Navigating Digital Derivatives Volatility

Engaging with high-frequency crypto options trading presents a distinct set of operational challenges and strategic imperatives for institutional participants. The digital asset landscape, characterized by its inherent volatility and rapid evolutionary pace, necessitates a sophisticated approach to risk management. Market participants often contend with the amplified effects of sudden price movements, which can significantly impact portfolio valuations and trading strategies. A deep understanding of market microstructure becomes paramount for those aiming to secure a decisive edge within this dynamic environment.

Recognizing the interconnectedness of various digital assets, and their susceptibility to swift, sometimes unpredictable, shifts, forms the foundational layer of any robust risk mitigation framework. This foundational understanding allows institutions to construct more resilient operational architectures.

The burgeoning institutional interest in Bitcoin and other crypto options underscores a growing recognition of these instruments as critical tools for both speculation and sophisticated hedging. With exposure levels now reaching tens of billions, these derivatives serve as a vital component within broader digital asset portfolios. ETF options, in particular, appeal to institutional players seeking regulated exposure, bridging the gap between traditional finance and the crypto-native derivatives market. This bifurcation creates parallel liquidity pools, each catering to specific investor bases and regulatory preferences.

Options contracts offer essential capabilities for managing exposure, allowing for nuanced directional bets and the construction of complex risk profiles. Consequently, institutional entities are increasingly demanding advanced tools for structured product engagement, signaling a trajectory toward more sophisticated market participation.

Effective risk mitigation in high-frequency crypto options trading begins with a comprehensive understanding of market microstructure and the inherent volatility of digital assets.

Tail risks, representing the extreme negative outcomes within probability distributions, demand particular attention within cryptocurrency markets. These markets frequently exhibit significant spillover effects, where extreme negative changes in one cryptocurrency often cascade into similar negative changes across others. This interconnectedness highlights a critical challenge ▴ traditional diversification strategies, while valuable, often prove insufficient for comprehensive risk mitigation in the face of correlated market shocks.

Identifying and managing these regime switches, periods where market dynamics fundamentally alter, becomes a strategic imperative for informed decision-making and the development of effective trading strategies. The potential for substantial losses, particularly given the significant institutional and retail capital deployed, necessitates a forward-thinking approach to risk modeling.

Developing novel systemic risk models, specifically tailored to the unique characteristics of cryptocurrencies, represents a significant advancement. Such models aim to capture tail risks effectively, considering the complex interdependencies that define these markets. By analyzing daily returns across a spectrum of digital assets, these advanced frameworks can significantly outperform conventional risk measures in predicting market drawdowns.

Risk managers must maintain vigilance over negative news flows within cryptocurrency markets and closely monitor shifting patterns among correlated assets to pre-emptively mitigate potential exposures. The continuous evolution of these analytical tools empowers institutions to gain a clearer estimation of underlying market risk, thereby informing more resilient investment decisions.

Precision Execution Protocols

Strategic frameworks for mitigating systemic risk in high-frequency crypto options trading revolve around a core principle ▴ establishing robust control over execution, liquidity, and information flow. Institutional participants employ a layered approach, integrating advanced technological capabilities with sophisticated trading protocols. This approach allows for the navigation of market complexities with precision, ensuring that large, complex, or illiquid trades are executed with minimal market impact.

The strategic objective involves not only avoiding adverse selection but also actively shaping the execution environment to one’s advantage. Operationalizing these strategies demands a deep understanding of how various market components interact to produce desired outcomes.

Request for Quote (RFQ) mechanics form a cornerstone of institutional strategy, particularly for block trades and bespoke options structures. RFQ protocols facilitate bilateral price discovery, enabling participants to solicit quotes from multiple liquidity providers simultaneously. This process enhances transparency and competitiveness, ensuring that the institution receives the best available price for a given instrument. High-fidelity execution for multi-leg spreads, which involve simultaneously trading several options contracts, benefits immensely from discreet RFQ protocols.

These private quotation mechanisms minimize information leakage, a critical concern in markets susceptible to front-running. Aggregated inquiries, where multiple requests are bundled, allow for efficient system-level resource management, streamlining the process of sourcing off-book liquidity. This structured interaction provides a significant advantage over attempting to execute large orders on lit order books, where immediate price impact can be substantial.

