Strategic Execution Foundations

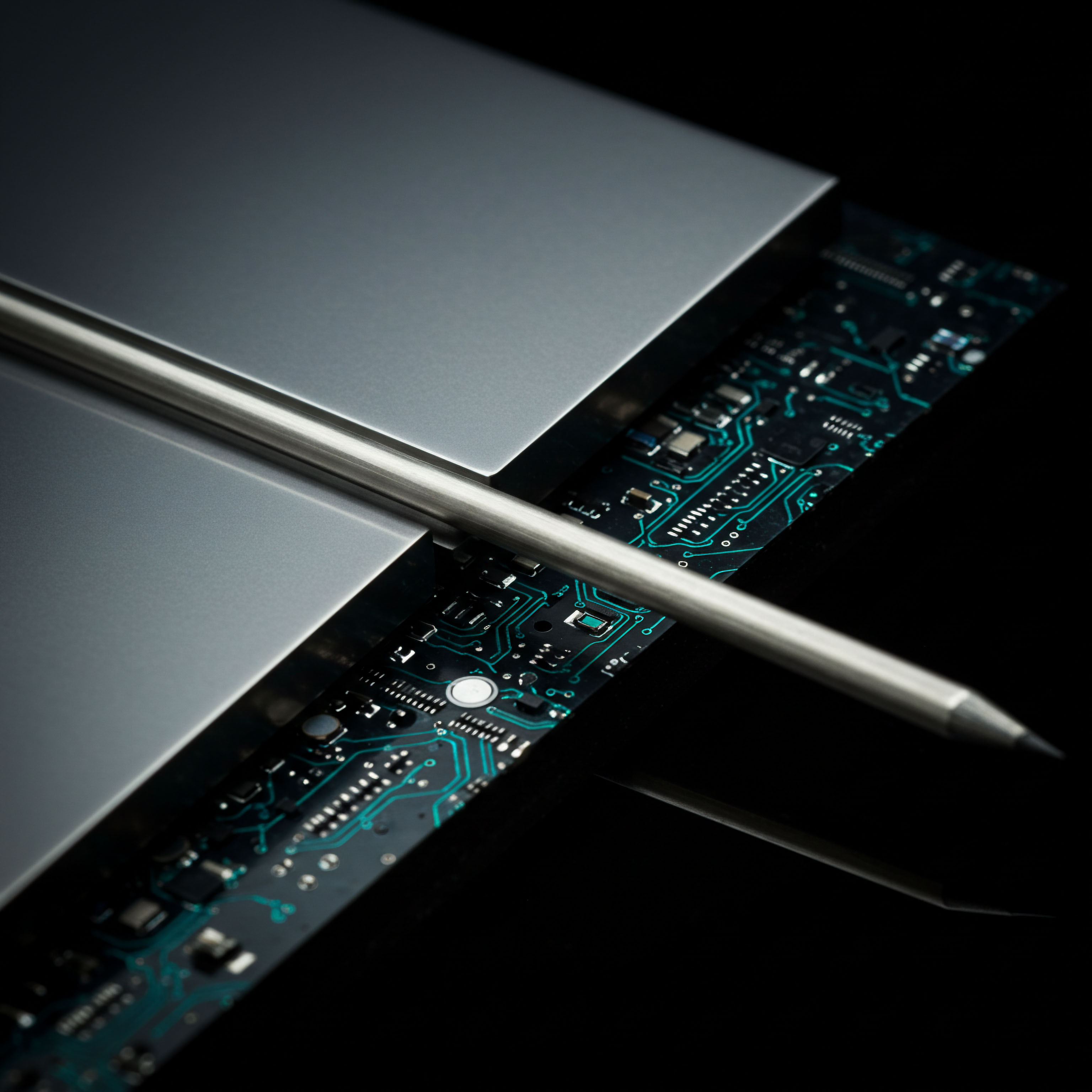

Mastering crypto options demands a commanding grasp of execution. A Request for Quote, or RFQ, serves as a direct channel to multi-dealer liquidity, offering a sophisticated pathway for price discovery and order fulfillment. This mechanism allows participants to solicit bids and offers from multiple market makers simultaneously for a specific options contract or spread. The process centralizes competitive pricing, moving beyond the limitations of single-venue order books.

Understanding the core function of an RFQ reveals its strategic advantage. It orchestrates a controlled environment for block trades, where significant capital can be deployed with minimal market impact. The system aggregates liquidity, providing a transparent view of prevailing market conditions for a defined trade size. This structured approach facilitates superior pricing outcomes, a cornerstone for any serious derivatives strategist.

