Precision in Price Discovery

For the institutional participant navigating the intricate landscape of large crypto options trades, the challenge of achieving optimal price discovery is a persistent concern. The inherent characteristics of digital asset markets, particularly the fragmented liquidity and episodic depth for substantial notional values, often obscure the true cost of execution. A traditional order book, while transparent, frequently broadcasts intent prematurely, leading to adverse price movements. This dynamic creates an imperative for a more sophisticated mechanism, one that facilitates competitive pricing without revealing the full scope of an institution’s trading interest.

Automated Request for Quote protocols represent a fundamental advancement in addressing this precise operational requirement. This methodology provides a structured channel for soliciting bespoke pricing from a curated network of liquidity providers. Rather than engaging with a public, visible order book that reacts to large order submissions, an automated RFQ system orchestrates a discreet, bilateral dialogue.

This direct communication with multiple market makers simultaneously cultivates a competitive environment, compelling participants to offer their most favorable terms for the specific options contract or complex strategy under consideration. The objective remains singular ▴ to unearth the tightest executable spread and the most advantageous mid-price for substantial block trades, thereby optimizing capital deployment and minimizing implicit transaction costs.

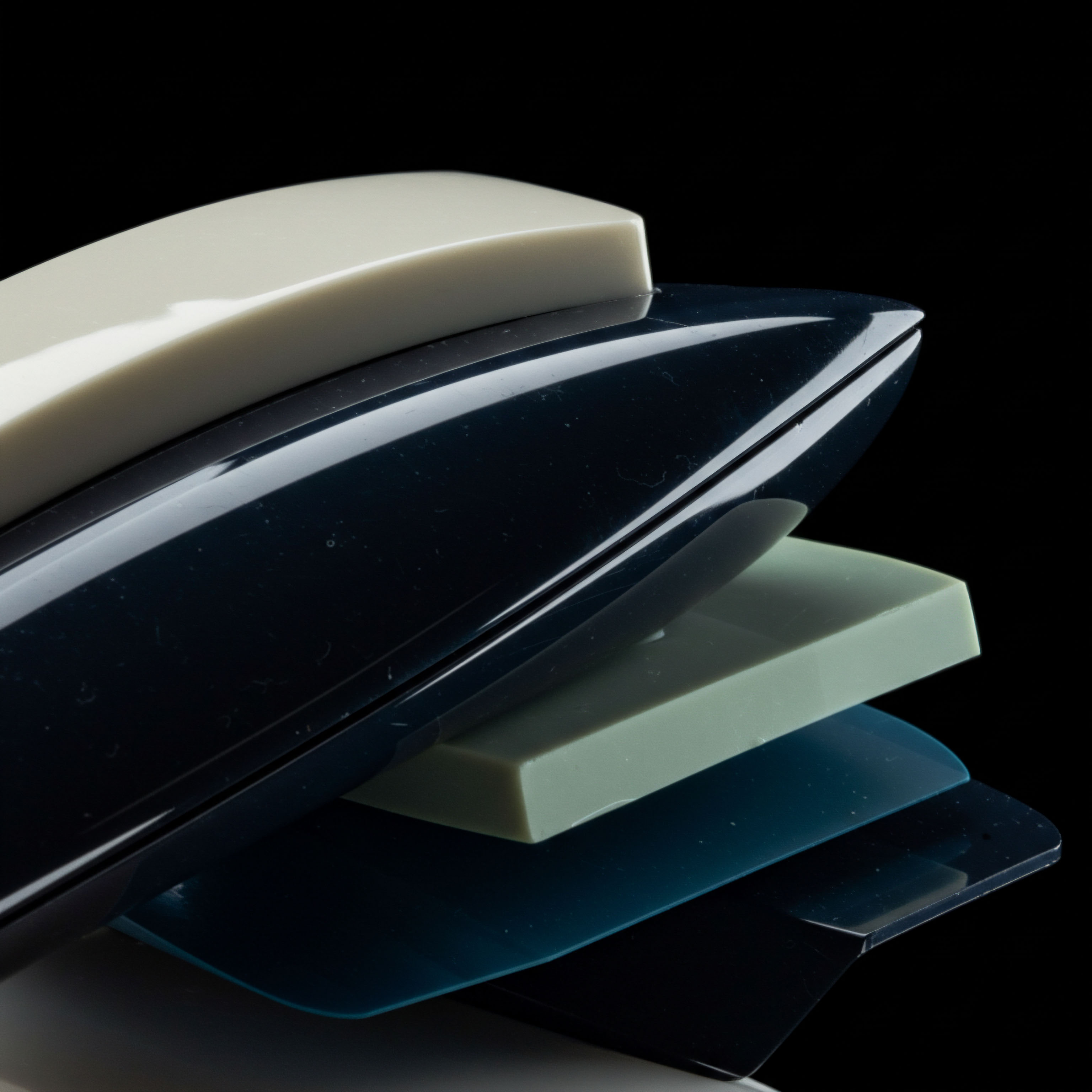

Automated RFQ systems offer a structured, discreet channel for institutional crypto options traders to solicit competitive pricing from multiple liquidity providers.

The efficacy of this approach lies in its capacity to aggregate liquidity across diverse venues and counterparties without revealing the principal’s order size or directionality to the broader market. This discretion is paramount for options, where volatility and gamma exposure can significantly amplify the impact of large orders. By submitting an inquiry for a specific crypto options spread or a multi-leg strategy, the institutional trader receives multiple, firm quotes, each reflecting the respective market maker’s assessment of risk and available liquidity.

The competitive tension among these quoting entities inherently drives superior price formation, ensuring that the institution secures an execution price that genuinely reflects the prevailing market equilibrium for that specific block. This process is a strategic tool for mitigating market impact and securing high-fidelity execution, particularly in instruments that might exhibit intermittent liquidity.

