The Chassis of Systemic Risk Control

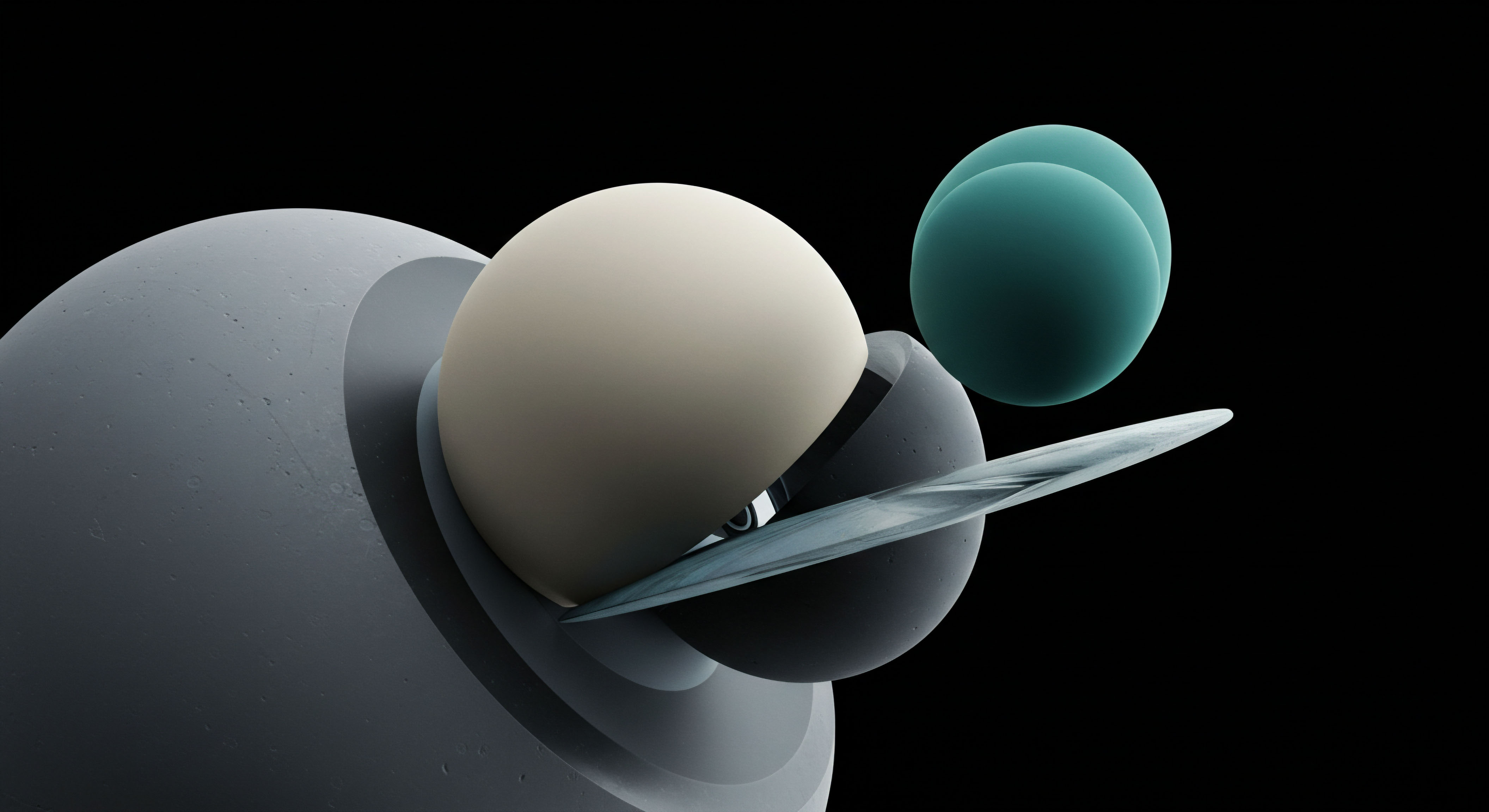

Index options are definitive instruments for managing broad market risk. Their structure provides a direct, efficient, and scalable method for insulating a portfolio from systemic shocks. An option on a major benchmark like the S&P 500 grants the holder exposure to the aggregate performance of 500 leading companies, effectively capturing the pulse of the entire U.S. large-cap equity market.

This intrinsic diversification is their primary strength; they are engineered to address the risks that cannot be diversified away by holding a variety of individual securities. Market risk, by definition, impacts all assets, and therefore requires a tool that acts on the market as a whole.

The operational mechanics of broad-based index options further enhance their suitability for sophisticated risk management. The majority of these instruments, particularly those on benchmarks like the S&P 500 (SPX), are European-style and cash-settled. European-style exercise means the options can only be exercised at expiration, which removes the risk of early assignment that complicates positions on individual equity options. Cash settlement provides a clean, operationally simple outcome.

Upon expiration, the net value of the contract is transferred as a cash credit or debit, eliminating the need to deliver or receive any underlying shares. This feature streamlines the hedging process, making it a pure financial overlay on a portfolio without the logistical complexities of managing physical stock positions.

A portfolio’s resilience is determined by its capacity to withstand adverse, market-wide events. While owning a diverse set of individual stocks mitigates company-specific risk, it offers little protection during a broad market downturn when correlations converge toward one. Index options are designed for this exact scenario.

They allow an investor to purchase a precise amount of market insurance, directly hedging the systemic risk inherent in their equity holdings. This transforms risk management from a passive hope based on diversification into an active, strategic process of defining and controlling portfolio-level exposures.

