Market Velocity Redefined

The introduction of minimum quote life regulations fundamentally alters the temporal dynamics of liquidity provision, presenting a profound shift for institutional market participants. Your operational framework, once optimized for instantaneous order book adjustments, now confronts a mandate for sustained presence. This regulatory evolution demands a re-evaluation of fundamental trading assumptions, moving beyond the transient nature of fleeting quotes towards a more deliberate commitment of capital.

Understanding this paradigm involves recognizing how a simple time constraint ripples through the complex interplay of price discovery, risk management, and execution efficacy. The market’s rhythm changes, necessitating a recalibration of internal systems and strategic approaches to maintain competitive positioning.

Minimum quote life regulations compel market makers to maintain price commitments for a specified duration, fundamentally reshaping liquidity provision dynamics.

Historically, market makers operated within an environment that often rewarded ultra-low latency strategies, where the ability to rapidly post, cancel, and re-post quotes allowed for dynamic adaptation to micro-market shifts. This agility, while fostering tight spreads, sometimes contributed to a perception of “phantom liquidity,” where displayed depth could vanish instantaneously during periods of market stress. Minimum quote life provisions directly address this phenomenon, requiring quotes to remain actionable for a defined period.

This structural change influences how market makers assess the opportunity cost of capital, demanding a more considered deployment of inventory and a heightened focus on the longevity of their price signals. The implications extend to the very essence of how liquidity is both perceived and provided across various asset classes, from equities to complex derivatives.

Such regulations impose a tangible cost on market makers, manifesting as increased exposure to adverse selection. When a quote must remain live for a specified duration, the market maker faces an elevated risk that new information, arriving during that interval, renders the existing quote stale or disadvantageous. This extended exposure necessitates a more robust framework for pre-trade analysis and real-time risk assessment.

The objective becomes providing reliable, persistent liquidity, shifting the emphasis from sheer speed to informed, stable presence. This transformation requires sophisticated modeling of information asymmetry and a proactive approach to hedging, thereby altering the fundamental economic calculus of market making.

Strategic Imperatives for Enduring Liquidity

Minimum quote life regulations compel market makers to engage in a profound strategic re-evaluation, recalibrating their approach to capital deployment, risk exposure, and competitive differentiation. The previous emphasis on ephemeral, high-frequency quoting yields to a strategic imperative for enduring liquidity provision. This shift demands a deeper commitment of capital for longer durations, transforming the core economic model of market making. Firms must now prioritize robust capital allocation frameworks that account for extended inventory holding periods and the increased probability of information-driven losses.

A central strategic pivot involves the re-engineering of pricing models. Traditional models, optimized for rapid quote adjustments, require enhancements to incorporate the explicit cost of quote life. This includes a more rigorous assessment of adverse selection risk, where the probability of being “picked off” by informed traders increases with the quote’s duration.

Market makers will strategically widen bid-ask spreads to compensate for this elevated risk, particularly in volatile market conditions or for less liquid instruments. The strategic determination of optimal spread width becomes a multi-dimensional problem, balancing the need for competitive pricing with the imperative of capital preservation.

Strategic adjustments under minimum quote life mandates involve re-engineering pricing models to incorporate extended adverse selection risk and optimizing capital deployment for sustained liquidity.

Another critical strategic dimension involves the re-calibration of inventory management systems. With quotes remaining active for longer, market makers accumulate inventory with greater certainty, but also with prolonged exposure to price fluctuations. The strategic goal is to minimize inventory imbalances through sophisticated hedging mechanisms and a more deliberate approach to order flow internalization.

This means a greater reliance on dynamic hedging strategies, potentially leveraging derivatives markets to offset directional risks accumulated from fulfilling minimum quote life obligations. The strategic interplay between spot market quoting and derivative hedging becomes paramount for maintaining a balanced risk profile.

Refined Risk Profiling and Capital Allocation

Market makers must develop a refined risk profiling methodology that quantifies the impact of minimum quote life on various risk vectors. This includes market risk, operational risk, and counterparty risk. The longer a quote remains live, the greater the potential for significant market movements to erode profitability.

Consequently, capital allocation decisions evolve to support a more resilient balance sheet, ensuring sufficient reserves to absorb potential losses from prolonged quote exposure. This involves stress-testing scenarios that simulate adverse market conditions coupled with extended quote life requirements, allowing for a proactive assessment of capital adequacy.

- Dynamic Spread Adjustment ▴ Market makers implement algorithms to adjust bid-ask spreads based on real-time volatility, order book depth, and the remaining duration of a quote’s life.

- Inventory Hedging Strategies ▴ Sophisticated derivative overlays and cross-asset hedging mechanisms mitigate the directional risk arising from mandated quote duration.

