Mastering Options Execution

The pursuit of superior execution in complex options markets defines the astute trader. Achieving this level of precision demands more than market intuition; it requires a systemic approach to liquidity sourcing. Private Request for Quote (RFQ) protocols stand as a foundational pillar in this endeavor, providing a controlled environment for pricing and executing intricate multi-leg options spreads. This mechanism empowers participants to command tailored liquidity, moving beyond the limitations inherent in public order books.

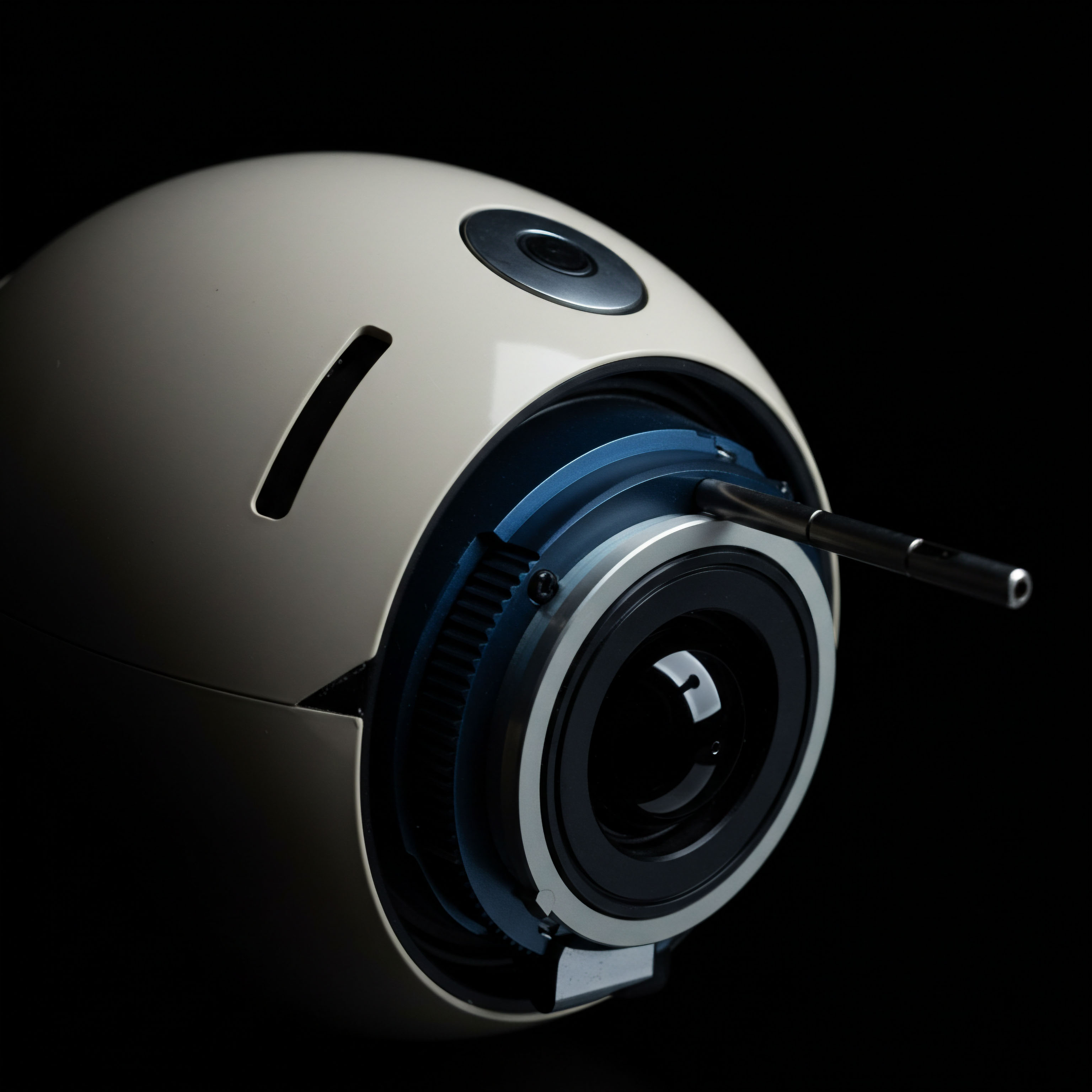

A Private RFQ operates by transmitting a specific options spread request to a curated group of liquidity providers. These providers then submit competitive quotes, unseen by the broader market, directly to the requesting party. This process ensures the trader receives bespoke pricing for their precise risk profile, mitigating adverse selection and optimizing the cost basis of the overall strategy. Understanding this direct interaction with institutional liquidity unlocks a significant advantage, establishing a clear path toward consistent, professional-grade execution outcomes.

