Concept

The core challenge of executing a significant order in any financial market is managing its signature. Every action, from the placement of a single limit order to a sweep of the order book, contributes to a data trail. Information leakage is the process by which other market participants analyze this trail to deduce your trading intention before your full order is complete. This predictive insight allows them to trade ahead of your remaining position, creating adverse price movements that directly translate into execution costs.

The task is to operate within this observable system without revealing the overarching strategy. Quantitative models provide the framework for this operational discretion.

These models function as a system of measurement and control. They begin with the premise that information is encoded in market data, such as trade volume, quote frequency, and order book dynamics. By building a statistical baseline of a market’s “normal” state, a model can then identify anomalies. A sudden, localized surge in buy-side volume or a persistent reappearance of orders from a specific routing signature are deviations that can signal the presence of a large, methodical participant.

The objective of these quantitative systems is to define the threshold of detection and architect an execution strategy that remains below it. This involves deconstructing a large parent order into a sequence of smaller, seemingly random child orders whose collective pattern is statistically indistinguishable from the market’s natural flow.

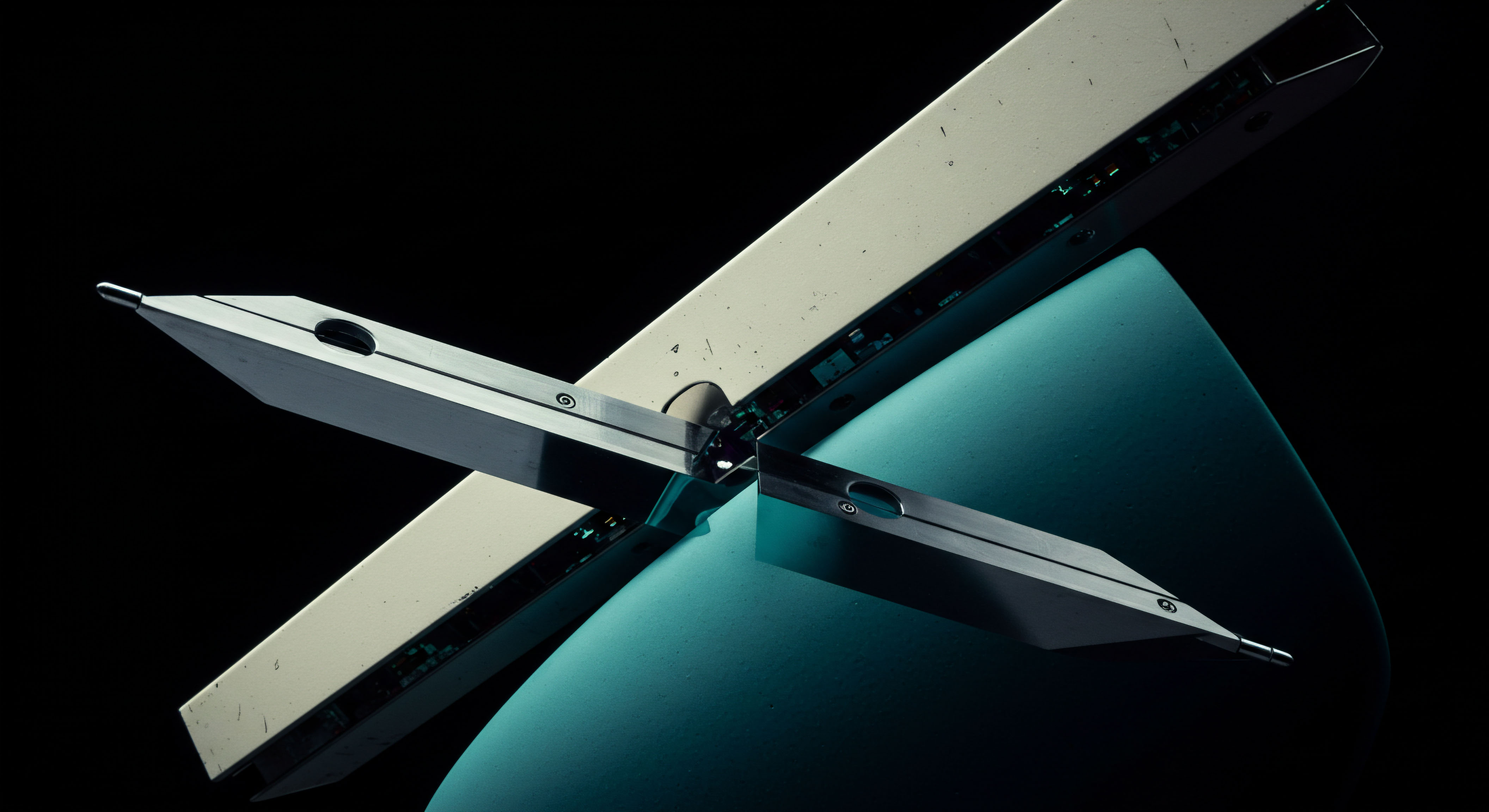

Quantitative models operate by deconstructing a large institutional order into a series of smaller trades designed to be statistically indistinct from ambient market noise.

The consequence of unmanaged information leakage is market impact. This impact has two primary components. Temporary impact is the direct cost of demanding liquidity; it is the price concession required to execute a trade immediately. Permanent impact is the lasting shift in the equilibrium price that occurs as the market internalizes the information revealed by your trading activity.

A successful quantitative approach seeks to minimize both. It does so by treating the execution process as a complex optimization problem, balancing the speed of execution against the information cost. Trading too quickly creates a loud, detectable signature and high temporary impact. Trading too slowly extends the window of exposure to adverse price trends and risks leaking information over a longer period, contributing to permanent impact.

Therefore, the conceptual foundation for using models to mitigate leakage is built on a deep understanding of market microstructure. It requires viewing the market as an adversarial environment where information is a valuable and contested resource. The models provide a mathematical language to describe the behavior of other participants, quantify the information content of one’s own actions, and ultimately design a trading methodology that achieves its objective with minimal informational footprint. It is a systematic approach to navigating a complex data landscape, turning the abstract threat of leakage into a measurable and manageable operational risk.

