The Orchestration of Liquidity

Navigating the complex currents of institutional block trading demands a precise understanding of how multi-dealer platforms engineer optimal pricing. Principals recognize that achieving superior execution for substantial orders, especially within the nuanced landscape of digital asset derivatives, hinges upon more than simply gathering bids. It involves a systemic optimization of liquidity access, information asymmetry, and counterparty engagement.

The architecture of these platforms directly addresses the inherent challenges of large-volume transactions, where market impact and price discovery can significantly influence outcomes. The objective is to secure the most favorable terms while minimizing market footprint and preserving alpha generation capabilities.

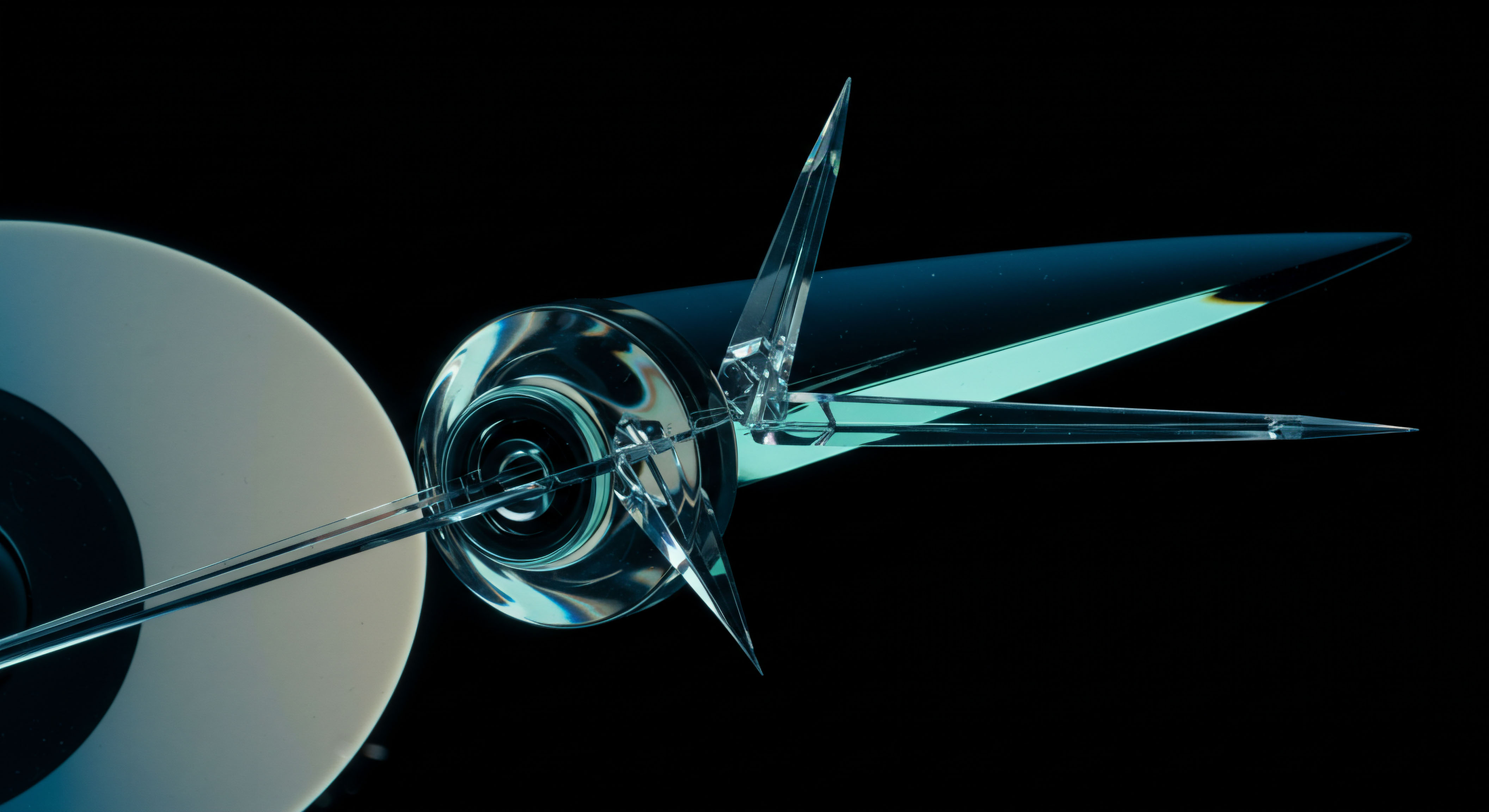

A multi-dealer platform serves as a sophisticated conduit, connecting a requesting client with a curated network of liquidity providers. This framework facilitates a competitive environment for price formation, moving beyond bilateral negotiations to a structured, transparent solicitation process. The core value proposition resides in its capacity to aggregate diverse pricing intentions from multiple dealers, each possessing unique inventory, risk appetites, and market perspectives.

