Execution Edge Unlocked

Commanding superior outcomes in crypto options demands a refined approach to liquidity and pricing. The Request for Quote mechanism for crypto options offers a distinct advantage, fundamentally reshaping how traders access and interact with market depth. This method permits participants to solicit personalized price streams from multiple liquidity providers, ensuring a competitive environment for substantial order sizes.

Understanding this process builds a foundation for advanced trading. Engaging directly with multiple dealers via an RFQ provides a direct conduit to deeper pools of capital, a significant departure from standard order book interactions. This direct engagement streamlines the discovery of optimal pricing, a critical factor for any trader seeking to maximize their capital deployment. Mastering this foundational interaction elevates one’s market participation.

A direct RFQ engagement optimizes price discovery, a crucial element for capital deployment in crypto options.

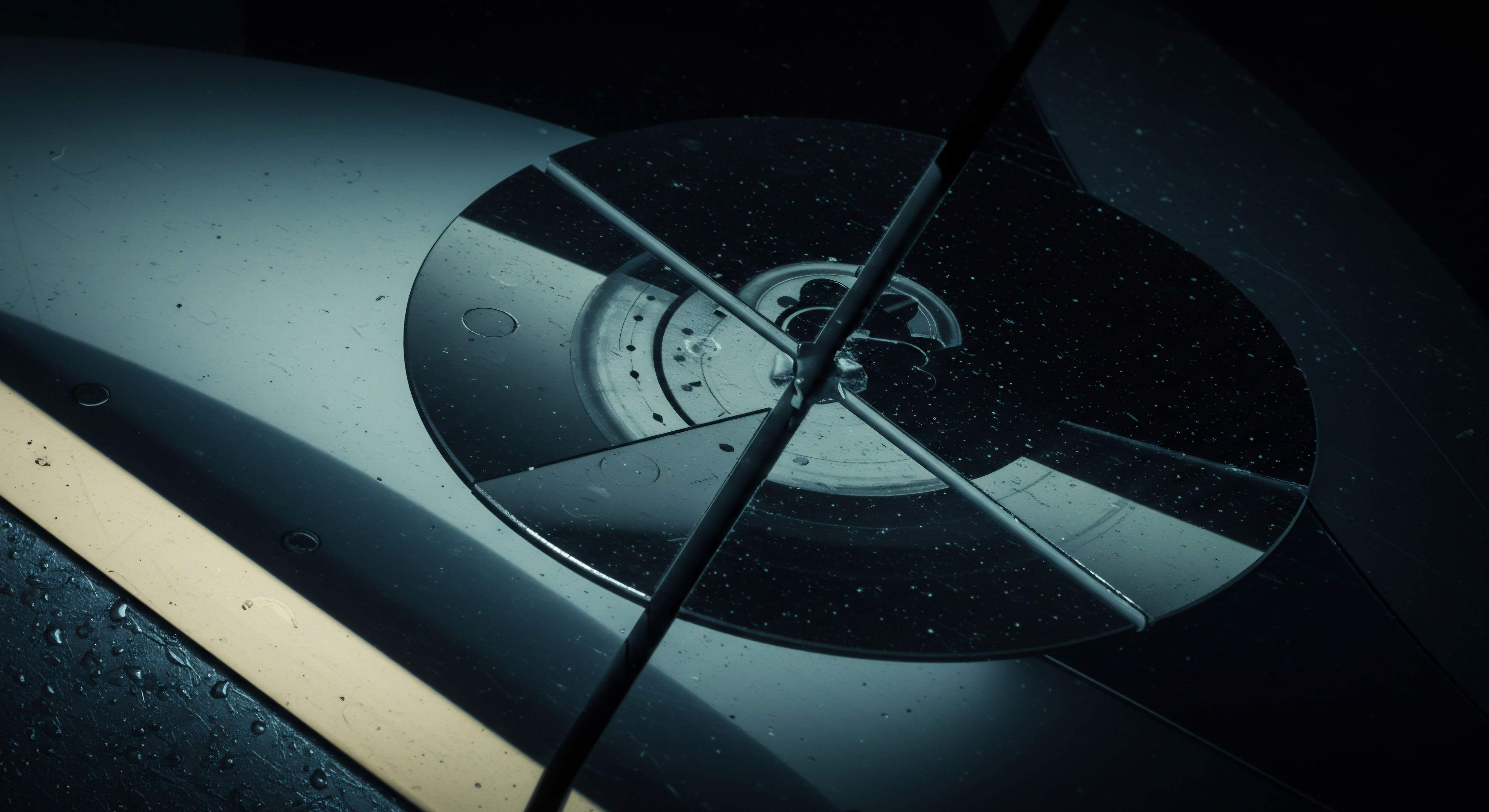

The mechanism itself simplifies complex transactions. Initiating a crypto options RFQ allows for the anonymous submission of trade intentions, safeguarding strategic positioning. This anonymity becomes a powerful tool, particularly when dealing with significant block trades, ensuring market impact remains contained. The ability to source bespoke pricing without revealing a full position prior to execution represents a tangible market edge.