Orchestrating Optimal Execution

The strategic deployment of an automated Request for Quote system transforms the execution paradigm for large crypto options trades, moving beyond mere price sourcing to a sophisticated orchestration of liquidity and risk. Institutional participants prioritize the mitigation of market impact and the achievement of best execution for significant notional volumes. RFQ protocols address these priorities by enabling a targeted approach to liquidity aggregation, allowing traders to tap into deep, off-exchange pools without disrupting public markets. This capacity for discreet engagement is especially vital in the nascent yet rapidly maturing crypto options landscape, where liquidity can be fragmented across centralized exchanges and decentralized protocols.

A core strategic advantage of automated quote solicitation lies in its support for complex, multi-leg options strategies. Constructing a synthetic knock-in option or an intricate volatility spread, for instance, requires simultaneous pricing and execution of several distinct options contracts. Attempting to leg into such a strategy on a traditional order book exposes the trader to significant leg risk and adverse price movements between individual fills. An RFQ system allows the institutional trader to submit a single, atomic request for the entire spread, compelling market makers to quote a consolidated price for the entire structure.

This ensures a synchronized execution, eliminating the risk of partial fills or price slippage on individual components of a complex trade. The system thus acts as a cohesive unit, allowing for comprehensive strategy implementation.

Multi-Dealer Engagement and Liquidity Aggregation

Engaging with multiple liquidity providers through a unified RFQ interface fosters genuine competition, which is a cornerstone of effective price discovery. Each market maker, aware of the potential for competing quotes, is incentivized to offer the sharpest pricing for the requested options structure. This competitive dynamic is amplified by sophisticated smart order routing capabilities inherent in advanced RFQ platforms, which can dynamically identify and engage the most relevant counterparties based on historical performance, available inventory, and specific risk parameters. The system’s ability to aggregate inquiries ensures that the institutional trader receives a holistic view of available liquidity, optimizing the selection process for the most advantageous quote.