Strategy

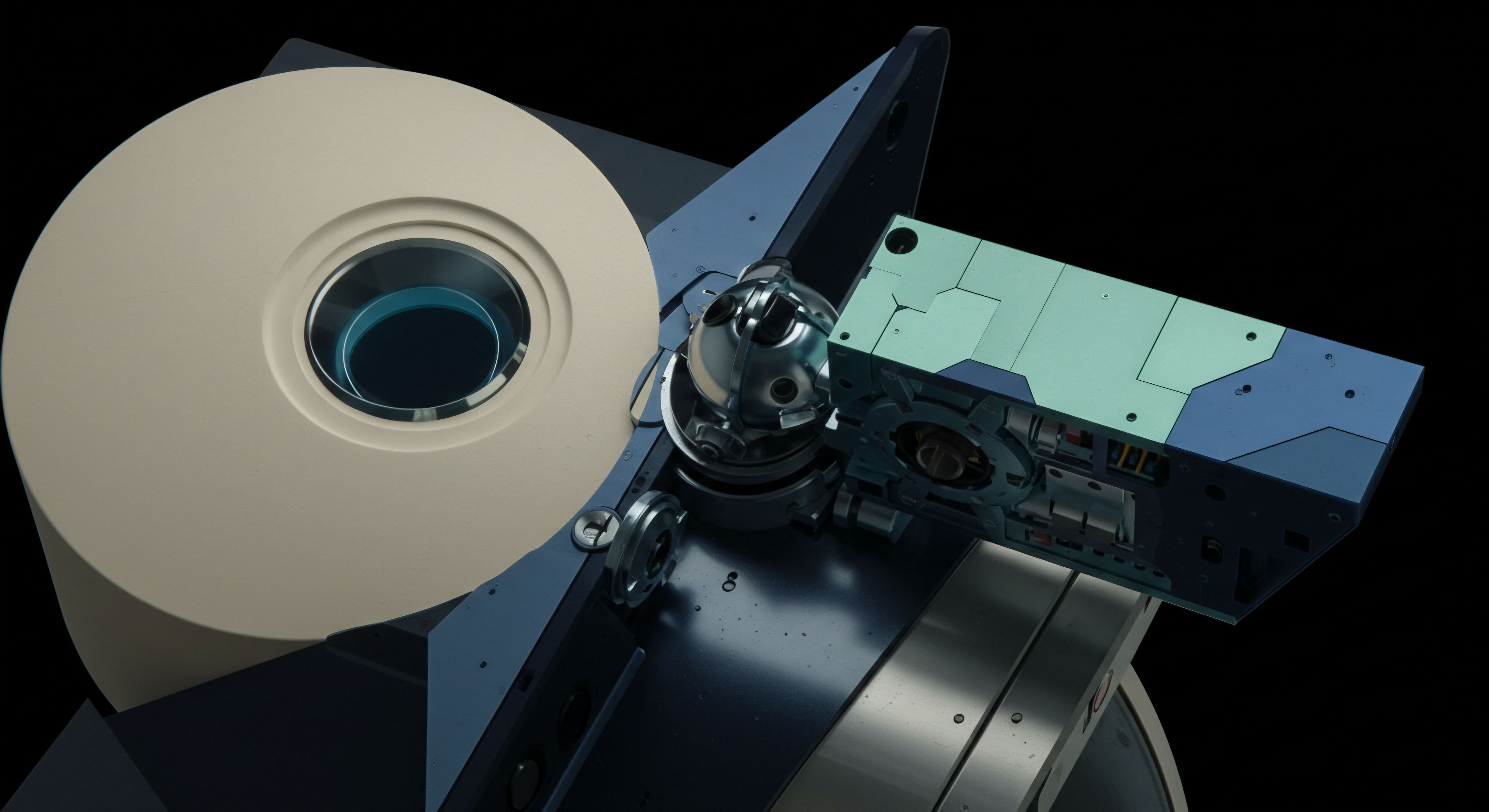

The strategic application of quantitative models to control information leakage involves a two-stage process ▴ pre-trade analysis for identification and intra-trade adaptation for mitigation. This framework moves from a static understanding of risk to a dynamic, responsive execution methodology. The core objective is to architect a trading plan that systematically minimizes its own detectability.

Pre Trade Risk Architecture

Before the first child order is sent to the market, a robust strategy begins with a quantitative assessment of the trading environment. This pre-trade analysis uses historical data to model the likely information footprint of a planned execution. The goal is to identify the specific characteristics of the asset and the market that will make leakage more probable.

Models like the Almgren-Chriss framework provide a foundational approach. This model explicitly formulates the trade-off between two primary costs ▴ market impact costs, which arise from rapid execution and are a direct proxy for information leakage, and timing or opportunity costs, which stem from the risk of adverse price movements during a prolonged execution. The model optimizes an execution schedule by minimizing a cost function that is a weighted sum of expected execution costs and the variance of those costs. The trader’s specified risk aversion parameter (lambda) dictates the balance, creating a frontier of possible execution strategies from aggressive (high impact, low timing risk) to passive (low impact, high timing risk).

What Are the Key Inputs for Pre Trade Models?

The effectiveness of these pre-trade models depends on the quality of their inputs. These are not generic parameters; they are specific, measurable characteristics of the security and its typical trading behavior.

- Historical Volatility This measures the asset’s inherent price risk. Higher volatility increases the timing risk component of the Almgren-Chriss model, suggesting a faster, more aggressive execution may be optimal to reduce exposure time, despite the higher information leakage.

- Liquidity Profile This is analyzed by examining the average daily volume (ADV), the depth of the order book, and the typical bid-ask spread. An order that represents a large percentage of ADV will inherently have a larger signature and a higher potential for leakage. Models use these liquidity metrics to calibrate the “market impact” parameters.

- Past Transaction Cost Analysis (TCA) Data By analyzing the market impact of previous trades of similar size and under similar conditions, models can generate a specific, empirically grounded forecast of the expected cost for the current order. This feedback loop is essential for refining the model’s accuracy over time.

Intra Trade Adaptive Mitigation

A pre-trade plan provides the initial blueprint, but market conditions are dynamic. A truly effective strategy must adapt in real time. This is where intra-trade models, often employing machine learning techniques, become central to the mitigation effort. These models monitor the execution in real-time, comparing its evolving signature to the expected baseline and to the ambient activity in the market.

The strategy here is one of dynamic camouflage. If a model detects that the trading algorithm’s pattern is becoming too regular or is creating a noticeable pressure on the order book, it can trigger a change in behavior. This can involve several tactics:

- Randomization The model can introduce randomness into the timing and size of child orders to break up any emerging patterns that could be identified by adversarial algorithms.

- Venue Switching If trading activity becomes concentrated on one exchange, the model can re-route subsequent orders across a wider array of lit and dark venues to diffuse the order’s footprint.

