Architecting Data Integrity

Institutional principals operate within an intricate web of market dynamics, where the precision of data directly correlates with the efficacy of execution and the robustness of risk management. Unifying block trade definitions presents a formidable data governance challenge, a complex endeavor extending beyond mere semantic alignment. This undertaking requires a profound understanding of how disparate data points, originating from varied systems and regulatory regimes, coalesce to form a coherent view of market activity.

The inherent scale and opacity of block trades, executed off-exchange or in dark pools, demand a rigorous approach to data integrity, where every attribute contributes to a comprehensive, auditable record. Your operational framework, therefore, depends on an unerring commitment to data consistency across the entire trade lifecycle, from initial negotiation to final settlement.

A unified block trade definition provides the bedrock for consistent risk assessment and regulatory compliance across diverse trading venues.

The core challenge arises from the diverse interpretations and contextual applications of what constitutes a “block trade” across different asset classes, jurisdictions, and trading platforms. Consider a large derivatives transaction ▴ its classification as a block trade in one regulatory domain might differ significantly from another, impacting reporting thresholds, latency, and disclosure requirements. This definitional fragmentation creates immediate data governance friction, as systems designed for one interpretation struggle to reconcile with data conforming to another. The underlying mechanisms of market microstructure ▴ specifically, how large orders affect liquidity and price discovery ▴ further complicate this definitional disparity, as regulators and market participants seek to balance transparency with minimizing market impact for substantial positions.

The Definitional Labyrinth

Defining a block trade consistently across an institutional ecosystem involves navigating a labyrinth of regulatory mandates and market conventions. Regulatory bodies, such as the CFTC and ESMA, establish specific notional thresholds and reporting delays for various derivatives products, which are subject to periodic recalibration. These thresholds, designed to protect the informational value of large trades while preserving market liquidity, inherently vary by asset class and product type.

For instance, an interest rate swap block threshold will differ substantially from that of an equity option block. Such variations necessitate a dynamic data model capable of ingesting, classifying, and processing trade data according to multiple, evolving criteria.

Furthermore, market participants often develop internal definitions that reflect their unique risk appetites, operational workflows, and client mandates. A prime broker’s internal block trade designation for risk capital allocation might encompass a broader range of transactions than the strict regulatory definition for public dissemination. This internal divergence, while operationally expedient for individual firms, exacerbates the challenge of creating a unified data standard across the broader financial ecosystem. The absence of a universally accepted, granular definition creates ambiguity in data aggregation, reconciliation, and ultimately, in the ability to construct a singular, authoritative view of trading activity.

Data Attribute Discrepancies

Beyond the primary definition, data attribute discrepancies further compound the governance challenge. A block trade record comprises numerous data fields, each potentially subject to varying interpretations or formats. Attributes such as execution time, counterparty identification, pricing methodology, and product taxonomy exhibit inconsistencies across trading venues and internal systems.

For example, a timestamp might be recorded to milliseconds in one system and microseconds in another, or a counterparty identifier might use a proprietary code versus a standardized Legal Entity Identifier (LEI). These subtle differences, while seemingly minor, create significant hurdles for automated data ingestion, validation, and analysis, requiring extensive data cleansing and transformation processes.

The Financial Information eXchange (FIX) protocol, while a foundational standard for electronic trading, also presents its own set of challenges in achieving absolute data uniformity. While FIX provides a standardized tag-value format for message exchange, the protocol’s flexibility, with optional fields and firm-specific tag usage, means that two FIX messages representing the same block trade might still contain subtle data discrepancies. This inherent adaptability, while beneficial for broad adoption, requires robust internal governance to ensure consistent interpretation and population of FIX fields, especially those critical for block trade identification and reporting.

Operationalizing Cohesion

Operationalizing cohesion in block trade definitions requires a strategic framework that transcends mere technical integration, focusing instead on a holistic data strategy. This involves establishing a robust data governance program that views data as a critical asset, ensuring its quality, consistency, and accessibility across all institutional functions. The strategic imperative involves moving towards a federated data model, where data ownership and stewardship are clearly defined, yet data standards are universally applied. This approach facilitates a singular “golden source” of truth for block trade information, even when originating from diverse platforms and geographical locations.

A federated data model with clear ownership underpins a consistent understanding of block trade dynamics across an organization.

