Market Volatility and Professional Execution

Navigating today’s dynamic financial landscapes demands more than mere intuition. It requires a robust framework for execution, particularly when market conditions shift with pronounced velocity. Professional traders understand the inherent challenge of securing optimal pricing and efficient liquidity, especially when dealing with larger block sizes or complex derivatives structures. This recognition fuels a continuous drive for superior operational tools.

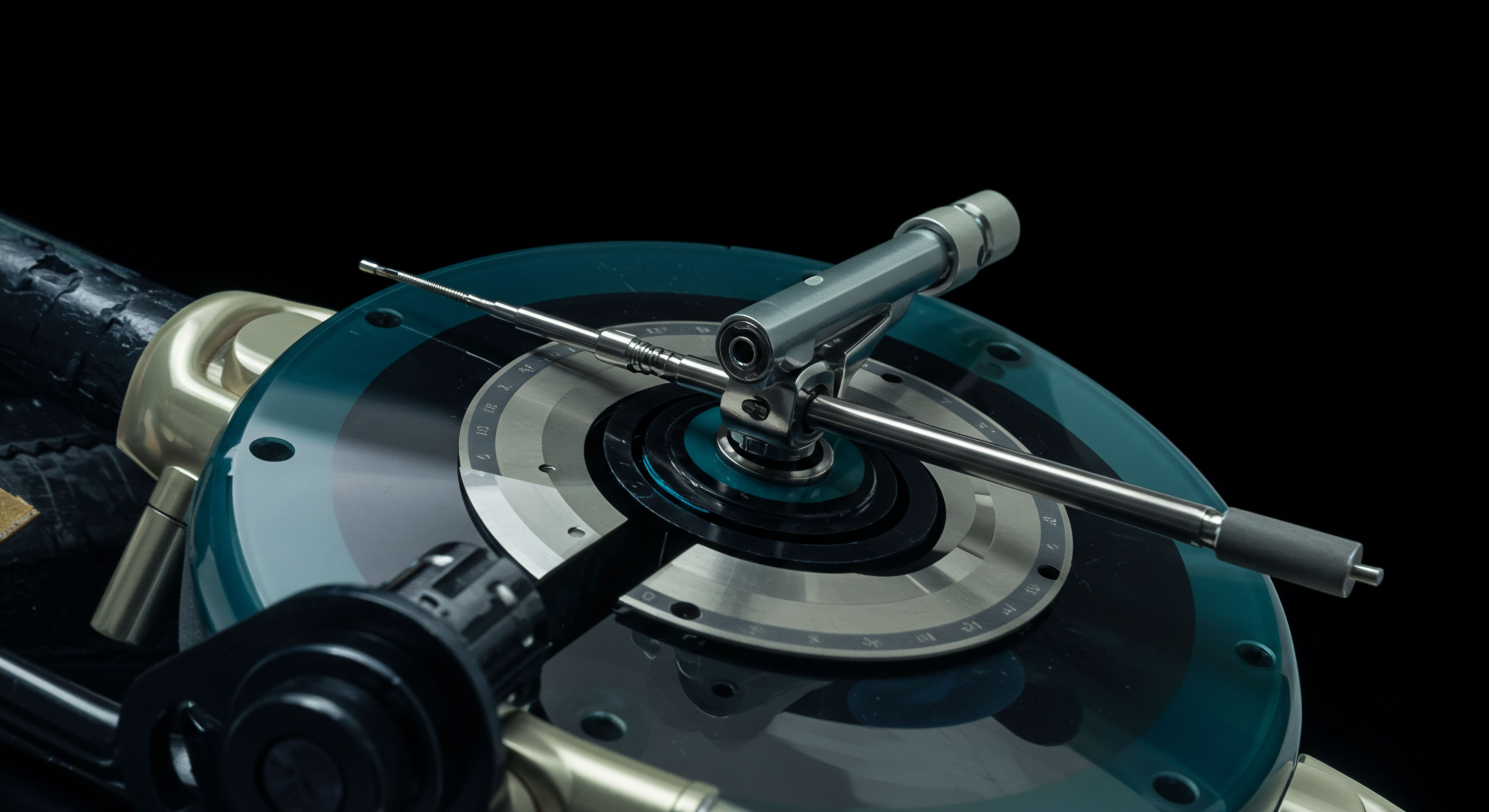

The Request for Quotation (RFQ) mechanism stands as a foundational instrument within sophisticated trading environments. It empowers participants to solicit competitive bids and offers directly from multiple liquidity providers for specific financial instruments. This direct interaction bypasses the fragmented nature of public order books, consolidating pricing discovery into a singular, controlled event. A direct line to concentrated liquidity provides a distinct advantage in a world of diffuse market access.

