Precision in Fragmented Realms

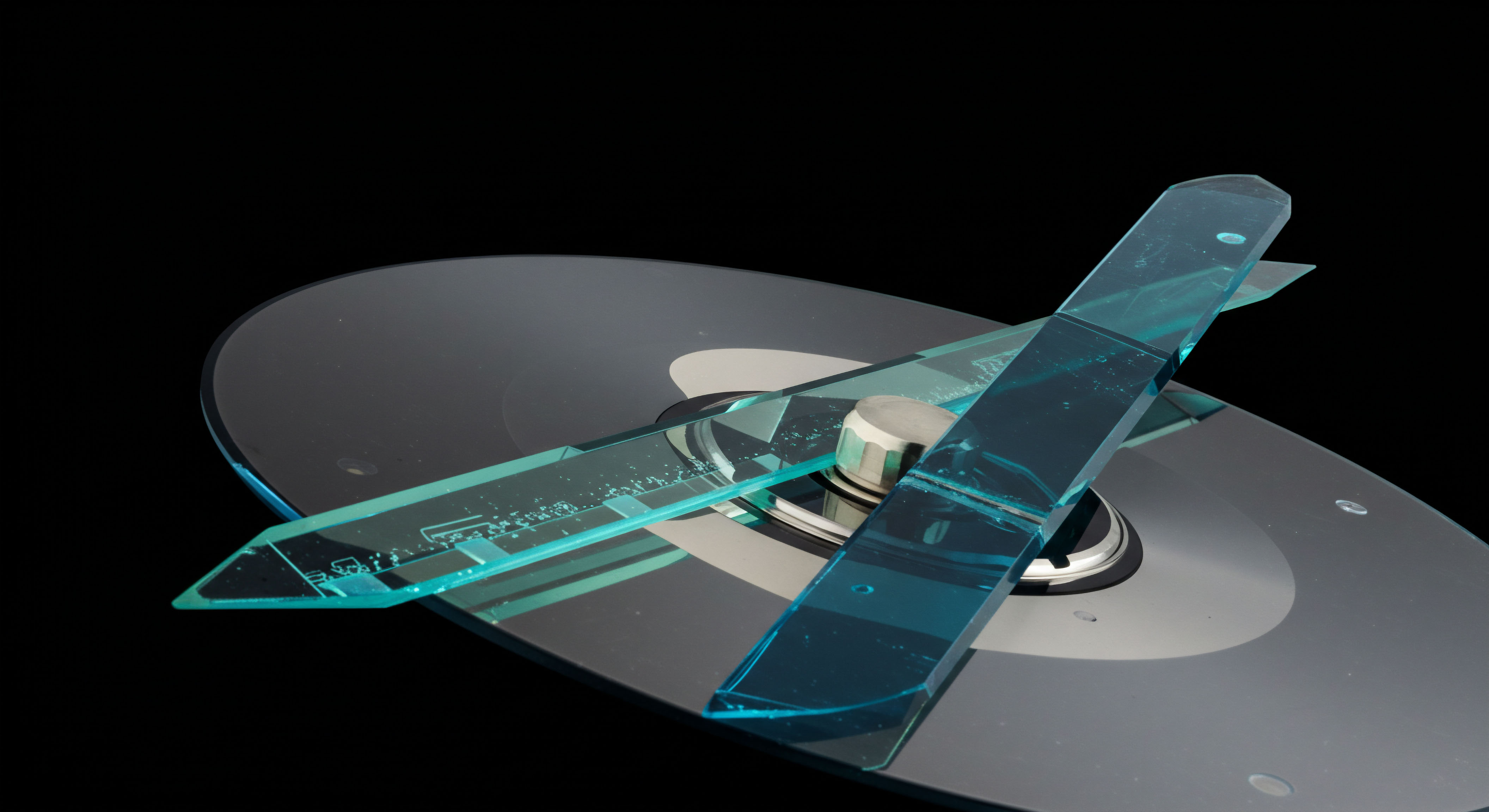

Navigating the fragmented landscape of crypto options markets presents a formidable challenge for institutional participants. Traditional exchange order books, designed for continuous, high-frequency interactions, often fall short when confronting the unique demands of large-scale, bespoke derivatives transactions. The inherent dispersion of liquidity across myriad centralized and decentralized venues exacerbates issues of price impact, slippage, and information leakage.

This operational reality necessitates a sophisticated approach to liquidity aggregation, one that transcends the limitations of conventional market structures. Request for Quote (RFQ) protocols emerge as a foundational mechanism, offering a structured, bilateral pathway for price discovery and execution that directly addresses these systemic frictions.

