Commanding Options Liquidity

Elite crypto options trading demands a systematic approach to execution, a domain where the Request for Quote (RFQ) mechanism stands paramount. This powerful tool empowers participants to solicit competitive pricing from multiple liquidity providers simultaneously, all within a private, controlled environment. Understanding this foundational element unlocks a significant advantage, moving beyond fragmented order books to direct engagement with market makers. The RFQ process fundamentally reshapes how traders access deep liquidity, especially for larger block sizes and complex multi-leg strategies.

Achieving superior execution in crypto options begins with mastering the RFQ mechanism.

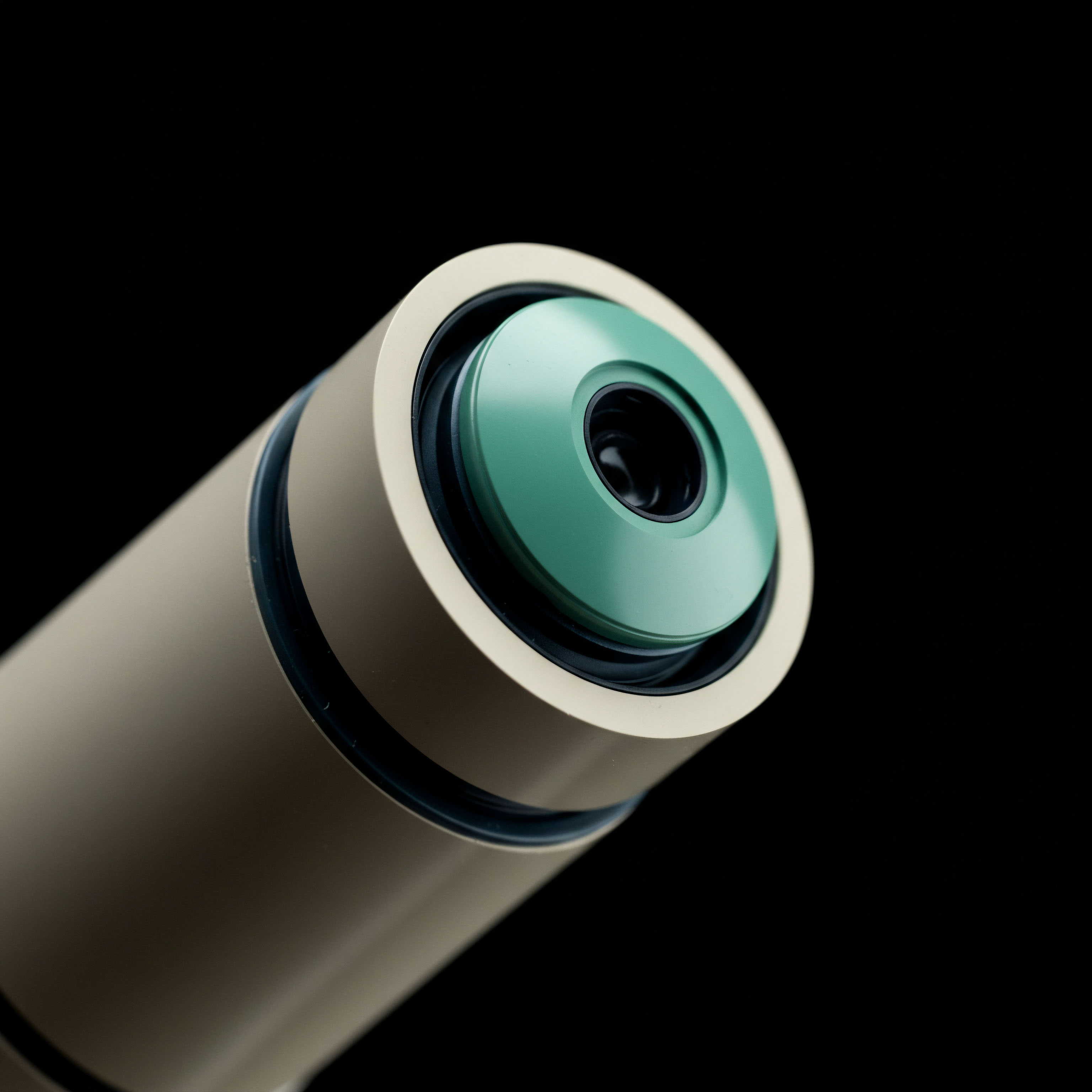

This direct negotiation capability ensures transparent price discovery, a critical component for managing basis risk and optimizing entry points. Deploying RFQ for crypto options means gaining immediate access to tailored quotes, often reflecting tighter spreads than available on public exchanges. It transforms execution from a reactive endeavor into a proactive strategic maneuver. Every sophisticated trader recognizes the imperative of precise execution, a goal directly served by RFQ’s inherent structure.