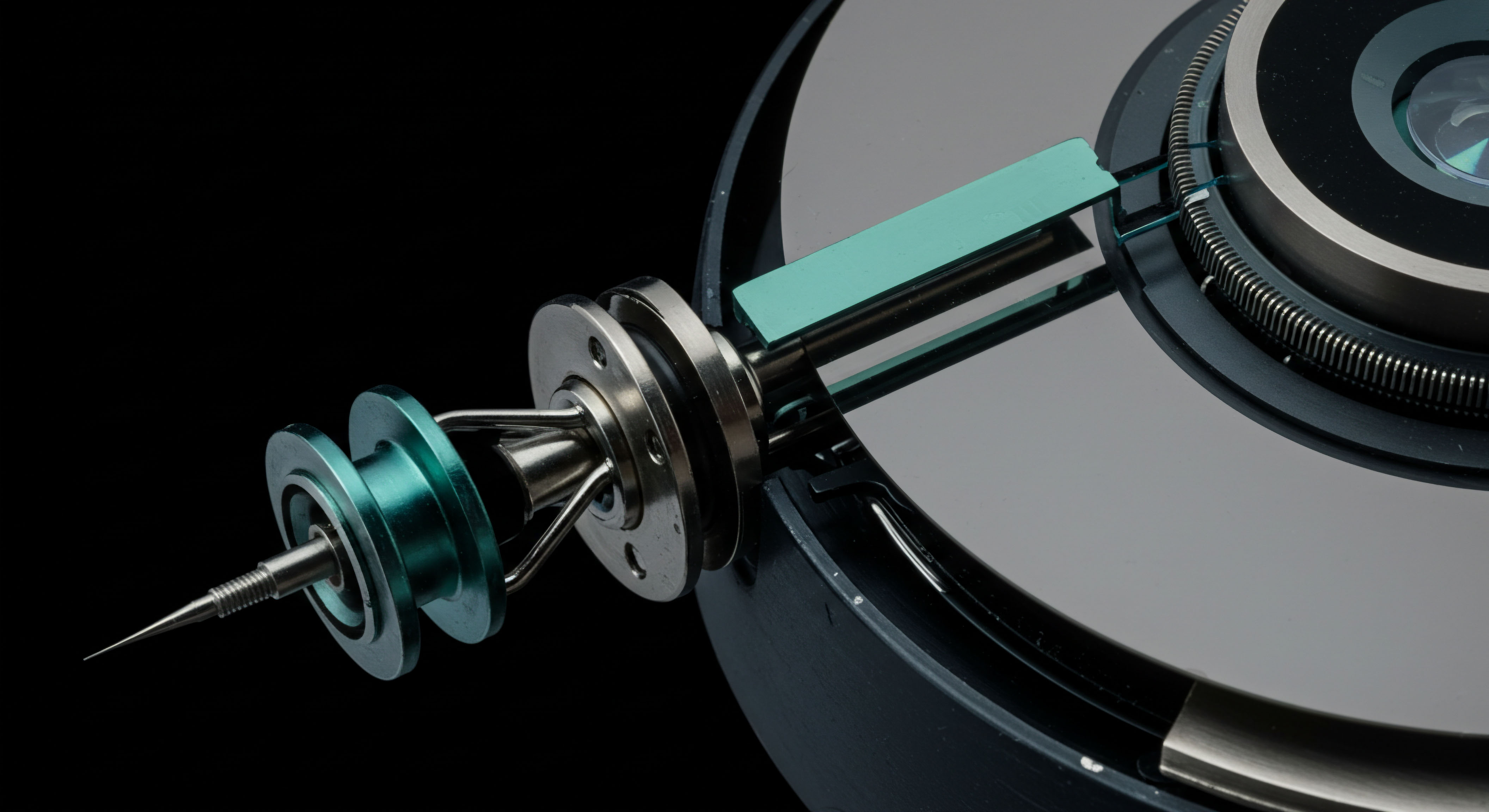

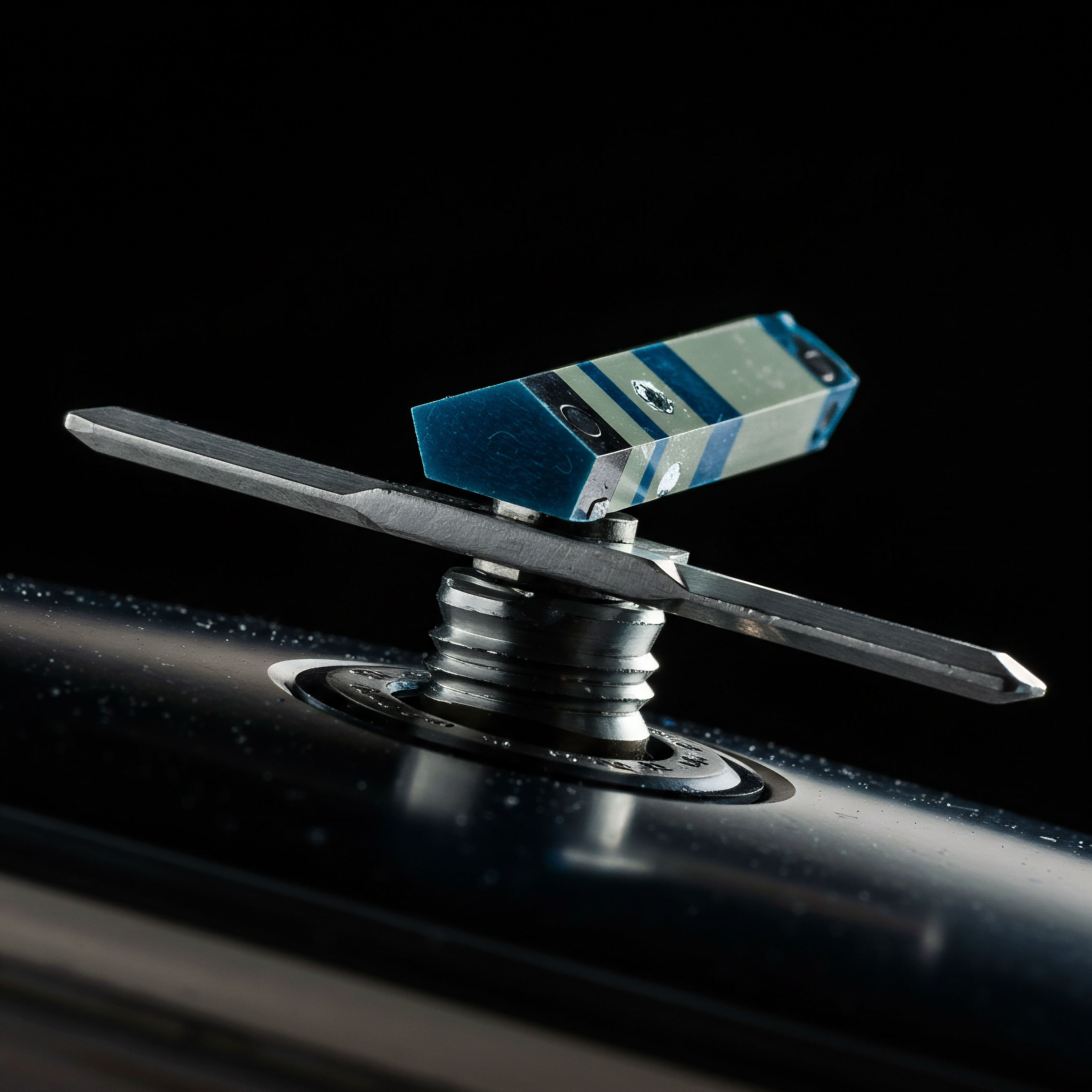

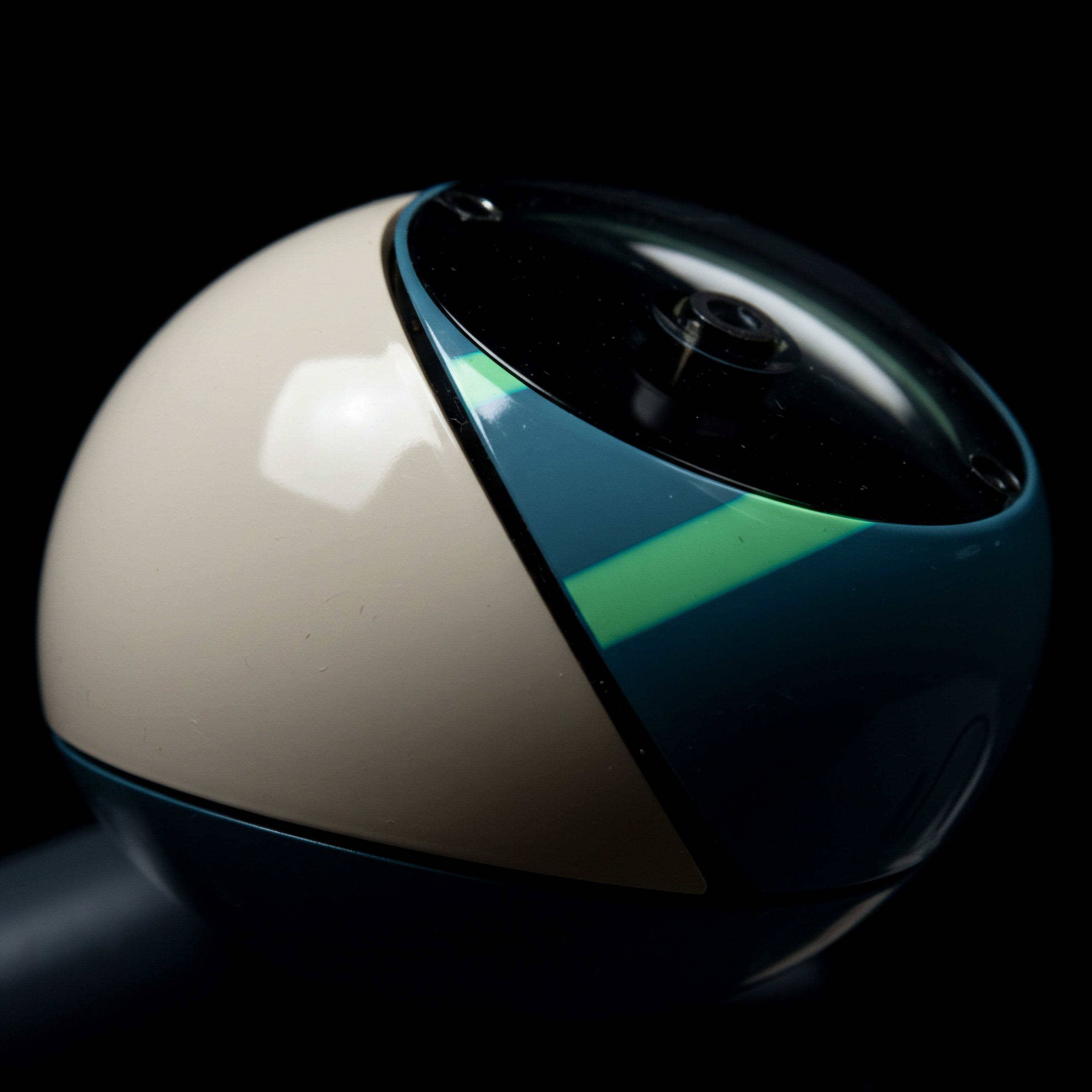

Calibrating the Financial Firewall

Deploying index options to manage risk is a process of strategic implementation. The objective is to construct a “financial firewall” that protects portfolio assets from the heat of a market decline. This requires a clear understanding of the specific strategies available and how they align with an investor’s risk tolerance and market outlook. Each approach offers a different calibration of protection, cost, and potential opportunity cost, allowing for a tailored defense.

