Execution Command

Superior derivatives execution hinges upon a decisive command over market dynamics. Anonymous Request for Quote (RFQ) execution represents a pivotal advancement, fundamentally reshaping how sophisticated participants engage with liquidity. This mechanism allows traders to solicit bids and offers from multiple dealers simultaneously, all while preserving their trading intent.

The core advantage stems from its capacity to aggregate deep liquidity, often inaccessible through conventional order books, by presenting a unified demand to a network of market makers. This method ensures a competitive environment for pricing, directly translating into better fills and optimized transaction costs for complex options structures and substantial block trades.

Understanding the underlying mechanics reveals its power. A trader submits an RFQ for a specific derivative, such as a Bitcoin options spread or an ETH collar. This request reaches multiple liquidity providers who then compete to offer the tightest pricing. Critically, these providers remain unaware of the originating party’s identity or broader trading strategy.

This anonymity safeguards against information leakage, a persistent challenge in high-value derivatives markets where large orders can otherwise signal intent and influence prices adversely. Securing superior pricing becomes a systematic outcome, not a fortuitous event.

Anonymous RFQ transforms derivatives execution into a competitive advantage, shielding trading intent while securing optimal pricing across diverse liquidity pools.

The true value emerges in its ability to standardize a high-quality execution process. Market participants often face fragmented liquidity, leading to suboptimal pricing and increased slippage. Anonymous RFQ unifies these disparate liquidity sources, channeling them into a single, efficient stream.

This operational streamlining allows for the efficient execution of multi-leg strategies, where precise, simultaneous fills across various option series are paramount. Mastering this foundational tool establishes a robust base for any serious derivatives strategy, providing a clear pathway to more controlled and effective market engagement.

Strategic Deployment

Deploying anonymous RFQ execution strategically transforms potential into realized gains, enabling precise control over market exposure and cost basis. This methodology empowers traders to navigate the complexities of derivatives markets with heightened confidence, translating strategic insight into tangible performance. The focus shifts to optimizing entry and exit points for options positions, thereby enhancing the overall profitability of investment theses.