Strategic Capital Deployment

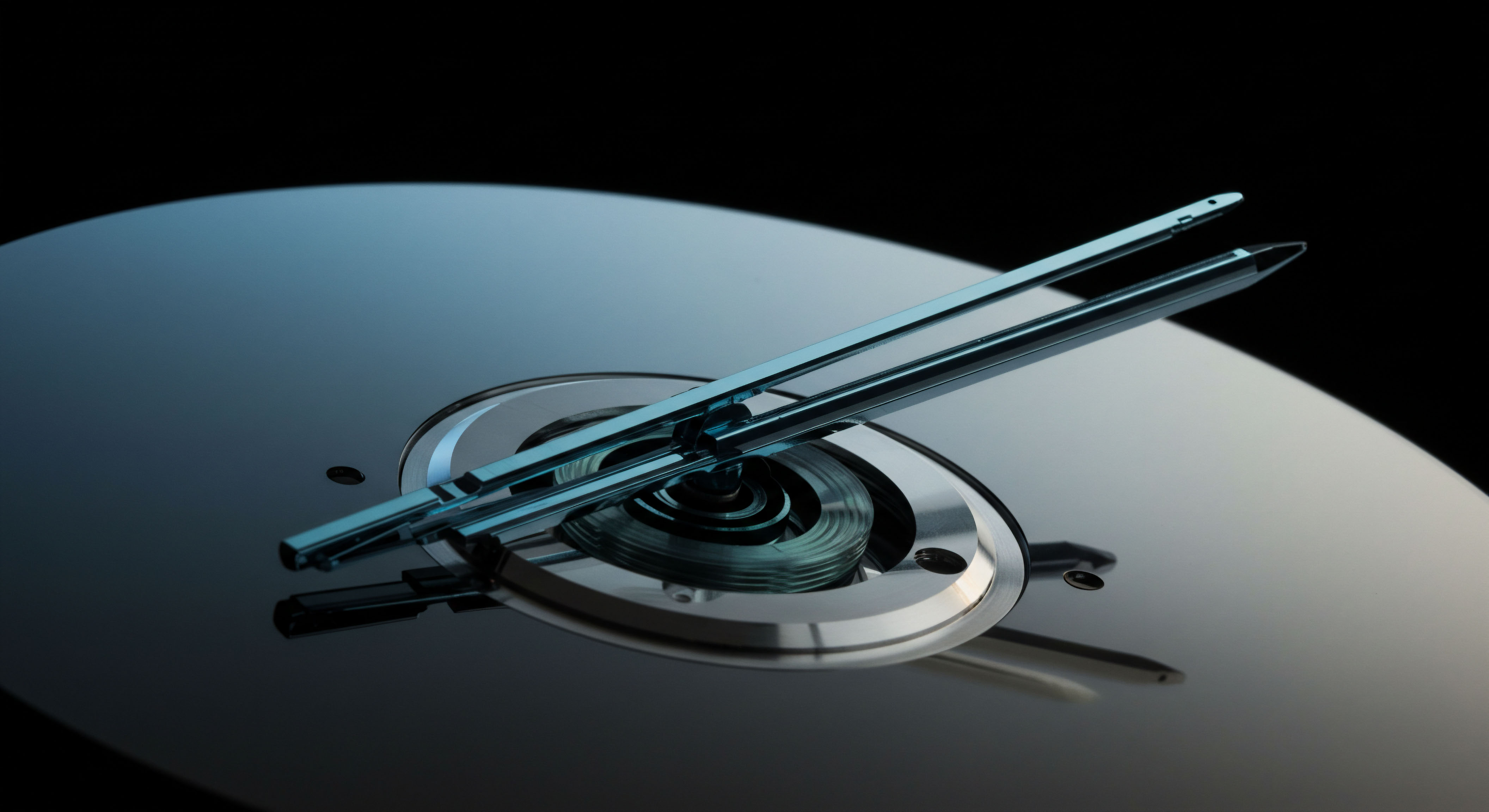

Deploying capital effectively in crypto options requires precision and a systemic framework. The RFQ mechanism offers a robust avenue for executing complex strategies, from managing volatility to establishing directional exposures with superior pricing. Traders can execute multi-leg options spreads with a single RFQ, securing synchronized pricing across all components. This unified execution reduces leg risk and improves overall strategy integrity.

Consider the BTC straddle block, a potent strategy for volatility plays. Initiating an RFQ for a straddle block allows for simultaneous execution of both call and put options at the same strike and expiry. This ensures that the desired volatility exposure is acquired with minimal slippage, a critical factor for profitability. Professional traders recognize the value of securing a tight bid-ask spread on these combined positions.

Multi-Leg Execution Advantages

Executing multi-leg strategies via RFQ presents distinct benefits.

- Synchronized Pricing Achieving uniform pricing across all legs of a complex options strategy.

- Reduced Leg Risk Minimizing the risk of adverse price movements between individual option legs.

- Enhanced Liquidity Access Tapping into deeper, multi-dealer liquidity pools for comprehensive orders.

- Operational Efficiency Streamlining the execution process for intricate option combinations.

An ETH collar RFQ provides another example of strategic application. This defensive strategy involves selling an out-of-the-money call and buying an out-of-the-money put, hedging a long ETH position. Executing this as a single RFQ block trade ensures the entire risk-defined structure is put in place efficiently. The resulting price certainty for the collar’s components solidifies the hedge’s effectiveness.

Executing multi-leg options strategies through RFQ delivers synchronized pricing and significantly reduces leg risk.

Volatility block trades, often substantial in size, benefit immensely from the RFQ environment. Traders seeking to capitalize on anticipated price swings can request quotes for large option positions without signaling their intent to the broader market. This discretion protects the trader’s edge, allowing for more favorable entry and exit points. Price impact matters.