Consider the strategic implications for managing significant options positions. An institution seeking to hedge a substantial Bitcoin options exposure, for example, can leverage an automated RFQ to solicit quotes for a tailored delta-hedging strategy. This might involve a combination of spot, futures, and various options strikes and expiries.

The RFQ mechanism facilitates the packaging of these disparate instruments into a single request, ensuring that the entire hedging portfolio is priced and executed coherently. This integrated approach reduces the operational overhead and minimizes the slippage that would invariably occur when executing each component individually across multiple venues.

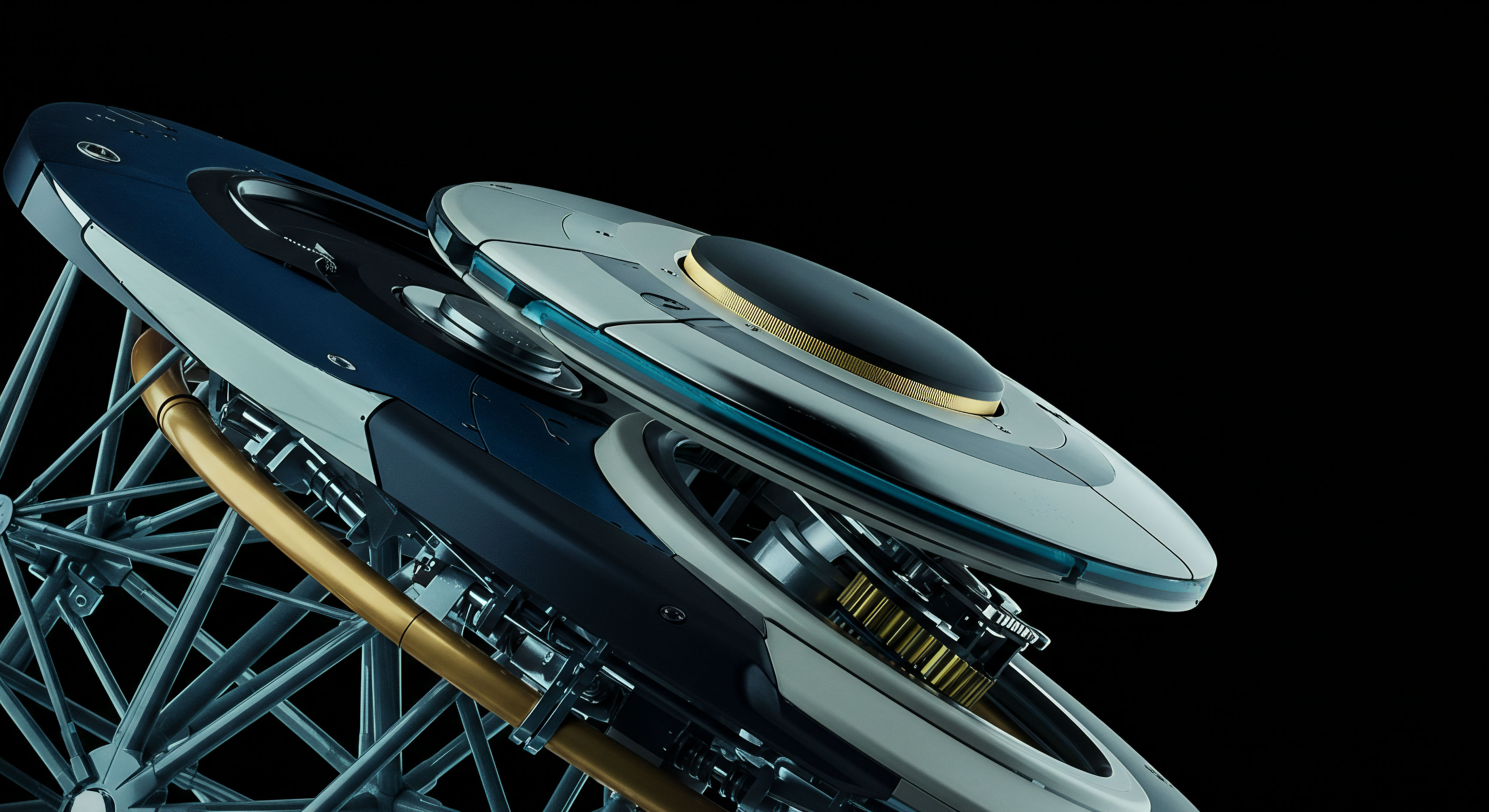

Automated RFQ platforms enable seamless execution of complex, multi-leg crypto options strategies by soliciting atomic pricing from multiple market makers.

Risk Management through Discreet Protocols

The discreet nature of automated quote solicitation protocols provides a significant advantage in risk management. Large block trades, if executed on public order books, often generate signaling risk, alerting other market participants to the institution’s directional bias or size. This information leakage can lead to front-running or adverse price movements, increasing execution costs.

By contrast, RFQ systems maintain the anonymity of the initiator, allowing the institution to explore liquidity and secure pricing without telegraphing its intentions. This preserves the integrity of the trading strategy and protects the alpha generated through careful market analysis.

Furthermore, RFQ platforms often integrate advanced payoff modeling and risk visualization tools. Before confirming a trade, institutional traders can simulate the potential profit and loss profiles of their proposed options strategies across various market scenarios. This integrated analytical capability provides a granular understanding of the risk exposures, allowing for precise adjustments to the trade parameters. The ability to visualize the risk landscape prior to execution enhances decision-making and ensures that the chosen strategy aligns precisely with the institution’s risk appetite and investment objectives.

| Feature | Automated RFQ Execution | Traditional Order Book Execution |

|---|---|---|