Engaging with this professional-grade system establishes a direct channel to wholesale liquidity, circumventing the public order book’s potential for price impact. This directness provides a distinct operational edge for those seeking to deploy capital with maximum efficiency. Mastery of RFQ lays the groundwork for advanced options strategies, positioning participants to capture opportunities with precision and confidence.

Strategic Deployment of RFQ

Deploying RFQ within a robust investment framework allows for superior execution across a spectrum of crypto options strategies. This approach secures optimal pricing for complex positions, directly impacting overall portfolio performance. This approach delivers a demonstrable edge in competitive markets.

Multi-Leg Spread Efficiency

Executing multi-leg options spreads through RFQ channels offers substantial efficiency gains. Rather than piecing together individual legs on an exchange, which introduces slippage and execution risk, RFQ enables a single, unified transaction. This unified execution ensures all components of a spread trade are filled simultaneously at a predetermined net price, eliminating leg risk. Traders frequently employ this for strategies such as iron condors, butterflies, and calendar spreads, where precise entry is paramount.

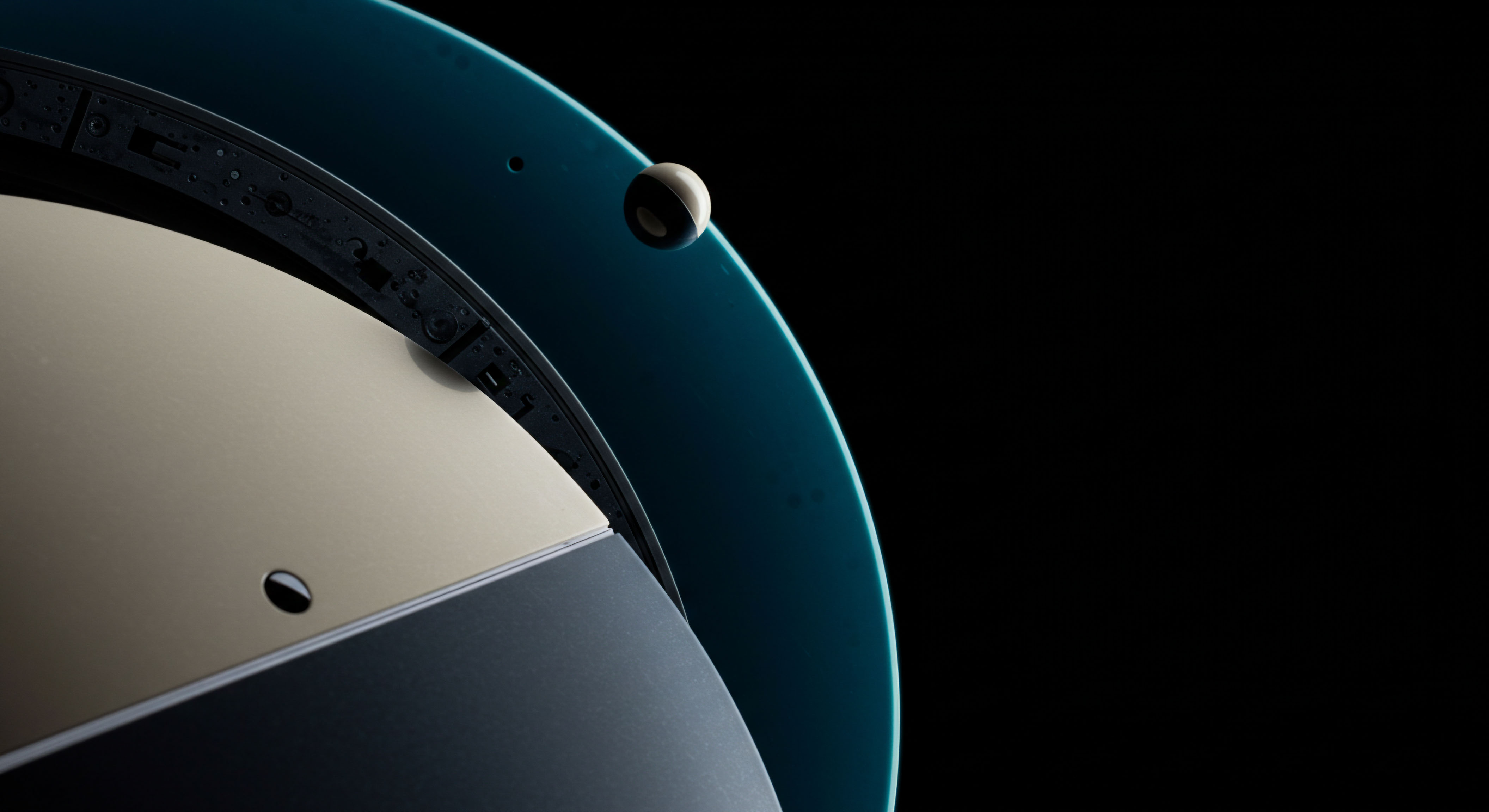

Block Liquidity Advantage

Block trading large crypto options positions demands an execution venue that minimizes market impact. RFQ provides this necessary environment, allowing institutions and high-net-worth individuals to move significant capital without signaling their intentions to the broader market. The private nature of the RFQ process ensures anonymous options trading, preserving informational advantage. This capability becomes especially valuable when entering or exiting substantial BTC Straddle Block or ETH Collar RFQ positions, where market depth on public venues might be insufficient.

Effective RFQ utilization demands a structured approach. Consider these critical steps for maximizing your execution edge:

