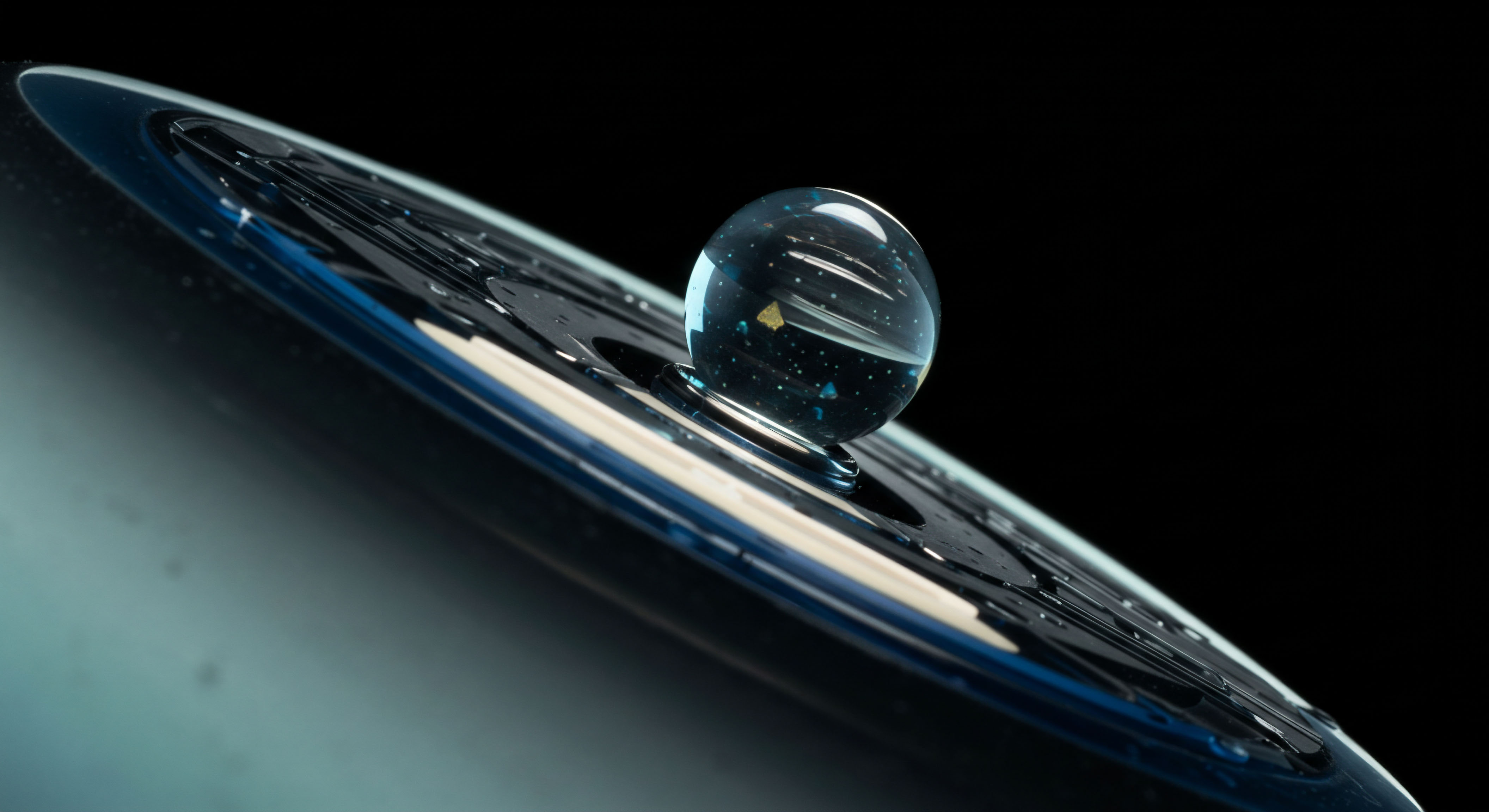

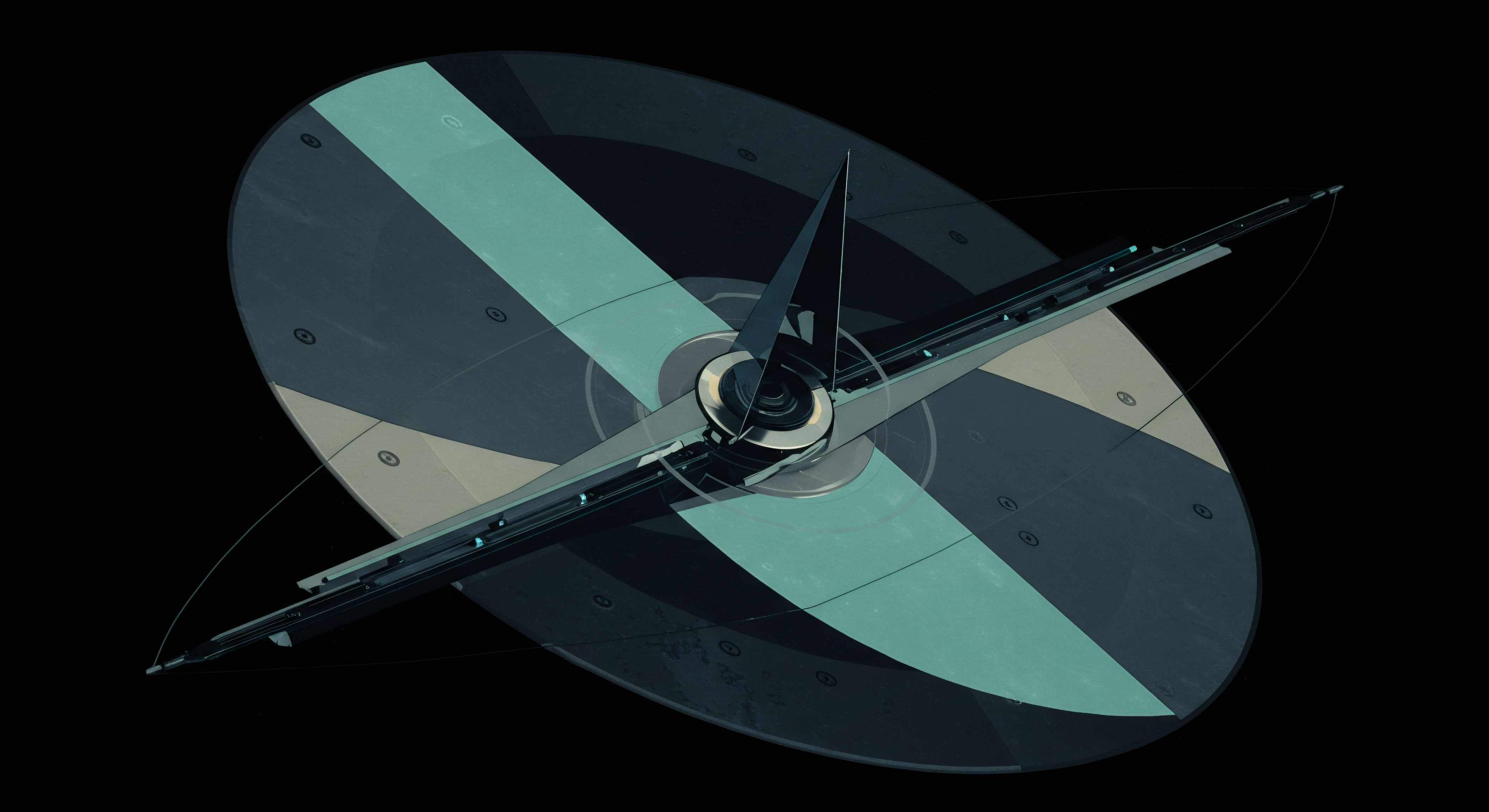

Concept

The inquiry into the penalties for operating an unregistered binary options platform presupposes a simple ledger of fines and sentences. This view, however, fails to capture the systemic function of financial regulation. From a systems perspective, registration is the primary protocol for connecting a market participant to the global financial network. It is a declaration of adherence to a shared set of rules governing transparency, capital adequacy, and fair dealing.

An unregistered platform is, therefore, a rogue node ▴ an entity that has intentionally decoupled itself from the system’s foundational protocols. Its operation introduces a critical vulnerability, not just for its direct users, but for the integrity of the interconnected market.

The regulatory framework, principally architected by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) in the United States, is designed to identify and purge these rogue elements. The penalties are a core part of this immune response. They are calibrated to achieve several objectives simultaneously ▴ punish the operators, remove ill-gotten gains from the system, compensate victims where possible, and, most critically, deter the future formation of similar unsanctioned nodes. Understanding the penalties requires looking beyond a simple dollar figure and instead analyzing the layered, multi-agency response designed to dismantle the illicit operation and neutralize its operators as a future threat.

Operating an unregistered binary options platform triggers a severe, multi-layered regulatory response designed to dismantle the entity, seize its assets, and permanently bar its operators from the financial markets.

Binary options themselves, when offered on a regulated exchange, are legitimate financial instruments. They are event-based contracts with a fixed payout and risk. The illegality arises from the operational structure of the platform. By failing to register, the platform sidesteps the critical safeguards that registration mandates.

These include segregating client funds, maintaining sufficient capital reserves, submitting to regular audits, and ensuring a transparent and fair trade execution process. An unregistered entity operates in an opaque environment where it can, and often does, function as a direct counterparty to its clients, creating a fundamental conflict of interest where the platform profits directly from client losses. This structure is inherently predatory and represents the core systemic risk that regulators are tasked with eliminating.