- Pacing Adjustment The model can dynamically adjust the execution speed. If the market becomes less liquid, the model might slow down the trading pace to avoid creating an outsized impact. Conversely, if a large source of contra-side liquidity appears, the model might accelerate execution to seize the opportunity.

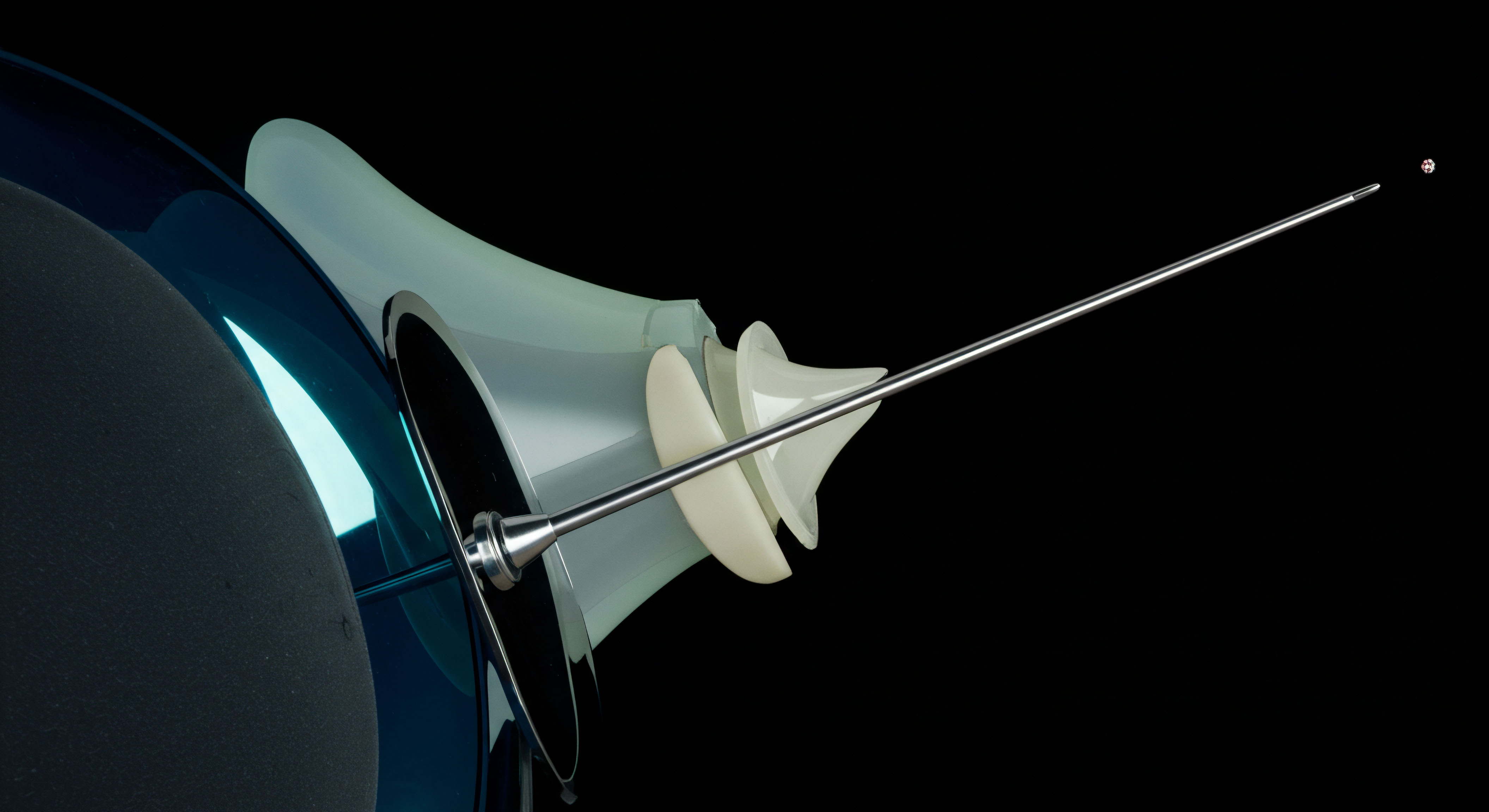

Effective intra-trade mitigation relies on adaptive algorithms that adjust their behavior in real time to blend with the changing character of market flow.