- Define Trade Parameters Precisely ▴ Clearly articulate the option type, strike, expiry, quantity, and desired spread structure.

- Select Qualified Liquidity Providers ▴ Engage with market makers known for competitive pricing and deep liquidity in your chosen crypto assets.

- Monitor Quote Validity ▴ Understand the time sensitivity of received quotes, acting decisively to secure the best available terms.

- Assess Post-Trade Analytics ▴ Review execution quality metrics, including slippage and price improvement, to refine future RFQ strategies.

- Maintain Discretion ▴ Leverage the private nature of RFQ to shield large orders from public market scrutiny.

Precision in Volatility Trading

Volatility block trade execution gains a distinct edge through RFQ. Traders expressing a specific view on implied volatility, whether through straddles, strangles, or other complex structures, benefit immensely from bespoke pricing. The direct engagement with dealers allows for nuanced adjustments to trade parameters, securing more favorable terms than standard order book execution. This method becomes indispensable for systematic strategies reliant on capturing subtle shifts in market sentiment.

Achieving best execution consistently requires a commitment to these disciplined practices. The direct interface with multi-dealer liquidity pools through RFQ channels fundamentally increases a trader’s capacity to minimize slippage across all transaction types. This strategic advantage translates directly into greater profitability, positioning a trader at the forefront of crypto derivatives markets.

Advanced RFQ Applications

Moving beyond basic execution, advanced RFQ applications utilize deeply into a comprehensive portfolio strategy, forming a core component of sustained alpha generation. This level of mastery utilizes a continuous feedback loop between execution data and strategic refinement. It demands understanding the intricate interplay of market microstructure and quantitative finance principles.

