Execution Command

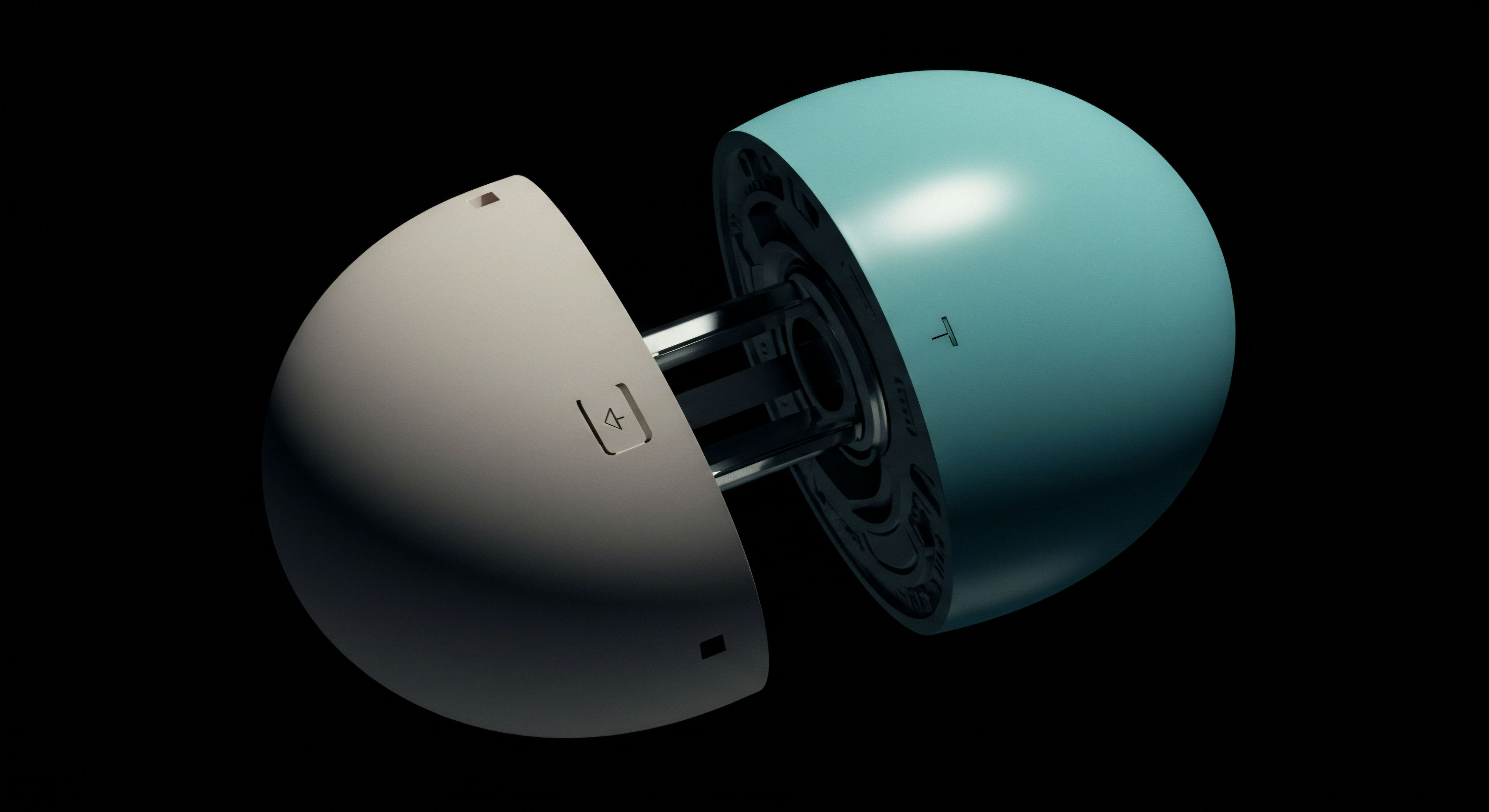

Superior market interaction hinges on precision and control. Anonymous Request for Quote (RFQ) stands as a foundational mechanism for discerning traders and institutions. It represents a direct, strategic engagement with liquidity providers, a departure from passive order book submissions.