RFQ mechanics offer institutions a structured pathway to source deep liquidity and achieve optimal pricing for complex options trades, minimizing market impact.

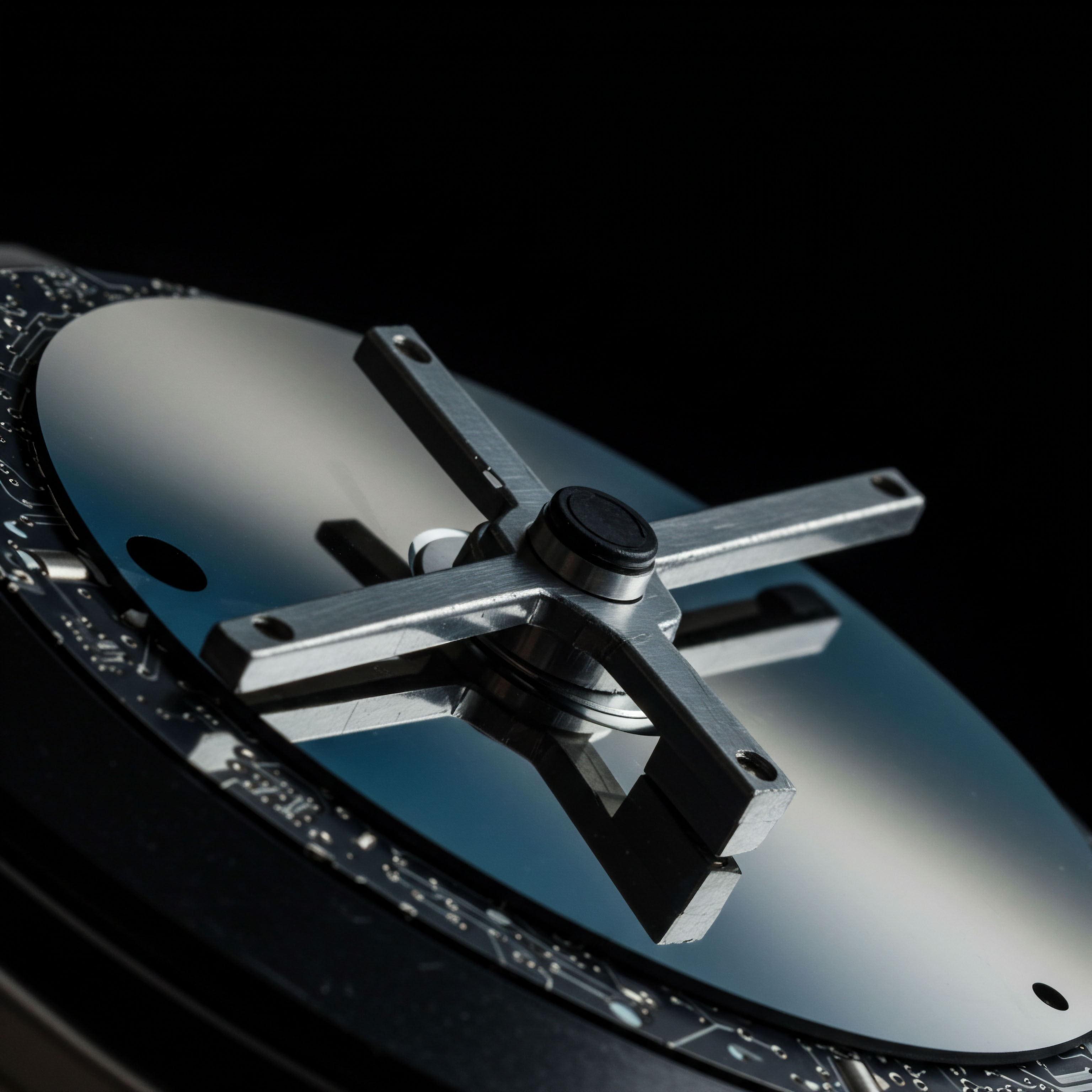

Advanced trading applications extend these capabilities, allowing sophisticated traders to automate and optimize specific risk parameters. Consider the mechanics of synthetic knock-in options, which activate only upon a specific underlying price threshold. These instruments require precise monitoring and dynamic adjustment. Automated Delta Hedging (DDH) systems are indispensable for managing the directional exposure of options portfolios.

