The Imperative of Discreet Execution

Navigating the volatile currents of crypto options markets presents a unique set of challenges for institutional participants. The sheer scale of institutional orders often clashes with the inherent transparency of public blockchains and traditional exchange order books, creating a fertile ground for information leakage. This leakage, if unmitigated, can lead to adverse price movements, diminished execution quality, and ultimately, a substantial erosion of capital efficiency. For principals and portfolio managers, understanding the systemic vulnerabilities of price discovery in a nascent, yet rapidly maturing, asset class is the first step toward building a robust operational defense.

Consider the intricate dance of liquidity provision and demand. A large block trade, when openly advertised, immediately signals directional intent, allowing predatory actors to front-run or manipulate prices against the institutional trader. This dynamic transforms a seemingly straightforward execution into a complex strategic maneuver, demanding sophisticated protocols that shield intent while securing optimal pricing. The pursuit of superior execution in crypto options, therefore, transcends mere transactional efficiency; it becomes an exercise in preserving alpha through operational discretion.

Information leakage in crypto options RFQ execution poses significant risks to institutional capital efficiency, necessitating advanced mitigation strategies.

The core challenge stems from the interplay of market microstructure and the request for quote (RFQ) mechanism itself. While RFQs offer a tailored approach to sourcing liquidity for complex or large orders, their design can inadvertently expose critical order information to market makers. This exposure creates an asymmetry, allowing liquidity providers to adjust their quotes to the detriment of the order initiator. A comprehensive understanding of these underlying market mechanics, encompassing order book dynamics and the behavior of diverse market participants, becomes paramount for effective risk management.

Mitigating information leakage is a multi-layered problem, demanding a holistic approach that integrates technological innovation with refined trading protocols. Solutions range from enhancing anonymity at the point of inquiry to leveraging cryptographic assurances that validate transaction parameters without revealing sensitive details. The goal remains consistent ▴ to enable the seamless execution of substantial crypto options positions at advantageous prices, without inadvertently broadcasting strategic intent to the broader market.

Strategic Frameworks for Preserving Alpha

Institutional traders confronting the challenge of information leakage in crypto options RFQ execution deploy a series of strategic frameworks designed to safeguard their capital and maintain a decisive market edge. These frameworks extend beyond simple transactional tactics, embodying a comprehensive approach to liquidity sourcing, counterparty management, and technological integration. The objective centers on creating an environment where large-scale derivatives positions can be established or unwound with minimal market impact.