- Information Leakage Control ▴ Protocols are strengthened to minimize the leakage of proprietary trading intentions, preserving the informational edge in a more constrained quoting environment.

The strategic competitive landscape also undergoes a transformation. Firms with superior technological infrastructure and more robust risk management capabilities gain a distinct advantage. These capabilities enable them to meet minimum quote life requirements with narrower spreads and larger sizes, thereby attracting a greater share of order flow.

This structural advantage creates a barrier to entry for less sophisticated participants, fostering a more concentrated market-making ecosystem where technological superiority and capital efficiency become decisive factors. The strategic imperative becomes an ongoing investment in infrastructure and quantitative talent to sustain a competitive edge.

Operational Command ▴ Engineering Persistent Market Presence

The shift mandated by minimum quote life regulations translates into a complex set of operational challenges and technological imperatives for market makers. Executing a successful market-making strategy under these rules demands an operational command center that integrates advanced quantitative models, robust system architecture, and a highly disciplined procedural playbook. This section delves into the granular mechanics of how institutional market makers adapt their execution strategies, leveraging cutting-edge technology and sophisticated analytical frameworks to engineer a persistent and profitable market presence.

Operationalizing minimum quote life requirements extends beyond merely adjusting a timer on an order. It necessitates a holistic overhaul of the trading system’s core logic, from initial quote generation to post-trade reconciliation. The emphasis on sustained liquidity means every component of the execution stack must function with heightened precision and resilience.

This includes pre-trade analytics that anticipate market impact over longer horizons, in-trade risk controls that dynamically manage exposure, and post-trade analysis that refines quoting parameters. The objective is to transform a regulatory constraint into a foundational element of a superior execution architecture.

Implementing minimum quote life demands a holistic overhaul of trading system logic, from pre-trade analytics to post-trade reconciliation, ensuring heightened precision and resilience.

The Operational Playbook

Successfully navigating minimum quote life regulations requires a meticulously crafted operational playbook, a series of defined procedures and protocols that guide every aspect of a market maker’s activity. This playbook codifies the strategic decisions into actionable steps, ensuring consistent and compliant execution.

Pre-Trade Analysis and Quote Generation

The initial phase involves an intensive pre-trade analysis that assesses market conditions, instrument characteristics, and the prevailing regulatory environment. Market makers employ advanced algorithms to generate quotes, considering not only current bid-ask spreads and order book depth, but also the projected market impact over the mandated quote life. This analytical depth informs the optimal quote size and price, balancing the desire for order flow capture with the need to mitigate adverse selection risk.

- Market Condition Assessment ▴ Real-time data feeds analyze volatility, volume, and order book imbalances to inform quoting parameters.

- Inventory Position Evaluation ▴ Current inventory levels and projected future inventory are factored into the bid-ask spread calculation to manage exposure.

- Adverse Selection Modeling ▴ Probabilistic models estimate the likelihood of being traded against by informed participants over the quote’s duration.

- Optimal Spread Determination ▴ Algorithms dynamically calculate the tightest sustainable spread that compensates for all identified risks.

- Quote Size Optimization ▴ The quantity at which the market maker is willing to trade is set to maximize fill rates while managing inventory risk.

Once generated, quotes are transmitted to the exchange or trading venue. The system ensures that each quote carries the correct time-in-force (TIF) instruction, aligning with the minimum quote life regulation. This is a critical technical detail, as any discrepancy can lead to regulatory breaches or suboptimal execution. The playbook dictates precise error handling procedures for any failed quote submissions or unexpected rejections from the venue.

In-Trade Risk Management and Adjustment

During the active life of a quote, continuous monitoring and dynamic risk management are paramount. The operational playbook outlines protocols for responding to significant market events, such as sudden price movements, news announcements, or order book dislocations.

- Dynamic Risk Limits ▴ Automated systems enforce real-time risk limits, triggering alerts or automatic quote adjustments if exposure exceeds predefined thresholds.

- Price Adjustment Logic ▴ While the quote life mandate prevents immediate cancellation, the system incorporates logic for adjusting other outstanding quotes or hedging positions to manage overall portfolio risk.

- Latency Monitoring ▴ Continuous monitoring of execution latency ensures that quotes are submitted and acknowledged within acceptable parameters, preventing unintended exposure.

- Compliance Monitoring ▴ Automated compliance checks verify that all active quotes adhere to the minimum quote life, size, and spread requirements.

The challenge involves managing the firm’s overall risk profile without violating the individual quote life constraints. This often means leveraging a portfolio-level hedging strategy that dynamically offsets aggregated exposure across multiple instruments and quotes. The playbook specifies the hierarchy of actions, prioritizing regulatory compliance while striving for optimal risk-adjusted returns.