RFQ systems enable market participants to solicit competitive bids and offers from multiple liquidity providers simultaneously, all within a private, controlled environment. This process is particularly advantageous in markets characterized by nascent depth or complex instruments, such as multi-leg crypto options. By centralizing the inquiry and distributing it to a curated network of dealers, an RFQ protocol effectively aggregates latent liquidity that might otherwise remain inaccessible or disaggregated across disparate platforms.

It creates a temporary, bespoke liquidity pool for a specific trade, optimizing execution for size and discretion rather than speed alone. This method is a cornerstone for institutions seeking to manage significant risk exposures or express complex directional views without inadvertently moving the market against their own positions.

RFQ protocols establish a private, competitive bidding environment, consolidating fragmented liquidity for large, complex crypto options trades.

The operational efficacy of RFQ protocols in digital asset derivatives stems from their capacity to mitigate the “invisible tax” of fragmentation. When liquidity is scattered, executing a substantial trade across numerous venues incurs wider spreads and increased slippage. RFQ systems counteract this by compelling multiple market makers to quote against each other for a single, large block of options.

This competitive dynamic often results in tighter spreads and superior execution prices compared to attempting to fill a large order piecemeal on an open order book. Furthermore, the private nature of the interaction shields the trade from pre-execution information leakage, a critical concern for institutional entities whose trade intentions can significantly influence market prices.

Foundational Market Dynamics

Understanding the intricate market microstructure of crypto options is paramount to appreciating the influence of RFQ protocols. Cryptocurrency markets exhibit unique characteristics, including higher volatility, fragmented liquidity across numerous exchanges, and varying levels of transparency. These factors combine to create an environment where traditional liquidity metrics and execution strategies often prove inadequate.

RFQ systems provide a structured overlay, allowing institutional traders to circumvent some of these inherent market inefficiencies by directly engaging with principal liquidity providers. The goal involves achieving a high-fidelity execution that aligns with the precise requirements of a sophisticated portfolio.

Price discovery in fragmented markets is a complex undertaking. With order books dispersed across various venues, a single, universally accepted “fair” price can be elusive. RFQ protocols contribute to more robust price discovery for large blocks by generating a real-time, competitive consensus from a pool of expert market makers. These market makers, equipped with their own pricing models and risk management frameworks, internalize the fragmented market data to provide a consolidated price.

The RFQ process effectively creates a temporary, localized clearing price for a specific block trade, reflecting the aggregate supply and demand from a network of informed participants. This mechanism helps to bridge the gap between theoretical fair value and executable price in illiquid or thinly traded options contracts.

Strategic Aggregation through Quote Solicitation

For institutional principals navigating the complex terrain of crypto options, a strategic approach to liquidity aggregation is not a luxury; it is an operational imperative. RFQ protocols serve as a pivotal strategic gateway, offering a disciplined methodology for sourcing deep, competitive liquidity that transcends the limitations of fragmented public order books. This method is particularly relevant for large block trades, multi-leg options strategies, or bespoke contracts where the desired size or complexity renders traditional exchange execution inefficient or prohibitively costly. A sophisticated RFQ framework allows for the targeted engagement of specific liquidity providers, ensuring that only qualified counterparties receive the trade inquiry.

One primary strategic advantage of RFQ systems involves their capacity for discreet protocols and private quotations. Executing substantial orders on a public order book risks significant market impact and adverse selection, as other participants may front-run the institutional flow. RFQ systems, by design, offer a confidential channel for price discovery. The requesting institution’s identity and trade intentions remain anonymous to the broader market, revealed only to the selected liquidity providers.

This discretion preserves alpha and mitigates the risk of price degradation that often accompanies large order placement in transparent, yet fragmented, environments. Maintaining anonymity is paramount for protecting proprietary trading strategies and ensuring optimal execution outcomes.

RFQ systems offer a discreet channel for price discovery, protecting institutional trade intentions from market impact.