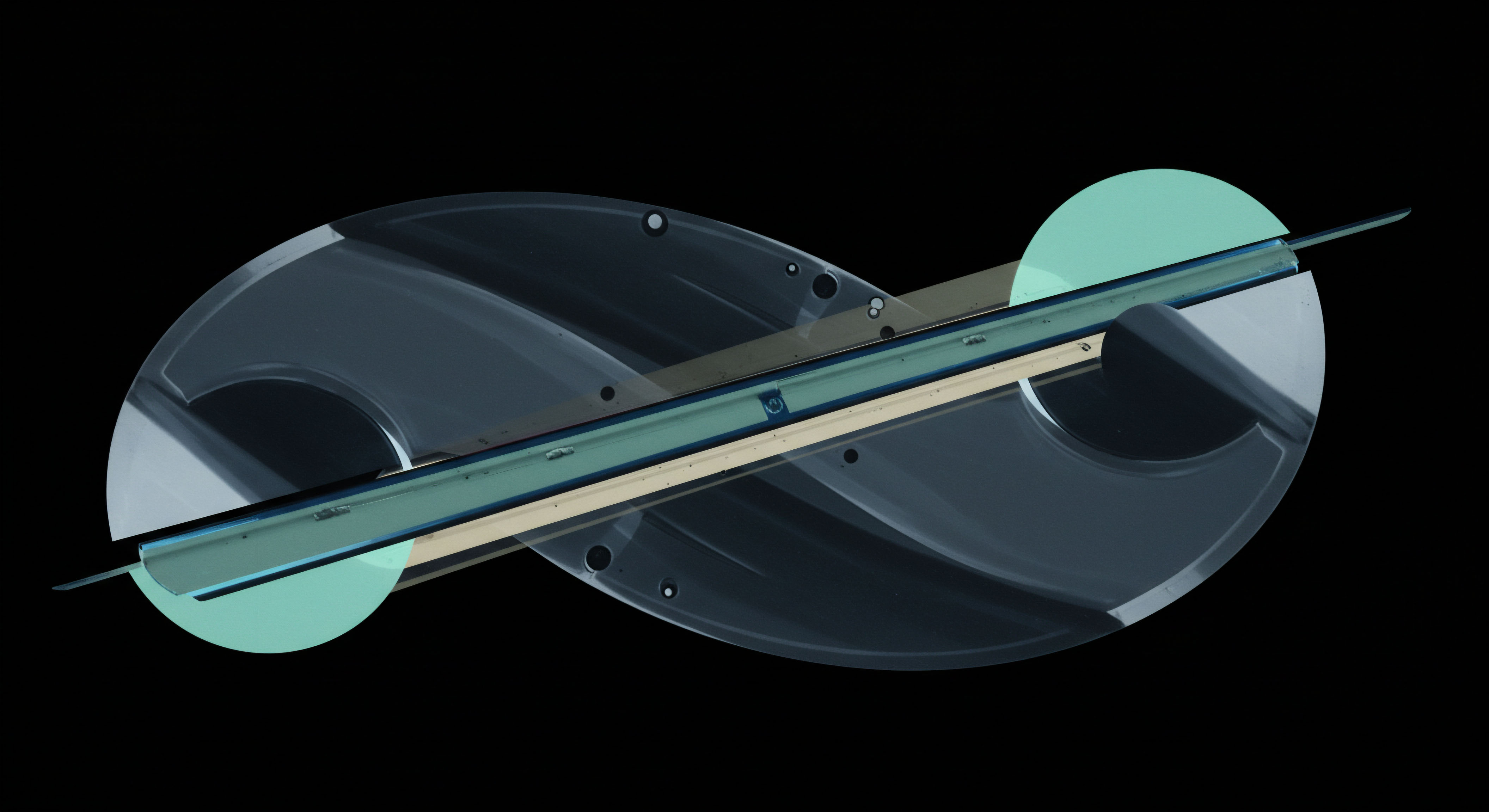

Algorithmic Execution Synergy

Smart Trading within RFQ and Crypto environments applies seamless execution algorithms. These algorithms dynamically adjust RFQ parameters based on real-time market conditions, liquidity depth, and desired price targets. This sophisticated automation ensures optimal fill rates and minimal price impact for even the largest orders. Deploying such systems moves trading from manual intervention to a systematic, data-driven approach, securing a verifiable edge.

Consider the persistent challenge of liquidity fragmentation across various crypto derivatives venues. While RFQ inherently addresses this by centralizing dealer interaction, true mastery demands an analytical lens. We must continuously ask ▴ what precise market conditions cause specific dealers to offer superior pricing on certain volatility structures? This intellectual grappling reveals deeper patterns, transforming raw execution into a source of strategic insight.

Risk Management Structures

Robust risk management forms the bedrock of any advanced derivatives strategy. RFQ execution, particularly for block trades, demands a sophisticated structure that accounts for counterparty risk, settlement risk, and the specific delta exposure of multi-leg positions. Financial engineering principles guide the construction of these structures, ensuring capital protection alongside profit pursuit. A disciplined approach to position sizing and hedging remains paramount.

Effective management requires a clear understanding of behavioral finance, recognizing how market participants react under stress. This awareness informs strategic timing for RFQ submissions and counterparty selection. Continuous backtesting and scenario analysis refine these structures, adapting them to evolving market dynamics. Precision is everything.

Mastery of RFQ transforms it from a mere tool into a strategic lever for portfolio construction. It enables proactive positioning in volatility, efficient deployment of capital, and systematic reduction of execution costs across all crypto options activities. This strategic elevation secures a lasting competitive advantage.

Unlocking Alpha Potential

The journey to elite crypto options trading culminates in a sophisticated understanding of execution mechanics, particularly through RFQ mastery. This refined approach transcends conventional market participation, elevating a trader’s capacity to dictate terms and secure a demonstrable edge. The commitment to these advanced methodologies defines the true derivatives strategist, shaping future market outcomes with informed precision.

Glossary

Crypto Options

Anonymous Options Trading

Btc Straddle Block

Volatility Block Trade

Multi-Dealer Liquidity