Post-Trade Reconciliation and Performance Analysis

Following the expiration or execution of a quote, a thorough post-trade reconciliation process begins. This involves verifying all fills against the original quote parameters and ensuring accurate settlement.

Performance analysis provides critical feedback for refining the market-making strategy. Metrics such as fill rates, realized spreads, adverse selection costs, and inventory holding costs are meticulously tracked. This data informs adjustments to the pre-trade models and in-trade risk parameters, creating a continuous feedback loop for operational improvement. The playbook mandates regular reviews of these performance metrics to identify areas for optimization and to ensure ongoing adherence to profitability targets under the evolving regulatory landscape.

Quantitative Modeling and Data Analysis

The efficacy of a market maker operating under minimum quote life regulations hinges upon the sophistication of its quantitative models and the rigor of its data analysis. These models translate market microstructure theory into actionable pricing and risk management decisions, directly influencing profitability and stability.

Optimal Quoting Algorithms with MQL Constraints

Optimal quoting algorithms are at the heart of modern market making. Under minimum quote life, these algorithms must explicitly incorporate the time dimension. A common approach involves dynamic programming or reinforcement learning models that optimize bid and ask prices and sizes over a finite horizon, subject to the MQL constraint. These models consider factors such as order arrival rates, volatility, inventory costs, and the probability of adverse selection.

The objective function typically seeks to maximize expected profit, which involves a trade-off between the revenue generated from the bid-ask spread and the costs associated with holding inventory and adverse selection. The MQL constraint acts as a boundary condition, limiting the flexibility of quote adjustment.

Consider a simplified model where a market maker aims to maximize profit over a discrete time horizon. The profit function might be represented as ▴

Profit = (BidPrice – CostToAcquire) Buys + (SellPrice – CostToHold) Sells – AdverseSelectionCost

With the MQL constraint, the BidPrice and SellPrice must remain constant for a minimum duration T_MQL. This introduces a look-ahead component, where current pricing decisions anticipate market conditions T_MQL periods into the future.

| Parameter | Description | Impact of MQL |

|---|---|---|

| Order Arrival Rate (λ) | Frequency of incoming buy/sell orders. | Influences expected fill probability over T_MQL. |

| Volatility (σ) | Expected price fluctuation. | Increases adverse selection risk over T_MQL. |

| Inventory Holding Cost (C_inv) | Cost associated with holding an unbalanced inventory. | Elevated due to longer holding periods. |

| Adverse Selection Probability (P_adv) | Likelihood of trading against an informed party. | Increases with T_MQL, requiring wider spreads. |

| Spread (S) | Difference between bid and ask. | Widens to compensate for increased P_adv and C_inv. |

Data analysis plays a crucial role in calibrating these models. High-frequency trade and quote data provide the empirical basis for estimating order arrival processes, volatility dynamics, and adverse selection probabilities. Machine learning techniques, such as recurrent neural networks, analyze historical order book data to predict short-term price movements and order flow imbalances, further refining quoting strategies under MQL.

Risk Factor Integration and Stress Testing

Minimum quote life mandates require a sophisticated integration of risk factors into the market maker’s quantitative framework. The extended exposure period for quotes means that traditional Value-at-Risk (VaR) or Expected Shortfall (ES) calculations must account for the duration of the quote.

| Risk Type | MQL Impact | Mitigation Strategy |

|---|---|---|

| Market Risk | Increased exposure to price changes over quote life. | Dynamic portfolio hedging, multi-asset class correlations. |

| Adverse Selection Risk | Higher probability of informed trading against stale quotes. | Wider spreads, advanced order flow analytics, liquidity detection. |

| Inventory Risk | Prolonged holding periods for accumulated positions. | Optimized inventory targets, cross-market balancing. |

| Operational Risk | System failures leading to unmanaged open quotes. | Redundant systems, automated fail-safes, robust monitoring. |

Stress testing becomes a more granular exercise. Scenarios include sudden spikes in volatility, significant news events, or flash crashes, all simulated with the constraint of fixed quote life. This allows the firm to quantify potential losses and ensure capital reserves are adequate. The analysis also considers the impact of MQL on hedging effectiveness, as dynamic hedging strategies might themselves be constrained by market liquidity or execution costs during stressed periods.

Predictive Scenario Analysis

Understanding the real-world implications of minimum quote life regulations transcends theoretical models; it requires a rigorous predictive scenario analysis. This approach allows market makers to simulate various market conditions and assess the tangible impact on their operational metrics, profitability, and risk exposure. Let us construct a detailed case study involving a hypothetical digital asset derivatives market maker, “Genesis Quants,” operating under a newly implemented 500-millisecond minimum quote life regulation for Bitcoin (BTC) options.

