Execution Efficiency in Complex Markets

Navigating the intricate currents of modern financial markets, particularly when orchestrating substantial block trades, demands an understanding of systemic interactions and predictive precision. Institutional participants frequently confront the challenge of minimizing market impact while securing optimal execution for large orders. The traditional reliance on heuristic algorithms or human intuition often encounters limitations in environments characterized by high volatility and fragmented liquidity.

A paradigm shift in this operational landscape arrives with the deployment of machine learning models, which offer a transformative capability to discern subtle market dynamics and optimize trade trajectories with unprecedented granularity. These advanced computational frameworks move beyond static rules, adapting to real-time market microstructure and anticipating the complex interplay of order flow, price formation, and liquidity availability.

The imperative for superior execution quality compels a deeper examination of how these intelligent systems function. Such systems leverage vast datasets, including historical trade logs, limit order book dynamics, and macro-economic indicators, to construct robust predictive frameworks. They offer a systematic methodology for addressing the inherent complexities of large-scale order placement, where even marginal improvements in execution price can translate into substantial alpha generation for portfolios. This analytical lens reveals machine learning not merely as a technological enhancement, but as a foundational component of a sophisticated operational architecture designed to master market dynamics and achieve decisive execution advantage.

The pursuit of optimized block trade execution represents a continuous engagement with probabilistic outcomes and dynamic risk profiles. Machine learning models offer a potent mechanism for converting market uncertainty into quantifiable strategic advantage. These models continuously refine their understanding of market impact, predicting how a large order, when dissected into smaller components, will influence price action over various time horizons. This dynamic adaptation is crucial for maintaining execution fidelity in rapidly evolving market conditions, ensuring that capital deployment aligns with the most favorable liquidity opportunities available.

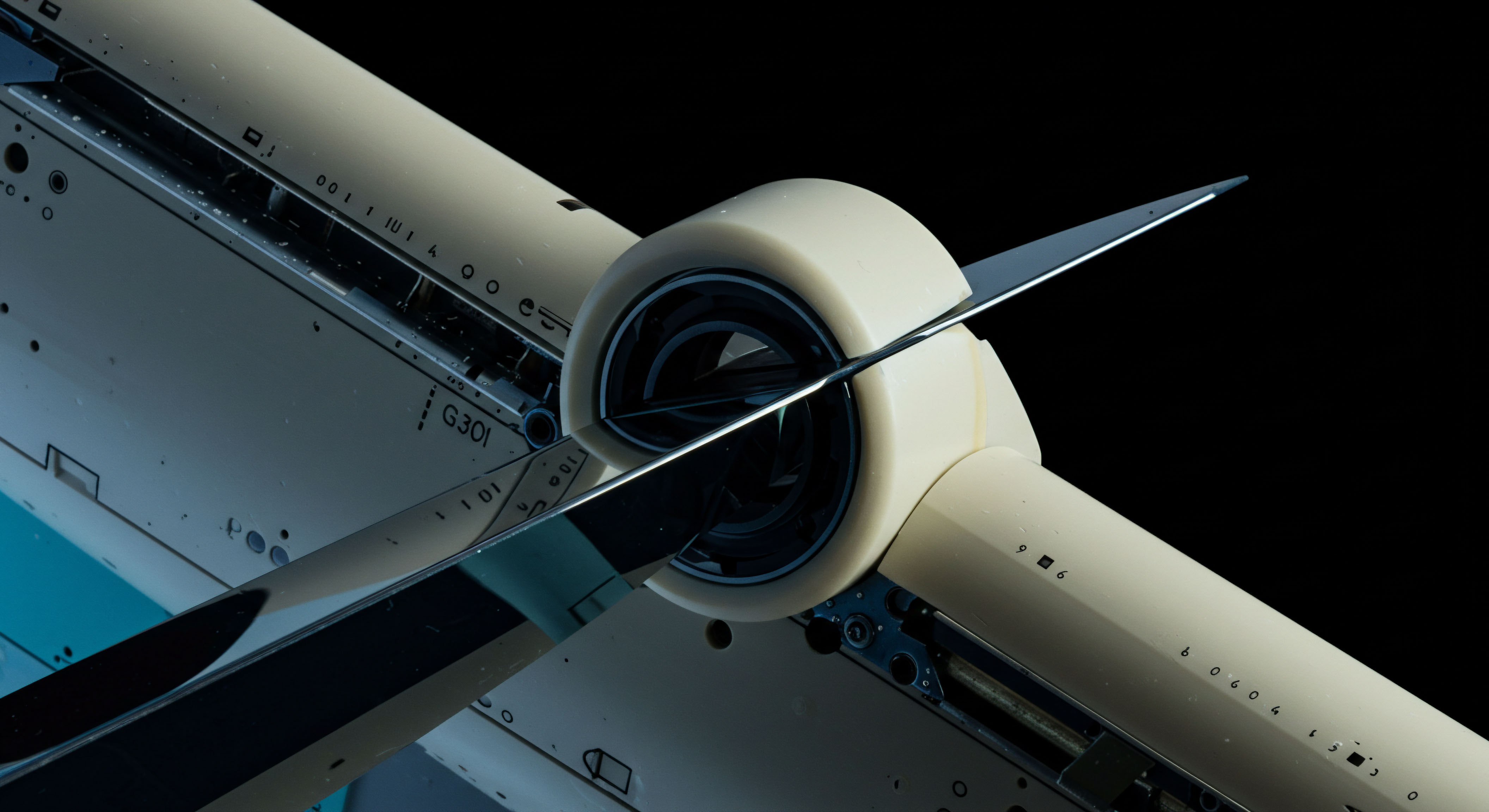

Machine learning models provide a dynamic, data-driven approach to minimizing market impact and enhancing execution quality for large block trades.