Multi-Dealer Liquidity Sourcing

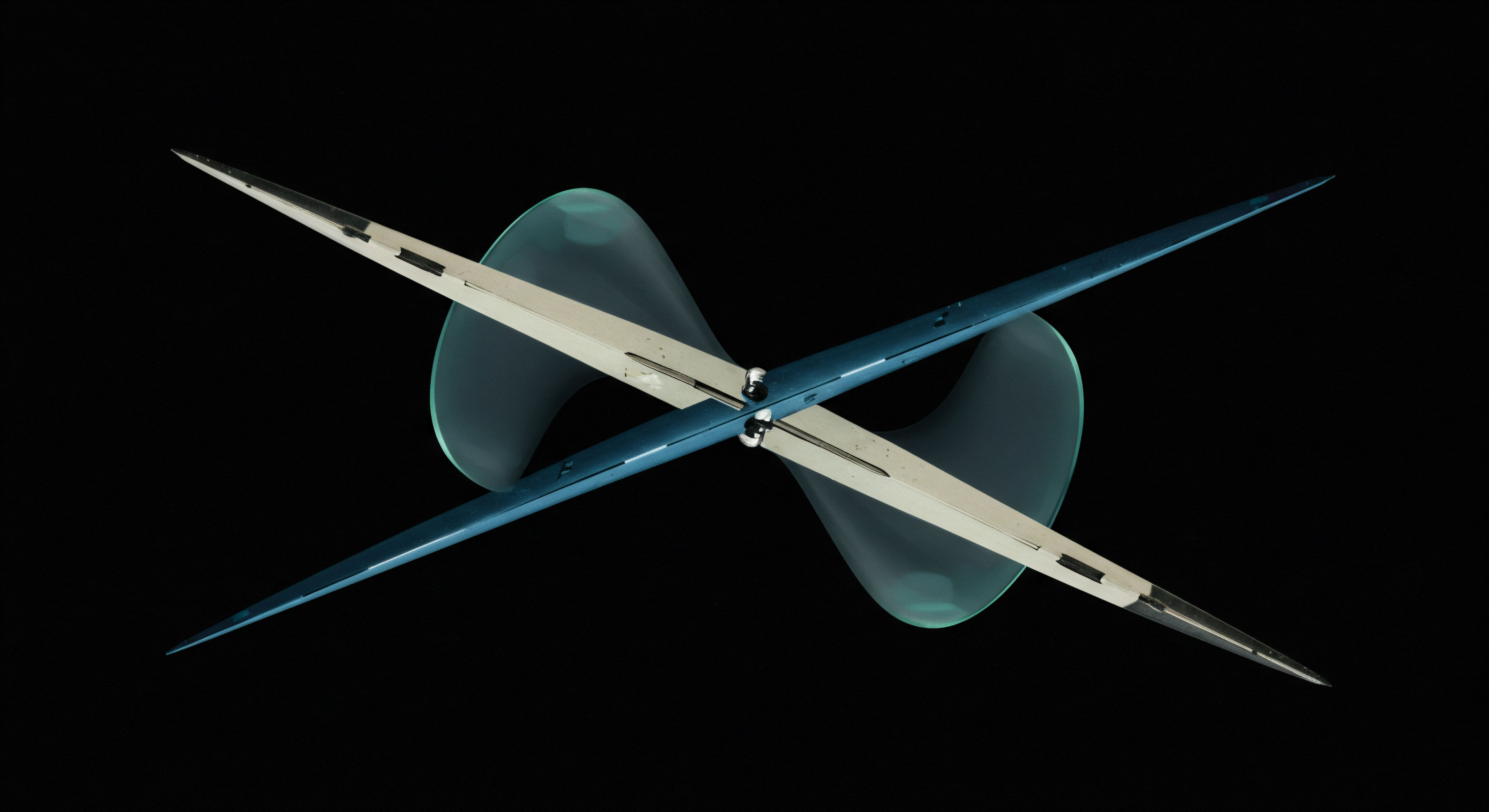

The strategic deployment of multi-dealer liquidity sourcing via RFQ is a cornerstone for achieving best execution in crypto options. Instead of relying on a single counterparty or attempting to sweep liquidity across multiple disparate venues, an RFQ allows for simultaneous price discovery from a diverse pool of market makers. This competitive dynamic among liquidity providers drives tighter spreads and more favorable pricing for the initiator.

The system effectively creates a temporary, competitive mini-auction for each trade, ensuring that the institution receives the most advantageous price available at that moment from its chosen network of dealers. This structured competition is a direct antidote to the inefficiencies born from market fragmentation.

Aggregated inquiries within an RFQ framework streamline the operational overhead associated with large trade execution. Instead of individually contacting multiple brokers or attempting to piece together liquidity from various order books, a single RFQ submission can reach a predefined group of liquidity providers. This centralization of the inquiry process significantly reduces the time and resources required for trade initiation and price negotiation.

It also standardizes the communication protocol, minimizing errors and ensuring that all participating dealers are quoting on the exact same terms. The efficiency gained allows trading desks to focus on strategic decision-making and risk management rather than manual liquidity sourcing.

- Targeted Engagement ▴ RFQ protocols allow institutions to select specific liquidity providers known for their expertise in particular crypto options, optimizing for price and counterparty quality.