Genesis Quants specializes in providing liquidity for short-dated BTC options, a market characterized by high volatility and rapid information dissemination. Before the MQL regulation, their algorithms optimized for sub-100-millisecond quote adjustments, frequently re-pricing based on every tick in the underlying spot market and incoming order flow. The new 500ms MQL represents a significant constraint, effectively increasing their exposure window fivefold.

Scenario 1 ▴ Stable Market Conditions

In a period of low volatility and balanced order flow, Genesis Quants observes an initial widening of spreads across the market as all participants adjust to the MQL. Their internal models, now incorporating the 500ms exposure, recommend a 5% increase in bid-ask spreads for at-the-money (ATM) BTC options compared to pre-MQL levels. Despite the wider spreads, order fill rates remain relatively stable, as institutional counterparties value the guaranteed liquidity. Genesis Quants’ inventory accumulation is gradual and balanced, with their delta hedging algorithms effectively neutralizing directional exposure in the underlying BTC spot market.

The additional revenue from the wider spreads comfortably offsets the marginally increased inventory holding costs and a slight uptick in adverse selection from slower-moving information. The predictive analysis here suggests a moderate, but sustainable, profit margin, albeit with a reduced trading velocity. The firm’s ability to maintain competitive spreads, even with the MQL, allows it to capture a significant portion of the available order flow, reinforcing its position as a primary liquidity provider. This scenario underscores the importance of a robust, MQL-aware pricing engine that accurately balances spread, size, and duration.

Scenario 2 ▴ Moderate Volatility Spike

A sudden, but anticipated, news event causes a moderate spike in BTC spot volatility, increasing implied volatility across the options curve. Pre-MQL, Genesis Quants would have immediately widened spreads and reduced quote sizes to manage risk. With the 500ms MQL, their ability to react instantaneously is curtailed.

Their predictive models, however, had pre-emptively widened spreads by an additional 10% for the next 30 minutes, anticipating the volatility increase and the inherent lag in quote adjustment. This proactive adjustment, based on leading indicators and a sophisticated volatility forecasting model, allows them to maintain a defensible position.

During the volatility spike, Genesis Quants experiences a higher rate of adverse selection on their outstanding quotes. Some of their bids are hit just before a downward price movement, and some of their offers are taken just before an upward swing. The 500ms window proves sufficient for informed traders to capitalize on these micro-movements. However, the pre-emptive spread widening limits the per-trade loss.

Their dynamic hedging system, while operating on a slower feedback loop due to the MQL, still manages to keep the overall portfolio delta within acceptable bounds. The predictive analysis shows a temporary dip in profitability during the peak volatility, but the pre-configured defenses prevent catastrophic losses. This scenario highlights the transition from reactive, sub-millisecond risk management to a more anticipatory, model-driven approach. The ability to forecast and pre-position quotes becomes a crucial determinant of success.

Scenario 3 ▴ Unexpected Flash Crash

The most challenging scenario involves an unforeseen flash crash in the BTC spot market, characterized by a rapid, severe price drop followed by a quick recovery. In this extreme event, Genesis Quants’ 500ms MQL becomes a significant liability. As the spot price plummets, their outstanding bids for BTC options, locked in for 500ms, are aggressively hit.

Simultaneously, their offers remain untouched as the market seeks lower prices. The firm experiences substantial adverse selection, as counterparties exploit the “stale” bids.

The immediate impact is a rapid accumulation of long options positions and a significant negative P&L. Their automated delta hedging system attempts to sell underlying BTC to rebalance, but the speed of the crash and the MQL on options quotes create a lag. The predictive scenario analysis quantifies this maximum potential loss, revealing that even with pre-emptive spread adjustments, an extreme, rapid market dislocation can overwhelm the MQL-constrained quoting engine. This forces a re-evaluation of the firm’s overall capital-at-risk limits and potentially leads to the implementation of “circuit breaker” mechanisms.

These mechanisms would temporarily withdraw quotes or significantly widen spreads across all instruments if a predefined market stress indicator is breached, even if it means momentarily failing to meet MQL for certain illiquid contracts (with appropriate regulatory notification). The predictive analysis in this scenario underscores the limits of MQL in extreme events and the necessity for robust, higher-level kill switches and capital safeguards.

These predictive scenarios illustrate that minimum quote life regulations transform market making from a purely speed-driven game into a sophisticated exercise in probabilistic forecasting, robust risk modeling, and strategic capital deployment. The operational imperative shifts towards building systems that can anticipate, rather than merely react, to market dynamics, ensuring resilience even when instantaneous quote adjustments are no longer an option.

System Integration and Technological Architecture

The imposition of minimum quote life regulations profoundly impacts the technological architecture and system integration requirements for institutional market makers. To thrive in this environment, firms require a robust, low-latency, and highly resilient trading infrastructure that supports sustained quote presence and sophisticated risk management.