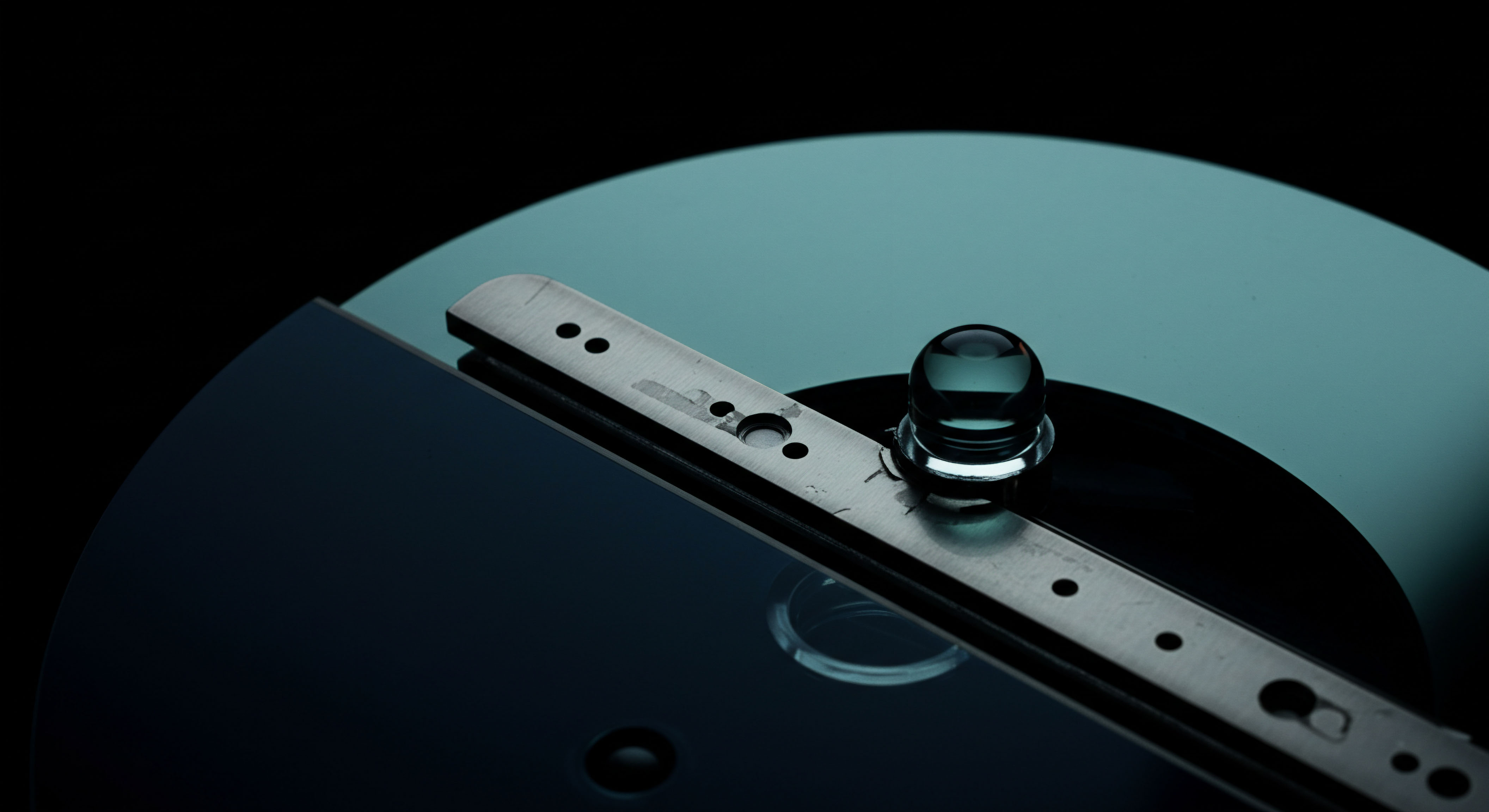

Foundational Portfolio Insurance the Protective Put

The most direct method for establishing a floor on a portfolio’s value is the protective put. This strategy involves purchasing put options on a broad-market index, such as the SPX, in a quantity that corresponds to the portfolio’s total value and market sensitivity (beta). A put option grants the right to sell the underlying index at a predetermined strike price, creating a gain that offsets losses in the equity portfolio during a market decline.

