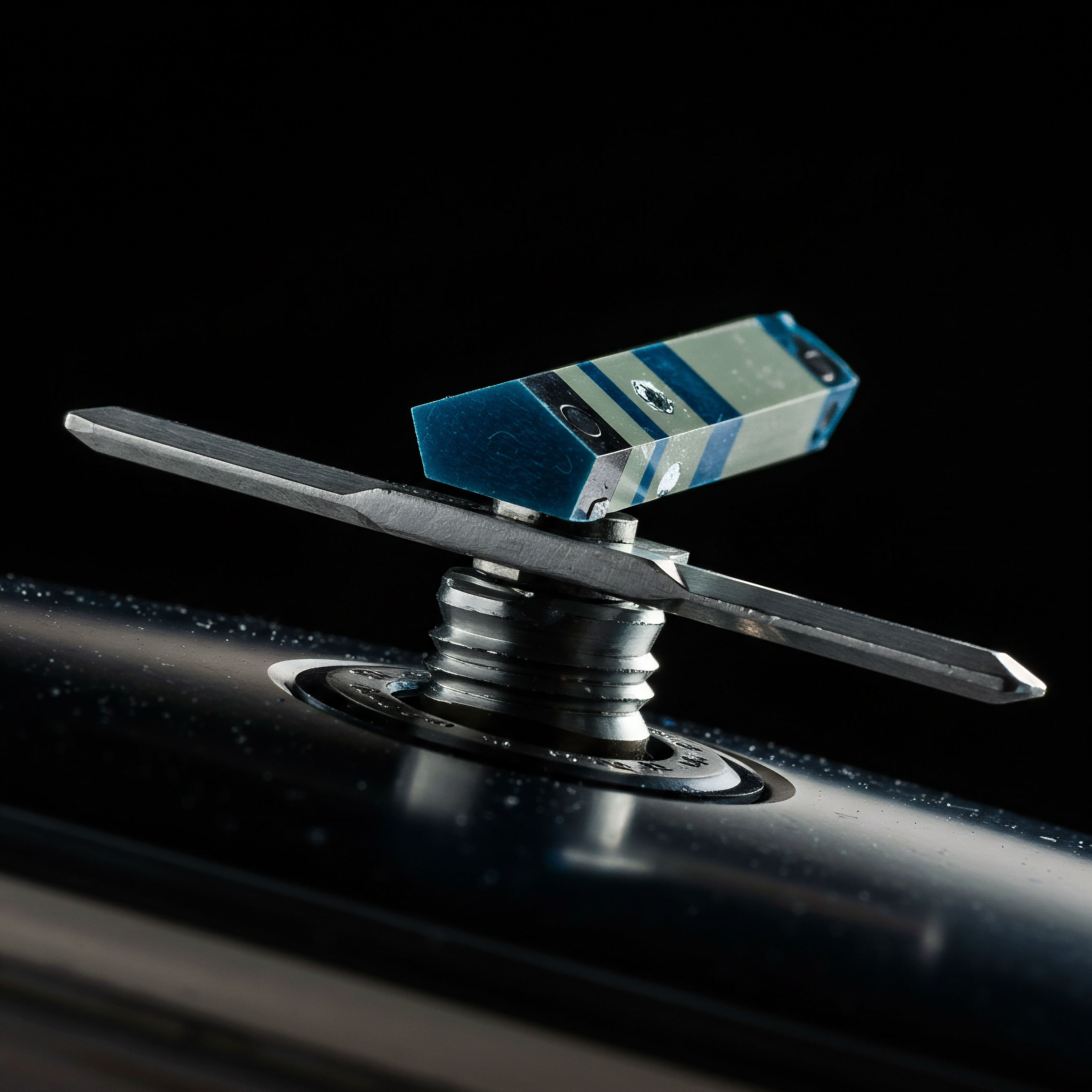

Concept

The intricate landscape of crypto options markets, characterized by heightened volatility and often fragmented liquidity, presents a formidable challenge for institutional participants. Traditional option pricing methodologies frequently falter when confronted with these unique dynamics, necessitating a sophisticated quantitative approach. Quantitative models serve as the indispensable computational engine for transforming opaque bilateral negotiations within a Request for Quote (RFQ) framework into structured, analytically driven engagements, enabling robust price discovery and precise risk management. These models provide the essential framework for deriving fair value, offering a crucial edge in a market where information asymmetry can otherwise distort valuations.

Understanding the fundamental role of these models requires recognizing the limitations of simpler frameworks. The Black-Scholes-Merton (BSM) model, a cornerstone of traditional finance, assumes constant volatility and a continuous price path, conditions rarely met in the rapidly evolving digital asset space. Crypto assets frequently exhibit significant price jumps, heavy tails in their return distributions, and a pronounced stochastic nature of volatility.

