Precision Liquidity Sourcing for Digital Asset Options

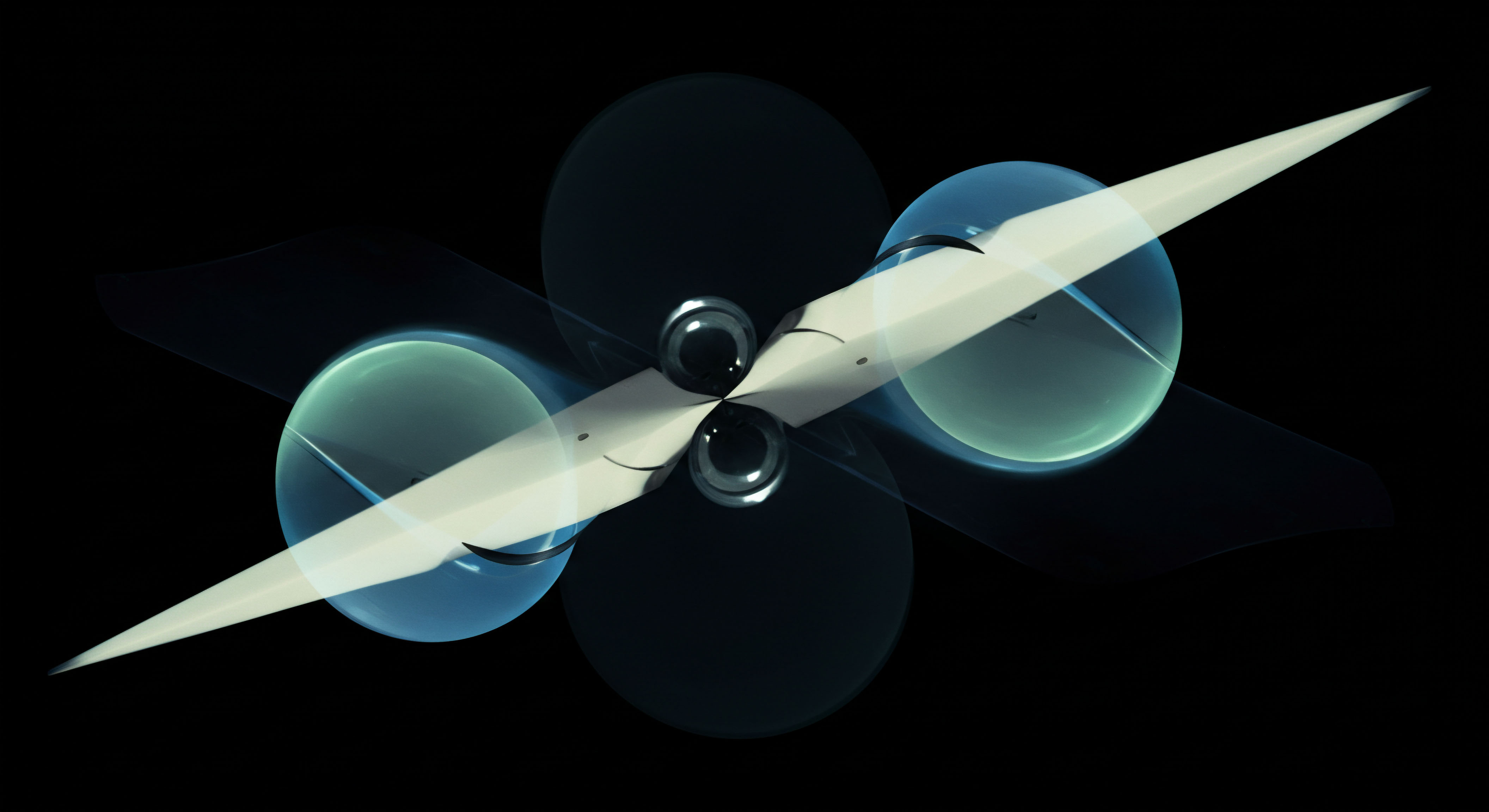

Navigating the complex currents of digital asset derivatives requires a sophisticated understanding of market mechanics, particularly concerning liquidity provision in crypto options. Institutional participants, confronting inherent volatility and fragmentation, seek robust frameworks enabling high-fidelity execution. The operational architecture underpinning Request for Quote (RFQ) platforms represents a critical advancement, transforming how large-scale options positions are managed.