Mastering Advanced Applications

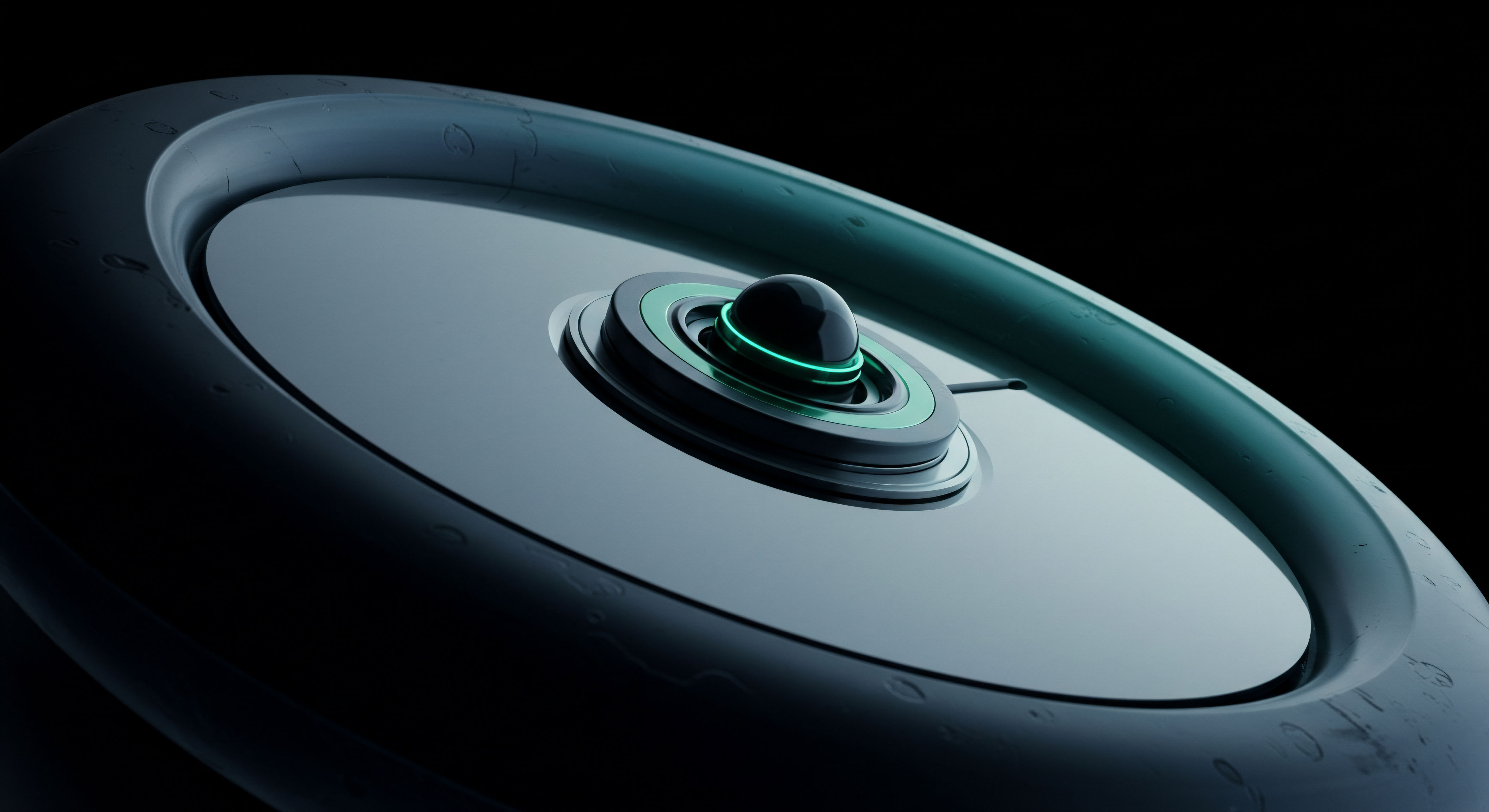

Elevating one’s command of crypto options extends beyond individual trades, integrating into a holistic portfolio management approach. Advanced traders utilize the RFQ mechanism to fine-tune their overall risk exposure, treating it as a dynamic tool within a broader financial framework. This allows for precise adjustments to delta, gamma, and vega, aligning the portfolio’s sensitivity with evolving market conditions. The pursuit of execution excellence never truly ends; it merely evolves.