Incorporating these empirical observations into pricing mechanisms becomes paramount for any institution seeking to accurately value and hedge crypto options. The application of more advanced models, therefore, moves beyond mere theoretical exercise; it becomes an operational imperative for achieving consistent best execution and mitigating information leakage in a multi-dealer RFQ environment.

Volatility’s Intrinsic Role

Volatility stands as the most critical parameter in options pricing. In crypto markets, its behavior is notably distinct, displaying rapid shifts, mean reversion tendencies, and often, an inverse correlation with asset price movements, particularly during periods of market stress. Accurately capturing these characteristics forms the bedrock of effective options valuation. The construction and continuous calibration of implied volatility surfaces are central to this endeavor, providing a three-dimensional representation of market expectations across different strike prices and maturities.

This surface offers a snapshot of the market’s collective view of future volatility, which sophisticated models then leverage to generate actionable quotes. Ignoring the complex behavior of volatility inevitably leads to mispricing and suboptimal hedging outcomes, directly impacting a portfolio’s risk-adjusted returns.

Quantitative models are the computational core for transforming crypto options RFQ into analytically driven engagements.

RFQ Framework Dynamics

Within an RFQ framework, institutional traders solicit competitive two-way quotes from multiple liquidity providers for large, often complex, digital asset derivatives. This process, designed to source block liquidity and minimize market impact, relies heavily on the market makers’ ability to generate accurate, real-time prices. The quantitative models employed by these market makers directly determine the quality and competitiveness of their quotes.

A superior modeling infrastructure allows a liquidity provider to offer tighter spreads and more precise valuations, securing order flow and managing their resultant risk exposures with greater efficiency. The RFQ environment, by its very nature, demands models capable of rapid calculation and dynamic recalibration, adapting instantaneously to incoming market data and evolving risk parameters.