Options Spreads Precision

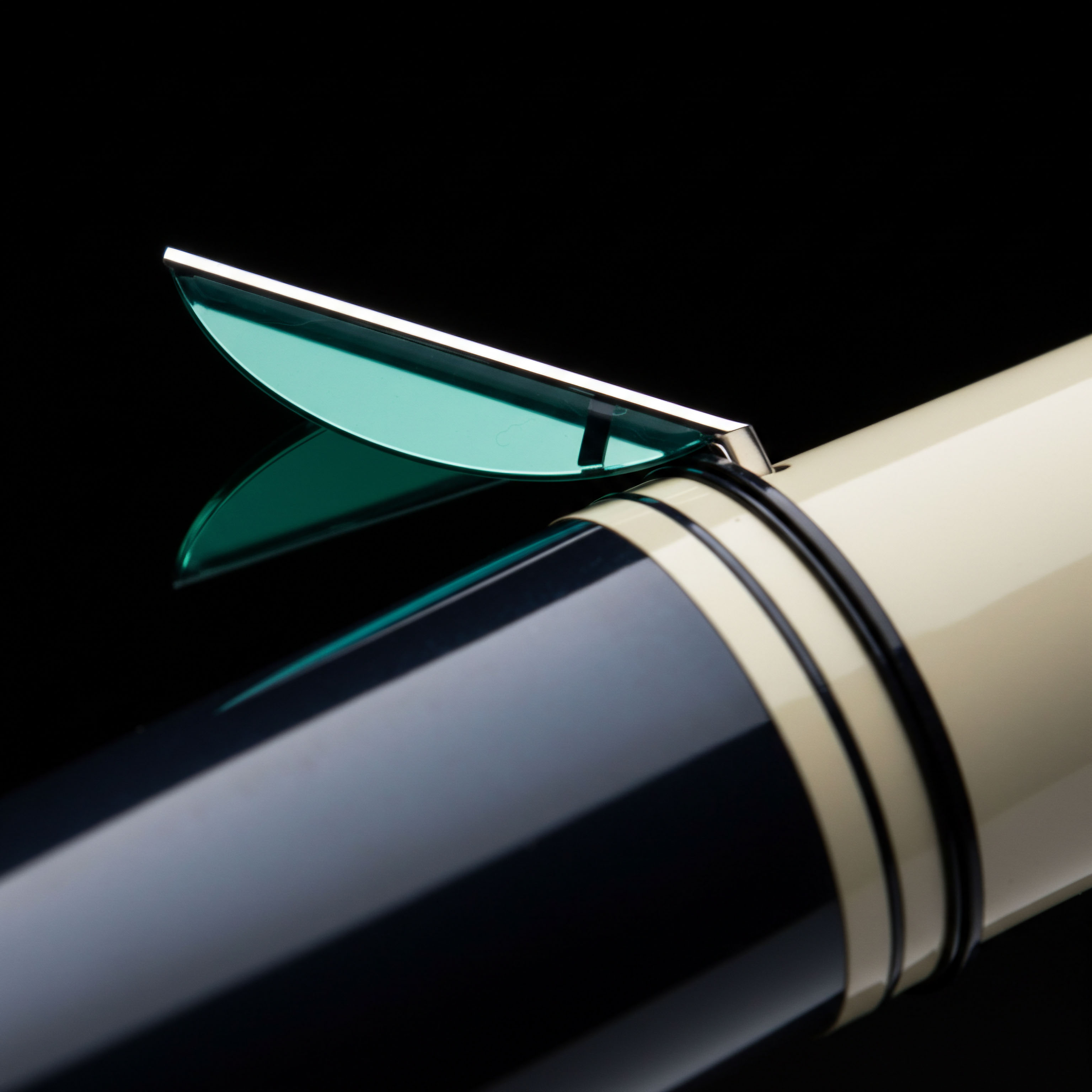

Constructing multi-leg options spreads demands exceptional execution accuracy. Anonymous RFQ excels here, facilitating the simultaneous pricing of complex structures. Consider a BTC straddle block; the ability to receive competitive quotes from numerous dealers at once mitigates the risk of leg slippage.

This coordinated pricing ensures the intended risk-reward profile of the spread remains intact, a fundamental requirement for systematic trading. Traders gain the ability to define their desired volatility exposure with unparalleled clarity.