The effectiveness of machine learning in this domain stems from its capacity to model non-linear relationships and identify latent patterns that elude conventional analytical methods. Factors such as bid-ask spread evolution, order book depth fluctuations, and the ephemeral nature of liquidity are continuously analyzed. This comprehensive data synthesis enables the generation of execution schedules that are responsive to immediate market conditions, thereby mitigating adverse selection and reducing overall transaction costs. The precision afforded by these models elevates the standard for institutional trade execution, moving towards a more deterministic control over market interactions.

Market Microstructure Dynamics and Intelligent Execution

Understanding the fundamental structure of financial markets, particularly their microstructure, is paramount for optimizing any trading strategy. Market microstructure encompasses the detailed processes and rules governing the exchange of financial assets, including order types, trading venues, and the mechanisms of price discovery. In the context of block trading, the immediate depth of the market is often limited, meaning a single large order can exhaust available liquidity, leading to significant price impact.

This phenomenon necessitates splitting large orders into smaller components, a process known as optimal execution. Traditional approaches, such as the Almgren-Chriss model, rely on stochastic optimal control, yet these methods often require stringent conditions and analytical solutions are rare.

Machine learning models, particularly reinforcement learning, address these limitations by learning data-driven execution policies without imposing rigid assumptions on market behavior. These models interact with the market, real or simulated, receiving feedback on trade performance and iteratively refining their strategies. This adaptive learning mechanism allows for the simultaneous optimization of strategic scheduling and tactical decision-making, bridging the gap between high-level trade planning and granular order placement in real time.

The core challenge in executing block trades lies in managing market impact and information leakage. A large order, if executed indiscriminately, can signal intent to other market participants, leading to unfavorable price movements. Machine learning algorithms are adept at identifying optimal execution paths that balance the speed of execution with the minimization of price dislocation.

They consider a multitude of real-time market variables, including current order book state, historical volatility, and the anticipated flow of incoming orders. This holistic consideration results in a more sophisticated approach to liquidity consumption and provision, safeguarding the integrity of the block trade.

A sophisticated execution system leverages various data streams to construct a comprehensive view of market liquidity. These streams include direct feeds from exchanges, proprietary dark pool data, and over-the-counter (OTC) quote solicitations. The aggregation and intelligent processing of this diverse information empower machine learning models to identify transient liquidity pockets and optimize order placement across multiple venues. This integrated approach ensures that the execution strategy is not confined to a single market segment but dynamically seeks the most advantageous trading conditions wherever they exist.

Strategic Frameworks for Optimal Block Trading

The strategic deployment of machine learning models in block trade execution represents a shift from reactive order management to proactive, predictive orchestration. Institutional traders, facing increasing market fragmentation and microstructural complexities, seek frameworks that transcend conventional algorithmic limitations. The strategic imperative involves harnessing advanced computational intelligence to navigate the trade-off between execution speed and market impact, a balance central to achieving superior capital efficiency.

Machine learning offers a potent means to dynamically adjust trading tactics, ensuring orders interact with the market in a manner that preserves value and minimizes information leakage. This forward-looking approach enables a more adaptive response to fluctuating liquidity conditions and evolving price dynamics.

Central to this strategic shift is the ability of machine learning to synthesize vast quantities of disparate market data into actionable insights. This includes real-time order book data, historical trade patterns, macroeconomic news sentiment, and even proprietary internal flow. By processing these diverse inputs, models can construct a nuanced understanding of market liquidity and predict short-term price movements with a higher degree of accuracy than traditional methods. This predictive capability is then translated into optimized order placement strategies, allowing for the intelligent fragmentation of large blocks and their judicious deployment across various trading venues, including lit markets, dark pools, and bilateral RFQ protocols.

The integration of machine learning into strategic execution frameworks extends beyond mere prediction. It encompasses a continuous learning loop where each executed trade provides new data to refine the model. This iterative improvement mechanism allows the system to adapt to subtle shifts in market behavior, regulatory changes, or the actions of other sophisticated market participants.

The outcome is an execution strategy that is not static but evolves, continuously seeking the optimal balance between cost minimization and the swift completion of large orders. This adaptive intelligence ensures that the strategic framework remains robust and effective across diverse market regimes.