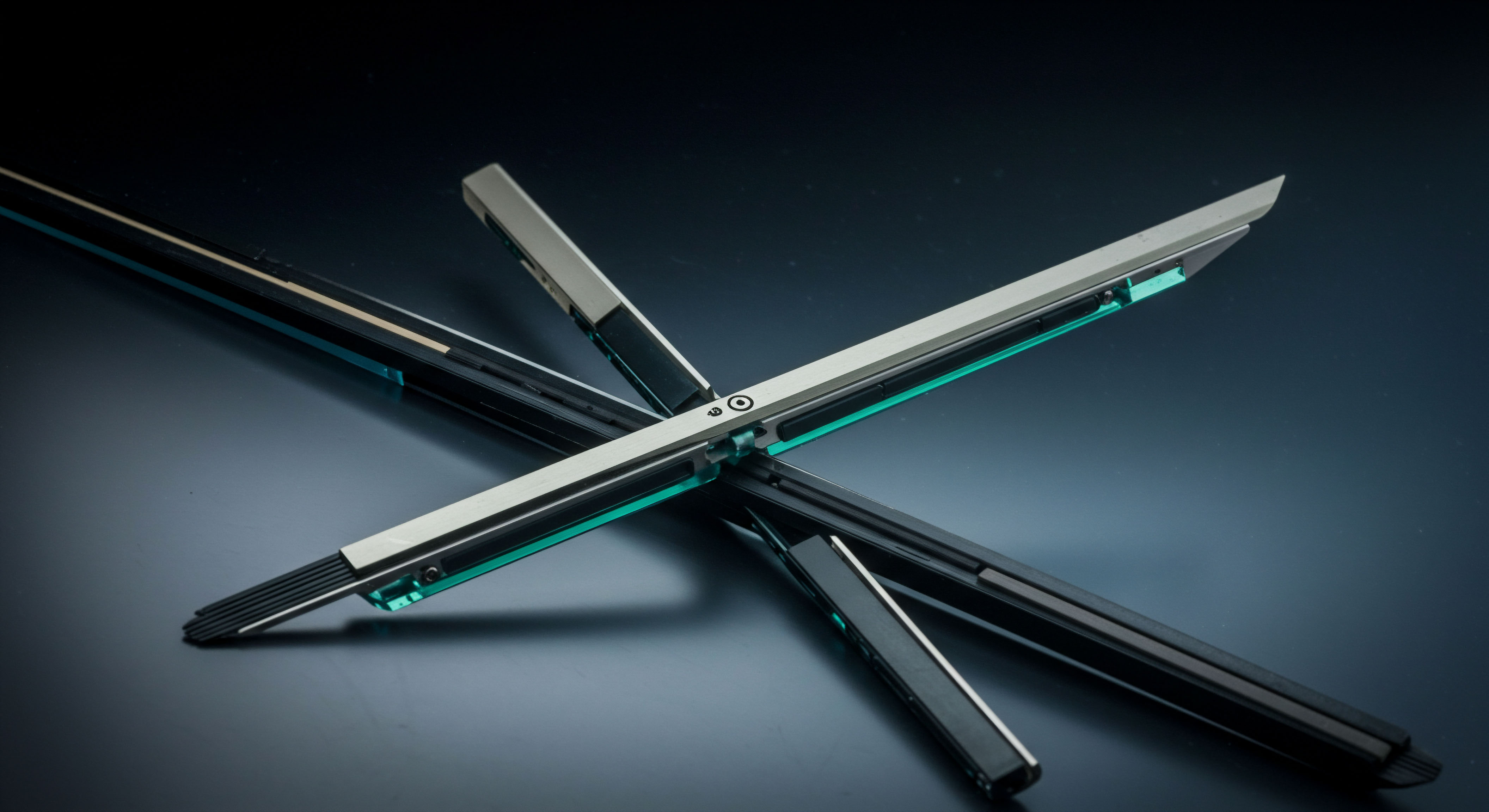

A primary strategic pillar involves the selective engagement of liquidity providers through highly controlled bilateral price discovery mechanisms. Rather than broadcasting an inquiry widely, institutions often leverage private quotation protocols that limit the number of counterparties receiving an RFQ. This targeted approach reduces the probability of information dissemination across the broader market.

Further enhancing this control, platforms offering multi-dealer RFQ capabilities allow institutions to solicit competitive bids from several dealers simultaneously, all while maintaining an anonymous profile. This anonymized bilateral price discovery ensures competitive tension among liquidity providers without revealing the initiator’s identity or trade direction.

Optimizing Liquidity Sourcing

Optimizing liquidity sourcing demands a nuanced understanding of market depth and the behavioral characteristics of various market makers. Institutions prioritize venues that offer deep, aggregated liquidity across diverse crypto options products, including complex multi-leg spreads. Access to such aggregated inquiries enables the efficient pricing and execution of intricate strategies, such as BTC straddle blocks or ETH collar RFQs, where price discovery across multiple legs is critical.

Another strategic imperative involves the judicious use of off-book liquidity sourcing mechanisms, commonly referred to as dark pools. These alternative trading systems provide a confidential environment for executing substantial transactions away from public order books. Dark pools significantly reduce the risk of pre-trade information leakage and adverse price movements by matching buy and sell orders internally, without public disclosure of intentions or trade sizes. This discretion proves invaluable for block trading, where market impact from a large order on a transparent exchange could trigger substantial slippage.

Employing anonymous multi-dealer RFQs and private liquidity networks protects trade intent and minimizes market impact.

The strategic deployment of these off-book venues, whether centralized or decentralized, hinges on their capacity to facilitate large-scale trades at predetermined prices, thereby ensuring minimal slippage and enhanced pricing. For sophisticated traders, this translates into a powerful tool for managing significant volatility block trades without distorting the underlying asset’s price dynamics.

Furthermore, a robust strategic framework incorporates advanced algorithmic execution strategies. Algorithms, such as Time-Weighted Average Price (TWAP) or Volume-Weighted Average Price (VWAP), dissect large orders into smaller, more manageable child orders, disseminating them over time or across multiple venues. This fragmentation effectively masks the true size and intent of the overall order, mitigating market impact and reducing the footprint of the institutional trader. These smart trading within RFQ protocols dynamically adapt to prevailing market conditions, optimizing for best execution by minimizing slippage and capturing favorable liquidity.

