Your Execution Imperative

Mastering the intricacies of crypto options demands an unwavering commitment to superior execution. Professional traders recognize the Request for Quote, or RFQ, as a fundamental mechanism for achieving optimal pricing and liquidity within the digital asset derivatives landscape. This process allows participants to solicit bids and offers from multiple market makers simultaneously, creating a competitive environment for bespoke transactions.

The core utility of an RFQ system rests upon its capacity to aggregate liquidity, particularly for larger block trades or complex options spreads. Traditional order books often struggle to accommodate substantial volume without incurring significant slippage, diminishing potential returns. A well-designed RFQ channels diverse liquidity sources into a single, efficient interaction, thereby ensuring participants receive a robust price discovery process.

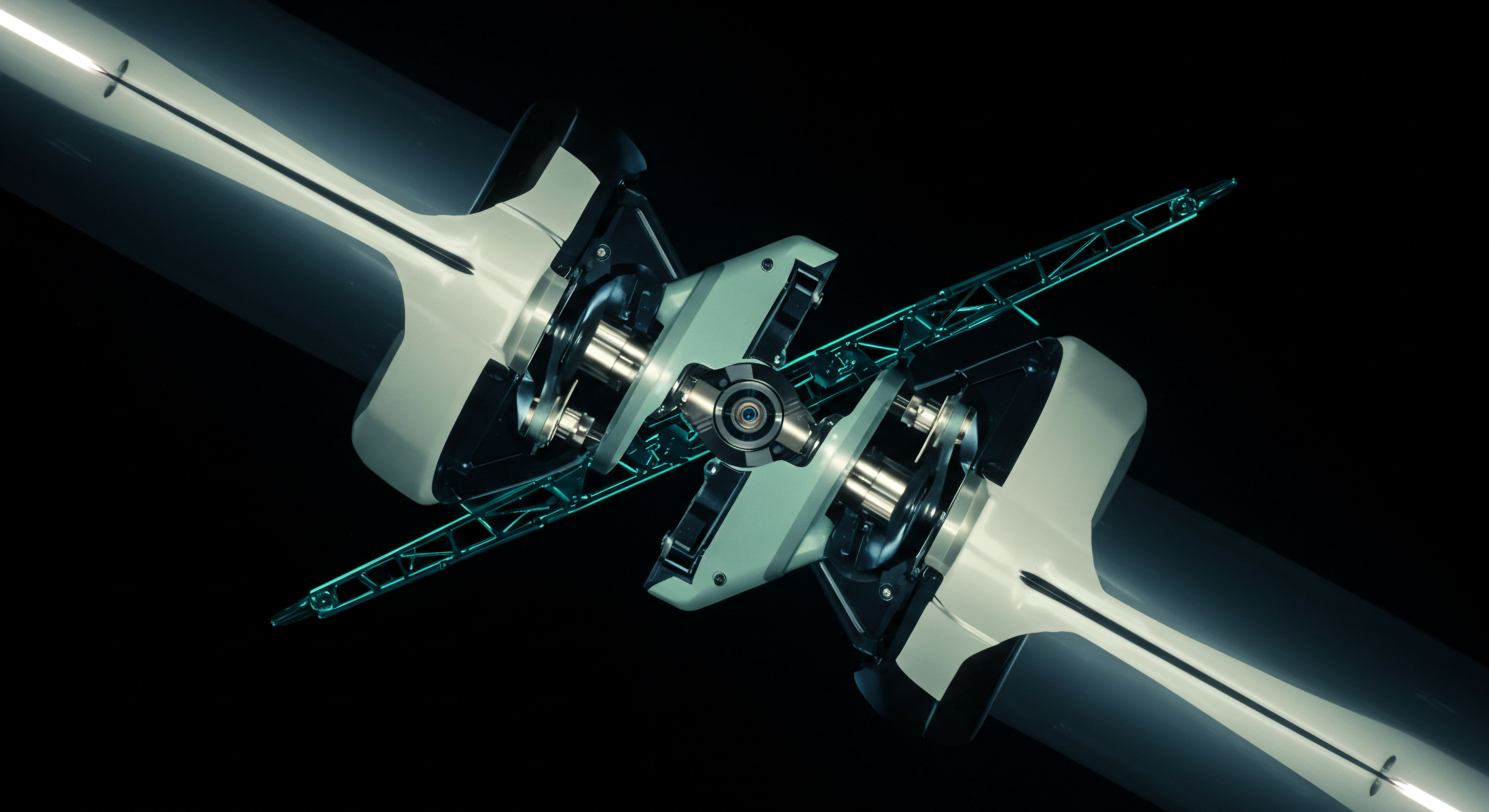

A robust RFQ system transforms fragmented liquidity into a singular, competitive arena, securing optimal pricing for sophisticated crypto options.