| Price Discovery Mechanism | Competitive quotes from selected liquidity providers. | Public bid/ask spread, depth limited by visible orders. |

| Market Impact | Minimized due to discreet, off-book negotiation. | Significant potential for adverse price movement. |

| Information Leakage | Low, as trade intent is private until execution. | High, as large orders signal intent to market. |

| Execution Certainty | High, firm quotes for specific size and terms. | Variable, subject to available liquidity and partial fills. |

| Complex Strategy Support | Atomic execution for multi-leg options spreads. | Leg risk and slippage for multi-leg strategies. |

| Counterparty Selection | Direct choice among quoting liquidity providers. | Anonymous matching with available orders. |

Operationalizing Superior Performance

The execution phase for large crypto options trades, powered by automated Request for Quote systems, represents a sophisticated convergence of technology, quantitative analysis, and market microstructure expertise. For institutional participants, the emphasis shifts from merely finding a price to systematically optimizing every parameter of the trade lifecycle. This operational imperative demands a robust technological framework capable of handling high-fidelity execution, intricate risk management, and seamless integration with existing trading infrastructure. The system’s capacity to process and respond to real-time market dynamics becomes a decisive factor in achieving superior outcomes.

At its core, an automated RFQ execution workflow commences with the structured generation of an inquiry. An institutional trader specifies the underlying asset, option type (call/put), strike price, expiry date, quantity, and any additional parameters for a single leg or a complex options strategy. This inquiry is then transmitted simultaneously to a pre-selected group of liquidity providers within the RFQ network. These providers, typically specialized market makers, respond with firm, executable quotes, often within milliseconds.

The speed and reliability of this quote dissemination and response mechanism are critical, particularly in volatile crypto markets where prices can shift rapidly. The system must process these incoming quotes, rank them based on predefined criteria (e.g. best bid/offer, total premium, implied volatility), and present the optimal choices to the trader for confirmation.