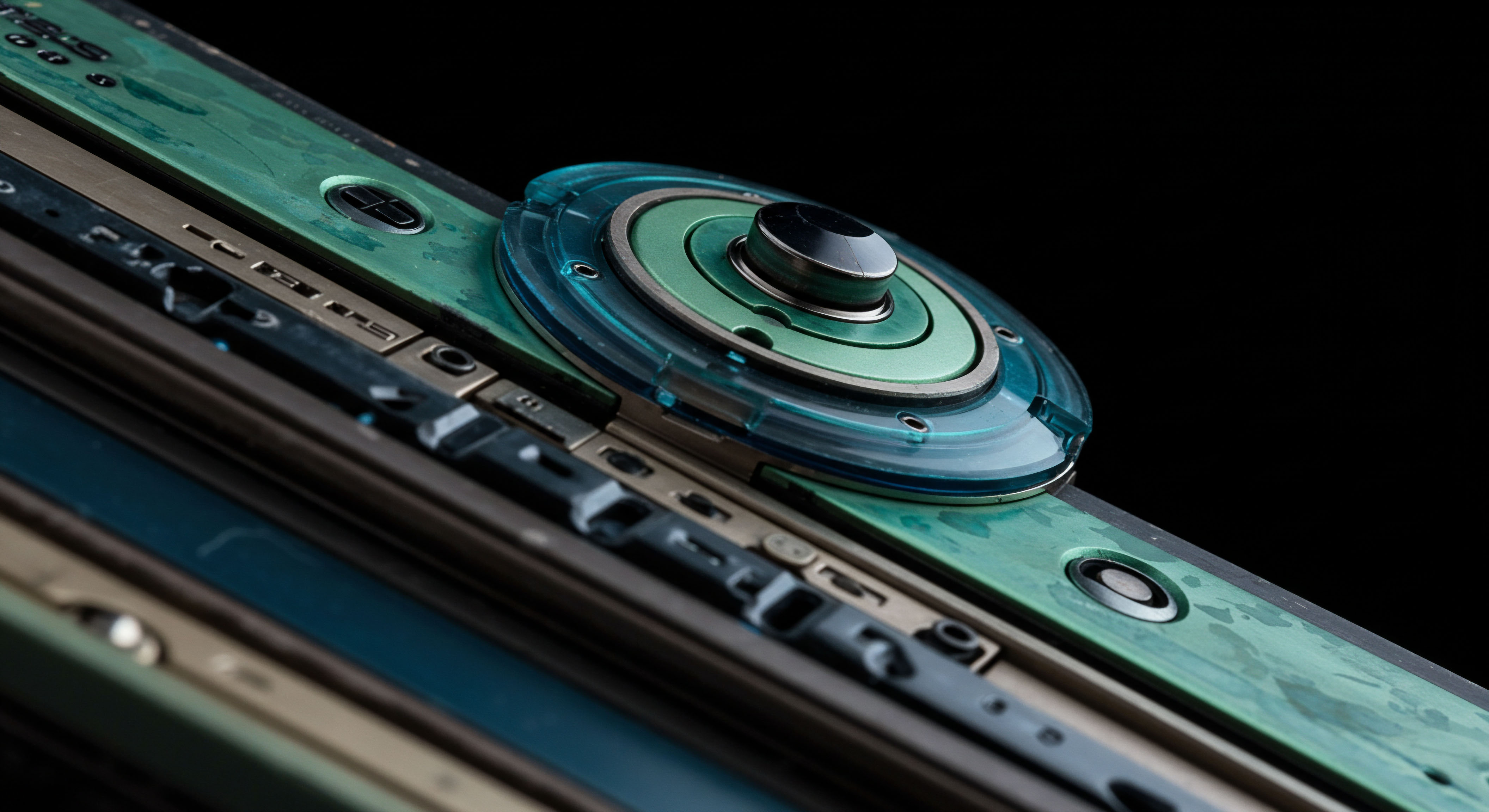

Strategy

Strategic deployment of quantitative models within the crypto options RFQ framework demands a discerning selection process, aligning model capabilities with specific market microstructure challenges and desired risk profiles. The inherent characteristics of digital asset markets, including their non-normal return distributions, pronounced jump components, and stochastic volatility, necessitate moving beyond the foundational Black-Scholes-Merton framework. Employing a robust suite of models allows institutions to adapt their pricing and hedging strategies to various option types, underlying crypto assets, and prevailing liquidity conditions.

Advanced Volatility Modeling

The strategic advantage in crypto options pricing often resides in superior volatility modeling. Stochastic volatility models, such as the Heston model, provide a more realistic representation of volatility dynamics by treating volatility itself as a random process correlated with the underlying asset’s returns. This approach significantly enhances pricing accuracy, particularly for longer-dated options and those sensitive to volatility shifts. Another class of models, jump-diffusion processes (e.g.

Merton Jump Diffusion, Kou model, Bates model), directly addresses the frequent, discontinuous price movements observed in cryptocurrencies. These models augment continuous diffusion with Poisson-distributed jumps, capturing the leptokurtic and skewed nature of crypto returns more effectively than purely continuous models. A judicious selection among these models, or even a combination thereof, allows for a more comprehensive capture of the underlying asset’s price path and volatility surface.

Strategic model selection optimizes pricing and hedging in volatile crypto options markets.

Model Suitability for Derivatives

The choice of a quantitative model also depends on the specific derivatives being priced. For vanilla European options, a well-calibrated Heston or jump-diffusion model offers substantial improvements over BSM. However, for exotic options, such as barrier options or American-style options, the computational complexity increases, often requiring numerical methods like Monte Carlo simulations or finite difference schemes. Local volatility models, which derive volatility as a deterministic function of both asset price and time, can precisely reproduce the market’s implied volatility surface for vanilla options.

While powerful for calibrating to observed vanilla prices, local volatility models might exhibit limitations in projecting realistic forward volatility dynamics, making stochastic volatility models preferable for path-dependent exotics. A comprehensive strategy involves a tiered approach, utilizing simpler models for rapid, indicative pricing and more complex, computationally intensive models for definitive valuations and risk assessments of complex structures.

Comparative Model Attributes for Crypto Options

A strategic overview of model attributes helps in selecting the most appropriate framework for different market conditions and option types. The following table delineates key characteristics.

| Model Class | Key Features | Strengths for Crypto | Limitations for Crypto |

|---|---|---|---|

| Black-Scholes-Merton (BSM) | Constant volatility, continuous price path, log-normal returns. | Analytical tractability, widespread familiarity. | Poor fit for volatility smile/skew, jumps, stochastic volatility. |

| Heston Stochastic Volatility | Volatility follows a mean-reverting square-root process, correlated with asset returns. | Captures volatility clustering, smile/skew, mean reversion. | May not fully capture extreme jumps, computationally more intensive. |

| Merton Jump Diffusion | Continuous diffusion with Poisson jumps (normal jump sizes). | Addresses sudden price changes, heavy tails, volatility smile. | Assumes constant jump intensity and distribution, volatility is constant between jumps. |

| Kou Jump Diffusion | Continuous diffusion with Poisson jumps (double exponential jump sizes). | Better captures asymmetric jumps and leptokurtosis. | Increased complexity in parameter estimation. |

| Local Volatility (Dupire) | Volatility is a deterministic function of spot price and time. | Exact calibration to market vanilla option prices, useful for exotics. | Implies unrealistic forward volatility dynamics, difficult for stochastic volatility hedging. |

Integrating Model Outputs into RFQ

The strategic interplay between quantitative models and the RFQ protocol is fundamental. Models generate the theoretical fair values, which are then adjusted for factors such as bid-ask spreads, liquidity premiums, and counterparty credit risk. A sophisticated RFQ system allows for the dynamic integration of these model-derived prices, offering market makers the ability to rapidly respond to inquiries with highly competitive and risk-managed quotes.

This real-time capability is essential for executing large, multi-leg options spreads or block trades, where slippage and information leakage pose significant threats to execution quality. The ultimate objective is to provide institutional principals with superior execution quality and capital efficiency, translating complex financial systems into a decisive operational edge.