Understanding this operational framework provides a distinct advantage. It positions traders to actively command their execution, moving beyond passive price acceptance towards a proactive stance in market engagement. This foundational insight empowers individuals to approach the crypto options market with precision, cultivating a mindset centered on strategic advantage rather than mere transactional activity.

Deploying Strategic Advantage

Translating foundational understanding into tangible investment outcomes requires disciplined application of the RFQ mechanism. This section details specific strategies for leveraging crypto options RFQ to secure superior execution and enhance portfolio performance. A focus on quantifiable edge guides these approaches, reflecting the rigorous demands of institutional-grade trading.

Optimizing Block Trade Execution

Executing large crypto options positions presents a unique challenge within volatile digital markets. Utilizing an RFQ for block trades mitigates adverse price impact, a common friction point in standard order book environments. Traders submit their desired size and instrument, receiving competitive quotes from multiple counterparties, ensuring depth of liquidity meets transactional scale.

Minimizing Slippage in BTC Options

A significant portion of a trade’s profitability erodes through slippage when executing substantial Bitcoin options positions. Engaging an RFQ allows for a pre-negotiated price across the entire block, locking in a more favorable average entry or exit point. This disciplined approach preserves capital and maximizes the realized value of a strategic market view.

Consider the strategic implications of executing a 500 BTC options block. Without an RFQ, a trader might face incremental fills at progressively worse prices, eroding the intended profit margin. The RFQ process centralizes this negotiation, presenting a consolidated price derived from multiple market makers competing for the order flow.

Crafting Options Spreads with Precision

Complex options strategies, such as straddles, collars, or butterflies, demand simultaneous execution of multiple legs to maintain the desired risk profile. RFQ systems excel in this domain, enabling the execution of multi-leg spreads as a single, atomic transaction. This prevents leg risk, where individual legs fill at unfavorable prices, distorting the intended strategy.

ETH Collar RFQ Applications

An Ethereum collar strategy, designed to hedge downside risk while capping upside potential, involves buying an out-of-the-money put option and selling an out-of-the-money call option against an existing ETH holding. Executing both legs concurrently via an RFQ ensures the spread’s net premium and strike differentials align precisely with the intended risk-reward profile. This synchronized execution protects the integrity of the strategic position.