Strategic Mitigation Protocols

The table below outlines key strategic mitigation protocols, detailing their function and the specific information leakage risks they address.

| Strategic Protocol | Primary Function | Information Leakage Risk Mitigated |

|---|---|---|

| Anonymous Multi-Dealer RFQ | Solicits bids from multiple counterparties without revealing initiator identity or trade direction. | Pre-trade signaling of directional intent, counterparty front-running. |

| Private Quotation Protocols | Limits RFQ distribution to a select, trusted group of liquidity providers. | Broad dissemination of order interest, opportunistic pricing. |

| Off-Book Liquidity Sourcing (Dark Pools) | Matches large orders away from public order books. | Market impact from large order visibility, price slippage. |

| Algorithmic Execution (TWAP/VWAP) | Breaks large orders into smaller segments for timed or volume-based release. | Order size signaling, rapid adverse price movements. |

Developing an overarching intelligence layer forms another critical component of a comprehensive strategy. This involves integrating real-time intelligence feeds for market flow data, allowing institutional desks to gain deeper insights into aggregated order imbalances and potential liquidity pockets. Expert human oversight, often provided by system specialists, complements these automated systems, offering a critical qualitative layer to complex execution decisions. These specialists can interpret subtle market cues that algorithms might overlook, providing adaptive guidance during periods of heightened volatility or unusual market behavior.

Operationalizing Discreet Transaction Flow

The transition from strategic intent to precise execution in crypto options RFQ environments demands an acute focus on operational protocols and technological safeguards. For institutional traders, operationalizing discreet transaction flow is paramount for securing best execution and safeguarding sensitive alpha-generating strategies. This section delves into the specific mechanisms and technical standards that underpin successful information leakage mitigation.

High-Fidelity Execution Protocols

High-fidelity execution for multi-leg spreads requires systems capable of atomic settlement, where all components of a complex options strategy are executed simultaneously or none at all. This eliminates leg risk, a significant concern when executing multi-faceted strategies such as options spreads RFQ, which involve simultaneous buying and selling of different option contracts. Decentralized clearing and settlement mechanisms further minimize counterparty risks, providing a robust operational framework. Platforms designed for institutional flow offer customizable RFQ builders, allowing traders to define intricate parameters for their options orders, including underlying assets, strikes, expiries, and sizes, with integrated payoff modeling for pre-trade risk visualization.

Central to maintaining discretion during the quote solicitation protocol is the deployment of anonymous options trading capabilities. This feature ensures that the identity of the inquiring institution remains shielded from market makers until a trade is agreed upon. Platforms achieve this through secure communication channels and pseudonymized identifiers, preventing liquidity providers from discerning the order initiator’s trading patterns or overall portfolio positioning. This level of anonymity fosters a more competitive bidding environment, as market makers must quote their tightest prices without the advantage of knowing their counterparty’s strategic hand.

Anonymous RFQ functionality, coupled with advanced cryptographic techniques, establishes a secure channel for price discovery.

System-level resource management, particularly through aggregated inquiries, plays a pivotal role in optimizing liquidity discovery. Instead of sending individual RFQs for each component of a complex strategy, platforms allow for aggregated requests that solicit quotes for the entire multi-leg structure. This not only streamlines the price discovery process but also reduces the overall communication footprint, further minimizing potential information leakage points. The system then intelligently collates and presents the most competitive aggregated quotes, enabling rapid decision-making and execution.

Algorithmic Control and Data Integrity

Algorithmic execution in this context extends beyond simple order slicing. Automated delta hedging (DDH) mechanisms become indispensable for managing the dynamic risk exposures inherent in options trading. These algorithms continuously monitor the delta of an options portfolio, automatically executing offsetting trades in the underlying asset to maintain a desired risk profile.

This proactive risk management minimizes the need for manual interventions, which can inadvertently create market signals. Sophisticated DDH systems operate with low latency, ensuring that hedges are placed efficiently and discreetly, thereby preserving the integrity of the overall options strategy.

Data integrity and the secure transmission of order parameters are foundational elements. This involves robust encryption protocols for all communications between institutional clients and liquidity networks. Furthermore, the emerging application of zero-knowledge proofs (ZKPs) offers a transformative approach to proving compliance and validating trade parameters without revealing the sensitive underlying data.

For example, an institution could prove it meets specific regulatory requirements or has sufficient collateral for a trade without disclosing its entire balance sheet. This “programmable privacy” allows for verifiable transparency that satisfies legal standards while maintaining operational confidentiality.

| Execution Mechanism | Technical Specification | Operational Benefit | Information Leakage Point Addressed |

|---|---|---|---|

| Atomic Multi-Leg Execution | Simultaneous execution of all components of a spread. | Eliminates leg risk, ensures strategy integrity. | Partial execution revealing directional intent. |

| Pseudonymized RFQ Identity | Secure, anonymous identifiers for initiating parties. | Fosters competitive quoting, prevents counterparty bias. | Identification of institutional trader’s strategic patterns. |

| Automated Delta Hedging (DDH) | Real-time, low-latency hedging of options delta. | Maintains risk profile, reduces manual market impact. | Manual hedging activities creating market signals. |

| Zero-Knowledge Proofs (ZKPs) | Cryptographic verification of data without revealing the data itself. | Ensures compliance and data privacy simultaneously. | Exposure of sensitive financial or transactional data. |