DDH algorithms continuously rebalance the delta of an options position by trading the underlying asset, thereby neutralizing market exposure within predefined tolerances. Other advanced order types, such as icebergs or pegged orders, provide additional layers of control, allowing for strategic order placement without fully revealing the total quantity. These tools, when integrated into a comprehensive trading system, provide a formidable defense against adverse market movements.

The intelligence layer, comprising real-time data feeds and expert human oversight, complements these automated systems. Real-time intelligence feeds provide granular market flow data, offering insights into order book dynamics, liquidity concentrations, and potential imbalances. This continuous stream of information allows algorithms to adapt rapidly to changing market conditions, identifying fleeting opportunities and potential risks. Expert human oversight, provided by system specialists, remains indispensable for managing complex execution scenarios.

These specialists monitor the performance of automated systems, intervene during anomalous events, and refine algorithmic parameters based on qualitative market observations. Their role extends to validating the efficacy of models and ensuring compliance with internal risk limits. The synergy between automated intelligence and human expertise creates a resilient operational framework.

Strategic deployment of capital within high-frequency crypto options markets also involves a meticulous focus on platform selection and infrastructural robustness. Platforms designed for high-frequency DeFi applications, such as Solana with its Alpenglow upgrade, offer significantly improved transaction finality and scalability. This technical prowess translates directly into reduced latency and higher transaction volumes, making such platforms highly appealing for institutional use cases.

Similarly, custom Layer 1 blockchains, exemplified by Hyperliquid, provide the necessary throughput and low-latency execution environment for high-frequency traders. These specialized infrastructures, capable of processing hundreds of thousands of transactions per second, ensure minimal slippage and efficient trade settlement.

| Pillar | Key Mechanism | Strategic Benefit |

|---|---|---|

| Execution Control | RFQ Protocols, Block Trading | Minimizes information leakage, optimizes price discovery, reduces market impact |

| Algorithmic Management | Automated Delta Hedging, Advanced Order Types | Neutralizes directional exposure, enables precise risk parameter optimization |

| Market Intelligence | Real-Time Data Feeds, Expert Oversight | Informs adaptive algorithms, facilitates rapid response to market shifts |

| Infrastructural Resilience | High-Throughput Blockchains, Low-Latency Systems | Ensures efficient transaction processing, minimizes slippage in high-frequency environments |