This aggregation allows for a dynamic assessment of available liquidity, ensuring that the client can evaluate a broader spectrum of executable prices than traditional methods might afford. Ultimately, the platform acts as a critical interface, translating complex market dynamics into actionable intelligence for the institutional trader.

Multi-dealer platforms function as sophisticated conduits, enabling clients to access a competitive array of pricing intentions from various liquidity providers.

The Request for Quote (RFQ) mechanism stands as the foundational protocol underpinning block trade pricing on these platforms. RFQ mechanics provide a structured, discreet method for a client to solicit firm, executable prices from a selected group of dealers. This process mitigates information leakage, a persistent concern with large orders, by controlling the dissemination of trading interest. Dealers, in turn, respond with prices reflecting their current inventory positions, risk assessments, and perceived market conditions.

The platform then presents these quotes to the client in a consolidated, anonymized view, fostering genuine competition among liquidity providers. This systematic approach transforms what might otherwise be a fragmented and opaque process into a streamlined, high-fidelity execution pathway, directly influencing the final trade price and overall transaction cost analysis.

Strategic Frameworks for Optimal Execution

Achieving optimal block trade pricing within a multi-dealer environment requires a deliberate strategic framework, one that extends beyond mere quote collection to encompass sophisticated liquidity management and risk mitigation. Institutional participants strategically deploy these platforms to exploit the competitive dynamics among dealers, aiming for a confluence of aggressive pricing and robust liquidity. The strategic advantage derives from the platform’s ability to orchestrate a rapid, controlled price discovery process across multiple counterparties. This contrasts sharply with less structured approaches, which often yield suboptimal pricing due to limited counterparty reach or elevated information leakage.

Liquidity Sourcing and Counterparty Engagement

A central tenet of effective block trade strategy involves intelligent liquidity sourcing. Traders strategically select a panel of dealers for each RFQ, balancing the desire for broad competition with the need to maintain discretion. Over-solicitation can paradoxically dilute competition, as dealers may reduce their quoting aggressiveness when facing too many competitors, or even choose not to respond at all. Therefore, a nuanced understanding of dealer strengths ▴ their historical pricing behavior, inventory depth in specific instruments, and overall market presence ▴ informs the optimal selection process.

This refined approach ensures that each RFQ reaches the most relevant and competitive liquidity providers, maximizing the probability of receiving superior pricing. The goal involves a calculated approach to maximize competitive tension without compromising execution quality.

- Targeted Dealer Selection ▴ Identifying liquidity providers with a demonstrated capacity and appetite for specific block sizes and instrument types.

- Anonymity Preservation ▴ Leveraging platform features to mask trading intent and size, reducing potential market impact from pre-trade signaling.

- Bid-Ask Spread Compression ▴ Utilizing the competitive quoting environment to drive down the effective transaction cost by narrowing the spread.

- Real-time Market Insights ▴ Interpreting aggregated quote data to discern underlying market sentiment and liquidity pockets.