This system allows participants to solicit bids and offers for a specific asset, quantity, and side from multiple dealers simultaneously, all while preserving the anonymity of the initiating party. The process cultivates a competitive environment among liquidity providers, compelling them to offer their most aggressive pricing.

Understanding this mechanism reveals its power in navigating fragmented market landscapes. It addresses the inherent challenge of locating significant pools of capital without inadvertently signaling intent, a critical concern for large-scale operations. The design of anonymous RFQ prioritizes discretion, enabling participants to gauge true market depth and secure optimal execution prices for substantial orders. This proactive approach ensures a direct line to actionable liquidity, moving beyond the visible layers of a public order book.

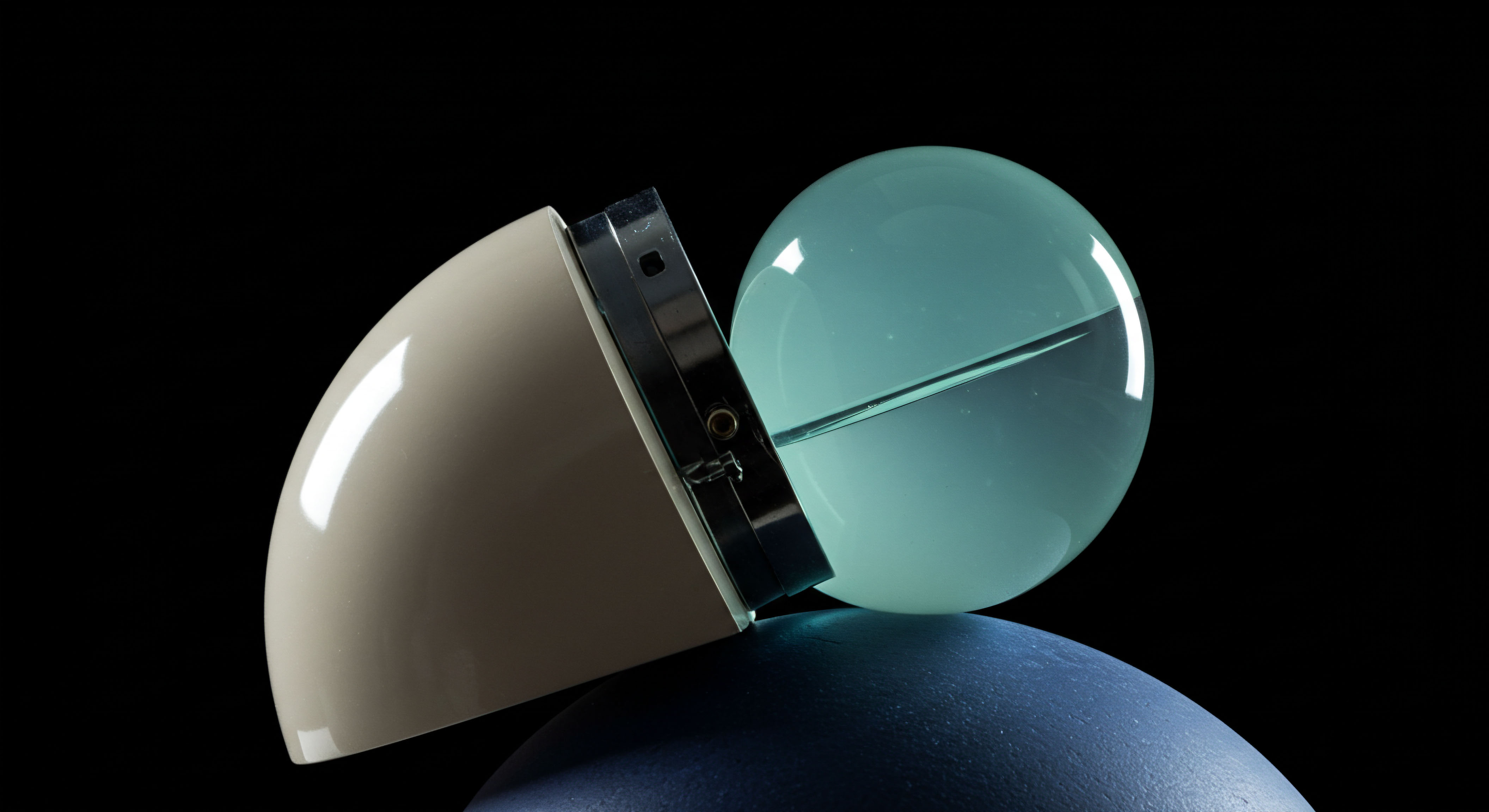

Anonymous RFQ fundamentally reshapes liquidity discovery, transforming passive market engagement into a deliberate, competitive pricing event.

