Execution Command

Achieving superior options execution at scale demands a direct engagement with liquidity, a fundamental truth often overlooked by those operating outside institutional channels. Request For Quote (RFQ) stands as a strategic imperative for serious participants, offering a decisive mechanism to command pricing and secure capacity for significant derivatives positions. This approach transforms the execution landscape, providing a structured pathway to obtain institutional-grade prices across various trading products.

RFQ functions as a sophisticated conduit, enabling traders to solicit firm, competitive bids and offers from multiple liquidity providers simultaneously. This direct interaction bypasses the limitations of traditional order books, particularly when addressing larger order sizes that might otherwise induce substantial market impact. The process grants participants an immediate view of available liquidity for their specific options structure, ensuring transparency in pricing.

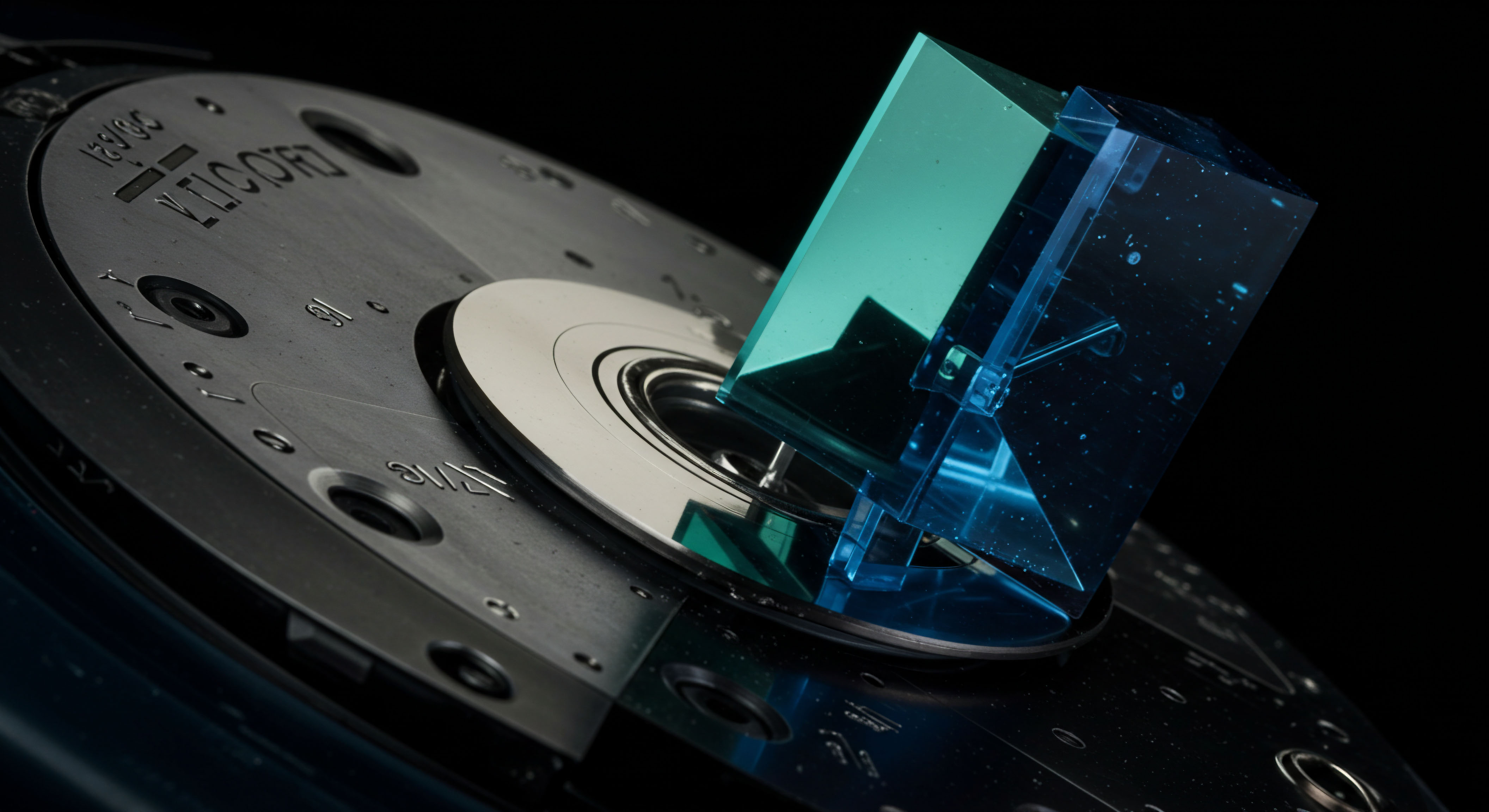

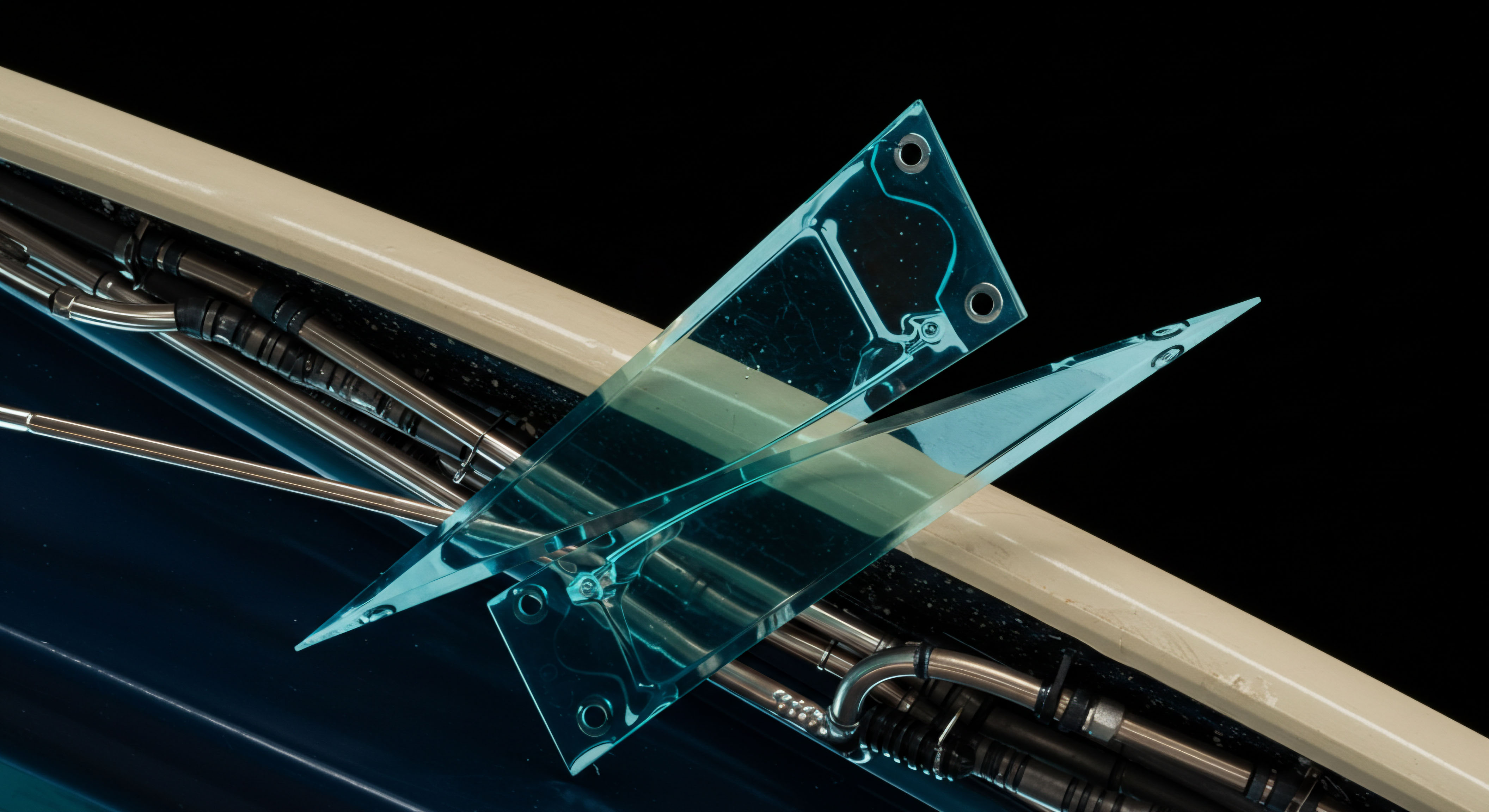

RFQ systems empower traders to secure deep liquidity and optimal pricing for substantial options orders.

