Forging Market Command

Achieving a distinct advantage in crypto derivatives trading fundamentally relies on a deliberate approach to liquidity access. Request for Quote (RFQ) mechanisms provide a powerful tool for professional participants, offering a structured pathway to engage multiple liquidity providers simultaneously. This system fundamentally reshapes how substantial orders, particularly in options and complex multi-leg strategies, find optimal execution. Its design directly addresses the inherent fragmentation prevalent across various digital asset venues, consolidating pricing power for the initiating trader.

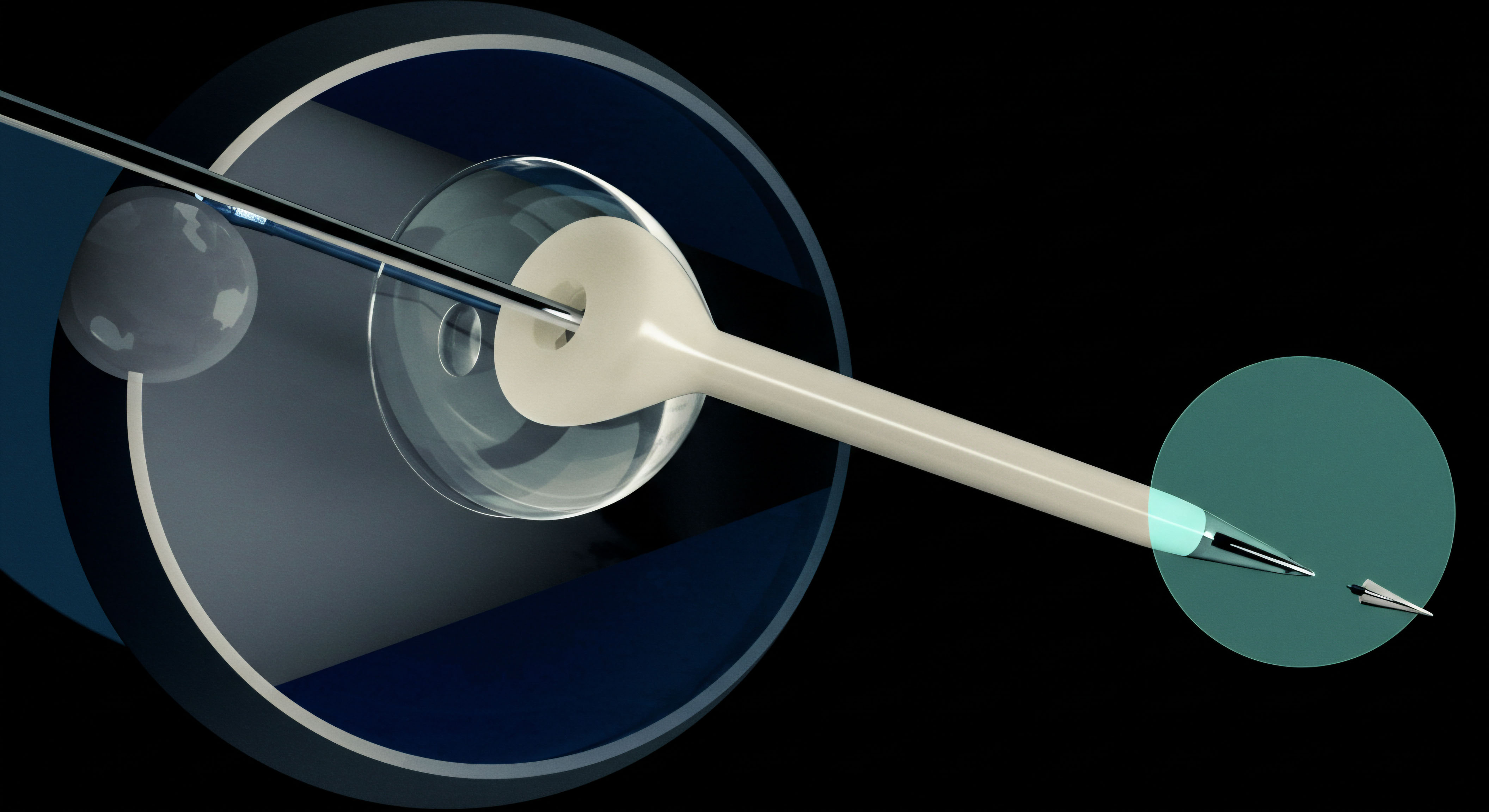

The operational mechanics of an RFQ system allow a trader to broadcast their desired trade parameters ▴ asset, quantity, side, and expiration ▴ to a selected group of market makers. These market makers then compete to offer their best executable prices within a private, contained environment. This competitive dynamic ensures a more favorable price discovery process than relying on order book depth alone. Securing superior pricing and tighter spreads on large positions becomes a repeatable outcome, not a fortuitous event.

