Market Telemetry Driving Block Execution

Principals navigating the intricate currents of institutional trading recognize a fundamental truth ▴ the efficacy of a block trade, that substantial transfer of assets, hinges upon the immediate, granular insights gleaned from live market telemetry. Understanding the precise interplay between real-time data feeds and execution decisions for large, off-exchange orders defines a critical operational advantage. A block trade, by its very nature, represents a concentrated liquidity event, demanding an acutely sensitive and responsive execution framework. Without a dynamic understanding of prevailing market conditions, the potential for adverse price impact and information leakage escalates significantly, directly eroding capital efficiency.

The financial markets, viewed through the lens of a systems architect, function as a complex adaptive organism, where real-time data acts as its central nervous system. This continuous flow of information ▴ encompassing order book depth, trade prints, bid-ask spreads, and derived volatility metrics ▴ provides the essential sensory input. For a block trade, this sensory input becomes particularly vital.

Executing a large order without disrupting market equilibrium requires a profound comprehension of liquidity pools and the immediate responses of other market participants. The very act of placing a large order can, in itself, alter the market’s perception of value, making instantaneous data assimilation a prerequisite for superior outcomes.

Real-time market data serves as the indispensable nervous system for institutional block trade execution.

Decoding Market Microstructure Dynamics

Market microstructure, the study of the processes and rules governing trade execution, offers the foundational context for appreciating real-time data’s influence. It examines how orders are placed, matched, and settled, illuminating the subtle mechanisms that dictate price formation. Within this framework, liquidity emerges as a paramount concern.

High liquidity permits substantial transactions with minimal price disruption, while low liquidity amplifies the potential for slippage and increased execution costs. Real-time data feeds provide a continuous pulse on this liquidity, allowing sophisticated trading systems to adapt their strategies dynamically.

The granular details transmitted through these feeds reveal transient supply and demand imbalances, which algorithms leverage to inform tactical decisions. Consider the continuous stream of limit order book updates ▴ each new bid or offer, each cancellation, provides a microscopic data point on immediate market sentiment. Aggregating and processing this torrent of information with ultra-low latency allows institutional platforms to construct a dynamic, high-definition map of the market’s immediate state. This mapping is crucial for navigating the often-fragmented liquidity landscape characteristic of modern financial markets, especially for assets where liquidity is not uniformly distributed across venues.

The Information Asymmetry Challenge

Information asymmetry represents a persistent challenge in block trading. The very existence of a large, impending order constitutes private information. If this information leaks prematurely, opportunistic market participants can front-run the block, moving prices adversely against the institutional trader. Real-time data feeds, paradoxically, can both exacerbate and mitigate this risk.

They transmit the outcomes of trades with incredible speed, meaning any misstep in execution ▴ such as an order placed too aggressively in a thin market ▴ is immediately visible and exploitable. Conversely, a sophisticated system using real-time data can employ discreet protocols to mask its intentions, thereby preserving informational advantage.

The velocity of information propagation in contemporary markets demands a defensive posture. Traders employ real-time analytics to detect subtle shifts in market behavior that might signal information leakage. This proactive monitoring allows for immediate adjustments to execution tactics, protecting the capital deployed in large orders. The goal involves not just reacting to price movements but anticipating them based on the flow and composition of real-time order data.

Strategic Frameworks for Liquidity Sourcing

Developing robust strategic frameworks for block trade execution demands a deep understanding of how real-time market data informs liquidity sourcing. A strategic approach to block trading transcends merely finding a counterparty; it encompasses optimizing the entire pre-trade, in-trade, and post-trade lifecycle. Institutional players leverage real-time feeds to calibrate their liquidity aggregation models, seeking optimal venues and protocols that minimize market impact while maximizing execution certainty. This involves a continuous assessment of available order book depth, quoted spreads, and the implicit costs associated with various execution channels.

