Cycle Navigation Foundations

Navigating crypto cycles demands a strategic framework, one that elevates market participation beyond speculative impulses. A robust approach centers on precise execution and calculated risk calibration. Mastering this environment requires tools designed for efficiency and control, offering a tangible edge.

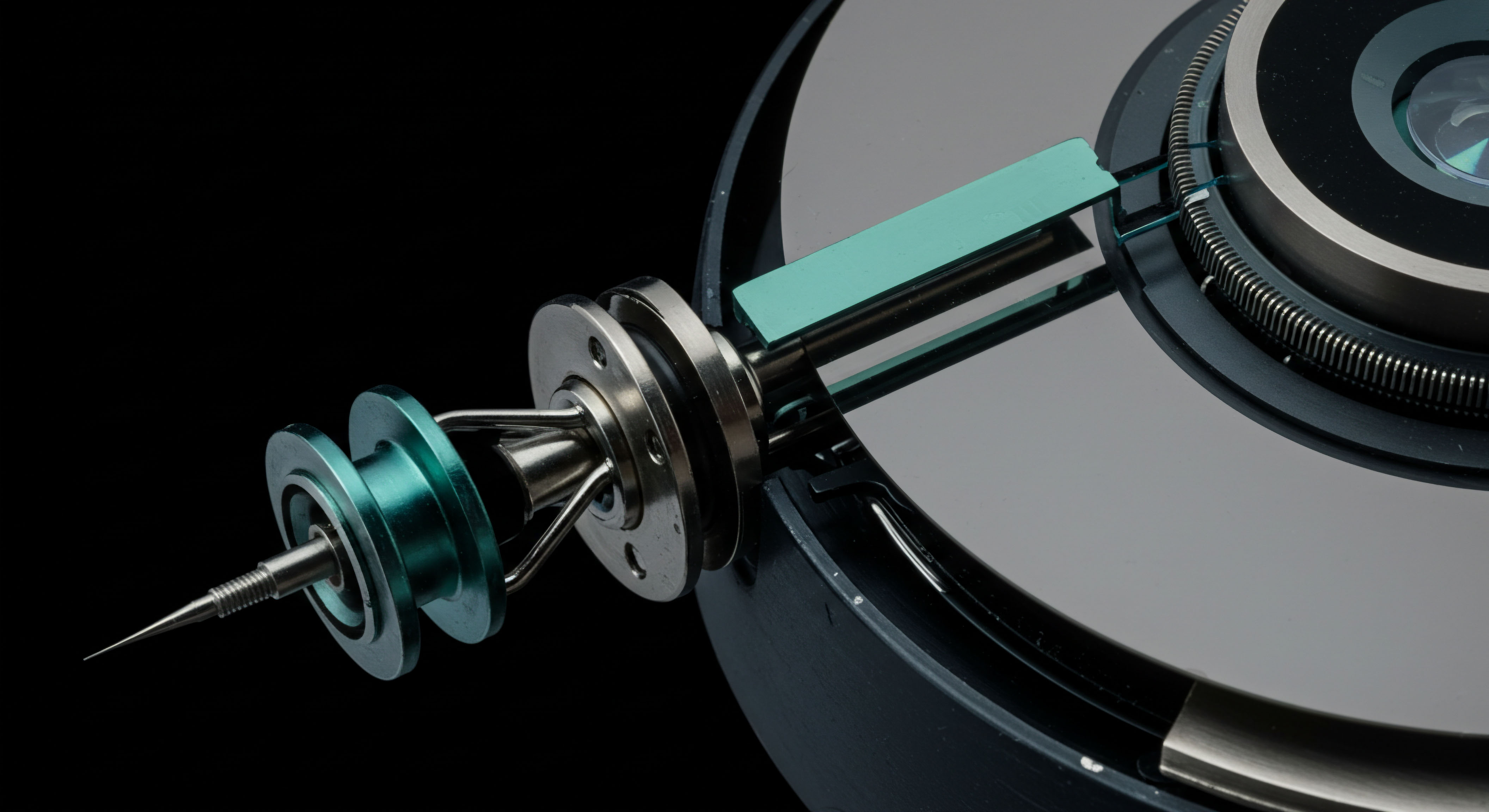

Understanding the mechanics of a Request for Quote (RFQ) system, particularly within the crypto derivatives landscape, provides a critical advantage. This mechanism allows participants to solicit bids and offers from multiple liquidity providers simultaneously for a specified trade size. Such a structure facilitates competitive pricing, a cornerstone of superior execution quality. The process empowers traders to secure optimal terms for their positions, whether initiating a new trade or adjusting existing exposures.