The ability to request quotes for complex, multi-leg options strategies streamlines what would otherwise be a fragmented, inefficient endeavor. This cohesive approach to sourcing liquidity minimizes transaction costs, a measurable advantage that directly influences overall portfolio performance. Every trader aiming for a consistent market edge must recognize RFQ as an indispensable tool for proactive capital deployment.

Strategic Capital Deployment

Deploying capital effectively in options markets necessitates precision and foresight. RFQ elevates this endeavor, providing the means to execute strategies with optimal pricing and minimal market friction. This section details actionable applications for leveraging RFQ in your investment strategy.

Block Trade Mastery

Executing large options blocks requires a specialized approach, protecting the trade from adverse price movements inherent in fragmented markets. RFQ offers a dedicated channel for privately negotiating these substantial transactions with multiple market makers. This direct engagement ensures a smoother, more stable transaction, preserving the integrity of your intended position.

Price Improvement Dynamics

RFQ systems consistently deliver price improvement over national best bid and offer (NBBO) for large orders. By generating competition among liquidity providers, the system compels participants to offer their most aggressive pricing, translating directly into enhanced entry or exit points for your trades. This measurable advantage significantly impacts profitability over time.

Anonymity and Position Concealment

Maintaining discretion when accumulating or unwinding substantial positions is paramount. RFQ platforms afford a level of anonymity, shielding your intentions from broader market scrutiny. This controlled environment mitigates the risk of front-running, safeguarding your strategic advantage.

Multi-Leg Strategy Execution

Complex options strategies, such as spreads, straddles, or collars, often require simultaneous execution of multiple legs. RFQ simplifies this, allowing traders to request a single, composite quote for an entire strategy. This eliminates the risk of legging, where individual components of a strategy are filled at suboptimal prices due to market movements between executions.