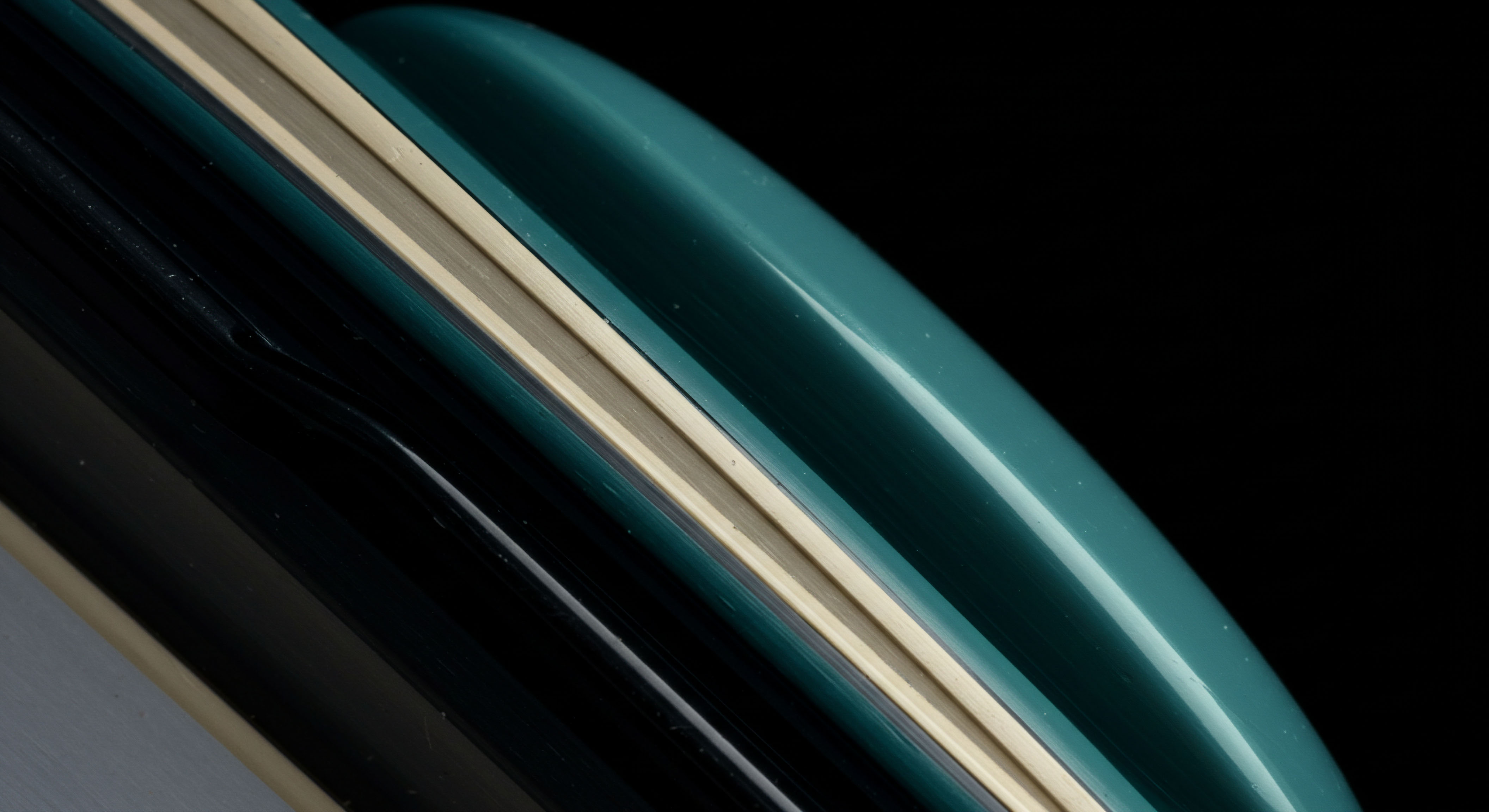

Risk Mitigation and Information Control

The strategic deployment of multi-dealer platforms also centers on robust risk mitigation, particularly concerning information leakage and adverse selection. For large block trades, revealing intent prematurely can lead to significant price deterioration. These platforms employ discreet protocols, such as private quotation systems, to ensure that trading interest remains confidential until a firm price is committed.

This control over information flow protects the client from predatory pricing by high-frequency traders or other market participants who might exploit knowledge of a large impending order. Furthermore, the ability to execute multi-leg strategies, such as options spreads, within a single RFQ streamlines the process and reduces the risk of slippage across individual legs, which can occur when components are traded separately.

Effective block trade strategies on multi-dealer platforms emphasize intelligent liquidity sourcing and robust risk mitigation, especially through information control.

The strategic interplay between price discovery and risk management becomes particularly salient in volatile markets. By obtaining simultaneous, firm quotes, institutional traders can lock in prices quickly, thereby mitigating the risk of adverse price movements during the execution window. This agility is paramount in fast-moving digital asset markets, where price dislocations can occur rapidly.

The platform’s ability to provide a comprehensive view of executable prices across various dealers allows for a swift assessment of market depth and the identification of the most advantageous counterparty. This holistic perspective empowers traders to make informed decisions under pressure, safeguarding portfolio value.