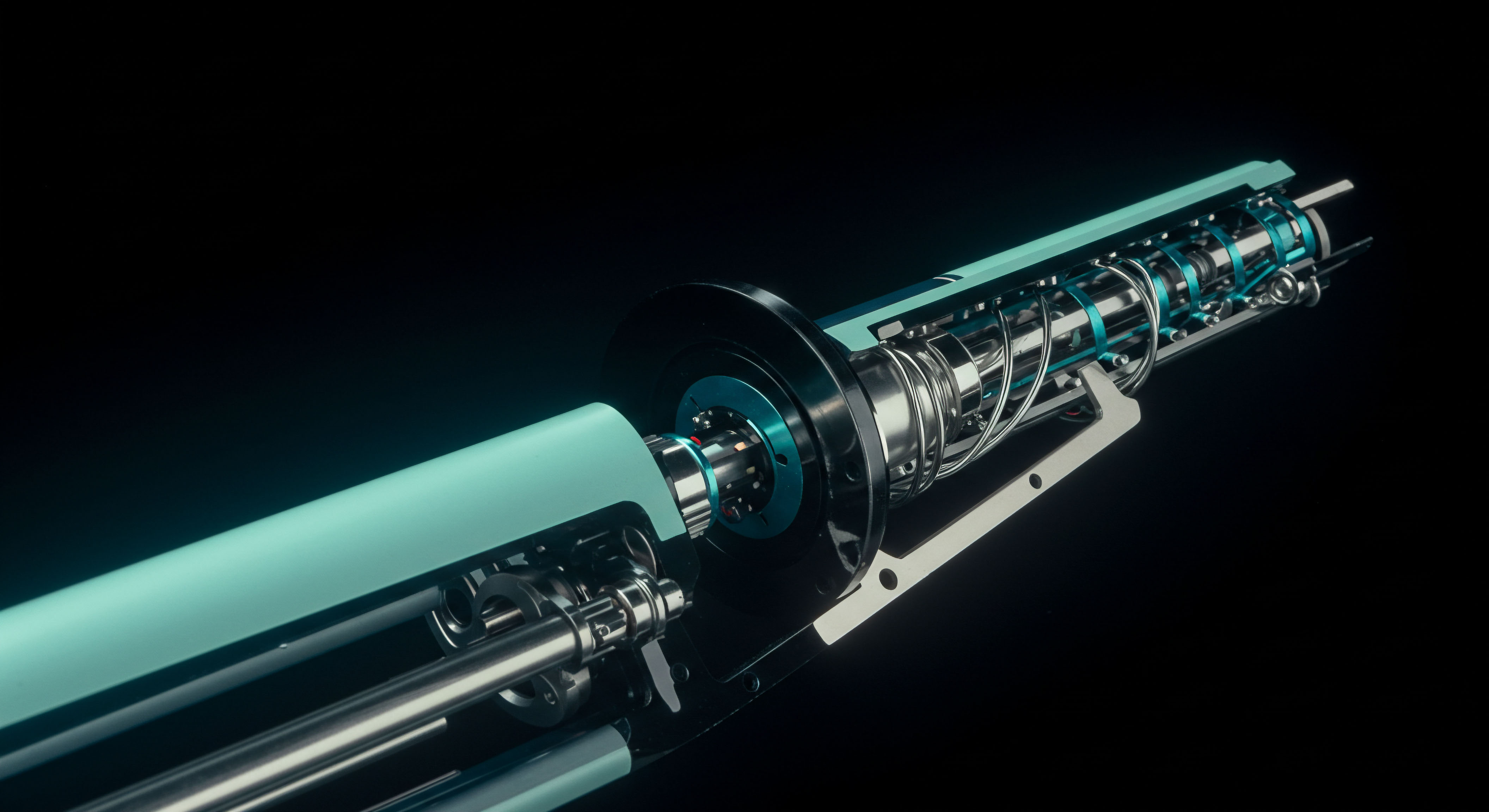

Machine learning transforms block trade strategy by providing dynamic insights into liquidity, optimizing order placement, and continuously adapting to market conditions.

Intelligent Order Fragmentation and Liquidity Sourcing

Optimal order fragmentation is a cornerstone of effective block trade execution. Instead of submitting a single, large order that risks significant market impact, the block is strategically divided into smaller child orders. Machine learning models excel at determining the optimal size, timing, and venue for these child orders.

Reinforcement learning (RL) algorithms, in particular, learn optimal execution strategies by interacting with simulated market environments, receiving feedback on trade performance, and iteratively adjusting their approach. This enables them to dynamically allocate market and limit orders to maximize expected revenue while minimizing transaction costs.

For example, RL agents can learn to be more aggressive when market conditions are favorable (e.g. high liquidity, tight spreads) and more passive during periods of low liquidity or high volatility. They consider factors such as the current state of the limit order book, bid-ask spreads, and the cost of submitting market orders. This adaptive behavior often outperforms traditional benchmark strategies like Volume Weighted Average Price (VWAP) or Time Weighted Average Price (TWAP), especially during periods of market stress.

Sourcing liquidity for block trades frequently involves engaging with Request for Quote (RFQ) protocols. These bilateral price discovery mechanisms allow institutional participants to solicit quotes from multiple dealers for large, often illiquid, instruments. Machine learning can significantly enhance RFQ mechanics by predicting which dealers are most likely to offer competitive prices, optimizing the timing of quote solicitations, and analyzing the price impact of historical RFQ interactions. This intelligent layer improves the efficiency of off-book liquidity sourcing, reducing information leakage and ensuring best execution.

The strategic value of multi-dealer liquidity aggregation cannot be overstated. By synthesizing quotes from various liquidity providers, institutional systems gain a comprehensive view of available depth and pricing. Machine learning algorithms can process these aggregated inquiries in real-time, identifying the optimal combination of dealers to engage with for a specific block trade.

This systematic approach to liquidity management minimizes slippage and provides a superior execution experience, especially for complex or bespoke instruments. The result is a more controlled and discreet protocol for large-scale capital deployment.