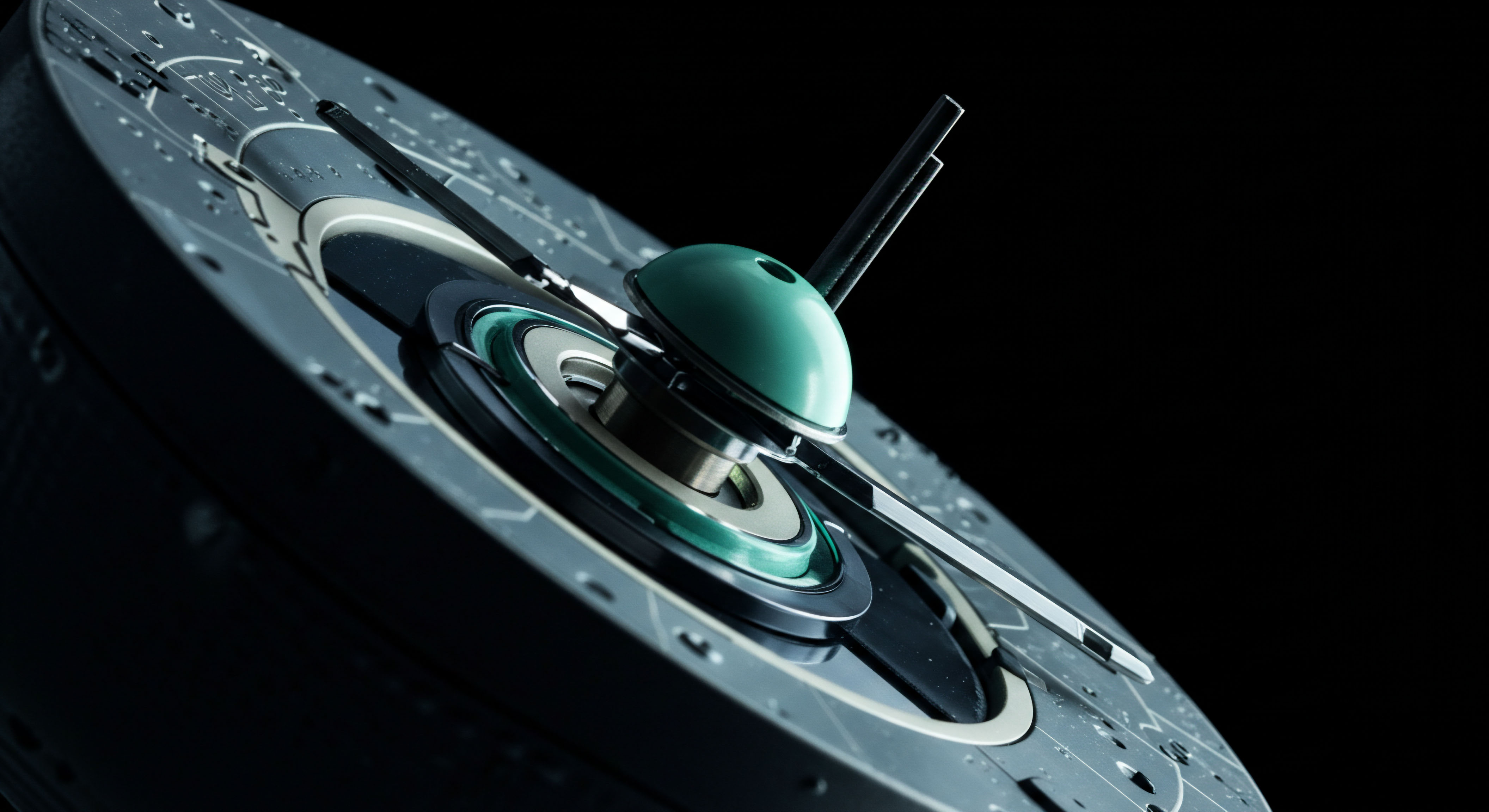

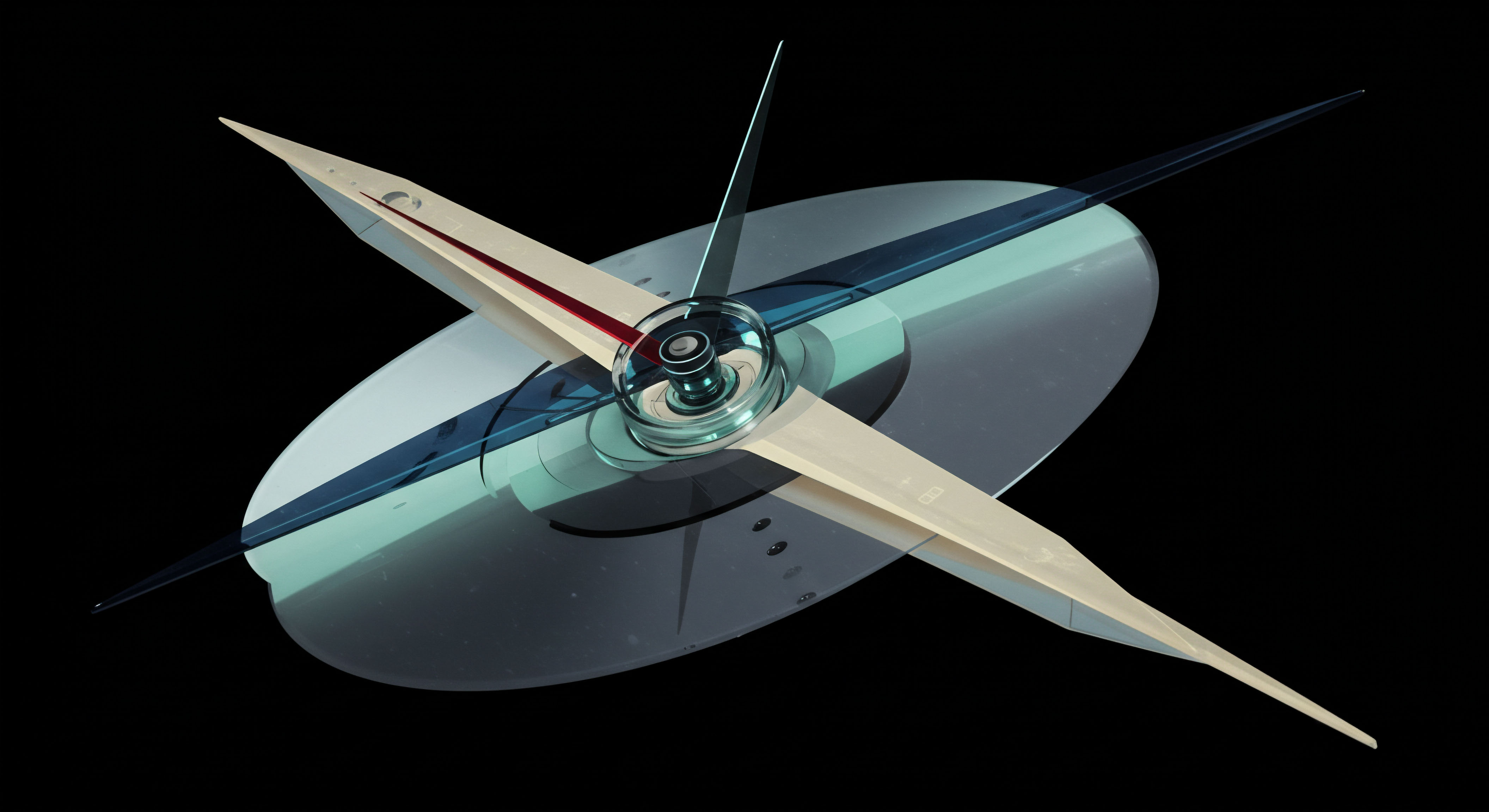

Strategy

The regulatory strategy against unregistered binary options platforms is a multi-pronged assault that combines financial penalties, civil injunctions, and criminal prosecution. This approach ensures that the operators face consequences from multiple angles, making continued operation untenable. The strategy is not merely punitive; it is designed to systematically deconstruct the illicit enterprise and create a permanent record of malfeasance that follows the individuals involved.

A Framework of Financial Annihilation

The financial penalties are designed to be overwhelming, stripping away all proceeds from the illegal activity and adding a substantial punitive multiplier. The primary tools in this arsenal are disgorgement and civil monetary penalties (CMPs).

- Disgorgement ▴ This is the process of reclaiming all profits gained from the illegal activity. Regulators, such as the CFTC, will calculate the total revenue generated from U.S. customers and order the defendants to return this amount. A recent case in 2024 saw a court order defendants to pay over $51 million in disgorgement.

- Civil Monetary Penalties (CMPs) ▴ These are fines levied on top of disgorgement. The amount can be a multiple of the ill-gotten gains, often up to three times the amount. In the same 2024 case, the CMP was over $153 million, three times the disgorgement amount, bringing the total financial penalty to more than $204 million.

This two-part financial structure ensures that the operators do not profit from their actions and face a ruinous financial penalty that serves as a powerful deterrent to others.

The Functional Exile from the Marketplace

Beyond financial ruin, the regulatory strategy aims to permanently remove the individuals and entities from the financial industry. This is achieved through a series of bans and injunctions that effectively serve as a professional death sentence.