Pre-Trade Analytics and Dynamic Venue Selection

Pre-trade analytics, powered by real-time data, forms the bedrock of any intelligent block trade strategy. Before initiating an order, a comprehensive analysis of the instrument’s liquidity profile across different trading venues becomes essential. This includes evaluating the prevailing bid-ask spread, the depth of the order book at various price levels, and recent trading volumes. Real-time data streams provide this dynamic snapshot, enabling algorithms to recommend the most suitable execution venue, whether it is a lit exchange, a dark pool, or an over-the-counter (OTC) Request for Quote (RFQ) mechanism.

The decision to utilize an RFQ protocol, for example, is heavily influenced by real-time market conditions. When public order books exhibit insufficient depth or wide spreads for a desired block size, an RFQ system allows the institutional trader to solicit private, executable quotes from multiple liquidity providers. Real-time data informs the decision of which dealers to include in the RFQ, based on their historical responsiveness, quoted competitiveness, and capacity for large orders. This selective engagement, guided by current market telemetry, helps mitigate information leakage and ensures competitive pricing for substantial transactions.

Strategic block execution demands continuous real-time assessment of liquidity across diverse trading venues.

Adaptive Order Placement and Price Impact Mitigation

Once a venue is selected, real-time data guides the adaptive placement of orders. Large orders, if placed carelessly, can significantly move the market against the trader, incurring substantial costs. The “square-root law” of price impact illustrates this, suggesting that market impact scales predictably with the square root of the volume traded.

Real-time feeds allow algorithms to continuously monitor market impact and adjust order placement tactics. This might involve dynamically slicing a large block into smaller, more manageable child orders, or employing advanced order types that only activate under specific liquidity conditions.

Algorithmic trading strategies, deeply integrated with real-time data, continuously re-evaluate the market. They adapt parameters such as participation rate, price limits, and venue routing based on the immediate feedback from the market. A sudden surge in volume on a particular exchange, for instance, might prompt an algorithm to temporarily increase its participation rate there, capitalizing on newly available liquidity. Conversely, signs of price erosion might trigger a reduction in activity or a shift to a more discreet execution channel.

| Execution Channel | Real-Time Data Influence | Primary Strategic Benefit | Key Risk Factor |

|---|---|---|---|

| Lit Exchange (Order Book) | Directly reflects immediate supply/demand, visible depth. | Price transparency, broad access to retail liquidity. | High market impact for large orders, information leakage. |

| Dark Pool | Monitors parent order book for reference pricing, volume cues. | Reduced market impact, anonymity for large orders. | Lower fill rates, potential for adverse selection. |

| Request for Quote (RFQ) | Informs dealer selection, validates quoted prices against market. | Price control, bespoke terms, minimized information leakage. | Dealer selection bias, potential for latency in quotes. |

| Systematic Internaliser (SI) | Tracks internal liquidity, validates prices against BBO. | Internalized liquidity, reduced external market footprint. | Limited capacity, potential for adverse selection. |

Risk Management and Predictive Modeling

Risk management in block trading is intrinsically linked to real-time data. Beyond immediate price impact, institutional traders confront the risks of adverse selection, where counterparties possess superior information, and execution risk, the possibility of not completing the trade at a desired price. Real-time feeds allow for the continuous calculation of metrics such as Value at Risk (VaR) and Expected Shortfall, adapted to the specific characteristics of the block order. This enables proactive adjustments to the trading strategy in response to evolving market volatility or shifts in correlation structures.

Predictive modeling, an advanced application of real-time data, seeks to forecast short-term price movements and liquidity dynamics. Machine learning algorithms ingest vast quantities of real-time market data ▴ including order book imbalances, trade intensity, and sentiment indicators ▴ to generate probabilistic forecasts. These forecasts then inform the optimal timing and sizing of child orders within a block trade.

