Crypto Capital Transformation

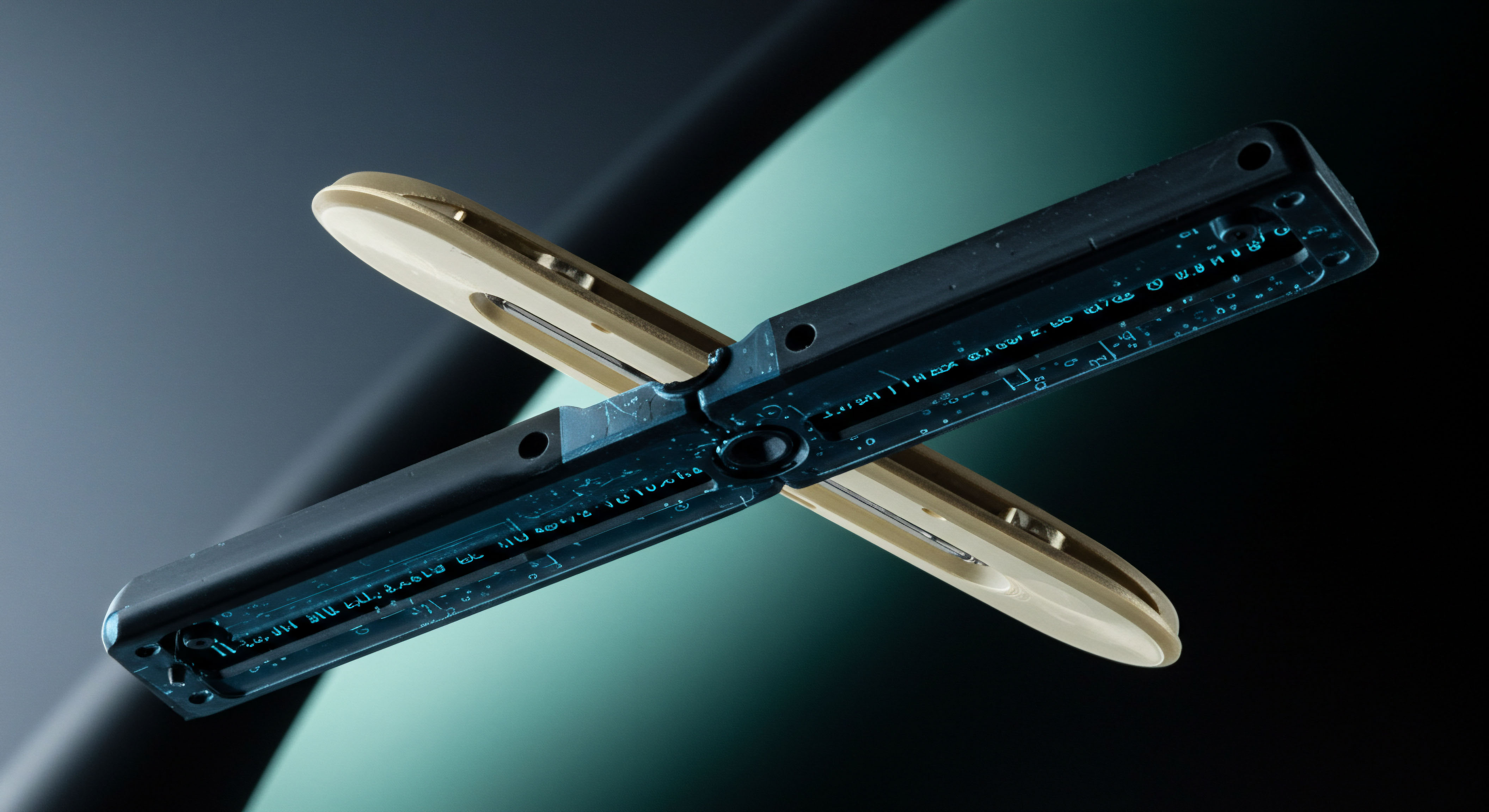

Converting stagnant crypto holdings into active income streams demands a strategic shift in perspective, moving beyond passive ownership. Discerning market participants recognize the imperative of leveraging sophisticated financial instruments for enhanced capital efficiency. The Request for Quote, or RFQ, mechanism stands as a foundational element in this advanced trading landscape. This system empowers participants to solicit bids and offers from multiple liquidity providers simultaneously, securing optimal pricing for substantial trades.

Options contracts represent another powerful tool within this dynamic framework, offering unparalleled versatility in expressing market views and managing exposure. Structuring these derivatives permits precise calibration of risk and reward profiles, enabling traders to generate yield from existing assets or hedge against market volatility. Mastering these instruments allows for a proactive stance in market engagement.