The table below outlines the strategic shift from a static, pre-planned execution to a dynamic, adaptive one.

| Strategic Component | Static Approach (e.g. Pure TWAP) | Adaptive Approach (e.g. Almgren-Chriss with ML Overlay) |

|---|---|---|

| Execution Schedule | Predetermined and fixed. Divides the order into equal increments over a set time period. | Dynamic and responsive. The schedule is an initial guide, but timing and size are adjusted based on real-time market data. |

| Information Assumption | Assumes market conditions will remain constant throughout the execution horizon. | Assumes market conditions are variable and models the cost of that variability (timing risk). |

| Leakage Mitigation | Relies solely on time-slicing to blend in. The pattern, however, is highly predictable. | Actively works to obscure the trading pattern by reacting to liquidity, randomizing orders, and managing its data signature. |

| Benchmark Focus | Typically targets a simple benchmark like Time-Weighted Average Price (TWAP). | Targets a more sophisticated benchmark like Implementation Shortfall (Arrival Price), focusing on total cost. |

Ultimately, the strategy is to build an intelligent execution system. This system uses pre-trade models to define the optimal path and intra-trade models to make intelligent deviations from that path, ensuring the execution remains as concealed as possible throughout its lifecycle.

Execution

The execution of a quantitative strategy to manage information leakage is a systematic, data-driven process. It translates the theoretical models of the strategy phase into a concrete operational playbook for the institutional trading desk. This process is cyclical, involving pre-trade forecasting, real-time algorithmic management, and post-trade analysis to continuously refine the system.

The Operational Playbook

A disciplined execution workflow is paramount. Each step is designed to embed quantitative analysis into the decision-making process, moving from high-level objectives to granular, real-time actions.

- Order Definition and Risk Profiling The process begins when a portfolio manager delivers an order to the trading desk. The first step is to quantify the order’s objectives and constraints. This includes the total size, the desired completion time (urgency), and the execution benchmark (e.g. Arrival Price, VWAP). This data forms the initial input for the risk profiling models.

- Pre-Trade Quantitative Analysis Using the order parameters, the desk employs its pre-trade analytics suite. The system generates a detailed forecast, including expected market impact, estimated transaction costs, and a liquidity profile for the security. This stage identifies potential red flags, such as the order size being a high percentage of the security’s average daily volume, which signals a high risk of information leakage.

- Algorithm Selection and Calibration Based on the pre-trade analysis, the trader selects the most appropriate execution algorithm. For a high-urgency order in a volatile stock, an Implementation Shortfall (IS) algorithm based on the Almgren-Chriss framework might be chosen. The trader then calibrates the algorithm’s parameters, setting the risk aversion (lambda) that reflects the specific trade-off between impact and timing risk for this order.

- Real-Time Execution Monitoring Once the algorithm is launched, its performance is monitored on a real-time dashboard. This is not passive observation. The trader watches key metrics designed to signal information leakage. These can include the fill rate, the deviation from the expected execution schedule, and, most importantly, the realized market impact versus the pre-trade forecast. Sophisticated systems will have alerts that trigger if these metrics breach certain thresholds, indicating that the algorithm’s signature may be becoming too visible.

- Manual Intervention and Adjustment If the monitoring systems flag a problem, the trader may need to intervene. This could involve pausing the algorithm, adjusting its aggression level, or even switching to a different execution strategy altogether. This “human-in-the-loop” component is a critical backstop to the automated process.

- Post-Trade Transaction Cost Analysis (TCA) After the order is complete, a detailed TCA report is generated. This report deconstructs the total execution cost into its constituent parts ▴ delay cost (slippage from decision to order placement), impact cost (slippage during execution), and timing cost. The actual impact is compared against the pre-trade model’s forecast. This variance analysis is the most critical output of the entire process, as it provides the data needed to refine the models for future trades.

Quantitative Modeling and Data Analysis

The operational playbook is powered by a deep layer of quantitative analysis. The following tables illustrate the type of data and modeling that underpins this process.

How Do Models Quantify Leakage Risk before Trading?