Consider the strategic positioning of a firm engaging in complex options strategies. A multi-dealer platform facilitates the execution of intricate multi-leg options spreads with a single RFQ. This capability prevents the fragmentation of liquidity and potential basis risk that might arise from executing each leg independently.

The platform’s system intelligently processes the combined risk of the spread, allowing dealers to quote a single, all-encompassing price for the entire structure. This streamlined approach minimizes execution uncertainty and enhances the overall efficiency of deploying sophisticated derivative overlays, directly contributing to capital efficiency.

Strategic Pillars for Multi-Dealer Block Trade Engagement

| Strategic Pillar | Key Objective | Mechanism of Action |

|---|---|---|

| Optimized Dealer Engagement | Maximize competitive pricing pressure | Curated RFQ panels, dynamic response analysis |

| Information Asymmetry Management | Minimize pre-trade signaling risk | Anonymous inquiry protocols, discreet quotation |

| Liquidity Aggregation | Consolidate diverse market interest | Simultaneous multi-dealer quoting, consolidated view |

| Execution Speed | Capitalize on fleeting price opportunities | Low-latency quote delivery, rapid order placement |

| Transaction Cost Reduction | Lower effective trading expenses | Tighter bid-ask spreads, reduced market impact |

Operationalizing Superior Execution

The operationalization of block trade pricing on multi-dealer platforms represents a convergence of sophisticated protocols, quantitative analysis, and technological architecture. This domain moves beyond strategic intent to the granular mechanics of execution, where every millisecond and every basis point holds significance. Institutional traders require a profound understanding of these underlying systems to translate strategic objectives into tangible, high-fidelity outcomes. The platform serves as a critical infrastructure, enabling the precise management of order flow, risk exposure, and ultimately, the achievement of best execution.