Advanced Trading Applications with Machine Learning

Machine learning models extend their utility to advanced trading applications, empowering sophisticated strategies that were previously difficult to implement or optimize. Consider the realm of synthetic options, where machine learning can be used to dynamically price and hedge complex multi-leg spreads. By analyzing implied volatility surfaces, historical price movements, and correlation structures, deep learning models can provide more accurate valuations and risk sensitivities, enabling more precise construction and management of these instruments.

Automated Delta Hedging (DDH) also benefits immensely from machine learning. Delta hedging aims to mitigate the directional risk of an options portfolio by dynamically adjusting positions in the underlying asset. Machine learning algorithms can predict future volatility and price movements with greater accuracy, allowing for more intelligent rebalancing of delta hedges.

This reduces transaction costs associated with frequent rehedging and improves the overall effectiveness of risk management. The system learns the optimal hedging frequency and size based on prevailing market conditions, minimizing slippage and maximizing portfolio stability.

The intelligence layer provided by machine learning integrates seamlessly with real-time intelligence feeds. These feeds provide granular market flow data, sentiment analysis from news, and order book imbalances. Machine learning models continuously process this information, identifying emergent patterns and potential dislocations.

This proactive intelligence allows for rapid adjustments to execution strategies, ensuring that trades are placed optimally in response to unfolding market events. The fusion of real-time data with predictive analytics creates a powerful feedback loop, enhancing the adaptability and responsiveness of the entire trading system.

The application of machine learning also extends to identifying and exploiting market trends that are often too subtle for human observation. Deep learning models, such as Long Short-Term Memory (LSTM) networks and Convolutional Neural Networks (CNNs), are particularly adept at processing time-series data and recognizing complex patterns in price and volume. This capability allows for the development of sophisticated trend-following or mean-reversion strategies that are automatically adjusted based on the model’s evolving understanding of market behavior. The integration of these predictive insights directly into the execution algorithms ensures that trading decisions are consistently aligned with the most current market intelligence, providing a sustained edge.

Precision Execution through Machine Intelligence

The journey from conceptual understanding to tangible outcomes in block trade optimization culminates in the precision of execution. This operational phase demands a rigorous application of machine learning models, translating strategic objectives into granular, real-time order management decisions. For institutional participants, the ultimate measure of success lies in the ability to minimize transaction costs, mitigate market impact, and achieve a superior average execution price for large orders.

Machine intelligence, specifically through advanced algorithms like reinforcement learning and deep learning, provides the necessary tools to navigate the complexities of market microstructure and achieve these demanding objectives. This section explores the definitive mechanics of implementing such systems, delving into the operational playbook, quantitative modeling, predictive scenario analysis, and system integration required for truly optimized block trade execution.

The operational reality of large-scale trading involves continuous interaction with dynamic and often unpredictable market forces. An execution framework empowered by machine learning offers a robust defense against adverse price movements and liquidity shocks. By continuously analyzing order book depth, bid-ask spreads, and the velocity of incoming orders, these systems can identify optimal entry and exit points with remarkable accuracy.

This adaptive capacity is a defining characteristic of modern, high-fidelity execution, ensuring that capital is deployed with surgical precision and strategic intent. The resulting improvements in execution quality directly contribute to enhanced portfolio performance and reduced operational risk.