Precision execution through RFQ systems represents a fundamental shift in securing optimal terms for crypto derivatives positions.

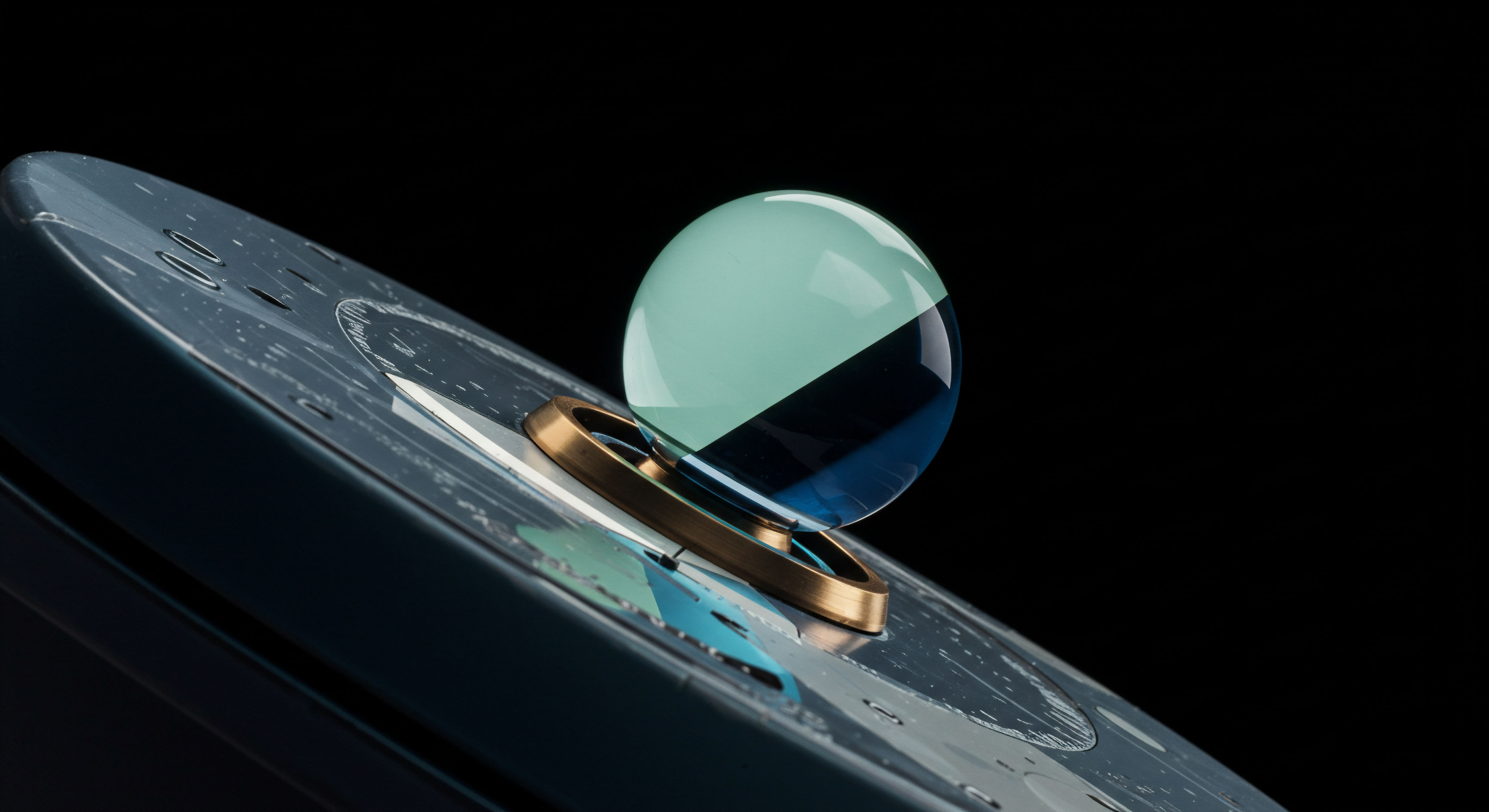

This foundational knowledge underpins a disciplined approach to options trading. Options contracts, when deployed with strategic intent, offer unparalleled flexibility in expressing directional views, managing volatility, or hedging existing spot positions. Grasping the basic elements of options ▴ strike price, expiration, and underlying asset ▴ becomes the initial step in constructing sophisticated market plays. The strategic application of these instruments moves a trader beyond simple buy-and-hold strategies, enabling a dynamic engagement with market dynamics.