This systemic shift moves beyond rudimentary order book interactions, offering a direct conduit to deep, curated liquidity pools. The design of these platforms addresses the unique challenges of crypto markets, where price discovery and impact mitigation remain paramount for significant capital deployments.

The Bilateral Price Discovery Mechanism

RFQ systems establish a direct, bilateral communication channel between an institutional trader and multiple liquidity providers. This structured interaction facilitates the solicitation of bespoke price quotes for specific options contracts or multi-leg strategies. Unlike traditional exchange order books, where bids and offers are publicly displayed and filled sequentially, RFQ protocols enable private negotiations. The discretion inherent in this process significantly reduces information leakage, a persistent concern for large block trades.

RFQ platforms streamline large options trades by connecting institutions directly with multiple liquidity providers, ensuring competitive pricing and minimizing market impact.

Market makers, upon receiving an RFQ, analyze the proposed trade’s parameters ▴ including underlying asset, strike price, expiry, and quantity ▴ and then provide firm, executable quotes. This dynamic interplay between the requesting party and diverse liquidity sources fosters genuine competition, which compresses bid-ask spreads. Such a mechanism proves particularly beneficial in less liquid segments of the crypto options market, where public order books might lack sufficient depth to absorb substantial orders without significant price slippage.

Customization and Strategic Latitude

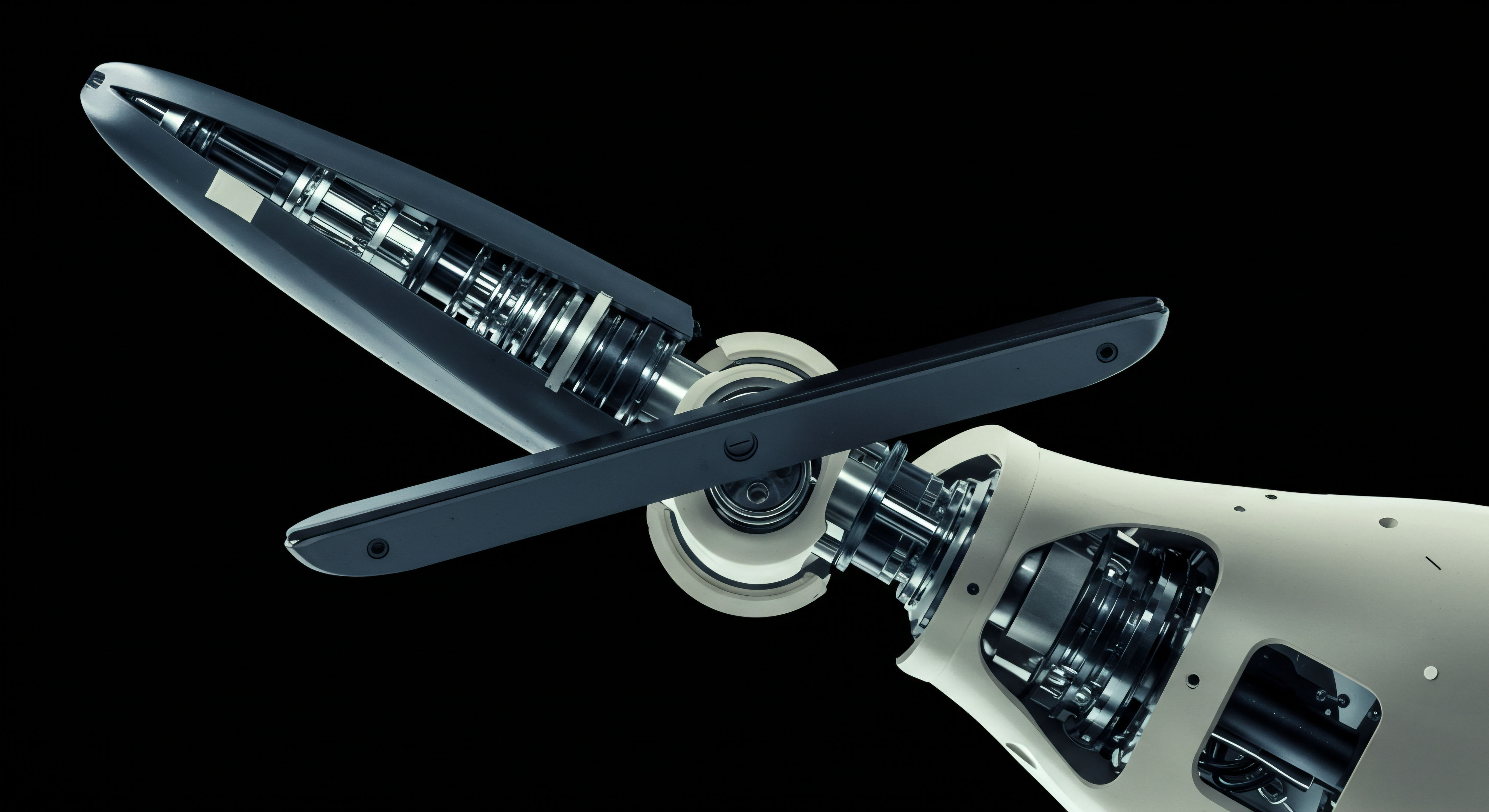

Modern RFQ platforms offer extensive customization capabilities, extending far beyond simple call or put options. Traders can specify complex multi-leg strategies, such as butterfly spreads, iron condors, or synthetic knock-in options, within a single quote request. This integrated approach simplifies execution for intricate positions, mitigating the leg risk associated with executing each component separately. The ability to craft advanced volatility exposures through a unified interface grants portfolio managers greater strategic latitude.

Visualizing potential payoff structures and risk profiles before execution is another vital feature. Integrated payoff modeling tools allow for a comprehensive assessment of various market scenarios, ensuring alignment with a portfolio’s hedging objectives or directional views. This pre-trade analytics layer supports informed decision-making, providing a clear understanding of potential outcomes for sophisticated strategies.

Orchestrating Optimal Execution Pathways