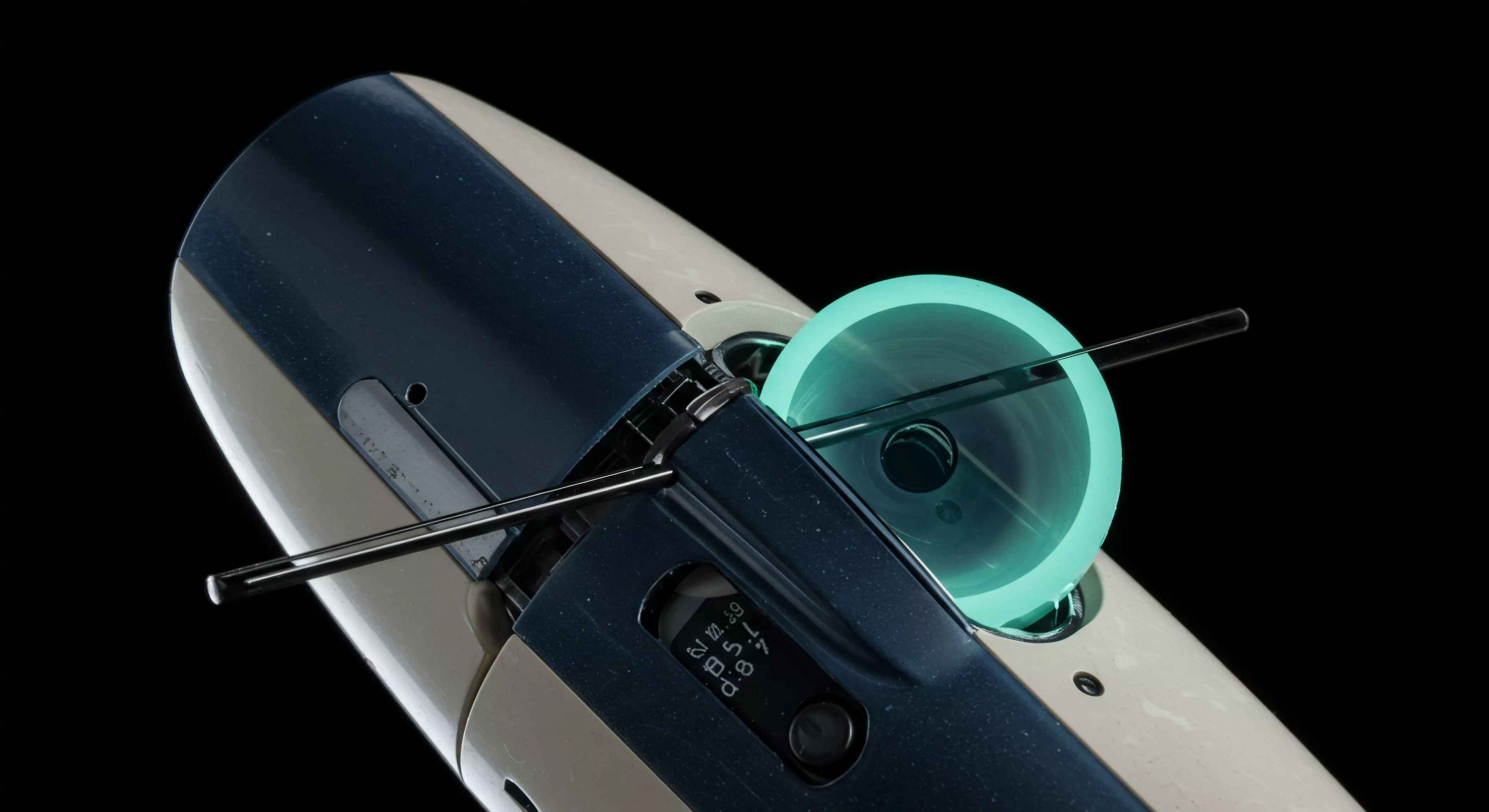

Precision execution for block trades relies on machine learning models that dynamically adapt to market microstructure, minimizing costs and optimizing price.

The Operational Playbook

Implementing an machine learning-driven system for block trade execution involves a structured, multi-stage procedural guide. This operational playbook ensures that the sophisticated capabilities of machine intelligence are seamlessly integrated into existing trading workflows, enhancing efficiency and control.

- Data Ingestion and Preprocessing ▴ Establish robust pipelines for real-time and historical market data, including limit order book snapshots, trade ticks, and relevant macroeconomic indicators. Data cleaning, normalization, and feature engineering are critical initial steps.

- Model Selection and Training ▴ Choose appropriate machine learning models, such as Deep Reinforcement Learning (DRL) for optimal execution or deep neural networks for price impact prediction. Train these models on extensive historical and simulated data, validating their performance against relevant benchmarks like VWAP or TWAP.

- Simulation and Backtesting ▴ Develop high-fidelity market simulators that accurately replicate market microstructure dynamics. Rigorously backtest trained models across diverse market regimes and stress scenarios to assess their robustness and identify potential vulnerabilities. This iterative process refines the model’s parameters and improves its generalization capabilities.

- Real-Time Market Monitoring ▴ Implement a comprehensive real-time market monitoring system that feeds live data to the execution algorithms. This includes tracking liquidity, volatility, order book imbalances, and news sentiment. The system should be capable of detecting anomalous market behavior or sudden shifts in liquidity.

- Dynamic Strategy Adjustment ▴ Configure the machine learning models to dynamically adjust execution parameters based on real-time market conditions and predefined risk limits. This includes modifying order sizes, placement strategies (e.g. passive vs. aggressive), and venue selection.

- Post-Trade Analytics and Learning ▴ Integrate a sophisticated Transaction Cost Analysis (TCA) system that utilizes machine learning to attribute execution performance to specific market factors and algorithmic decisions. This continuous feedback loop provides new data for retraining and improving the models, fostering an environment of perpetual learning and optimization.

- Human Oversight and Intervention ▴ Establish clear protocols for human oversight, allowing system specialists to monitor algorithm performance, intervene in extreme market conditions, or override automated decisions when necessary. This ensures a blend of automated efficiency with expert judgment.

Each step in this playbook is interdependent, forming a cohesive operational architecture. The meticulous attention to data quality, model validation, and continuous learning creates a resilient and highly performant execution system. The goal remains a reduction in market impact and an improvement in overall execution quality, directly contributing to superior returns for institutional portfolios.

Quantitative Modeling and Data Analysis

The efficacy of machine learning in optimizing block trade execution is fundamentally rooted in advanced quantitative modeling and rigorous data analysis. These models translate complex market dynamics into a framework for informed decision-making, systematically reducing uncertainty. Key models employed include reinforcement learning, deep learning architectures, and sophisticated statistical methods for transaction cost analysis.

Reinforcement Learning for Optimal Execution

Reinforcement Learning (RL) models, particularly Deep Q-Networks (DQN) and Proximal Policy Optimization (PPO), are adept at learning optimal execution trajectories. These algorithms frame the execution problem as a Markov Decision Process (MDP), where the agent (the execution algorithm) interacts with the environment (the market) by placing orders and receives rewards or penalties based on the resulting execution quality. The objective is to learn a policy that maximizes cumulative rewards, which translates to minimizing market impact and achieving the best possible price.