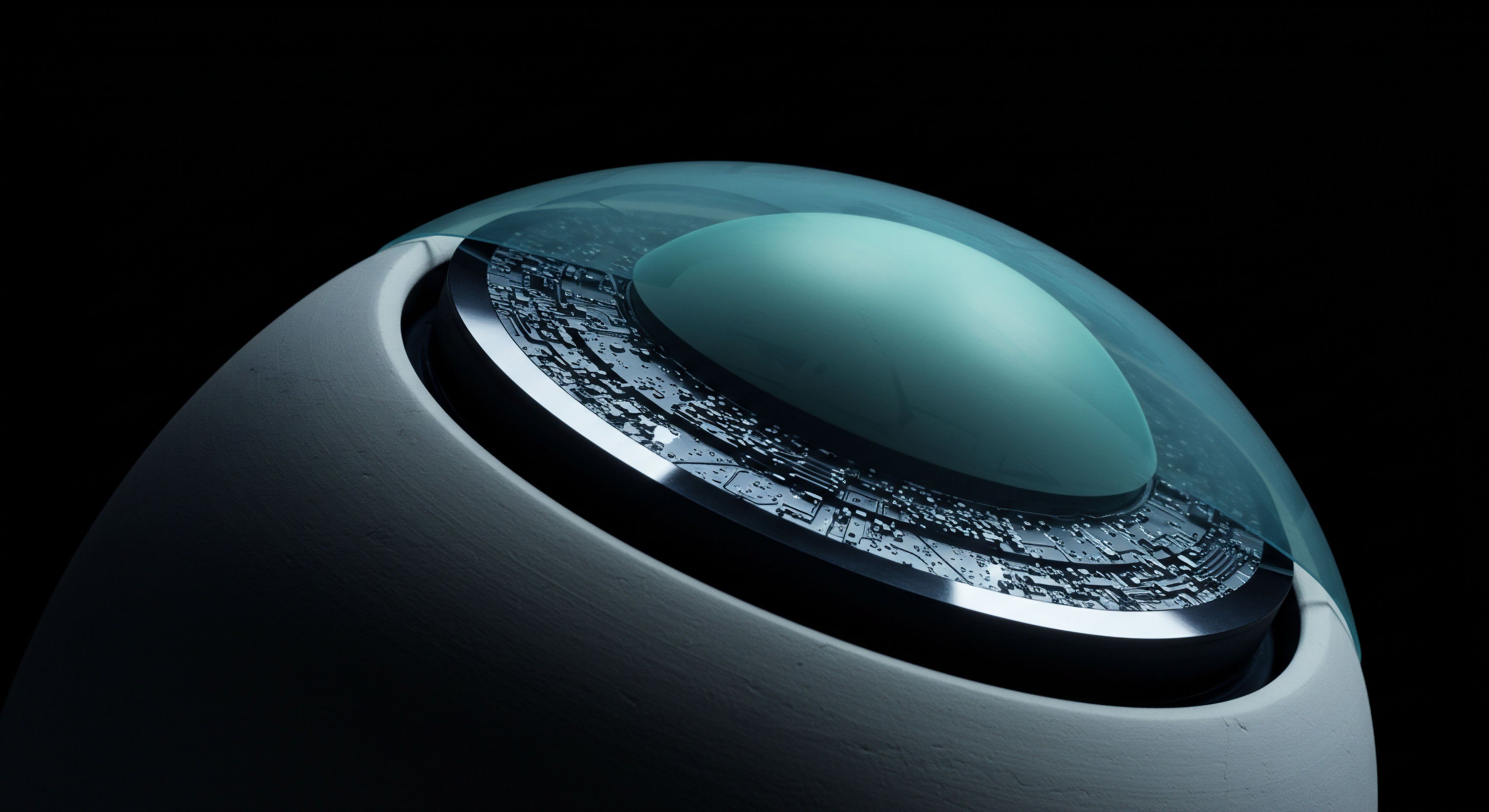

The integration of smart contracts into institutional trading workflows provides a further layer of strategic control and transparency. These self-executing agreements, with terms directly written into code, function as strategic tools for managing risk, optimizing timing, and simplifying reporting. Firms construct risk-managed automation systems that execute trades, rebalance portfolios, and stake collateral, all through smart contracts.

This verifiable logic ensures every action is trackable and transparent, maintaining protocol transparency at all operational layers. The ability to audit contract behavior in real-time provides internal oversight, which is essential for compliance and robust risk governance.

Robust technological infrastructure and the judicious application of smart contracts underpin institutional strategies for managing digital asset derivatives.

- Discreet Protocols ▴ Utilizing private quotation mechanisms within RFQ systems to minimize information leakage during large block trades, preserving anonymity and reducing adverse price movements.

- Automated Hedging ▴ Implementing dynamic delta hedging (DDH) algorithms that continuously adjust portfolio exposure to underlying assets, maintaining a desired risk profile with precision.

- High-Fidelity Data ▴ Consuming real-time market data feeds to inform algorithmic decision-making, enabling rapid adaptation to evolving liquidity and volatility conditions.

- On-Chain Transparency ▴ Leveraging fully on-chain order books for enhanced auditability and compliance, fostering trust through immutable transaction records.

- Systemic Oversight ▴ Employing system specialists to monitor automated trading systems, intervening during anomalies and refining parameters to ensure optimal performance and risk adherence.

Operational Framework Precision

The operationalization of systemic risk mitigation in high-frequency crypto options trading demands an exhaustive focus on granular detail, from network latency optimization to sophisticated quantitative modeling. Institutional execution mandates a system that not only reacts to market conditions but actively anticipates and shapes them. This involves a confluence of advanced technological infrastructure, meticulously designed trading algorithms, and a rigorous risk governance framework.

The ultimate goal remains achieving superior execution quality while maintaining stringent capital efficiency and safeguarding against unexpected market dislocations. Every component within this operational framework is engineered for resilience and performance under extreme conditions.