The selection of the strike price determines the level of the “deductible” ▴ a lower strike price reduces the premium paid for the option but increases the potential drawdown before the protection engages. Conversely, a higher strike price offers more immediate protection at a greater cost.

The faith-like belief in Modern Portfolio Theory and diversification has crumbled as more investors realize that market risk by definition, cannot be diversified away; it must be hedged.

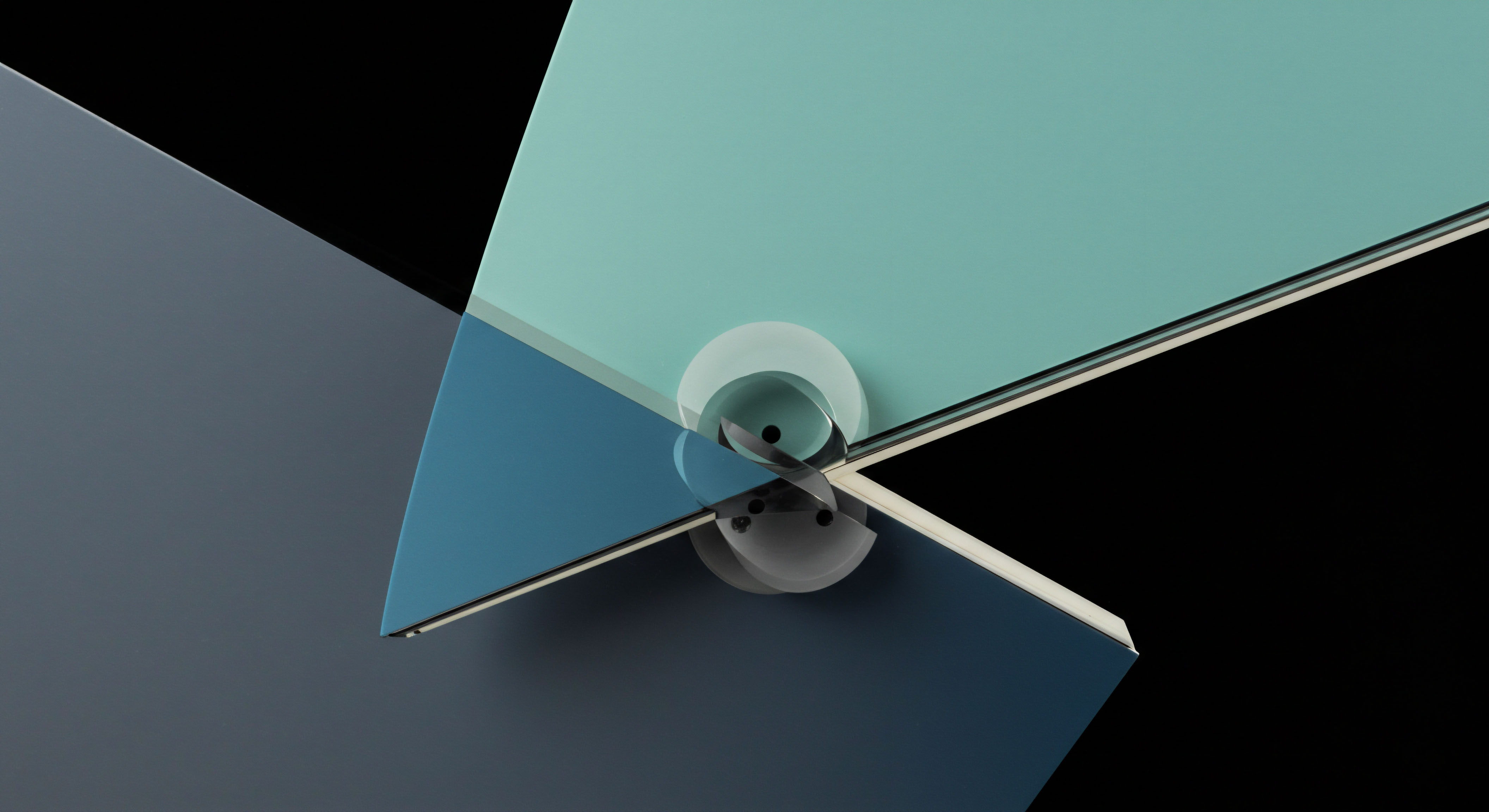

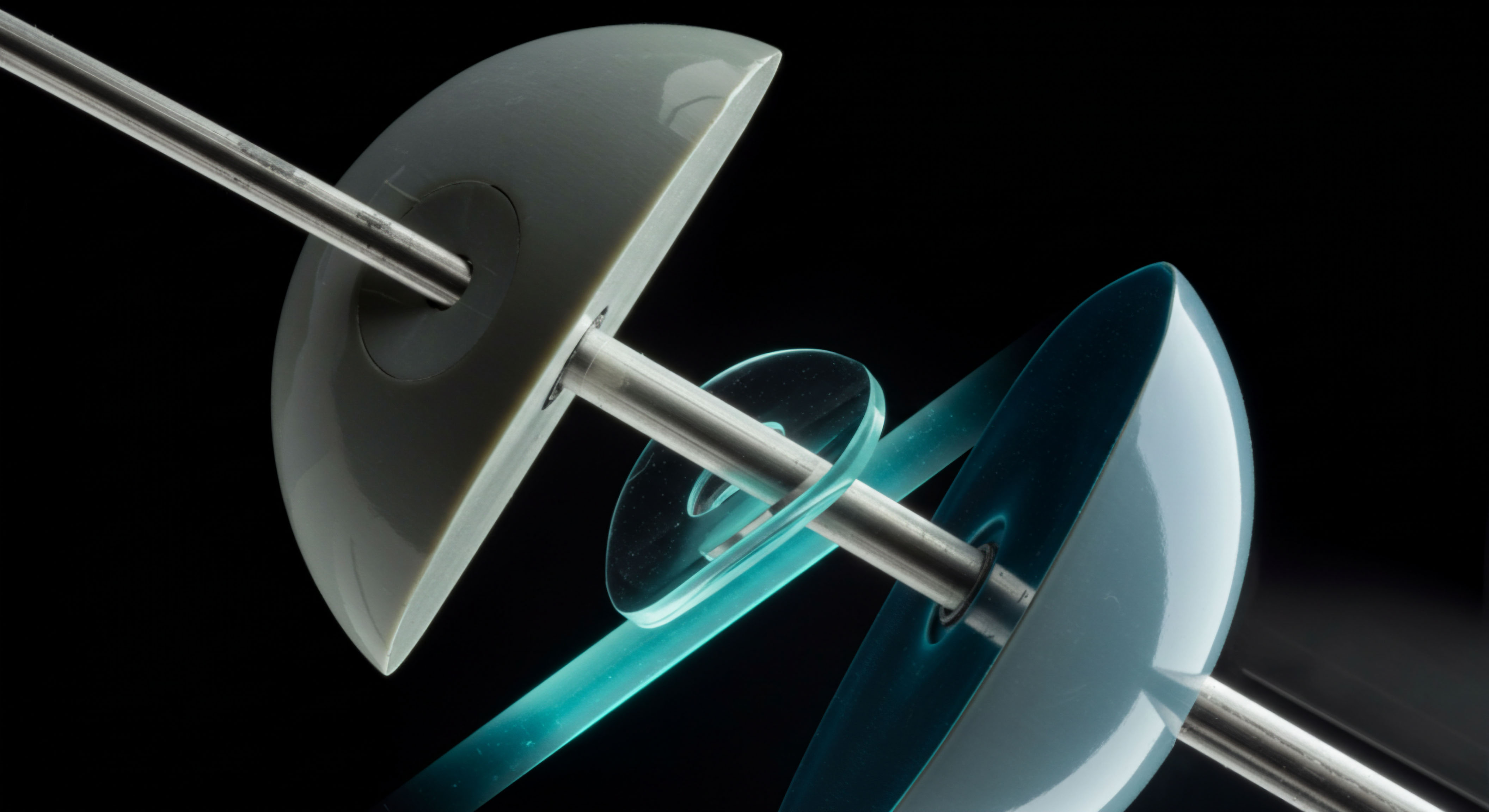

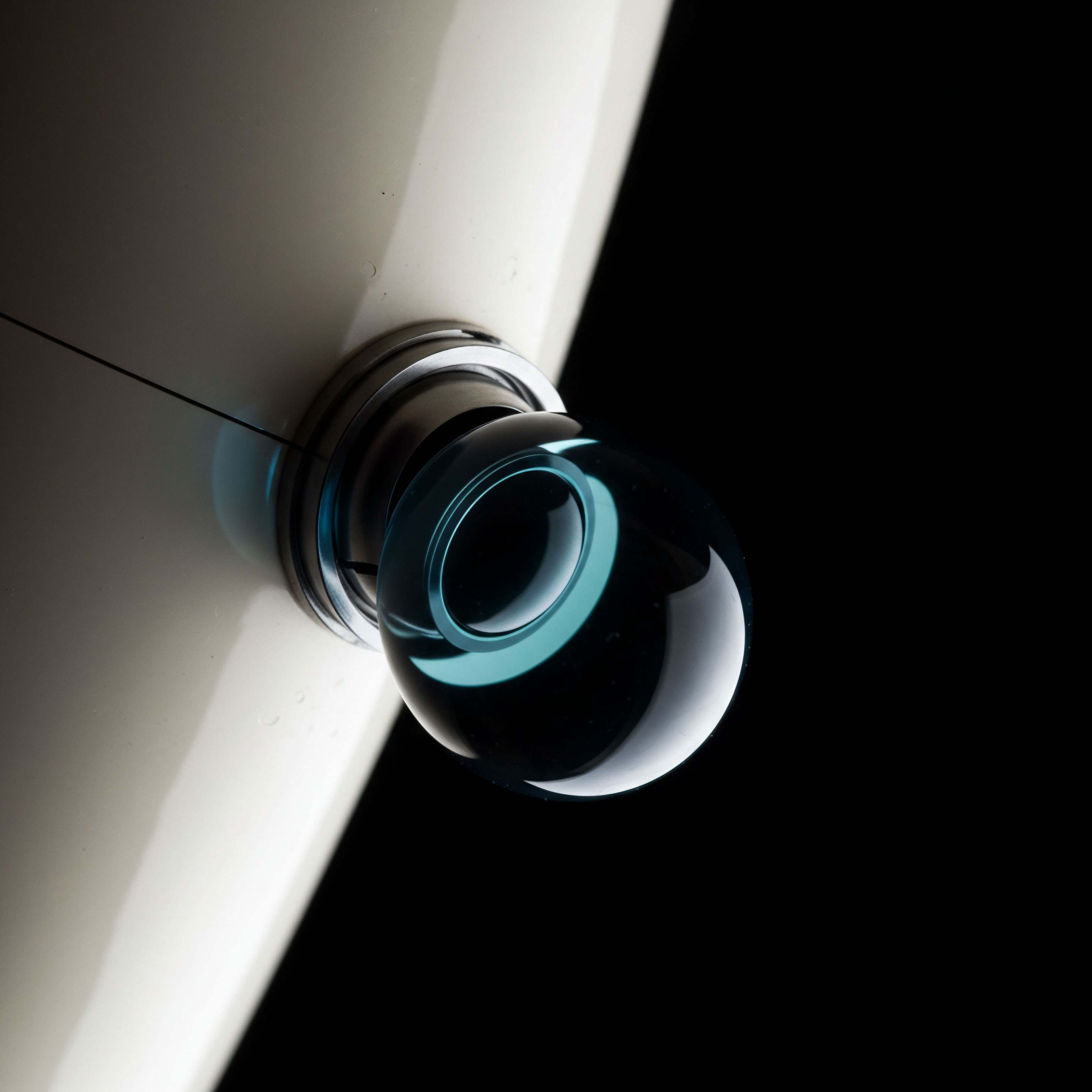

The Zero-Cost Collar a Hedging Structure

For investors seeking to reduce the explicit cost of protection, the collar is a highly effective construction. This strategy involves two simultaneous transactions ▴ the purchase of a protective put option and the sale of a covered call option on the same index. The premium received from selling the call option is used to finance, either partially or entirely, the cost of purchasing the put. The result is a defined range of outcomes for the portfolio.

The purchased put establishes a protective floor, while the sold call creates a ceiling on potential upside gains. The primary strategic decision revolves around the trade-off. An investor accepts a cap on their portfolio’s appreciation in exchange for downside protection at a significantly reduced, or even zero, out-of-pocket cost. This makes collars a capital-efficient tool for risk management over a specific period.