Permanent injunctions prohibit the defendants from ever again engaging in conduct that violates the Commodity Exchange Act or relevant securities laws. Crucially, they are also barred from registering with the CFTC or trading on any registered exchange. This ban is comprehensive, preventing them from participating in the regulated markets in any capacity, whether as a broker, trader, or even a client. This functional exile is a critical component of protecting the integrity of the market system.

The regulatory apparatus treats unregistered platforms as a systemic contagion, employing a strategy of financial expropriation and permanent exclusion from the market to neutralize the threat.

Comparative Analysis of Enforcement Actions

The SEC and CFTC often work in parallel, and sometimes together, to bring actions against unregistered platforms. While their mandates differ slightly, their enforcement tools are complementary.

| Enforcement Body | Primary Jurisdiction | Key Violations Charged | Primary Penalties |

|---|---|---|---|

| CFTC (Commodity Futures Trading Commission) | Derivatives, Commodities, Futures, and certain Binary Options | Illegal off-exchange contracts, Fraud, Failure to register as a Futures Commission Merchant (FCM) | Disgorgement, Civil Monetary Penalties, Permanent Trading & Registration Bans |

| SEC (Securities and Exchange Commission) | Securities, including Binary Options classified as securities | Offering unregistered securities, Operating as an unregistered broker-dealer, Fraud | Disgorgement, Civil Penalties, Officer & Director Bars, Penny Stock Bars |

| DOJ (Department of Justice) | Federal Criminal Law | Wire Fraud, Mail Fraud, Conspiracy to Commit Fraud | Criminal Fines, Forfeiture of Assets, Incarceration |

This coordinated approach ensures that operators cannot exploit regulatory loopholes. A platform may face parallel investigations, leading to a cascade of penalties that address every facet of their illegal operation, from the financial products they offered to the means by-of-communication they used to solicit investors.