Achieving superior market outcomes requires a direct engagement with professional-grade trading mechanisms.

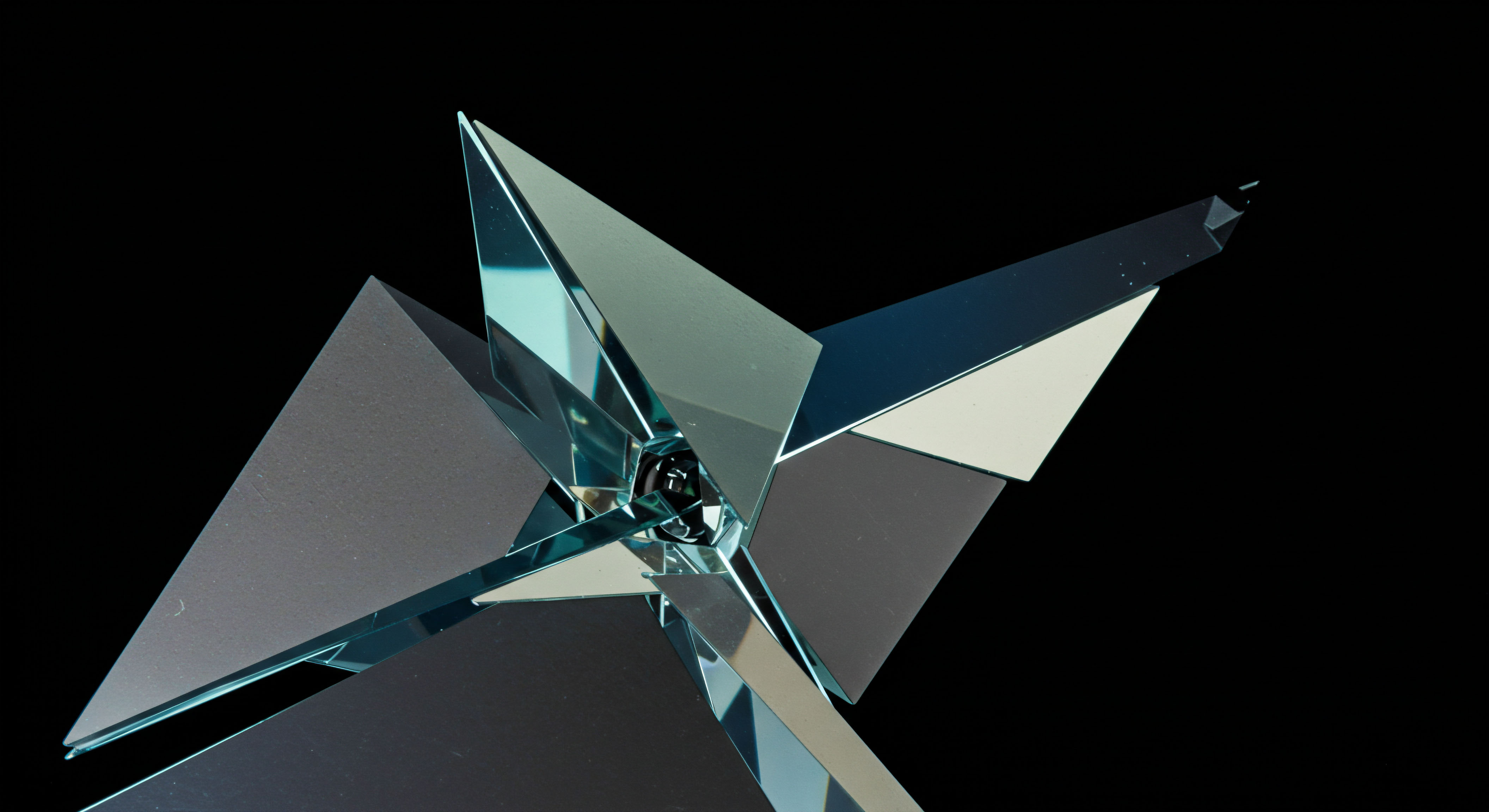

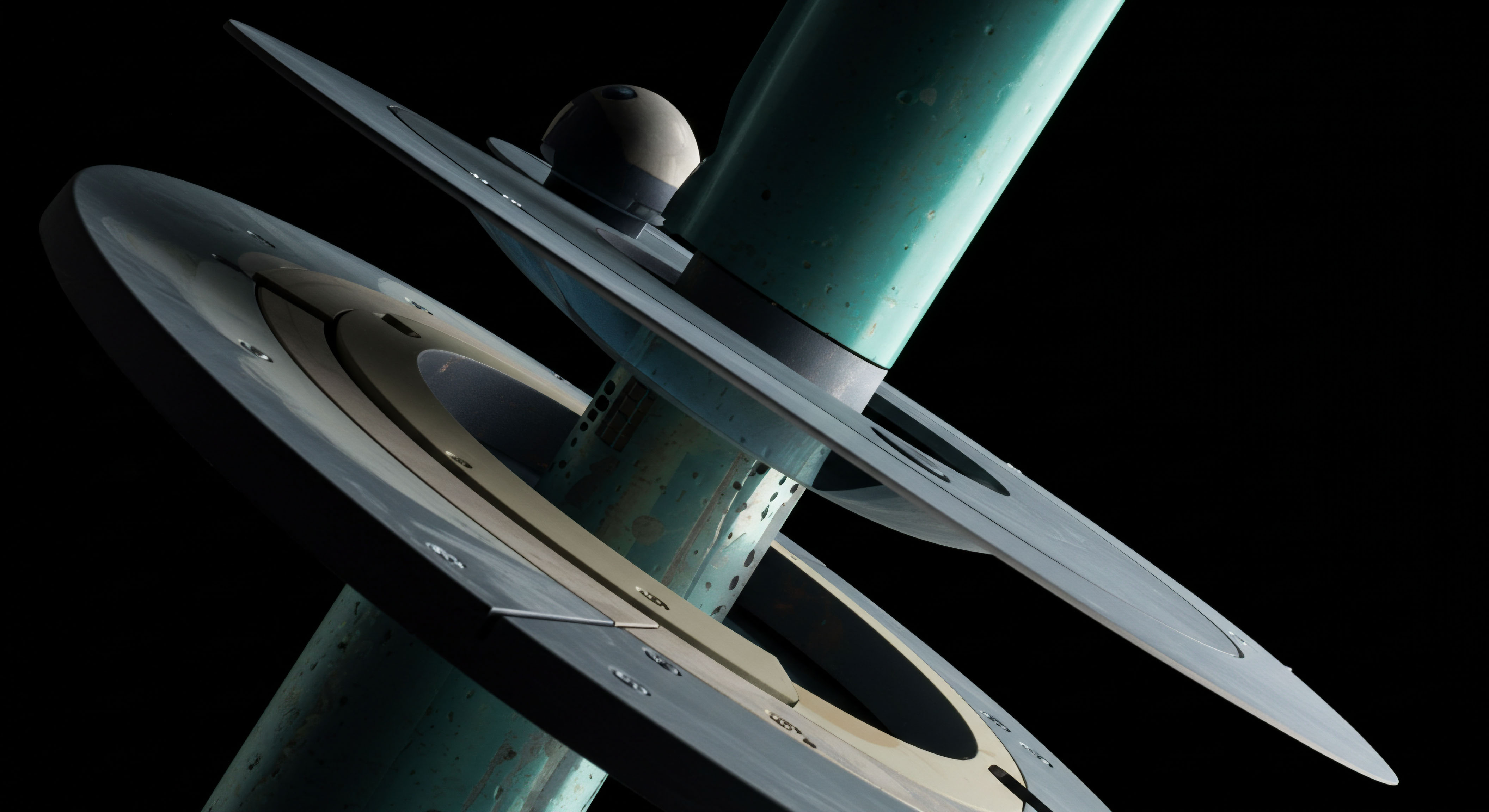

Block trading further refines this execution methodology, providing a conduit for transacting large volumes without undue market impact. Executing significant positions discreetly preserves price integrity, a critical consideration for any substantial portfolio. Integrating these advanced execution methods into one’s trading repertoire defines the pathway to consistent market advantage.

Strategic Income Generation

Deploying a strategic approach to crypto holdings unlocks opportunities for consistent income generation. The integration of RFQ, options, and block trading provides a robust framework for extracting value from various market conditions. This systematic application of professional-grade tools allows for precise execution and controlled risk.