The pre-trade risk assessment is a multi-factor process. Models synthesize various data points to generate a holistic risk score for a given order. The table below provides a simplified example of such a model’s components.

| Risk Factor | Metric | Model Interpretation | Actionable Insight |

|---|---|---|---|

| Size Impact | Order Size as % of ADV | A higher percentage indicates the order will consume a significant portion of daily liquidity, making its presence obvious. | Orders above 10% of ADV require a more passive, extended execution strategy to minimize leakage. |

| Liquidity Cost | Bid-Ask Spread (bps) | A wider spread signifies lower liquidity and higher costs for crossing the spread to execute. | In wide-spread stocks, the strategy should prioritize passive execution via limit orders to capture the spread. |

| Volatility Risk | 30-Day Realized Volatility | Higher volatility increases the risk of adverse price moves during execution (timing risk). | For high-volatility assets, the Almgren-Chriss model will favor a shorter execution horizon to reduce exposure. |

| Adversarial Presence | Short-Term Reversion Score | A high reversion score (based on historical data) suggests the presence of high-frequency traders who fade price moves, indicating a predatory environment. | In a high-reversion environment, the algorithm should use greater randomization in order size and timing. |

A Look inside an Almgren-Chriss Execution Schedule

The core output of the Almgren-Chriss model is an optimal trading trajectory. The following table shows a hypothetical schedule for liquidating 1,000,000 shares over a 60-minute period, with a moderate risk aversion setting. Notice how the trade rate is highest at the beginning and tapers off toward the end.

| Time Interval (Minutes) | Shares to Sell | Cumulative Shares Sold | Expected Temporary Impact (bps) | Expected Permanent Impact (bps) |

