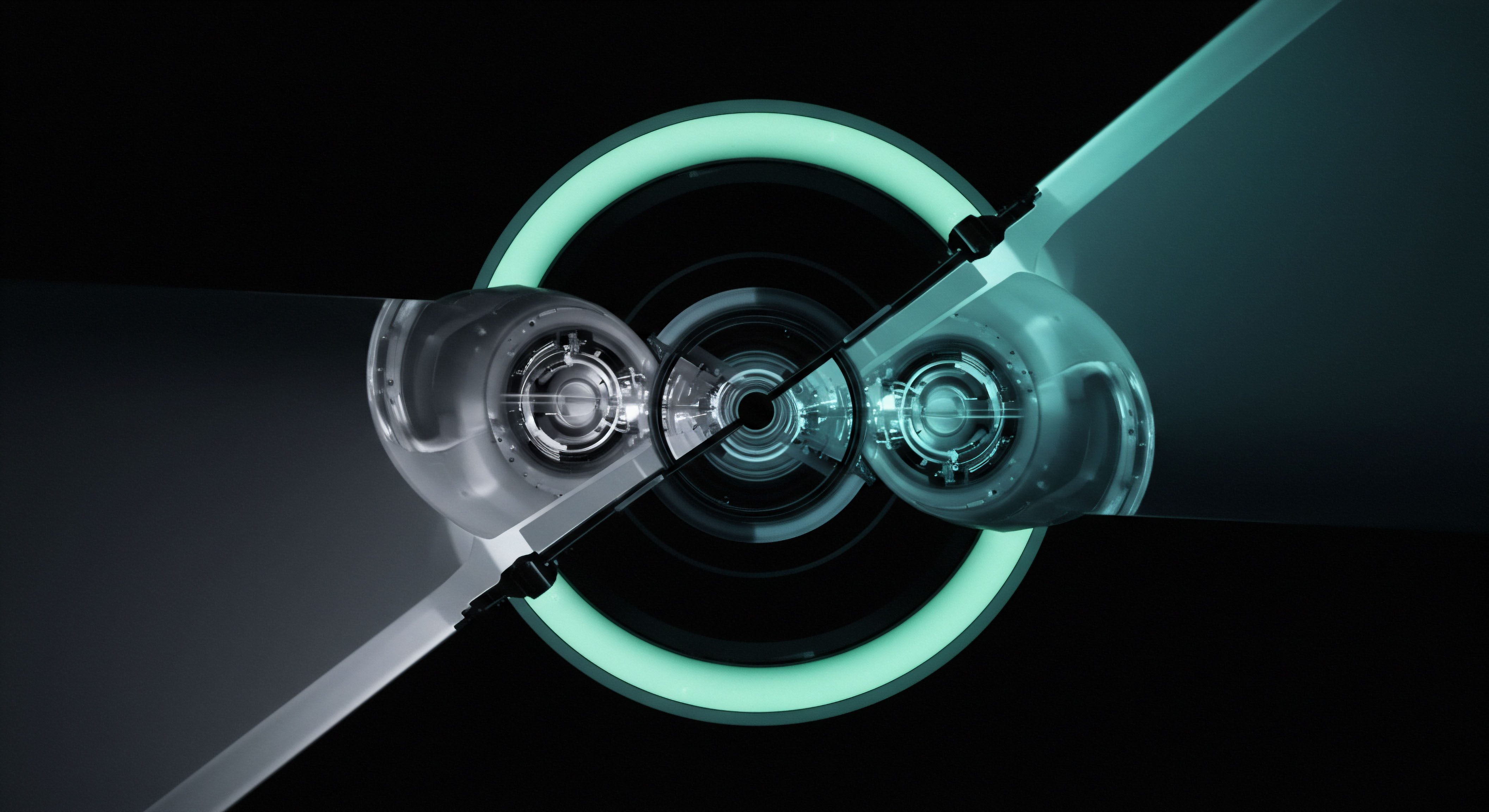

The breach of Bitcoin’s realized price above its 200-week moving average constitutes a critical inflection point in the asset’s market lifecycle. This convergence, observed for the first time since June 2022, systematically redefines the long-term support baseline. Historically, this technical configuration has served as a robust precursor to extended bull cycles, indicating a fundamental recalibration of investor cost bases and market sentiment.

The immediate consequence is a strengthening of the asset’s underlying structure, supporting sustained upward price discovery. This systemic shift influences institutional adoption trajectories and capital flow dynamics, providing a clearer operational landscape for strategic positioning.

The Bitcoin realized price exceeding its 200-week moving average indicates a robust, data-driven validation of a new bull market phase, reinforcing market resilience and attracting institutional capital.

- Realized Price Value ▴ $51,888

- 200WMA Threshold ▴ $51,344

- BTC All-Time High ▴ $124,000

Signal Acquired from ▴ Binance Square

Glossary

Moving Average

Realized Price