The state space for an RL agent includes current inventory, time remaining for execution, and various market microstructure features like bid-ask spread, order book depth, and recent price volatility. Actions available to the agent might involve placing market orders, limit orders at different price levels, or canceling existing orders. The reward function is typically designed to penalize market impact and implementation shortfall while rewarding timely completion of the order.

A critical component of RL model training involves high-fidelity market simulators. These simulators replicate the complex dynamics of limit order books, including the behavior of other market participants (e.g. noise traders, tactical traders, market makers). By training in such an environment, the RL agent learns robust strategies that generalize well to real-world market conditions, overcoming the limitations of relying solely on historical data.

| Parameter Category | Specific Parameter | Description | Typical Range/Example |

|---|---|---|---|

| Environment State | Current Inventory | Remaining volume of the block trade | 0 to N shares |

| Environment State | Time Remaining | Duration left until execution deadline | 0 to T minutes/hours |

| Environment State | Bid-Ask Spread | Difference between best bid and best ask | 0.01 to 0.50 price units |

| Environment State | Order Book Depth | Volume available at various price levels | Varies by instrument |

| Environment State | Volatility Index | Measure of price fluctuation | Historical or implied volatility |

| Agent Actions | Market Order Size | Volume to execute immediately | 0 to remaining inventory |

| Agent Actions | Limit Order Price | Price level for passive order placement | Best bid/ask +/- tick size |

| Agent Actions | Limit Order Volume | Volume for passive order | 0 to remaining inventory |

| Reward Function | Implementation Shortfall | Difference between benchmark and actual execution price | Negative (penalty) |

| Reward Function | Market Impact Cost | Adverse price movement caused by own trades | Negative (penalty) |

| Reward Function | Order Completion | Reward for finishing the trade within deadline | Positive (bonus) |

Deep Learning for Price Impact and Liquidity Prediction

Deep learning models, including Long Short-Term Memory (LSTM) networks and Convolutional Neural Networks (CNNs), are powerful tools for predicting price impact and liquidity. LSTMs are particularly effective for time-series data, capturing long-term dependencies in market dynamics that influence price movements. CNNs can analyze market data as images, identifying patterns in order book heatmaps or price charts.

These models can predict the immediate and sustained price impact of a given order size, allowing the execution algorithm to optimize its fragmentation strategy. They learn from historical data how different order types and sizes interact with varying market conditions, providing a probabilistic forecast of price evolution. Similarly, deep learning can predict transient liquidity pockets by analyzing order flow imbalances, news sentiment, and the activity of large institutional players. This predictive capability enables the execution system to target moments of high liquidity for optimal order placement.

| Feature Category | Specific Feature | Description | Data Type |

|---|---|---|---|

| Order Book Features | Bid/Ask Price Levels | Prices at various levels of the limit order book | Numerical (real-time) |

| Order Book Features | Bid/Ask Volumes | Aggregated volumes at price levels | Numerical (real-time) |

| Order Book Features | Order Imbalance | Ratio of buy vs. sell pressure in the book | Numerical (derived) |

| Trade Flow Features | Trade Volume | Volume of recent executed trades | Numerical (real-time) |

| Trade Flow Features | Trade Direction | Indicator of aggressive buy/sell trades | Categorical (derived) |

| Volatility Features | Realized Volatility | Historical price fluctuations over short periods | Numerical (derived) |

| Volatility Features | Implied Volatility | Market’s expectation of future volatility (from options) | Numerical (real-time) |

| Macro/News Features | Sentiment Score | Analysis of news articles for market sentiment | Numerical (NLP-derived) |

| Macro/News Features | Economic Data Releases | Scheduled economic announcements | Categorical/Numerical |

The integration of these quantitative models allows for a comprehensive and dynamic approach to block trade execution. The models continuously learn, adapt, and refine their strategies based on new market data, ensuring that the execution system remains at the forefront of efficiency and performance.

Predictive Scenario Analysis

A deep dive into predictive scenario analysis illuminates the transformative power of machine learning in navigating the treacherous waters of block trade execution. Consider a hypothetical institutional asset manager, “Alpha Capital,” tasked with liquidating a substantial block of 500,000 shares of “Quantum Dynamics Inc.” (QDI) within a three-hour trading window. The QDI stock typically trades around $100 per share, with an average daily volume (ADV) of 2 million shares.

This represents a significant portion of the daily liquidity, posing a considerable market impact risk. Alpha Capital’s primary objective is to minimize implementation shortfall against the arrival price, while maintaining anonymity and avoiding adverse price movements.

Traditionally, a human trader might employ a Time-Weighted Average Price (TWAP) or Volume-Weighted Average Price (VWAP) algorithm, splitting the order evenly over time or according to historical volume profiles. However, these static strategies often fail to account for real-time market microstructure shifts. A sudden influx of sell orders, a liquidity squeeze, or an unexpected news announcement could severely degrade execution quality. This is where a machine learning-driven predictive scenario analysis proves invaluable.

Alpha Capital’s execution system, powered by a Deep Reinforcement Learning (DRL) agent, initiates the block liquidation. The DRL model has been trained on years of historical order book data, micro-level trade data, and simulated market environments, allowing it to learn complex, non-linear relationships between order flow, price impact, and liquidity.