A Private RFQ delivers bespoke pricing, directly optimizing the cost basis for complex options strategies.

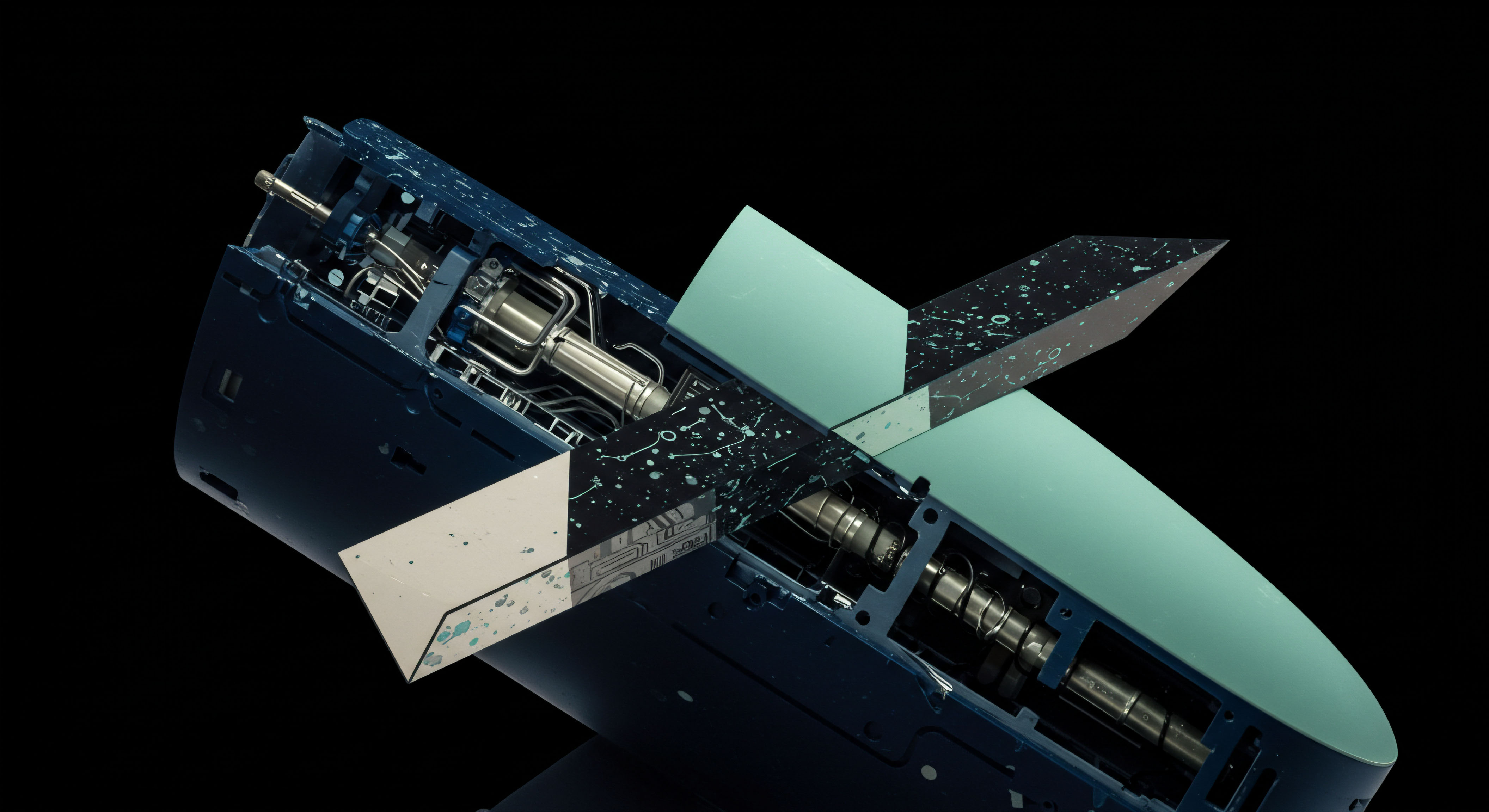

The inherent design of a Private RFQ streamlines the execution of multi-leg strategies, which often face challenges in fragmented public markets. Consolidating the pricing of an entire spread into a single executable quote drastically reduces leg risk and slippage. This architectural efficiency provides a critical tool for traders aiming to implement sophisticated directional, volatility, or income-generating strategies with unwavering confidence.

