Execution Command

Superior pricing for substantial crypto trades hinges upon mastering specialized execution methods. These mechanisms transcend conventional market interactions, offering a direct conduit to optimized liquidity and pricing. Understanding their fundamental mechanics equips serious participants with a decisive advantage, transforming large-scale transactions from potential liabilities into strategic assets. This foundational knowledge empowers a trader to engage with the market on their own terms, securing advantageous entry and exit points.

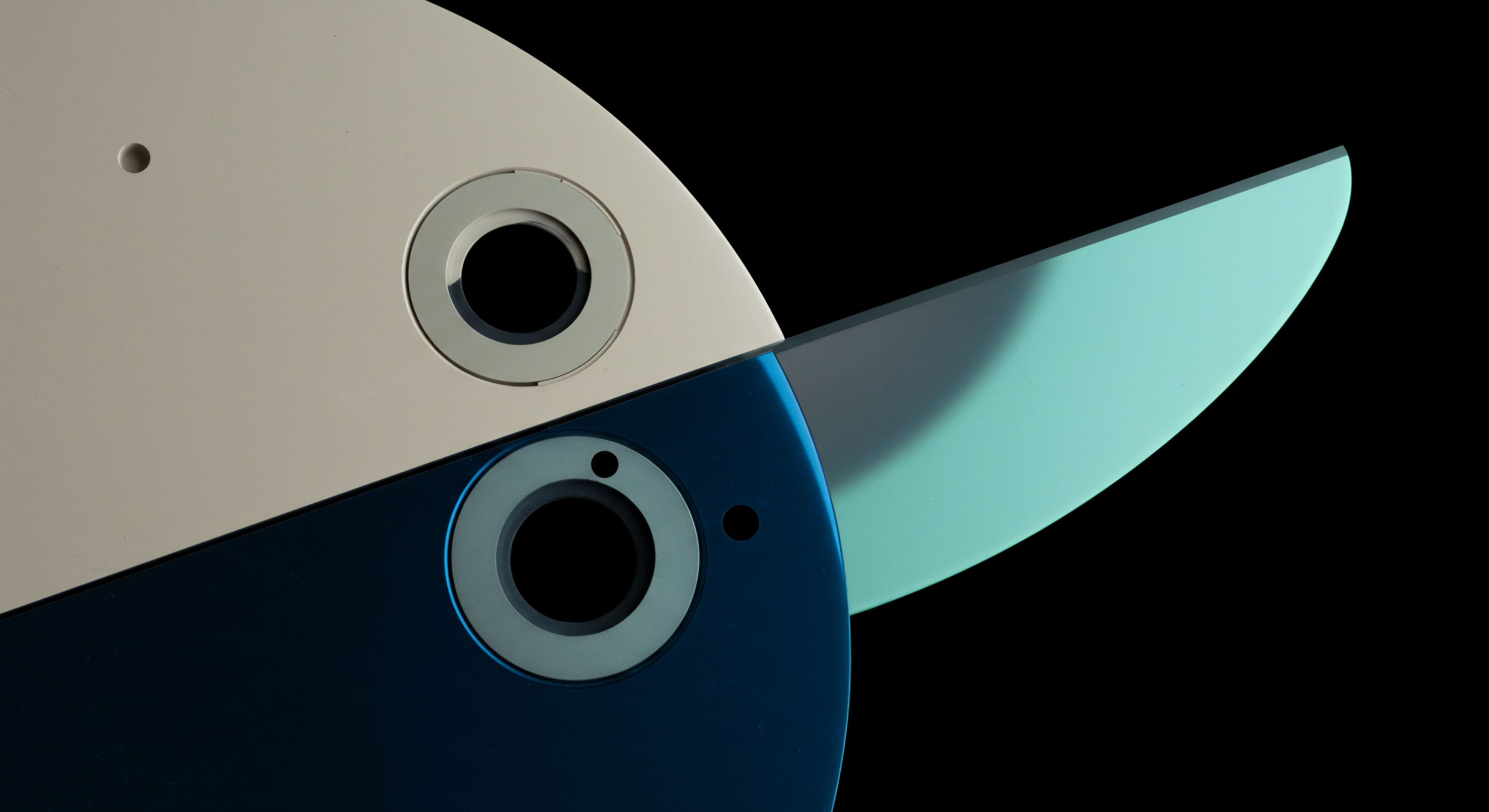

A Request for Quote (RFQ) system provides a structured pathway for traders to solicit bids and offers from multiple liquidity providers simultaneously. This competitive dynamic ensures a narrow spread, translating directly into superior pricing for significant order sizes. Similarly, block trading, often conducted through these RFQ systems, facilitates the execution of large orders without adverse market impact. These approaches allow for the discreet and efficient movement of capital, preserving the integrity of the trade and the overall portfolio position.