A model predicting a temporary increase in selling pressure, for example, might instruct an algorithm to temporarily reduce its buy-side activity, awaiting a more favorable entry point. This continuous feedback loop between real-time observation and predictive adjustment represents a sophisticated operational capability.

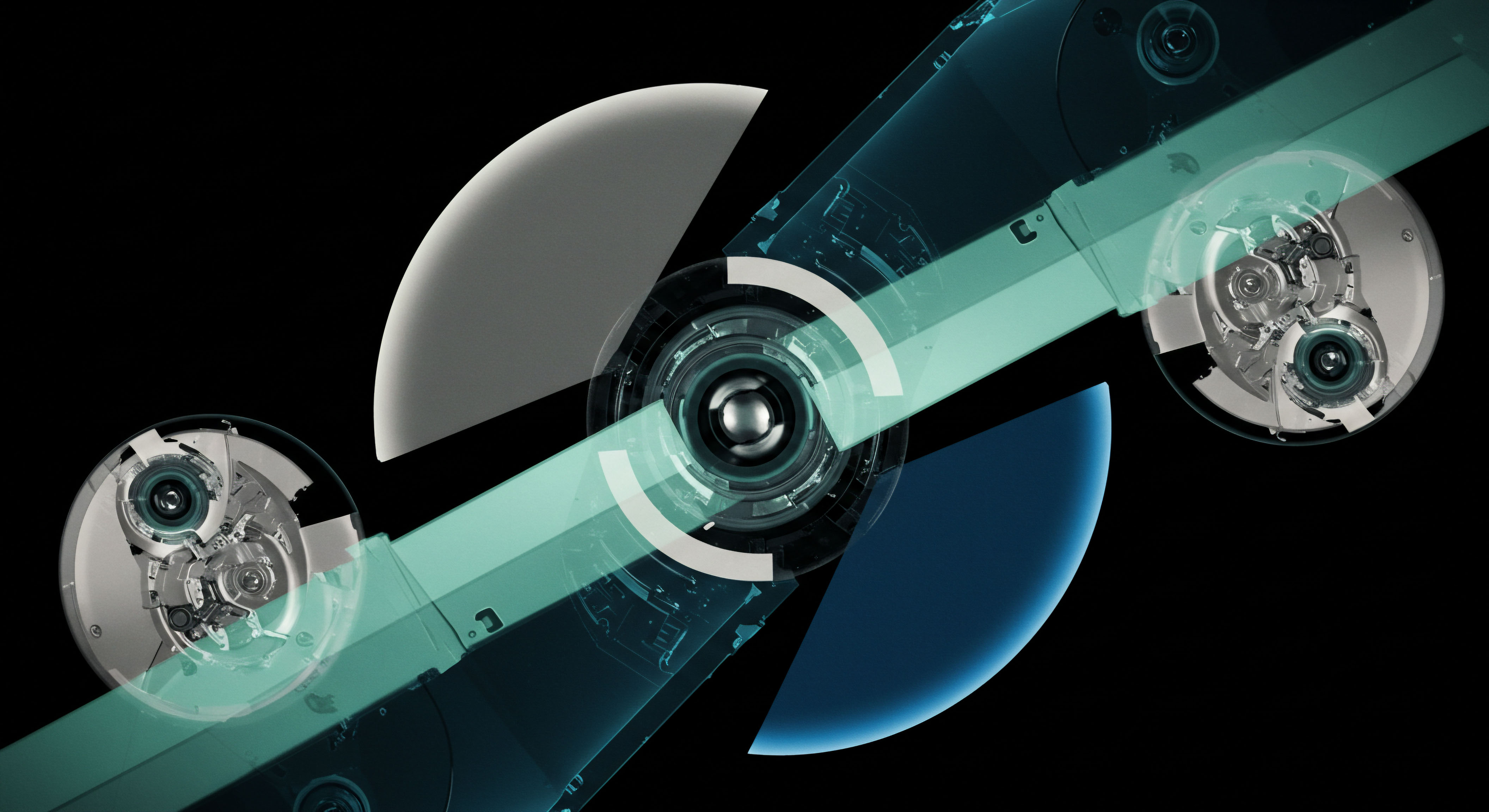

Precision Execution Protocols

The execution phase of a block trade, particularly in digital asset derivatives, demands an unparalleled degree of precision and responsiveness, directly driven by real-time market data feeds. This phase transforms strategic objectives into tangible market actions, where microseconds dictate the difference between optimal fill and significant slippage. A robust execution system acts as a high-performance engine, continuously ingesting market telemetry, processing it through sophisticated algorithms, and issuing discreet, impactful orders. The goal remains consistent ▴ securing superior execution quality while preserving the informational integrity of the institutional position.