Strategic Deployment of Private RFQ

Deploying Private RFQ effectively transforms theoretical options knowledge into tangible market performance. This mechanism is not a mere convenience; it is a strategic imperative for any trader serious about optimizing their entry and exit points for complex options spreads. Mastering its application directly correlates with superior risk-adjusted returns and a disciplined approach to capital deployment.

Precision in Volatility Spreads

Volatility strategies, such as straddles, strangles, and iron condors, demand exacting execution. Private RFQ excels here, allowing a trader to solicit quotes for the entire spread simultaneously. This ensures the implied volatility surfaces of each leg are consistently priced within the overarching strategy, eliminating the risk of individual leg price dislocations.

- Defining the Volatility Horizon ▴ Traders specify the desired expiration and strike prices for each leg of the spread.

- Selecting Liquidity Providers ▴ Curating a list of market makers known for competitive pricing in volatility products enhances the outcome.

- Evaluating Composite Quotes ▴ The received quotes represent the net premium for the entire spread, enabling a clear, immediate assessment of value.

Hedging Portfolio Exposures

Implementing protective hedges or income-generating overlays across a portfolio requires a surgical approach. Covered calls, protective puts, and collar strategies, when executed via Private RFQ, benefit from the consolidated pricing and deep liquidity pool. This ensures that the hedge is established at the most favorable terms, preserving capital and managing systemic risk with precision.

Consider a portfolio manager seeking to implement a large-scale collar on a significant equity holding. Executing the purchase of an out-of-the-money put and the sale of an out-of-the-money call simultaneously through a Private RFQ guarantees a unified price for the entire structure. This minimizes the chance of one leg executing poorly, undermining the intended risk reduction. The process facilitates a robust defense against market downturns while monetizing upside participation.

Arbitrage and Relative Value Capture

For sophisticated traders focused on arbitrage opportunities or relative value strategies across options markets, Private RFQ provides a conduit for efficient execution. Identifying mispricings between related options contracts, or between options and their underlying assets, becomes actionable when the execution channel supports multi-leg, high-volume transactions with minimal price impact. The ability to transact large blocks anonymously shields the strategy from front-running, preserving the alpha generated by the price discrepancy.

The systematic approach to identifying and then executing these ephemeral opportunities separates proficient traders. The Private RFQ environment facilitates the capture of these fleeting advantages, transforming theoretical models into realized gains. This systematic execution pathway enables a consistent approach to market inefficiencies.