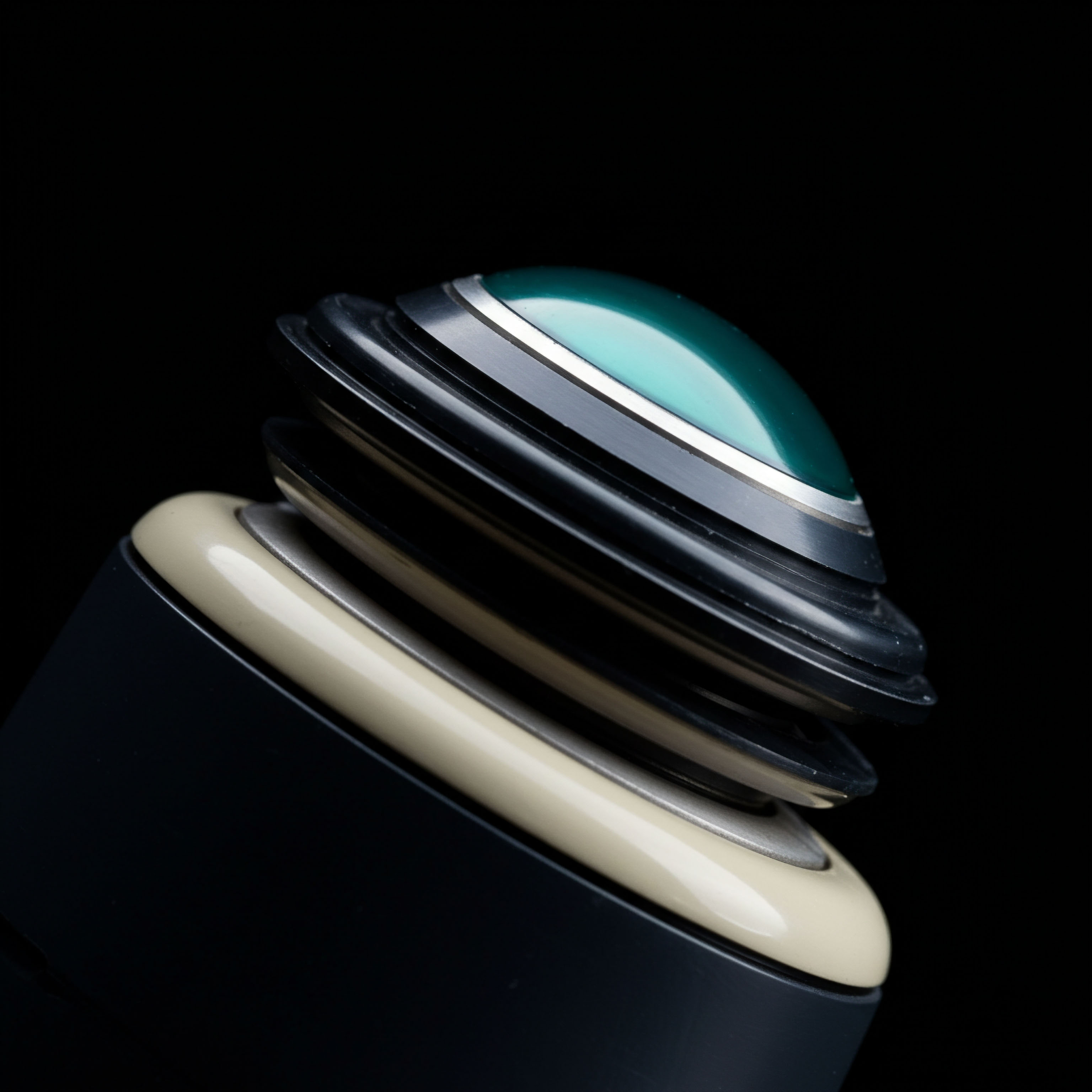

Engaging with an ETH collar RFQ provides another example. Investors seeking to protect gains on their ETH holdings while generating income can submit an RFQ for the entire collar structure. The competitive responses from liquidity providers compress the overall cost of the hedge, maximizing capital efficiency. This integrated approach to execution supports a disciplined management of portfolio risk, converting theoretical hedges into practical, cost-effective realities.