- Reduced Information Asymmetry ▴ By soliciting multiple quotes, institutions gain a broader view of market depth and pricing, mitigating risks associated with trading with a single dealer.

- Enhanced Price Optimization ▴ Competitive bidding among multiple market makers often yields superior execution prices compared to fragmented, bilateral negotiations.

Advanced Trading Applications and Risk Management

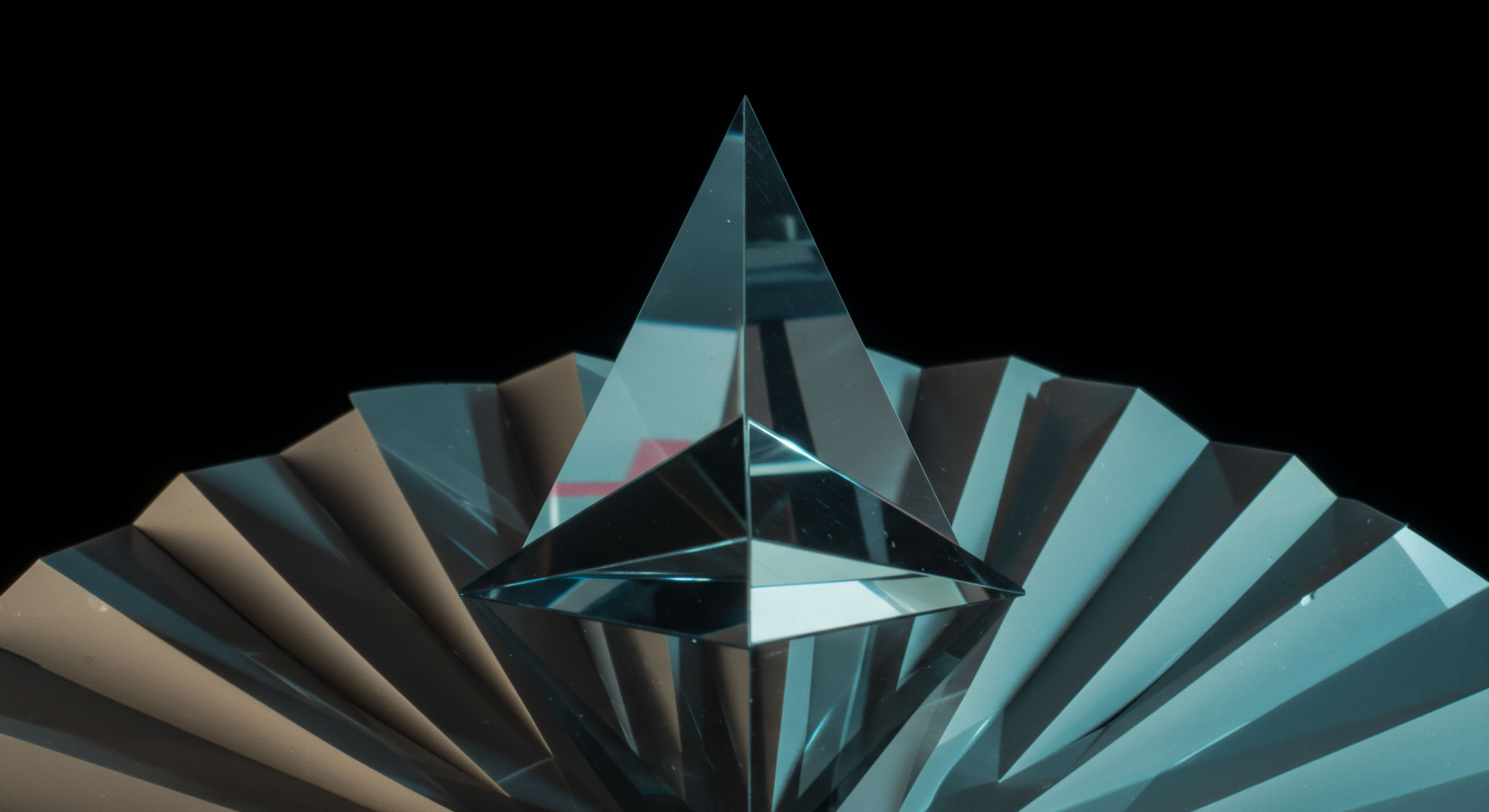

RFQ protocols extend beyond simple block trades, enabling advanced trading applications crucial for sophisticated risk management. Consider the mechanics of executing complex multi-leg options spreads, such as iron condors or butterfly spreads, on illiquid crypto options. Constructing these strategies on an order book is fraught with execution risk, as each leg must be traded sequentially, exposing the position to price movements between fills.