Systemic Integration and Technological Backbone

The effectiveness of an automated RFQ system is inextricably linked to its technological architecture. Robust APIs and standardized communication protocols, such as FIX (Financial Information eXchange), are fundamental for seamless integration with an institution’s Order Management Systems (OMS) and Execution Management Systems (EMS). This integration ensures that trade instructions flow efficiently from the front office to the RFQ platform, and executed trade confirmations are routed back for straight-through processing. The underlying infrastructure must possess ultra-low latency capabilities to minimize the time lag between quote receipt and trade confirmation, thereby reducing the risk of stale prices.

Furthermore, advanced RFQ platforms incorporate an “intelligence layer” that continuously monitors market flow data and liquidity conditions. Real-time intelligence feeds provide insights into order book depth on public exchanges, implied volatility surfaces, and potential market-moving events. This data informs the RFQ process, allowing the system to intelligently select liquidity providers, anticipate price movements, and even suggest optimal times for submitting inquiries. The combination of automated execution with real-time market intelligence empowers institutional traders with a formidable operational edge.

Automated Delta Hedging and Advanced Risk Controls

For institutions trading large crypto options, managing the dynamic risk profile of their positions is paramount. Automated delta hedging (DDH) is a critical component of this operational framework. Upon the execution of an options trade via RFQ, the system can automatically trigger corresponding spot or futures trades to neutralize the delta exposure of the newly acquired position.

This instantaneous hedging minimizes directional risk, preventing unwanted exposure to underlying asset price fluctuations. The DDH mechanism relies on precise real-time pricing and efficient execution across integrated spot and derivatives venues.

Beyond delta, comprehensive risk controls within an RFQ system extend to managing gamma, vega, and theta exposures. The platform provides real-time portfolio analytics, allowing “System Specialists” to monitor the Greeks of their entire options book. Thresholds can be set to automatically flag or even trigger re-hedging activities when specific risk parameters are breached.

This proactive risk management capability is essential for preserving capital and ensuring that complex options strategies perform as intended, even in rapidly evolving market conditions. The granularity of these controls offers an unparalleled level of operational oversight.

