Commanding Crypto Options Execution

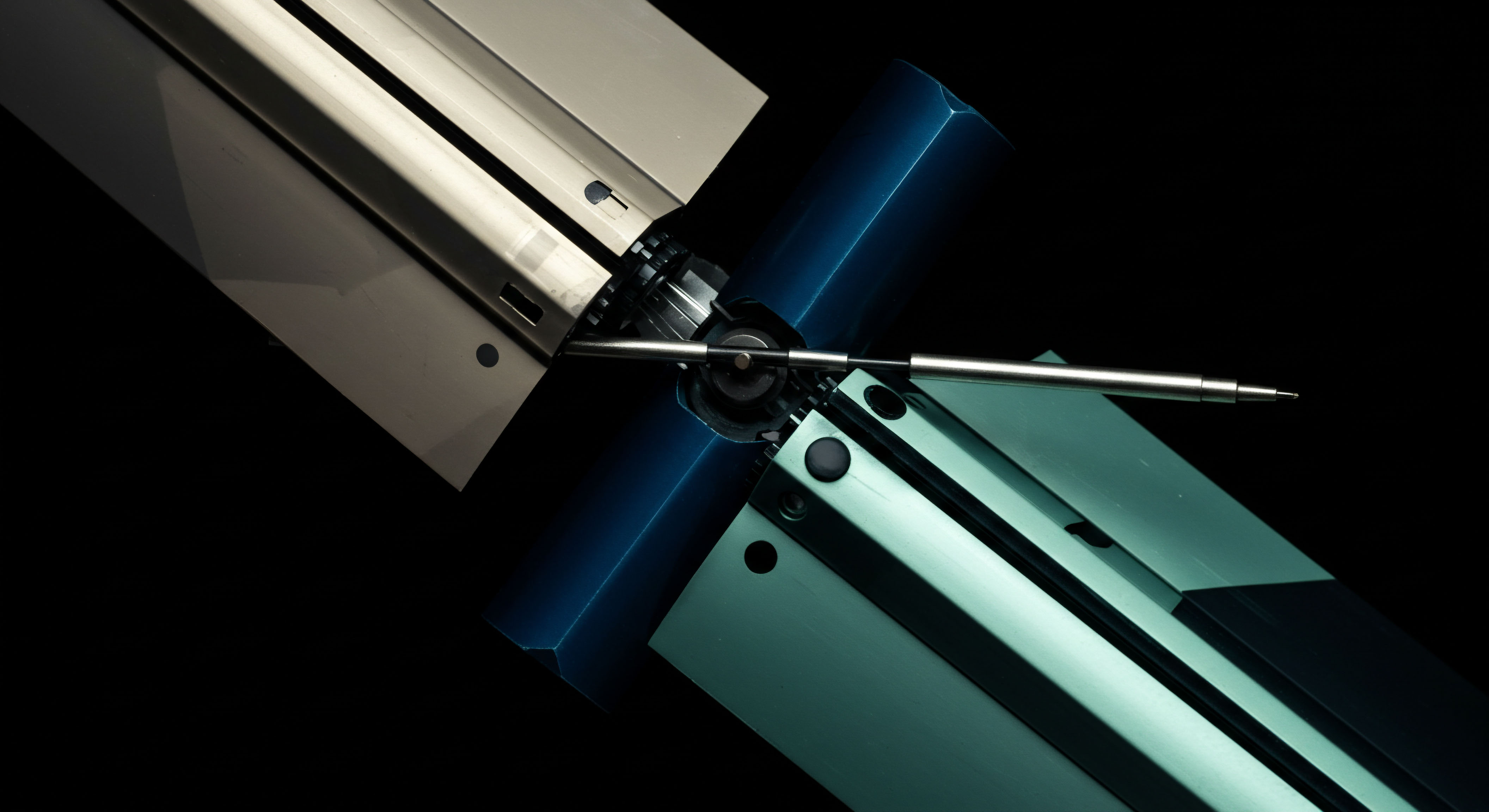

Achieving superior execution in crypto options demands a precise operational design. Request for Quote (RFQ) systems represent a foundational element for this precision, allowing traders to solicit competitive pricing from multiple liquidity providers for block trades. This mechanism grants direct access to deeper liquidity pools, moving beyond the limitations of standard order books. Professional traders recognize RFQ as a direct pathway to reduced market impact and improved price discovery, particularly for larger positions.

The system operates by allowing a trader to specify the exact parameters of their desired options trade, including asset, strike, expiry, and quantity. This request is then broadcast to a curated group of market makers. These market makers respond with firm, executable quotes, often tailored to the specific request.