RFQ Protocol Mechanics for Block Orders

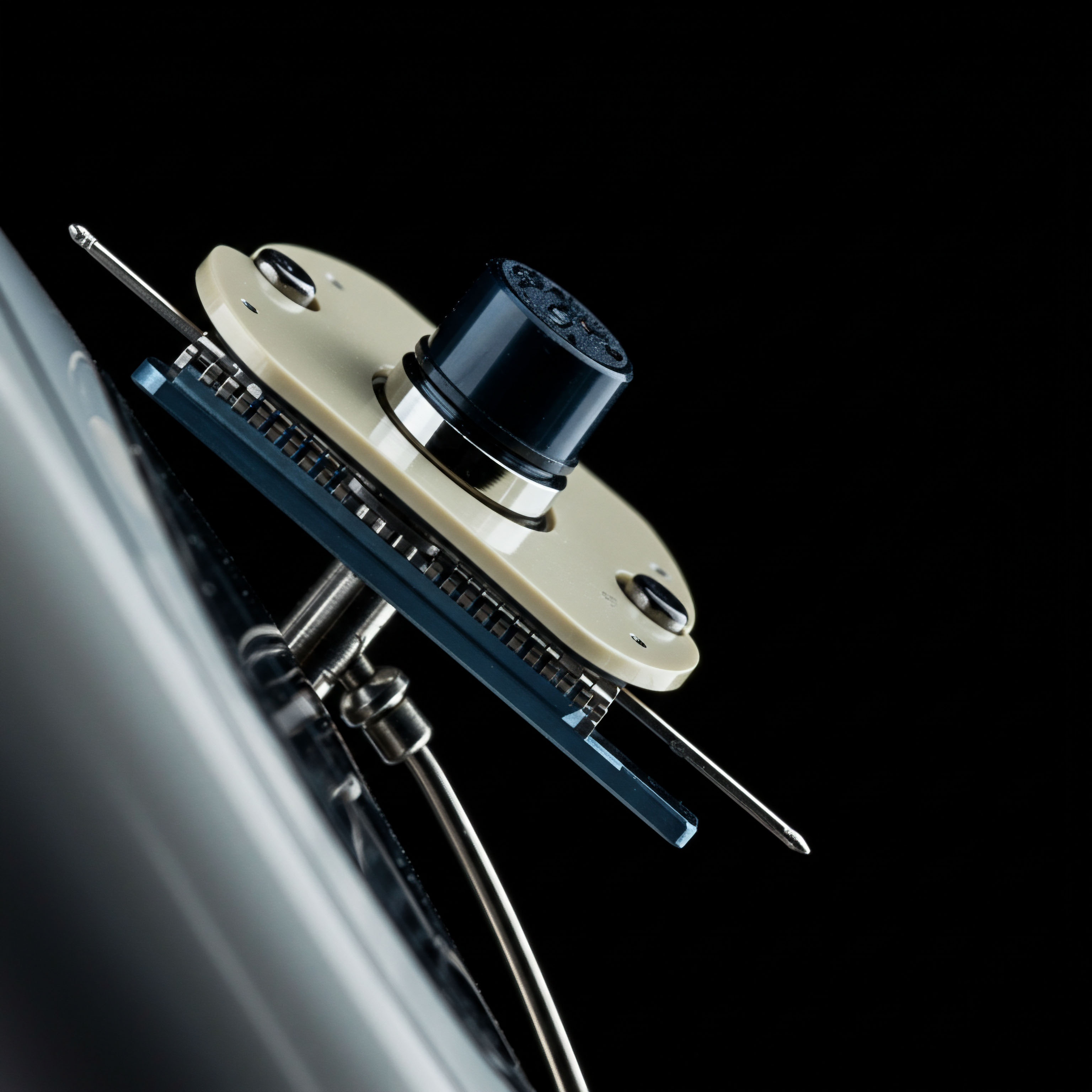

The Request for Quote protocol, when applied to block orders, operates with specific mechanics designed to handle size and discretion. Upon initiation, a client transmits an RFQ to a pre-selected group of liquidity providers. This transmission is often facilitated through standardized messaging protocols, such as FIX (Financial Information eXchange), ensuring seamless communication between the client’s Order Management System (OMS) or Execution Management System (EMS) and the platform. Each dealer receives the inquiry, assesses the request against its inventory, risk limits, and market view, and then submits a firm, executable price.

The platform aggregates these responses, typically presenting them to the client in a ranked, anonymized format. This structure allows the client to evaluate competitive bids and offers without revealing individual dealer identities, fostering a truly competitive environment.

For instance, in crypto options block trading, the RFQ system facilitates the pricing of large, often illiquid, derivative contracts. Dealers leverage their internal pricing models, which account for implied volatility, underlying asset price, time to expiration, and their own inventory delta, to generate a competitive quote. The platform’s ability to handle multi-leg options spreads within a single RFQ is particularly valuable.

A complex strategy, such as a BTC straddle block or an ETH collar RFQ, receives a single, aggregated price from each dealer, simplifying execution and minimizing the risk of adverse price movements across individual components. This systemic integration is paramount for managing the intricate risk profiles of derivative portfolios.

Operationalizing superior block trade execution demands a precise understanding of RFQ protocol mechanics, enabling efficient price discovery and risk management.

Key Phases of a Multi-Dealer Block RFQ Workflow

| Phase | Description | Core Operational Function |

|---|---|---|

| Inquiry Initiation | Client submits trade parameters to selected dealers | Discreet communication, parameter definition |

| Dealer Response | Liquidity providers submit firm, executable prices | Internal pricing model integration, risk assessment |

| Quote Aggregation | Platform consolidates and anonymizes dealer quotes | Competitive display, best price identification |

| Client Execution | Client selects optimal quote and executes trade | Low-latency order routing, immediate confirmation |

| Post-Trade Processing | Trade confirmation, clearing, and settlement | Automated workflow, compliance adherence |

Quantitative Modeling and Data Analysis

Quantitative modeling forms the bedrock of optimal block trade pricing. Dealers on multi-dealer platforms employ sophisticated algorithms to generate prices, balancing the probability of winning a trade against expected profitability and inventory risk. An aggressive quote might secure the trade but reduce margins or expose the dealer to adverse selection.

Conversely, a conservative quote might protect against risk but reduce the likelihood of execution. The models consider factors such as:

- Order Size and Market Depth ▴ Larger orders typically incur greater market impact, which is factored into the quote.

- Volatility Profile ▴ Higher volatility instruments necessitate wider spreads to compensate for increased risk.

- Inventory Skew ▴ A dealer’s existing position in an instrument influences their willingness to buy or sell, leading to a potential bias in their bid or offer.

- Historical Hit Ratios ▴ Dealers analyze past performance to refine their quoting strategy, aiming to optimize their win rate while maintaining profitability.