This method of engagement offers a direct conduit to professional-grade pricing. It establishes a dynamic where multiple counterparties vie for your flow, often yielding tighter spreads and better fill rates than might be achieved through conventional means. Mastering this initial understanding equips you with a powerful lens through which to view market opportunities, providing a tangible advantage in the pursuit of enhanced trading outcomes. This strategic tool becomes indispensable for those committed to elevating their market presence.

Strategic Deployment

Deploying anonymous RFQ effectively demands a strategic mindset, focusing on quantifiable advantages in options trading and block transactions. This method unlocks deeper institutional liquidity, offering a pathway to superior execution for complex positions. The process centers on extracting maximum value from market interactions, ensuring your investment objectives align with optimal pricing.

Options Block Liquidity Acquisition

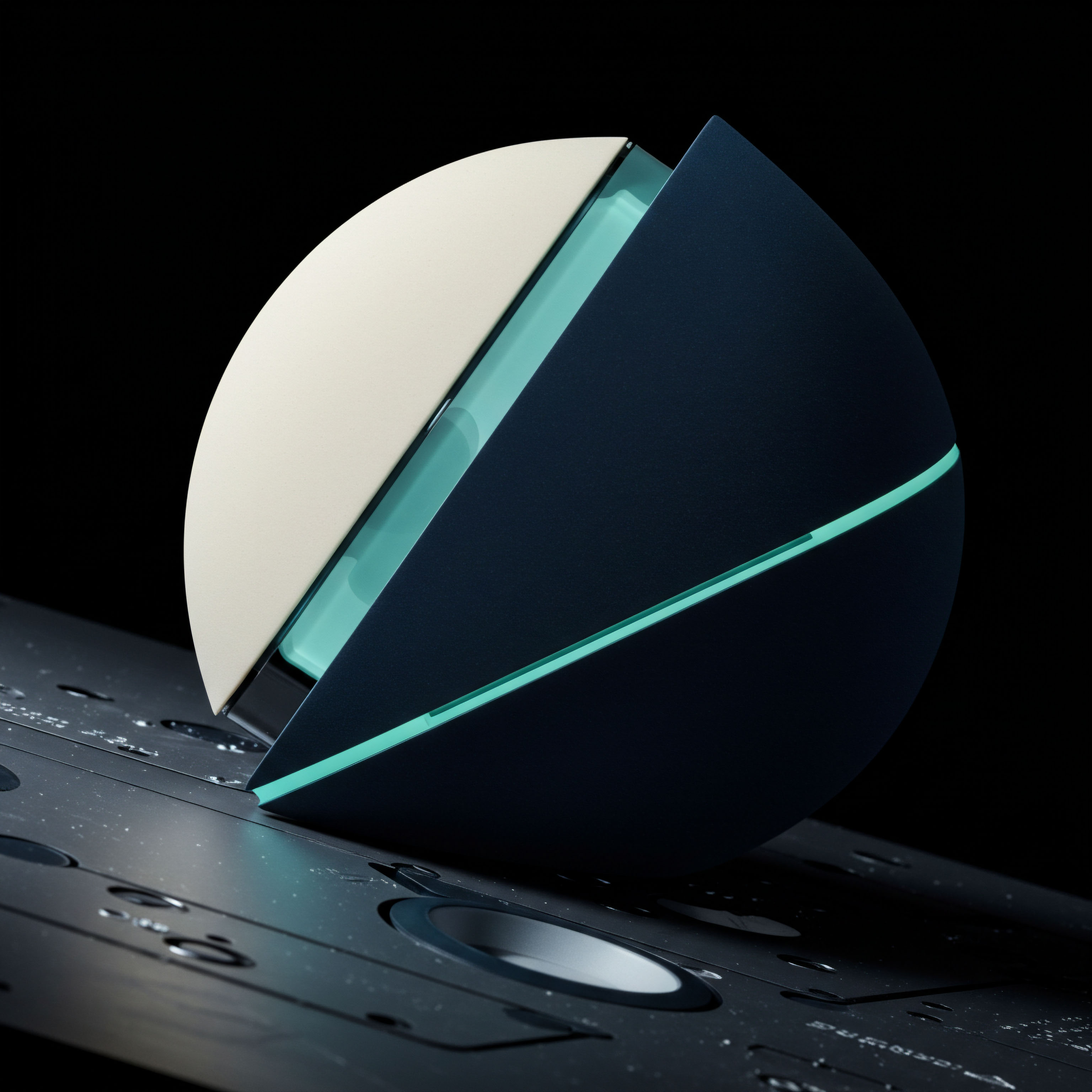

Securing substantial options blocks requires a direct line to market makers. Anonymous RFQ provides this access, allowing you to solicit pricing for large notional values without disclosing your identity or precise directional bias until execution. This prevents adverse price movement that often accompanies visible large orders. The competitive tension among dealers vying for the trade frequently results in tighter pricing than an equivalent order placed on an open exchange.

Multi-Leg Options Spreads Execution

Executing multi-leg options spreads efficiently presents a unique challenge, given the need for simultaneous fills across various strikes and expiries. Anonymous RFQ simplifies this complexity. You define the entire spread as a single inquiry, receiving a composite price from multiple liquidity providers. This ensures coordinated execution, mitigating leg risk and slippage across the individual components of the spread.

- Define the entire multi-leg structure within a single RFQ.

- Specify desired quantity and tenor for each leg.

- Evaluate composite prices from competing dealers.

- Execute the entire spread as one atomic transaction.