High-Fidelity Execution for Multi-Leg Spreads

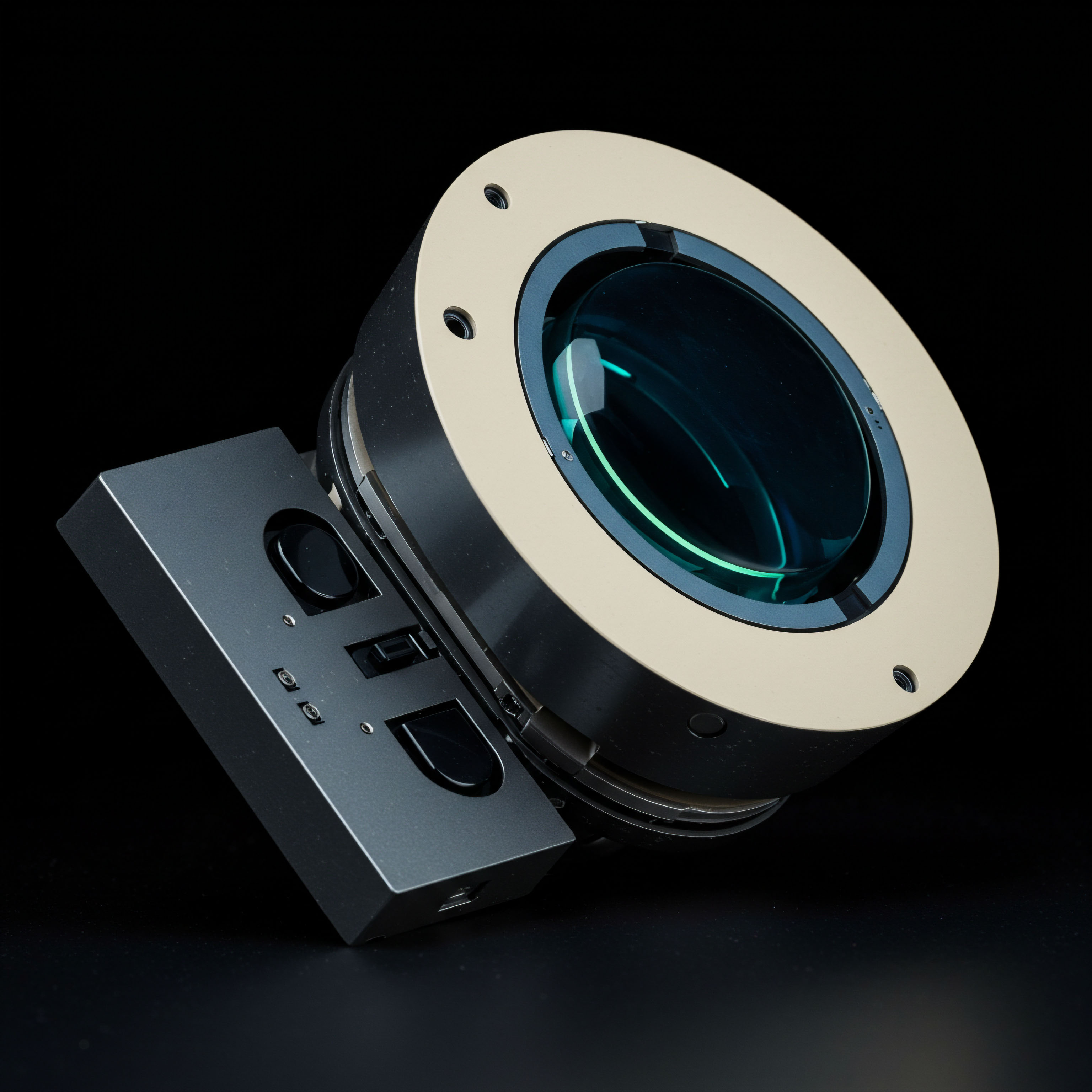

Executing multi-leg options spreads, a common strategy for institutional derivatives traders, presents a complex challenge that real-time data directly addresses. These strategies involve simultaneous transactions across multiple option contracts and potentially the underlying asset, aiming to capitalize on specific volatility or directional views. The success of a multi-leg spread hinges on executing all legs at advantageous prices relative to each other, minimizing the risk of adverse price movements between legs. Real-time data feeds provide the synchronized pricing information necessary to construct these complex orders.

A high-fidelity execution system leverages real-time bid-ask quotes and last-traded prices across all constituent legs of a spread. It monitors the implied volatility surface and correlation dynamics in real-time, calculating the theoretical fair value of the spread. Any deviation from this fair value, as indicated by incoming market data, triggers an opportunity for arbitrage or optimal execution. The system then employs smart order routing to simultaneously place orders across various venues, seeking the best available prices for each leg, often utilizing conditional orders that execute only when all legs can be filled within a predefined price range.

Real-time feeds are indispensable for synchronized pricing in multi-leg options spread execution.