Options Spreads for Yield Enhancement

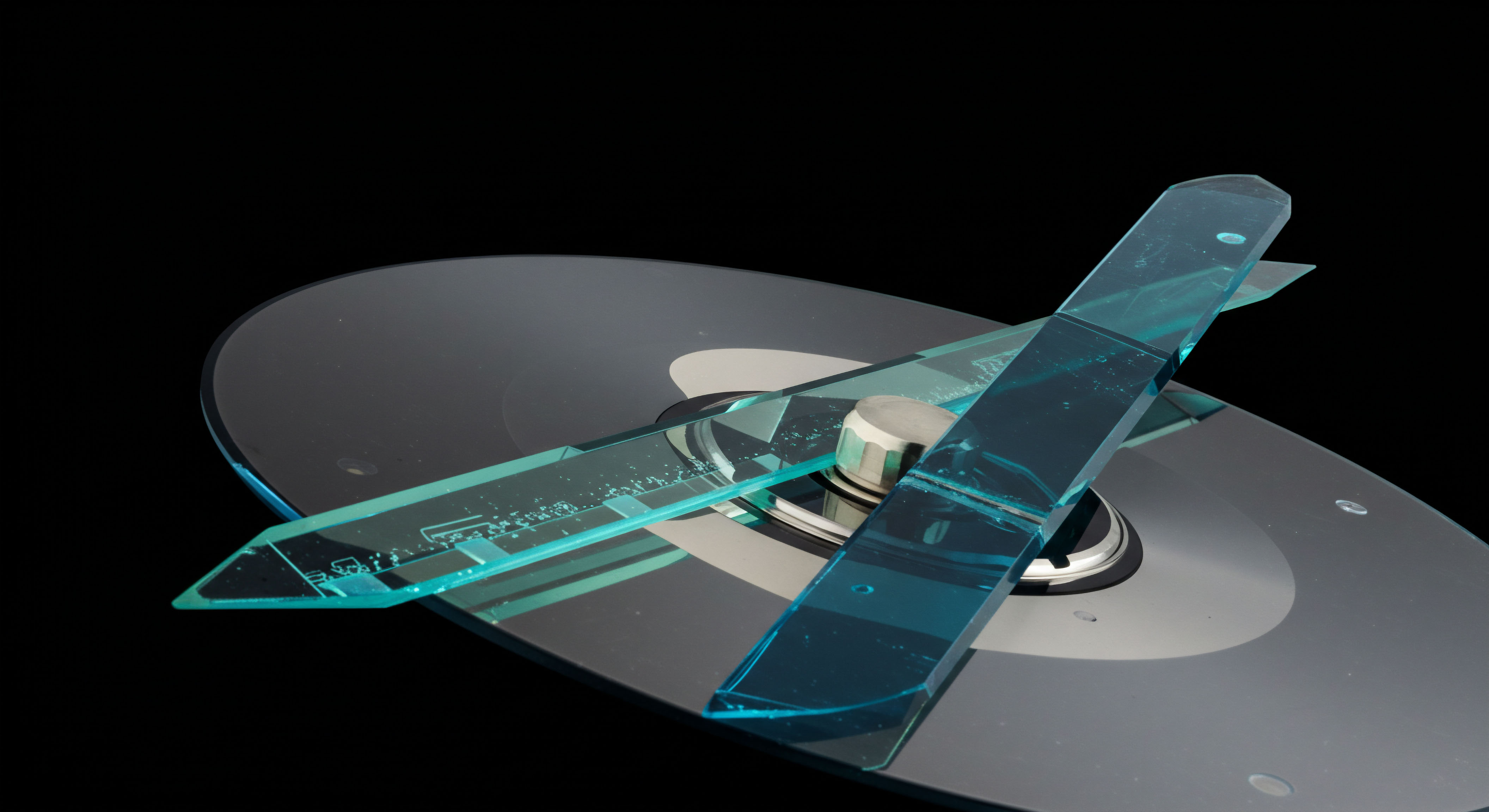

Constructing options spreads permits the capture of premium while defining risk parameters. A common strategy involves selling covered calls against existing crypto holdings, generating immediate income. This approach works particularly well in sideways or moderately bullish markets. Executing these structures through an RFQ system ensures competitive pricing and minimal slippage.

Covered Call Construction

A covered call strategy involves holding a long position in a cryptocurrency and simultaneously selling call options on that same asset. This generates income from the option premium. Should the asset price remain below the strike price, the options expire worthless, and the premium is retained.

- Identify a stable crypto asset with moderate volatility.

- Determine an appropriate strike price above the current market value, balancing income potential with the desire to retain the asset.

- Select an expiry date that aligns with market expectations, typically 30-60 days out.

- Execute the sale of the call option via a multi-dealer RFQ to secure optimal premium collection.

