RFQ Execution Fundamentals

Institutional traders consistently seek pathways to optimize execution quality, a critical determinant of sustained profitability. The Request for Quotation (RFQ) mechanism stands as a foundational instrument, empowering participants to solicit competitive pricing for block trades across various derivative instruments. This structured inquiry process directly addresses the inherent challenges of liquidity fragmentation prevalent in electronic markets. A direct communication channel opens between a liquidity seeker and multiple market makers, facilitating tailored price discovery for substantial order sizes.

Understanding RFQ involves recognizing its role in active price formation. It transcends merely finding a counterparty; it engineers a competitive environment where liquidity providers vie for order flow. This dynamic process compresses bid-offer spreads for large positions, a benefit often elusive in continuous order book environments. Executing a trade through RFQ means engaging a pre-vetted network of professional market makers, each equipped to price complex, multi-leg strategies with precision.

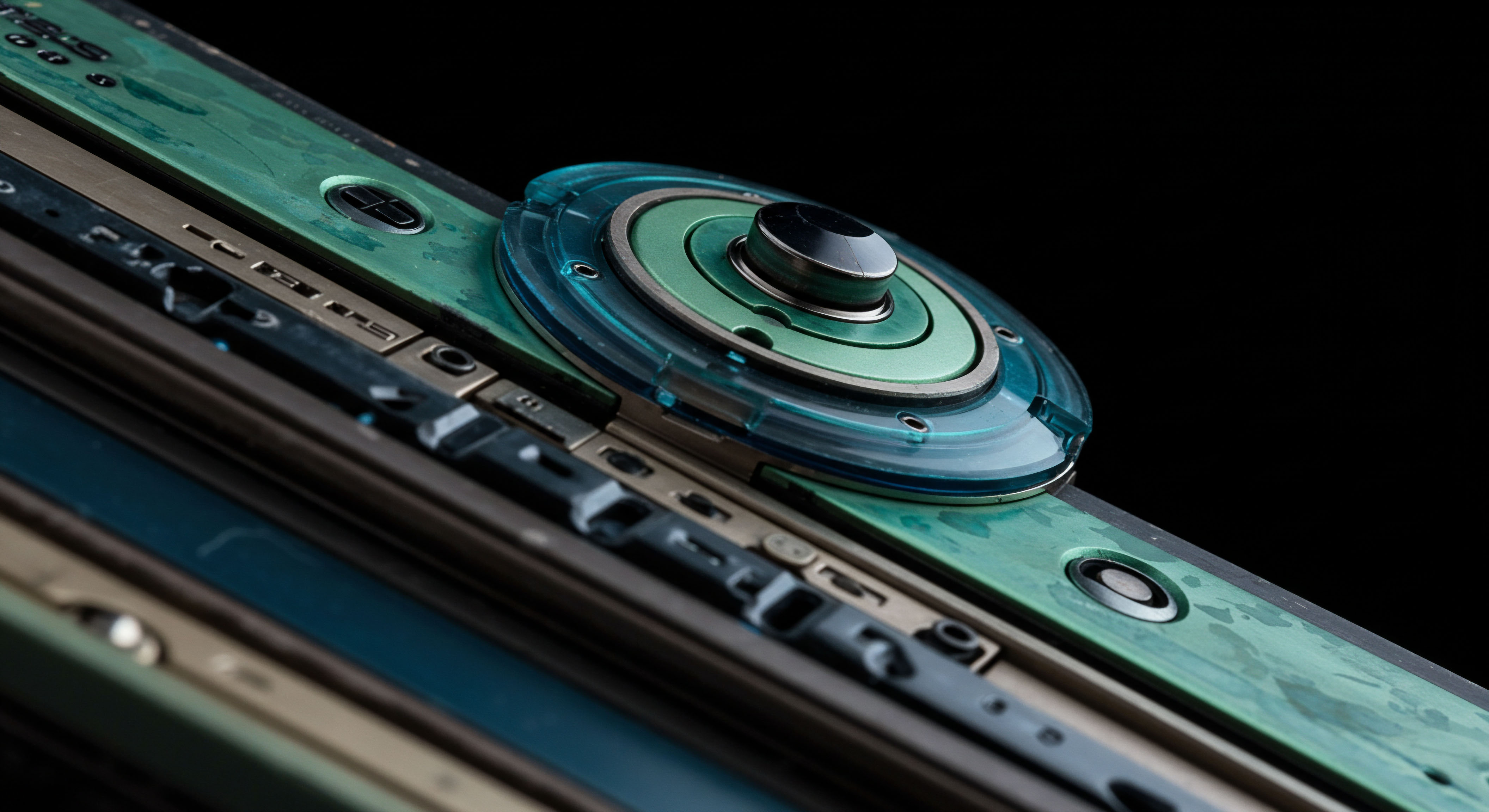

RFQ orchestrates competitive price discovery for block derivatives, directly addressing liquidity fragmentation.