|---|---|---|---|---|

| 0-10 | 250,000 | 250,000 | 2.5 | 0.5 |

| 10-20 | 200,000 | 450,000 | 2.0 | 0.9 |

| 20-30 | 160,000 | 610,000 | 1.6 | 1.2 |

| 30-40 | 130,000 | 740,000 | 1.3 | 1.5 |

| 40-50 | 110,000 | 850,000 | 1.1 | 1.7 |

| 50-60 | 150,000 | 1,000,000 | 1.5 | 2.0 |

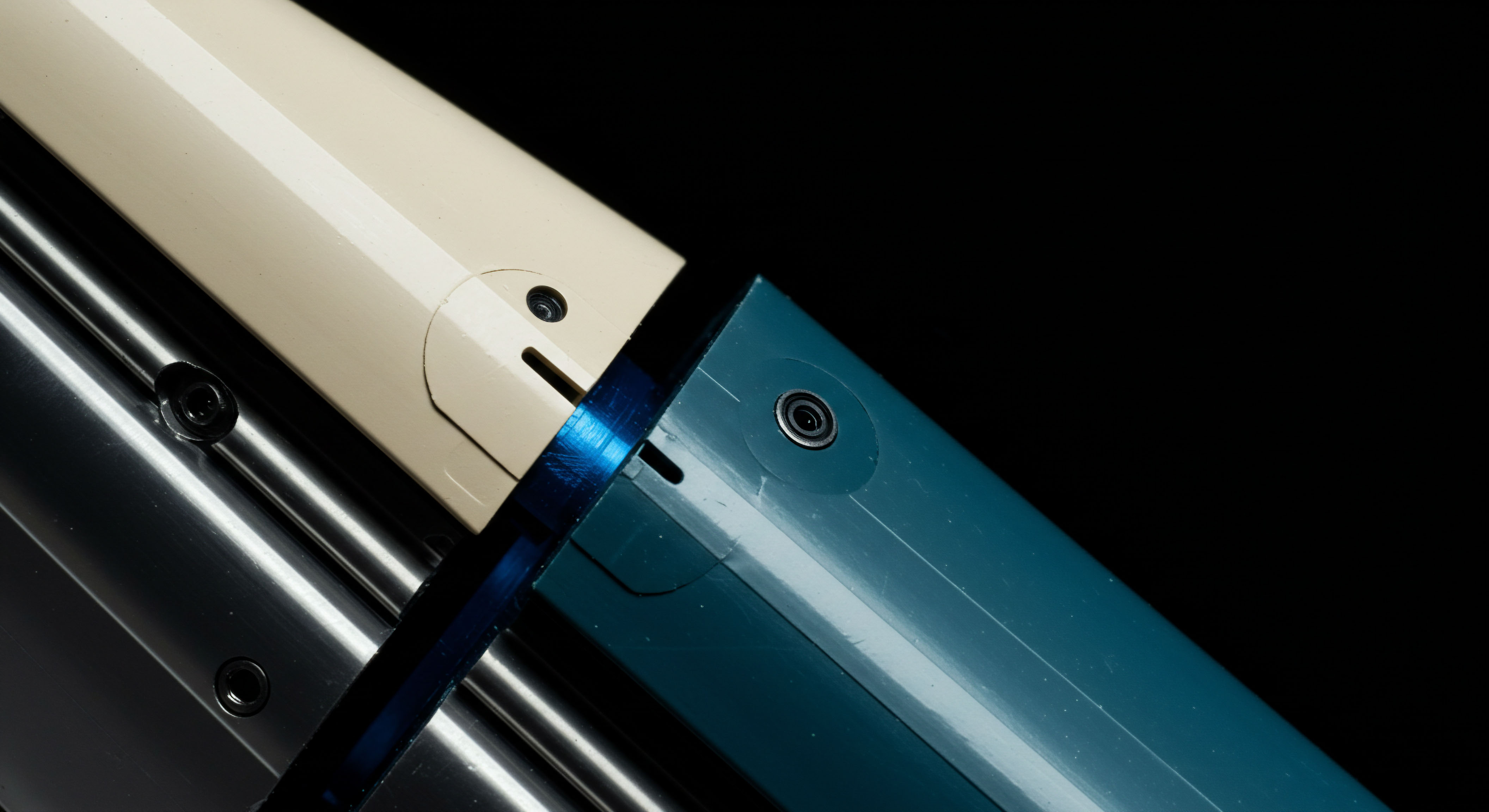

The ultimate goal of the execution process is to feed post-trade performance data back into pre-trade models, creating a continuously learning system.

This detailed, quantitative approach transforms the management of information leakage from an intuitive art into an engineering discipline. It provides a structured, measurable, and optimizable framework for achieving superior execution quality while protecting the confidentiality of a firm’s trading intentions.

References

- Almgren, R. and N. Chriss. “Optimal execution of portfolio transactions.” Journal of Risk, vol. 3, no. 2, 2000, pp. 5-39.

- Kyle, A. S. “Continuous auctions and insider trading.” Econometrica, vol. 53, no. 6, 1985, pp. 1315-1335.

- Brunnermeier, M. K. “Information Leakage and Market Efficiency.” Princeton University, 2005.

- Bouchaud, J-P. et al. “Secrets of the order book ▴ an analysis of the market impact of orders.” Quantitative Finance, vol. 9, no. 5, 2009, pp. 535-546.

- Gatheral, J. “No-dynamic-arbitrage and market impact.” Quantitative Finance, vol. 10, no. 7, 2010, pp. 749-759.

- Huberman, G. and W. Stanzl. “Price manipulation and quasi-arbitrage.” Econometrica, vol. 72, no. 4, 2004, pp. 1247-1275.

- Cont, R. and A. Kukanov. “Optimal order placement in limit order books.” Quantitative Finance, vol. 17, no. 1, 2017, pp. 21-39.