The RFQ mechanism centralizes competitive pricing, offering a direct pathway to superior execution in dislocated markets.

Consider the historical progression of market access, moving from open outcry pits to electronic exchanges. The RFQ represents a logical evolution, bringing the efficiency of bilateral negotiation into the digital age. It transforms what might otherwise be a diffuse search for pricing into a structured solicitation, ensuring transparency and competitive tension among counterparties. This structured approach fosters a more disciplined engagement with market opportunities.

Understanding the RFQ’s core mechanism reveals its power. A trader initiates a request for a specific derivative, perhaps a crypto option or a multi-leg spread. This request reaches a pre-selected group of market makers. Each market maker then submits their best available price.

The trader evaluates these responses, selecting the most advantageous quote for immediate execution. This streamlined process mitigates adverse price movements often encountered when executing large orders through conventional means.

Deploying RFQ for Investment Strategies

Harnessing the RFQ mechanism elevates trading strategies from speculative endeavors to calculated investment operations. Its application extends across various asset classes, from traditional equities to the rapidly expanding realm of crypto options. A deliberate application of this tool ensures capital efficiency and precision in execution, directly impacting portfolio performance.

Precision Execution for Options Spreads

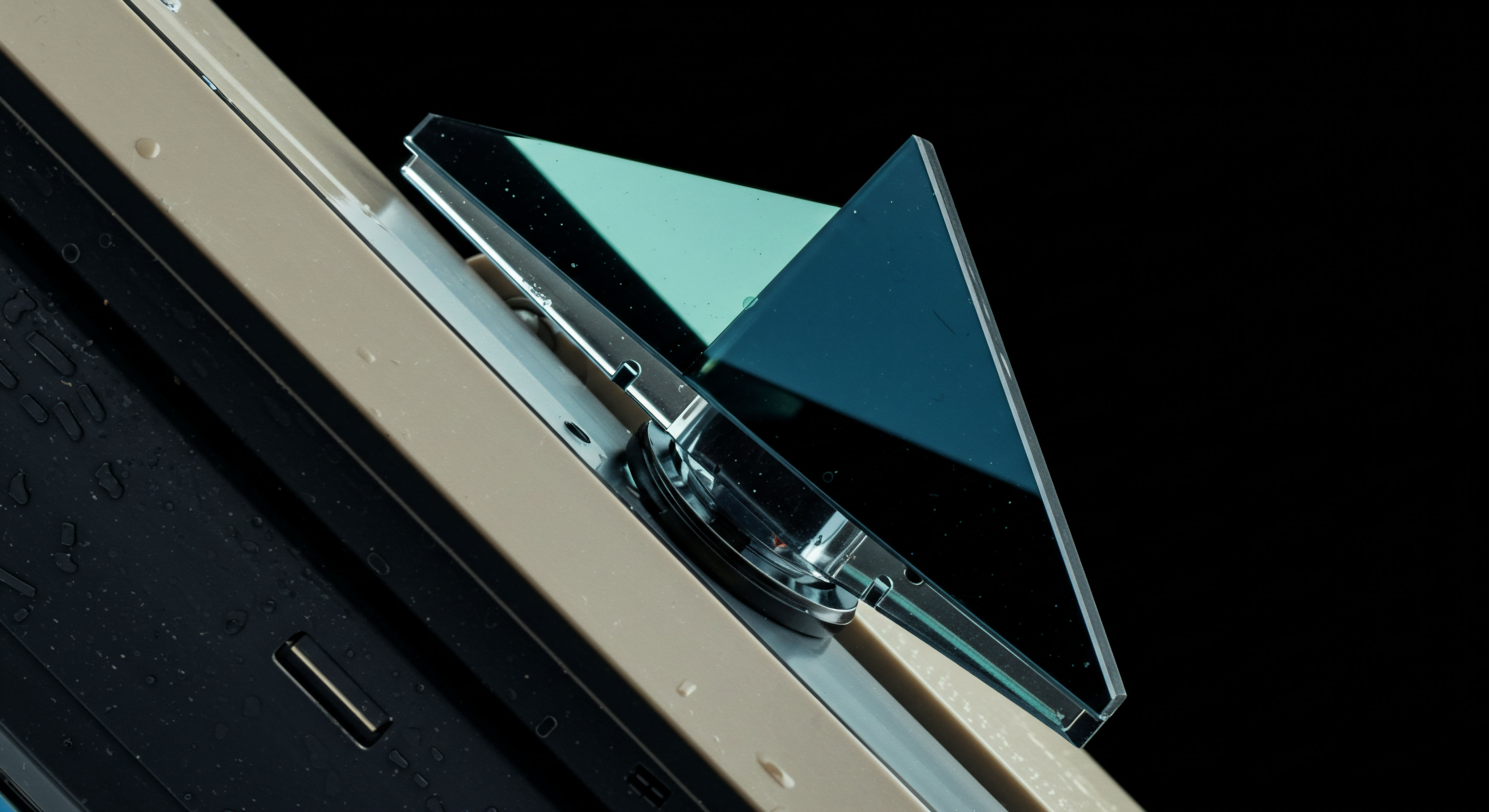

Constructing multi-leg options spreads demands exacting execution to preserve the intended risk-reward profile. Slippage on individual legs can erode profitability, especially in volatile periods. RFQ allows traders to request quotes for an entire spread as a single entity, ensuring simultaneous pricing from liquidity providers. This synchronous execution preserves the structural integrity of complex positions.

- Define the desired options spread, including strikes, expirations, and quantities for each leg.

- Transmit the multi-leg RFQ to a curated selection of market makers specializing in crypto options or other derivatives.

- Review the aggregated quotes, comparing the net premium or debit for the entire spread.

- Execute the optimal quote, securing the desired spread at a single, confirmed price point.

This approach eliminates the sequential execution risk inherent in attempting to leg into a spread through disparate orders. It provides a comprehensive view of the entire position’s cost, a critical factor for accurate profit and loss attribution. Managing this execution through a centralized process becomes a defining characteristic of professional engagement.