Harmonizing Global Regulatory Divergence

A central strategic challenge involves harmonizing data definitions and reporting requirements across a global regulatory landscape. Financial institutions frequently operate across multiple jurisdictions, each with its own specific rules governing block trade thresholds, reporting delays, and disclosure obligations. MiFID II in Europe, SEC regulations in the United States, and various Asian regulatory frameworks impose distinct mandates.

A strategic response involves creating an adaptable data dictionary that maps these disparate regulatory definitions to a common internal taxonomy. This mapping process requires continuous monitoring of regulatory updates and proactive adjustments to data models, ensuring ongoing compliance without compromising internal consistency.

Developing a robust reconciliation engine forms a crucial part of this strategy. This engine compares internal trade records with external reports, identifying discrepancies that stem from definitional variances or data quality issues. Automated reconciliation workflows, augmented by machine learning algorithms, can significantly reduce the manual effort involved in identifying and resolving these mismatches. Such a system also provides an audit trail, documenting how different regulatory interpretations are applied to the same underlying trade data, a critical component for demonstrating compliance to oversight bodies.

Establishing a Unified Data Taxonomy

The creation of a unified data taxonomy stands as a foundational strategic objective. This taxonomy serves as the authoritative glossary for all block trade-related data elements, encompassing both descriptive and quantitative attributes. It must define not only the overarching concept of a block trade but also granular details such as ▴ asset class identifiers, product type specifications, execution venue codes, counterparty roles, and pricing conventions. The taxonomy needs to be comprehensive enough to accommodate the nuances of various derivatives instruments, from plain vanilla swaps to complex multi-leg options strategies.

This taxonomy should be centrally managed, with clear governance protocols for modifications and version control. A cross-functional working group, comprising representatives from trading, risk, compliance, and technology, ought to oversee its development and maintenance. This collaborative approach ensures that the taxonomy reflects the operational realities and regulatory obligations of all stakeholders. The strategic advantage of such a unified taxonomy extends beyond mere compliance; it enables more accurate risk aggregation, facilitates advanced analytics, and improves the overall efficiency of post-trade processing.

Consider the strategic implications for multi-leg options spreads. Without a unified definition for the composite block trade, individual legs might be reported inconsistently, obscuring the true risk profile and market impact of the overall transaction. A standardized approach ensures that the entire spread is recognized as a single block for reporting and risk management purposes, providing a more accurate representation of the firm’s exposure and market activity. This granular consistency within the data architecture provides a significant operational advantage, particularly for firms executing large, complex, or illiquid trades.