- Cartea, Á. S. Jaimungal, and J. Penalva. “Algorithmic and High-Frequency Trading.” Cambridge University Press, 2015.

- O’Hara, M. “Market Microstructure Theory.” Blackwell Publishing, 1995.

- Bishop, A. et al. “Information Leakage Can Be Measured at the Source.” Proof Trading Whitepaper, 2023.

Reflection

The models and frameworks detailed here provide a powerful system for managing the tangible costs of information leakage. They represent a significant evolution in execution management, moving the discipline toward a more rigorous, data-centric foundation. The underlying principle is one of control; by understanding the information content of its own actions, an institution can begin to architect its interactions with the market with purpose and precision.

Consider your own operational framework. How is information leakage currently conceptualized and measured? Is it viewed as an unavoidable cost of doing business, or as a variable risk that can be actively managed? The transition from the former perspective to the latter is the critical step.

The tools discussed are components within a larger system of intelligence. Integrating them effectively requires a commitment to a culture of measurement, analysis, and continuous improvement. The ultimate advantage is found in the synthesis of quantitative power and skilled human oversight, creating an execution capability that is both adaptive and resilient.

Glossary

Information Leakage

Adverse Price

Quantitative Models

Order Book

Execution Strategy

Market Impact

Market Microstructure

Execution Schedule

Timing Risk

Almgren-Chriss Model

Liquidity Profile

Transaction Cost Analysis

Pre-Trade Analytics