Mastering specialized execution methods transforms large crypto transactions into strategic assets, ensuring optimized liquidity and pricing.

The core value of these sophisticated trading avenues resides in their capacity to aggregate liquidity. Fragmentation across various exchanges and over-the-counter desks presents a challenge for large orders. Centralized RFQ environments consolidate these disparate sources, presenting a unified view of available pricing. This systemic advantage streamlines the execution process, offering a level of control and efficiency unavailable through standard exchange order books.

Strategic Capital Deployment

Deploying capital strategically requires a methodical approach to execution, particularly when dealing with significant crypto holdings. Options trading, when integrated with RFQ and block trading, provides a powerful framework for expressing complex market views while controlling risk. This synergy unlocks advanced strategies for both hedging and speculative positioning.

Options Spreads for Defined Risk

Constructing options spreads through RFQ systems allows for precise risk management and targeted exposure. Traders can solicit quotes for multi-leg strategies such as straddles, collars, or iron condors on Bitcoin (BTC) or Ethereum (ETH) options. This enables a trader to define maximum profit and loss parameters before execution, ensuring alignment with a predetermined risk appetite. Obtaining competitive quotes across several dealers for these complex structures significantly reduces the overall transaction cost, enhancing the profitability of the spread.

Executing an ETH collar RFQ, for example, involves simultaneously buying an out-of-the-money put option and selling an out-of-the-money call option, while holding the underlying ETH. This strategy caps potential upside but provides downside protection and generates income from the sold call. Securing best execution for each leg through an RFQ ensures the spread’s efficacy.