An RFQ allows for the entire spread to be quoted and executed as a single, atomic transaction, eliminating leg risk and ensuring the desired spread relationship. This high-fidelity execution for multi-leg spreads is a powerful tool for expressing nuanced volatility views or hedging complex exposures with precision.

Automated Delta Hedging (DDH) strategies, while primarily post-trade, benefit significantly from the efficient initial execution provided by RFQ protocols. A precise initial options trade, achieved through competitive RFQ pricing, establishes a solid foundation for subsequent delta management. If the initial options position is acquired at a suboptimal price due to fragmented liquidity, the ongoing delta hedging costs can escalate.

RFQ systems ensure that the entry point for the options leg is as favorable as possible, thereby contributing to the overall efficiency of the DDH strategy and minimizing total hedging costs. This synergy between initial execution and ongoing risk management is a testament to the comprehensive value RFQ protocols provide.

Executing complex options spreads via RFQ ensures atomic transactions, eliminating leg risk inherent in fragmented order book execution.

The integration of RFQ systems into a comprehensive system-level resource management framework allows institutions to optimize capital allocation and operational efficiency. By providing a centralized mechanism for large-volume, off-book transactions, RFQs reduce the need for significant capital deployment on public exchanges to absorb market impact. This allows for more efficient utilization of trading capital across various strategies.

Furthermore, the auditable trail generated by RFQ processes aids in regulatory compliance and internal risk reporting, offering transparency into bilateral transactions that might otherwise be opaque. This robust record-keeping is vital for demonstrating best execution practices and managing counterparty credit risk in the OTC derivatives space.

Operationalizing Bilateral Price Discovery

The operationalization of RFQ protocols within fragmented crypto options markets represents a sophisticated leap in institutional trading. This is not a mere technological overlay; it is a fundamental shift in how deep liquidity is sourced and complex derivatives are executed. For principals, the execution phase of an RFQ is where strategic intent translates into tangible market outcomes ▴ superior pricing, minimal slippage, and robust risk control.

The mechanics demand meticulous attention to detail, from the initial construction of the quote request to the final settlement, all while operating within a landscape characterized by diverse technical standards and dynamic market conditions. This section delineates the precise steps and underlying considerations that define high-fidelity execution through RFQ.

The Operational Playbook

Implementing RFQ protocols for crypto options requires a structured, multi-step procedural guide to ensure consistent and optimal execution. This playbook begins with pre-trade analytics and extends through post-trade reconciliation, emphasizing system integration and continuous monitoring.

- Pre-Trade Analysis and Inquiry Formulation ▴

- Define Trade Parameters ▴ Precisely specify the crypto option contract (e.g. BTC-PERP-25DEC25-C-50000), notional amount, strike price, expiry, and desired side (buy/sell). For multi-leg strategies, detail each component and the desired spread relationship.

- Select Liquidity Providers ▴ Curate a list of qualified market makers with demonstrated expertise and competitive pricing in the specific crypto options segment. Leverage historical RFQ data to inform this selection.

- Construct RFQ Message ▴ Generate a standardized RFQ message, typically via API or a dedicated trading interface, containing all trade parameters and a unique identifier. Ensure the message adheres to established FIX protocol standards where applicable for interoperability.

- Quote Solicitation and Aggregation ▴

- Broadcast Inquiry ▴ Transmit the RFQ to the selected liquidity providers simultaneously. The system must timestamp the broadcast and track responses.

- Receive and Normalize Quotes ▴ Collect incoming bids and offers from multiple dealers. Normalize disparate quote formats into a unified view for comparison, accounting for varying fee structures, settlement terms, and implied volatilities.

- Evaluate Best Price ▴ Employ an automated best execution algorithm to identify the most favorable quote based on predefined criteria (e.g. tightest spread, largest size at a given price, best implied volatility).

- Execution and Confirmation ▴

- Accept Best Quote ▴ Electronically accept the chosen quote within the specified validity period. This initiates the trade execution with the selected counterparty.

- Trade Confirmation ▴ Receive immediate confirmation of the executed trade, including the final price, quantity, and counterparty details.

- Internal Record-Keeping ▴ Log all RFQ interactions, quotes received, and execution details for audit trails, compliance, and Transaction Cost Analysis (TCA).

- Post-Trade Processing and Risk Management ▴

- Settlement Instruction ▴ Generate and transmit settlement instructions to relevant custodians or clearing agents, ensuring alignment with the bilateral agreement.

- Position Update ▴ Integrate the executed trade into the internal portfolio management system for real-time position and risk updates.

- Delta Hedging Initialization ▴ Initiate automated delta hedging strategies based on the new options position, if applicable, leveraging the precise entry point achieved through RFQ.