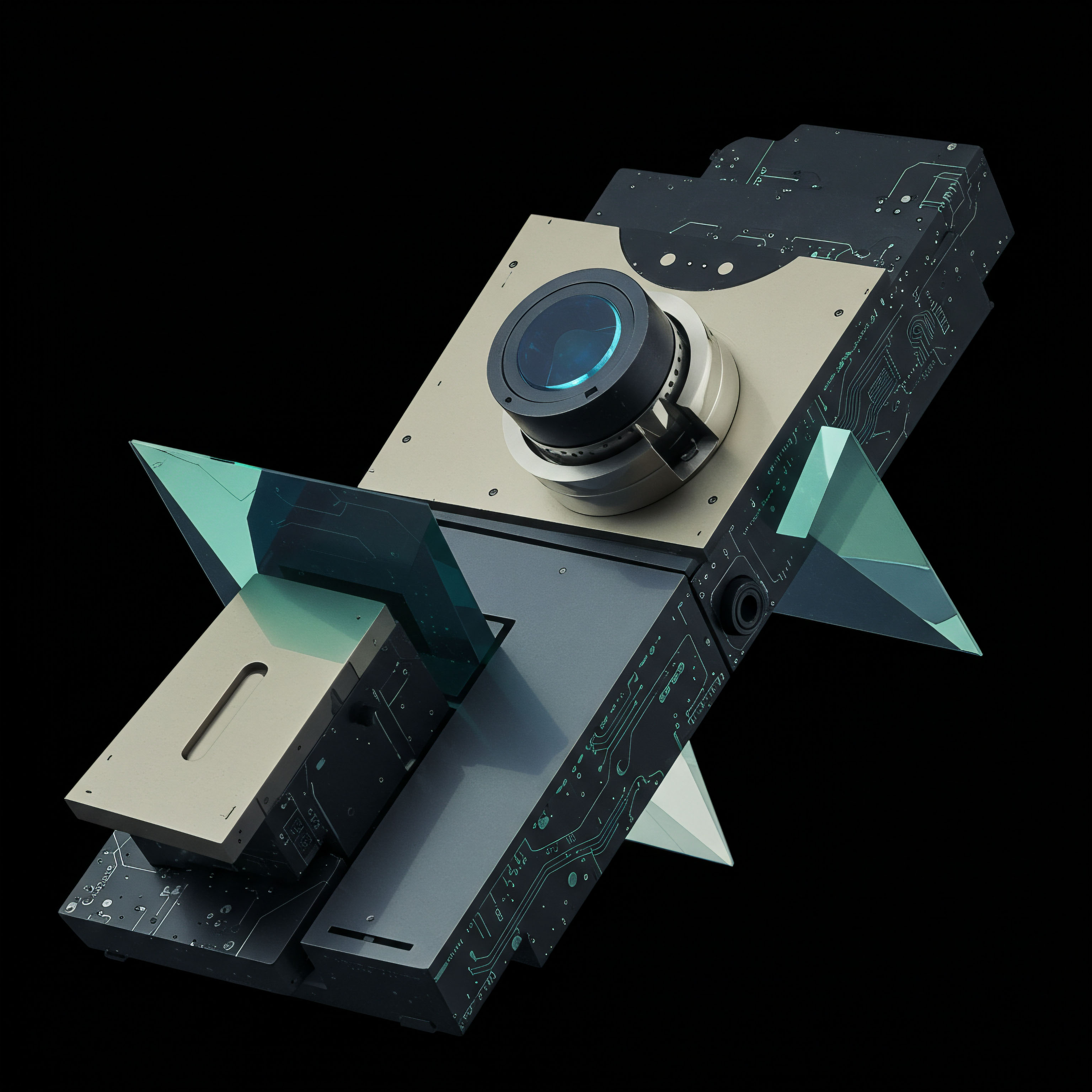

- Price Discovery ▴ RFQ aggregates competitive bids/offers from multiple dealers for specific options contracts.

- Execution Certainty ▴ Secures a single, consolidated price for multi-leg strategies, eliminating leg risk.

- Reduced Transaction Costs ▴ Competition among market makers drives tighter spreads and lower implicit costs.

- Anonymity ▴ Provides a layer of anonymity for large orders, preventing information leakage that could move the market.

- Customization ▴ Supports tailored options structures and expiry dates, accommodating unique market views.

This systematic approach to spread trading elevates execution quality. It shifts the focus from managing individual option contracts to optimizing the holistic strategy, a hallmark of sophisticated portfolio management.

Advanced Portfolio Integration

Moving beyond individual trades, the true power of mastering crypto options RFQ emerges in its integration within a comprehensive portfolio management framework. This involves leveraging the mechanism for advanced risk management, volatility expression, and systematic alpha generation, solidifying a long-term market edge.

Systematic Volatility Trading

Volatility represents a distinct asset class, and RFQ facilitates its precise expression through complex options structures. Traders can execute large volatility block trades, such as long or short gamma positions, with minimal market impact. This enables the implementation of sophisticated quantitative models that capitalize on anticipated shifts in implied volatility, moving beyond directional bets.