Volatility Block Trade Opportunities

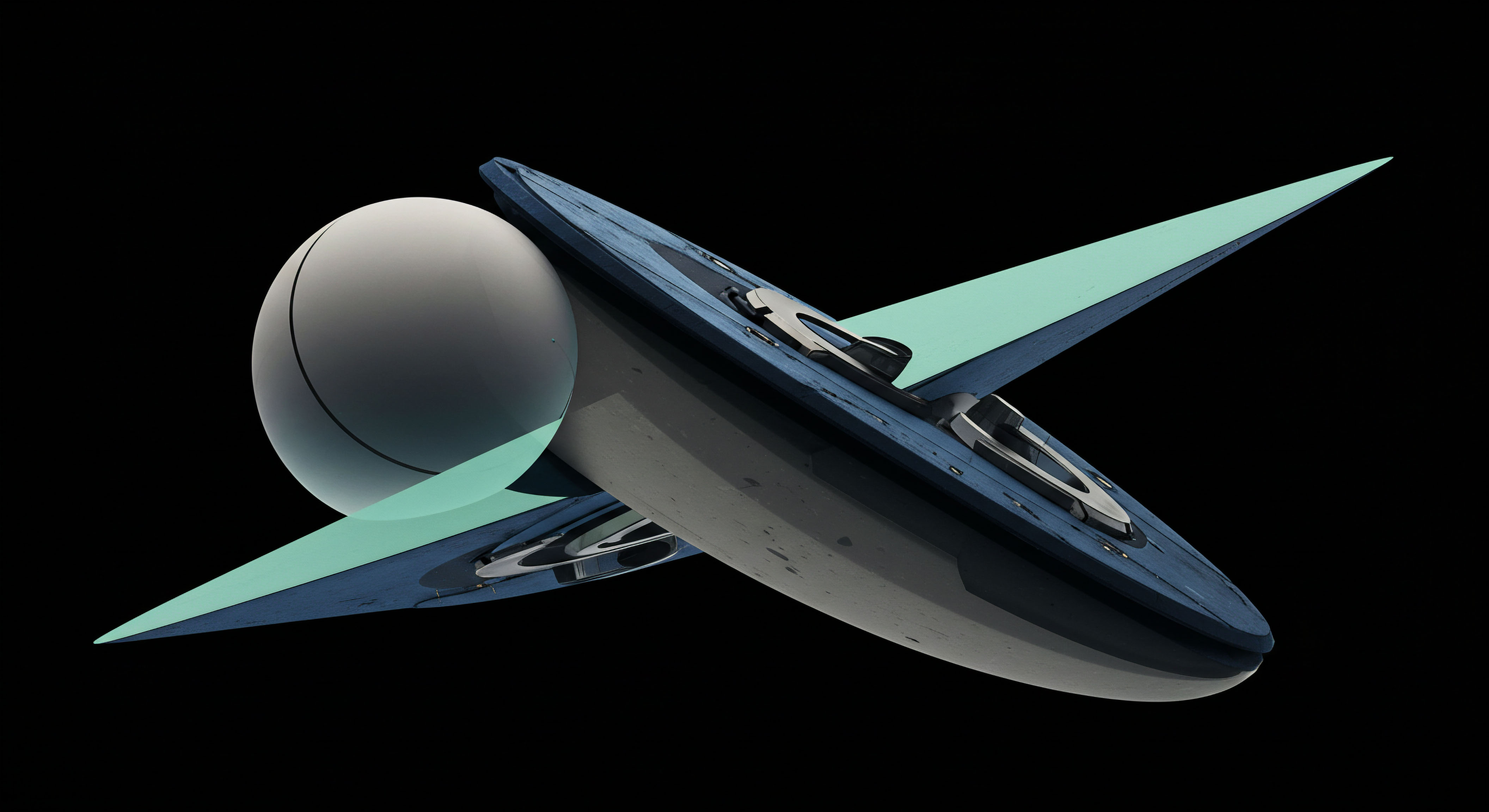

Volatility block trades represent a sophisticated approach to capitalizing on anticipated price swings or stability. Traders holding a conviction on future volatility can execute large positions in BTC or ETH options blocks, either buying or selling volatility. The RFQ mechanism becomes indispensable here, allowing for anonymous engagement with multiple liquidity providers to secure optimal pricing for these substantial, often directional, plays. A direct negotiation channel via RFQ prevents signaling market intent, preserving alpha.

Consider a scenario anticipating a significant market event. A trader might seek to purchase a BTC straddle block, simultaneously buying an at-the-money call and an at-the-money put. This strategy profits from a large price movement in either direction.

The efficiency of an RFQ system allows for rapid execution of both legs, capturing the volatility view effectively. Execution precision is paramount.

Anonymous Options Trading and Multi-Dealer Liquidity

Anonymous options trading within an RFQ framework provides a distinct advantage for large orders. Disclosing significant trading interest can move the market against a participant. The RFQ process allows a trader to remain anonymous while soliciting competitive pricing from a network of dealers. This multi-dealer liquidity environment ensures that even the most substantial orders receive tight spreads, directly translating into superior fill rates and reduced slippage.

The impact of reduced slippage on a large trade compounds significantly. Even a marginal improvement in execution price across a multi-million dollar position translates into substantial capital preservation. This systematic approach to securing best execution establishes a robust foundation for consistent trading outcomes.

Advanced Strategic Integration

Elevating trading beyond individual transactions demands a strategic integration of execution methods into a holistic portfolio framework. Mastering RFQ and block trading means viewing them as foundational elements for achieving systemic market advantage. This moves beyond mere trade execution, extending into the realms of capital efficiency and sustained alpha generation.

Market microstructure research highlights the critical impact of execution methods on overall portfolio performance. Studies demonstrate that optimizing trade entry and exit points through competitive quoting mechanisms significantly reduces transaction costs over time. This consistent cost reduction contributes directly to enhanced net returns.

Understanding the interplay between order flow, liquidity dynamics, and execution protocols provides a powerful lens for continuous improvement. The complexities of price impact, particularly with larger orders, necessitate a proactive approach to liquidity sourcing.

Integrating these advanced execution capabilities into an algorithmic trading framework offers a compelling avenue for next-level optimization. Automated systems can leverage RFQ functionality to dynamically source liquidity and execute multi-leg strategies with unparalleled speed and precision. This approach transforms theoretical advantages into quantifiable performance metrics, offering a demonstrable edge in competitive markets. Such a framework also facilitates the rapid deployment of advanced risk management overlays.

Optimizing trade entry and exit points through competitive quoting mechanisms significantly reduces transaction costs, directly enhancing net returns.

Considering the evolving landscape of digital assets, the strategic value of sophisticated execution channels continues to grow. Liquidity fragmentation, while a persistent challenge, also presents opportunities for those equipped with the right tools. RFQ systems, by unifying disparate liquidity sources, act as a strategic fulcrum, allowing traders to command pricing across a diverse set of market participants. This capability ensures that capital is deployed with maximum efficiency and minimal market footprint.

The long-term strategic impact of mastering these execution pathways extends to overall portfolio resilience. Reduced transaction costs and precise entry/exit points allow for more agile portfolio rebalancing and risk hedging. This operational excellence becomes a distinct competitive advantage, reinforcing the pursuit of consistent, superior outcomes.

Mastering Market Dynamics

The pursuit of superior pricing in large crypto trades culminates in a profound understanding of market dynamics and the tools that shape them. This journey equips a trader with the capacity to influence their own outcomes, moving beyond passive acceptance of market prices. Commanding liquidity, optimizing execution, and deploying capital with surgical precision defines the next generation of trading excellence. The landscape continually shifts, yet the principles of strategic advantage remain constant.

Glossary

Options Trading

Best Execution

Eth Collar Rfq

Btc Straddle Block

Anonymous Options Trading

Multi-Dealer Liquidity