Block Trade Execution

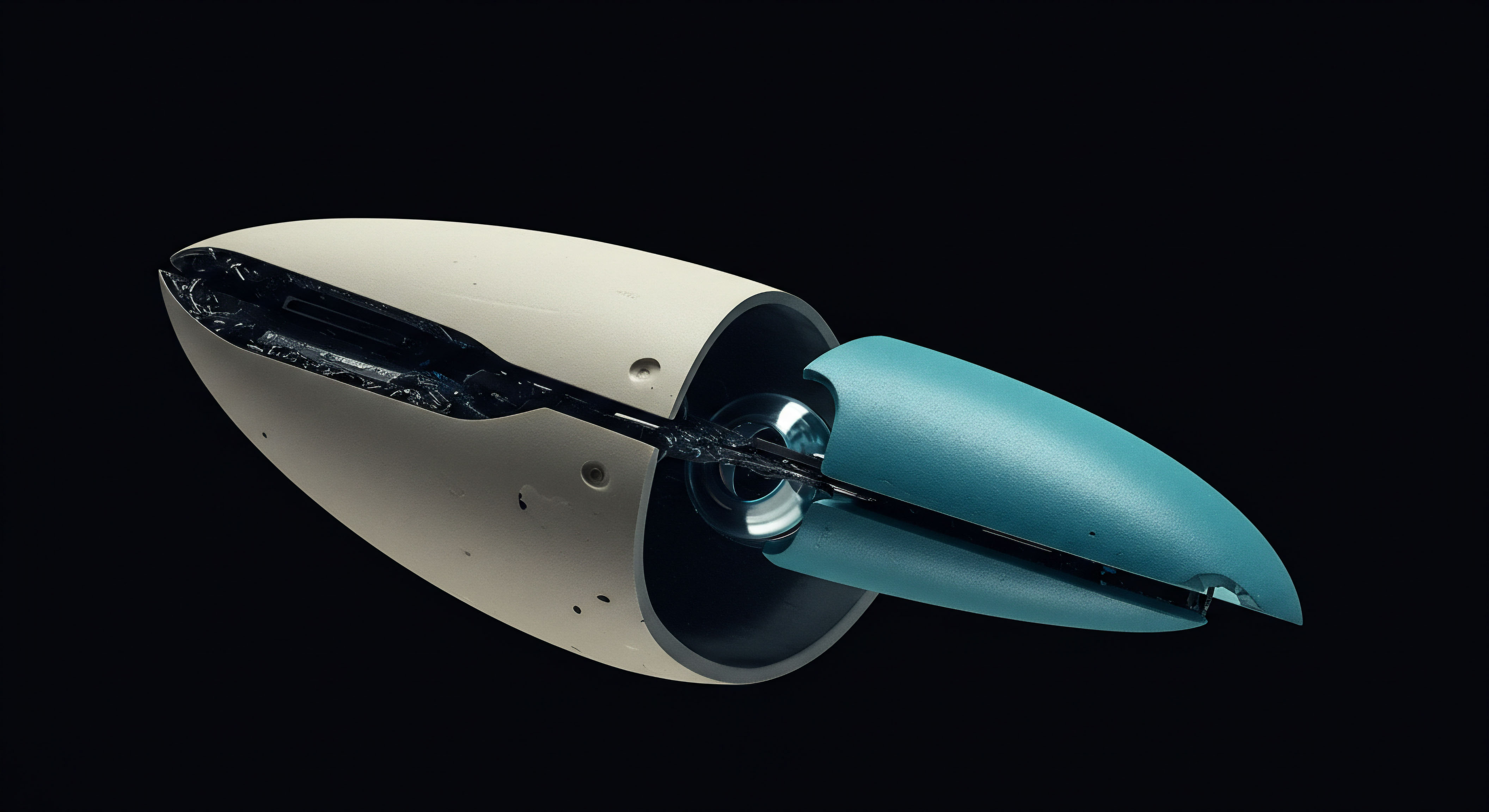

Executing large derivatives blocks through anonymous RFQ is a definitive competitive advantage. Significant order sizes, particularly in less liquid crypto options, can incur substantial price impact. RFQ mitigates this by allowing multiple dealers to bid on the entire block, concealing the size and direction of the trade from the broader market until execution. This proactive engagement ensures best execution, minimizing the adverse impact that might otherwise erode alpha.

Price impact represents a silent tax on large orders. Anonymity in RFQ execution effectively shields these trades from front-running or signaling effects. Dealers compete on their tightest spreads, knowing they must win the entire block to secure the trade.

This dynamic shifts power towards the initiating trader, who retains optionality across multiple quotes, selecting the most advantageous offer. Securing superior pricing on large trades directly contributes to the fund’s bottom line.

- Identify Core Strategy ▴ Determine the specific options spread or block trade (e.g. BTC straddle, ETH collar, volatility block).

- Define Parameters ▴ Specify strike prices, expiries, quantities, and desired execution conditions.

- Submit RFQ ▴ Broadcast the request to a curated network of liquidity providers, ensuring anonymity.

- Evaluate Quotes ▴ Compare bids and offers received, assessing tightness, size, and overall competitiveness.

- Execute ▴ Select the optimal quote, locking in the most favorable terms for the entire structure or block.

This structured approach to execution becomes a repeatable process for capturing market inefficiencies. Each successful RFQ transaction reinforces a trader’s capacity to command liquidity, turning potential market frictions into opportunities for superior performance. A clear understanding of the bid-offer spread compression achievable through this method illuminates its profound financial implications.

Systemic Edge Mastery

Mastering anonymous RFQ execution transcends individual trade benefits, becoming a foundational element of a systemic edge in derivatives trading. This advanced application integrates seamlessly into a broader portfolio construction framework, providing a sustained advantage against less sophisticated market participants. The long-term impact extends to enhanced capital deployment and a superior risk-adjusted return profile across all derivatives exposures.