Block Trading Efficiency

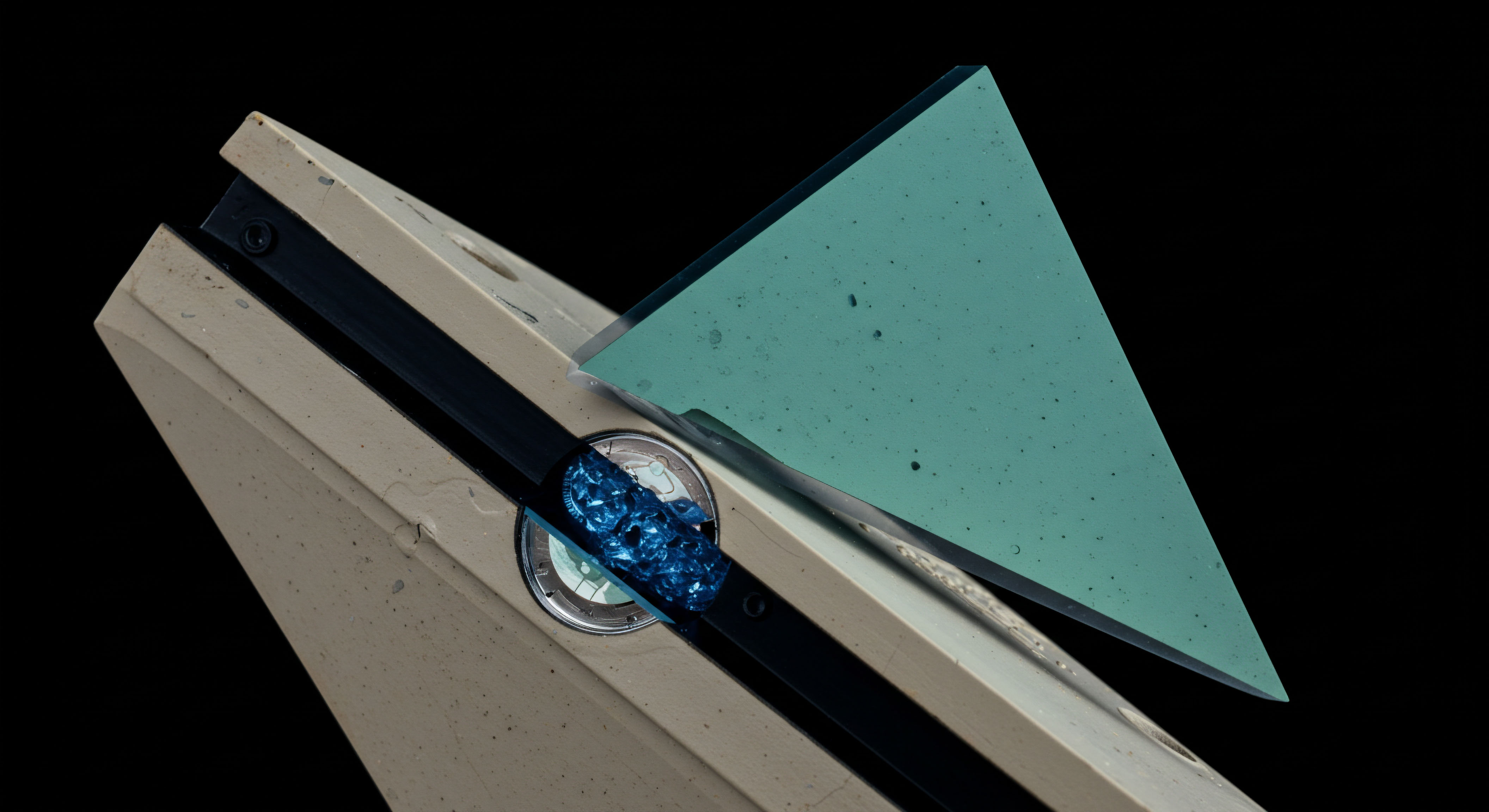

Executing substantial block trades without influencing market prices presents a persistent challenge. The RFQ environment provides a discrete channel for such transactions, shielding large orders from public scrutiny. This anonymity preserves market integrity and prevents front-running, allowing for the deployment of significant capital with minimal footprint.

A seasoned portfolio manager recognizes that the effective deployment of large capital allocations hinges upon discretion and efficiency. RFQ facilitates this by offering a private, negotiated environment. This is particularly valuable for Bitcoin options block and ETH options block trades, where public order books might lack the depth for immediate, frictionless execution of considerable size.

The ability to command liquidity for large positions, rather than simply accepting prevailing market prices, reshapes the landscape of institutional crypto engagement. This strategic advantage accrues directly to the bottom line, demonstrating a clear edge in managing substantial capital.

Volatility Hedging and Position Adjustment

Volatile markets necessitate dynamic hedging and swift position adjustments. RFQ provides a responsive mechanism for these operations. Traders can rapidly solicit quotes for instruments designed to hedge specific volatility exposures, such as straddles or collars, even for significant notional values. This responsiveness supports robust risk management frameworks.

Dynamic Collar Implementation

Implementing an ETH collar RFQ, for instance, involves selling an out-of-the-money call option and buying an out-of-the-money put option while holding the underlying asset. RFQ streamlines the pricing and execution of these components, enabling traders to establish or adjust their volatility hedges with precision and speed. The competitive nature of the RFQ ensures optimal pricing for these risk-mitigating structures.