The RFQ mechanism offers a clear path to superior execution for participants navigating options, crypto options, and other derivatives. It ensures a systematic approach to securing advantageous terms, a cornerstone of professional trading operations. This process builds confidence, providing the essential knowledge required to engage with a professional-grade tool.

Strategic Capital Deployment

Deploying capital effectively through RFQ necessitates a disciplined, strategic approach. This mechanism excels in scenarios requiring significant size or complex structuring, where conventional order books might incur substantial market impact. Professional traders leverage RFQ for its capacity to minimize slippage and achieve best execution benchmarks.

Optimizing Options Spreads

Options spreads, multi-leg strategies designed to capture specific market views, find their optimal execution venue within an RFQ framework. Constructing a BTC Straddle Block or an ETH Collar RFQ, for example, demands precise, simultaneous pricing across multiple legs. An RFQ submission allows market makers to price the entire strategy as a single unit, eliminating the leg risk and potential price degradation associated with sequential order book execution. This integrated pricing ensures the intended risk-reward profile of the spread remains intact.

Multi-Dealer Liquidity Access

Accessing multi-dealer liquidity through RFQ transforms the execution landscape. Rather than relying on a single price feed, a trader receives quotes from numerous liquidity providers. This competitive dynamic inherently drives down execution costs. The anonymous options trading aspect of RFQ further shields large orders from predatory front-running, preserving the integrity of the desired entry or exit price.

Consider the tactical advantage of requesting quotes for a substantial volatility block trade. The sheer volume might overwhelm a public order book, signaling intent and causing adverse price movements. RFQ channels this demand privately, securing a price that accurately reflects prevailing market conditions without revealing the trader’s full position.

This tactical maneuver safeguards alpha. A deep understanding of these mechanisms yields consistent results.

The strategic application of RFQ extends to OTC options markets, where bespoke agreements necessitate direct negotiation. RFQ formalizes this negotiation, providing a structured, auditable process for obtaining multiple bids and offers. This elevates the transparency and efficiency of OTC execution, a vital consideration for complex, illiquid instruments. Mastering this approach provides a tangible market edge.

Here are key applications of RFQ in active investment strategies:

- Block Trade Execution ▴ Securing competitive pricing for large orders in Bitcoin Options Block and ETH Options Block without adverse market impact.

- Multi-leg Strategy Pricing ▴ Obtaining unified, simultaneous quotes for complex options spreads, minimizing leg risk and ensuring coherent pricing.

- Volatility Exposure Management ▴ Executing significant volatility trades discreetly, preserving price integrity for instruments like BTC straddle blocks.

- OTC Derivatives Negotiation ▴ Structuring competitive bid-offer processes for customized, off-exchange options contracts.

- Slippage Reduction ▴ Leveraging competitive market maker responses to achieve tighter spreads and superior fill rates compared to public order books.

This relentless focus on optimizing every basis point of execution cost compounds into significant performance enhancements over time. The professional trader views RFQ as an indispensable tool for maintaining a superior capital efficiency trajectory, consistently outperforming less sophisticated methods.

Advanced Portfolio Command

Expanding beyond individual trade execution, RFQ integrates into a comprehensive framework for advanced portfolio command. This involves viewing the mechanism not as a standalone tool, but as a critical component of a systematic approach to risk management and alpha generation. Its application extends to sophisticated strategies, reinforcing a long-term market edge.

Systemic Risk Mitigation

The ability to execute large positions with precision directly contributes to systemic risk mitigation within a portfolio. Imagine adjusting a significant hedge in a rapidly moving market. Relying on an RFQ for anonymous, multi-dealer pricing ensures the adjustment occurs at optimal levels, preserving the intended risk offset.

This level of control minimizes unintended portfolio drift and protects capital during volatile periods. The market’s complexity demands such robust methods.

Developing a comprehensive understanding of market microstructure dynamics allows for the nuanced deployment of RFQ. Recognizing moments of fragmented liquidity or anticipating significant order flow enables a trader to proactively engage the RFQ system. This forward-thinking approach transforms potential execution hurdles into opportunities for superior pricing.

Integrating RFQ into algorithmic execution workflows represents the zenith of strategic deployment. Automated systems can trigger RFQ requests based on predefined parameters, such as desired price improvement thresholds or specific liquidity conditions. This smart trading within RFQ and crypto environments elevates execution efficiency to an unprecedented level, combining human oversight with computational speed.