The trader then reviews these bids and offers, selecting the most advantageous price. This structured approach fosters a competitive environment, ensuring optimal pricing for the specified trade parameters.

RFQ systems offer a structured conduit for competitive price discovery in block crypto options, delivering a measurable edge.

Understanding the operational mechanics of an RFQ system is the first step toward commanding your trading outcomes. It is a systematic approach to securing liquidity, providing transparency in a market often characterized by fragmentation. The direct interaction with multiple liquidity sources ensures a trader consistently accesses the most favorable terms available at the moment of execution.

Strategic Capital Deployment

Deploying capital with RFQ crypto options transforms speculative activity into a calculated exercise in market advantage. The Alpha-Focused Portfolio Manager understands that execution quality directly impacts realized returns. This section outlines specific, actionable strategies for leveraging RFQ to secure superior pricing and manage exposure effectively.

Optimizing Block Trades

Block trading in Bitcoin and Ethereum options finds its most efficient expression through RFQ. Executing substantial positions via an RFQ minimizes price slippage, a critical factor when moving large amounts of capital. The ability to anonymously solicit quotes protects a trader’s intentions, preventing adverse price movements that often accompany large orders on open exchanges.

- Direct Liquidity Access ▴ Engage directly with market makers for specific Bitcoin and Ethereum options blocks, bypassing public order books.

- Reduced Price Impact ▴ Mitigate the effect of large orders on market prices by obtaining competitive, firm quotes before execution.

- Enhanced Anonymity ▴ Maintain discretion over trading intentions, preserving market integrity during significant capital deployment.