Advanced RFQ Applications and Mastery

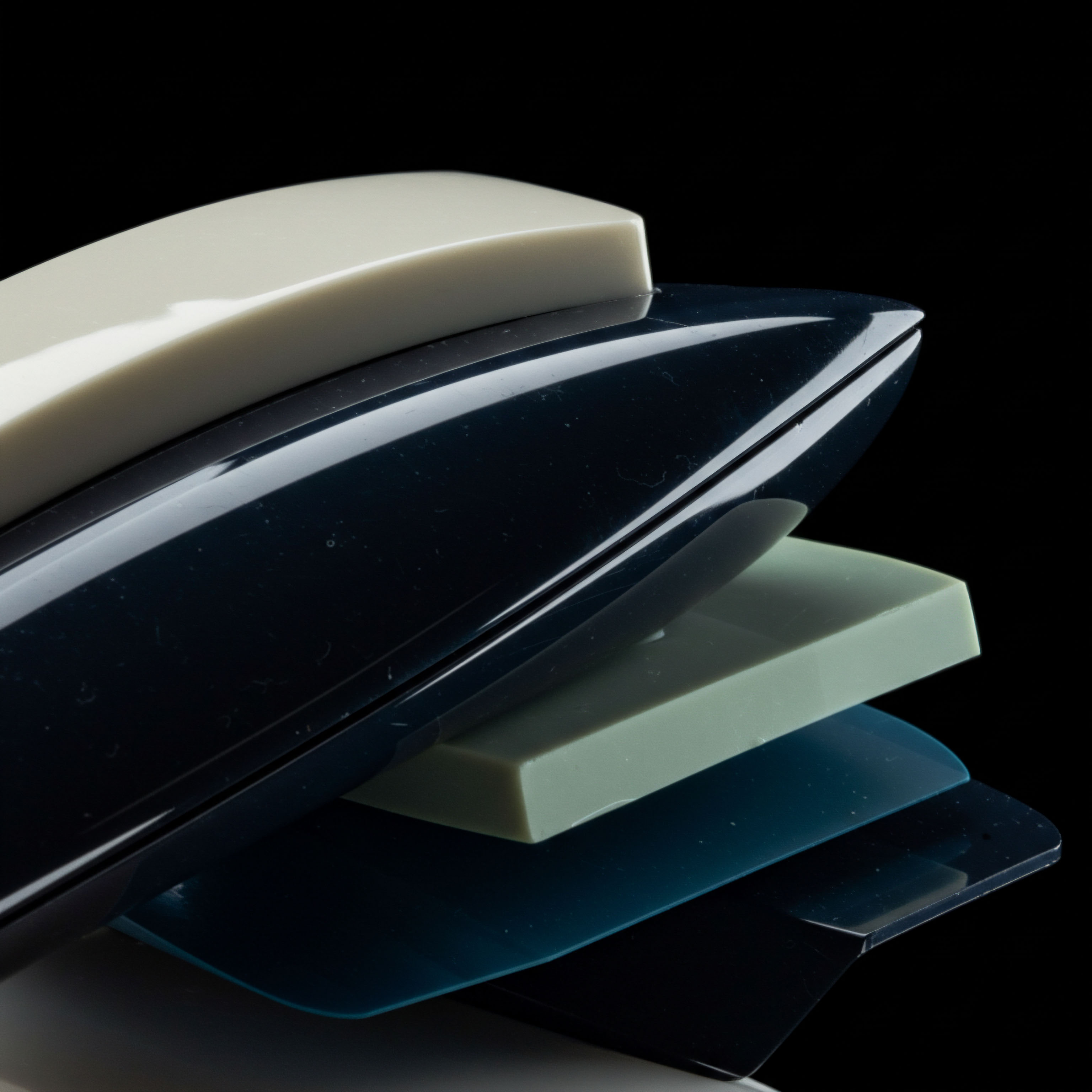

The true mastery of Private RFQ extends beyond routine execution; it involves integrating this mechanism into a broader strategic framework, optimizing portfolio performance, and commanding market influence. This represents the next frontier for traders aiming to refine their edge and elevate their market presence.