Integrating OTC Options

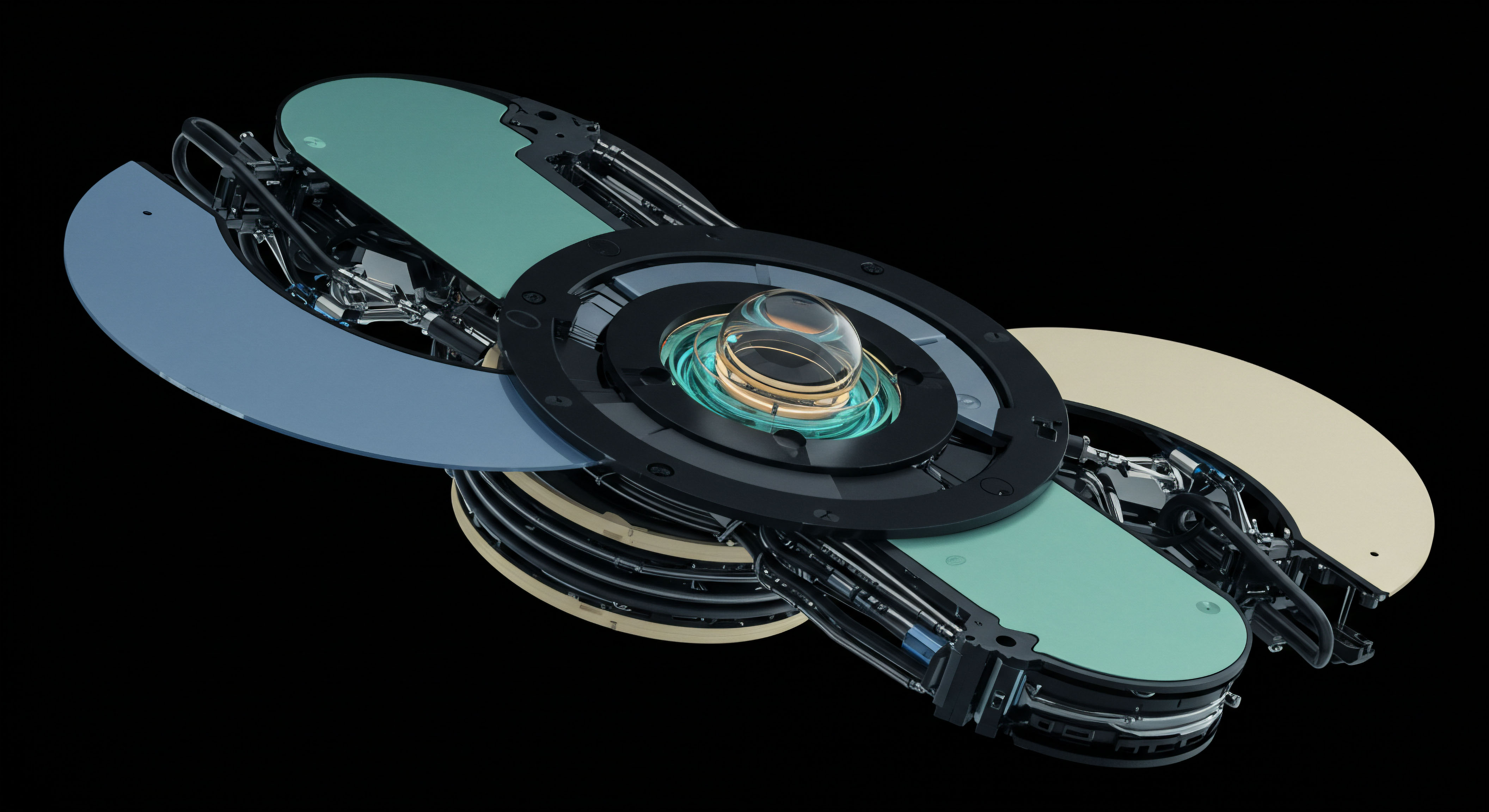

Over-the-counter (OTC) options, facilitated by RFQ, open avenues for highly customized risk transfer. These bespoke contracts cater to specific risk parameters, allowing for maturities, strikes, and underlying assets that standard exchange offerings may not provide. A trader might require a unique expiration date for a specific event, or a precise strike to hedge an illiquid asset. The RFQ process connects the trader with liquidity providers capable of structuring these tailored instruments.

Considering the profound impact of market microstructure on execution quality, the RFQ stands as a bulwark against liquidity fragmentation. It synthesizes diverse pools of capital, effectively creating a unified bidding environment for large orders. This systemic advantage minimizes the implicit costs associated with trading size in fragmented markets, translating directly into superior fill rates and tighter spreads.

The RFQ mechanism, by unifying diverse capital pools, acts as a systemic advantage against market fragmentation.

Sophisticated traders employ RFQ to manage their implied volatility exposure with exceptional granularity. Whether selling premium against a long position or buying options to express a volatility view, the ability to source competitive quotes for large blocks provides a distinct advantage. This refined control over volatility surfaces allows for the implementation of complex quantitative strategies, enhancing the overall alpha generation potential of a portfolio.

The Unseen Advantage

The pursuit of certainty in crypto options execution transcends simple price points; it involves a command of the underlying mechanisms that shape market interaction. Mastering the RFQ process provides an unseen advantage, a strategic lever for those who recognize that superior outcomes arise from superior operational design. This is not merely about trading; it is about engineering a persistent edge.

Glossary

Crypto Options

Crypto Options Rfq

Options Spreads

Multi-Dealer Liquidity