Data analysis on these platforms extends to pre-trade and post-trade transaction cost analysis (TCA). Pre-trade analytics help in selecting the optimal execution strategy and dealer panel, while post-trade TCA evaluates the effectiveness of the chosen strategy. Metrics such as slippage against a benchmark (e.g. arrival price, volume-weighted average price), market impact costs, and spread capture are rigorously analyzed.

This continuous feedback loop refines future execution decisions, contributing to a virtuous cycle of optimization. For instance, a detailed analysis might reveal that certain dealers consistently offer tighter spreads for specific block sizes in particular market conditions, informing future RFQ routing decisions.

Consider a scenario involving a large institutional order for Bitcoin options. The dealer’s pricing engine would ingest real-time market data, including spot BTC price, implied volatility surfaces for various strikes and expiries, and the current order book depth on relevant exchanges. This data feeds into a complex Black-Scholes or binomial tree model, which then incorporates proprietary adjustments for liquidity risk, inventory hedging costs, and counterparty credit risk.

The resulting bid and ask prices are then transmitted to the multi-dealer platform. The iterative nature of this process, informed by live market conditions and sophisticated algorithms, allows for dynamic and competitive pricing, even for substantial, illiquid instruments.

System Integration and Technological Architecture

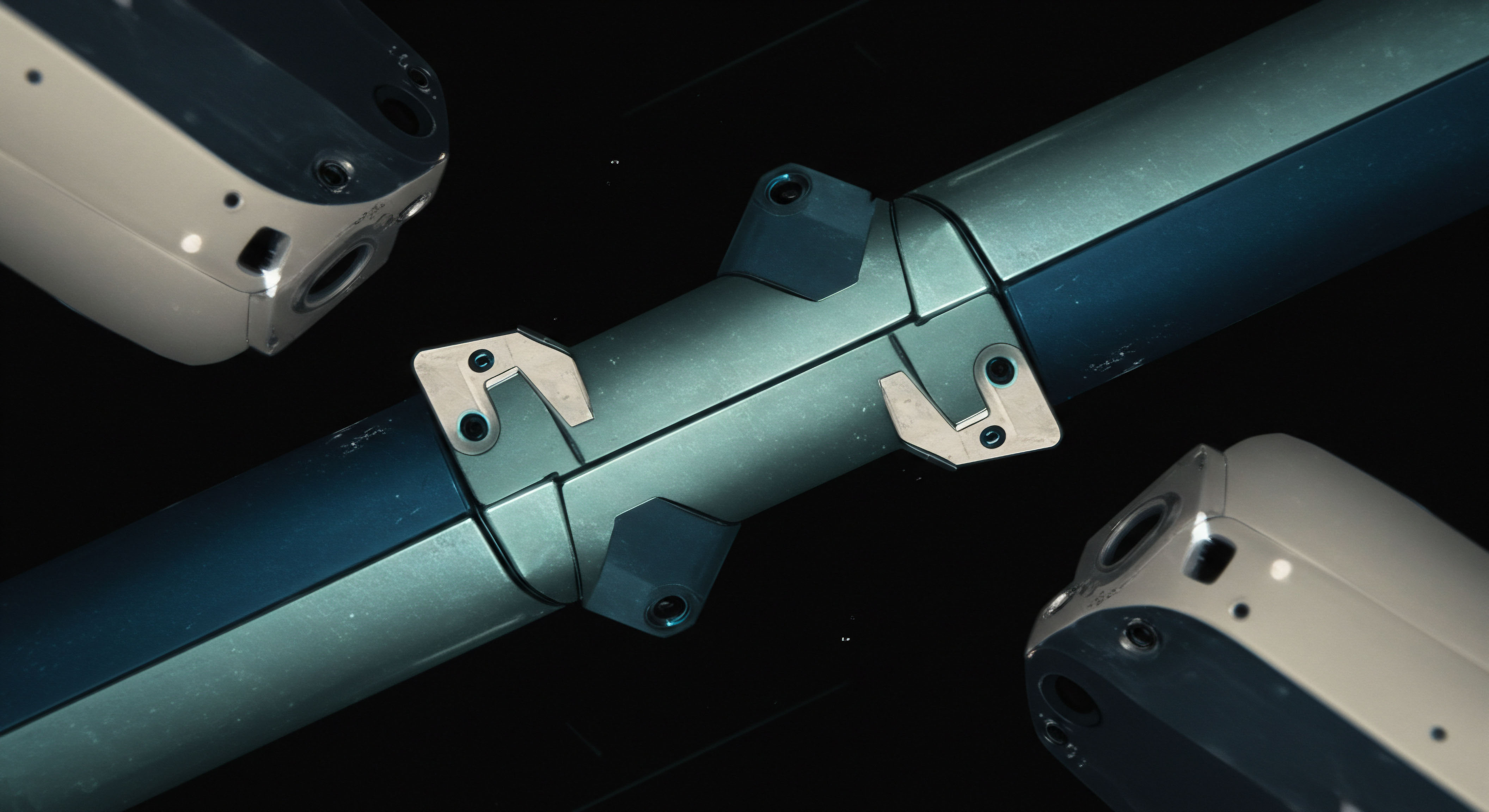

The seamless integration of multi-dealer platforms into an institutional client’s trading ecosystem is a cornerstone of operational efficiency. This integration typically involves robust API connectivity, often utilizing the FIX protocol for order and execution management. The platform acts as an extension of the client’s internal systems, allowing for automated RFQ generation, real-time quote reception, and one-click execution. This level of automation minimizes manual intervention, reducing operational risk and accelerating execution cycles.