At the commencement of the three-hour window, the market for QDI appears relatively calm. The DRL agent, having analyzed the current order book depth, bid-ask spread (currently $0.05), and recent volatility, begins by placing small, passive limit orders at the bid, aiming to capture liquidity without signaling aggressive selling pressure. The model’s initial strategy prioritizes minimizing market impact, recognizing the sensitivity of such a large block.

One hour into the trading window, a significant news headline breaks ▴ a competitor announces a breakthrough in a technology segment where QDI is a key player. The market reacts swiftly. QDI’s price begins to decline, and the bid-ask spread widens to $0.15.

Concurrently, the order book depth on the bid side thins dramatically, indicating a sudden reduction in buying interest. A traditional TWAP algorithm would continue to sell at its predetermined schedule, likely incurring substantial losses due to the deteriorating market conditions.

The DRL agent, however, immediately detects this regime shift. Its embedded deep learning modules for sentiment analysis and real-time liquidity prediction flag the news event and the subsequent market response. The model’s internal state representation updates dynamically, recognizing the increased risk of adverse selection and heightened market impact. Instead of continuing passive limit order placement, the DRL agent rapidly adjusts its strategy.

It shifts to a more aggressive approach, but with surgical precision. The model predicts that waiting for a price recovery in this volatile environment carries a higher risk than immediate, albeit slightly more impactful, execution. It starts to consume available liquidity at the bid more quickly, utilizing carefully sized market orders to clear immediate demand, but avoids flooding the market. Simultaneously, it places smaller, opportunistic limit orders at slightly higher prices, anticipating brief bounces or temporary liquidity injections from other algorithmic participants.

The DRL agent’s decision-making is driven by a continuous re-evaluation of its reward function, which balances the trade-off between current price realization, potential future price deterioration, and the risk of not completing the order within the three-hour window. The model calculates the expected implementation shortfall under various micro-scenarios in real-time. For instance, it might determine that executing 50,000 shares via market orders over the next 15 minutes, despite a predicted average slippage of $0.08 per share, is preferable to a potential $0.20 per share loss if it waits for a hypothetical recovery that may not materialize.

As the second hour progresses, the market stabilizes somewhat, though remaining volatile. The DRL agent identifies a brief period of increased buying interest, perhaps from short-covering or other institutional rebalancing. It capitalizes on this fleeting liquidity by accelerating its selling, placing a larger tranche of shares into the market through a combination of aggressive limit orders and small market orders, ensuring the available demand is met without overwhelming it. This dynamic responsiveness allows Alpha Capital to liquidate a significant portion of the block during a relatively more favorable, albeit short-lived, market window that a static algorithm would have missed.

In the final hour, with approximately 100,000 shares remaining, the market enters a calmer phase. The DRL agent reverts to a more passive strategy, prioritizing minimal impact for the remaining volume. It places limit orders near the current bid, patiently waiting for natural buying interest to absorb the shares. By the end of the three-hour window, Alpha Capital successfully liquidates the entire 500,000 shares of QDI.

The post-trade analysis reveals an implementation shortfall significantly lower than what a traditional VWAP or TWAP strategy would have incurred, particularly given the mid-session market shock. The DRL model’s ability to adapt its execution profile in real-time, based on a sophisticated understanding of market microstructure and predictive analytics, provided a demonstrable edge. This case study underscores the profound advantage of machine intelligence in optimizing block trade execution, transforming a high-risk operation into a strategically managed, high-fidelity process.

This illustrates a fundamental shift in operational control. The DRL agent is not merely following a set of pre-programmed rules; it is learning, adapting, and making complex, probabilistic decisions in real-time, much like an experienced human trader, but with superior speed and data processing capabilities. The continuous feedback loop from market interaction refines its policy, ensuring that future block executions benefit from past experiences, leading to a perpetual enhancement of execution efficiency. This capability defines the next generation of institutional trading, where computational power augments human expertise to achieve unprecedented levels of market mastery.

System Integration and Technological Architecture

The successful deployment of machine learning models for block trade execution necessitates a robust system integration and a meticulously designed technological architecture. This framework ensures that predictive insights translate into actionable orders with minimal latency and maximum reliability. The underlying infrastructure must support high-frequency data processing, low-latency communication, and seamless interoperability with existing trading systems.

At the core of this architecture is a high-performance data pipeline. This pipeline ingests massive volumes of real-time market data ▴ including full depth-of-book data, trade feeds, and news ▴ at millisecond granularity. Technologies like Apache Kafka or other message queuing systems facilitate the efficient streaming of this data to the machine learning inference engines.

A distributed data store, such as a time-series database or a columnar database, provides rapid access to historical data for model training and backtesting. The integrity and speed of this data flow are paramount for the machine learning models to make timely and accurate predictions.

The machine learning inference engines, responsible for generating execution signals, typically run on high-performance computing clusters. These clusters leverage GPUs for accelerated model inference, ensuring that predictions are delivered with sub-millisecond latency. The models output optimal order placement parameters, such as order size, price, type (limit or market), and preferred venue. These signals are then transmitted to the execution management system (EMS) and order management system (OMS) for routing to the market.

Communication between the machine learning engines, OMS, and EMS predominantly relies on industry-standard protocols. The FIX (Financial Information eXchange) protocol is a cornerstone of this integration, providing a standardized messaging layer for pre-trade, trade, and post-trade communication. FIX messages facilitate the transmission of execution instructions, order status updates, and trade confirmations.