Crafting a strategic advantage in crypto options necessitates a meticulous approach to execution, one that leverages specialized platforms to circumvent inherent market frictions. RFQ systems serve as a foundational component within this operational architecture, enabling institutions to secure superior pricing and manage market impact for significant derivatives positions. The strategic deployment of these platforms addresses the imperative for capital efficiency and risk mitigation in volatile digital asset environments.

Navigating Liquidity Fragmentation

The cryptocurrency market, by its very nature, exhibits a fragmented liquidity landscape. Spot and derivatives markets often operate across numerous centralized and decentralized venues, creating discrepancies in pricing and depth. RFQ platforms strategically aggregate liquidity from diverse professional market makers and over-the-counter (OTC) desks. This aggregation capability provides institutional traders with a consolidated view of available pricing, allowing them to tap into deep liquidity pools that might not be visible on public order books.

Strategic RFQ utilization allows institutions to access fragmented liquidity across multiple venues, enhancing price discovery and execution quality.

The strategic imperative involves selecting an RFQ platform that offers connectivity to a broad network of liquidity providers. A wider network translates directly into more competitive quotes, as market makers vie for the opportunity to execute large blocks. This competitive dynamic is particularly valuable for instruments with lower trading volumes, where liquidity on a single exchange might be insufficient for institutional-sized orders.

Comparing Execution Models ▴ RFQ versus Order Book

Understanding the fundamental differences between RFQ and traditional order book execution models is essential for strategic decision-making. Each model presents distinct advantages and disadvantages, depending on trade size, desired discretion, and market conditions.

| Execution Model | Primary Advantage | Key Strategic Benefit | Typical Use Case |

|---|---|---|---|

| Request for Quote (RFQ) | Private price discovery, competitive bidding | Minimized market impact, reduced slippage for large orders | Block trades, complex multi-leg options strategies, illiquid instruments |

| Central Limit Order Book (CLOB) | Transparency, continuous trading, immediate execution for small orders | High speed for small-to-medium orders, clear market depth visualization | Retail trading, highly liquid spot pairs, smaller derivatives positions |

The strategic choice hinges on the trade’s specific requirements. For substantial crypto options positions, where market impact and information leakage are critical concerns, RFQ protocols offer a superior execution pathway. Conversely, for smaller, highly liquid trades, a CLOB may provide adequate efficiency.