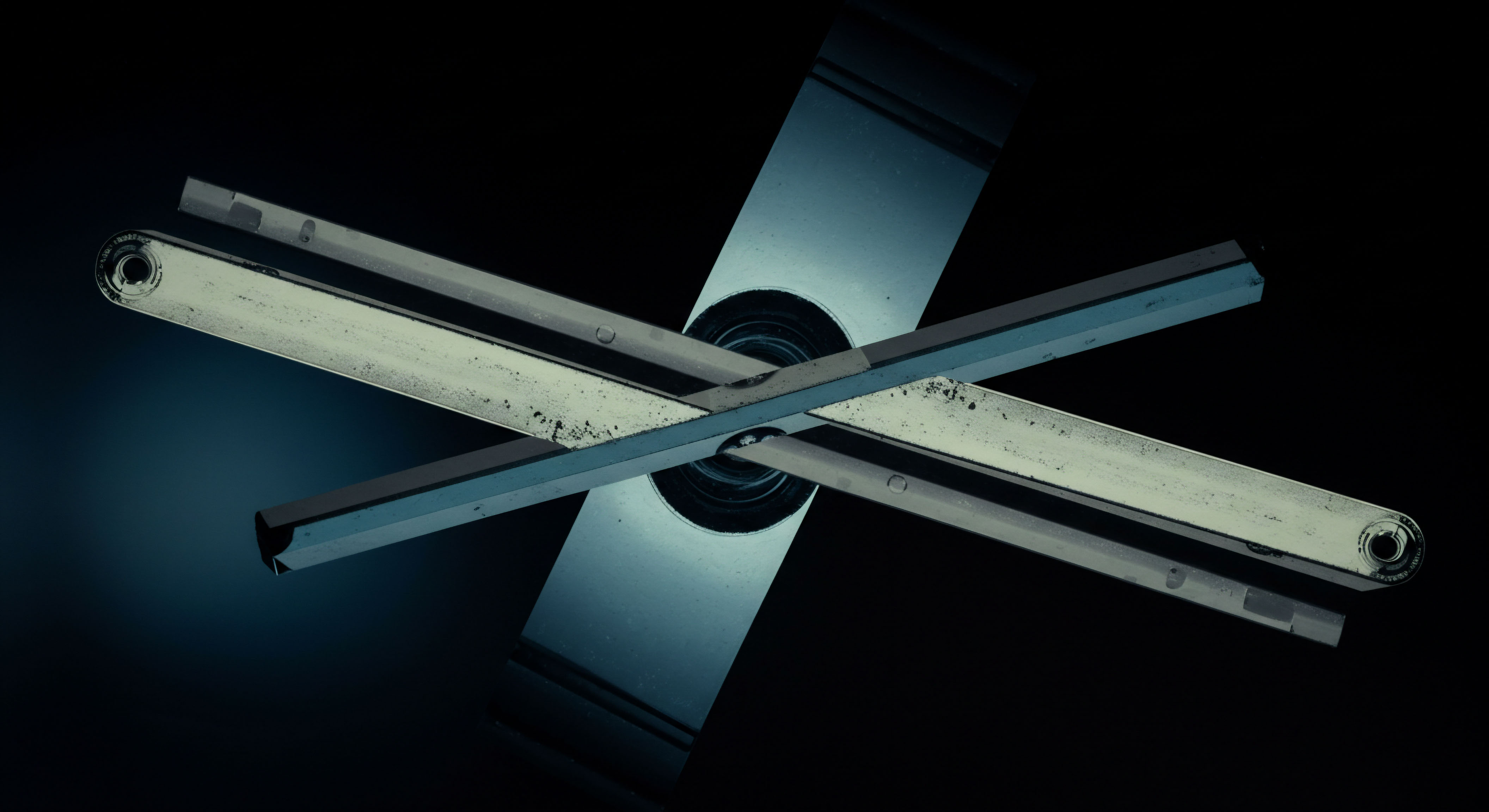

Systematic Income Generation the Covered Call

While often viewed as an income strategy, selling covered calls on a broad-market index can function as a form of risk mitigation. By selling a call option against a long portfolio, an investor collects a premium, which provides a small buffer against minor price declines. The income generated effectively lowers the cost basis of the holdings over time.

This approach is most suitable for investors with a neutral to moderately bullish outlook who are willing to forgo potential upside appreciation beyond the strike price of the sold call in exchange for a consistent stream of income. Studies examining options-based strategies have frequently found that covered call writing improves risk-adjusted returns over the long term.

The practical application of these strategies requires careful consideration of several variables. The choice of expiration date, the selection of strike prices, and the sizing of the position are all critical inputs that determine the effectiveness of the hedge. Below is a simplified framework for implementing a protective put strategy on a portfolio benchmarked to the S&P 500.

- Portfolio Assessment ▴ Determine the total market value of the equity portfolio and its beta relative to the S&P 500. A portfolio with a beta of 1.0 moves in line with the market, while a beta of 1.2 implies 20% greater volatility. The notional value to be hedged is the portfolio value multiplied by its beta.

- Instrument Selection ▴ Choose the appropriate index option. SPX options, with a multiplier of $100, are the standard for large institutional portfolios. For smaller portfolios, the Mini-SPX (XSP) options, at one-tenth the size, offer greater flexibility.

-

Hedge Parameterization ▴

- Determine Protection Level: Decide the maximum drawdown the portfolio can sustain. A 10% decline from current market levels is a common parameter. Select a put option strike price that reflects this floor.

- Select Time Horizon: Choose an expiration date that aligns with the perceived period of risk. Common choices range from three to six months, providing a meaningful period of protection while managing the impact of time decay.

- Calculate Contracts Needed: Divide the notional value to be hedged by the notional value of a single option contract (Index Level x $100 Multiplier). For example, to hedge a $5,000,000 portfolio with the SPX at 5000, one would need to hedge a notional value of $5,000,000. Each SPX contract represents $500,000 (5000 x $100), so 10 put contracts would be required.

- Execution and Management ▴ For large orders, execution quality is paramount. Utilizing a Request for Quote (RFQ) system allows institutional traders to source liquidity from multiple dealers anonymously, minimizing slippage and achieving best execution. Once the hedge is in place, it must be monitored. As the market moves, the hedge’s effectiveness (its delta) will change, potentially requiring adjustments to maintain the desired level of protection.