The Operational Playbook for Systemic Resilience

Establishing an institutional-grade operational playbook for high-frequency crypto options requires a multi-step procedural guide, meticulously detailing each phase of execution and risk control. This playbook functions as a living document, constantly refined through post-trade analysis and scenario testing. A primary step involves comprehensive counterparty due diligence, extending beyond basic financial health to encompass their technological stack, operational reliability, and historical performance in handling large options blocks.

Onboarding requires establishing dedicated, secure communication channels for RFQ and order submission, often leveraging proprietary APIs or specialized FIX protocol extensions tailored for digital assets. Furthermore, defining clear escalation protocols for system outages or market dislocations ensures rapid, coordinated responses across trading, risk, and compliance desks.

A crucial procedural element involves the pre-allocation of capital and collateral across various venues and clearinghouses to optimize margin utilization while maintaining sufficient buffers for unforeseen volatility spikes. Implementing a real-time position monitoring system, capable of aggregating exposure across all options legs and underlying assets, provides a consolidated view of risk. This system must integrate seamlessly with automated hedging mechanisms, ensuring immediate rebalancing when delta or gamma thresholds are breached.

Finally, a robust post-trade reconciliation process, validating execution prices, fees, and settlement against internal records and counterparty confirmations, completes the operational loop. This comprehensive approach ensures that every aspect of the trading lifecycle is subject to rigorous control and continuous verification.

Quantitative Modeling and Data Analysis for Predictive Control

Quantitative modeling forms the analytical bedrock for mitigating systemic risk, enabling institutional participants to move beyond reactive measures to predictive control. This involves developing sophisticated models for volatility forecasting, correlation analysis, and tail-risk estimation. For crypto options, volatility surfaces are rarely smooth; they exhibit significant skew and kurtosis, requiring advanced econometric models like GARCH variants or jump-diffusion processes to capture their dynamic behavior. Correlation matrices, especially during periods of market stress, become highly unstable, necessitating dynamic conditional correlation models to account for time-varying interdependencies among assets.

Consider a scenario where an institution actively trades a portfolio of Bitcoin and Ethereum options. A key analytical task involves calculating the Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR) for the combined portfolio, accounting for the non-normal returns and fat tails characteristic of cryptocurrencies. This often involves Monte Carlo simulations, drawing from empirical distributions or fitting advanced statistical distributions (e.g. Student’s t-distribution) to historical data.

The output of these models directly informs position sizing, capital allocation, and the dynamic adjustment of hedging strategies. Furthermore, transaction cost analysis (TCA) models are deployed to evaluate execution quality, measuring slippage, market impact, and the efficacy of different execution algorithms. These models dissect every trade, providing granular insights into execution efficiency and identifying areas for algorithmic refinement.

| Metric | BTC Options Portfolio | ETH Options Portfolio | Combined Portfolio |

|---|---|---|---|

| Delta (USD) | +5,000,000 | +3,000,000 | +8,000,000 |

| Gamma (USD/%) | +150,000 | +80,000 | +230,000 |

| Vega (USD/%) | +250,000 | +120,000 | +370,000 |

| 99% VaR (USD) | -750,000 | -400,000 | -1,300,000 |

| 99% CVaR (USD) | -1,200,000 | -650,000 | -2,100,000 |

The calculation of VaR (Value at Risk) and CVaR (Conditional Value at Risk) in this context utilizes historical simulation or parametric methods, often with adjustments for the fat-tailed nature of crypto returns. For example, a 99% VaR of -$1,300,000 for the combined portfolio indicates that there is a 1% chance the portfolio could lose $1,300,000 or more over a specific time horizon (e.g. 24 hours). The 99% CVaR of -$2,100,000 represents the expected loss given that the loss exceeds the 99% VaR.

These metrics are fundamental for setting capital reserves and defining maximum loss limits for various trading strategies. Furthermore, quantitative analysts continuously backtest these models against real market data, refining parameters and ensuring their predictive accuracy under diverse market regimes. This iterative refinement process is central to maintaining an adaptive risk management system.