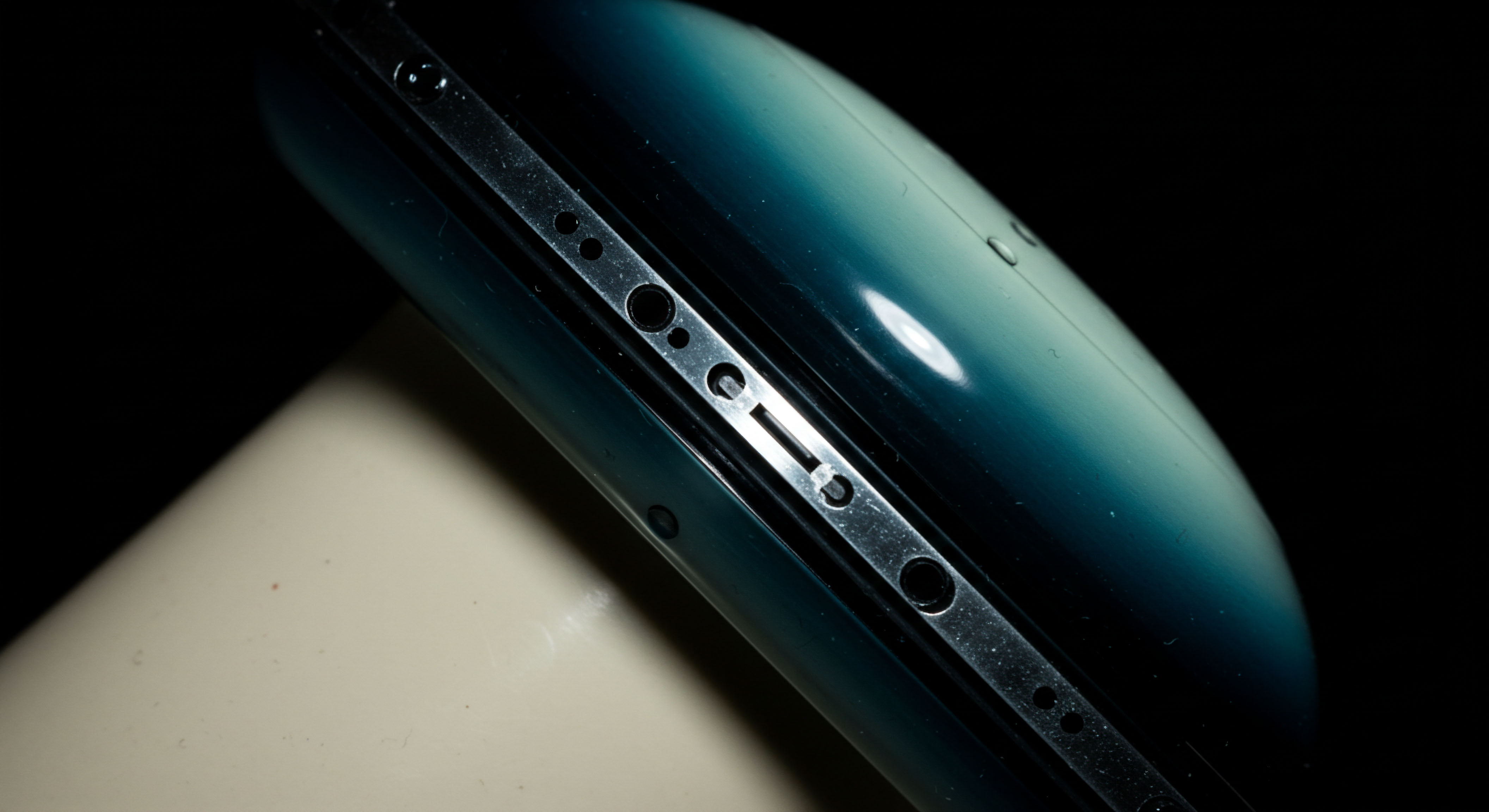

Discreet Protocols and Off-Book Liquidity Sourcing

The inherent sensitivity of block trades to information leakage necessitates the deployment of discreet protocols. Real-time data, while public, can be used strategically to identify opportunities for off-book liquidity sourcing that minimize market footprint. Private quotation protocols, such as enhanced Request for Quote (RFQ) systems, are central to this approach. In this context, real-time data validates the competitiveness of bilateral price discovery, ensuring that quotes received from liquidity providers remain aligned with the prevailing market environment without exposing the full size of the intended trade.

An advanced RFQ system, integrated with real-time feeds, allows institutional traders to selectively ping a curated list of liquidity providers for bespoke pricing. The system analyzes the incoming quotes in real-time against a composite benchmark derived from public market data and internal fair value models. This instantaneous comparison enables the trader to accept the most favorable quote, or to refine their request, all while maintaining anonymity regarding the full order size. The execution, once agreed, often occurs off-exchange, with the trade reported to the consolidated tape only after completion, further reducing immediate market impact.