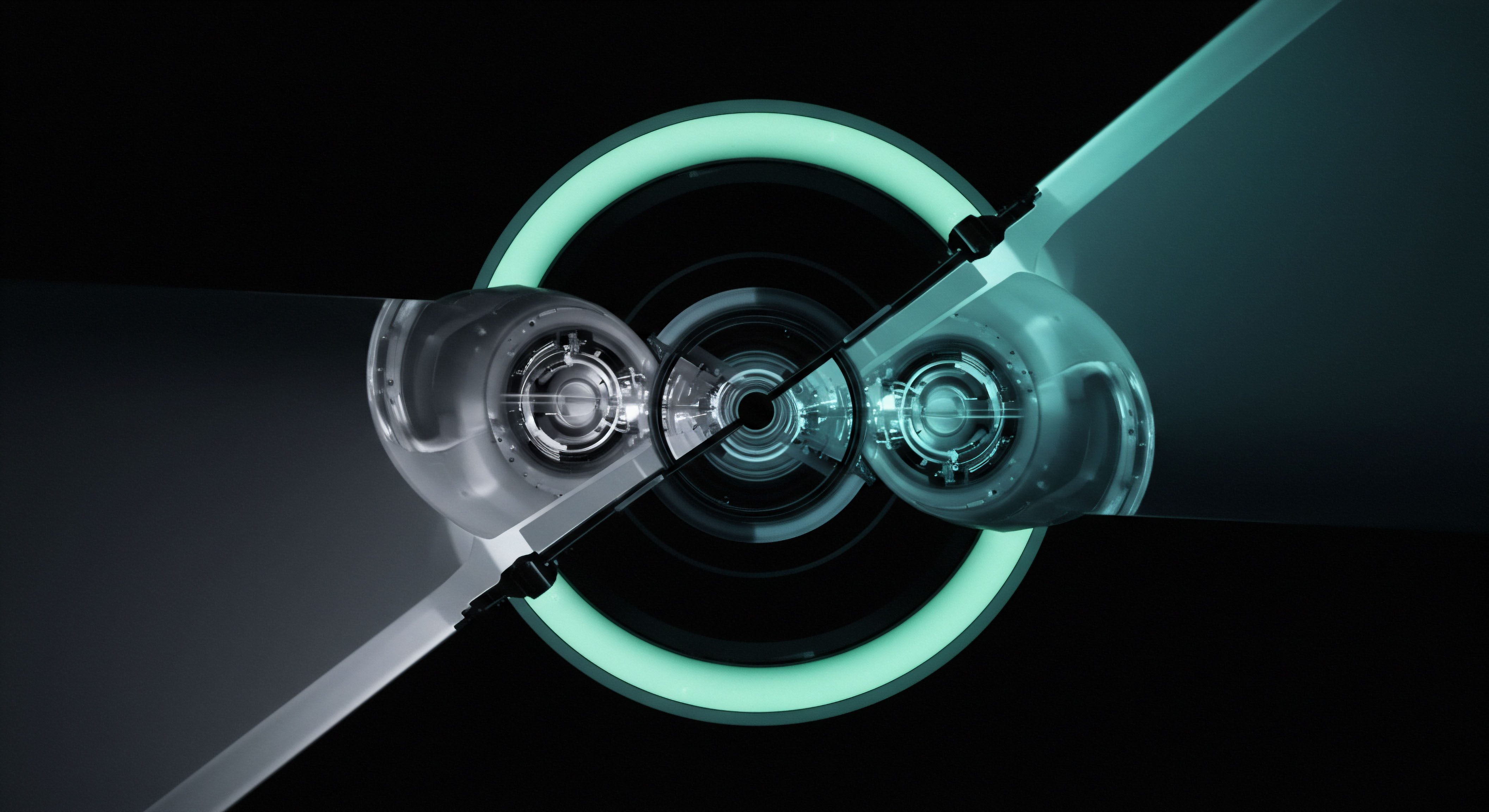

Volatility Block Trade Precision

Trading volatility via large block options demands an acute sense of timing and price discovery. Whether constructing a BTC straddle block or an ETH collar RFQ, the anonymous system allows for precise price negotiation on these sophisticated instruments. It isolates your intent from public perception, securing a pricing edge when expressing a specific volatility view.

This systematic approach transforms market noise into a structured opportunity. It provides a direct channel for institutional participants to express complex views on underlying assets, such as Bitcoin and Ethereum, with confidence. The discretion afforded by this method becomes a measurable factor in the overall performance of a volatility-centric strategy.

Mastering Market Edge

Achieving true market mastery involves integrating advanced execution methodologies into a comprehensive portfolio framework. Anonymous RFQ, when deployed with sophistication, transcends a mere trading tool, becoming a strategic component of capital efficiency and risk mitigation. This evolution in application transforms individual trades into systematic advantages, securing long-term alpha generation.

Portfolio Hedging with Discretion

Large-scale portfolio hedging requires executing significant options positions without disrupting underlying markets. Anonymous RFQ facilitates this by allowing discrete, substantial transactions that absorb market impact rather than creating it. Constructing an ETH collar RFQ for a large Ether holding, for example, becomes a controlled process, where multiple dealers compete to offer the best terms for a protective overlay. This ensures the hedging strategy itself avoids becoming a source of adverse price action.

The strategic deployment of these instruments through a discreet channel provides a financial firewall, shielding your holdings from unforeseen market dislocations. It offers a tangible mechanism for preserving capital while maintaining exposure to upside potential, a critical balance for sophisticated asset managers. This systematic approach to risk management reflects a deep understanding of market microstructure.