Mastering Advanced RFQ Applications

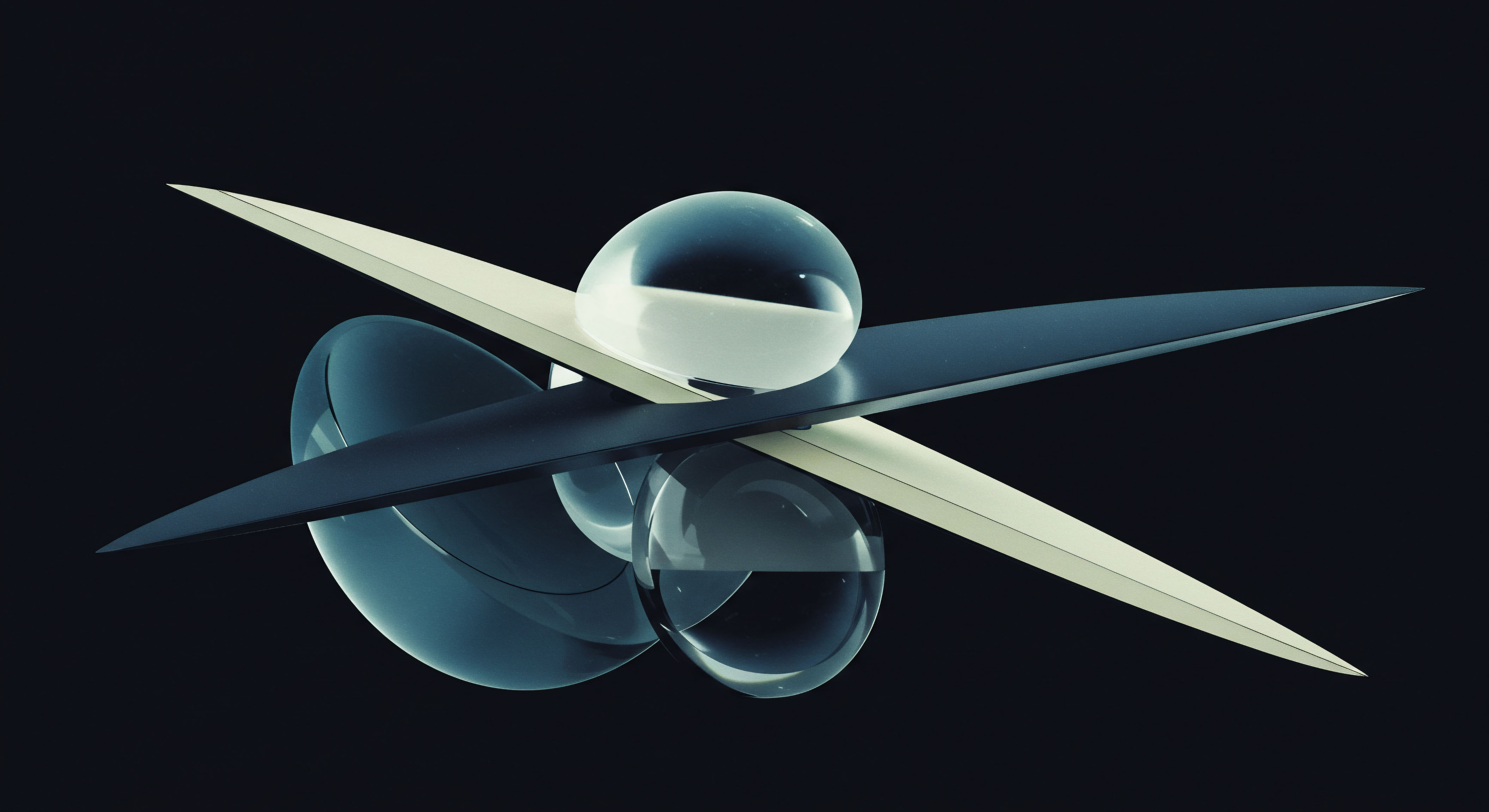

Beyond direct execution, the RFQ mechanism integrates into a broader framework of strategic market mastery. It becomes a central component of an overarching capital deployment strategy, enabling sophisticated portfolio construction and advanced risk management. This progression moves traders from competent application to a state of profound market command.

Liquidity Aggregation and Smart Order Routing

The RFQ’s power extends into sophisticated liquidity aggregation strategies. While it offers direct access to multiple dealers, its output also provides valuable data for refining smart order routing algorithms. Understanding which liquidity providers consistently offer the best pricing for specific instruments and sizes informs subsequent trading decisions. This feedback loop creates an iterative process of execution refinement.

The concept of “best execution” transforms from a theoretical ideal into a measurable outcome through consistent RFQ utilization. By analyzing the spread capture and price improvement achieved through competitive quotes, traders gain quantifiable metrics of their execution quality. This empirical feedback allows for continuous optimization of trading parameters, solidifying a sustained market edge.

Evaluating execution quality requires a deep understanding of market microstructure, particularly how different order types interact with available liquidity. A nuanced perspective on these interactions allows for a more informed assessment of true execution costs.

Integrating RFQ with Algorithmic Trading Systems