Strategic Capital Deployment

Deploying capital with purpose during crypto cycles requires a keen understanding of how advanced trading mechanisms amplify returns and mitigate exposure. Integrating Request for Quote (RFQ) functionality into your investment process transforms execution, particularly for substantial positions. This method ensures a competitive price discovery, a vital component for preserving capital and enhancing profitability in volatile markets.

Optimizing Block Trades

Block trading in Bitcoin or Ethereum options through an RFQ system represents a significant advancement for institutional participants. Executing large orders discreetly minimizes market impact, a persistent concern for significant capital allocations. The multi-dealer liquidity inherent in these systems creates an environment where price takers command superior terms, directly impacting portfolio performance.

Consider the scenario of a substantial directional conviction in Ethereum. A direct market order for a large ETH options block might incur considerable slippage. Utilizing an RFQ system, conversely, solicits firm quotes from various market makers, allowing for a comparative assessment and selection of the most advantageous price. This structured approach shields the trade from adverse price movements often associated with large market orders.

Structured Options Strategies

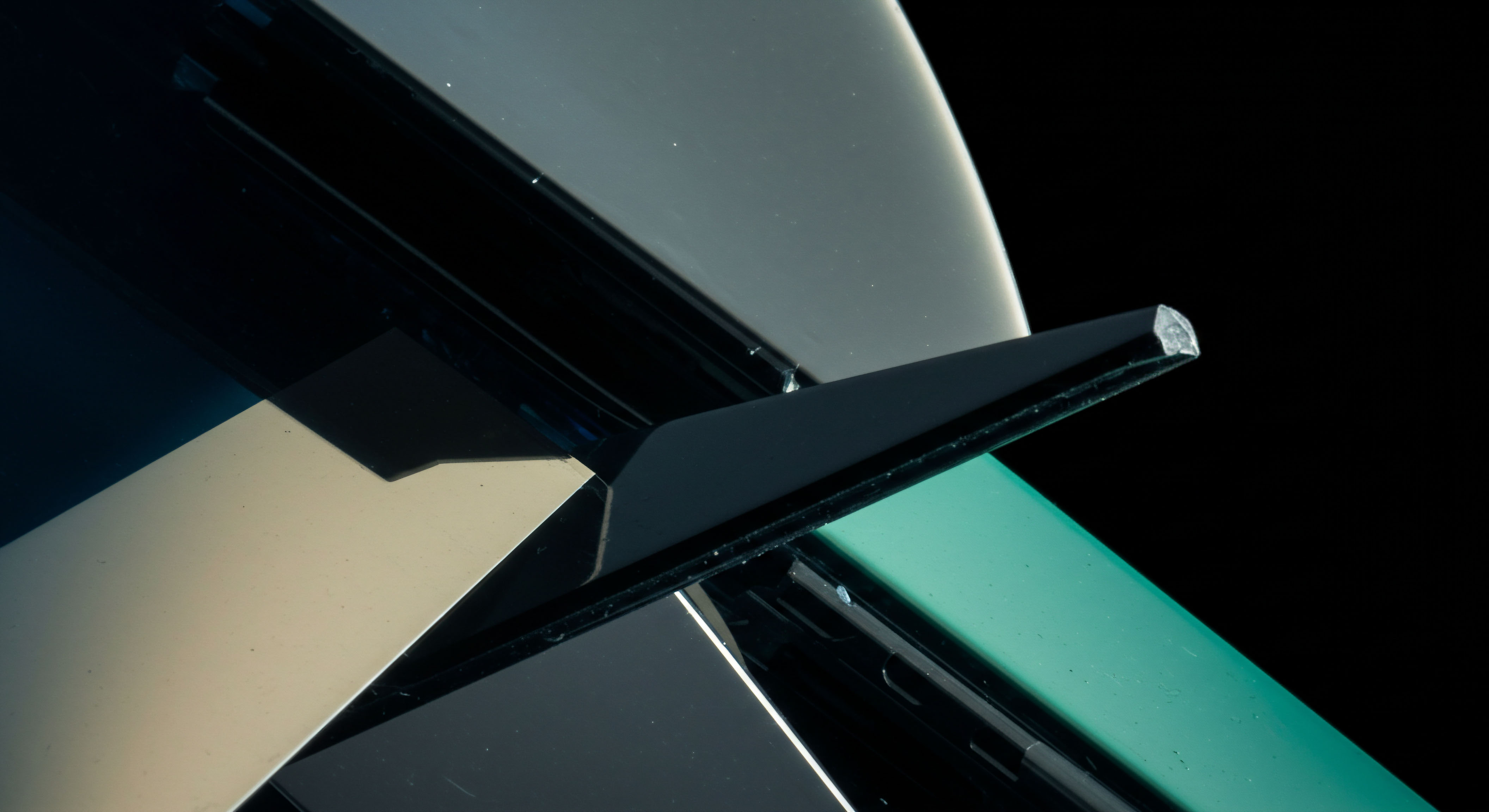

Options spreads, executed via RFQ, provide a nuanced framework for expressing complex market views while managing risk parameters. These multi-leg strategies allow for precise calibration of risk and reward profiles, adapting to various market conditions.