The operational flow must incorporate robust error handling and fallback mechanisms. Should a selected liquidity provider fail to respond or withdraw a quote, the system must be capable of swiftly re-routing the RFQ or moving to the next best available quote. This resilience is fundamental to maintaining execution integrity in volatile digital asset markets.

Quantitative Modeling and Data Analysis

Quantitative modeling underpins the effectiveness of RFQ protocols, particularly in assessing execution quality and managing the inherent risks of crypto options. Analyzing the data generated by RFQ interactions provides critical insights into market microstructure, dealer performance, and the true cost of liquidity.

One key metric involves the Effective Spread , which measures the actual cost of trading relative to the midpoint of the bid-ask spread at the time of execution. For RFQ trades, this requires careful calculation, as the “midpoint” might be derived from a composite of indicative prices across various fragmented venues or the average of the received quotes.

The Price Improvement metric quantifies the difference between the executed price and the best available price on public order books (if a reference exists) or the initial indicative quote from the dealer. A consistently positive price improvement demonstrates the value added by the competitive nature of RFQ.

Quantitative analysis of RFQ data provides insights into effective spreads and price improvement, optimizing future execution strategies.

Execution Slippage is another critical analytical focus, measuring the difference between the expected price when the RFQ was sent and the actual execution price. While RFQs aim to minimize slippage, particularly for large blocks, real-time market movements can still introduce deviations.

| Metric | Calculation Method | Significance for RFQ |

|---|---|---|

| Effective Spread | 2 |Executed Price – Midpoint Price| | Measures the actual transaction cost, revealing the impact of competitive quoting. |

| Price Improvement | (Reference Midpoint – Executed Price) / Reference Midpoint | Quantifies savings compared to a benchmark, validating RFQ value. |

| Execution Slippage | (Actual Execution Price – Quoted Price) / Quoted Price | Indicates deviation from expected price due to market dynamics or latency. |

| Response Time Latency | Time from RFQ send to first quote received | Assesses dealer efficiency and platform responsiveness. |

| Quote Hit Ratio | Number of accepted quotes / Total quotes received | Evaluates the competitiveness and relevance of dealer quotes. |

Analyzing these metrics over time allows institutions to refine their liquidity provider selection, optimize RFQ routing strategies, and continuously improve their overall execution framework. The data provides an empirical basis for assessing the performance of the RFQ system and its contribution to capital efficiency.

Predictive Scenario Analysis

Consider a hypothetical scenario involving an institutional fund manager, “Apex Capital,” managing a substantial portfolio of digital assets. Apex Capital aims to express a bearish volatility view on Ethereum, specifically targeting a short straddle position on ETH-PERP-25JUN26 with a strike price of $4,000, for a notional value equivalent to 5,000 ETH. Executing such a large, multi-leg options trade on a public order book, even a highly liquid one, would present significant challenges.

The sheer size of the order could easily absorb available liquidity, leading to substantial slippage on both the call and put legs, and potentially move the underlying ETH price against Apex Capital before the entire straddle is constructed. The fragmentation of ETH options liquidity across various centralized exchanges and OTC desks further complicates this, requiring Apex Capital to manually aggregate prices and execute across disparate venues, incurring higher transaction costs and increasing operational risk.

Instead, Apex Capital leverages its integrated RFQ platform. The fund’s trading desk initiates an RFQ for the ETH straddle. The system automatically packages the specific contract details ▴ short 5,000 ETH calls at $4,000, short 5,000 ETH puts at $4,000, both expiring June 25, 2026 ▴ and broadcasts this inquiry simultaneously to its pre-approved network of ten tier-one crypto options market makers. These market makers receive the RFQ instantly, analyze their internal inventory, risk limits, and real-time market data from various sources, then submit their competitive two-sided quotes within seconds.

Within a mere seven seconds, Apex Capital’s platform receives responses from eight of the ten dealers. The quotes vary slightly, reflecting each dealer’s unique view on implied volatility, inventory position, and risk appetite. For instance, Dealer A offers to buy the straddle at a premium of $500 per ETH, while Dealer B offers $505, and Dealer C, seeking to offload some ETH long-gamma exposure, offers an aggressive $510.

Apex Capital’s best execution algorithm, configured to prioritize the highest premium for a short straddle, automatically identifies Dealer C’s quote as the most advantageous. The platform then sends an acceptance message to Dealer C.