For high-frequency or systematically driven strategies, RFQ integration with algorithmic trading systems presents a significant frontier. Algorithms can be designed to automatically generate and respond to RFQs based on predefined parameters, such as target prices, volatility levels, or time-based execution windows. This automation ensures consistent application of the RFQ advantage at scale.

Consider a scenario where a large portfolio rebalancing requires the execution of multiple options blocks across various crypto assets. An integrated system could programmatically issue RFQs for each block, aggregate responses, and execute optimal trades, all while adhering to strict risk limits. This systematic approach transcends manual limitations, achieving a level of precision and speed unattainable through conventional methods. It elevates the entire trading operation, embedding superior execution directly into the operational DNA.

Strategic Volatility Management

Volatility block trades, often executed through RFQ, become a proactive tool for managing portfolio gamma and vega exposures. Traders can strategically initiate these trades to adjust their sensitivity to market movements, moving beyond reactive adjustments. This anticipatory positioning capitalizes on market dislocations and provides a robust defense against unexpected price swings. Mastering this dimension of trading distinguishes truly sophisticated market participants.

Commanding Market Flow

The RFQ mechanism is more than a mere transactional tool; it is a command center for liquidity, a strategic advantage in a market defined by its ceaseless motion. Professionals who master its application do not simply react to volatility; they engage it, shaping their execution outcomes with precision and foresight. This is the bedrock of sustained performance, a testament to strategic design meeting market opportunity.

Glossary

Rfq Mechanism

Eth Collar Rfq

Best Execution