Systematic Crypto Derivatives

Achieving superior trading outcomes demands a systematic approach to crypto derivatives. This involves understanding the operational mechanics of professional-grade tools. Mastery of these instruments moves a trader beyond speculative reactions toward a structured, analytical engagement with market forces.

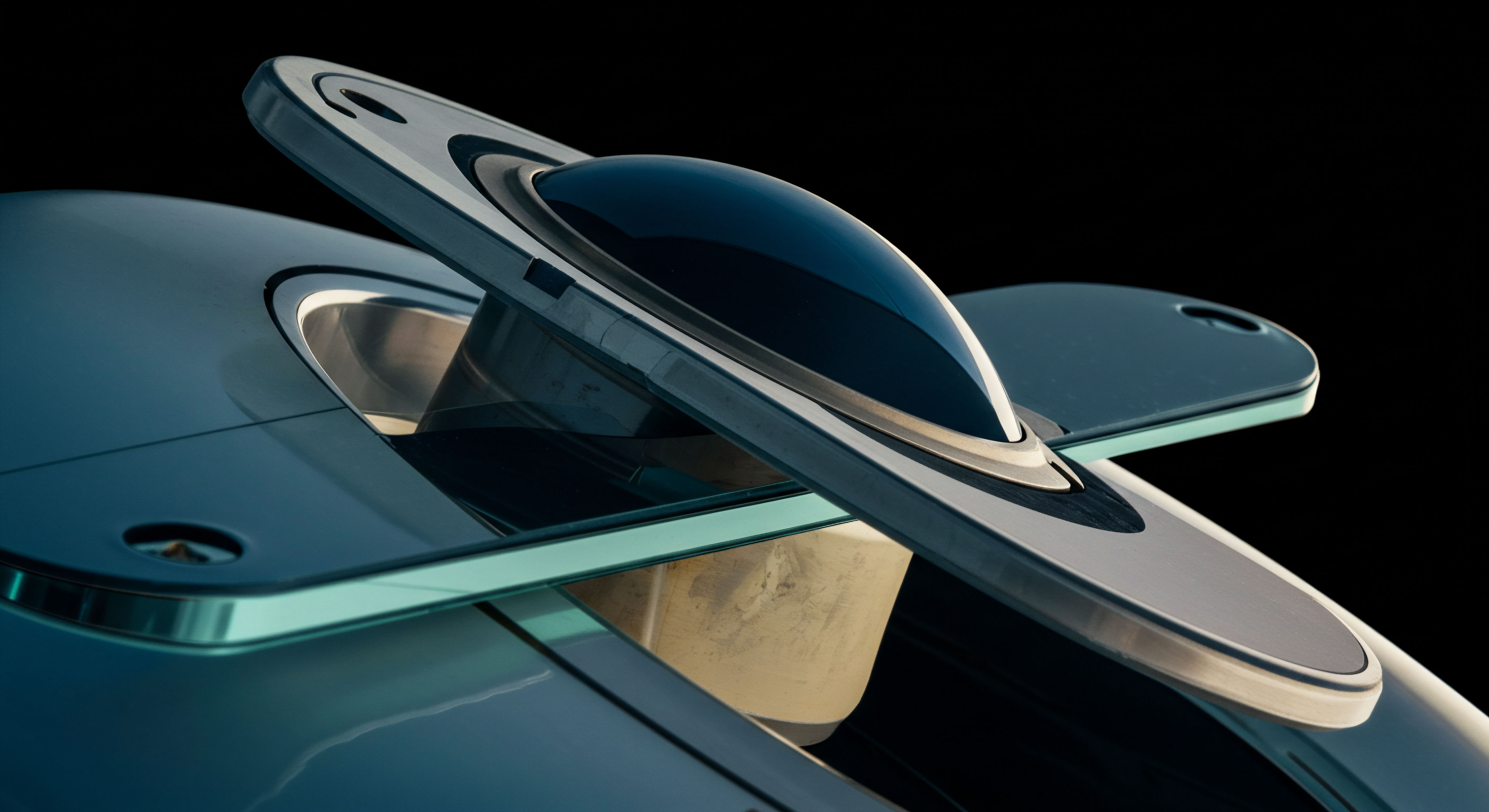

Request for Quote (RFQ) systems represent a direct conduit to deep liquidity pools, allowing participants to solicit competitive pricing from multiple market makers simultaneously. This mechanism ensures efficient execution for substantial order sizes. It circumvents the typical limitations of order book trading, where large trades often encounter significant price impact.