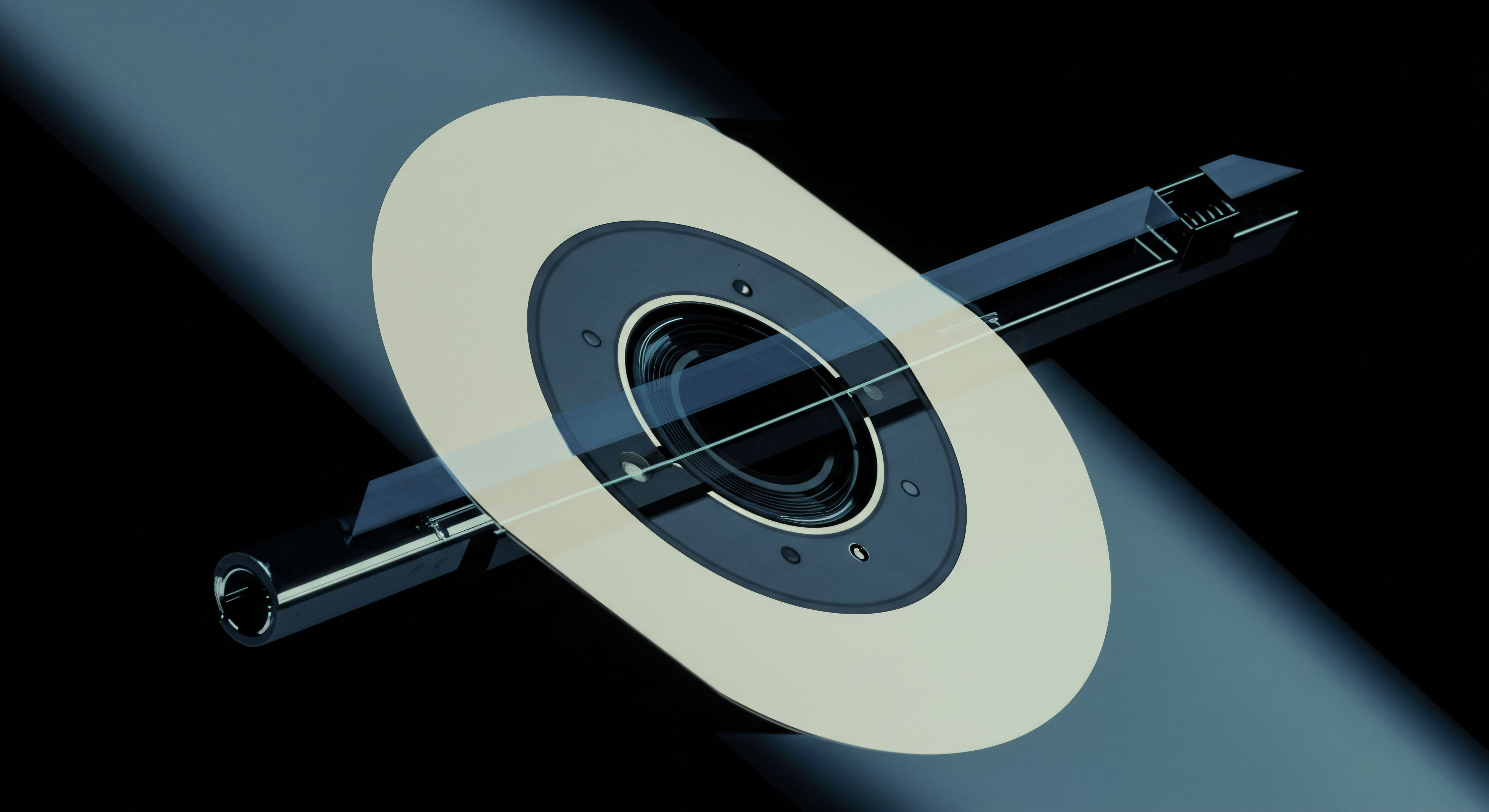

Algorithmic Execution Integration

Connecting proprietary algorithmic trading systems directly to Private RFQ platforms unlocks a new dimension of efficiency. Automated logic can generate optimal spread parameters, solicit quotes, and execute trades with unparalleled speed and consistency. This synergy allows for the real-time capture of fleeting opportunities, ensuring that execution aligns perfectly with pre-defined quantitative models and risk thresholds. Such integration provides a powerful leverage point, scaling sophisticated strategies across diverse market conditions.

The evolution of trading intelligence increasingly relies on such seamless integration. Automating the RFQ process for complex options spreads provides a significant competitive advantage, reducing human latency and maximizing throughput. This transforms theoretical alpha into realized portfolio gains with remarkable consistency.