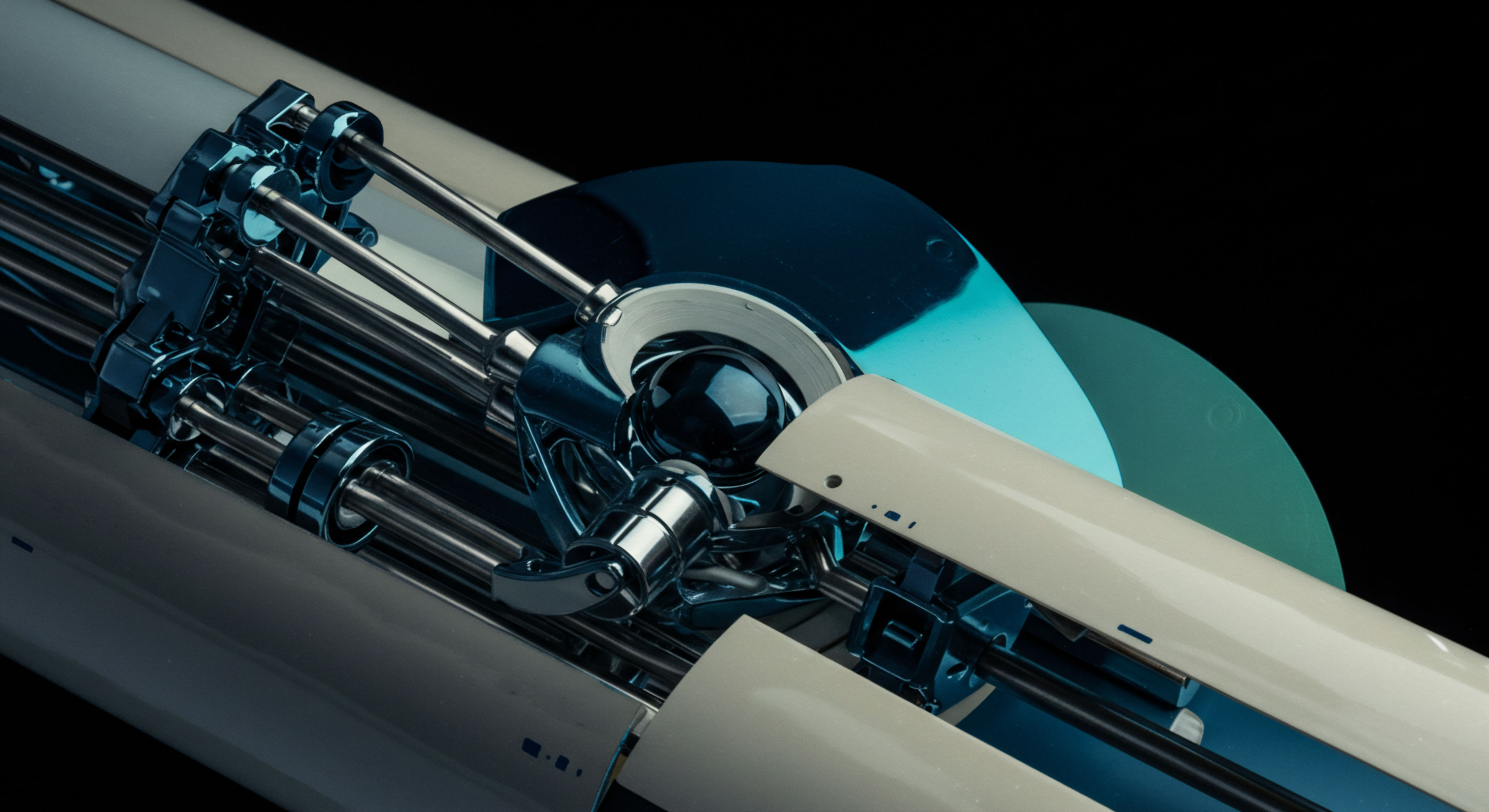

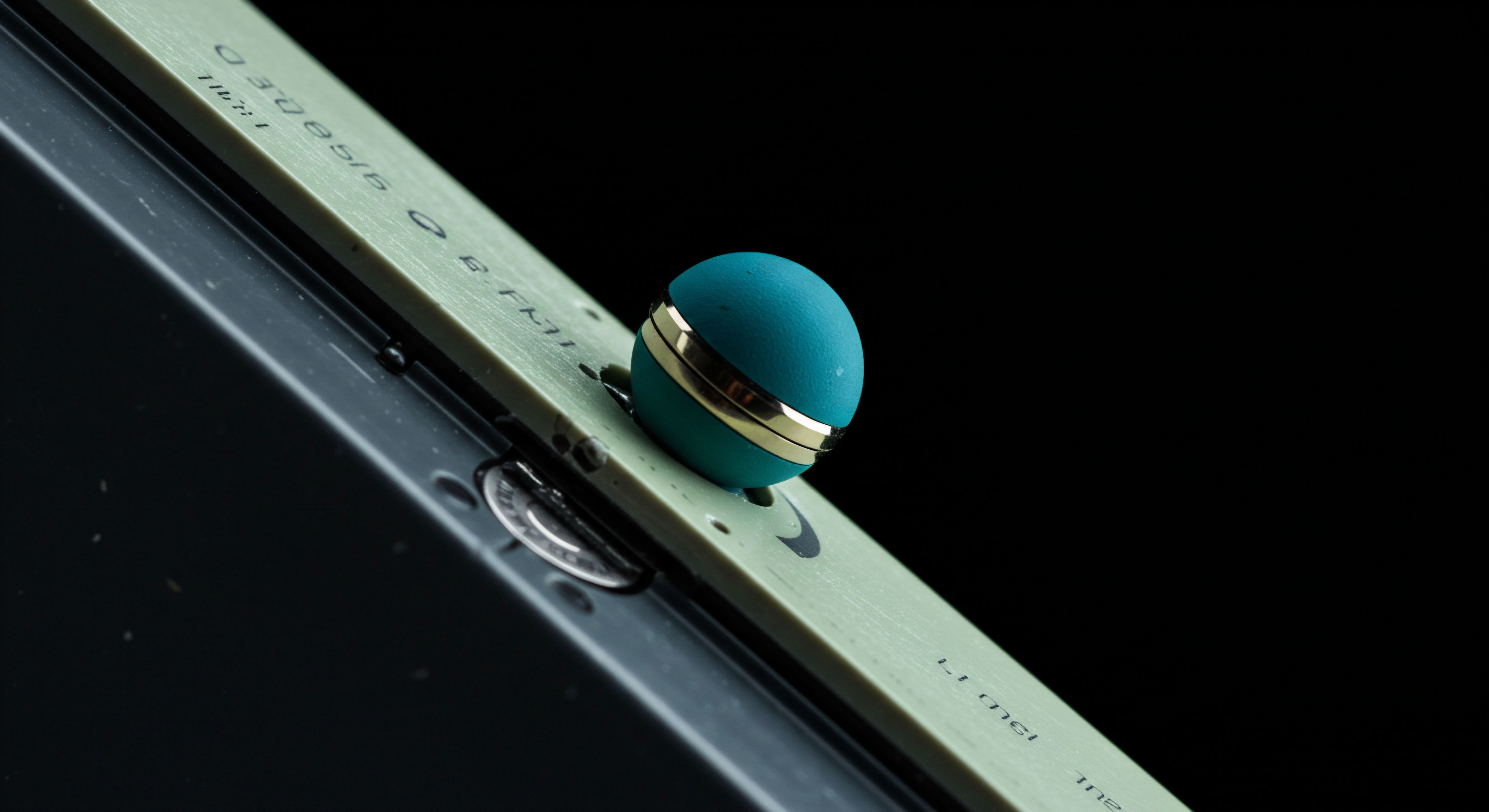

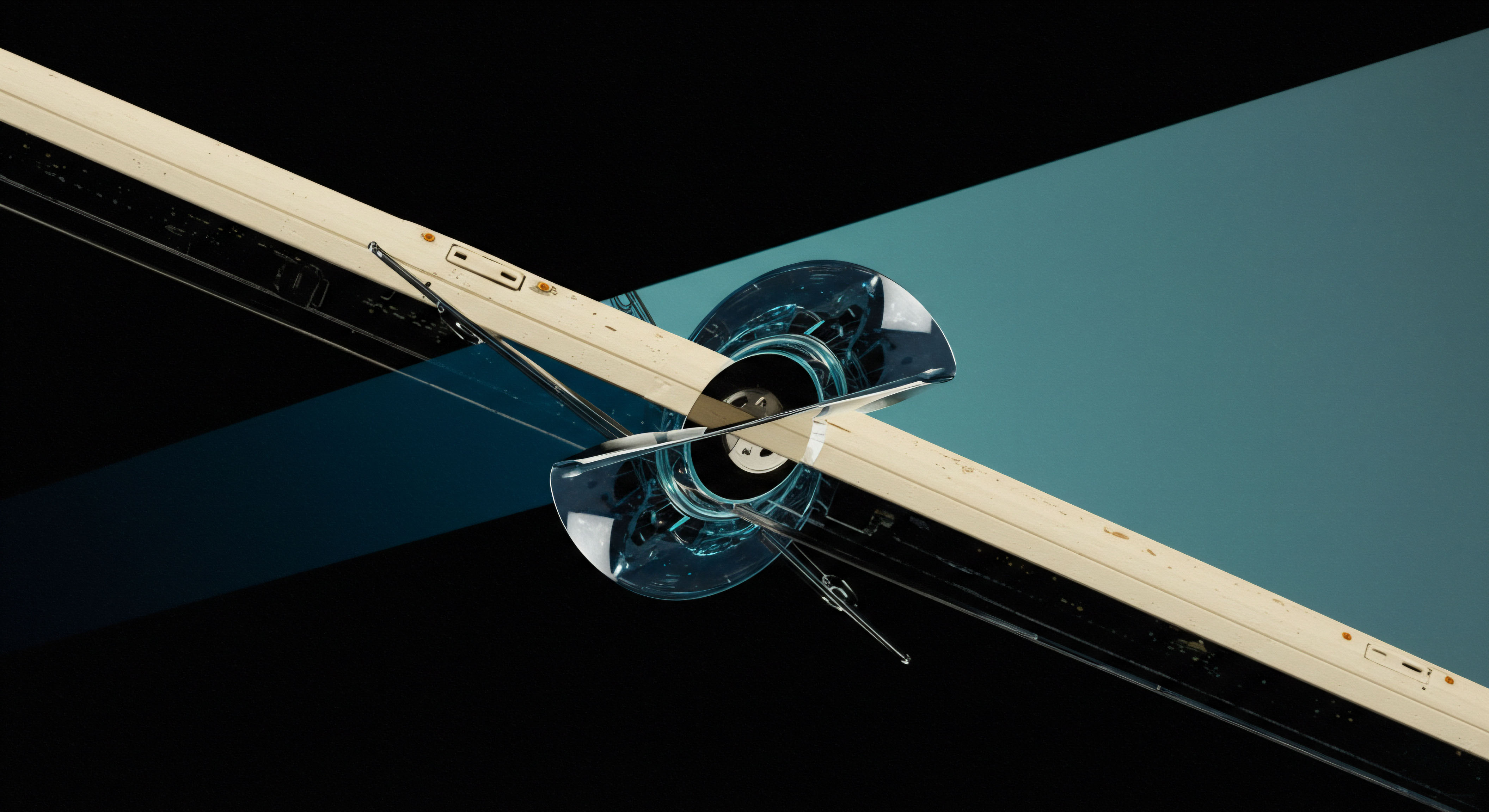

Execution

The execution of an enforcement action against an unregistered binary options platform is a methodical process. It moves from detection and investigation to litigation and the ultimate imposition of penalties. This operational playbook reveals how regulatory bodies systematically dismantle these fraudulent enterprises.

The Operational Playbook of Enforcement

The process of bringing an unregistered platform to justice follows a clear, multi-stage playbook, often involving collaboration between multiple domestic and international agencies.

- Detection and Intelligence Gathering ▴ The initial phase involves identifying the illegal operation. This can originate from various sources:

- Consumer Complaints ▴ The CFTC and SEC portals are primary sources of tips from victims who have been unable to withdraw funds.

- Automated Surveillance ▴ Regulators use web scraping and data analysis tools to identify platforms advertising to U.S. residents.

- Whistleblowers ▴ Insiders may provide detailed information about the operation in exchange for protections and potential financial rewards.