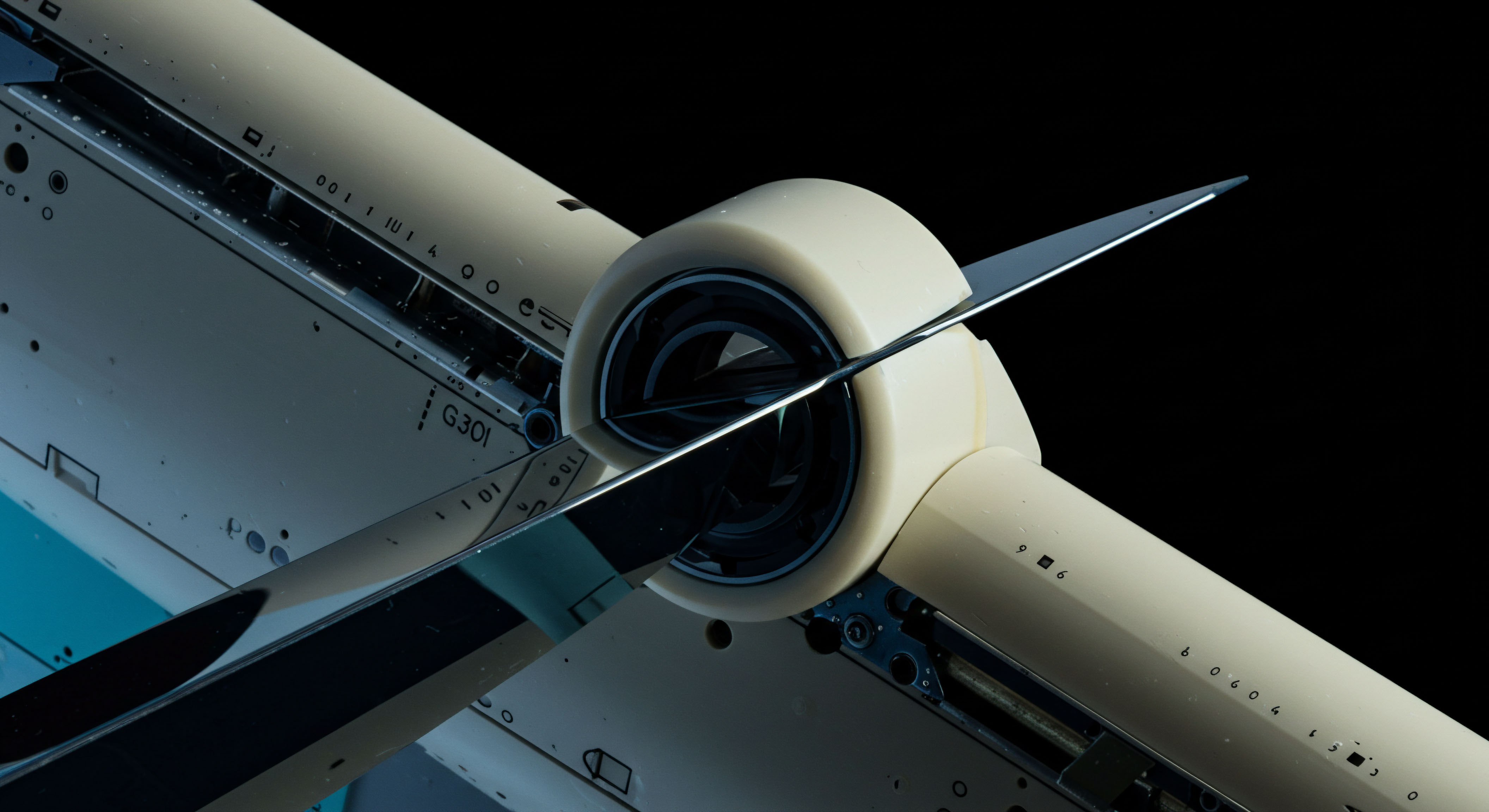

System-Level Resource Management and Aggregated Inquiries

Effective block trade execution involves a sophisticated system-level resource management framework, where real-time data orchestrates the deployment of trading capital and connectivity. For large, complex block orders, a single RFQ might not suffice. Aggregated inquiries, where a system intelligently combines smaller, anonymized RFQs or directs portions of the block to different liquidity pools, become essential. Real-time market data drives the allocation strategy, determining which segment of the block is best suited for a particular venue or counterparty at any given moment.