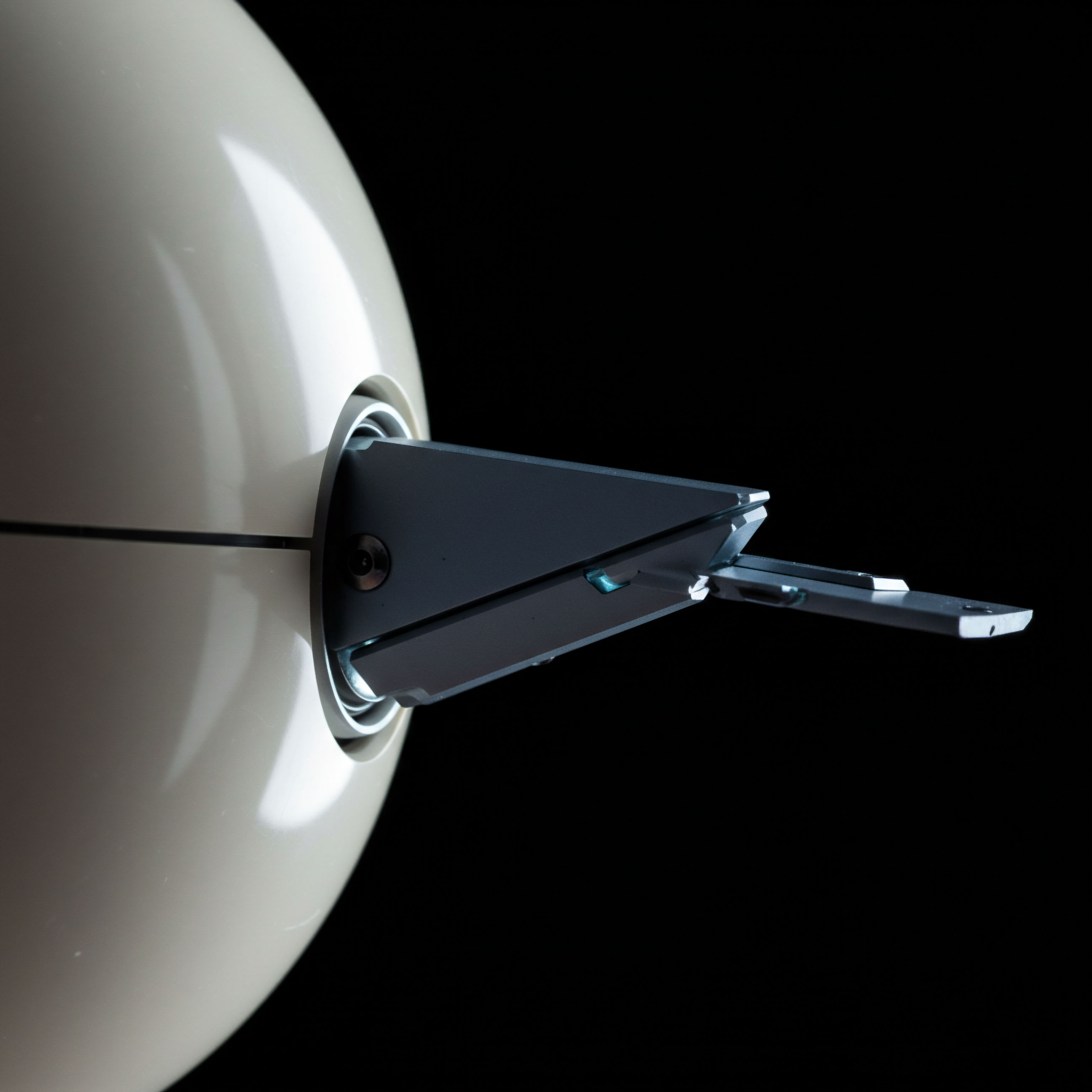

Liquidity Provision and Market Impact Mitigation

Understanding the dynamics of Private RFQ positions a trader to influence liquidity provision, not merely consume it. By strategically timing RFQ submissions and adjusting parameters, participants can subtly signal their interest without revealing their full intent to the broader market. This nuanced approach minimizes market impact, particularly for large block trades that might otherwise move prices adversely in public venues. The ability to anonymously interact with multiple dealers fosters genuine price discovery, benefiting both sides of the transaction.

Mastering this subtle interplay between demand and supply within the private environment requires an acute understanding of market microstructure. It demands a calculated approach to order placement, recognizing the profound effect execution choices have on price formation. This deep comprehension transforms a trader from a participant into an architect of liquidity, shaping market conditions to their advantage.

Integrating Private RFQ into algorithmic systems provides a powerful leverage point, scaling sophisticated strategies across diverse market conditions.

Strategic control over execution is paramount. The difference between average and exceptional performance often lies in these granular details. This demands an unwavering commitment to refining every facet of the trading process.