- International Cooperation ▴ Foreign regulators, such as the Ontario Securities Commission or the Australian Securities and Investments Commission, often share intelligence with their U.S. counterparts.

- Investigation and Case Building ▴ Once a target is identified, investigators build a case. This involves going undercover to open accounts, tracing the flow of funds through payment processors and crypto wallets, and documenting fraudulent claims made on the platform’s website or by its agents. They will issue subpoenas to banks and other financial intermediaries to gather evidence.

- Litigation and Adjudication ▴ The regulatory body, like the CFTC, files a complaint in a federal district court. The complaint outlines the alleged violations, such as offering illegal, off-exchange binary options and engaging in fraudulent solicitation. The case proceeds through the legal system, often resulting in a default judgment or summary judgment if the defendants, who are typically based offshore, fail to appear.

- Imposition of Sanctions ▴ Following a successful judgment, the court imposes sanctions. This includes the monetary penalties (disgorgement and CMPs), permanent injunctions, and trading bans as detailed previously. The court’s order gives the regulators the legal authority to pursue the defendants’ assets.

Quantitative Modeling of Financial Sanctions

The financial penalties are not arbitrary. They are calculated based on the scale of the fraud. The table below provides a hypothetical model based on precedent from real enforcement actions, illustrating how penalties are structured.

| Metric | Calculation Formula | Hypothetical Example (“Ephemeral Edge Options”) | Rationale |

|---|---|---|---|

| Total U.S. Customer Deposits | Sum of all funds received from U.S. persons | $15,000,000 | This represents the total harm to the market. |

| Disgorgement | Total U.S. Customer Deposits – Payouts to U.S. Customers | $15,000,000 – $1,500,000 = $13,500,000 | To remove all ill-gotten gains. The platform’s net revenue from the fraud. |

| Civil Monetary Penalty (CMP) | Disgorgement x Multiplier (typically 1x to 3x) | $13,500,000 x 3 = $40,500,000 | A punitive fine to punish and deter. The multiplier reflects the severity of the fraud. |

| Total Financial Penalty | Disgorgement + CMP | $13,500,000 + $40,500,000 = $54,000,000 | The final judgment amount ordered by the court. |

Predictive Scenario Analysis a Case Study

Let us construct a realistic case study. A firm, “Ephemeral Edge Options,” is established in a jurisdiction with lax financial oversight. It uses a slick website, YouTube tutorials, and social media influencers to target U.S.-based retail investors, promising quick, high-yield returns. The platform offers 60-second binary options on currency pairs and crypto assets, a product format explicitly forbidden in the U.S. unless on a designated exchange.

The user interface is designed to look like a legitimate trading platform, but in reality, the platform is the direct counterparty to every trade. The underlying code includes a price manipulation module that can slightly alter the expiry price to ensure a higher rate of customer losses, particularly for large or consistently profitable accounts. Funds are accepted via credit card and cryptocurrency transfers to obscure the money trail. For months, the operation thrives.

Early users who make small profits are allowed to withdraw funds to build a veneer of legitimacy, their testimonials used in marketing materials. However, as customer deposits grow, withdrawal requests are increasingly met with delays, exorbitant fees, or outright refusal. Customer service agents, following a script, blame these issues on “anti-money laundering checks” or “blockchain network congestion.”

The downfall begins when a cluster of complaints is filed on the CFTC’s website. Several victims detail how their accounts, worth tens of thousands of dollars, were frozen after a period of successful trades. An analyst at the CFTC’s Division of Enforcement flags the pattern. Simultaneously, a financial regulator in Australia notes the same platform targeting its citizens and shares its intelligence file with the CFTC through a memorandum of understanding.

The CFTC launches a formal investigation. An undercover agent successfully opens an account from a U.S. IP address and records conversations with a “senior account manager” who guarantees a 90% return on investment, a clear instance of fraudulent solicitation. Subpoenas are issued to the third-party payment processors used by Ephemeral Edge, revealing the identities of the principal operators and the flow of millions of dollars to offshore bank accounts. The CFTC’s technical team analyzes the platform’s source code, obtained through a cooperating witness, and documents the trade manipulation algorithm.

Armed with overwhelming evidence, the CFTC files a complaint in the U.S. District Court for the Southern District of New York, charging the platform and its three principals with fraud, offering illegal off-exchange commodity options, and failing to register. The Department of Justice, alerted by the CFTC, files a parallel criminal indictment for wire fraud and conspiracy. The court grants the CFTC a statutory restraining order, freezing all known assets of the company and its principals. The platform’s website is seized.

The final civil judgment orders the defendants to jointly pay $13.5 million in disgorgement and a $40.5 million civil monetary penalty. Concurrently, the two captured principals plead guilty to the criminal charges and are sentenced to 7 years in federal prison, a common outcome for large-scale financial fraud. They are also subject to permanent trading and registration bans, ensuring their complete and irreversible expulsion from the financial system.

References

- Bain, C. (2022). The Nadex Guide to Binary Options. Trader’s Library.

- Commodity Futures Trading Commission. (2024). Customer Advisory ▴ Beware of Off-Exchange Binary Options Scams. CFTC.gov.

- Financial Industry Regulatory Authority (FINRA). (2017). Binary Options ▴ These All-Or-Nothing Options Are All-Too-Often Fraudulent. FINRA.org.

- Harris, L. (2003). Trading and Exchanges ▴ Market Microstructure for Practitioners. Oxford University Press.

- McMillan, L. G. (2012). Options as a Strategic Investment. Prentice Hall Press.

- O’Hara, M. (1995). Market Microstructure Theory. Blackwell Publishing.