Execution

The operational protocols governing the execution of crypto options within an RFQ framework demand analytical sophistication and a meticulous approach to implementation. For institutional participants, the precise mechanics of execution are paramount, translating strategic model choices into tangible performance advantages. This section delves into the deeply researched aspects of quantitative model deployment, providing a comprehensive guide for investing and managing risk in this dynamic environment.

Achieving superior execution requires a seamless integration of models into the trading infrastructure, enabling real-time calibration, dynamic hedging, and robust risk management. The depth of this exploration aims to provide the maximum understanding necessary for operationalizing these complex systems.

The Operational Playbook

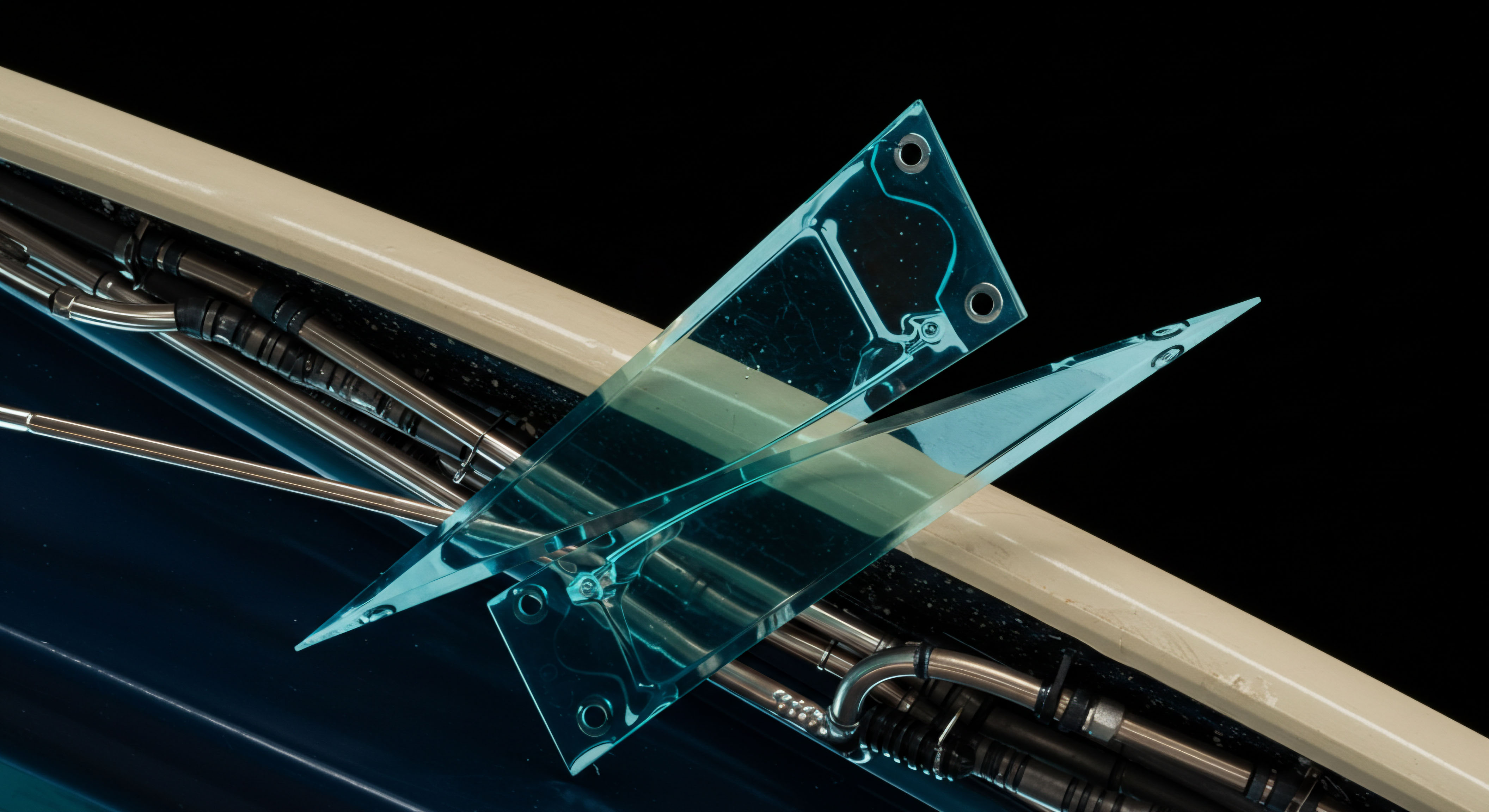

Operationalizing quantitative models within an RFQ system for crypto options involves a multi-stage procedural guide, ensuring high-fidelity execution and stringent risk controls. This sequence of actions underpins a robust trading desk’s capabilities.

