquidity providers.

- Reduced Slippage ▴ Block trading through RFQ minimizes price impact for substantial orders.

- Tailored Risk Profiles ▴ Multi-leg options allow for custom-engineered exposure to market variables.

- Capital Efficiency ▴ Options provide leveraged exposure, optimizing return on invested capital.

- Dynamic Portfolio Protection ▴ Protective strategies shield against adverse market movements.

Mastering Advanced Options Applications

Achieving true market mastery involves integrating advanced options applications into a comprehensive portfolio management framework. This requires a systems-engineering perspective, viewing the market as a complex adaptive system where optimal execution and strategic positioning create a durable advantage. The focus shifts to leveraging sophisticated tools for sustained alpha generation and robust risk mitigation.

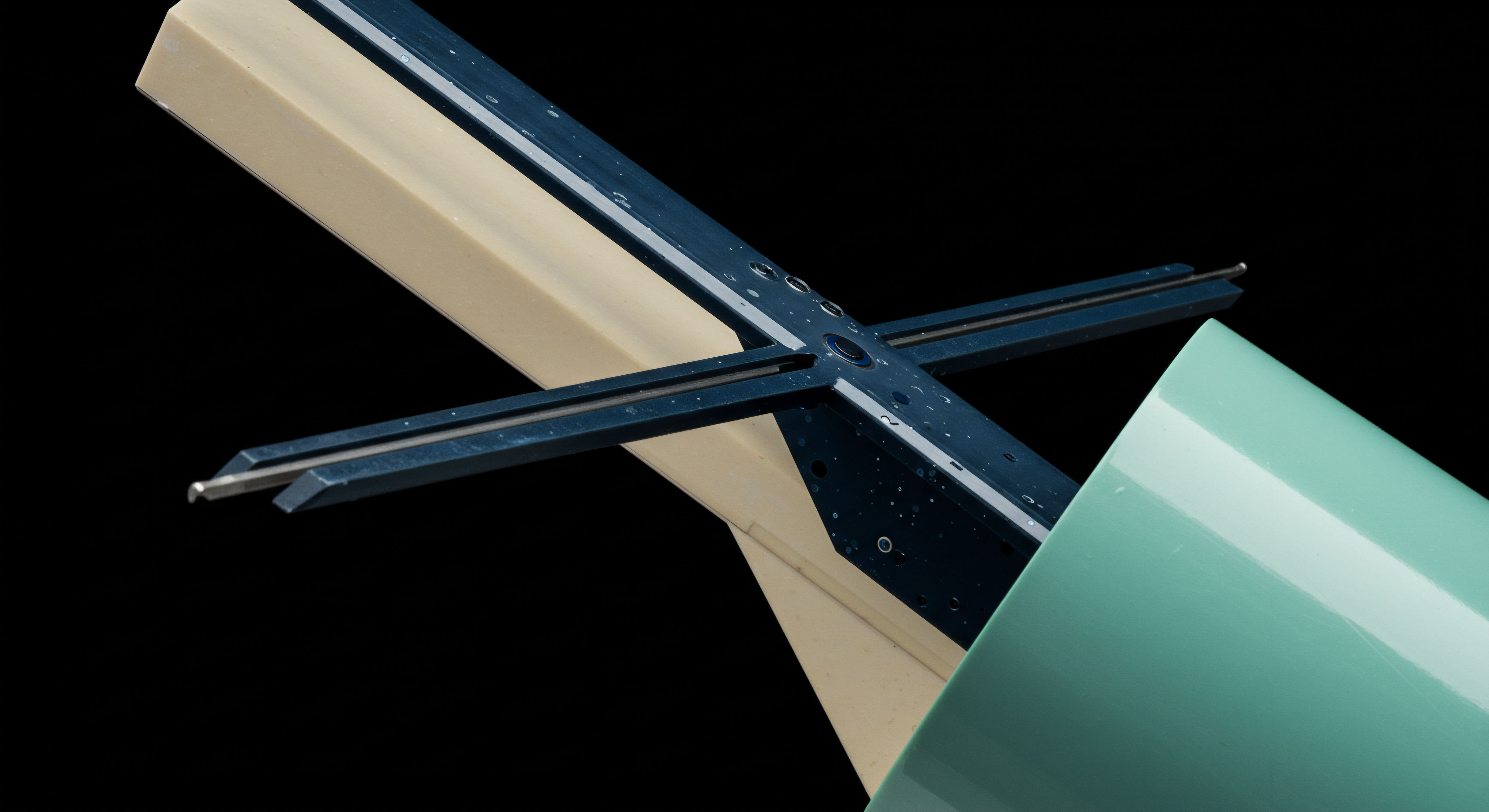

Integrating Options Block Liquidity

Engaging with crypto options at scale necessitates access to deep block liquidity. This involves direct interaction with OTC options desks and multi-dealer RFQ platforms capable of handling substantial order sizes without adverse price movements. Securing block liquidity ensures that large strategic positions can be established or unwound efficiently, preserving intended trade economics.

The impact of execution quality on overall portfolio performance cannot be overstated. Superior fill rates and minimal slippage, facilitated by specialized block trading mechanisms, directly translate into higher net returns. Investors prioritizing these operational efficiencies establish a quantifiable edge over less sophisticated market participants.

Volatility Block Trade Dynamics

Exploiting nuanced volatility trends demands the deployment of volatility block trades. These involve constructing large options positions designed to capitalize on anticipated shifts in implied volatility, independent of directional price movements. Mastering these complex trades requires a deep understanding of derivatives pricing models and their sensitivity to market parameters.

The inherent challenge lies in accurately forecasting volatility regimes and structuring trades that profit from those predictions while managing residual directional exposure. This demands constant calibration and an iterative refinement of the trading model. The strategic investor understands that sustained success in this domain hinges on intellectual rigor and adaptive execution.

This process, demanding a synthesis of quantitative analysis and market intuition, presents a significant hurdle for many. It is precisely this demanding integration that separates routine trading from the truly strategic deployment of capital.

Strategic Risk Management Frameworks

Advanced options strategies require equally sophisticated risk management frameworks. This extends beyond individual trade risk to encompass portfolio-wide Greek management, scenario analysis, and stress testing. A robust framework ensures that complex options exposures remain within defined tolerance levels, safeguarding capital across diverse market conditions.

Deploying tools for real-time risk monitoring and dynamic hedging allows investors to proactively adjust positions in response to changing market dynamics. This systematic approach transforms potential vulnerabilities into controlled variables, ensuring the portfolio’s resilience against unforeseen market shifts. Mastering these frameworks underpins long-term success in the intricate world of crypto derivatives.

Commanding Your Market Future

The strategic investor’s journey into crypto options represents a commitment to market excellence. It involves a relentless pursuit of operational precision and a deep understanding of how sophisticated instruments shape outcomes. The path to sustained advantage unfolds through continuous learning, disciplined execution, and an unwavering focus on evolving methodologies. Your capacity to command liquidity and engineer precise portfolio exposures defines your market future, elevating your presence in the digital asset landscape.