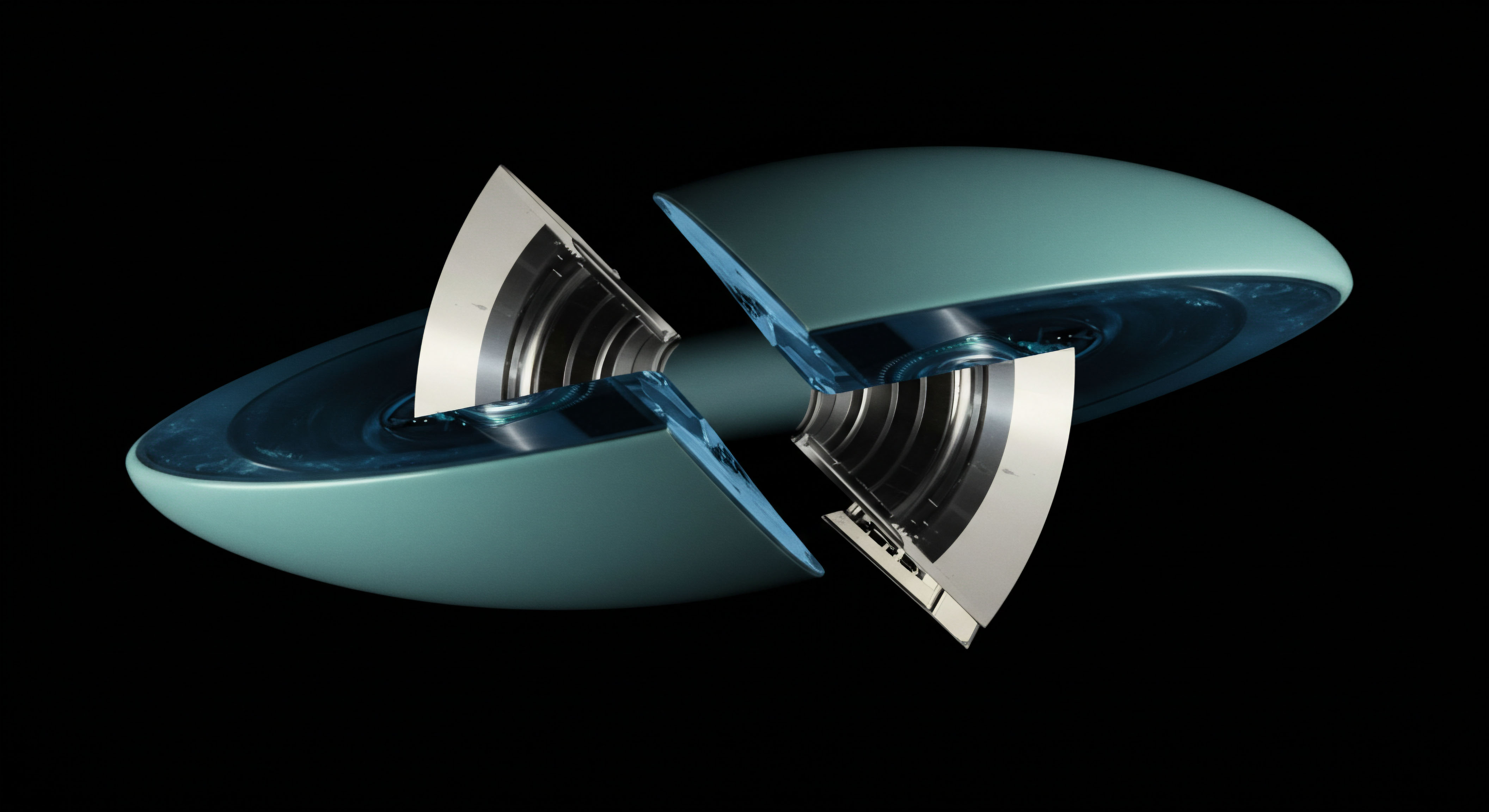

Multi-Leg Options Structures

Complex options strategies, such as straddles, collars, and iron condors, achieve their true potential with RFQ. Constructing multi-leg positions demands precise simultaneous execution across all components to minimize basis risk. RFQ facilitates this by allowing traders to request a single, aggregated quote for the entire strategy. This capability streamlines execution, ensuring the intended risk-reward profile remains intact.

BTC Straddle Block Execution

A Bitcoin straddle block executed via RFQ allows for a defined volatility view with superior pricing. A trader requests simultaneous bids and offers for an equivalent number of calls and puts at the same strike and expiry. The system aggregates these components into a single, competitive quote, ensuring a clean entry into the position.

ETH Collar RFQ Implementation

Implementing an Ethereum collar strategy through RFQ provides capital protection and income generation with controlled costs. A trader simultaneously sells an out-of-the-money call and purchases an out-of-the-money put, hedging a long ETH position. RFQ allows for a unified quote, optimizing the premium received and paid, thereby defining the protective band with precision.

The systematic application of RFQ to these structures allows for a strategic edge. A trader gains the ability to execute sophisticated strategies with the confidence of knowing they have secured competitive pricing, a hallmark of professional market engagement. The focus remains on engineering the desired outcome with optimal cost efficiency.

A profound satisfaction stems from knowing every basis point of execution improvement directly contributes to portfolio performance. The meticulous selection of liquidity providers and the analytical rigor applied to quote evaluation define this professional approach. This commitment to detail transforms trading into a deliberate exercise in extracting market value, a practice honed by continuous refinement and an unwavering dedication to quantifiable outcomes.

This deliberate pursuit of precision, often overlooked in the rush of market dynamics, stands as a testament to the discipline required for sustained success. The true measure of a strategist resides in the consistent application of these superior methods, turning potential into tangible gain.