- Data Ingestion and Pre-processing ▴ The initial step involves capturing real-time market data, including spot prices for underlying crypto assets, options quotes (bid/ask), implied volatility data, and relevant interest rate curves. Data integrity and low-latency ingestion are critical. Pre-processing includes cleaning, normalization, and handling missing values, preparing the data for model consumption. This foundational layer ensures that subsequent pricing calculations are based on the most accurate and timely information available.

- Model Selection and Parameterization ▴ For each incoming RFQ, the system dynamically selects the most appropriate quantitative model based on the option’s characteristics (e.g. vanilla, exotic, maturity, underlying asset) and prevailing market conditions (e.g. volatility regime, liquidity). Parameter estimation involves calibrating the chosen model to the current market implied volatility surface. This often includes techniques like least-squares optimization or maximum likelihood estimation, ensuring the model’s theoretical prices align with observable market quotes for liquid vanilla options.

- Real-time Quote Generation ▴ The calibrated model then computes the theoretical fair value for the requested option structure. This fair value is adjusted by a dynamically determined spread, which accounts for factors such as desired profit margin, perceived market risk, inventory delta, and the current liquidity profile of the underlying asset and option series. For multi-leg strategies, the system calculates the fair value of each component leg and aggregates them, accounting for correlation and basis risk.

- Risk Assessment and Hedging ▴ Concurrent with quote generation, a sophisticated risk engine evaluates the potential impact of the proposed trade on the firm’s overall portfolio risk. This involves calculating sensitivities (Greeks ▴ delta, gamma, vega, theta, rho) for the proposed position and assessing its contribution to value-at-risk (VaR) or expected shortfall. The system then identifies and proposes optimal hedging strategies, often involving dynamic delta hedging with futures or spot crypto, or even gamma and vega hedging with other options.

- Execution Logic and Order Routing ▴ Upon acceptance of a quote by the counterparty, the system executes the trade. For block trades, this typically involves direct, off-exchange settlement or via specialized block trading venues. For hedging, orders are routed to the most liquid spot or futures exchanges, considering factors like execution venue fees, available liquidity, and potential market impact. The goal remains minimizing slippage and ensuring best execution for both the primary option trade and its hedges.

- Post-Trade Analysis and Performance Attribution ▴ Following execution, comprehensive Transaction Cost Analysis (TCA) is performed. This evaluates the quality of execution against benchmarks, analyzes slippage, and attributes profit and loss to various factors (e.g. market movement, volatility changes, hedging effectiveness). This feedback loop is essential for continuous improvement of model calibration, spread logic, and hedging strategies.

A multi-stage operational playbook ensures high-fidelity crypto options execution within RFQ.

Quantitative Modeling and Data Analysis

The core of an institutional crypto options RFQ framework resides in its quantitative modeling and data analysis capabilities. The selection and implementation of specific models are critical for achieving accurate pricing and effective risk management. A primary focus involves the nuanced application of stochastic volatility and jump-diffusion models, which capture the unique empirical properties of crypto assets.

Heston Model Implementation

The Heston model, a cornerstone for modeling stochastic volatility, posits that the underlying asset’s price and its variance follow correlated stochastic processes. Its implementation for crypto options involves estimating parameters such as the long-run mean of variance (θ), the rate of mean reversion (κ), the volatility of volatility (σ_v), and the correlation between asset returns and volatility (ρ). These parameters are typically calibrated to observed market implied volatility surfaces using optimization algorithms. The model’s characteristic function provides a semi-analytical solution for European options, making it computationally efficient for real-time pricing within an RFQ system.

The Heston model’s ability to capture the volatility smile and skew, often pronounced in crypto options markets, provides a significant advantage over constant volatility models. A continuous recalibration of its parameters is necessary to adapt to changing market regimes, ensuring that the model remains aligned with current market expectations of future volatility. This dynamic adjustment is crucial for maintaining pricing accuracy and hedging efficacy.

Jump-Diffusion Models for Discontinuous Movements

Crypto assets are known for their sudden, large price movements, or “jumps,” which are not adequately captured by continuous diffusion processes. Jump-diffusion models, such as Merton’s or Kou’s, explicitly account for these discontinuities. Merton’s jump-diffusion model incorporates a Poisson process for jump occurrences, with jump sizes typically assumed to be log-normally distributed. Kou’s model extends this by using a double exponential distribution for jump sizes, allowing for asymmetric jumps and a better fit to the observed leptokurtosis and skewness in crypto returns.

Implementing these models involves estimating jump intensity (λ), mean jump size (μ_J), and standard deviation of jump size (σ_J), in addition to the continuous diffusion parameters. Calibration often requires specialized numerical techniques, potentially combining Fourier inversion methods with optimization routines. The enhanced accuracy provided by these models, particularly for out-of-the-money options which are highly sensitive to tail events, justifies the increased computational complexity.

A hybrid approach, integrating stochastic volatility with jump diffusion (e.g. Bates model), offers a powerful framework for a comprehensive representation of crypto price dynamics.