Precision in Execution Dynamics

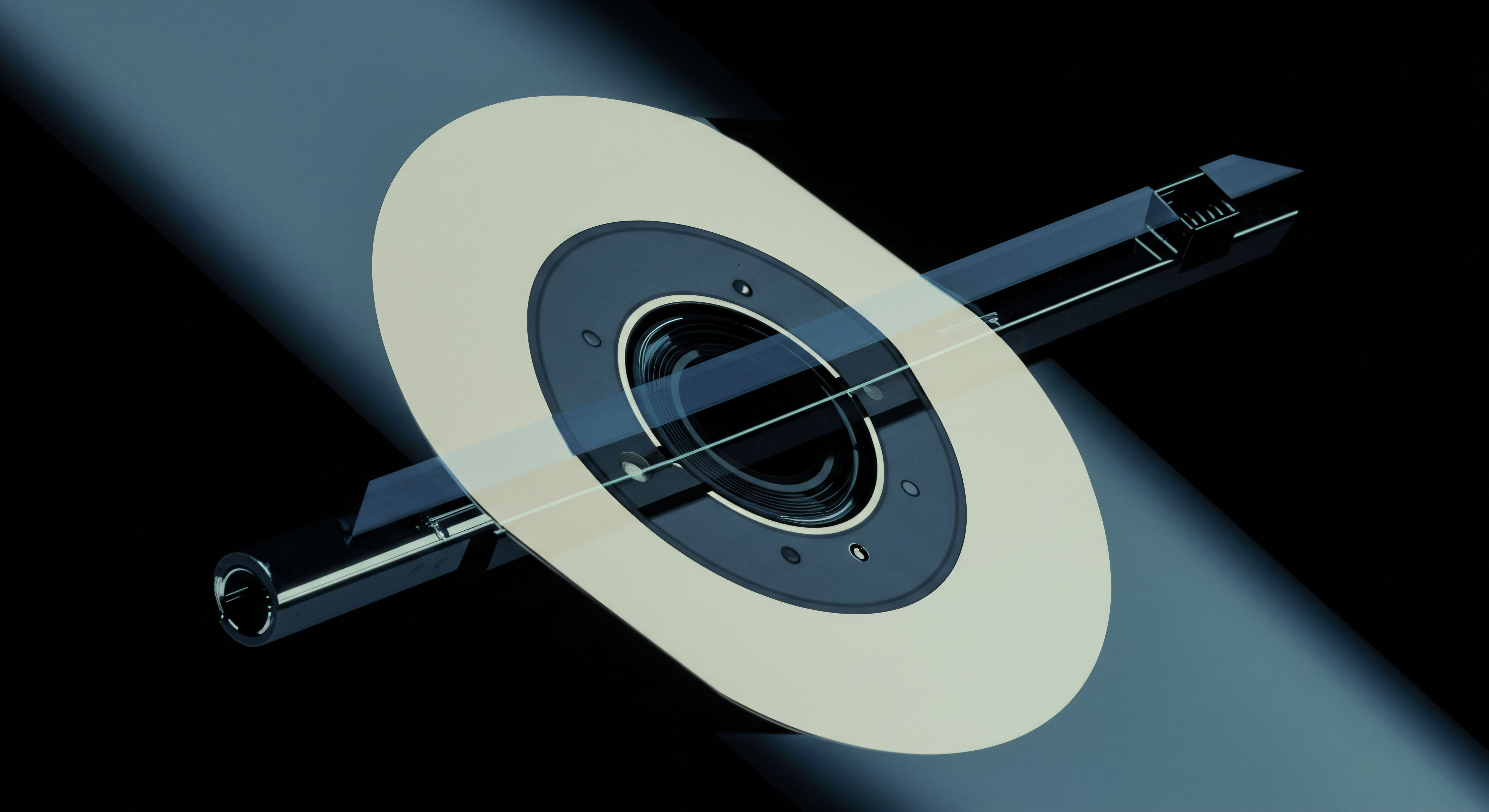

Achieving precision in execution dynamics for block trades hinges on a meticulously engineered data governance framework, extending from front-office capture to regulatory submission. This requires a systematic approach to data ingestion, validation, transformation, and reporting, ensuring every data point aligns with predefined standards and regulatory mandates. The operational protocols must account for the inherent complexities of block trades, including their varying size thresholds, delayed reporting mechanisms, and the critical need to preserve market anonymity during execution. A robust data pipeline, therefore, becomes the central nervous system of this execution strategy, providing an unimpeded flow of accurate, consistent information.

The Operational Playbook

The operational playbook for unifying block trade definitions mandates a multi-step procedural guide, meticulously detailing each phase of data handling. This begins with the establishment of a master data management (MDM) system, serving as the authoritative source for all reference data, including product taxonomies, legal entity identifiers, and venue codes. The MDM system ensures that fundamental identifiers are consistent across all trading and reporting platforms.

Implementing automated data quality checks at the point of entry prevents erroneous or inconsistent data from propagating downstream, thereby mitigating the need for extensive post-processing. These checks encompass validation rules for data types, formats, and permissible values, ensuring immediate feedback on data integrity.

A crucial procedural step involves the dynamic classification of block trades based on evolving regulatory thresholds. This requires a rule-based engine that can ingest real-time market data, assess trade size against current thresholds for specific asset classes and products, and apply the correct block trade designation. The system must then automatically apply appropriate reporting delays, as stipulated by regulations like MiFID II or CFTC rules, which can vary from immediate to 15 minutes or more for certain instruments. This automated classification and delay management mechanism reduces operational risk and ensures compliance with complex disclosure requirements, particularly for over-the-counter (OTC) derivatives where block trades are prevalent.

Furthermore, the playbook outlines stringent data lineage protocols. Every data element within a block trade record must be traceable back to its origin, through all transformation stages, to its final reported state. This includes tracking modifications, aggregations, and enrichments, providing a comprehensive audit trail for regulatory scrutiny.

This granular lineage facilitates root cause analysis for any data discrepancies, allowing for rapid identification and remediation of issues. A centralized data dictionary, linked directly to the MDM, supports this process by providing clear definitions and metadata for every field, ensuring all stakeholders understand the context and provenance of the data.

Comprehensive data lineage provides an unimpeachable audit trail, crucial for demonstrating regulatory compliance and internal accountability.