BTC Straddle Block Execution

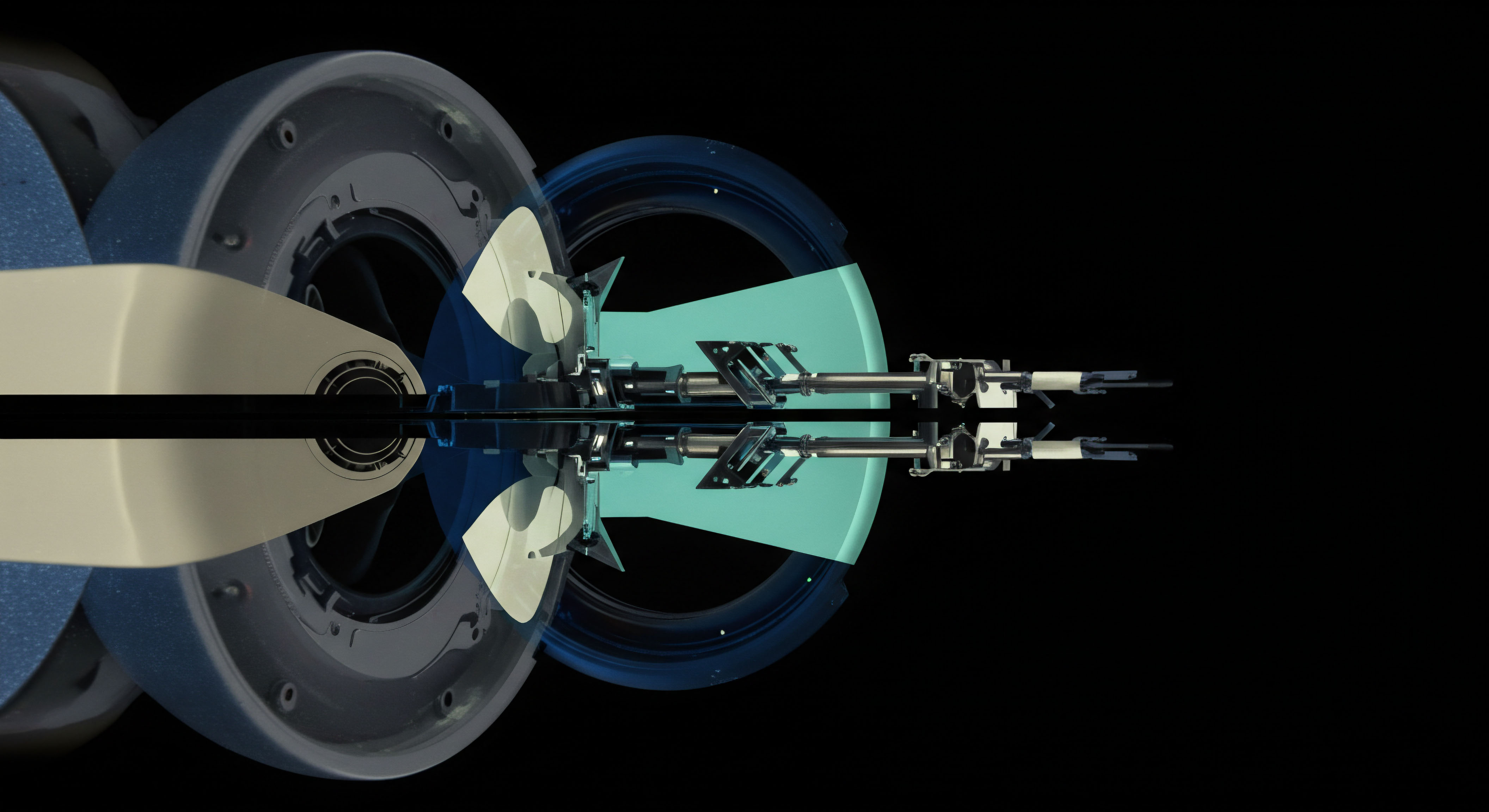

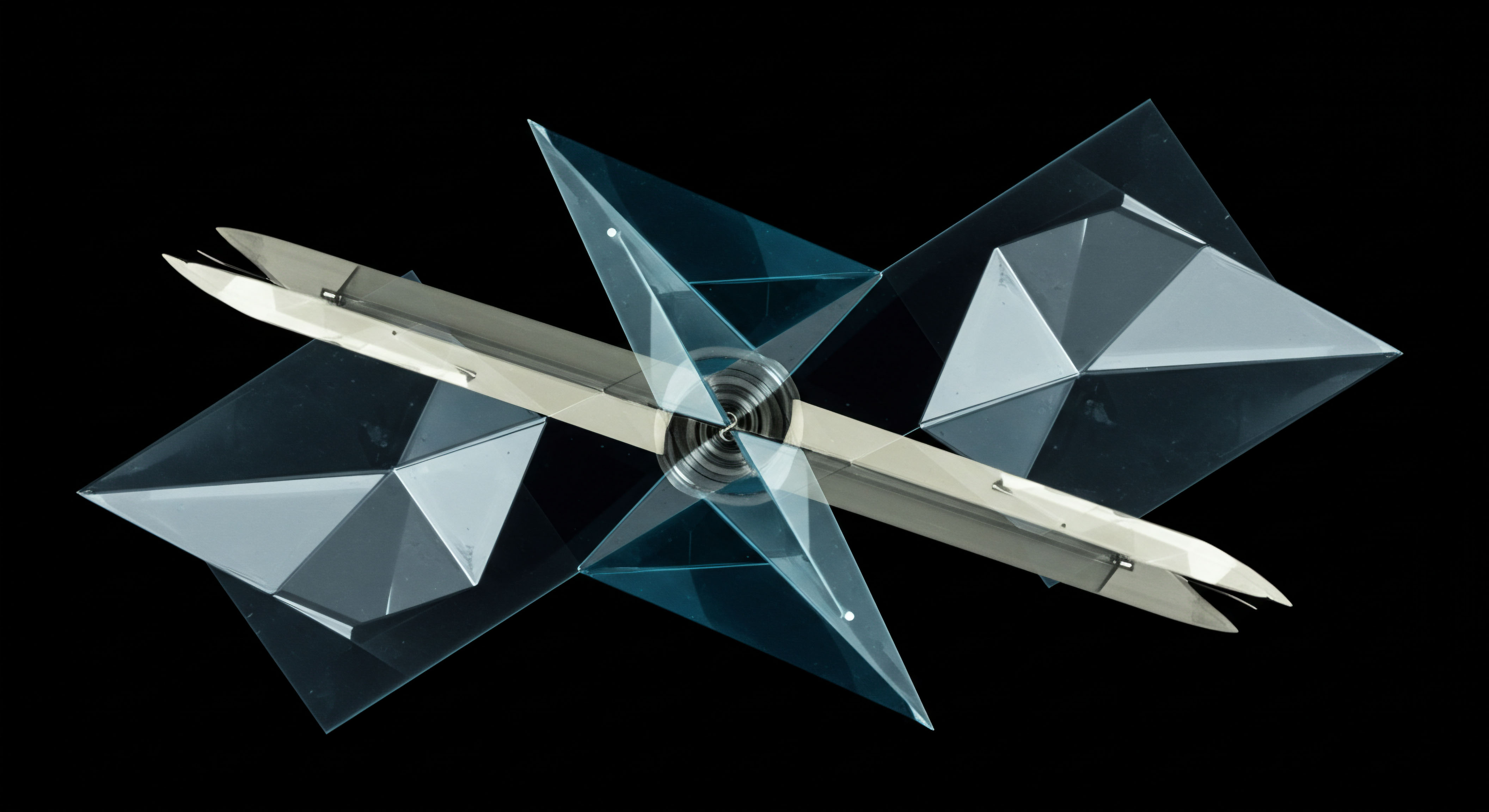

Implementing a BTC straddle block allows for profiting from significant price movements in either direction, suitable for periods of anticipated volatility. This involves purchasing both a call and a put option with the same strike price and expiry date. Employing block execution for these trades reduces market footprint.

Positioning a straddle requires a clear understanding of implied volatility. When implied volatility is low, acquiring straddles can be a cost-effective way to capitalize on subsequent price excursions. Careful selection of the strike price, usually at-the-money, optimizes the potential for profit.