Quantitative Parameters for Optimal Execution

Optimal execution hinges on a meticulous analysis of quantitative parameters, ensuring that the desired outcome aligns with the prevailing market microstructure. Key metrics, such as realized slippage, market impact costs, and execution speed, are continuously monitored and optimized. Realized slippage, the difference between the expected price and the actual executed price, serves as a direct measure of information leakage’s financial cost. Minimizing slippage, therefore, becomes a core objective, achieved through the intelligent routing of orders to deep liquidity pools and the strategic timing of executions.

Market impact costs, which quantify the price movement induced by an order, are managed through careful order sizing and the utilization of execution algorithms. These algorithms are configured with parameters that dictate the pace and aggression of order placement, balancing the need for rapid execution with the imperative to avoid market signaling. The speed of execution, particularly in fast-moving crypto markets, remains a critical factor. Low-latency systems and direct market access (DMA) capabilities allow institutional traders to react instantaneously to market opportunities and price changes, thereby reducing the window for adverse information-based trading.

The implementation of a robust pre-trade analytics suite empowers traders with a comprehensive understanding of potential execution costs and market impact before initiating an RFQ. This suite provides granular data on historical liquidity, volatility, and typical slippage for specific crypto options contracts. Armed with this intelligence, institutions can refine their RFQ parameters, selecting optimal trade sizes, acceptable price ranges, and preferred execution venues to maximize their probability of achieving best execution. This analytical rigor transforms execution from a reactive process into a proactive, data-driven discipline.

Furthermore, post-trade transaction cost analysis (TCA) offers an invaluable feedback loop, enabling institutions to evaluate the effectiveness of their information leakage mitigation strategies. TCA reports dissect every aspect of the trade, comparing executed prices against various benchmarks, analyzing market impact, and identifying any hidden costs. This continuous evaluation refines execution protocols, providing actionable insights for improving future RFQ processes and enhancing overall trading performance.

References

- Harris, Larry. Trading and Exchanges ▴ Market Microstructure for Practitioners. Oxford University Press, 2003.

- O’Hara, Maureen. Market Microstructure Theory. Blackwell Publishers, 1995.

- Madhavan, Ananth. “Market Microstructure ▴ A Survey.” Journal of Financial Markets, vol. 3, no. 3, 2000, pp. 205-258.

- Lehalle, Charles-Albert. “Optimal Trading with Market Impact and Transaction Costs.” Quantitative Finance, vol. 12, no. 5, 2012, pp. 783-796.

- Foucault, Thierry, Marco Pagano, and Ailsa Röell. Market Liquidity ▴ Theory, Evidence, and Policy. Oxford University Press, 2013.

- Glosten, Lawrence R. and Paul R. Milgrom. “Bid, Ask and Transaction Prices in a Specialist Market with Heterogeneously Informed Traders.” Journal of Financial Economics, vol. 14, no. 1, 1985, pp. 71-100.

- Gorton, Gary B. and James Kahn. “The Design of Bank Loan Contracts ▴ The Role of Collateral.” Journal of Financial Economics, vol. 35, no. 2, 1994, pp. 151-185.

Evolving Operational Control

The continuous evolution of digital asset markets demands an equally dynamic approach to operational control. The insights presented here form components of a larger system of intelligence, a framework that empowers institutional traders to navigate the complexities of crypto options RFQ execution with unparalleled discretion and efficiency. Reflect upon your existing operational infrastructure ▴ does it truly provide the granular control and anonymity required to preserve alpha in a landscape defined by rapid innovation and persistent information asymmetries?

Mastering these advanced protocols and embracing cutting-edge cryptographic solutions transcends mere technical adoption; it signifies a strategic commitment to operational excellence. The capacity to execute large, sensitive trades without inadvertently revealing strategic intent defines a new frontier of competitive advantage. This mastery ensures that every transaction aligns with the broader portfolio objectives, reinforcing capital efficiency and maintaining a decisive edge in the ever-shifting currents of digital finance.

Glossary

Information Leakage

Price Discovery

Crypto Options

Market Microstructure

Liquidity Providers

Without Revealing

Liquidity Sourcing

Crypto Options Rfq

Market Impact

Best Execution

Smart Trading

Options Rfq

Anonymous Options Trading

Automated Delta Hedging