Capital Efficiency and Risk Mitigation

RFQ platforms enhance capital efficiency by enabling precise, tailored execution at competitive prices. This directly impacts transaction costs, as competitive quotes often lead to tighter spreads than those found on public exchanges for large orders. The ability to execute multi-leg strategies as a single, atomic transaction also reduces operational risk, eliminating the potential for adverse price movements between individual leg executions.

Risk management within an RFQ framework extends to counterparty risk. Platforms that facilitate decentralized clearing and settlement, or offer robust collateral management, provide an added layer of security. This architectural consideration becomes increasingly important in a nascent asset class like crypto, where counterparty solvency can pose a significant concern. The system’s design ensures that the agreed-upon terms are met, safeguarding capital.

Optimized RFQ frameworks significantly reduce counterparty risk through decentralized clearing and robust collateral management.

Strategic deployment also involves leveraging RFQ for advanced hedging. For instance, an institution holding a substantial spot position in Bitcoin might utilize an RFQ platform to solicit quotes for a deep out-of-the-money put option or a protective collar. This allows for tailored downside protection without having to sell the underlying asset, thereby maintaining long-term exposure while managing short-term volatility. The flexibility of RFQ in crafting such bespoke hedges is a powerful strategic tool.

Mastering High-Fidelity Execution Protocols

Achieving superior outcomes in crypto options trading hinges upon a mastery of execution protocols, transforming strategic intent into tangible results. RFQ platforms, at their operational core, provide the necessary infrastructure for high-fidelity execution, particularly for block trades and complex derivatives structures. This section dissects the granular mechanics, technical integrations, and quantitative considerations essential for institutional participants.