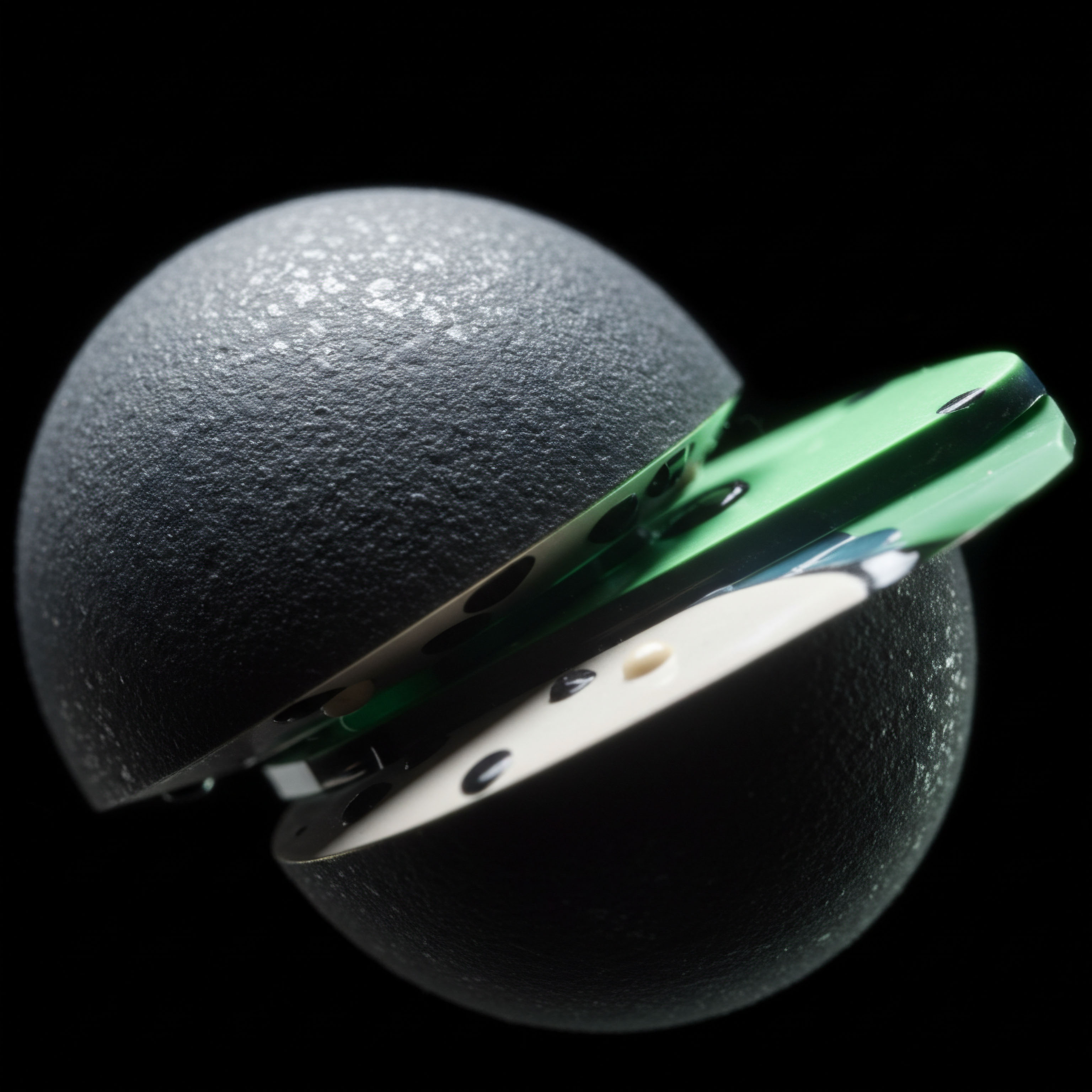

Cross-Asset Derivates and Structured Products

The principles of Private RFQ extend beyond single-asset options, finding powerful application in cross-asset derivatives and structured products. When dealing with bespoke instruments that combine elements of equities, fixed income, or commodities with options overlays, the ability to solicit competitive quotes from specialized dealers becomes indispensable. This facilitates the creation and pricing of highly customized risk transfer solutions, catering to unique portfolio requirements. The structured nature of these products benefits immensely from a controlled, multi-dealer pricing environment, ensuring fair value and efficient capital allocation.