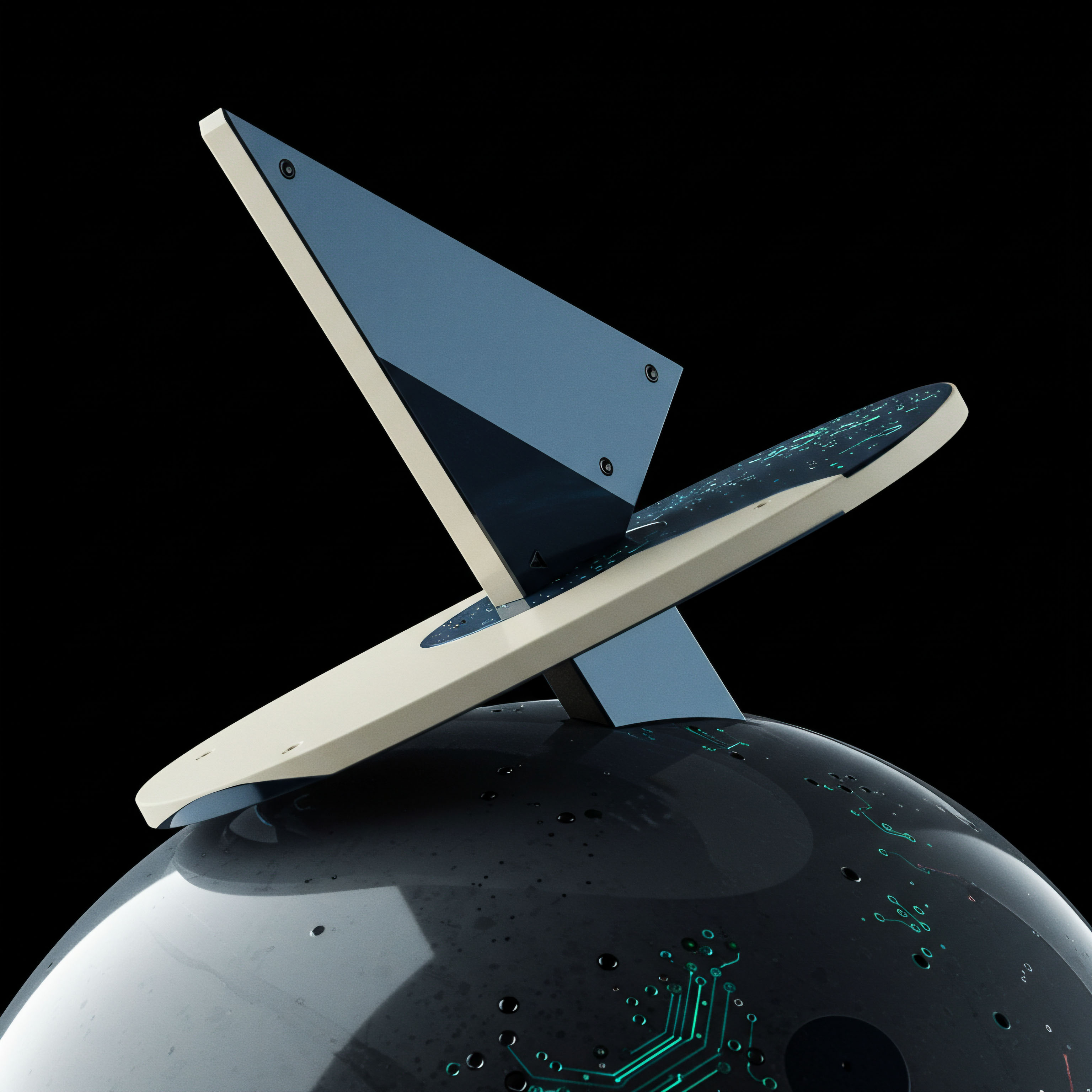

Consider the structured approach to executing a synthetic long position or an iron condor using RFQ. You define all parameters ▴ strikes, expiries, quantities ▴ and receive a single, executable price for the entire structure. This systematic process ensures the intended risk-reward profile of your strategy remains intact.

The complexity of constructing these positions necessitates a tool that offers holistic execution, reducing operational overhead and increasing precision. The very nature of this pursuit, striving for absolute market command, demands a mechanism that responds with singular clarity.

Below outlines key considerations for RFQ-driven options execution:

- Define your precise options strategy, including all legs, strike prices, and expiry dates.

- Specify the desired notional size or contract quantity for the entire position.

- Transmit your request to a diverse pool of market makers through the RFQ platform.

- Evaluate competitive quotes, focusing on the tightest bid-offer spread and overall pricing.

- Execute the trade with a chosen counterparty, securing the full strategy at a single, firm price.

Advanced Positional Command

Mastering RFQ extends beyond single-trade execution; it becomes an integral component of a comprehensive portfolio management system. This advanced perspective frames RFQ as a dynamic lever for optimizing capital efficiency and refining risk exposures across diverse market conditions.

Volatility Trading Optimization

Traders with a distinct view on implied volatility can significantly refine their execution using RFQ. Acquiring or divesting large volatility positions, such as those derived from long straddles or strangles, benefits immensely from competitive pricing. RFQ facilitates the efficient scaling of these trades, ensuring that the cost of establishing a volatility exposure aligns precisely with the strategic intent. This minimizes slippage on large delta-neutral positions, a critical factor for volatility arbitrageurs.