Key Parameters and Calibration Data

Effective quantitative modeling relies on high-quality, real-time data and robust calibration techniques. The following table illustrates essential data inputs and typical calibration methods for advanced crypto options pricing models.

| Parameter Category | Key Data Inputs | Calibration Methodologies | Relevance to RFQ |

|---|---|---|---|

| Underlying Asset Dynamics | Spot prices (BTC, ETH), futures prices, historical returns. | Historical volatility, GARCH models, maximum likelihood. | Determines drift and diffusion components for pricing. |

| Volatility Structure | Implied volatility surface (strike, maturity, IV). | Least squares optimization, Fourier inversion, machine learning. | Shapes the volatility smile/skew, critical for accurate pricing. |

| Jump Characteristics | High-frequency price data, historical jump detection. | Non-parametric tests, generalized method of moments, maximum likelihood. | Captures extreme price movements, crucial for tail risk options. |

| Risk-Free Rate | Relevant crypto lending rates, stablecoin yields. | Interpolation of market rates, proxy rates. | Discounting future payoffs, less volatile but still essential. |

| Dividends/Carry | Staking rewards, tokenomics, funding rates for perpetuals. | Direct observation, modeling of yield curves. | Adjusts the underlying asset’s expected growth rate. |

Predictive Scenario Analysis

A sophisticated RFQ framework extends beyond mere pricing to encompass robust predictive scenario analysis, enabling proactive risk management and strategic decision-making. Consider a hypothetical scenario involving an institutional desk managing a portfolio of Bitcoin (BTC) and Ether (ETH) options, receiving an RFQ for a large, complex ETH options block trade. The request is for a December 2025 expiry, 4000-strike call option on ETH, with a notional value equivalent to 500 ETH, to be executed as a block trade.

The current spot price of ETH is 3800, and the prevailing implied volatility for similar maturities is around 75%. This is a substantial trade, demanding precise valuation and immediate risk assessment.

Upon receiving the RFQ, the system initiates a multi-model valuation cascade. The Heston model, calibrated to the latest ETH implied volatility surface, provides an initial theoretical price, accounting for the stochastic nature of ETH’s volatility and its observed mean-reverting behavior. Simultaneously, a Kou jump-diffusion model, with parameters reflecting the historical frequency and magnitude of ETH price jumps, calculates an alternative theoretical value.

This dual-model approach provides a crucial cross-validation, highlighting potential discrepancies arising from differing assumptions about market dynamics. For instance, the Heston model might produce a slightly lower price if it understates the probability of extreme upward jumps, while the Kou model might yield a higher price due to its explicit inclusion of fat tails.

The risk engine immediately calculates the Greeks for the prospective position. The delta, representing the sensitivity to changes in the underlying ETH spot price, indicates the required spot or futures position to maintain a delta-neutral hedge. Given the size of the trade, this delta hedge could be substantial, potentially moving the spot market if executed carelessly.

The vega, measuring sensitivity to changes in implied volatility, highlights the exposure to shifts in the ETH volatility surface. A high vega implies a significant profit or loss if implied volatility moves, necessitating a careful consideration of vega hedging strategies, perhaps through a portfolio of other options or variance swaps.

Beyond these first-order sensitivities, the system conducts a series of stress tests and scenario analyses. One scenario might simulate a 20% drop in ETH spot price combined with a 15% surge in implied volatility ▴ a plausible “tail event” in crypto markets. The models re-price the option under these conditions, revealing the potential P&L impact on the overall portfolio. Another scenario could model a sudden, large upward jump in ETH, similar to past historical events, to assess the exposure to positive fat tails.

The system then evaluates the effectiveness of various hedging strategies under these stressed conditions. For instance, a static delta hedge might prove insufficient in a jump scenario, prompting the consideration of dynamic gamma hedging or the use of options with higher gamma. The computational engine also projects the capital required to support the trade under these adverse scenarios, ensuring compliance with internal risk limits and regulatory capital requirements.

The outcome of this predictive analysis is not a single price, but a risk-adjusted range of potential quotes, coupled with a detailed hedging strategy and a clear understanding of the residual risk. This comprehensive approach allows the trading desk to confidently respond to the RFQ with a competitive price, backed by a robust understanding of the trade’s systemic impact and a predefined plan for managing its associated risks. This deep dive into potential futures transforms the RFQ response from a reactive quote into a strategically informed decision, safeguarding capital and optimizing returns even in highly volatile markets.