- Patterson, S. (2012). Dark Pools ▴ The Rise of the Machine Traders and the Rigging of the U.S. Stock Market. Crown Business.

- U.S. Securities and Exchange Commission. (2021). Investor Alert ▴ Binary Options and Fraud. SEC.gov.

- U.S. Commodity Futures Trading Commission, Office of Public Affairs. (2024, March 14). Federal Court Orders Binary Options Firm and Owners to Pay Over $204 Million in Monetary Sanctions for Fraudulent Binary Options Scheme. Press Release Number 8876-24.

- Ganti, A. (2023). Binary Option ▴ What It Is, How It Works, Examples. Investopedia.

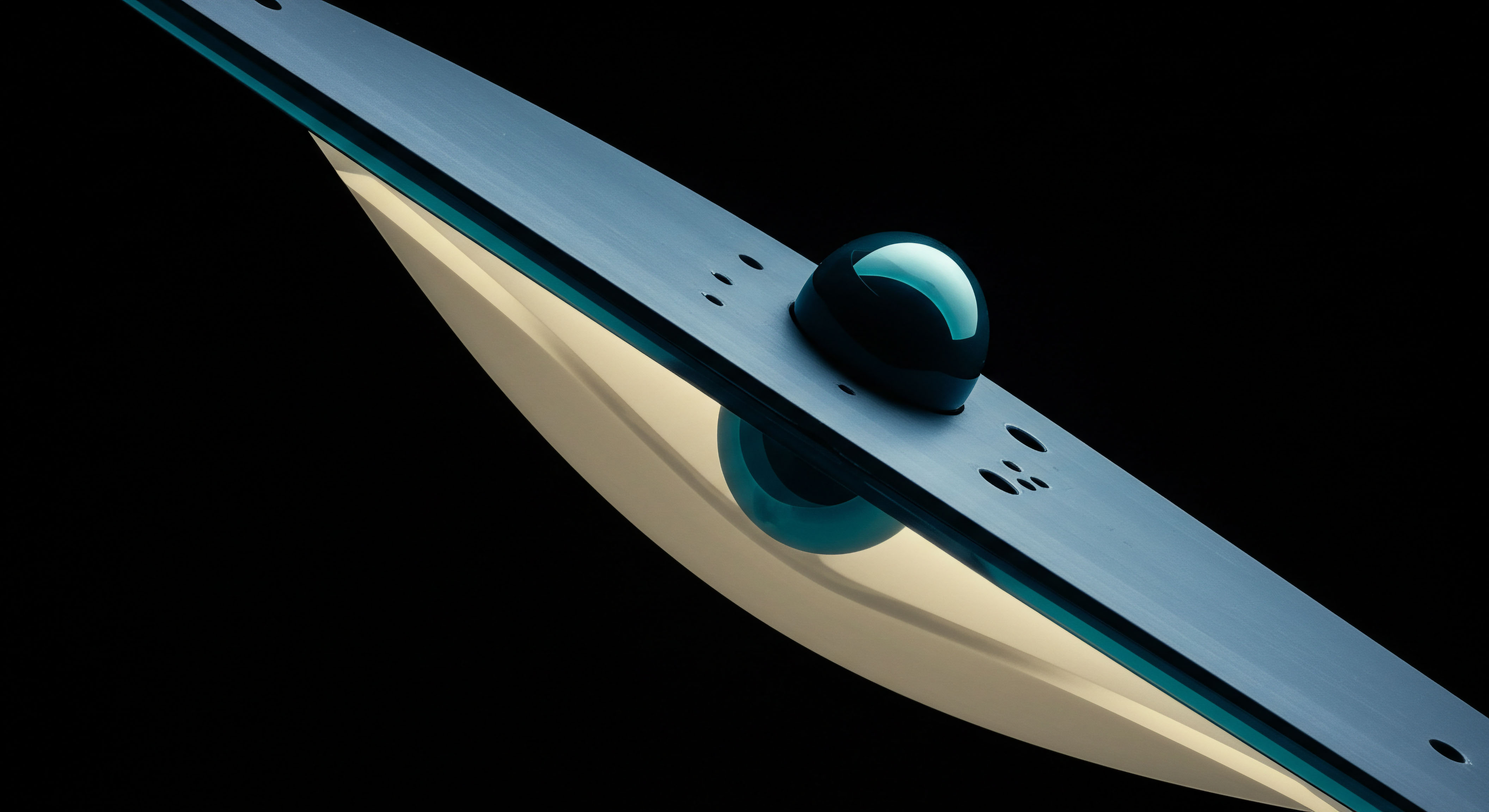

Reflection

The architecture of penalties surrounding unregistered financial platforms reveals a foundational principle of market design ▴ integrity is a prerequisite for participation. The complex interplay of civil, financial, and criminal sanctions is a system designed to protect the network from catastrophic failure caused by rogue actors. Viewing these consequences merely as punishments is to miss the point. They are systemic defense mechanisms.

An operator’s decision to bypass registration is a decision to function outside the established protocols of trust and transparency. The resulting enforcement action is the system’s logical and necessary response. For the legitimate market participant, understanding this framework provides a deeper appreciation for the value of a regulated environment.

The regulatory structure, while demanding, provides the stability and predictability necessary for capital to be deployed with confidence. The ultimate strategic advantage lies not in circumventing the rules, but in mastering the tools and protocols that operate within them, building an operational framework so robust that its very architecture becomes a competitive asset.

Glossary

Unregistered Binary Options Platform

Commodity Futures Trading Commission

Securities and Exchange Commission

Binary Options

Unregistered Binary Options

Civil Monetary

Disgorgement

Commodity Exchange Act

Wire Fraud