This management includes dynamic capacity allocation across multiple broker relationships and direct market access (DMA) connections. Real-time monitoring of network latency, exchange queue depths, and counterparty performance metrics ensures that the execution pathway remains optimal. Should a particular venue exhibit signs of latency or reduced liquidity, the system, informed by real-time telemetry, reroutes order flow to maintain execution efficiency. This proactive system-level control, underpinned by continuous data analysis, safeguards the overall integrity of the block execution process.

| Metric Category | Specific Data Points | Influence on Decision |

|---|---|---|

| Order Book Depth | Cumulative volume at price levels, bid-ask spread, order count. | Determines immediate liquidity capacity, potential market impact. |

| Trade Prints | Last traded price, volume, aggressor side, time stamps. | Indicates recent price momentum, execution urgency, information flow. |

| Derived Volatility | Implied volatility from options, realized volatility, VIX. | Assesses risk, informs options pricing, identifies market stress. |

| Market Imbalance | Ratio of buy/sell orders, order flow pressure. | Predicts short-term price direction, informs aggressive/passive placement. |

| Latency Metrics | Execution latency, data feed latency, network jitter. | Optimizes routing to low-latency venues, identifies system bottlenecks. |

Automated Delta Hedging and Risk Parameter Optimization

For block trades involving derivatives, particularly options, real-time market data is paramount for automated delta hedging (DDH). Delta, a measure of an option’s price sensitivity to changes in the underlying asset’s price, constantly shifts with market movements. Maintaining a neutral delta position, a common institutional strategy to mitigate directional risk, requires continuous, real-time adjustments to the underlying asset’s position. An automated DDH system ingests real-time prices for both the options and the underlying, recalculating the portfolio’s delta and executing necessary trades to rebalance.

This optimization extends beyond delta to other risk parameters like gamma, vega, and theta. Real-time volatility surfaces, derived from live options quotes, enable dynamic adjustments to vega hedges. Similarly, time decay (theta) and its impact on options portfolios are continuously monitored against real-time data, allowing for timely adjustments.

The system’s ability to instantaneously process these complex relationships and execute corrective trades, all driven by the live market feed, transforms theoretical risk management into a practical, high-frequency operational capability. This continuous feedback loop ensures the institutional portfolio remains within its defined risk tolerances, even amidst volatile market conditions.

References

- Guéant, O. (2014) Execution and Block Trade Pricing with Optimal Constant Rate of Participation. Journal of Mathematical Finance, 4, 255-264.

- Vailraj, K. (2025) Innovations in real-time trade execution ▴ database speed, latency and resilience. World Journal of Advanced Engineering Technology and Sciences.

- Kanazawa, K. & Sato, Y. (2024) Does the Square-Root Price Impact Law Hold Universally? Kyoto University.

- Cube Exchange. (2024) What is RFQ (Request for Quote)? DeFi and Web3 Trading Guide.

- London Stock Exchange. (2024) Service & Technical Description – Request for Quote (RFQ).

Operational Intelligence Refinement

Reflecting upon the intricate mechanisms governing block trade execution reveals a profound truth ▴ true mastery arises from a continuous refinement of operational intelligence. The insights gleaned from real-time market data are not static directives; they represent a dynamic, evolving stream of opportunities and risks. Each successful block execution, each deftly navigated liquidity challenge, contributes to a larger system of knowledge.

Consider the implications for your own operational framework. How robust is your system’s capacity to transform raw market telemetry into decisive, high-fidelity actions?

The ultimate edge in institutional trading lies in the iterative process of learning, adapting, and optimizing your execution architecture. The market is an unforgiving tutor, but also a generous one for those equipped to listen to its constant, real-time dialogue. Your capacity to interpret this dialogue, to calibrate your systems with ever-increasing precision, determines your strategic advantage. This ongoing pursuit of operational excellence, informed by the ceaseless flow of market information, empowers a sustained strategic potential.

Glossary

Real-Time Data Feeds

Information Leakage

Order Book Depth

Real-Time Data

Market Microstructure

Trade Execution

Data Feeds

Order Book

Large Orders

Block Trade Execution

Real-Time Market Data

Request for Quote

Block Trade

Market Telemetry

Real-Time Market

Market Impact

Price Impact

Real-Time Feeds

Market Data