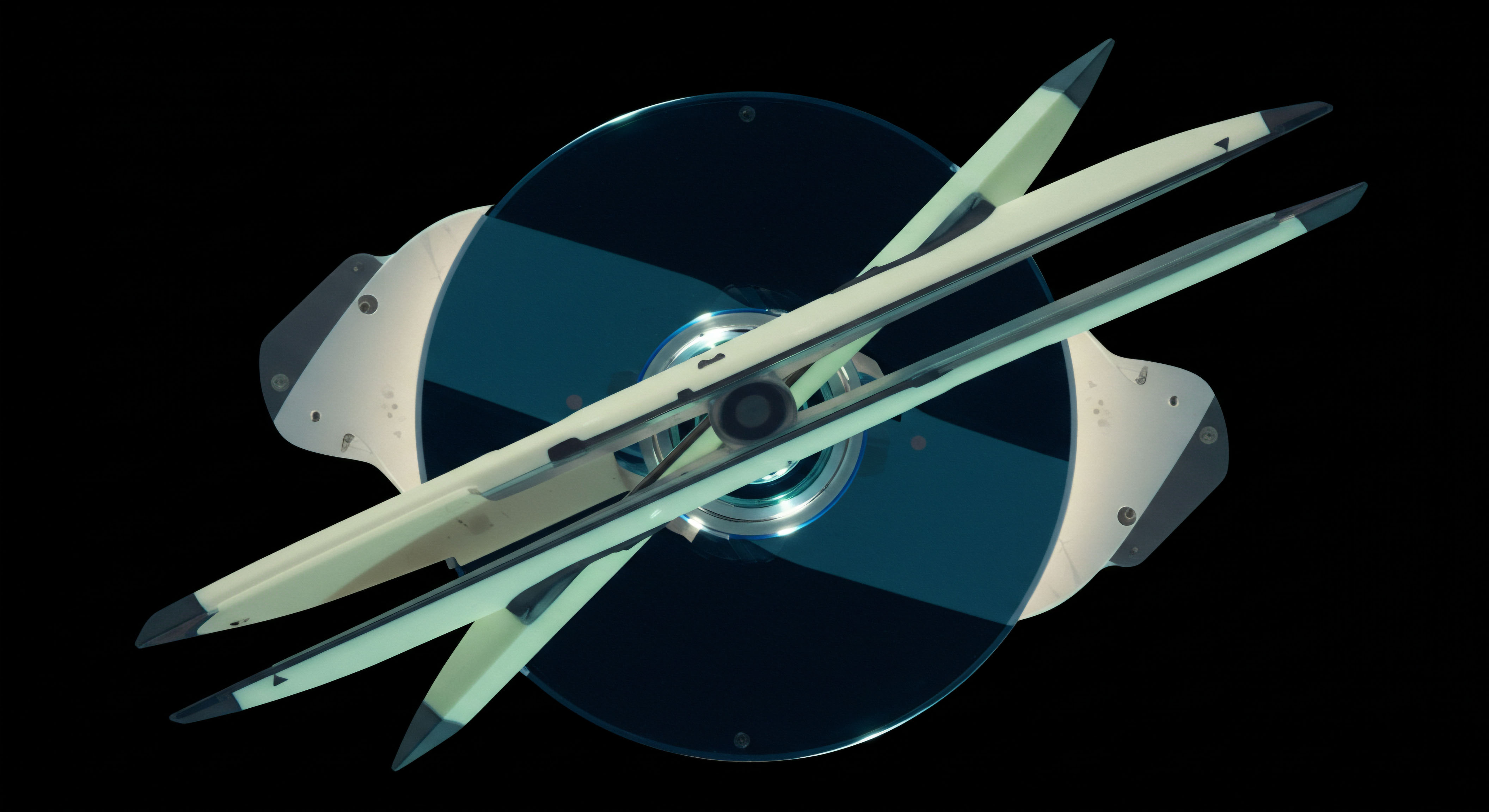

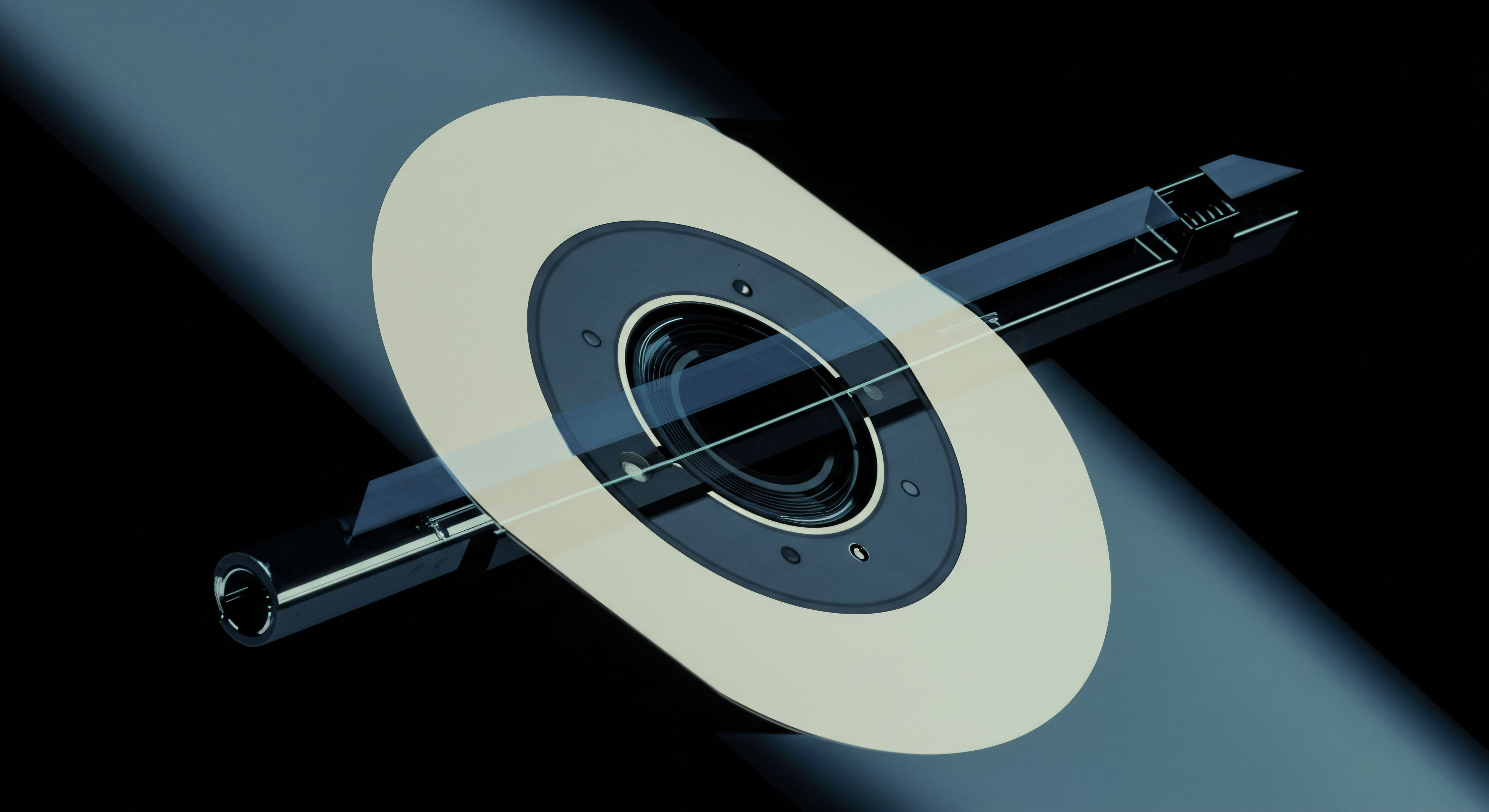

ETH Collar RFQ Strategy

Protecting existing ETH holdings while generating a modest income involves the implementation of an ETH collar strategy. This entails selling an out-of-the-money call option and using a portion of the premium received to purchase an out-of-the-money put option. This creates a defined range for potential profit and loss.

A collar effectively caps potential upside gains in exchange for downside protection and a net credit or reduced cost. Initiating these multi-leg executions through an RFQ system ensures synchronized pricing across all components, a vital aspect for preserving the strategy’s intended risk profile.

Advanced Portfolio Command

Elevating crypto investment beyond foundational strategies requires a deeper understanding of market microstructure and the nuanced application of sophisticated execution methods. Mastering these elements allows for the construction of portfolios that exhibit resilience and consistent alpha generation across varied market cycles. The ability to command liquidity and mitigate price impact stands as a hallmark of advanced trading.

Volatility Block Trade Optimization

Executing large volatility trades, such as substantial straddles or iron condors, demands an optimized block trading approach. These strategies often involve multiple legs, requiring precise, simultaneous execution to prevent adverse price movements between components. Leveraging multi-dealer liquidity within an RFQ environment ensures that complex volatility views translate into efficient trades. This minimizes the risk of slippage, a critical consideration when deploying capital into intricate options structures.

The true advantage of block trading for volatility strategies lies in its capacity to absorb significant order flow without telegraphing intentions to the broader market. Maintaining discretion during execution preserves the integrity of the pricing received. A disciplined approach to block size and timing can materially enhance the overall profitability of these complex positions.