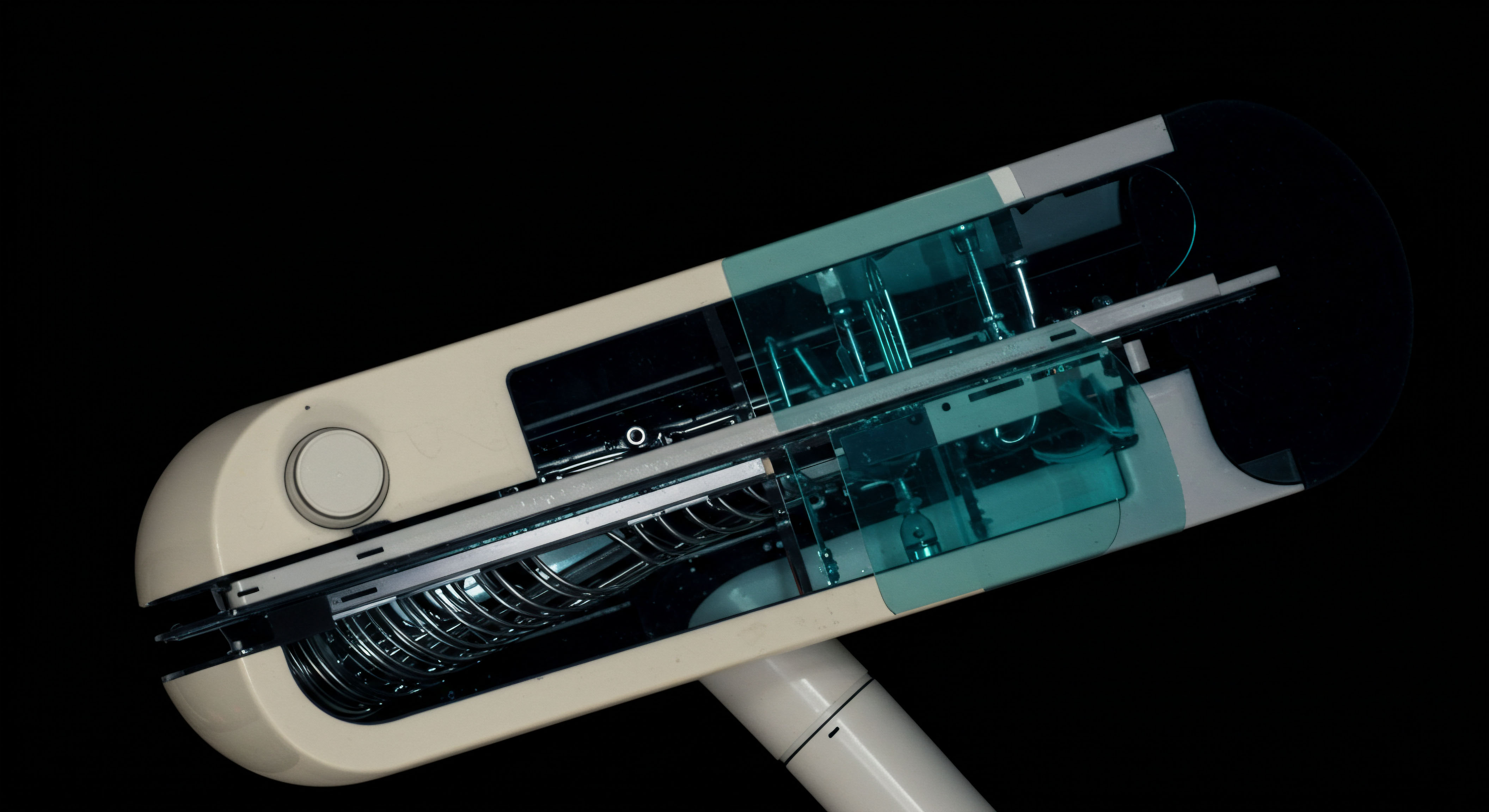

Foundational Infrastructure ▴ Low-Latency and Resilience

At the core of any successful market-making operation lies a meticulously engineered low-latency infrastructure. This includes proximity hosting in exchange co-location facilities, direct market access (DMA) connections, and optimized network pathways. While MQL regulations reduce the urgency of sub-millisecond quote updates, the ability to rapidly process market data, compute optimal quotes, and transmit them efficiently remains paramount. This efficiency ensures that the quote is placed as soon as the pricing decision is made, maximizing the window for potential fills within the MQL duration.

System resilience takes on increased importance. A system outage or a significant delay in market data processing means a market maker’s quotes could remain stale for the entire MQL period, leading to substantial adverse selection. Therefore, redundant systems, failover mechanisms, and continuous monitoring of all hardware and software components are architectural imperatives. This includes geographically distributed data centers and automated recovery procedures that minimize downtime and ensure continuous operational capability.