The trade executes instantly at the $510 premium, with the entire 5,000 ETH notional straddle being transacted as a single, atomic unit. This process bypasses the fragmented order books, eliminating leg risk and minimizing price impact on the underlying ETH market. Had Apex Capital attempted to execute this trade on an exchange, a similar order might have been filled at an average premium of $480 due to slippage and market impact across multiple order book levels, resulting in a $150,000 opportunity cost (5,000 ETH ($510 – $480)). The RFQ mechanism delivered a price improvement of approximately 6.25% in this scenario.

Furthermore, the RFQ system ensures complete anonymity for Apex Capital during the price discovery phase. No market participant, other than the selected dealers, becomes aware of Apex Capital’s intent to initiate a large bearish volatility position. This discretion is critical for preventing predatory trading strategies that might otherwise capitalize on leaked information. The trade is then recorded in Apex Capital’s internal systems, triggering an immediate update to its delta hedging models, which begin dynamically adjusting the underlying ETH spot exposure to maintain a neutral position.

The transparency of the RFQ audit trail also provides a clear record for regulatory compliance and internal performance attribution. This demonstrates how RFQ protocols function as a robust operational framework, transforming the execution of complex, large-volume crypto options from a high-risk, fragmented endeavor into a controlled, optimized process.

System Integration and Technological Framework

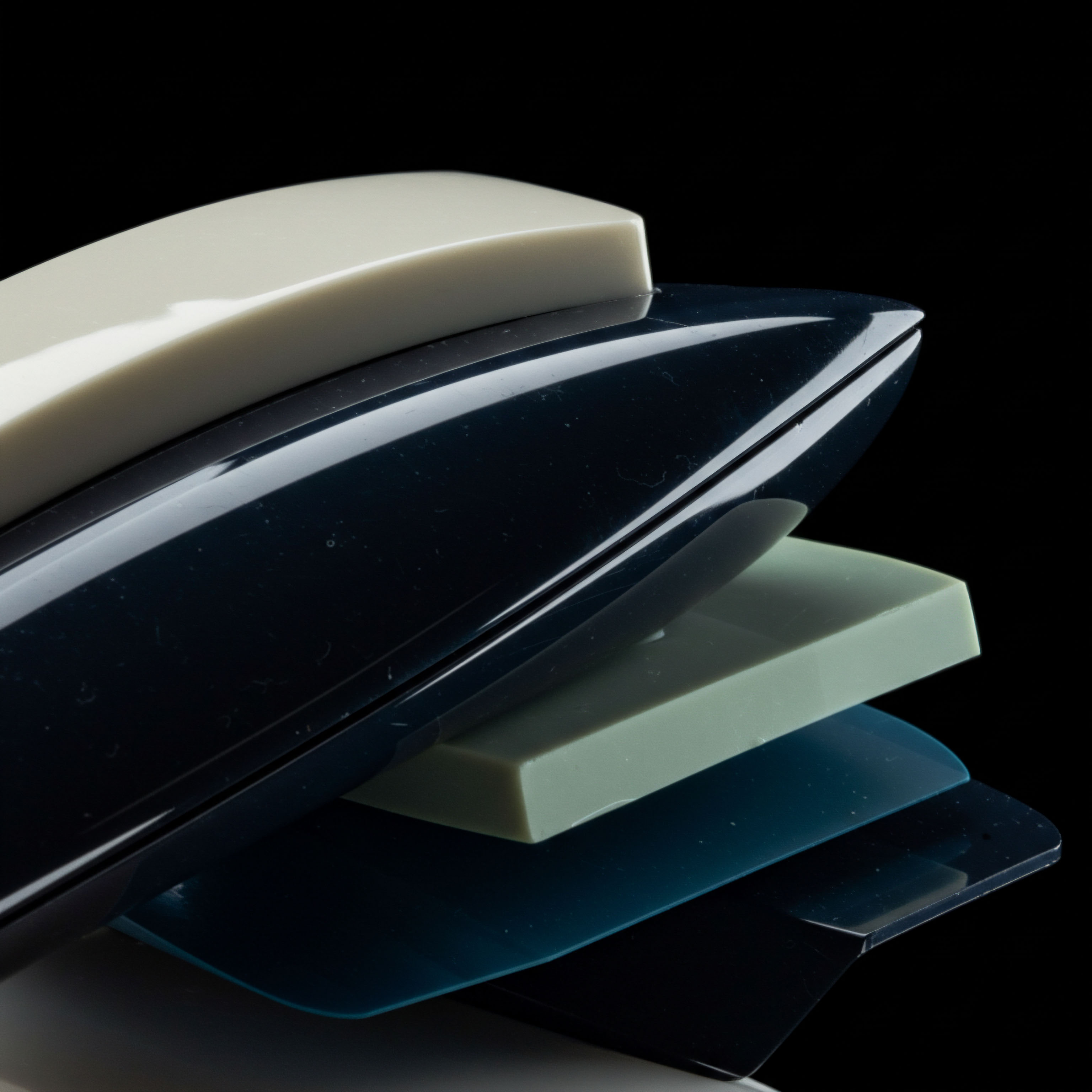

The robust implementation of RFQ protocols demands a sophisticated technological framework, characterized by seamless system integration and adherence to industry-standard communication protocols. The core of this framework rests on a high-performance trading engine capable of processing requests, aggregating quotes, and facilitating rapid execution across a distributed network of liquidity providers.