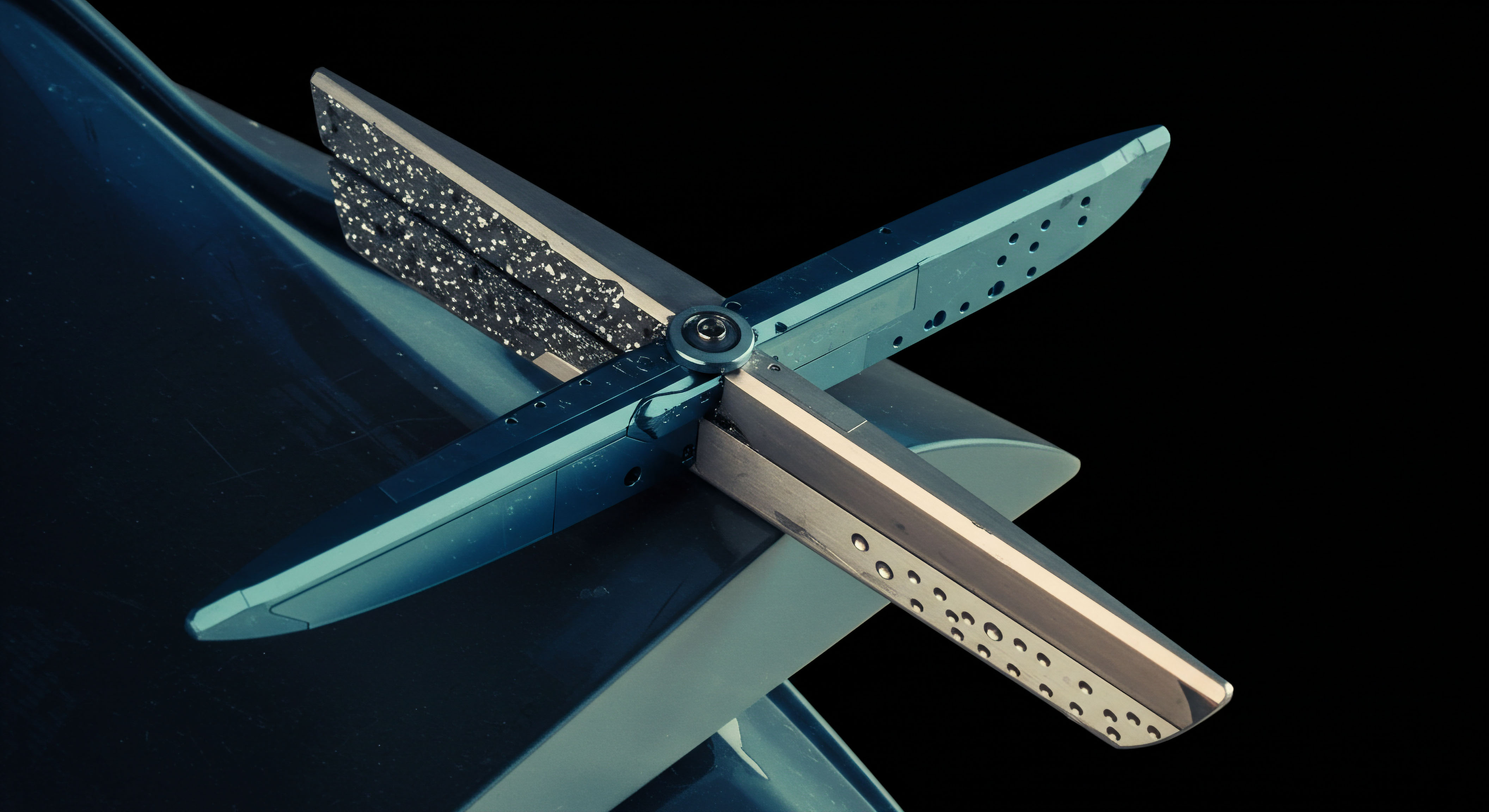

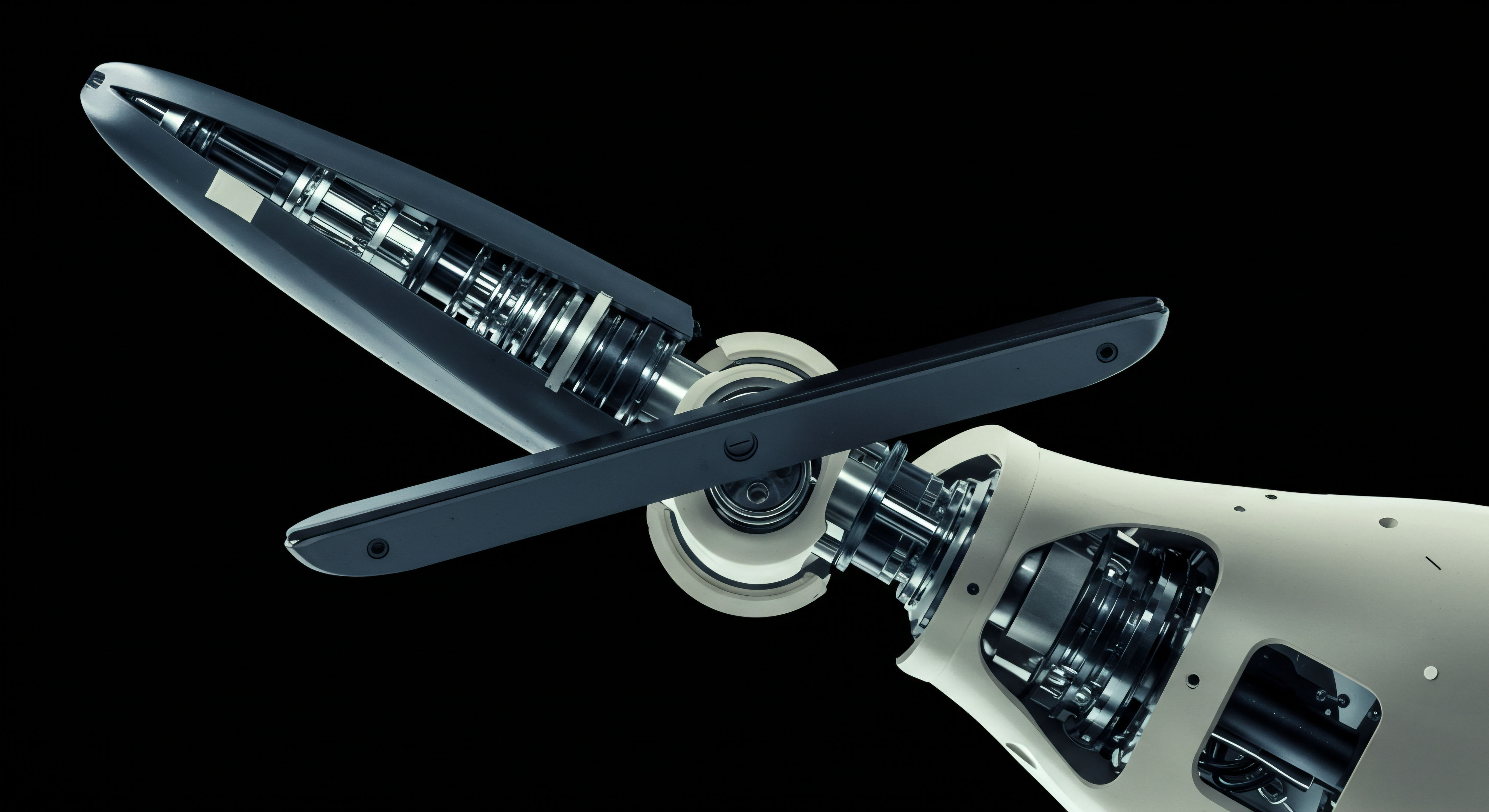

The Volatility Edge and Structural Alpha

Mastering index options involves moving beyond simple hedging to integrate them as a core component of a dynamic, alpha-generating portfolio strategy. This advanced application centers on the understanding that these instruments are tools for managing and expressing views on market volatility itself, a distinct asset class. Furthermore, their structural characteristics, such as their tax treatment, provide a persistent edge that compounds over time.