Quantitative Modeling and Data Analysis

Quantitative modeling and data analysis are integral to validating the effectiveness of unified block trade definitions and optimizing execution strategies. The analysis commences with a detailed examination of trade data to identify patterns in block trade execution, including average size, frequency, and market impact across different asset classes. This involves statistical analysis of historical transaction data, comparing actual trade sizes against regulatory thresholds and observing the correlation between block trade characteristics and post-trade price movements. The objective involves quantifying the efficacy of delayed reporting regimes in mitigating information leakage and minimizing adverse selection.

Consider a model for analyzing the impact of block trade reporting delays on volatility. Using high-frequency data, a quantitative model can assess price changes immediately following the public dissemination of block trade information versus the period preceding the report. This analysis helps determine whether current reporting delays adequately protect the informational value of large trades.

A robust model would incorporate variables such as prevailing market liquidity, volatility of the underlying asset, and the size of the block trade relative to average daily volume. The insights derived from such models inform adjustments to internal execution algorithms and contribute to industry discussions on optimal reporting parameters.

Data quality metrics form another critical aspect of quantitative analysis. Regular assessments of data completeness, accuracy, consistency, and timeliness (C.A.T.) for block trade records are essential. These metrics quantify the reliability of the underlying data, highlighting areas where data ingestion or transformation processes require refinement.

For example, a quantitative analyst might develop a score for each block trade record, aggregating scores for individual data fields based on their adherence to validation rules and consistency checks. A low score would trigger an alert for manual review and remediation, ensuring continuous improvement in data quality.

The following table illustrates a simplified data quality scoring model for block trade attributes:

| Data Attribute | Validation Rule | Score if Compliant | Score if Non-Compliant |

|---|---|---|---|

| Trade ID | Unique, Alphanumeric (12 chars) | 10 | 0 |

| Asset Class | Matches Approved Taxonomy List | 10 | 0 |

| Notional Value | Positive Decimal, > Min Threshold | 15 | -5 |

| Execution Timestamp | ISO 8601 Format, UTC, Millisecond Precision | 15 | -5 |

| Counterparty LEI | Valid 20-Digit LEI | 10 | 0 |

| Reporting Delay Applied | Matches Regulatory Mandate for Product | 10 | 0 |

| Venue Code | Matches Approved MIC List | 10 | 0 |

| Product Identifier | Unique Product Identifier (UPI) or ISIN | 10 | 0 |

Total Score Range ▴ -10 to 90. Trades with scores below a predetermined threshold (e.g. 70) would automatically be flagged for manual review and correction, ensuring a high level of data veracity for all block trade records. This systematic approach transforms data quality from a subjective assessment into a measurable, actionable metric, providing a clear pathway for continuous improvement.

Predictive Scenario Analysis

Predictive scenario analysis allows institutions to anticipate the impact of evolving market structures and regulatory shifts on block trade data governance. Imagine a scenario where a major global regulator proposes a significant reduction in block trade reporting delays for a highly liquid derivatives product, such as Bitcoin options. Currently, a 15-minute delay might be standard for large BTC options blocks, providing market makers sufficient time to hedge their positions without immediate public disclosure of the trade’s full size. The proposed change would reduce this delay to five minutes, significantly compressing the window for risk mitigation.

Our predictive model would simulate the effects of this reduced delay on various operational and market microstructure metrics. First, the model would project an increase in the potential for information leakage. With a shorter delay, the market has less time to absorb the information implied by a large trade before its details become public. This could lead to heightened price volatility immediately following public disclosure, as other market participants react more swiftly to the revealed order flow.

The model would quantify this potential volatility increase by analyzing historical price movements around block trade reports, adjusting for the hypothetical shorter delay. For instance, if historical data indicates a 0.5% average price movement within the first minute post-disclosure with a 15-minute delay, the model might predict a 0.75% movement with a 5-minute delay, assuming all other factors remain constant.

Second, the analysis would focus on the operational burden on trading desks and risk management systems. A compressed reporting window necessitates faster internal processing and validation of trade data. Our model would simulate the increased data throughput and processing latency required to meet the new five-minute deadline. This involves evaluating the current system’s capacity for real-time data capture, transformation, and submission.

Hypothetically, if current systems average a 3-minute internal processing time, a 5-minute reporting delay leaves only 2 minutes for external submission and any necessary re-validations. This narrow window could lead to an increased rate of reporting errors or missed deadlines, triggering potential regulatory penalties. The model would project a 15% increase in reporting exceptions for firms that fail to upgrade their low-latency data pipelines.