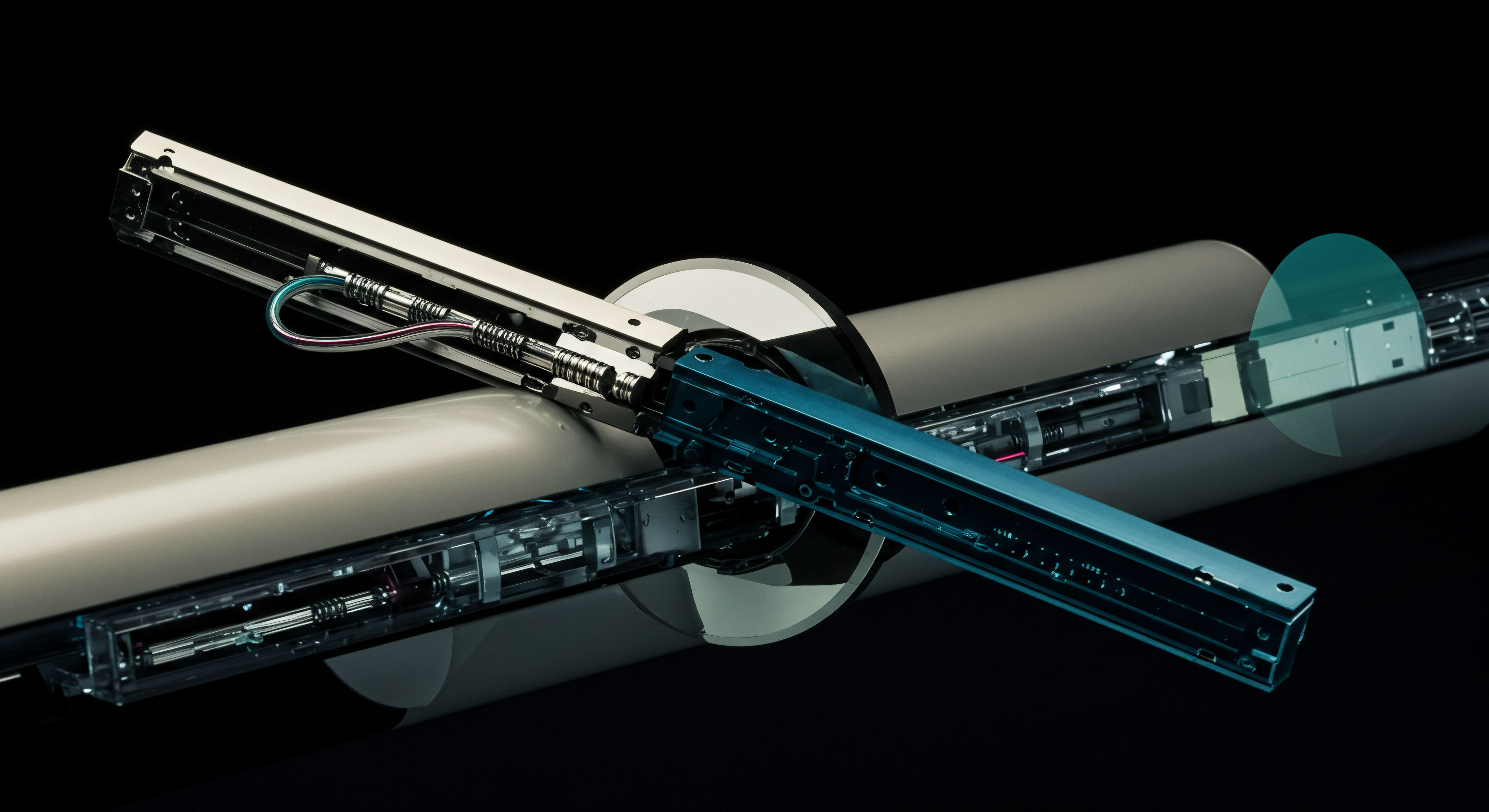

The underlying technological architecture of these platforms emphasizes low-latency data processing and high-throughput transaction capabilities. This ensures that quotes are delivered and orders are processed with minimal delay, which is paramount in fast-moving markets where price advantage can be fleeting. Components of this architecture include:

- Market Data Infrastructure ▴ High-speed feeds aggregating pricing data from various sources, providing a comprehensive view of market conditions.

- Pricing Engines ▴ Dealer-side systems that dynamically generate competitive quotes based on proprietary models and real-time risk parameters.

- RFQ Orchestrator ▴ The platform’s core engine managing the lifecycle of each RFQ, from distribution to aggregation and execution.

- Connectivity Modules ▴ Standardized APIs and FIX gateways facilitating seamless integration with client OMS/EMS and dealer trading systems.

- Risk Management Modules ▴ Real-time monitoring of counterparty exposure, credit limits, and overall market risk.

The robust technological framework also supports advanced trading applications. Features such as automated delta hedging (DDH) for options positions, or the ability to execute synthetic knock-in options, are built upon this integrated architecture. These capabilities empower traders to manage complex risk exposures with precision and efficiency.

The platform becomes a central nervous system for institutional trading, where every component works in concert to optimize execution and capital deployment. The strategic integration of these technological elements provides a decisive edge, allowing institutions to navigate market complexities with confidence and control.

The platform’s capacity for rapid data ingestion and analysis provides a critical intelligence layer. Real-time intelligence feeds deliver market flow data, offering insights into aggregate liquidity movements and potential price pressures. This dynamic flow of information, coupled with expert human oversight from system specialists, ensures that complex executions are managed with both algorithmic precision and informed discretion. The symbiosis of advanced technology and human expertise forms the ultimate defense against market inefficiencies, securing superior outcomes for the institutional participant.