A direct engagement with RFQ mechanisms delivers a systemic advantage, ensuring competitive price discovery across fragmented digital asset markets.

Understanding this framework transforms a trader’s perspective from passively accepting prevailing market conditions to actively shaping them. The process yields a significant reduction in implicit transaction costs, directly contributing to enhanced overall trade profitability. This structured interaction provides a robust foundation for anyone aiming to elevate their execution capabilities within the demanding crypto landscape. Acquiring proficiency with RFQ protocols represents a critical step towards professional-grade trading.

Deploying Precision Execution Strategies

Transitioning from conceptual understanding to actionable deployment demands a systematic approach to RFQ utilization. Successful traders integrate these mechanisms into their core investment and trading strategies, targeting specific outcomes with surgical precision. The objective remains consistent ▴ to secure optimal pricing and liquidity for positions that would otherwise suffer significant market impact.

Orchestrating Options Spreads

Executing multi-leg options spreads through an RFQ system significantly reduces the slippage commonly encountered when leg-by-leg execution occurs on a public order book. Traders can submit complex structures, such as Bitcoin straddles or ETH collars, as a single, indivisible quote request. This method ensures all legs fill at a predetermined net price, eliminating the risk of adverse price movements between individual fills. This unified execution preserves the intended risk-reward profile of the strategy.

The competitive nature of multi-dealer liquidity within an RFQ environment often results in tighter net spreads for these complex trades. Market makers, aware of the entire structure, price the package holistically, factoring in internal hedging efficiencies. This translates directly into a more favorable cost basis for the trader.