Predictive Scenario Analysis for Stress Testing Resilience

Constructing a detailed narrative case study illuminates the practical application of risk mitigation concepts under duress. Consider a hypothetical scenario ▴ “The ‘Quantum Leap’ Event.” It is early Q4 2025. An institutional trading desk, ‘Alpha Prime Digital,’ holds a substantial, delta-hedged portfolio of short-dated Bitcoin and Ethereum call options, designed to profit from modest upward price movements and volatility compression.

Their quantitative models indicate a 99% VaR of -$1.3 million for the combined portfolio, with a CVaR of -$2.1 million. The desk utilizes automated delta hedging, recalibrating every 100 milliseconds, and relies on RFQ protocols for larger block trades to manage spread risk.

Suddenly, a major, unexpected global regulatory announcement regarding stablecoins triggers a “Quantum Leap” event. This event, characterized by a sudden, simultaneous 20% flash crash in both Bitcoin and Ethereum prices, combined with a 50% spike in implied volatility across all crypto options maturities, occurs within a single hour. The market experiences a rapid, aggressive unwinding of leveraged positions, leading to significant liquidity dislocations on centralized exchanges. Bid-ask spreads widen dramatically, and order books become thin, particularly for options further out of the money.

Alpha Prime Digital’s automated delta hedging system, designed for more typical market fluctuations, begins to struggle. The sudden price drop causes their short call options to move deeper into the money, generating significant negative delta exposure. The system attempts to buy the underlying assets to re-hedge, but the widening spreads and limited liquidity mean each re-hedge incurs substantial slippage. The implied volatility surge also significantly impacts the portfolio’s vega, turning what was a positive vega position into a rapidly eroding one as options become more expensive to close or roll.

The desk’s real-time intelligence feeds, usually a source of clarity, begin to show conflicting signals due to the extreme market conditions and potential data feed delays. System specialists, observing the rapidly deteriorating market microstructure, initiate an emergency protocol. They manually pause a portion of the automated delta hedging, recognizing that continued algorithmic re-hedging in illiquid conditions would exacerbate losses through excessive transaction costs. Instead, they pivot to a more strategic, discreet approach.

Leveraging their established RFQ relationships, they initiate a series of private inquiries with their most trusted liquidity providers, seeking bilateral quotes for larger blocks of underlying Bitcoin and Ethereum, as well as specific options spreads to rebalance their vega and gamma exposure. This off-book execution mitigates further market impact from their own hedging activities.

Concurrently, the risk management team, informed by their advanced CVaR models, recognizes the potential for losses far exceeding the standard VaR thresholds. They activate pre-defined circuit breakers, which automatically reduce maximum position limits and increase margin requirements across all active strategies. They also initiate a review of their collateral utilization, ensuring sufficient capital buffers are available to cover potential margin calls, even as the value of their crypto collateral temporarily declines. The “Quantum Leap” event, while challenging, is navigated with a controlled, albeit painful, outcome.

Alpha Prime Digital experiences a 15% drawdown on the portfolio, exceeding their 99% VaR but remaining within their extreme stress-test limits. The post-mortem analysis reveals the critical role of the hybrid approach ▴ combining automated systems with strategic human intervention and robust counterparty relationships ▴ in preventing a catastrophic systemic failure within their own operations. This incident underscores the ongoing necessity for adaptive risk frameworks, capable of functioning effectively even amidst unprecedented market turbulence. The ability to pivot from automated to discretionary execution, informed by real-time risk analytics and strong counterparty networks, proves decisive in such scenarios.

System Integration and Technological Architecture for Seamless Control

The technological architecture supporting institutional high-frequency crypto options trading is a complex interplay of low-latency systems, robust data pipelines, and highly optimized execution engines. This intricate system is designed for maximum throughput, minimal latency, and unwavering reliability. At its core lies a custom-built Order Management System (OMS) and Execution Management System (EMS), specifically engineered to handle the unique characteristics of digital asset derivatives. These systems are not merely adaptations of traditional finance platforms; they are bespoke solutions built from the ground up to interact with both centralized crypto exchanges and decentralized protocols.