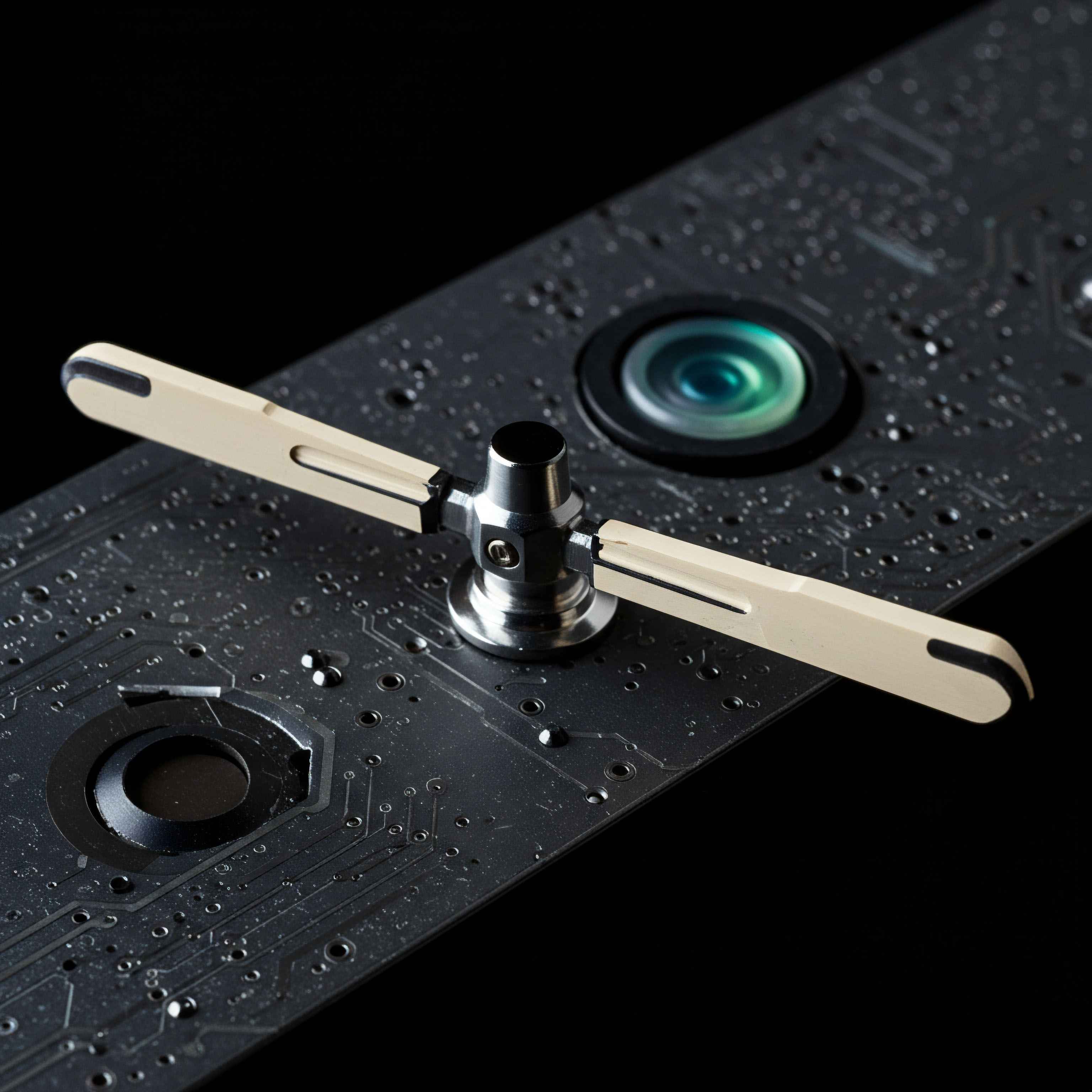

The Operational Flow of a Quote Solicitation Protocol

The RFQ process commences with the precise articulation of a trade’s parameters. A trader initiates a request, specifying the underlying asset, option type (call or put), strike price, expiry date, quantity, and whether the intention is to buy or sell. For multi-leg strategies, each component, or “leg,” is meticulously defined within the same request. This consolidated approach ensures that all elements of a complex strategy are priced and executed synchronously.

Upon submission, the RFQ is disseminated to a pre-selected network of liquidity providers. These market makers, utilizing their proprietary pricing models and real-time market data, generate competitive two-way quotes (bid and ask prices). The system then presents these quotes to the initiating trader, often displaying them in a comparative format to facilitate optimal selection. The trader reviews the received quotes, considering factors such as price, size, and the reputation of the quoting entity.

Once a quote is accepted, the platform orchestrates the atomic execution of the trade. This ensures that all legs of a multi-component strategy are executed simultaneously at the agreed-upon prices, eliminating adverse price movements between individual fills. Settlement typically occurs either on-chain, leveraging smart contracts for decentralized clearing, or through established off-chain mechanisms with robust collateral management. This structured workflow provides certainty and efficiency for large transactions.

Key Operational Parameters for RFQ Engagement

- RFQ Expiry Settings ▴ Customizable timeframes for quote validity, allowing traders to control exposure to fleeting market conditions.

- Settlement Window Times ▴ Flexible scheduling for trade finalization, accommodating various operational requirements and underlying asset characteristics.

- RFQ Type Selection ▴ Options for fixed base, fixed quote, or open size requests, providing adaptability for different trading objectives.

- Underlying Asset Versatility ▴ Support for a broad spectrum of crypto assets, from major cryptocurrencies like Bitcoin and Ethereum to emerging altcoins.

Quantitative Modeling and Data Analysis in RFQ

Quantitative analysis forms the bedrock of effective RFQ engagement. Market makers employ sophisticated models to derive options prices, considering factors such as implied volatility, interest rates, time to expiry, and dividend yields (or their crypto equivalent, such as staking rewards). Institutional traders, in turn, leverage similar models for quote validation and to assess the fairness of received prices against their internal benchmarks. This continuous feedback loop of quantitative analysis drives price discovery.

The analytical sophistication extends to transaction cost analysis (TCA). By meticulously tracking the difference between the requested price and the executed price, alongside implicit costs like market impact, institutions can evaluate the effectiveness of their RFQ strategies and the performance of their liquidity providers. This data-driven approach allows for continuous refinement of execution algorithms and counterparty selection.

The precision required for effective crypto options trading necessitates a deep understanding of volatility surfaces. Unlike simpler assets, options pricing depends heavily on the implied volatility for different strike prices and expiries, forming a “volatility smile” or “skew.” RFQ platforms facilitate the discovery of these complex surfaces by allowing requests for quotes across a range of strikes and maturities. This helps traders construct more accurate risk profiles and identify potential mispricings.

Consider the scenario of a large block trade for a Bitcoin options straddle. The institutional trader needs to buy both a call and a put option with the same strike and expiry. Executing this on a public order book might incur significant slippage on each leg, potentially widening the overall cost of the straddle.