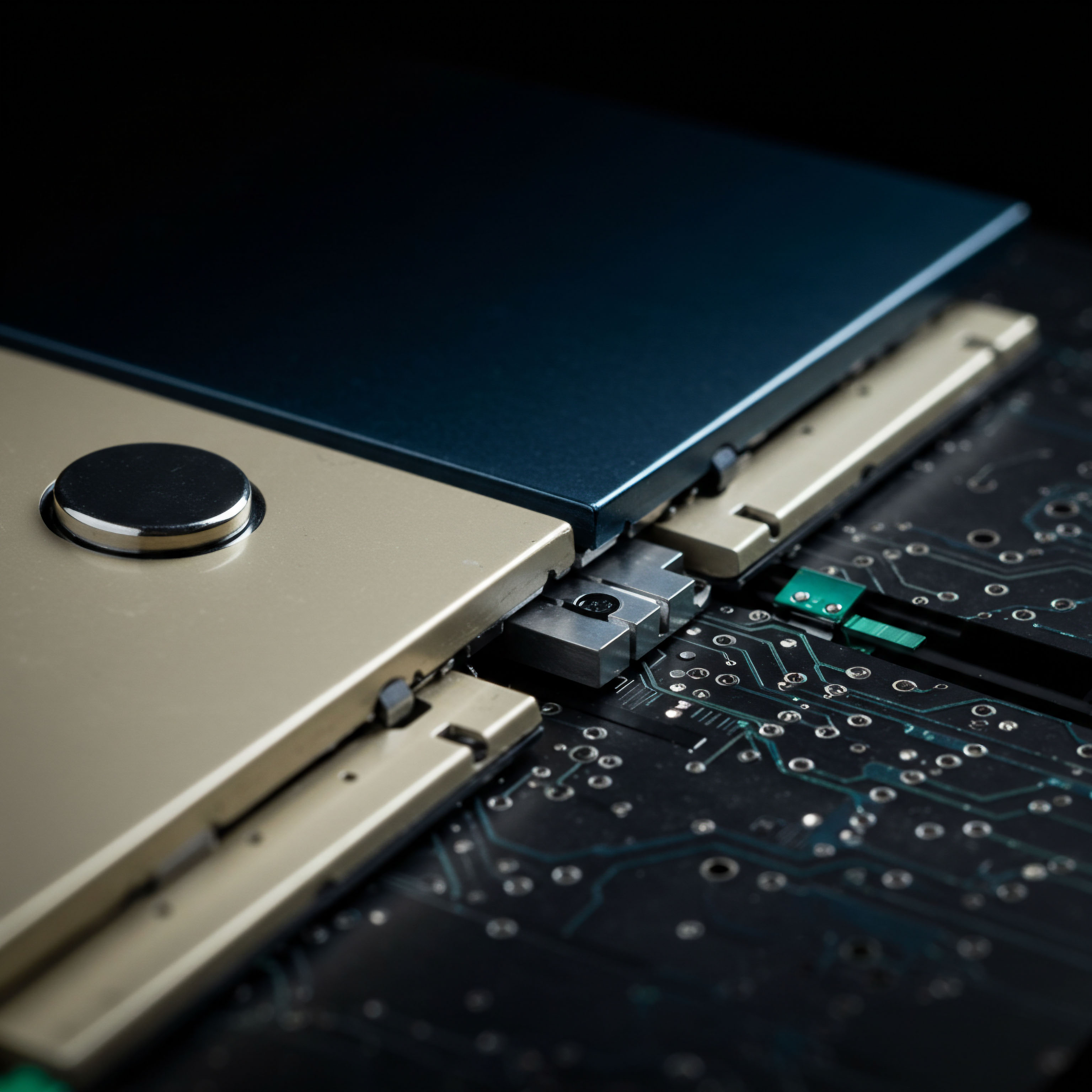

A deep understanding of market microstructure, coupled with the ability to command liquidity through RFQ, allows for the deployment of advanced strategies. This includes dynamically adjusting portfolio delta and gamma exposures, optimizing hedges, and capitalizing on dislocations in the volatility surface. Such operations demand an execution pathway that ensures precision and minimizes implicit costs.