The disciplined application of advanced execution tools distinguishes a market participant from a market master.

Dynamic Hedging with Options RFQ

Implementing dynamic hedging strategies through an options RFQ framework provides a robust defense against adverse market movements. Rather than static positions, dynamic hedging involves continuously adjusting options exposures to maintain a desired risk profile. This proactive stance requires frequent, efficient execution of options contracts.

Consider a portfolio heavily weighted in a particular crypto asset. A derivatives strategist might employ a rolling put option strategy, acquiring new protection as existing contracts approach expiration. Utilizing an RFQ for these continuous adjustments guarantees access to competitive pricing and sufficient liquidity, even for larger notional values. This ensures the hedging cost remains optimized, contributing directly to overall portfolio performance.

The systematic management of risk through these advanced techniques transcends simple protection; it forms an integral component of an aggressive, yet disciplined, capital deployment strategy. Each adjustment refines the portfolio’s exposure, aligning it with evolving market dynamics.

The Strategic Edge Refined

Navigating the crypto markets with an eye towards dynamic income streams demands more than participation; it calls for a deliberate engagement with superior tools. The integration of RFQ, options, and block trading provides a blueprint for transforming passive holdings into active, income-generating assets. This strategic pivot positions you at the forefront of market execution. The path to sustained advantage unfolds through a commitment to precision and a relentless pursuit of optimal outcomes.

Glossary

Block Trading

Btc Straddle Block