Through an RFQ, multiple market makers would bid on the combined straddle, offering a single, consolidated price that reflects their aggregated view of risk and liquidity. This leads to a more efficient and less impactful execution.

| Metric | Definition | Relevance to RFQ Execution |

|---|---|---|

| Implied Volatility (IV) | Market’s expectation of future price fluctuations for an underlying asset. | Directly influences options premiums; RFQ allows for price discovery of IV across strikes/expiries. |

| Bid-Ask Spread | Difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. | RFQ competition aims to compress spreads, reducing transaction costs. |

| Market Impact | The effect of a trade on the asset’s price. | RFQ minimizes impact for large trades by executing off-book or in dark pools. |

| Slippage | Difference between the expected price of a trade and the price at which the trade is actually executed. | Atomic execution of multi-leg RFQs mitigates slippage across individual components. |

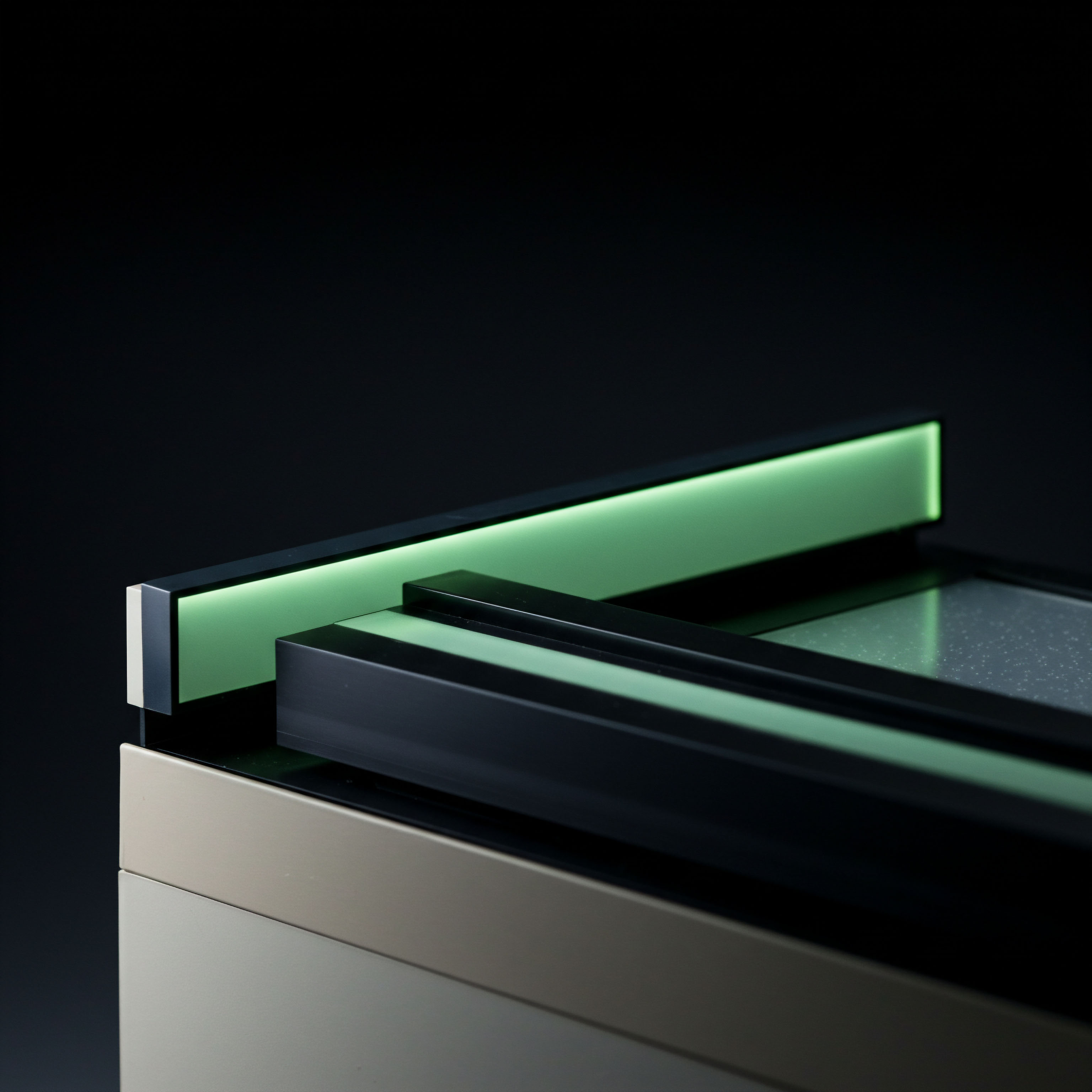

System Integration and Technological Architecture

The efficacy of RFQ platforms is inextricably linked to their underlying technological architecture and integration capabilities. Seamless connectivity via Application Programming Interfaces (APIs) is paramount, enabling institutional trading systems (e.g. Order Management Systems, Execution Management Systems) to programmatically generate and manage RFQs. This automation reduces manual intervention, enhances speed, and ensures consistency in trade execution.

Furthermore, the integration with real-time market data feeds is critical for both price discovery and risk management. Platforms must consume and process vast amounts of data ▴ including spot prices, options chain data, and order book depth ▴ to inform pricing models and provide traders with a comprehensive view of market conditions. Low-latency data pipelines are essential for maintaining a competitive edge in fast-moving crypto markets.

Robust API integration and low-latency data feeds are fundamental for automated, high-speed RFQ execution in institutional crypto trading.

The architectural design must also account for robust security protocols, given the high value of digital assets. This includes encryption for communication channels, multi-factor authentication for access, and secure custody solutions for collateral. Decentralized settlement mechanisms, when integrated, can further reduce counterparty risk by leveraging the immutability and transparency of blockchain technology.