Options trading offers a versatile instrument for expressing precise market views, whether anticipating directional moves, volatility shifts, or managing existing portfolio exposures. The inherent leverage and defined risk profiles of options positions empower traders to calibrate their market participation with exactitude. Crafting a sophisticated options position demands a keen understanding of implied volatility and its relationship to price discovery.

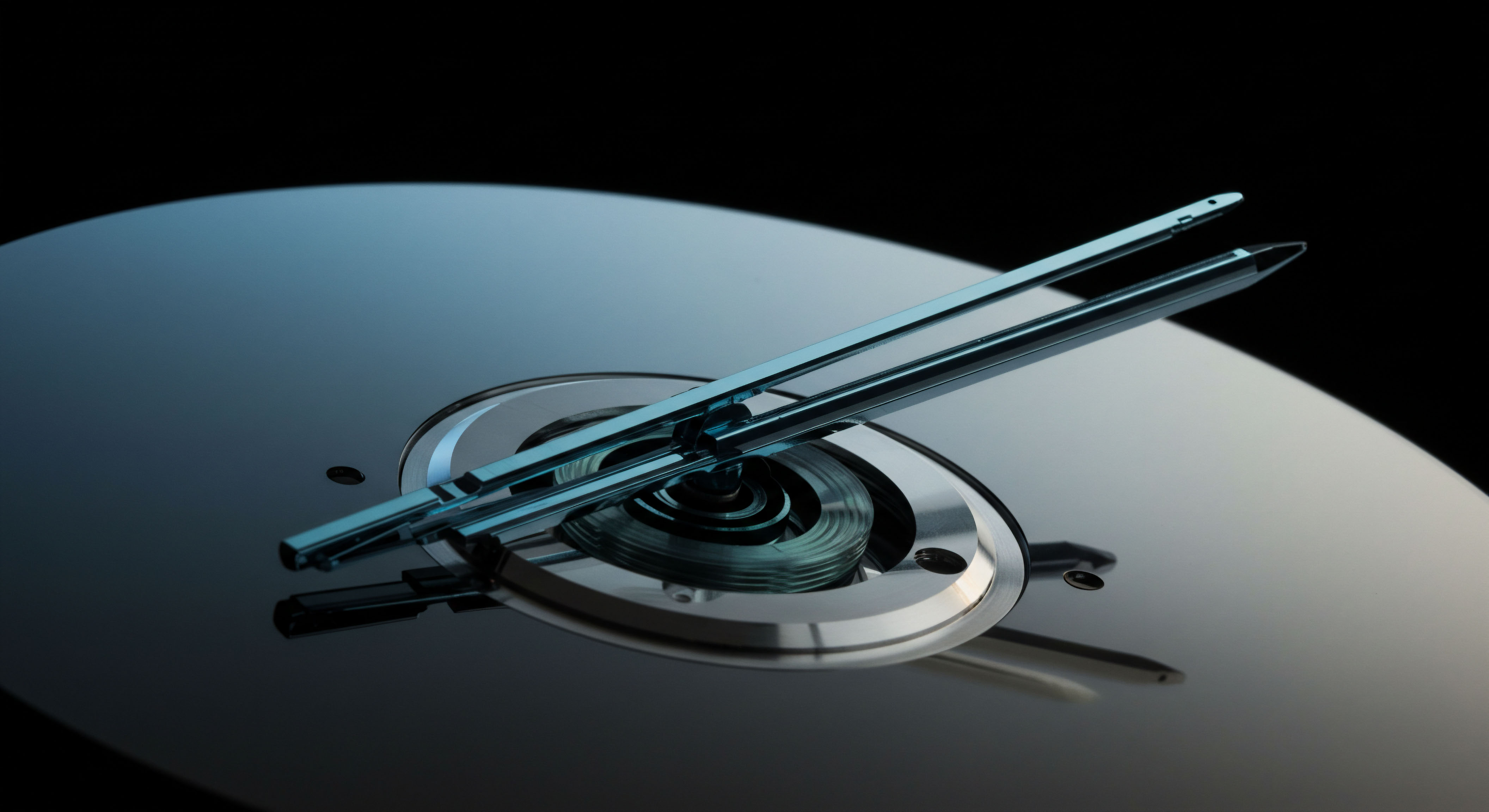

Block trading facilitates the execution of significant order volumes outside the continuous order book environment. This method preserves price integrity and minimizes information leakage. Engaging in block trades enables institutions and sophisticated individuals to move substantial capital without disrupting market equilibrium, securing advantageous fills that public markets seldom offer.

A systematic execution framework transforms market uncertainty into a measurable opportunity.

Capitalizing on Opportunities

Deploying a systematic edge in crypto derivatives involves integrating advanced execution channels with refined options strategies. This requires a disciplined methodology, translating market insights into tangible capital appreciation. A trader’s ambition to command market movements finds its expression through these professional-grade avenues.