Portfolio Alpha Generation

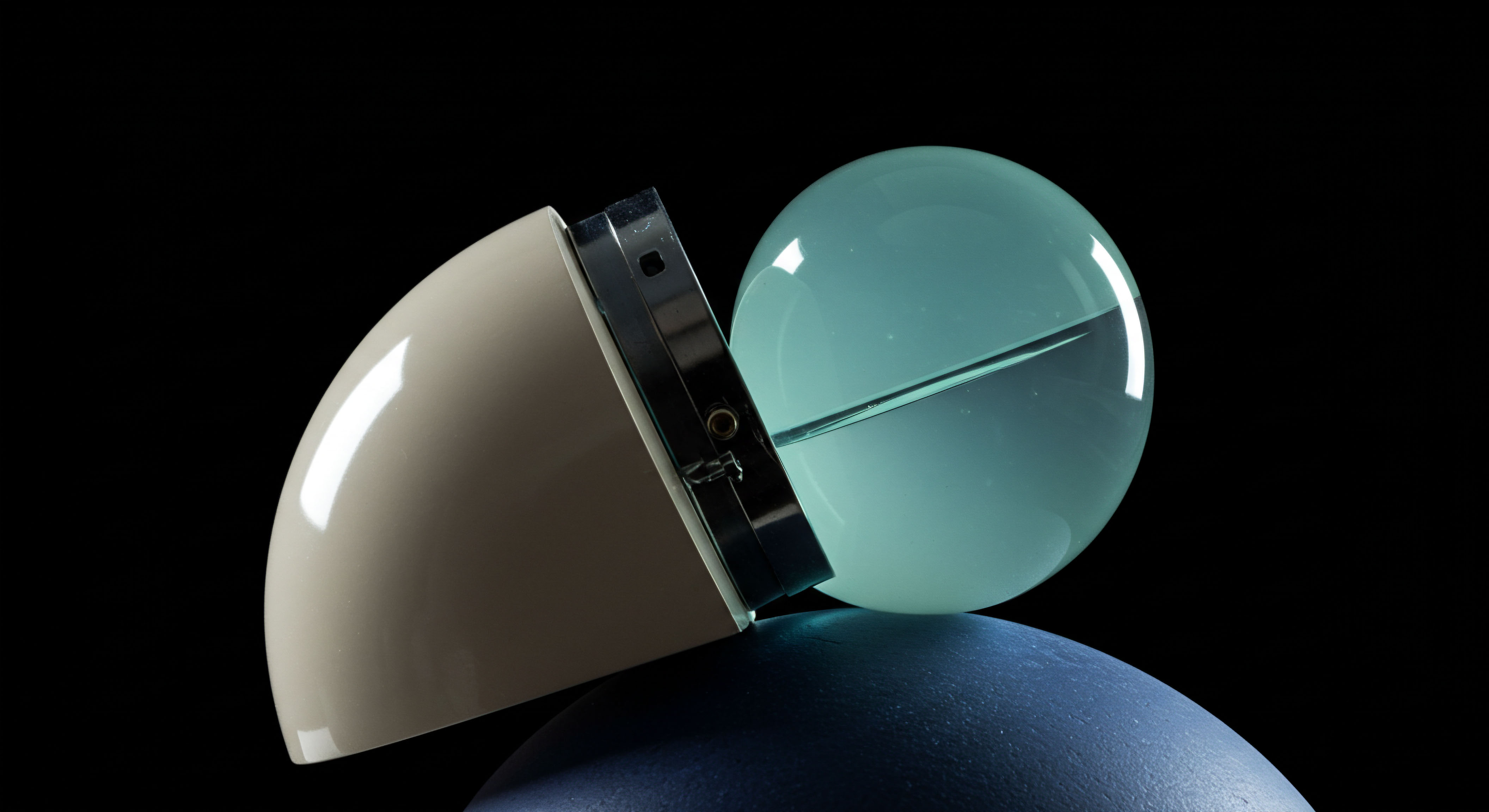

Integrating anonymous RFQ into portfolio management elevates alpha generation from episodic gains to a consistent outcome. Consider the systematic execution of volatility trades. A portfolio manager can continuously adjust their implied volatility exposure through precise, anonymously executed options blocks. This dynamic rebalancing, driven by competitive RFQ pricing, optimizes the portfolio’s sensitivity to market movements, generating alpha through superior entry and exit valuations.

The ability to transact large, multi-leg options strategies with minimal market impact frees up significant capital. This capital can then be redeployed more efficiently across other opportunities, amplifying overall portfolio returns. This sophisticated approach to execution acts as a force multiplier for any quantitative or discretionary derivatives strategy. The impact on Sharpe ratios becomes demonstrably positive.

Advanced Risk Management

Anonymous RFQ execution reinforces advanced risk management frameworks. When rebalancing a large derivatives book, the challenge lies in executing offsetting trades without signaling market direction. An RFQ for a large options block allows a portfolio to adjust its delta, gamma, or vega exposure discreetly. This precise control over risk parameters prevents adverse price movements that might otherwise occur during public market execution.

Managing tail risk or extreme market scenarios often necessitates rapid, large-scale adjustments to options positions. Anonymous RFQ provides the necessary agility and depth of liquidity for such critical actions. The confidence derived from knowing that substantial hedges or speculative positions can be deployed with optimal pricing is invaluable.

This operational resilience becomes a cornerstone of any robust trading operation. Execution quality dictates the ultimate efficacy of any risk mitigation strategy.

A strategic rephrasing for precision illuminates this further ▴ securing competitive pricing on large derivative blocks minimizes the financial friction inherent in market entry and exit.

The ongoing evolution of market microstructure further solidifies the position of anonymous RFQ as an indispensable tool. As liquidity continues to fragment across various venues, the ability to command a unified response from a diverse set of liquidity providers becomes a decisive factor. This strategic adaptation ensures a continuous edge in a perpetually shifting landscape. Precision matters.

Commanding Your Financial Future

The journey through derivatives markets rewards strategic foresight and disciplined execution. Anonymous RFQ execution represents more than a tool; it embodies a philosophical stance toward market engagement ▴ a commitment to extracting every possible advantage through superior operational design. This method provides the leverage to sculpt market outcomes on your terms, ensuring that your strategic intent translates directly into quantifiable success. Embracing this approach positions you at the vanguard of sophisticated trading, ready to navigate the future of financial markets with an unyielding edge.

Glossary

Anonymous Rfq

Anonymous Rfq Execution

Btc Straddle Block

Eth Collar Rfq

Best Execution