A sophisticated RFQ system functions as a modular operating system for derivatives trading. Its components ▴ from the quote generation engine to the risk visualization interface and the post-trade analytics module ▴ are designed to interact seamlessly, creating a unified environment for managing complex options exposures. This integrated approach elevates the trading experience, moving beyond disparate tools to a cohesive, high-performance execution ecosystem.

The core conviction remains that a fragmented toolkit invariably leads to fragmented outcomes. A truly integrated platform provides a singular, authoritative command center for navigating the intricacies of crypto options.

References

- Hou, Jun, et al. “Price discovery in the cryptocurrency option market ▴ A univariate GARCH approach.” Journal of Economic Dynamics and Control, vol. 109, 2019.

- Makarov, Igor, and Antoinette Schoar. “Price Discovery in Cryptocurrency Markets.” MIT Sloan Research Paper No. 5440-18, 2018.

- Binance Academy. “What Is Binance Options RFQ?” Binance, 23 Feb. 2025.

- FinchTrade. “RFQ vs Limit Orders ▴ Choosing the Right Execution Model for Crypto Liquidity.” FinchTrade, 10 Sep. 2025.

- Convergence. “Launching Options RFQ on Convergence.” Medium, 29 Dec. 2023.

- Coincall. “The Future of Crypto Options ▴ From Institutional Hedging to Market-Driven Yield.” Coincall, 29 Oct. 2025.

- Debut Infotech. “How Liquidity Providers Propel OTC Crypto Exchange Development?” Debut Infotech, 17 Feb. 2025.

- OKX. “OKX Liquid Marketplace | Crypto OTC Trading | Best Liquidity Network.” OKX, n.d.

- HeLa Labs. “Institutional Crypto Trading ▴ A Practical Guide for Funds and Firms.” HeLa Labs, 12 Sep. 2025.

- UEEx Technology. “Crypto Market Microstructure Analysis ▴ All You Need to Know.” UEEx Technology, 15 Jul. 2024.

Strategic Command in Digital Derivatives

The journey through RFQ platforms for crypto options reveals a profound truth ▴ operational excellence dictates strategic advantage. Reflect on your current operational framework. Does it merely react to market conditions, or does it proactively shape execution outcomes? The intelligence gleaned from a robust RFQ system is a component of a larger, integrated intelligence layer, a sophisticated mechanism that provides real-time insights into market flow and counterparty dynamics.

A superior edge is not an aspiration; it is the inevitable consequence of a superior operational framework. Consider how current systems integrate human oversight with automated protocols, ensuring complex executions receive the expert attention they demand. The objective remains clear ▴ achieve decisive control over market interactions, transforming volatility into a structured opportunity.

Glossary

Crypto Options

Price Discovery

Order Book

Liquidity Providers

Underlying Asset

Market Makers

Rfq Platforms

Capital Efficiency

Risk Mitigation

Market Impact

Adverse Price Movements between Individual