Order and Execution Management Systems (OMS/EMS)

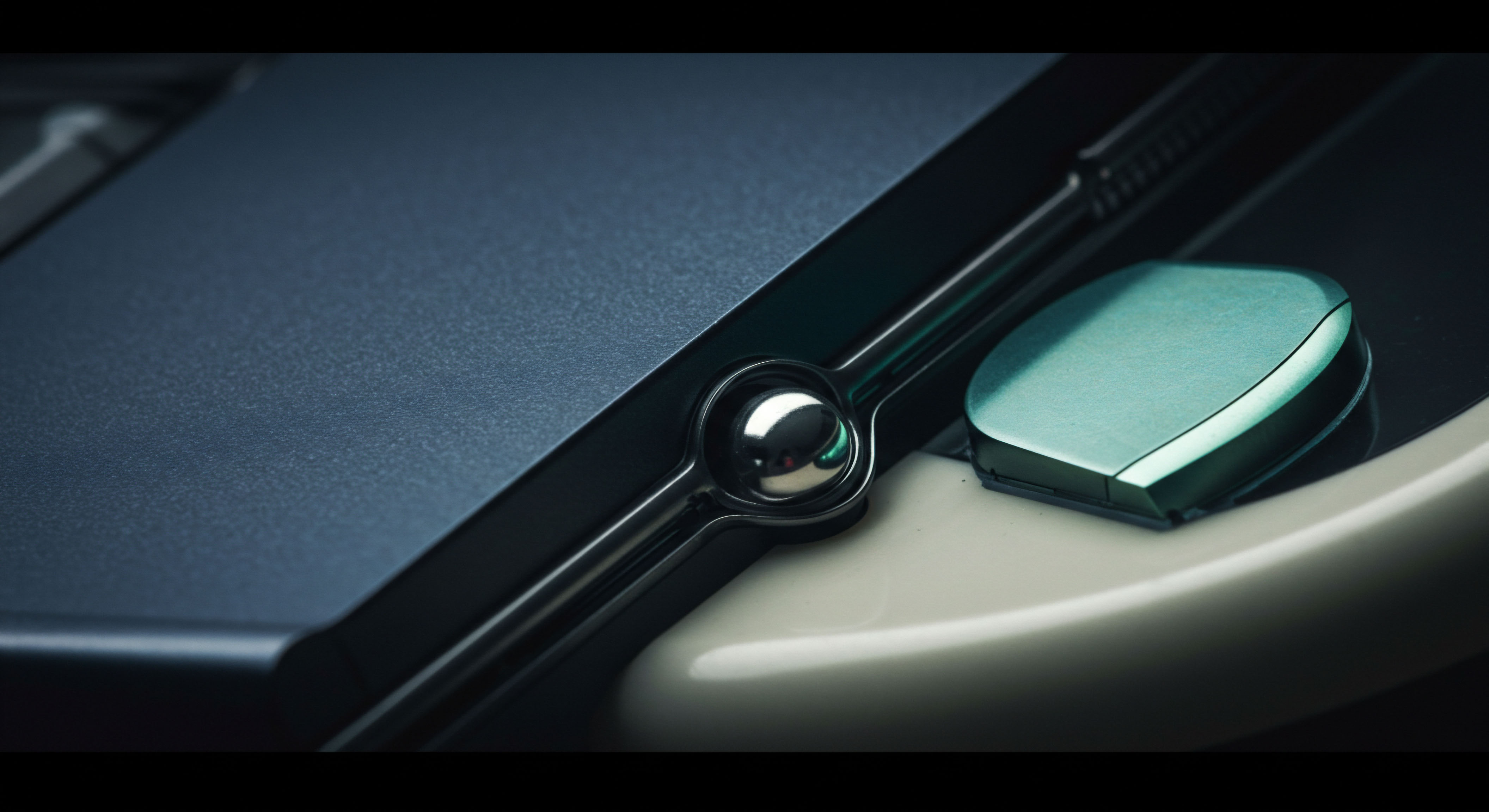

The integration of Order Management Systems (OMS) and Execution Management Systems (EMS) forms the backbone of the trading workflow. For market makers, these systems are critical for managing the lifecycle of quotes and orders under MQL.

- OMS Functions ▴ The OMS handles the firm’s overall inventory, position keeping, and compliance checks. It ensures that the aggregate exposure across all outstanding quotes and positions remains within regulatory and internal limits. Under MQL, the OMS must track the remaining life of each quote, flagging those nearing expiration or those that have become significantly “out of market” due to price movements.

- EMS Functions ▴ The EMS is responsible for the actual transmission and management of quotes to the various trading venues. It integrates directly with exchange APIs, often via the FIX protocol. The EMS must precisely manage the time-in-force parameters for each quote, ensuring strict adherence to MQL. It also provides real-time feedback on quote status, fills, and rejections.