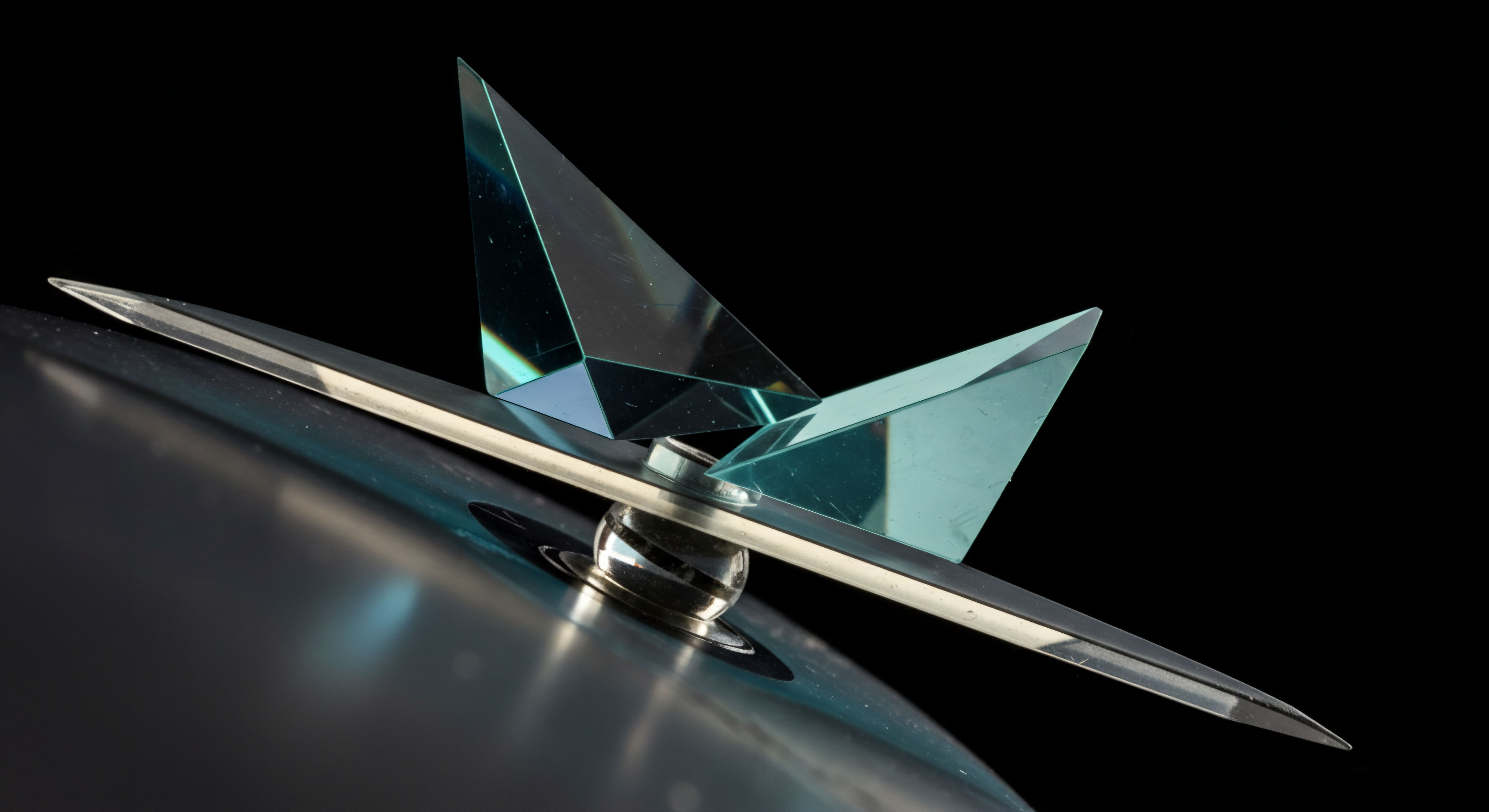

Commanding Market Precision

The trajectory from market participant to market master is a journey of relentless optimization. Private RFQ represents a critical juncture in this evolution, a mechanism for commanding precision in the most intricate corners of derivatives trading. It elevates options execution from a reactive endeavor to a proactive, strategic advantage. Traders who embrace this approach fundamentally reshape their relationship with market liquidity, transitioning from observers to architects of their own execution outcomes.

The capacity to dictate terms, secure optimal pricing, and shield intentions in complex options spreads defines a new echelon of trading prowess. This disciplined application of superior tools yields a demonstrable, enduring edge.

Glossary

Complex Options

Private Rfq

Sophisticated Strategies across Diverse Market Conditions