Custom API endpoints also play a crucial role, enabling proprietary systems to exchange data and control signals efficiently. These APIs are designed for low-latency communication, often utilizing binary protocols or gRPC for maximum speed.

The OMS is responsible for the lifecycle of an order, from its initial entry to its final execution and settlement. When an institutional trader initiates a block trade, the OMS receives the parent order. The machine learning execution algorithm, residing within or integrated with the EMS, then takes this parent order and dynamically fragments it into child orders based on its real-time predictions.

The EMS, in turn, routes these child orders to various liquidity venues ▴ exchanges, dark pools, or bilateral RFQ systems ▴ optimizing for factors like price, liquidity, and anonymity. The EMS provides granular control over order routing logic, allowing the machine learning system to dynamically adjust venue selection based on prevailing market conditions.

The integration points are meticulously engineered to ensure fault tolerance and scalability. Redundant data feeds, failover mechanisms for inference engines, and robust error handling protocols are essential. Furthermore, the architecture supports continuous deployment and A/B testing of new machine learning models, allowing for iterative improvements without disrupting live trading operations. This sophisticated technological ecosystem underpins the advanced capabilities of machine learning in optimizing block trade execution, transforming complex market interactions into a controlled and highly efficient process.

A further dimension of this integration involves the continuous feedback loop from post-trade analytics. Transaction Cost Analysis (TCA) systems, themselves often enhanced by machine learning, ingest executed trade data and market benchmarks to evaluate the performance of the execution algorithms. This analysis provides critical insights into slippage, market impact, and the effectiveness of different strategies under various market conditions.

The results of TCA are then fed back into the machine learning models, serving as a vital input for retraining and refinement. This closed-loop system ensures that the models continuously learn from real-world outcomes, adapting their parameters to achieve even greater execution efficiency over time.

References

- Almgren, Robert. “Optimal Execution of Portfolio Transactions.” Journal of Risk, 2002.

- Almgren, Robert. “Market Microstructure and Algorithmic Trading.” PIMS Summer School, University of Alberta, Edmonton, 2016.

- Bao, W. Yue, J. & Rao, Y. “A Deep Learning Framework for Financial Time Series Prediction with an Integration of Wavelet Transform, Stacked Autoencoders and LSTM.” Neurocomputing, 2017.

- Cartea, Álvaro, J. Penalva, and S. Jaimungal. Algorithmic Trading ▴ Quantitative Strategies and Methods. Chapman and Hall/CRC, 2018.

- Cont, Rama, Arseniy Kukanov, and Anthony Neuberger. “Optimal Execution with Reinforcement Learning.” arXiv preprint arXiv:2311.06209, 2023.

- Drissi, Fayçal. “Lecture Notes on Market Microstructure and Algorithmic Trading.” University of Oxford – Mathematical Institute, 2020.

- Nevmyvaka, Y. Feng, Y. & Kearns, M. “Reinforcement Learning for Optimized Trade Execution.” CIS UPenn, 2006.

- Roche, Paul. “Trading innovation ▴ Man versus machine ▴ Is AI really improving execution efficiency?” The TRADE, 2023.

- Sadeghi, Nesa, Kamran Kianfar, Nasser Ghaem Doust, and Jaber Fooladi. “Algorithmic trading strategy based on the integration of deep learning models and natural language processing.” CoLab, 2024.

- Sparrow, Chris, and Melinda Bui. “Machine learning engineering for TCA.” The TRADE, 2019.

- Moallemi, Ciamac. “A Reinforcement Learning Approach to Optimal Execution.” 2020.

- Quod Financial. “Future of Transaction Cost Analysis (TCA) and Machine Learning.” 2019.

Strategic Intelligence for Market Mastery

The exploration of machine learning models for optimizing block trade execution reveals a fundamental truth about modern financial markets ▴ mastery arises from an integrated understanding of system dynamics and intelligent adaptation. Reflect upon your own operational framework. Are your current execution protocols sufficiently dynamic to navigate the relentless evolution of market microstructure? Does your system possess the capacity for continuous learning, transforming each trade into a data point for future optimization?

The insights presented here serve as components of a larger system of intelligence, where a superior edge is not merely achieved but perpetually refined. The true strategic potential lies in building an adaptive framework that can anticipate, respond, and ultimately shape execution outcomes with unparalleled precision, securing a decisive advantage in the intricate dance of capital deployment.

Glossary

Minimizing Market Impact

Optimal Execution

Machine Learning Models

Market Microstructure

Order Book Dynamics

Execution Quality

Block Trade Execution

Market Conditions

Machine Learning

Order Book Depth

Price Impact

Reinforcement Learning

Learning Models

Price Movements

Market Impact

Real-Time Market

Block Trade

Execution System

Order Placement

Trade Execution

Market Data

Order Book

Limit Orders

Limit Order Book

Market Orders

Block Trades

Multi-Dealer Liquidity

Deep Learning Models

Automated Delta Hedging

Real-Time Intelligence Feeds

Deep Learning

Predictive Scenario Analysis

Book Depth

Limit Order

Deep Reinforcement Learning

These Models

Transaction Cost Analysis

Optimizing Block Trade Execution

Transaction Cost

Implementation Shortfall

Reward Function