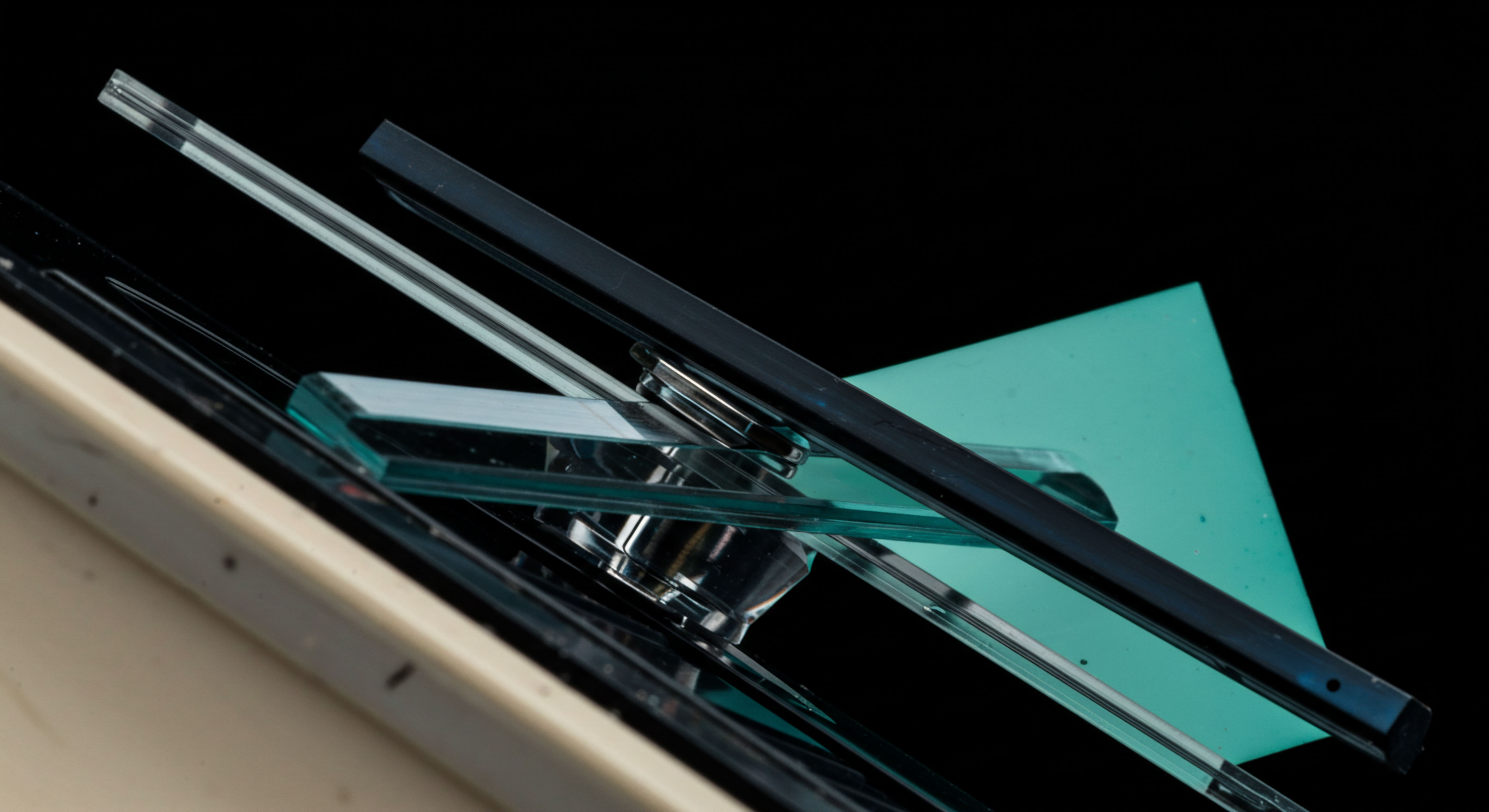

System Integration and Technological Architecture

The effective deployment of quantitative models for crypto options pricing within an RFQ framework relies heavily on a robust and meticulously integrated technological architecture. This operational backbone ensures low-latency performance, data integrity, and secure communication, all critical for institutional-grade trading. The entire system functions as a high-performance computational grid, designed for precision and resilience.

Core Integration Points

Integration begins with real-time market data feeds, which are the lifeblood of any pricing engine. These feeds, typically delivered via WebSocket or FIX protocol, provide continuous updates on spot prices, order book depth, and implied volatility surfaces from multiple exchanges and liquidity providers. A high-throughput data pipeline ingests, validates, and normalizes this disparate data, ensuring a consistent and clean input for the quantitative models. This normalization process is crucial given the varying data formats and conventions across different crypto venues.

The pricing engine, housing the suite of quantitative models (Heston, jump-diffusion, local volatility), consumes this normalized data. It is engineered for parallel processing, allowing for simultaneous valuation of multiple option structures and rapid recalibration of model parameters. The output ▴ theoretical prices, Greeks, and risk metrics ▴ is then fed into a central risk management system.

This system aggregates exposures across all active positions, calculates real-time VaR and other risk measures, and monitors compliance with predefined limits. A robust risk system also provides real-time alerts for limit breaches or unusual market behavior, enabling immediate human oversight and intervention.

The RFQ messaging protocol itself forms a critical integration point. Institutional RFQ platforms often leverage secure, low-latency APIs (e.g. FIX, REST, WebSocket) to facilitate private, bilateral price discovery between liquidity providers and institutional clients.