RFQ orchestrates competitive pricing for block trades, ensuring minimal market impact and superior execution.

The initial perception of negotiating multi-dealer liquidity can appear intricate. Yet, the underlying logic is remarkably straightforward ▴ centralizing competition for optimal terms. This process ensures traders command better pricing, mitigating the slippage often associated with large orders in fragmented markets. It represents a systematic approach to securing advantageous entry and exit points, a critical component for achieving alpha.

Engaging with RFQ transforms execution into a proactive discipline. It provides a direct line to institutional-grade liquidity, allowing for tailored order specifications. This capability moves beyond simply reacting to available prices, empowering traders to shape their execution environment. The foundation for consistent profitability rests upon such refined operational channels.

Deploying Options Strategies

Transitioning from understanding to active deployment defines a strategic trader. RFQ becomes an indispensable tool for executing a range of crypto options strategies, ensuring optimal pricing for complex structures. Its utility spans from simple calls and puts to intricate multi-leg configurations, offering a robust method for capturing specific market views.

Volatility Capture with RFQ

Harnessing market volatility requires precise execution. Strategies like straddles and strangles, designed to profit from significant price movements, benefit immensely from RFQ. Soliciting quotes for both call and put components simultaneously ensures a balanced entry price, crucial for managing the initial cost basis. This coordinated approach minimizes adverse selection.

Executing Straddles and Strangles

Building a straddle or strangle involves buying both a call and a put with the same (straddle) or similar (strangle) strike price and expiration. Executing these as a single RFQ package ensures the entire position fills at a coherent price. The multi-dealer competition drives down the combined premium, enhancing the strategy’s potential return profile. Precision matters.

Directional Plays and Hedging

Directional options strategies, such as covered calls or protective puts, also gain significant advantage through RFQ. For a covered call, selling the call leg via RFQ optimizes the premium received, augmenting income generation. When constructing a protective put, RFQ secures the lowest possible premium for downside protection, preserving capital more effectively.

Optimizing Collar Structures

A collar strategy, combining a long asset, a sold call, and a bought put, balances income generation with downside protection. Executing the options legs through RFQ allows for a tighter spread between the premium received and the premium paid. This refined execution improves the overall risk-adjusted return of the hedged position, making capital deployment more efficient.

- Identify the specific crypto options strategy and its constituent legs.

- Specify the desired size and strike prices for each option component.

- Submit the multi-leg request for quotation to multiple liquidity providers.

- Evaluate the aggregated bids and offers for the best available pricing.

- Execute the entire options package as a single, unified transaction.

Mastering Market Edge

The true measure of a strategist lies in integrating individual tools into a coherent, alpha-generating framework. RFQ, when viewed as a core component of a sophisticated execution system, unlocks advanced applications that refine portfolio performance and risk management. This progression moves beyond tactical trades, reaching into the realm of systemic advantage.

Portfolio Hedging with Precision

Large-scale portfolio hedging demands execution channels that absorb significant order flow without compromising price. RFQ provides this capability for crypto options, enabling the precise deployment of complex hedging structures. Whether implementing a volatility hedge across an entire crypto asset basket or establishing dynamic delta hedges, RFQ ensures minimal market distortion. This approach safeguards capital against adverse market movements with institutional-grade efficiency.

Strategic Block Trading

Executing substantial block trades in crypto options often presents liquidity challenges. RFQ overcomes this by compelling multiple dealers to compete for the order, creating an environment where deep liquidity materializes on demand. This is particularly relevant for BTC options block and ETH options block trades, where significant size can impact prices. Engaging with RFQ ensures optimal fill rates and price certainty, critical for managing large positions.

Mastery of RFQ transforms execution into a strategic differentiator. It provides the capability to navigate fragmented liquidity landscapes, ensuring that capital is deployed and protected with unparalleled efficiency. This advanced understanding allows traders to sculpt their market exposure, building robust portfolios resilient to volatility and responsive to opportunity. The consistent application of such refined execution channels separates transient gains from enduring market advantage.

The Strategic Imperative

The journey toward commanding crypto options markets demands a commitment to superior tools and a relentless pursuit of execution excellence. RFQ stands as a testament to this imperative, offering a direct path to optimized pricing and capital efficiency. It reshapes the trading landscape, providing a definitive edge for those who choose to wield its power. This guide serves as a beacon, illuminating the path from tactical engagement to enduring strategic dominance.

Glossary

Multi-Dealer Liquidity

Crypto Options

Risk Management