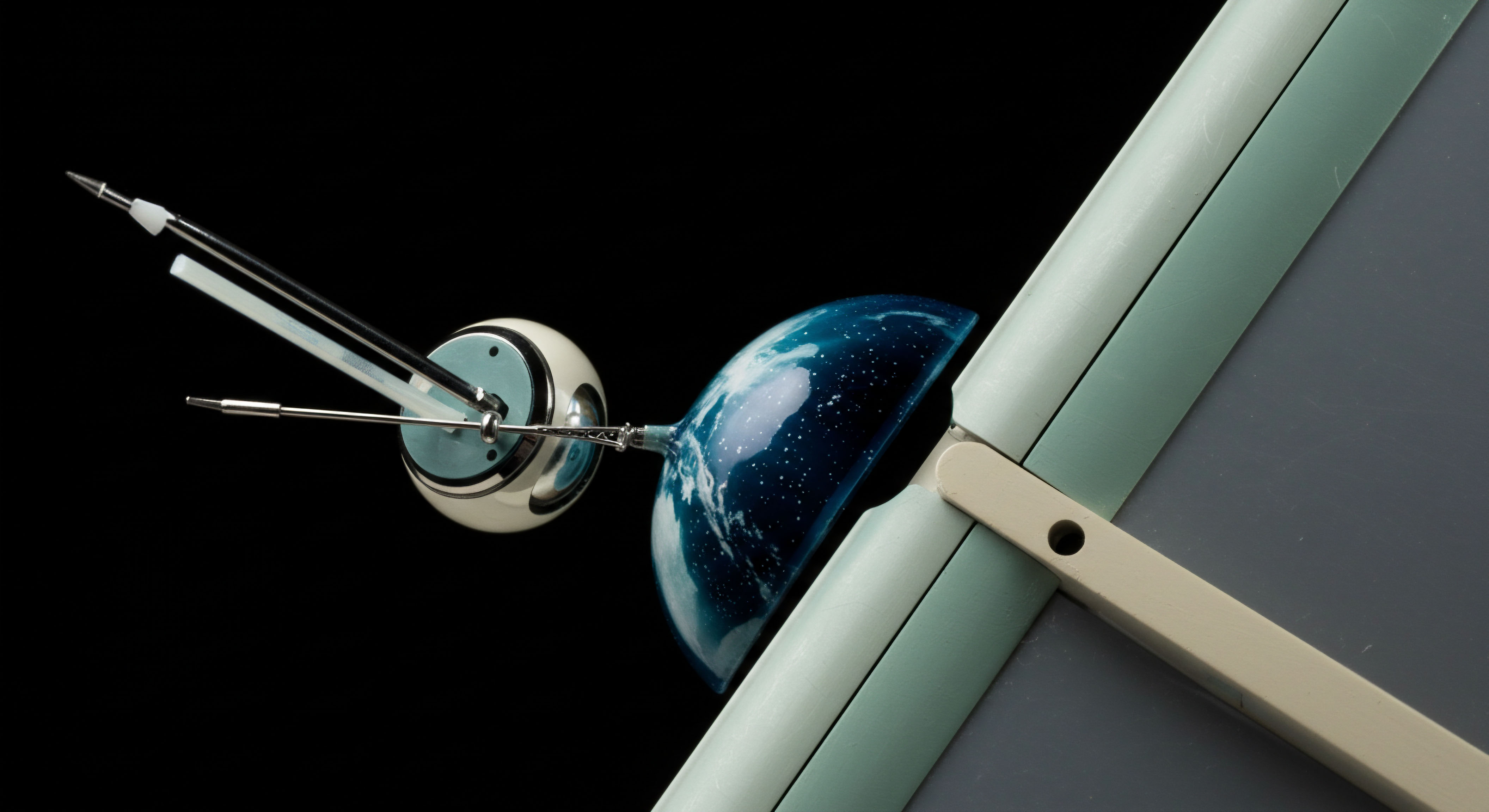

Integrating RFQ mastery into portfolio construction transforms tactical trades into a systematic advantage, driving consistent, risk-adjusted returns.

The process of identifying a market opportunity, structuring the appropriate options position, and executing it efficiently through an RFQ forms a cohesive, high-performance loop. This cycle continuously refines a trader’s capacity to generate alpha across diverse market conditions, solidifying a reputation for exceptional market acumen.

The Persistent Pursuit of Edge

The journey through crypto options trading, marked by its inherent dynamism, continually rewards those who embrace strategic execution. Mastering the RFQ mechanism represents a significant leap in this pursuit, offering a pathway to operational excellence and superior outcomes. It refines the craft of trading, transforming conceptual advantage into realized gains.

This persistent focus on refined processes, from initial market assessment to final execution, defines the professional approach. It is a continuous feedback loop, where each trade informs the next, building a deeper understanding of market mechanics and personal discipline. The commitment to precise execution remains an enduring cornerstone of successful engagement within these evolving markets.

The most compelling aspect of this strategic evolution lies in the capacity for continuous improvement. Every successful RFQ execution, every refined options spread, contributes to a growing body of expertise. This intellectual capital becomes the true differentiator, a profound asset in the relentless quest for market advantage.

Glossary

Crypto Options

Crypto Options Rfq

Options Block

Risk Management