Third, the model would assess the impact on liquidity provision. Market makers, who facilitate block trades, rely on the reporting delay to manage their inventory risk. A shorter delay reduces their ability to offload or hedge large positions discreetly. Our simulation might predict a temporary reduction in the willingness of market makers to quote aggressive prices for large block orders, or a widening of bid-ask spreads for BTC options.

For example, if the average bid-ask spread for a standard BTC options block is currently 5 basis points, the model might project an expansion to 7 basis points in a five-minute delay regime, reflecting the increased risk premium demanded by liquidity providers. This would directly impact execution costs for institutional clients, necessitating adjustments to their execution strategies.

Finally, the predictive analysis would consider the potential for regulatory arbitrage. If some jurisdictions maintain longer reporting delays while others adopt shorter ones, institutions might strategically route block trades to venues with more favorable disclosure rules. The model would quantify this potential flow shift, projecting how a divergence in reporting delays could impact market share across different trading venues. This comprehensive scenario analysis provides a proactive framework for institutions to adapt their data governance strategies, technology infrastructure, and trading protocols in anticipation of future market and regulatory evolutions, maintaining a decisive operational edge.

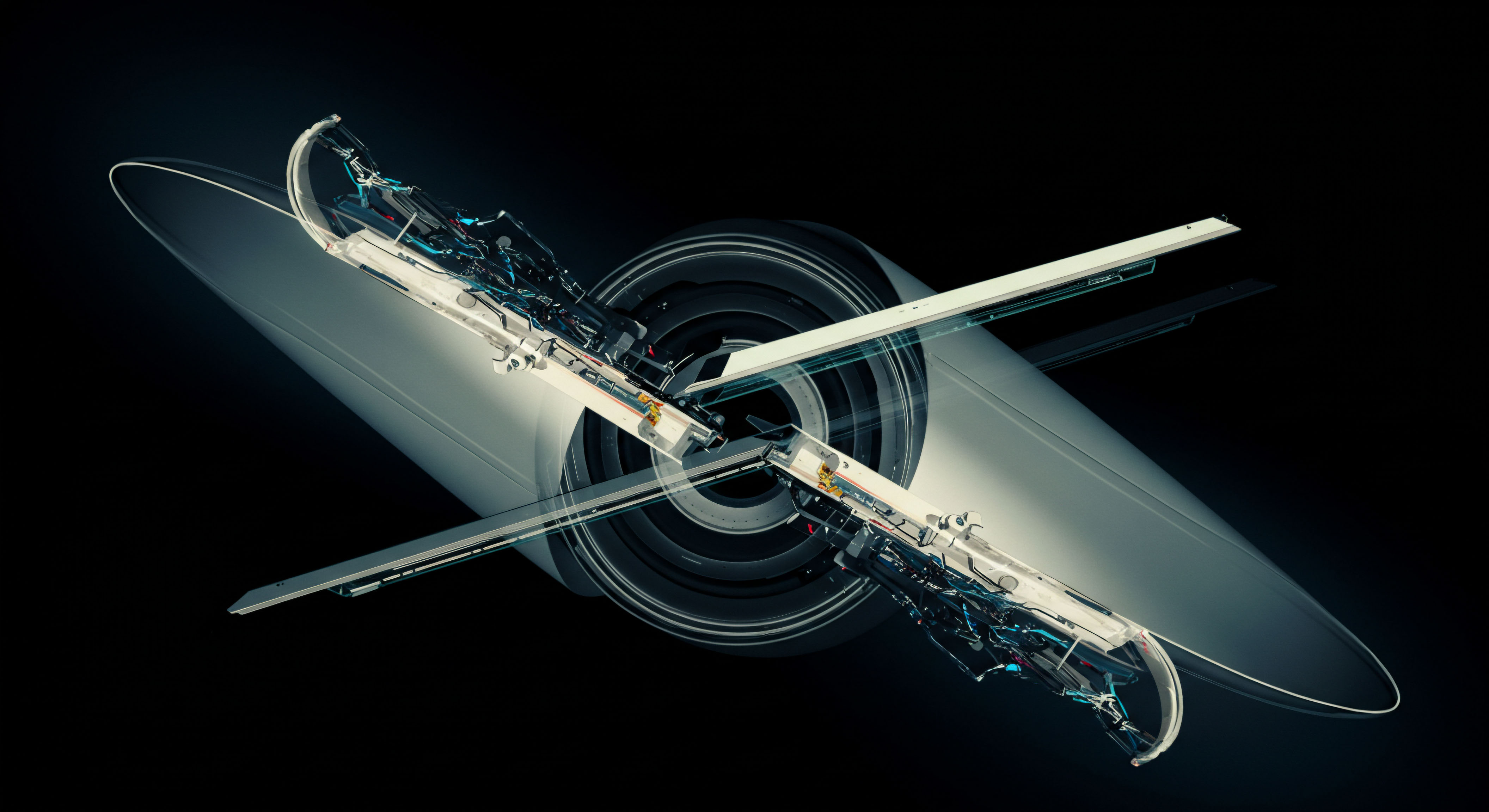

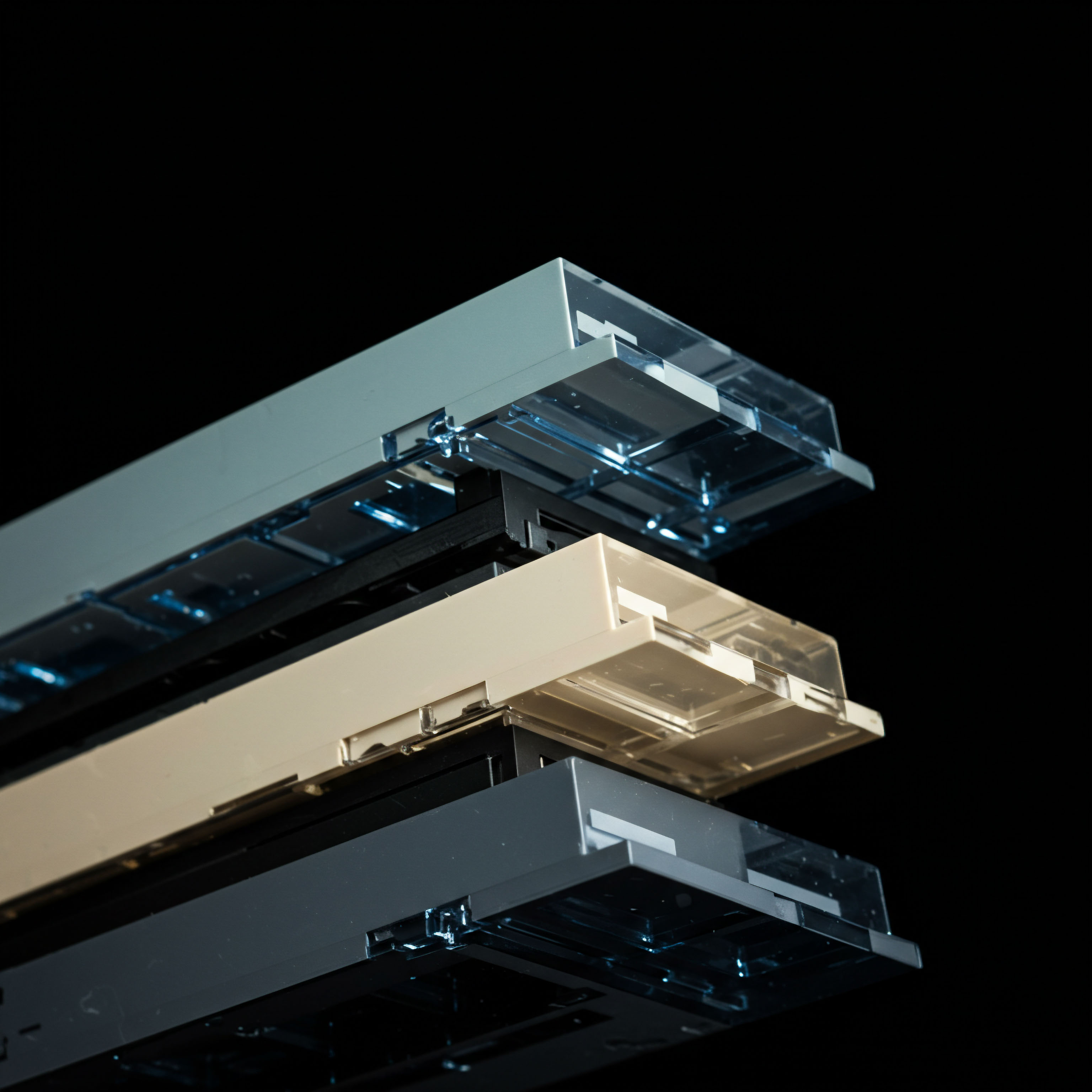

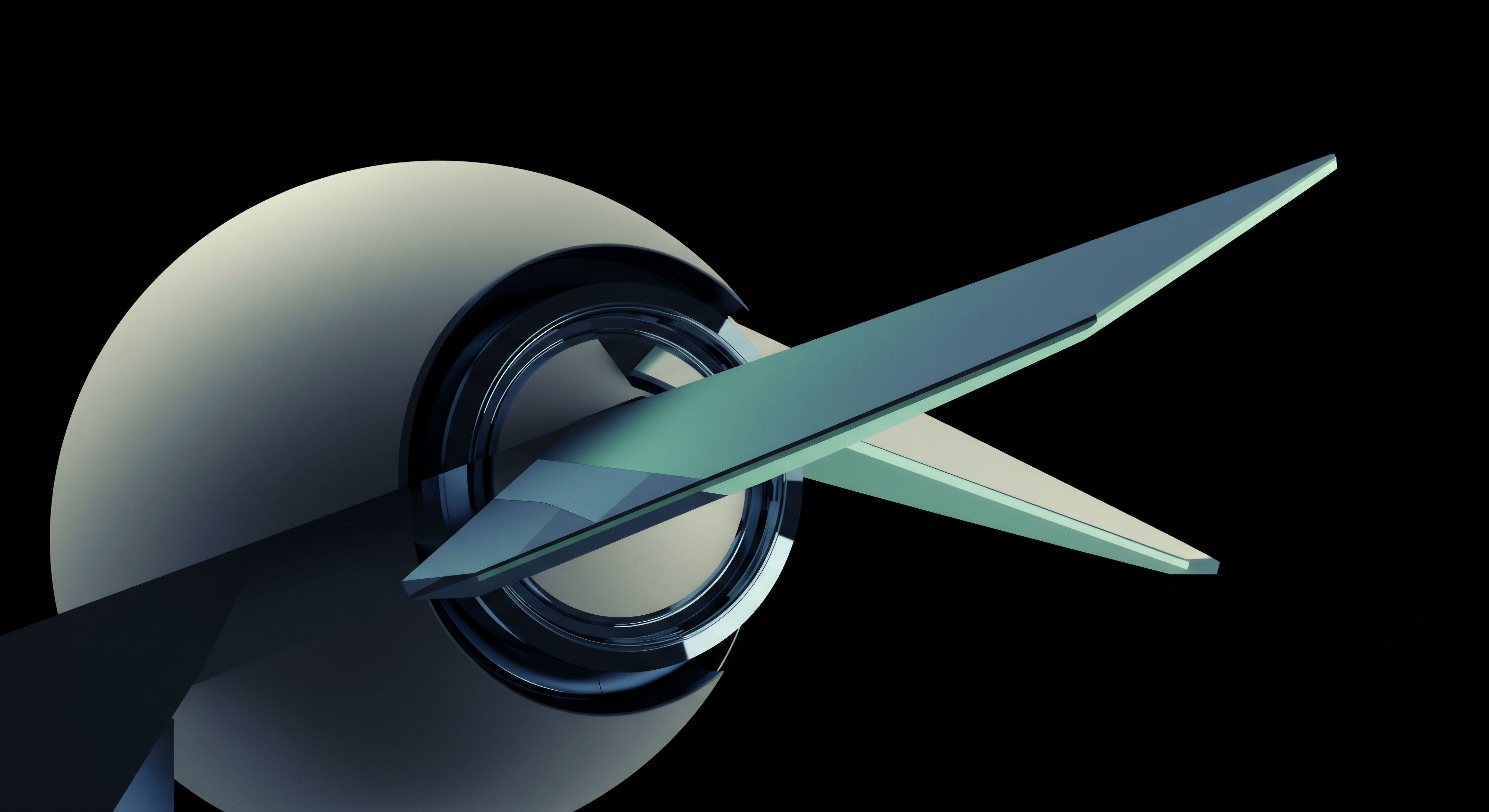

System Integration and Technological Architecture

The system integration and technological architecture supporting unified block trade definitions must embody resilience, scalability, and precision. The foundational layer consists of high-performance data ingestion engines capable of capturing trade events from diverse sources, including proprietary trading systems, electronic communication networks (ECNs), and request-for-quote (RFQ) platforms. These engines must handle high-volume, low-latency data streams, often leveraging message queuing technologies like Apache Kafka to ensure reliable delivery and processing. Data normalization services then transform these raw inputs into a consistent internal format, aligning disparate field names, data types, and enumeration values with the enterprise’s unified data taxonomy.