- OEMS Integration ▴ Many modern firms opt for an integrated Order and Execution Management System (OEMS) to streamline workflows. This unified platform provides a single view of positions, orders, and executions, reducing the risk of data discrepancies and improving operational efficiency. The OEMS’s ability to seamlessly link parent orders from the OMS to child orders and executions from the EMS is crucial for managing the complex interplay of MQL-constrained quotes and their hedging counterparts.

FIX Protocol and API Endpoints

The Financial Information eXchange (FIX) protocol remains the ubiquitous standard for electronic communication between market participants and trading venues. For market makers operating under MQL, FIX protocol messages are the primary conduit for quote submission, modification, and cancellation.

Specific FIX message types become critical ▴

| FIX Message Type | Description | MQL Relevance |

|---|---|---|

| NewOrderSingle (MsgType=D) | Submits a new order/quote. | Contains TimeInForce (Tag 59) and ExpireTime (Tag 126) for MQL. |

| OrderCancelReplaceRequest (MsgType=G) | Modifies an existing order/quote. | Limited use during MQL; requires careful logic to avoid violations. |

| ExecutionReport (MsgType=8) | Reports the status of an order/quote. | Confirms fills, rejections, and quote expiration. |

| MarketDataRequest (MsgType=V) | Requests market data. | Crucial for real-time pricing inputs to MQL-aware algorithms. |

API endpoints provided by exchanges and liquidity venues offer direct, programmatic access to order books and trading functionalities. These APIs, often supporting FIX or proprietary binary protocols, enable the low-latency interaction necessary for market making. The architectural design must account for rate limits, error handling, and the specific nuances of each venue’s implementation to ensure consistent quote delivery and management under MQL.