References

- Wang, Chuan-jie. “The Limits of Multi-Dealer Platforms.” Wharton Finance, University of Pennsylvania, 2020.

- Wang, X. Zhao, Y. & Liu, X. “Research on pricing models for technology‐trading platforms with different business models ▴ A two‐stage dynamic game model.” ResearchGate, 2020.

- Marín, Paloma, Sergio Ardanza-Trevijano, and Javier Sabio. “Causal Interventions in Bond Multi-Dealer-to-Client Platforms.” arXiv, 2025.

- Rhoads, Russell. “The Benefits of RFQ for Listed Options Trading.” Tradeweb Markets, TABB Group Report, 2020.

- Tradeweb Markets. “How Electronic RFQ Has Unlocked Institutional ETF Adoption.” Tradeweb Markets, 2022.

Mastering Market Dynamics

Reflecting upon the intricate mechanisms of multi-dealer platforms reveals a profound truth ▴ mastering block trade pricing is an ongoing pursuit of systemic optimization. The knowledge gained regarding RFQ protocols, quantitative models, and integrated architectures forms a vital component of a larger intelligence system. This understanding should prompt a continuous introspection into one’s own operational framework. Are your systems truly leveraging the full competitive potential of multi-dealer environments?

Are your quantitative models sufficiently agile to adapt to evolving market microstructures? The strategic edge in institutional trading does not reside in static solutions, but in a dynamic, adaptive approach to market engagement. Empowering your operational framework with this deeper insight enables a proactive stance against market frictions, paving the way for sustained superior execution and capital efficiency.

Glossary

Multi-Dealer Platforms

These Platforms

Market Impact

Liquidity Providers

Block Trade Pricing

Trade Pricing

Block Trade

Best Execution

Btc Straddle Block