Advanced Strategic Integration

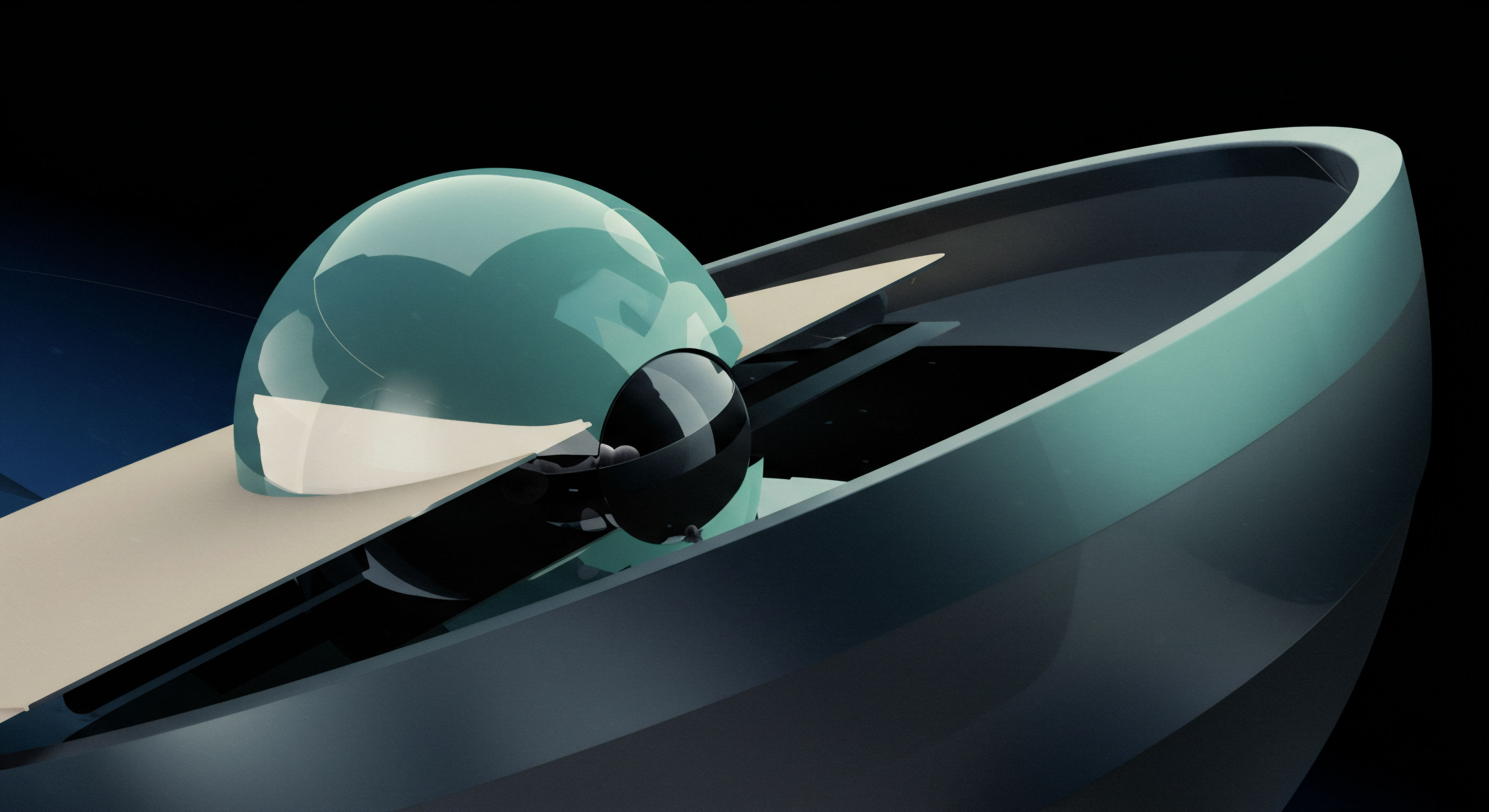

Expanding one’s command over RFQ crypto options involves integrating this execution capability into a broader, more resilient portfolio strategy. This moves beyond individual trade optimization, focusing on how RFQ contributes to overall risk management and sustained alpha generation. A master advisor views the market as a complex system where each tool serves a distinct purpose within a cohesive design.

Market Microstructure and Execution Quality

Understanding market microstructure provides context for RFQ’s strategic value. Liquidity fragmentation across various venues presents a challenge for large orders. RFQ directly addresses this by aggregating liquidity from multiple dealers, effectively centralizing access to diverse pools. This systemic advantage translates into superior fill rates and reduced implicit transaction costs.

The quantitative assessment of execution quality involves metrics such as slippage, price impact, and fill rates. RFQ offers a verifiable improvement across these dimensions, providing data-driven validation for its deployment. Comparing RFQ execution against traditional methods consistently reveals its efficacy in preserving capital during trade entry and exit.

Mastering RFQ transforms execution into a strategic asset, providing a demonstrable edge in competitive crypto derivatives markets.