Precision Options Strategies

Volatility Capture

Straddles and strangles offer direct exposure to volatility fluctuations, allowing a trader to capitalize on anticipated price swings without predicting direction. Constructing these positions demands a careful selection of strike prices and expiration dates. This calibration ensures optimal sensitivity to implied volatility changes.

Effective deployment of these strategies requires a rigorous assessment of the underlying asset’s historical volatility against its implied counterpart. Identifying discrepancies presents opportunities for strategic entry. A systematic review of these relationships can reveal exploitable edges, particularly during periods of market dislocation.

Directional Hedging

Collars and covered calls provide a sophisticated means of managing risk while generating income from existing asset holdings. A covered call, for instance, monetizes an asset’s static position by selling upside potential. This reduces the overall cost basis of the holding.

Implementing a collar strategy involves purchasing a protective put option while simultaneously selling a call option against an owned asset. This establishes a defined range of potential outcomes, safeguarding against downside risk. Precise selection of strike prices for both the put and call components ensures alignment with a specific risk tolerance and desired return profile.

Optimizing Execution

RFQ for Superior Fills

RFQ systems significantly reduce slippage by compelling multiple market makers to compete for order flow. This competition drives tighter spreads and more favorable pricing for the executing party. The transparent nature of this price discovery mechanism provides an undeniable advantage in large-scale transactions.

Quantifying the benefits of RFQ involves comparing executed prices against prevailing order book rates. Data consistently demonstrates improved fill rates and reduced transaction costs. This efficiency translates directly into enhanced profitability for every trade, reinforcing the value of a professional execution channel.

Block Trading Advantages

Executing large positions via block trades minimizes the market impact that often accompanies substantial orders placed on public exchanges. This method shields a trader’s intentions from the broader market. It secures liquidity without telegraphing moves that could adversely affect pricing.

Block trading facilitates private price negotiation between sophisticated parties, ensuring confidentiality and optimal execution conditions. This preserves the integrity of capital deployment, allowing for strategic position building. It maintains a distinct edge in managing substantial portfolio rebalancing efforts.

- Assess market maker spreads and liquidity depth for RFQ efficacy.

- Calibrate options positions with precise delta, gamma, and vega exposures.

- Monitor historical volatility versus implied volatility for strategic entry.

- Prioritize off-exchange execution for orders exceeding typical market depth.

- Review execution quality reports to quantify slippage reduction.

This approach elevates trading beyond mere speculation.

Systematic application of advanced tools redefines execution quality and expands return potential.

Advanced Strategic Deployment

Advancing from tactical application to strategic mastery demands integrating these tools within a comprehensive portfolio management framework. This involves moving beyond individual trades to construct a resilient, alpha-generating capital structure. A holistic view of market mechanics informs every decision, driving long-term advantage.

Portfolio Resilience

Dynamic Risk Management

Continuous delta hedging maintains a neutral directional exposure, insulating a portfolio from sudden price movements in the underlying asset. This technique requires constant monitoring and adjustment of positions. Gamma scalping capitalizes on short-term volatility by systematically adjusting delta as the underlying price moves.

Implementing stress testing and scenario analysis provides a robust defense against unforeseen market shocks. These methods simulate extreme market conditions, evaluating portfolio performance under duress. Such rigorous preparation strengthens a portfolio’s ability to withstand adverse events, preserving capital during turbulent periods.

Algorithmic Integration

Automated Execution Frameworks

The integration of sophisticated algorithms into RFQ and block trading workflows streamlines execution processes. These automated systems identify optimal liquidity sources and execute trades with unparalleled speed and precision. This minimizes human error and maximizes efficiency.

Developing bespoke execution algorithms allows for highly customized trading strategies, adapting to specific market conditions and liquidity profiles. Such frameworks ensure consistent application of defined trading rules. They provide a measurable advantage in securing best execution across diverse market environments.

Understanding the interplay of market microstructure with advanced derivatives strategies demands a deep cognitive commitment. The complexity of these systems, their interdependencies, and the subtle feedback loops they generate present a formidable intellectual challenge. Achieving true mastery requires not just deploying the tools, but comprehending the fundamental forces they harness, a continuous refinement of one’s mental models of market behavior.

Mastering advanced applications creates an enduring, structural advantage in capital markets.

Commanding Your Market Trajectory

The journey toward a systematic edge in crypto derivatives represents an ongoing pursuit of operational excellence. Each successful execution, every precisely calibrated options position, contributes to a broader command over market forces. The future belongs to those who view the market as a system, ready for strategic optimization, rather than an unpredictable expanse.