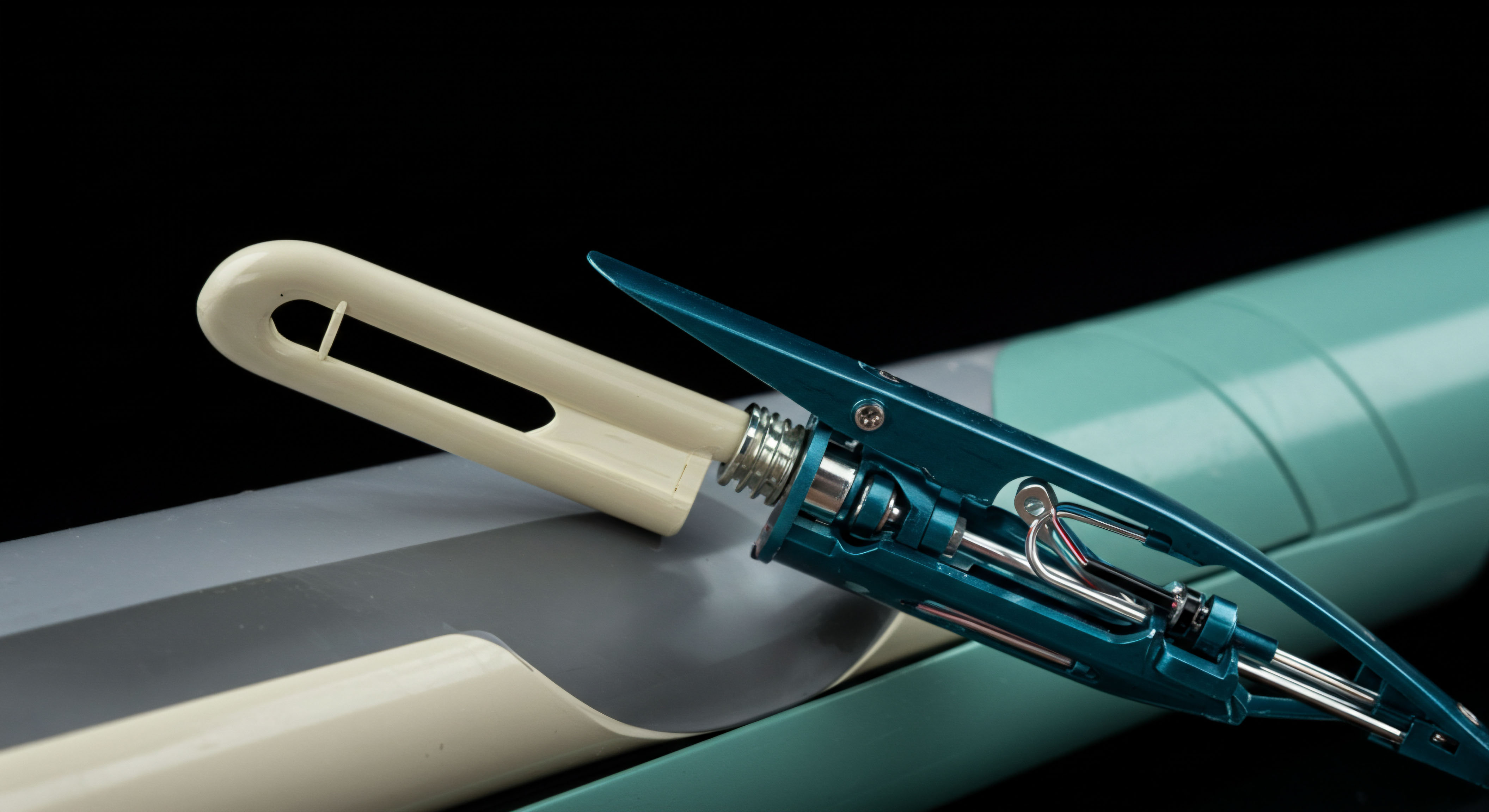

Robust API integration, low-latency infrastructure, and real-time intelligence feeds are crucial for optimizing automated RFQ execution.

Quantitative Modeling for Quote Evaluation

The evaluation of quotes received through an automated RFQ is a sophisticated quantitative exercise. Institutions do not merely select the lowest ask or highest bid; they assess the overall value proposition, factoring in implied volatility, theoretical value, and the market maker’s historical fill rates. Quantitative models within the RFQ system perform rapid calculations to determine the fair value of the options contracts, comparing incoming quotes against these theoretical benchmarks. This analytical rigor ensures that the chosen quote represents genuine value and not merely a superficial price.

For complex options strategies, the modeling becomes even more intricate. The system calculates the aggregate premium, the effective delta, gamma, and vega of the entire spread, and assesses how the incoming quotes impact the portfolio’s overall risk profile. This rapid, multi-dimensional analysis is beyond the capacity of manual processing and highlights the indispensable role of automation in achieving optimal execution for large, sophisticated crypto options trades. The continuous refinement of these quantitative models, informed by market data and execution outcomes, drives a perpetual cycle of performance enhancement.

| Parameter Category | Specific Parameter | Operational Significance |

|---|---|---|

| Trade Specification | Underlying Asset | Identifies the crypto asset (e.g. BTC, ETH) for the options contract. |

| Option Type | Specifies call or put, defining directional exposure. | |

| Strike Price | Determines the price at which the underlying asset can be bought or sold. | |

| Expiry Date | Sets the contract’s expiration, influencing time decay (theta). | |

| Quantity/Notional | Defines the size of the options position, impacting market sensitivity. | |

| Liquidity Provider Selection | Curated Dealer Network | Pre-approved market makers with established relationships and liquidity. |

| Historical Performance Metrics | Data on past fill rates, pricing competitiveness, and response times. | |

| Execution Criteria | Price Tolerance | Maximum acceptable deviation from fair value or desired price. |

| Time-in-Force | Duration for which the RFQ remains active for quotes. | |

| Minimum Fill Quantity | Ensures a meaningful portion of the order is executed. | |

| Risk Management Integration | Automated Delta Hedging | Instantaneous offsetting trades to neutralize directional risk. |

| Real-time Greeks Monitoring | Continuous calculation and display of delta, gamma, vega, theta. | |

| Position Limits | Predefined maximum exposures to prevent excessive risk accumulation. |