Direct Volatility Exposure the VIX Instrument

The Cboe Volatility Index (VIX) is a real-time measure of the market’s expectation of 30-day volatility derived from S&P 500 option premiums. Options on the VIX provide a pure-play instrument for hedging against or speculating on changes in market fear and uncertainty. A long VIX call position is a direct hedge against a volatility spike, as the VIX typically has a strong negative correlation with the S&P 500. During periods of market stress, the VIX tends to rise sharply, generating gains on VIX calls that can offset losses in an equity portfolio.

A University of Massachusetts study highlighted that investments in VIX futures and options could have significantly reduced downside risk during the 2008 financial crisis. This makes VIX options a powerful tool for tail-risk hedging, specifically designed to perform best during the most severe market dislocations.

The Capital Efficiency of Section 1256 Contracts

A significant, often underappreciated, advantage of broad-based index options is their classification under Section 1256 of the U.S. Internal Revenue Code. This designation carries substantial tax benefits. Regardless of the holding period, all capital gains from these contracts are treated as 60% long-term and 40% short-term. For an investor in the highest tax bracket, this results in a blended rate significantly lower than the ordinary income rate applied to short-term gains from single-stock or ETF options.

This favorable tax treatment directly translates to higher after-tax returns, creating a structural alpha for traders who consistently use index options. The mark-to-market rule for Section 1256 contracts also simplifies year-end reporting and eliminates the wash sale rule, providing greater flexibility for active position management.

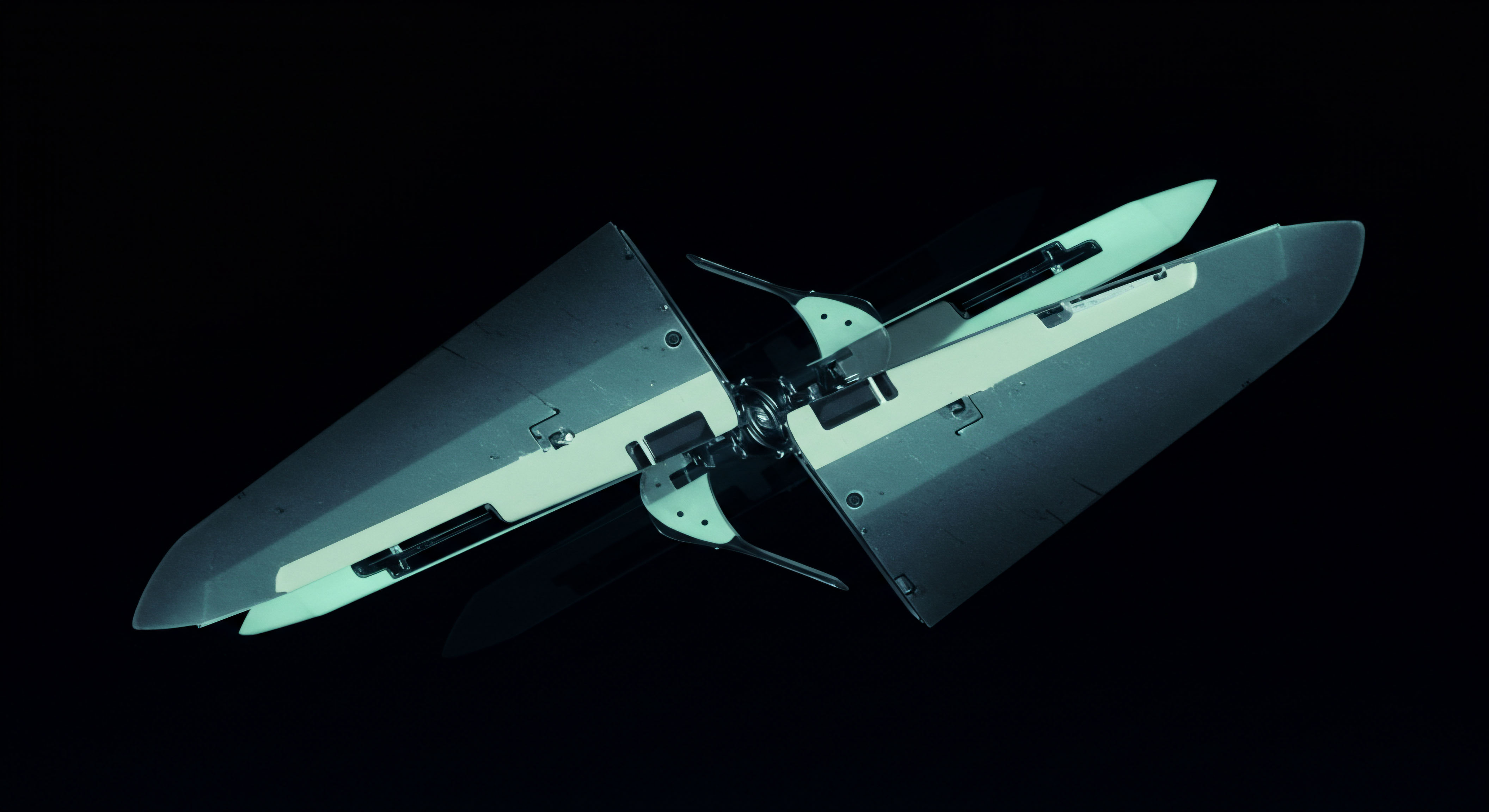

Executing at Scale with Institutional Grade Tooling

For asset managers and other institutional investors, the ability to execute large trades without moving the market is a critical component of performance. The index options market is exceptionally deep and liquid, but executing multi-million-dollar block trades requires specialized tools. This is where Request for Quote (RFQ) systems become indispensable. An RFQ platform allows a trader to anonymously submit a large or complex multi-leg options order to a network of competitive liquidity providers.

These dealers respond with their best price, and the trader can execute against the most favorable quote. This process minimizes information leakage and reduces slippage, ensuring that the intended strategy is implemented at the best possible price. It is the professional standard for achieving best execution in the options market, transforming a potentially hazardous open-market order into a controlled, competitive auction.

A New Definition of Portfolio Command

The journey through the strategic application of index options culminates in a redefined sense of control over investment outcomes. It moves the operator from a position of passive exposure to market whims to one of active command over risk parameters. The knowledge of these instruments and their sophisticated deployment is the dividing line between reacting to market events and proactively structuring a portfolio to withstand them. This is the foundation of enduring financial resilience.

The deliberate calibration of risk, the strategic harvesting of volatility premiums, and the intelligent use of structural advantages are the pillars of a superior investment operation. The market will always present uncertainty; the objective is to possess the tools and the insight to navigate it with authority.

Glossary

Index Options

Market Risk

Risk Management

Protective Put

Strike Price

Collars

Covered Calls

Notional Value

Spx Options

Request for Quote

Vix Options

Section 1256