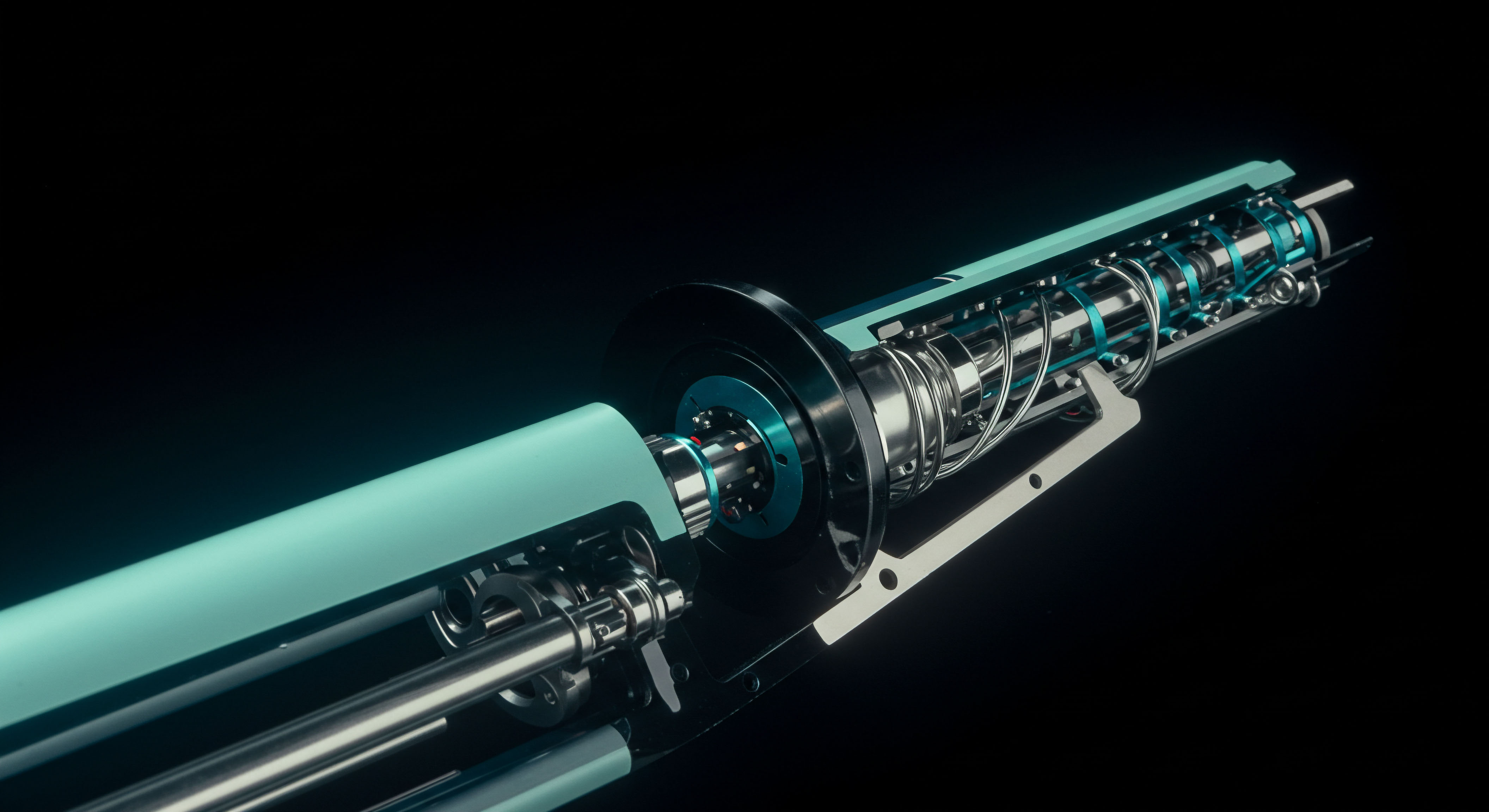

Algorithmic RFQ Integration

Integrating algorithmic trading strategies with anonymous RFQ capabilities represents the frontier of execution optimization. Advanced systems can dynamically generate RFQs based on real-time market conditions, liquidity signals, and predefined execution parameters. This automates the process of soliciting bids and offers, ensuring that even highly complex multi-leg options spreads are priced and executed with optimal precision and speed.