- BTC Straddle Blocks ▴ Deploying a Bitcoin straddle block allows a trader to capitalize on significant volatility shifts, irrespective of direction. This strategy involves buying both a call and a put option with the same strike price and expiration date. Executing this as a block via RFQ ensures optimal entry pricing for both legs, preserving the profitability potential.

- ETH Collar RFQ ▴ Implementing an Ethereum collar offers a robust risk management solution for existing ETH holdings. This strategy combines buying an out-of-the-money put option (for downside protection) and selling an out-of-the-money call option (to finance the put and cap upside). An RFQ execution for this multi-leg structure streamlines the process, securing competitive prices for both components and minimizing overall transaction costs.

- Options Spreads RFQ ▴ A wide array of options spreads ▴ verticals, butterflies, condors ▴ become actionable through RFQ. The ability to request quotes for the entire spread, rather than individual legs, guarantees a coherent execution price and mitigates leg risk. This integrated approach elevates the precision of strategic deployment.

Smart trading within an RFQ environment translates directly into capital efficiency. By minimizing slippage and securing best execution, each trade contributes positively to the overall alpha generation of a portfolio. The transparency and competitive dynamics fostered by multi-dealer liquidity empower traders to consistently achieve superior outcomes.

Advanced Application Mastery

Advancing beyond foundational understanding involves integrating sophisticated trading techniques into a comprehensive portfolio management strategy. Mastery of RFQ systems and complex options structures elevates a trader’s capacity to navigate the intricate dynamics of crypto cycles with unparalleled precision. This next level of engagement focuses on how these tools become intrinsic components of a resilient, alpha-generating framework.