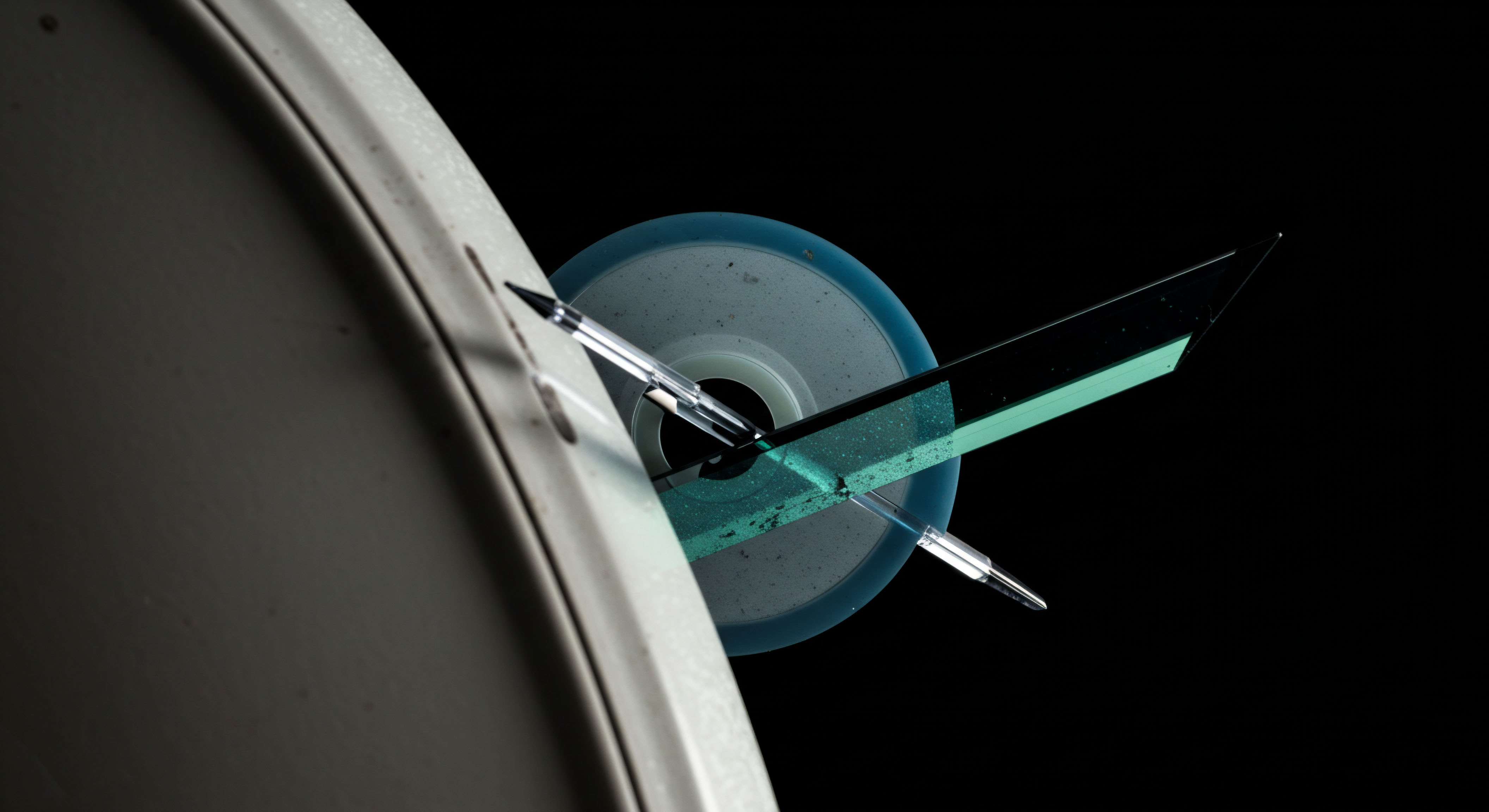

Key integration points involve high-speed API connections to multiple liquidity venues, often leveraging proprietary FIX protocol messages tailored for crypto derivatives. These APIs facilitate rapid order submission, cancellation, and real-time market data consumption. The data pipeline itself is a critical component, ingesting vast quantities of market data ▴ including order book depth, trade ticks, and implied volatility surfaces ▴ at sub-millisecond speeds.