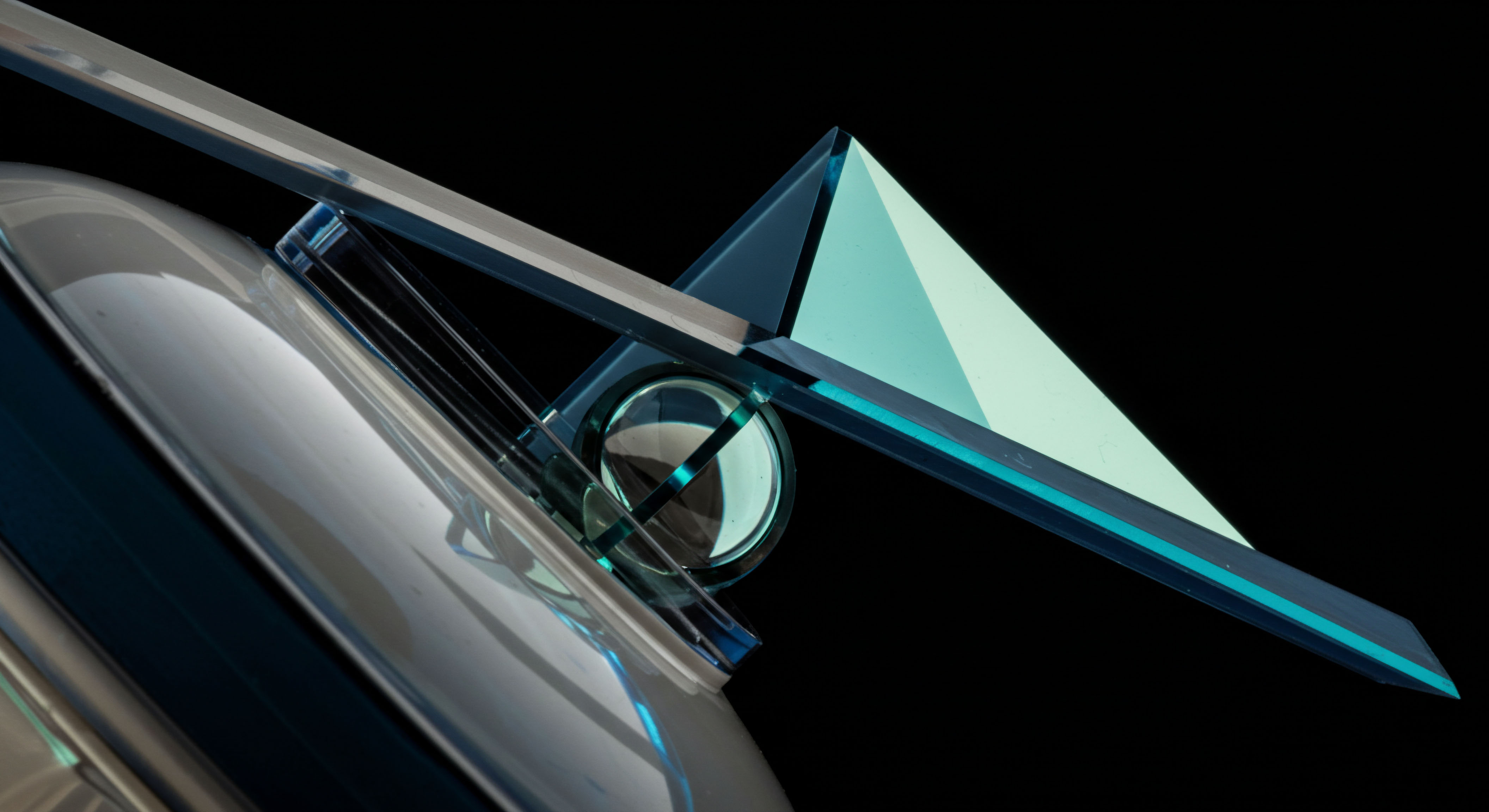

This level of integration pushes the boundaries of trading efficacy. It allows for a systematic capture of transient liquidity opportunities, transforming a manual process into a high-frequency, intelligent execution workflow. The outcome is consistently superior fill rates and minimal slippage across diverse market scenarios, establishing a robust, adaptive trading framework. A profound conviction guides this ▴ sustained success arises from relentlessly optimizing every facet of execution.

Unlocking Latent Liquidity

The pursuit of superior execution drives every decisive action in modern markets. Anonymous RFQ emerges as a powerful conduit, transforming the search for institutional liquidity into a deliberate act of market shaping. It empowers participants to command pricing, securing an undeniable edge in an environment often characterized by opacity.

This mechanism offers a pathway to unlock capital pools previously obscured, reshaping the very dynamics of large-scale trading. The strategic implication for those who master this approach is clear ▴ control over execution directly translates into a measurable, compounding advantage.

Glossary

Anonymous Rfq

Btc Straddle Block

Eth Collar Rfq

Market Microstructure