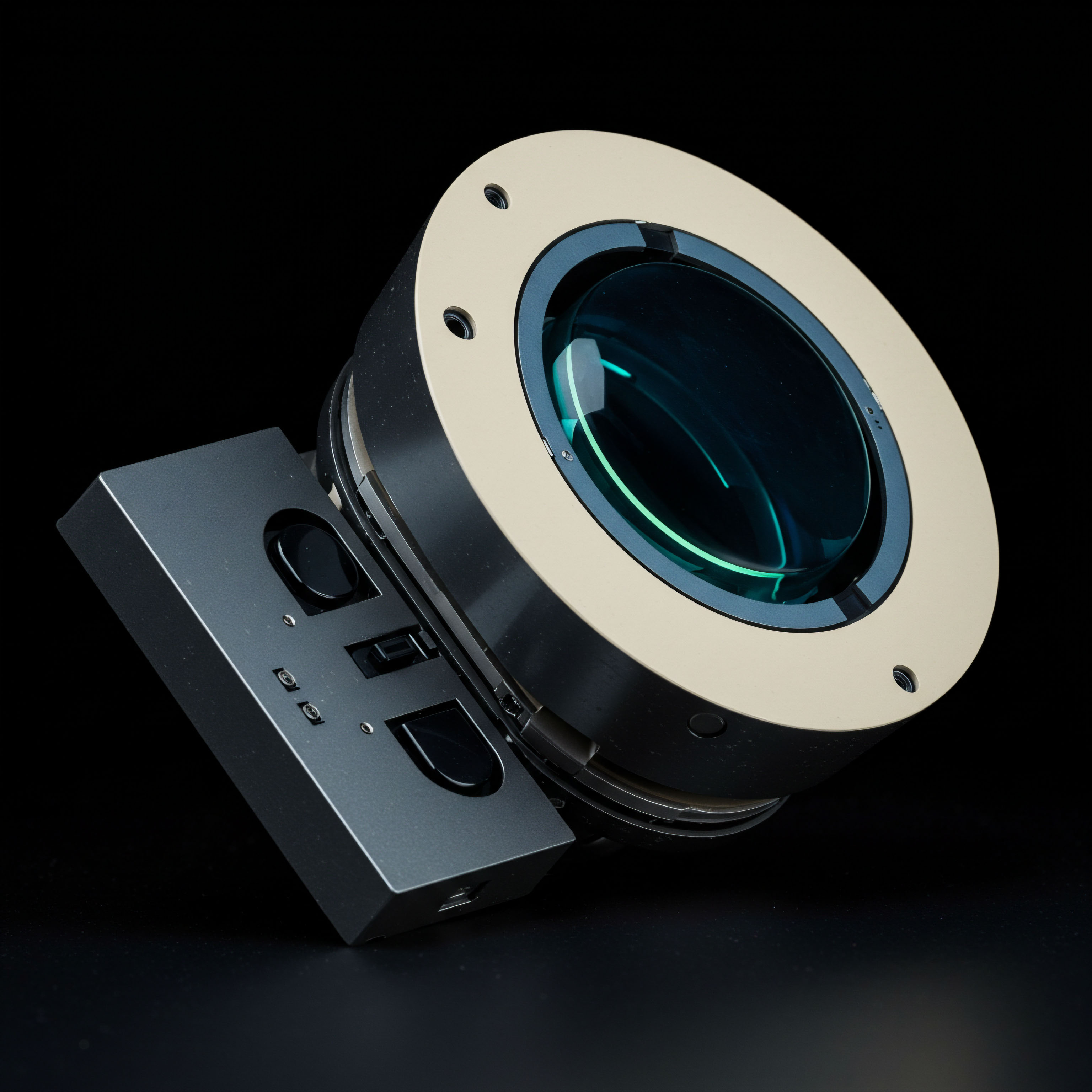

Data Pipelines and Real-Time Analytics

A robust data pipeline is indispensable for collecting, processing, and analyzing the vast quantities of market data required for MQL-compliant market making. This includes tick-by-tick order book data, trade prints, and reference data.

Real-time analytics engines consume this data, feeding it into the optimal quoting algorithms and risk management systems. These engines perform functions such as ▴

- Volatility Surface Calculation ▴ For options market making, continuously updating volatility surfaces is essential for accurate pricing under MQL.

- Order Flow Imbalance Detection ▴ Identifying shifts in buying or selling pressure informs dynamic spread adjustments and hedging decisions.

- Latency Arbitrage Detection ▴ While MQL reduces opportunities, systems still monitor for potential latency advantages held by other participants.

The architectural design of these data pipelines prioritizes speed and integrity, often employing stream processing technologies to ensure that pricing models operate on the freshest possible information. The continuous flow of data underpins the predictive capabilities required to manage the extended exposure introduced by minimum quote life regulations.

References

- Christie, William G. and Paul H. Schultz. “Why Do NASDAQ Market Makers Avoid Odd-Eighth Quotes?” The Journal of Finance, vol. 49, no. 5, 1994, pp. 1813-1840.

- Cont, Rama, Hanna Assayag, Alexander Barzykin, and Wei Xiong. “Competition and Learning in Dealer Markets.” SSRN Electronic Journal, 2024.

- Grossman, Sanford J. and Merton H. Miller. “Liquidity and Market Structure.” The Journal of Finance, vol. 43, no. 3, 1988, pp. 617-633.

- Harris, Larry. Trading and Exchanges ▴ Market Microstructure for Practitioners. Oxford University Press, 2003.

- O’Hara, Maureen. Market Microstructure Theory. Blackwell Publishers, 1995.

- O’Hara, Maureen, and Robert Bartlett. “Navigating the Murky World of Hidden Liquidity.” SSRN Electronic Journal, 2024.

- Parlour, Christine A. “Order Choice in a Limit Order Market.” Journal of Financial Markets, vol. 3, no. 3, 2000, pp. 301-322.

- Foucault, Thierry, Marco Pagano, and Ailsa Röell. Market Liquidity ▴ Theory, Evidence, and Policy. Oxford University Press, 2013.

- Lehalle, Charles-Albert. Market Microstructure in Practice. World Scientific Publishing Co. Pte. Ltd. 2019.

Navigating the New Temporal Order

The imposition of minimum quote life regulations serves as a profound reorientation for market makers, moving beyond the simple metrics of speed to encompass a deeper understanding of temporal commitment and systemic resilience. Your operational intelligence, honed through years of navigating complex market structures, now faces the challenge of engineering enduring liquidity. This regulatory shift invites introspection ▴ how adaptable are your current models to sustained exposure? What unseen vulnerabilities might prolonged quote life expose within your existing risk framework?

Mastering this evolving landscape requires a commitment to continuous refinement of both quantitative prowess and technological infrastructure. The ability to integrate advanced predictive analytics with a robust, MQL-aware execution architecture separates the resilient from the vulnerable. Consider this an opportunity to elevate your operational framework, transforming a regulatory mandate into a structural advantage that provides persistent, high-fidelity liquidity. The future of market making belongs to those who command not merely speed, but also the strategic foresight to thrive within a new temporal order.

Glossary

Quote Life Regulations

Liquidity Provision

Risk Management

Minimum Quote Life

Market Makers

Adverse Selection

Market Maker

Market Making

Minimum Quote

Adverse Selection Risk

Quote Life

Market Conditions

Bid-Ask Spreads

Inventory Management

Order Flow

Dynamic Hedging

Order Book

Capital Efficiency

Selection Risk

Regulatory Compliance

Market Microstructure

Optimal Quoting Algorithms

Genesis Quants

Management Systems

Fix Protocol

Volatility Surface