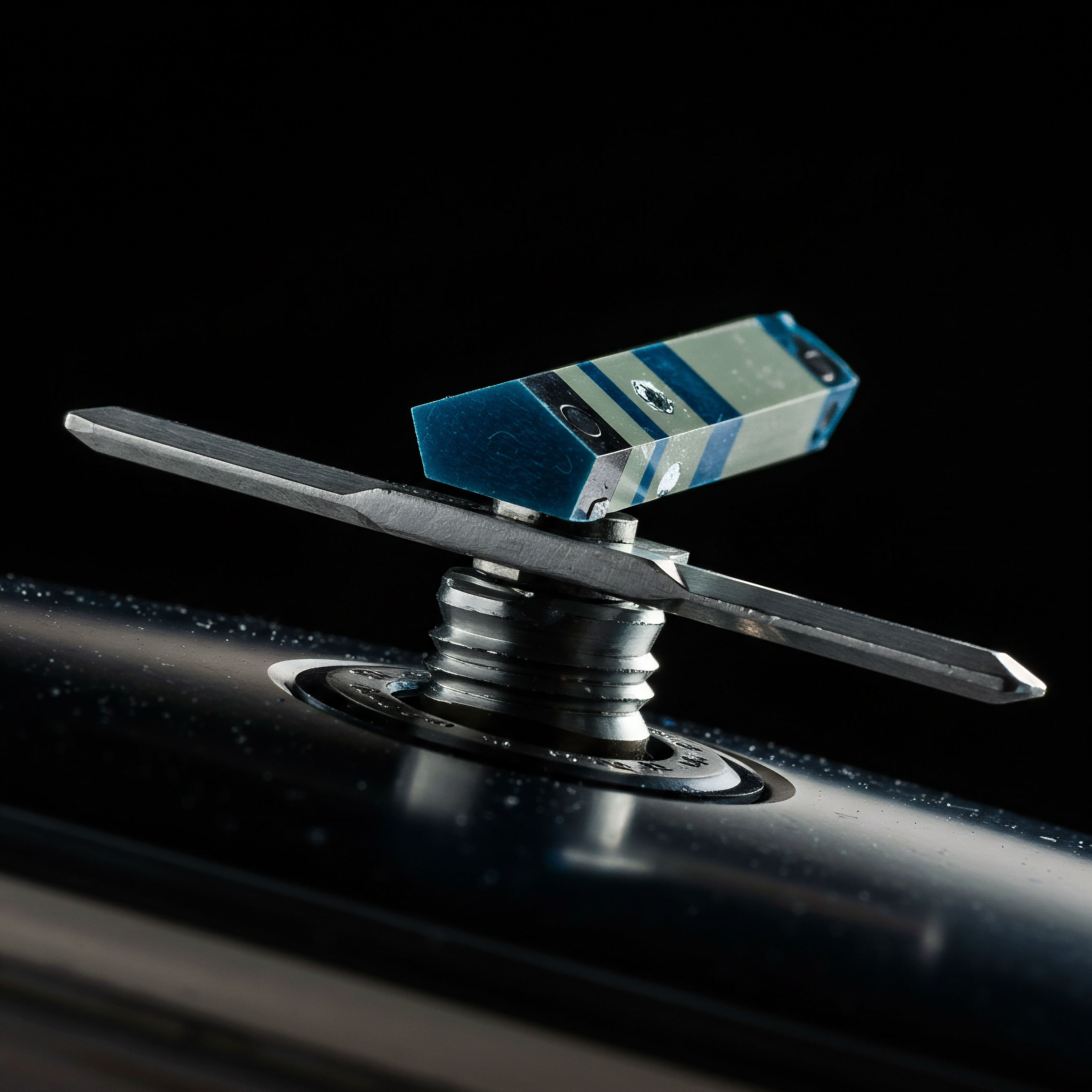

Algorithmic Integration for Volatility Trades

Sophisticated traders integrate RFQ into their algorithmic execution frameworks, particularly for volatility-driven strategies. An AI trading bot, for instance, can dynamically analyze market conditions and initiate RFQ requests for options spreads when specific volatility signals arise. This automation ensures rapid response and consistent execution quality, removing human latency from the decision-making loop.

The precise execution of complex volatility blocks, such as strangles or butterflies, benefits immensely from RFQ’s ability to source multi-leg quotes. This allows for the swift and accurate positioning required to capitalize on transient market anomalies or to construct nuanced hedging positions. The system becomes an extension of a trader’s analytical edge, translating insights into action with unparalleled fidelity.

The pursuit of next-level edge in derivatives demands a constant refinement of execution methods. Acknowledging the inherent complexity of price discovery across a fragmented landscape, the astute strategist must continuously calibrate their approach. This involves not only understanding the theoretical underpinnings of market mechanisms but also meticulously observing their real-world impact.

The subtle interplay of order flow, dealer incentives, and information asymmetry shapes the actual cost of a trade. Discerning these dynamics, and then leveraging RFQ to navigate them, constitutes a distinct advantage, moving beyond conventional assumptions to empirically verifiable results.

Unlocking Your Market Command

The journey to elite execution with RFQ crypto options redefines a trader’s interaction with the market. It positions the individual as a commander of liquidity, dictating terms with precision and strategic foresight. This shift empowers a trader to engineer outcomes, transforming ambitious goals into consistent market victories. The opportunity awaits those prepared to seize control of their execution destiny.

Glossary

Crypto Options

Rfq Crypto Options

Market Microstructure

Algorithmic Execution