Liquidity Aggregation and Impact Mitigation

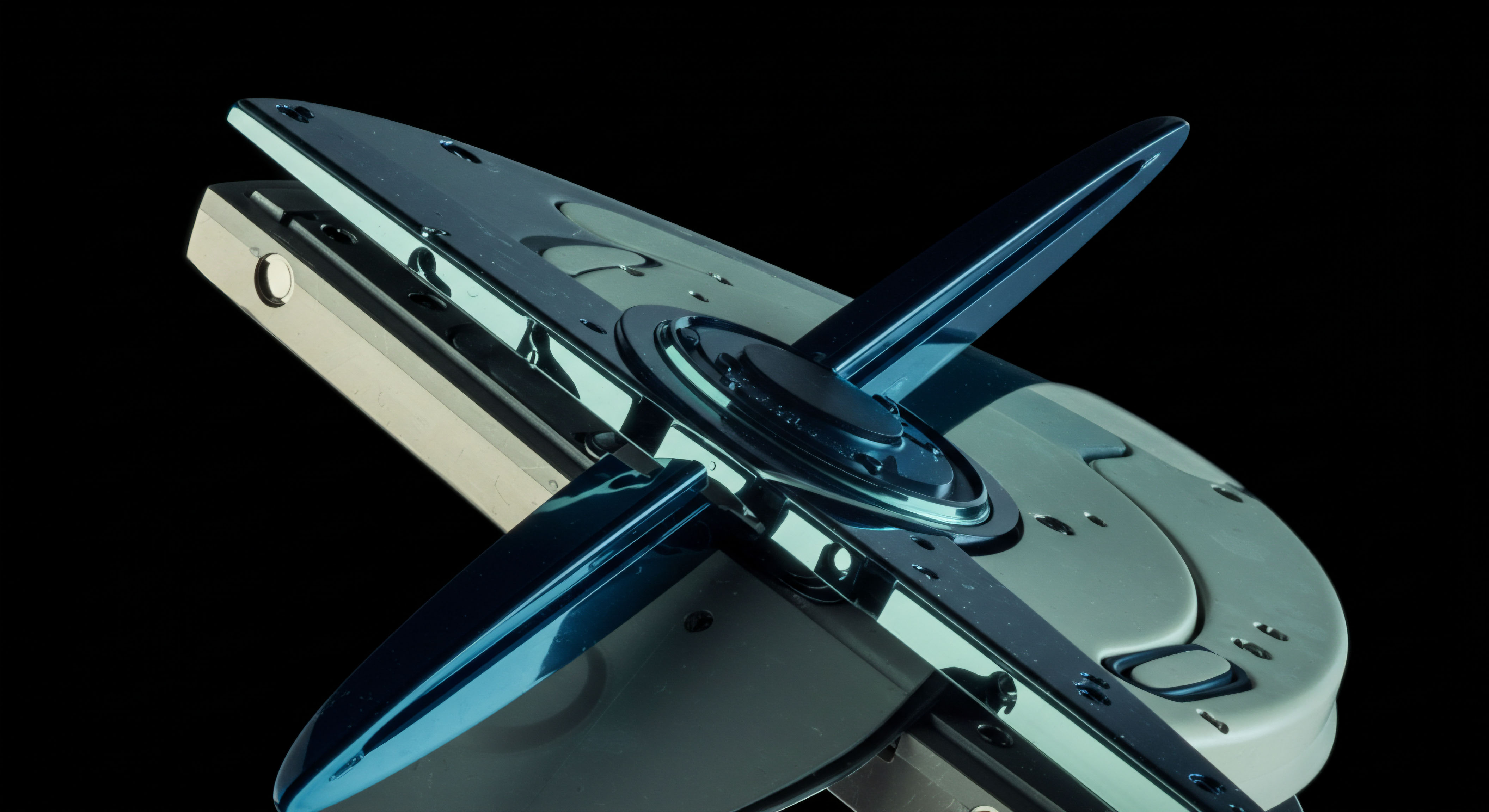

The derivatives landscape often presents fragmented liquidity across various venues and counterparties. RFQ acts as a powerful aggregator, drawing quotes from a broad spectrum of market makers into a single, actionable interface. This centralized quotation process effectively concentrates liquidity, transforming disparate pools into a cohesive source for your orders. The direct benefit accrues from a significant reduction in market impact costs, a persistent drag on returns for larger trading operations.

Hedging Portfolio Exposures

Sophisticated portfolio managers frequently employ options to hedge existing exposures or to express complex directional views. Executing these hedges at scale requires an instrument that delivers consistent, transparent pricing for large clip sizes. RFQ provides this capability, allowing for the precise calibration of portfolio risk.

This involves securing competitive prices for protective puts on a large equity holding or selling calls to generate income against a substantial asset base. The ability to execute these large-scale adjustments efficiently protects capital and enhances overall portfolio stability.

Consider the strategic advantage derived from an RFQ-driven approach to hedging. When managing a substantial cryptocurrency portfolio, a sudden shift in market sentiment might necessitate a rapid, large-scale options overlay. Attempting to execute such a position on an open order book risks significant price deterioration. RFQ, by contrast, offers a controlled environment to solicit competitive bids for thousands of protective puts, ensuring the hedge is implemented at an optimal cost basis.

This systematic risk mitigation preserves the integrity of your alpha generation efforts, distinguishing a reactive approach from a proactive defense of capital. This methodical deployment of options, facilitated by RFQ, represents the apex of strategic financial engineering.

Commanding Market Destiny

The journey toward market mastery in options trading is an evolution from tactical engagement to strategic command. RFQ stands as a testament to this progression, offering a sophisticated tool for those who recognize that superior execution is not a luxury, but a fundamental driver of enduring success. It reshapes the trading landscape, enabling participants to dictate terms rather than merely react to them. This mechanism provides a decisive advantage, ensuring every capital allocation is optimized for impact and efficiency.