The core of this architecture is a centralized, immutable ledger or data lake, providing a single source of truth for all block trade records. This data repository, often built on distributed ledger technology or a highly scalable columnar database, ensures data integrity and provides a comprehensive historical record for audit and analytical purposes. Integration with existing Order Management Systems (OMS) and Execution Management Systems (EMS) is paramount.

This typically involves API endpoints that allow the OMS/EMS to publish trade details post-execution and subscribe to validated block trade classifications and reporting statuses. The FIX protocol remains a critical component here, serving as the lingua franca for trade communication.

Specific integration points and architectural considerations include:

- FIX Protocol Integration ▴

- Tag 35 (MsgType) ▴ Ensuring consistent use of Execution Report (MsgType=8) for post-trade details, with specific block trade indicators.

- Tag 150 (ExecType) ▴ Standardizing values for “New” (0), “Fill” (1), and “Trade” (F) for block trade executions.

- Custom Tags ▴ Implementing firm-specific custom tags (e.g. in the 5000-9999 range) for internal block trade attributes not covered by standard FIX, while ensuring clear documentation and mapping to external standards.

- API Endpoints for Regulatory Reporting ▴ Developing RESTful or gRPC APIs for automated submission of block trade data to various Trade Repositories (TRs) and Approved Reporting Mechanisms (ARMs). These APIs must adhere to strict data formats and submission protocols mandated by regulatory bodies. The system should manage rate limits, error handling, and acknowledgment receipts from regulatory platforms.

- Real-Time Validation and Alerting Module ▴ An independent module performs real-time validation of block trade data against a comprehensive set of business rules, regulatory thresholds, and data quality standards. Any validation failure triggers immediate alerts to relevant operational teams, allowing for rapid remediation. This module might leverage complex event processing (CEP) technologies to detect anomalies and inconsistencies across multiple data streams.

- Data Lake and Analytics Platform ▴ A robust data lake stores all raw and processed block trade data, enabling advanced analytics, machine learning models for market impact analysis, and predictive scenario simulations. This platform should provide secure access for quantitative analysts and risk managers, facilitating deeper insights into trading performance and market microstructure.

The system must possess an inherent capacity for adaptability. Regulatory landscapes shift, market structures evolve, and new asset classes emerge. The architecture, therefore, requires modular components and flexible configuration capabilities, allowing for rapid updates to data models, validation rules, and reporting logic without requiring a complete system overhaul. This agility provides a critical competitive advantage, enabling institutions to quickly respond to changes while maintaining data integrity and compliance.

References

- Clarus Financial Technology. New Block Trading Rules for Derivatives. September 30, 2020.

- ISDA. Block trade reporting for over-the-counter derivatives markets. January 18, 2011.

- Earn2Trade. How does Standardization work in derivatives contract markets? November 3, 2023.

- JPX. How does standardization work in derivative markets? Evidence from the options on JGB Futures. May 27, 2022.

- FIX Trading Community. FIX Implementation Guide.

- Andreev, Mark. FIX Protocol for Market Data Feeds ▴ A Comprehensive Developer’s Guide. October 13, 2025.

- QuestDB. Block Trade Reporting.

- AFME. Enhancing data quality for effective Surveillance in Capital Markets.

- LSEG. The heightened focus on data quality for transaction reporting.

- Gable.ai. Data Governance in Financial Institutions ▴ Key Considerations. July 8, 2025.

Strategic Intelligence Synthesis

The journey towards unifying block trade definitions reveals itself as a continuous strategic imperative, not a finite project. The insights gained from meticulously addressing data governance challenges serve as building blocks for a more sophisticated operational framework. Consider how these granular insights into data lineage, taxonomy, and regulatory harmonization contribute to a larger system of intelligence within your organization. This knowledge becomes a force multiplier, enabling not merely compliance, but a proactive stance in navigating market complexities.

The ability to precisely define, track, and analyze every block trade empowers a firm to discern subtle market shifts, optimize execution protocols, and fortify its risk posture. Ultimately, mastering these data intricacies represents a profound commitment to achieving superior operational control and a decisive strategic advantage in an ever-evolving financial landscape.

Glossary

Unifying Block Trade Definitions

Data Governance

Data Integrity

Block Trades

Market Microstructure

Block Trade

Reporting Delays

Trade Data

Block Trade Definitions

Data Quality

Risk Management

Operational Protocols

Execution Strategy

Trade Definitions

Data Lineage

Block Trade Reporting

Model Would

Quantitative Analysis

Block Trade Data

Trade Reporting

System Integration

Fix Protocol