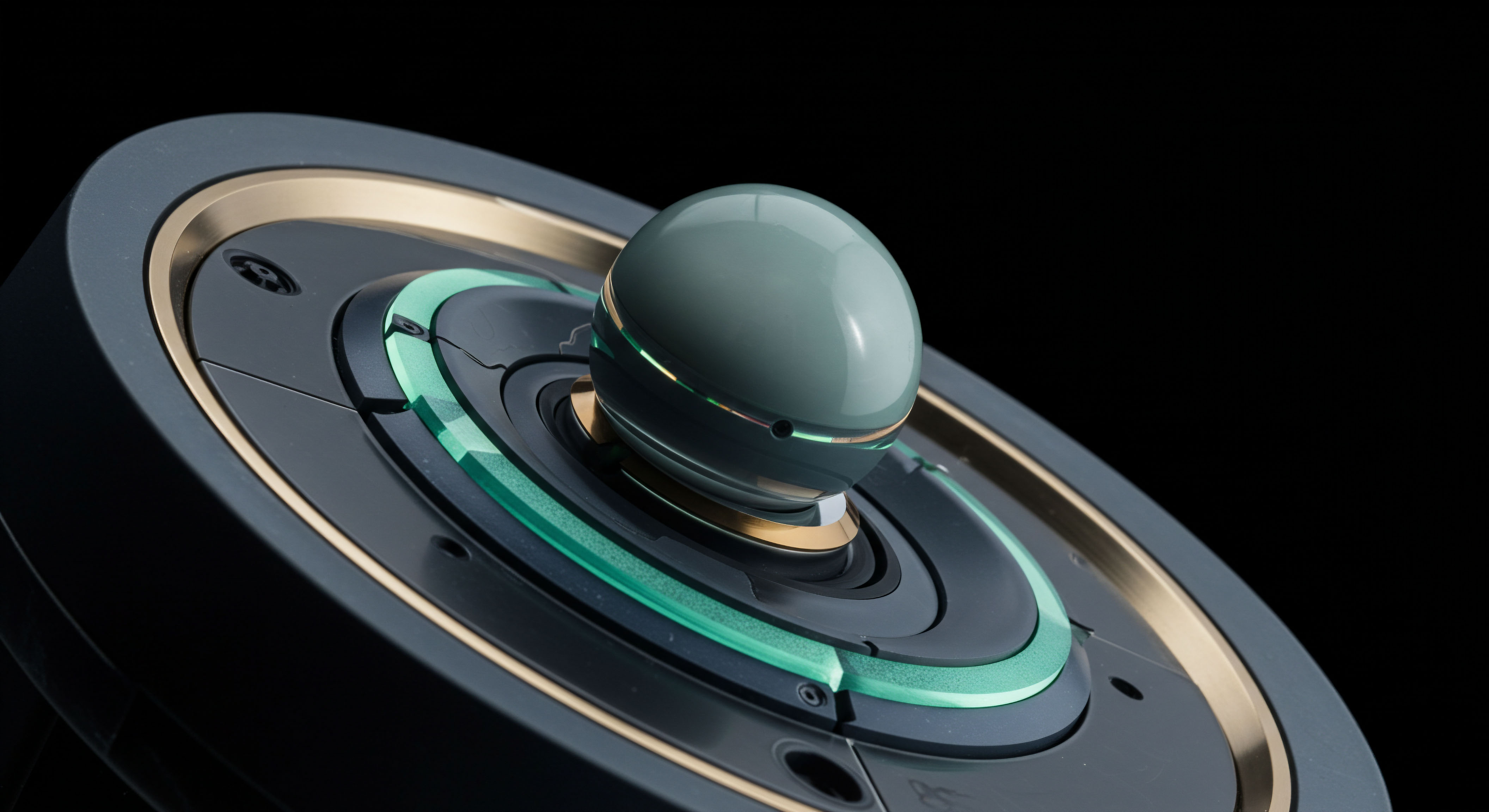

Advanced RFQ deployment elevates portfolio management, integrating precise execution with strategic risk oversight.

The evolution of derivatives markets continues to underscore the value of tools that aggregate liquidity and command competitive pricing. RFQ stands as a testament to this evolution, providing a robust mechanism for professional traders to consistently secure a quantifiable advantage. Mastering its applications transforms a reactive approach to market conditions into a proactive stance, solidifying a position of market leadership.

Alpha Generation Pathways

The pursuit of alpha defines the institutional trader’s mission. RFQ stands as a powerful conduit for this pursuit, transforming the abstract concept of “best execution” into a tangible, repeatable outcome. Its inherent design creates a competitive environment, compelling market makers to offer their keenest prices for block liquidity.

This strategic advantage accrues directly to the trader’s bottom line, reinforcing a proactive stance in dynamic markets. Understanding its nuanced applications unlocks a continuous pathway to superior portfolio performance.