Executing Large Block Trades

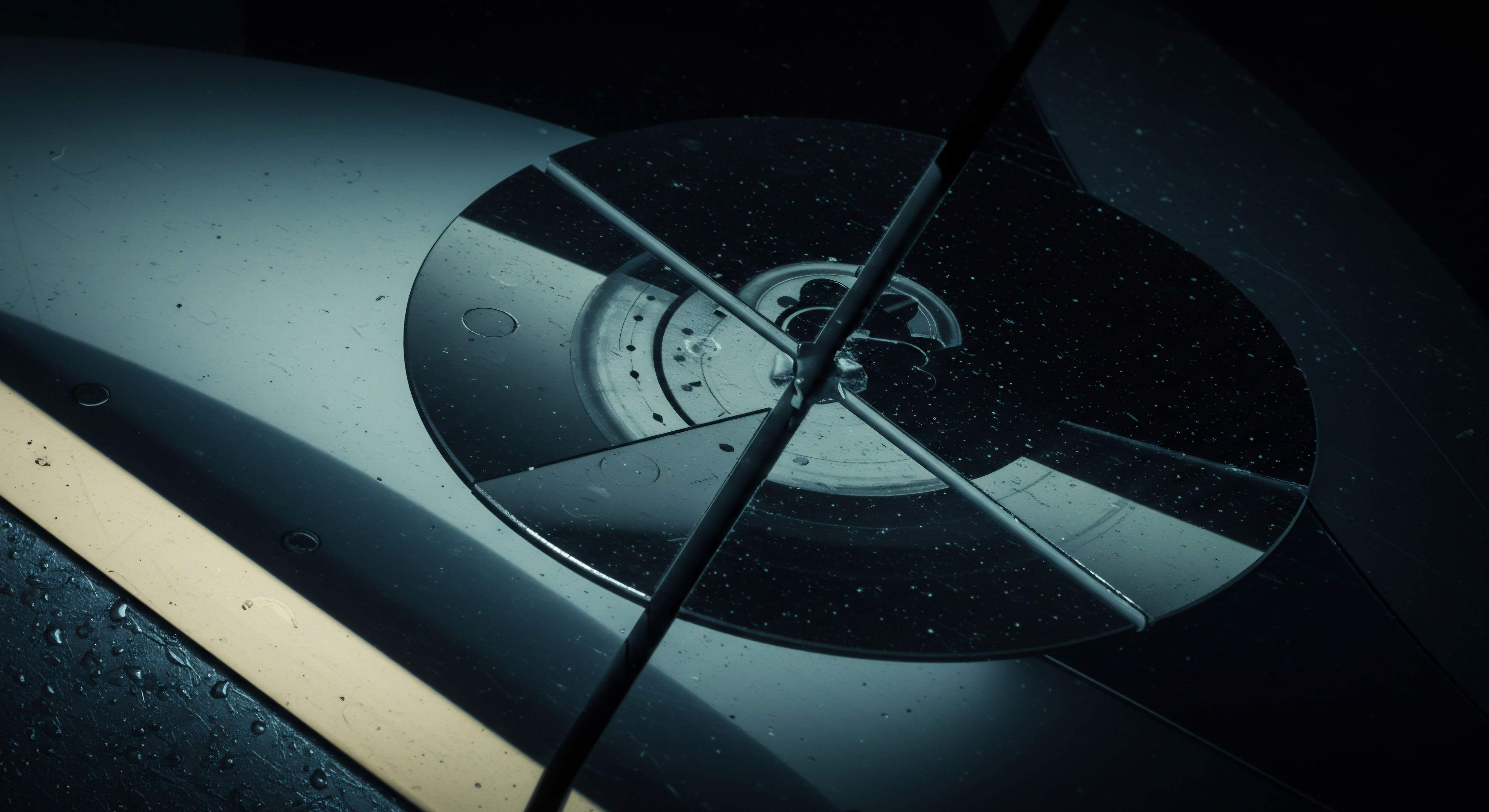

For substantial block trades in crypto options, an RFQ system becomes indispensable. Attempting to execute such volumes on open order books inevitably leads to considerable price impact and information leakage. The anonymous options trading environment of an RFQ allows institutions and sophisticated individual traders to move significant size without signaling their intentions to the broader market. This discretion protects the integrity of their trading strategy.

The protocol facilitates anonymous interaction with multiple liquidity sources, securing the best execution for large orders. Fill rates remain consistently high, a direct consequence of the committed quotes received from competing market makers. This ensures capital efficiency and minimizes the opportunity cost associated with partial fills or extended execution timelines. It simply works.

Integrating Volatility Plays

Traders actively capitalizing on volatility movements find RFQ particularly advantageous for constructing volatility block trades. Whether establishing a long volatility position via a large straddle or shorting volatility with a multi-leg iron condor, the RFQ system provides the necessary infrastructure for precise entry. It enables the efficient execution of large-scale positions designed to capture specific directional or non-directional volatility views.

The ability to source bespoke pricing for these advanced strategies directly contributes to a superior alpha generation profile. Market makers often possess a deeper understanding of implied volatility surfaces and can provide competitive quotes that reflect their nuanced risk assessments. This collaborative price discovery mechanism enhances the trader’s ability to capitalize on transient market dislocations.

- Submitting a multi-leg options spread as a single package mitigates execution risk.

- Leveraging RFQ for large block trades prevents significant market impact.

- Sourcing competitive quotes for volatility strategies improves entry points.

- Utilizing multi-dealer liquidity consistently yields tighter spreads.

- Achieving best execution through RFQ directly impacts the P&L of substantial positions.

Mastering Strategic Portfolio Calibration

Moving beyond individual trade execution, the true mastery of RFQ liquidity resides in its integration within a broader portfolio strategy. This involves a continuous calibration of risk exposures and a proactive stance towards market dynamics. The professional trader views RFQ as a dynamic component of their capital allocation framework, enhancing both offensive and defensive postures.

Advanced Risk Mitigation Frameworks

Implementing sophisticated risk management strategies often requires the precise execution of complex hedging instruments. RFQ protocols allow for the rapid and efficient deployment of tailored hedges, such as dynamic delta adjustments or gamma scalping overlays, without incurring undue transaction costs. This capacity provides a crucial advantage in managing the inherent convexity of crypto options portfolios. Maintaining tight control over portfolio Greeks becomes a streamlined, repeatable process.

The ability to source liquidity for these bespoke hedging instruments across multiple dealers provides a robust defense against unexpected market shocks. It ensures that risk parameters remain within predefined thresholds, safeguarding capital during periods of heightened volatility. This systematic approach to risk management transforms potential liabilities into manageable components of the overall strategy.

Strategic deployment of RFQ for portfolio rebalancing and hedging elevates risk management to a proactive, rather than reactive, discipline.

Integrating Algorithmic Execution Flows

Sophisticated traders increasingly integrate RFQ capabilities into their algorithmic execution systems. This allows for automated identification of optimal liquidity opportunities for large or complex orders, triggering RFQ requests when predefined market conditions are met. Such a fusion of quantitative analysis and bespoke execution channels represents a frontier in smart trading. The seamless interaction between algorithms and multi-dealer liquidity optimizes overall portfolio performance.

This programmatic approach minimizes human latency and ensures consistent adherence to execution policy, even in fast-moving markets. The data generated from these RFQ interactions provides invaluable feedback for refining algorithmic models, creating a virtuous cycle of continuous improvement in execution quality. The strategic implication for portfolio managers is profound ▴ a consistent, measurable edge derived from superior operational infrastructure. My professional experience reinforces the undeniable impact of these refined processes.

The Enduring Command of Liquidity

The pursuit of superior outcomes in crypto derivatives demands an unwavering commitment to execution excellence. RFQ liquidity stands as a testament to this principle, providing a tangible mechanism for traders to assert control over their market interactions. It elevates the trading process from a reactive engagement with fragmented order books to a proactive command of competitive pricing. This operational sophistication fundamentally reshapes the potential for alpha generation, establishing a clear delineation between passive participation and strategic market influence.

Glossary

Market Makers

Rfq System

Multi-Dealer Liquidity

Anonymous Options Trading

Block Trades