API endpoints serve as the primary conduits for RFQ communication. These interfaces must support low-latency message exchange, enabling institutions to send quote requests and receive responses in milliseconds. Standardized protocols, such as a tailored FIX (Financial Information eXchange) protocol for crypto derivatives, are essential for ensuring interoperability between the institutional trading system and various dealer platforms. A FIX-based RFQ message would encapsulate all necessary trade parameters, including instrument identifiers, quantity, side, and expiry, allowing for automated parsing and processing by market makers.

| Endpoint Function | Description | Typical Data Payload |

|---|---|---|

| /rfq/request | Initiates a new Request for Quote to selected dealers. | Instrument ID, Quantity, Side, Expiry, Strike, Legs (for spreads) |

| /rfq/quote_stream | Receives real-time quote responses from liquidity providers. | Quote ID, Dealer ID, Bid Price, Ask Price, Bid Size, Ask Size, Validity |

| /rfq/execute | Confirms acceptance of a specific quote for execution. | Quote ID, Quantity to Execute, Client Order ID |

| /trade/confirmations | Receives final trade confirmation details post-execution. | Trade ID, Executed Price, Executed Quantity, Counterparty, Fees |

Order Management Systems (OMS) and Execution Management Systems (EMS) play a pivotal role in the RFQ workflow. The OMS manages the lifecycle of the order, from initial entry to final settlement, while the EMS optimizes its execution. An integrated EMS would dynamically route RFQs, apply best execution logic to incoming quotes, and manage the immediate post-execution processes, such as position updates and initial hedging instructions. This seamless integration minimizes manual intervention, reduces operational risk, and enhances the overall efficiency of the trading desk.

The technological stack must also account for the unique characteristics of crypto assets, including secure wallet integration for settlement and robust real-time market data feeds. These feeds aggregate price information from various spot and derivatives exchanges, providing market makers with the comprehensive view necessary to generate competitive quotes. Furthermore, the system requires resilient infrastructure to handle high message volumes and maintain uptime, especially given the 24/7 nature of crypto markets. Redundancy and failover capabilities are critical to ensuring continuous operation and preventing execution failures.

References

- Atanasova, Christina, et al. “Illiquidity Premium and Crypto Option Returns.” (2024).

- Delattre, Simon, et al. “Liquidity Dynamics in RFQ Markets and Impact on Pricing.” arXiv preprint arXiv:2406.12658 (2024).

- Easley, David, Maureen O’Hara, Songshan Yang, and Zhibai Zhang. “Microstructure and Market Dynamics in Crypto Markets.” Cornell University (2024).

- Makarov, Igor, and Antoinette Schoar. “Cryptocurrencies and Blockchains ▴ An Introduction to New Digital Technologies.” Journal of Economic Perspectives 35, no. 3 (2021) ▴ 209-32.

- Robert, Charles, and Mathieu Rosenbaum. “Estimating an efficient price for large-tick assets.” Quantitative Finance 20, no. 11 (2020) ▴ 1797-1815.

Operational Command in Volatile Environments

The landscape of digital asset derivatives continually evolves, presenting both unprecedented opportunities and complex challenges. Understanding the systemic influence of RFQ protocols on liquidity aggregation within these fragmented markets moves beyond theoretical comprehension; it compels introspection into one’s own operational framework. How robust are your current mechanisms for sourcing deep liquidity for bespoke options trades? Are your execution strategies truly optimizing for discretion and price, or are they inadvertently incurring hidden costs from market impact and slippage?

The insights presented herein serve as a catalyst for evaluating and enhancing the foundational components of institutional trading. True mastery in this domain stems from a continuous refinement of execution architecture, transforming market complexities into a decisive operational edge.

Glossary

Crypto Options

Order Books

Price Discovery

Liquidity Providers

Rfq Systems

Market Makers

Rfq Protocols

Order Book

Market Microstructure

Risk Management

Market Impact

Multi-Dealer Liquidity

Best Execution

Delta Hedging

Execution Quality

Price Improvement

Minimize Slippage