This data is then normalized, validated, and fed into quantitative models for real-time risk calculations and algorithmic decision-making. The infrastructure relies heavily on co-location strategies and dedicated network connectivity to minimize transmission delays, ensuring that trading signals reach exchanges with the utmost speed.

- OMS Integration ▴ Connecting proprietary Order Management Systems directly to multiple crypto exchanges and OTC desks via high-speed APIs for consolidated order routing and execution tracking.

- EMS Optimization ▴ Deploying Execution Management Systems with embedded smart order routing logic, dynamically selecting the optimal venue for each options leg based on liquidity, price, and latency considerations.

- Data Normalization ▴ Implementing robust data normalization layers to process disparate market data feeds from various sources into a unified, consistent format for quantitative analysis.

- Low-Latency Connectivity ▴ Utilizing co-location services and dedicated fiber optic networks to minimize latency between trading infrastructure and exchange matching engines.

- Smart Contract Interfacing ▴ Developing modules within the trading system to interact directly with on-chain smart contracts for collateral management, automated portfolio rebalancing, and decentralized options execution.

The computational backbone consists of high-performance computing clusters, capable of running complex options pricing models and risk simulations in parallel. This processing power enables real-time Greeks calculation (delta, gamma, vega, theta) across the entire portfolio, providing an immediate understanding of exposure. Automated failover mechanisms and redundant systems are fundamental to the architecture, ensuring continuous operation even in the event of hardware failures or network disruptions. Security protocols, including multi-factor authentication, cold storage solutions for digital assets, and continuous penetration testing, are integrated at every layer to protect against cyber threats.

This holistic architectural design underpins the institution’s ability to operate with confidence and control within the high-stakes environment of crypto options trading. The inherent complexity of managing digital asset collateral, which may reside on-chain or with custodians, requires specialized modules within the OMS/EMS to track and manage these assets dynamically, integrating with blockchain explorers and custodial APIs for real-time verification of holdings and movements.

References

- Gomber, P. Kauffman, R. J. Parker, M. & Weber, B. (2011). A primer on high-frequency trading. Journal of Trading, 6(4), 6-23.

- O’Hara, M. (1995). Market microstructure theory. Blackwell Business.

- Cont, R. (2001). Empirical properties of asset returns ▴ Stylized facts and statistical models. Quantitative Finance, 1(2), 223-236.

- Hull, J. C. (2018). Options, futures, and other derivatives. Pearson Education.

- Lehalle, C. A. & Neuman, S. (2013). Market microstructure in practice. World Scientific Publishing Company.

- Harris, L. (2003). Trading and exchanges ▴ Market microstructure for practitioners. Oxford University Press.

- Fabozzi, F. J. & Mann, S. V. (2015). The Handbook of Fixed Income Securities. McGraw-Hill Education.

- Glasserman, P. (2003). Monte Carlo methods in financial engineering. Springer Science & Business Media.

- Jarrow, R. A. & Turnbull, S. M. (1996). Derivative securities. South-Western College Pub.

- Shiller, R. J. (2015). Irrational exuberance. Princeton University Press.

Strategic Command Imperatives

The complexities inherent in high-frequency crypto options trading demand a continuous evolution of an institution’s operational framework. Consider the fundamental question ▴ Does your current system provide a true informational advantage, or merely keep pace with market entropy? The insights gleaned from a rigorous analysis of market microstructure, coupled with the strategic deployment of advanced quantitative models and resilient technological architecture, serve a singular purpose ▴ to empower decisive action. This is not about incremental gains; it concerns securing a structural edge.

Reflect on the adaptability of your current risk models to unforeseen market dislocations and the responsiveness of your execution protocols under extreme volatility. A superior operational framework is not a static construct; it represents a dynamic, intelligent system, constantly learning and refining its capabilities to master the intricate dance of digital asset derivatives. Your command over these elements ultimately dictates your strategic potential.

Glossary

High-Frequency Crypto Options Trading

Market Microstructure

Risk Mitigation

Digital Assets

Crypto Options

Digital Asset

Systemic Risk

High-Frequency Crypto Options

Market Impact

Automated Delta Hedging

Operational Framework

High-Frequency Crypto

Discreet Protocols

Delta Hedging

Market Data

On-Chain Order Books

Crypto Options Trading

Capital Efficiency

Risk Management

Automated Delta