This level of detailed control over execution parameters and integrated risk management defines the institutional approach to crypto options. The ability to precisely calibrate an RFQ, from the selection of counterparties to the automated hedging of exposures, transforms the act of trading into a highly engineered process. It ensures that large positions are entered or exited with maximum efficiency and minimal disruption, reflecting a commitment to operational excellence. The continuous evolution of these systems will undoubtedly introduce further layers of automation and predictive intelligence, further cementing their role in advanced digital asset trading.

References

- Foucault, Thierry, Marco Pagano, and Ailsa Röell. “Market Liquidity ▴ Theory, Evidence, and Policy.” Oxford University Press, 2013.

- Harris, Larry. “Trading and Exchanges ▴ Market Microstructure for Practitioners.” Oxford University Press, 2003.

- O’Hara, Maureen. “Market Microstructure Theory.” Blackwell Publishers, 1995.

- Lehalle, Charles-Albert. “Market Microstructure in Practice.” World Scientific Publishing Company, 2013.

- Cont, Rama, and Anatoly B. Schmidt. “Stochastic Models of Order Book Dynamics.” Market Microstructure and Limit Order Books, Springer, 2011.

- Madhavan, Ananth. “Market Microstructure ▴ A Practitioner’s Guide.” Oxford University Press, 2019.

- Gatheral, Jim. “The Volatility Surface ▴ A Practitioner’s Guide.” John Wiley & Sons, 2006.

- Hull, John C. “Options, Futures, and Other Derivatives.” Pearson, 2018.

- Fabozzi, Frank J. and Svetlozar T. Rachev. “Handbook of Quantitative Finance and Risk Management.” John Wiley & Sons, 2010.

- Assayag, Hanna, Alexander Barzykin, Rama Cont, and Wei Xiong. “Competition and Learning in Dealer Markets.” SSRN, 2024.

Refining the Operational Blueprint

The strategic deployment of automated Request for Quote mechanisms in large crypto options trades transcends a mere tactical advantage; it fundamentally redefines an institution’s capacity for market engagement. Consider the intricate interplay between liquidity provision, risk management, and the relentless pursuit of execution quality. Each component, when meticulously engineered and seamlessly integrated, contributes to a holistic operational framework. Reflect upon the robustness of your current protocols.

Do they truly provide the discretion and precision demanded by significant notional volumes in volatile digital asset markets? The path to sustained alpha in this dynamic environment lies in a continuous re-evaluation of the underlying systems, ensuring they are not just reactive to market conditions but proactively shaping superior outcomes.

The objective extends beyond the immediate trade; it encompasses the cultivation of a resilient and adaptive trading infrastructure. A system architect’s mindset dictates a constant quest for refinement, questioning assumptions, and iterating on methodologies. The true power resides in the ability to translate complex market microstructure insights into tangible, automated processes that consistently deliver optimal price discovery and controlled risk. This ongoing evolution of operational intelligence ultimately forms the bedrock of a durable competitive advantage, enabling principals to navigate the complexities of crypto derivatives with unwavering confidence and strategic clarity.

Glossary

Large Crypto Options Trades

Price Discovery

Automated Request for Quote

Liquidity Providers

Market Makers

Crypto Options

High-Fidelity Execution

Crypto Options Trades

Request for Quote

Options Strategies

Order Book

Rfq Platforms

Automated Rfq

Risk Management

Market Microstructure

Large Crypto Options

Automated Rfq Execution

Rfq System

Real-Time Intelligence Feeds

Automated Delta Hedging