These APIs enable the seamless submission of RFQs, the rapid dissemination of competitive quotes, and the immediate execution of accepted trades. The system must handle multiple concurrent RFQs, prioritize responses, and ensure cryptographic security for all communications, preserving the discretion inherent in block trading.

Order and Execution Management Systems

An integrated Order Management System (OMS) and Execution Management System (EMS) are indispensable components. The OMS manages the lifecycle of all orders, from initial quote generation to final settlement, ensuring proper audit trails and compliance. It tracks the status of each RFQ, records all quotes received and sent, and logs execution details. The EMS, conversely, focuses on the optimal routing and execution of hedging trades.

When an options trade is executed via RFQ, the EMS automatically generates and routes corresponding spot or futures orders to designated execution venues. This automation minimizes latency and reduces the operational burden of manual hedging, which can be prone to errors and delays in fast-moving crypto markets.

The EMS employs smart order routing algorithms that consider factors such as liquidity depth, effective spread, execution fees, and latency across various exchanges. It may also incorporate algorithms for optimal trade slicing (e.g. TWAP, VWAP) to minimize market impact for large hedging orders.

The integration between the pricing engine, risk system, and EMS is tight, ensuring that hedging strategies are continuously informed by the latest risk metrics and model valuations. This continuous feedback loop creates a self-optimizing execution ecosystem, constantly adapting to market conditions and risk exposures.

Computational Infrastructure and Resilience

The underlying computational infrastructure must be highly scalable, fault-tolerant, and geographically distributed to ensure uninterrupted operation. This involves deploying pricing engines and data pipelines across multiple availability zones, utilizing cloud-native technologies for elasticity, and implementing robust disaster recovery protocols. Low-latency network connectivity to key exchanges and liquidity providers is a non-negotiable requirement.

Hardware acceleration, such as GPUs, can be employed for computationally intensive tasks like Monte Carlo simulations or complex parameter calibrations, further reducing processing times. Security considerations extend beyond cryptographic protocols to include robust access controls, intrusion detection systems, and regular security audits, protecting sensitive trading strategies and client data from malicious actors.

References

- Kończal, Julia. “Pricing options on the cryptocurrency futures contracts.” arXiv preprint arXiv:2506.14614 (2025).

- Kończal, Julia. “Pricing options on the cryptocurrency futures contracts.” ResearchGate (2025).

- Sene, N. Konte, M. & Aduda, J. “Pricing Bitcoin under Double Exponential Jump-Diffusion Model with Asymmetric Jumps Stochastic Volatility.” Journal of Mathematical Finance, 11, 313-330 (2021).

- Chen, Yu-Chuan, and Kuo-Shing Huang. “Detecting Jump Risk and Jump-Diffusion Model for Bitcoin Options Pricing and Hedging.” Mathematics 9.20 (2021) ▴ 2643.

- Saef, M. et al. “Regime-based Implied Stochastic Volatility Model for Crypto Option Pricing.” WWW ’23 Companion, April 30 ▴ May 04, 2023, Austin, TX, USA (2023).

- Heston, Steven L. “A closed-form solution for options with stochastic volatility with applications to bond and currency options.” The Review of Financial Studies 6.2 (1993) ▴ 327-343.

- Derman, Emanuel, and Iraj Kani. “The dynamics of a smile.” Risk 7.1 (1994) ▴ 6-11.

- Dupire, Bruno. “Pricing with a smile.” Risk 7.1 (1994) ▴ 18-20.

- Sepp, Artur. “Modeling Implied Volatility Surfaces of Crypto Options.” Imperial College London (2022).

Reflection

The journey through quantitative models for crypto options within an RFQ framework reveals a fundamental truth ▴ mastery of these markets stems from a superior operational design. The challenge is not merely in understanding complex mathematics, but in translating theoretical elegance into a resilient, high-performance execution system. Every model choice, every calibration parameter, and every integration point within the technological stack contributes to a holistic intelligence layer. Consider how your current operational framework anticipates market discontinuities and dynamically manages volatility exposures.

Is your system merely reacting to quotes, or is it proactively shaping them, underpinned by deep analytical insight and robust technological resilience? The ultimate edge belongs to those who view their trading infrastructure not as a collection of tools, but as a unified, intelligent system designed for precise control and strategic advantage in the ever-evolving digital asset landscape.

Glossary

Quantitative Models

Risk Management

Crypto Assets

These Models

Crypto Options

Implied Volatility Surfaces

Options Pricing

Digital Asset Derivatives

Rfq Framework

Stochastic Volatility

Hedging Strategies

Crypto Options Pricing

Volatility Models

Continuous Diffusion

Volatility Surface

Implied Volatility Surface

Jump-Diffusion Model

Local Volatility

Execution Quality

Implied Volatility

Block Trading

Jump-Diffusion Models

Heston Model