Volatility Block Trade Execution

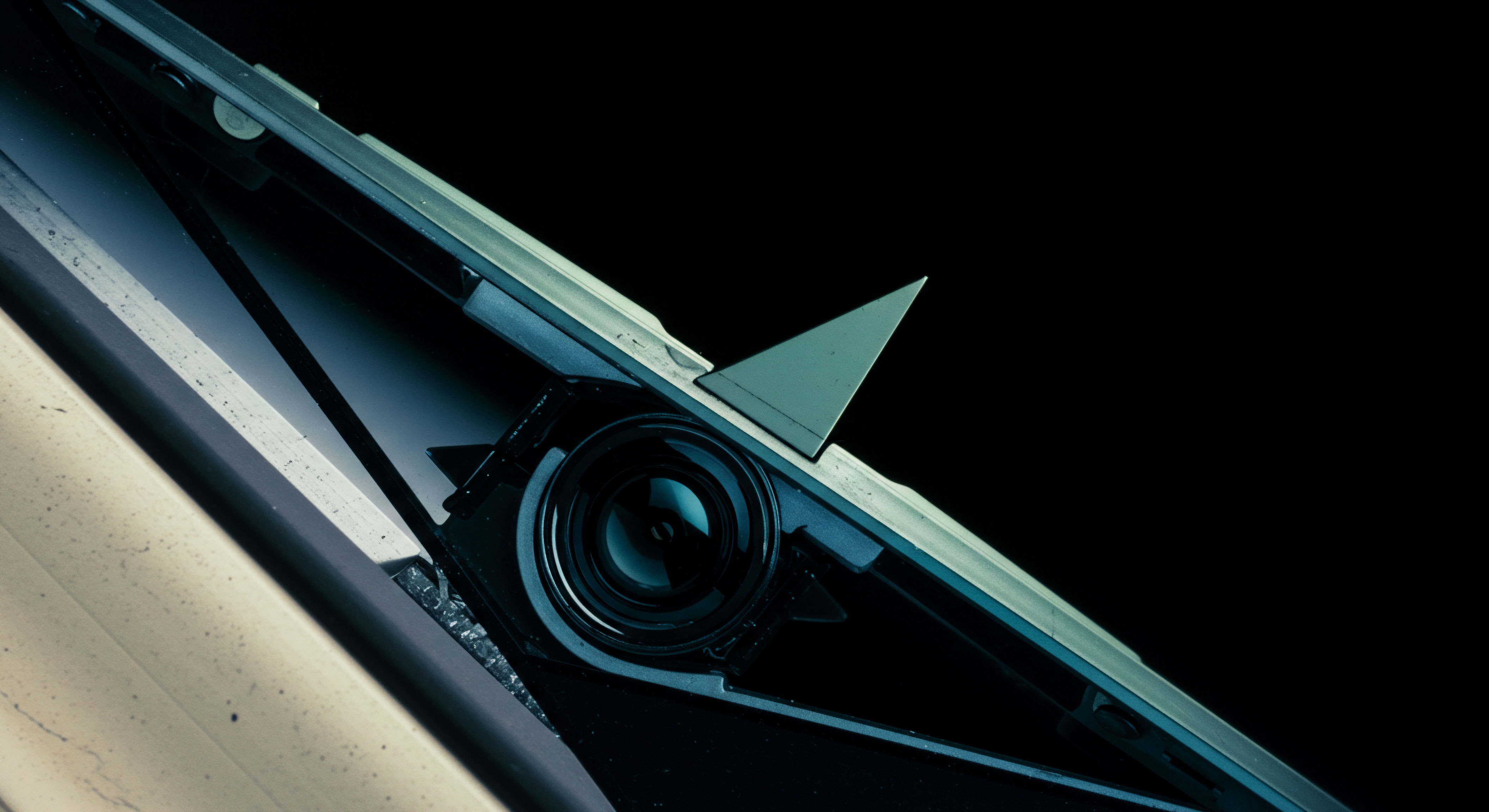

Executing volatility block trades requires a profound understanding of implied volatility surfaces and their relationship to market sentiment. A strategic approach leverages RFQ to transact large positions in options, targeting specific volatility regimes. This method ensures optimal pricing for instruments designed to capture changes in market uncertainty, a core driver of derivatives valuation. The capacity to execute such trades anonymously further shields positions from front-running, preserving the integrity of the intended market exposure.

The strategic deployment of multi-leg execution within an RFQ framework represents a critical capability. Constructing intricate options positions ▴ such as iron condors or ratio spreads ▴ demands meticulous attention to pricing across all legs. RFQ streamlines this complexity, allowing for simultaneous quotation requests that ensure a cohesive and advantageous overall trade price. This unified execution minimizes the inherent risks associated with leg-by-leg market entry, a common pitfall in less sophisticated trading environments.

Integrating multi-leg execution through RFQ transforms complex options strategies into coherent, competitively priced market engagements.

Risk Management Integration

A robust risk management framework underpins all advanced applications. Utilizing OTC options, facilitated through RFQ, provides a critical avenue for tailoring risk profiles precisely to portfolio requirements. These customized instruments offer flexibility beyond standardized exchange offerings, allowing for highly specific hedging or exposure management. The strategic decision to engage in OTC options via RFQ ensures competitive terms even for bespoke contracts, safeguarding capital.

The continuous refinement of execution quality, particularly minimizing slippage, remains a paramount objective. Advanced traders continually assess the efficacy of their RFQ engagement, seeking to further optimize fill rates and price impact. This iterative process of analysis and adjustment drives a sustained market edge, translating theoretical advantages into tangible returns. The evolution from merely understanding RFQ to actively shaping its application within a comprehensive trading strategy marks a definitive step towards market mastery.

Unlocking Cycle Dominance

The pursuit of superior outcomes in crypto markets transcends mere observation; it demands active participation with an engineered advantage. This strategic blueprint, built upon the bedrock of RFQ systems and sophisticated options strategies, provides the tools to command market opportunities. Embracing these professional-grade mechanisms positions you not as a reactor, but as a proactive force, shaping your financial trajectory. The journey towards market mastery begins with this deliberate choice for execution excellence.

Glossary

Options Trading

Multi-Dealer Liquidity

Block Trading

Eth Collar Rfq

Best Execution

Smart Trading

Multi-Leg Execution